CySEC Forex Brokers

Forex Brokers with CySEC regulation can offer their services to forex traders throughout Europe. This guide features the best CySEC brokers based on features such as trading platforms, spreads and social trading.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

The Forex Brokers With CySEC regulation for European traders are:

- Eightcap - Best CySEC Forex Broker

- Pepperstone - Best MT4 Forex Broker

- IC Markets - Low Spread No Commission Broker

- eToro - Great Social and Copy Trading Platform

- FP Markets - Best Forex CFD and Shares Broker

- Plus500 - Top Platform for Charting and Analysis

- FXTM - Good Platform for Micro lot Trading

What is the best CySEC regulated forex broker?

CySEC (Cyprus Securities and Exchange Commission) regulates brokers throughout Europe under ESMA guidelines, offering MiFID II passport rights and 30:1 retail leverage caps. Eightcap leads with CySEC and FCA regulation, delivering RAW spreads from 0.06 pips across 56 currency pairs on MT5 and TradingView platforms. We also shortlisted other CySEC brokers based on their European regulatory compliance and trading conditions.

1. Eightcap - Best CySEC Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.1 AUD/USD = 0.2

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

Tight spreads mean lower trading costs (and higher profits), so it’s no surprise we awarded the top spot to the broker offering the lowest spreads to traders, along with the automated and algorithmic trading tools needed to capture every opportunity. While we’re eager for Eightcap to add TradingView to its roster of platforms, we found the MT5 trading experience with Eightcap more than satisfactory, particularly regarding support for technical questions.

Pros & Cons

- Has low spreads on forex

- Best range of crypto coins to trade

- Provides automated trading tools

- Limited range of trading products

- No copy trading features

- Leverage is 1:400 not 1:500

Broker Details

Eightcap Accounts and Spreads

Whether you opt for a Standard or a RAW account, Eightcap offers some of the tightest spreads we’ve seen in the EU.

Eightcap Standard Account Spreads

Spreads for the Eightcap Standard account start at 1.0. While that may seem a bit high, it’s important to remember that just because another broker advertises a lower spread, that doesn’t mean you’ll get to take advantage. What good is a spread that starts at 0.6 pips but, more often than not, hovers around 1.8?

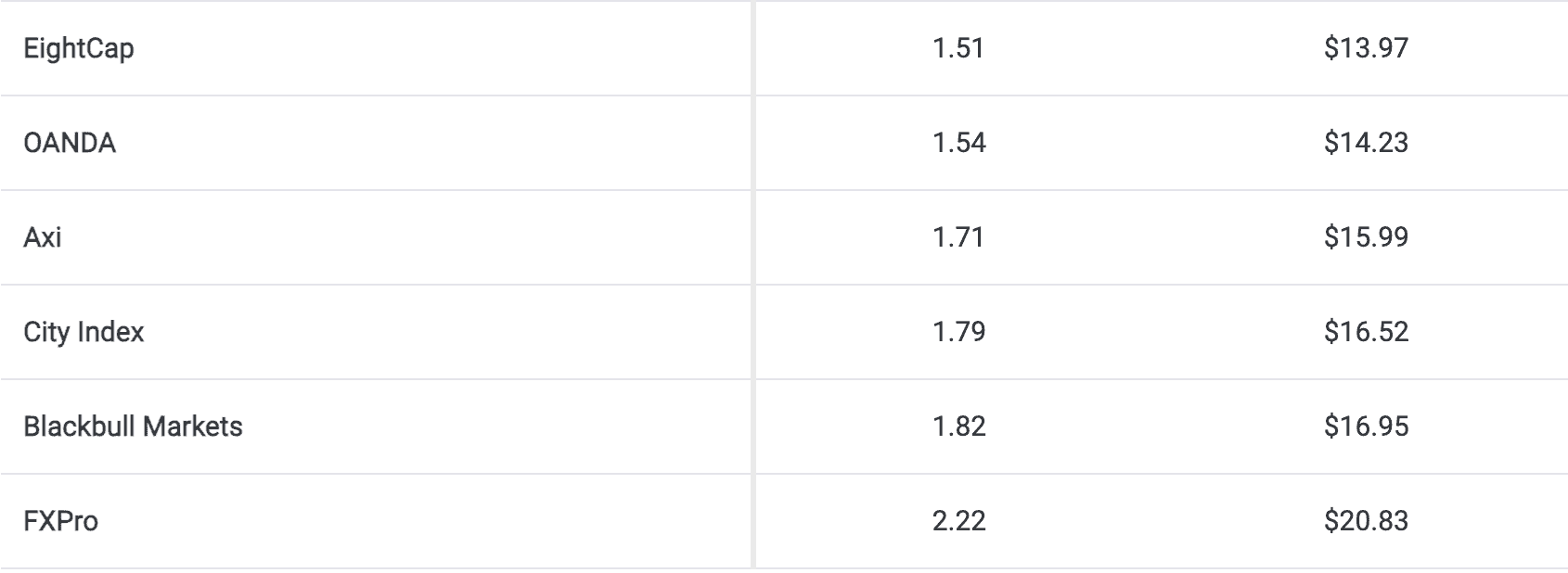

We measured average spreads based on pips and cost and found that Eightcap outperformed other brokers with lower minimum standard account spreads. The average minimum spread for an Eightcap standard account is 1.51 pips (USD 13.97) and lower for most major currency pairs. When you consider that similar brokers regularly post spreads higher than 2.2 pips, you understand Eightcap’s appeal.

Eightcap Raw Account Spreads

We were similarly impressed with how well Eightcap’s Razor account performed in our spread testing. The Raw Account Spreads averaged 0.5 pips – versus .94 for our poorest performing broker – and some of the best commissions. With Eightcap, you pay USD 3.50 to open or close a position. (That’s USD 7.00 per round-turn trade.)

Eightcap Trading Platforms

Eightcap offer MT5 abs TradingView trading platforms. MT5 is quickly becoming the go to platform in continues the forex landscape especially as retail traders finally have access to centralised exchanges making it great for Shares and crypto trading. We slso recommend MetaTrader 5 like fundamental market analysis tools to develop your trading strategy. Eightcap’s version affords you access to 30 in-built indicators, along with over 2,000 free add-ons.

We’re also big fans of Eightcap’s advanced charting package, which includes over 30 analytical objects: lines, channels, the Gann and Fibonacci tools, shapes, and arrows.

If you’re more interested in automated trading, MetaTrader 5 allows you to build or purchase a customer Expert Advisor to manage your trading activity.

If, on the other hand, you’re interested in assets traded on centralised exchanges – shares, for example – you’ll want to opt for MT5. Eightcap’s version includes many of the same features as its MT4 offering but with some additional tools. Advanced market depth features include a separate accounting of orders and trades, including full support trading orders and execution nodes.

MT5 also makes trading from charts more straightforward. We tested Eightcap’s statement that the platform would allow us to open up to 100 charts and found that the system worked fine. We also enjoyed playing with the 21 different time frames and 80 technical indicators.

One thing to be aware of: if you’re moving from MT4 to MT5, you’ll need to rebuild your automation. Expert Advisers coded for MetaTrader4 work only on that platform. A bit of a drag, but MT5 users always have the option of purchasing a trading bot from the MetaQuotes marketplace.

Eightcap Range of Markets

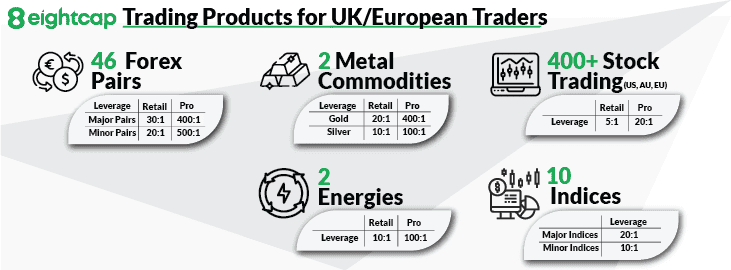

If you’re interested in more than just forex, Eightcap should appeal. The broker offers access to a diverse collection of instruments beyond currency pairs: commodities, stocks and indices.

You’ll also have to the option to enlarge your positions with leverage: 30:1 for major currency pairs and 20:1 for minors. That’s the maximum permitted by CySEC and FCA rules, so take care.

Eightcap Education and Research Resources

Eightcap has gone all-in on creating a knowledge base for its customers. The proprietary Eightcap Labs offers free articles, courses and tutorials on everything from trading fundamentals to advanced charting how-tos.

Our Verdict on Eightcap

Tight spreads and top-notch trading tools pushed Eightcap to the number one spot in our list of CySEC-regulated brokers. While the absence of MT4 might frustrate a minority, MT5 and TradingView are excellent (arguably superior) platforms (especially for crypto trading), and they have top educational materials. For these reasons, Eightcap is our top picks for new traders.

2. Pepperstone - Top Broker for Trading with the MetaTrader 4 Platform

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We liked Pepperstone for its regulatory solid backing, holding licenses from CySEC, the UK’s Financial Conduct Authority, and Germany’s BaFIN. This positions it as one of the most regulated forex brokers in the region. Moreover, the competitive spreads that Pepperstone offers, driven by its ECN-style execution and straight-through processing (STP), truly impressed us.

Pros & Cons

- Enhanced MetaTrader 4 with 28+ tools

- Fast execution speeds on MT4

- Low spreads from one pip

- Only offers CFDs

- The demo account is limited to 30 days

- Does not offer copy trading tools

Broker Details

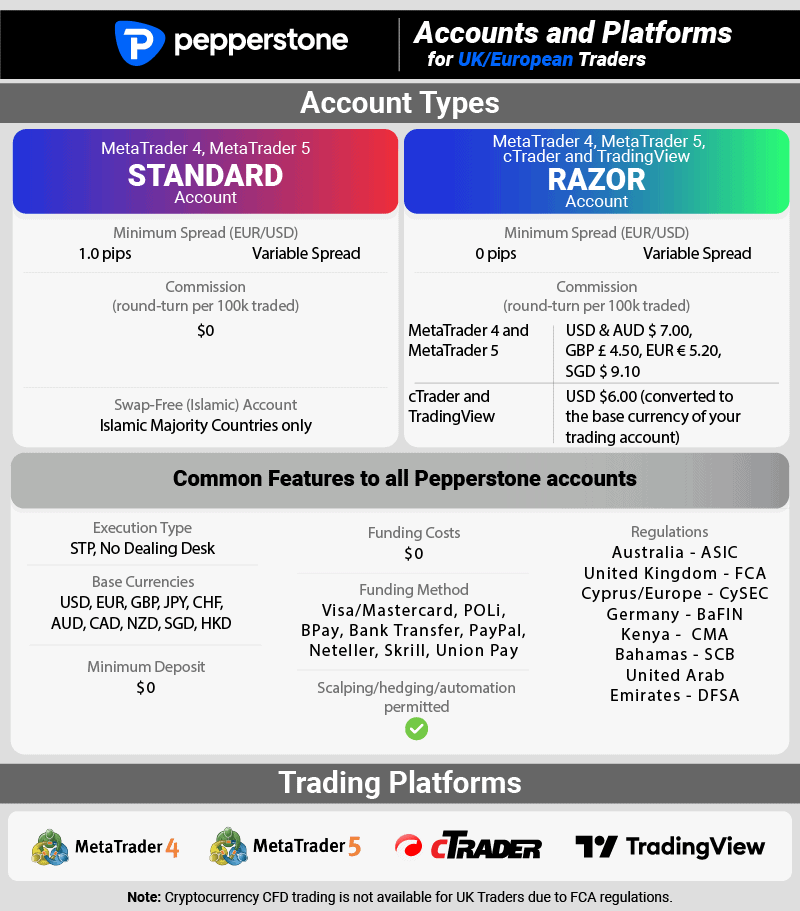

Pepperstone Accounts and Spreads

We found that Pepperstone’s Standard account provides commendably tight spreads, especially for a no-dealing desk, market-making broker. Minimum spreads for currency pairs with this account include:

- EUR/USD, AUD/USD, GBP/USD and all other majors – 1.0 pips

- EUR/GBP, EUR/JPY, EUR/CHF, AUD/JPY – 1.0 pips

- CAD/CHF, AUD/CAD – 1.3 pips

- EUR/CAD – 1.4 pips

Pepperstone Standard Account Spreads

If you take a look at the module below, you’ll see that Pepperstone more than matches up against comparable brokers when it comes to spreads for a standard account. (We collect this data from each broker we cover every month and perform our own in-house analysis.) As you can see, Pepperstone compares very well with other brokers for the standard accounts.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Pepperstone Razor Account Spreads

If you’re looking for the tightest possible spreads, Pepperstone also offers the Razor account, which charges only the commission for opening and closing your position (plus the spread).

We developed the tool below to help you compare your trading costs with other brokers that use an ECN pricing plus commission model.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Common Pepperstone Account Features

Regardless of which account type you choose, you’ll benefit from a range of common features with Pepperstone, including:

- Scalping

- Hedging

- Expert advisors (MetaTrader), cAutomate (cTrader)

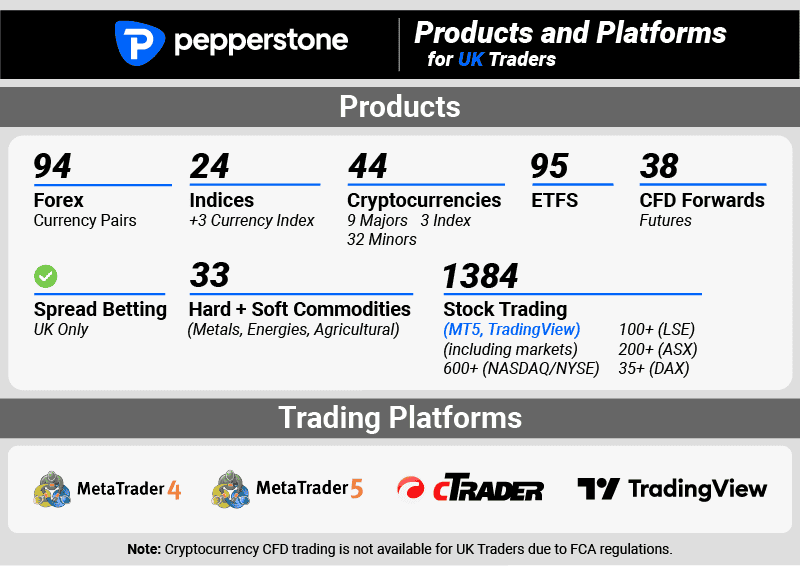

Pepperstone Trading Platforms

One of the reasons we consistently rank Pepperstone among the top forex brokers is its range of trading platforms. Besides MetaTrader 4 and MetaTrader 5 (which you can find with many brokers), Pepperstone also offers cTrader. You’ll also have access to a diverse selection of trading platforms, such as MetaTrader Signals, Pelican and DupliTrade.

MetaTrader 4 remains the world’s most popular trading platform. We strongly recommend it for beginners, given its proven track record and collection of essential tools. Key features include:

- 9 Timeframes

- 30 chart indicators

- 33 analytical objects

- 6 pending order types

- MQL4 for Expert Advisors and backtesting

Choose MT4 if:

- You want access to the MT4 trading community, which is one of the world’s largest communities

- You don’t intend to trade shares

- You don’t have a powerful server that can take advantage of the extra grunt MT5 may require

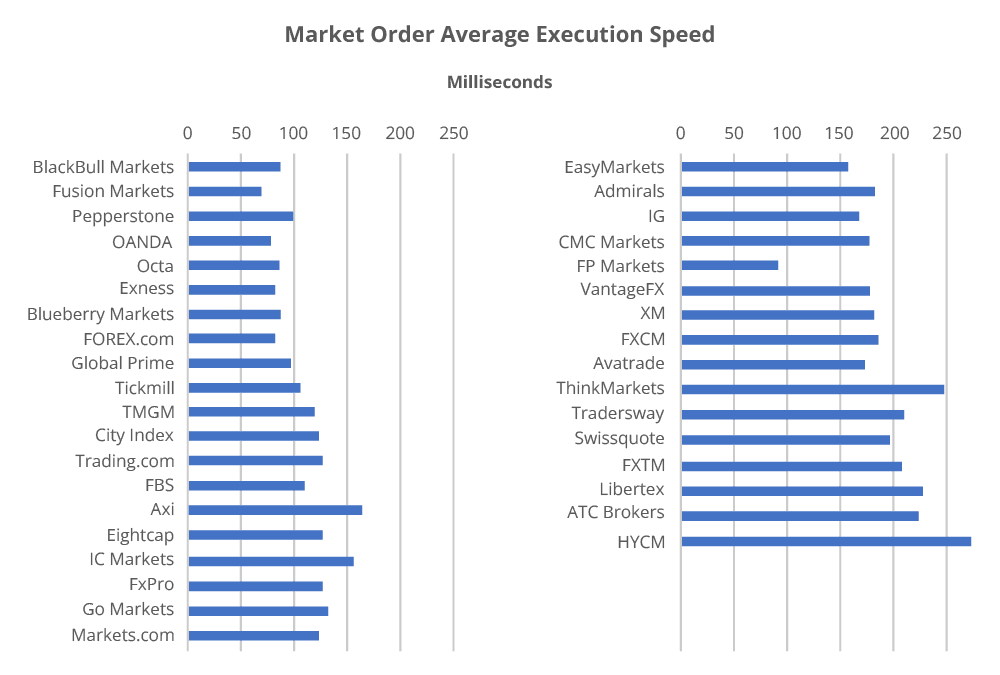

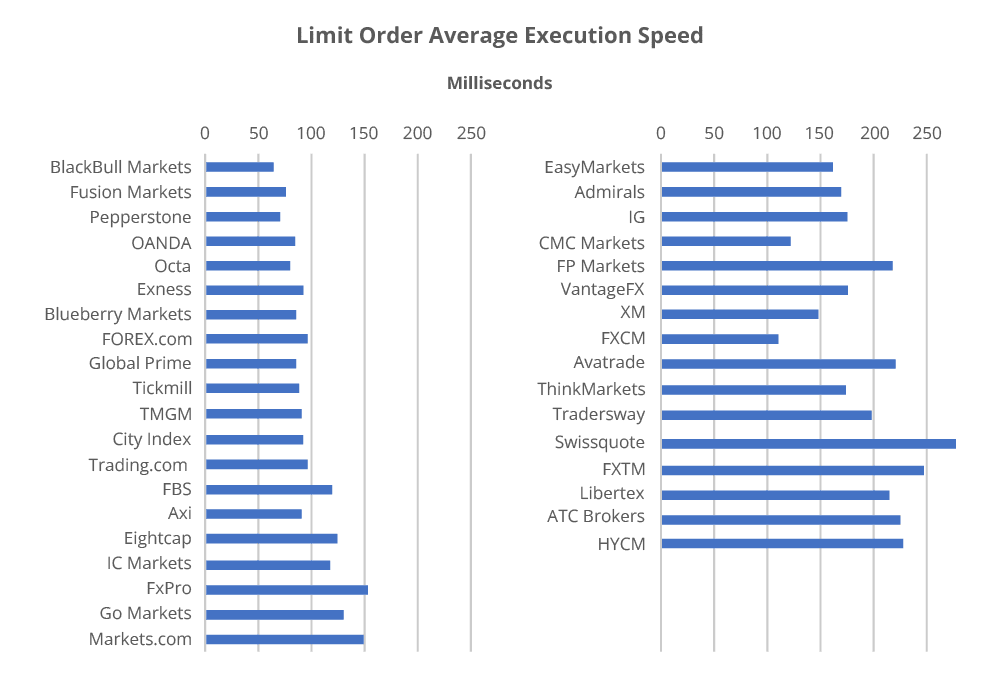

Pepperstone Execution Speeds

Regarding execution speed, our tests showed Pepperstone at the forefront, excelling in reducing slippage and ensuring your order fills at the quoted price. We observed a round-turn trade with market order execution wrapping up in a swift 100ms, while a limit order concluded in less than 75 ms.

Our Verdict on Pepperstone

From our perspective, Pepperstone ranks among the premier CySEC-regulated brokers and delivers a stellar MT4 trading experience. We had over 1000 instruments to trade, spanning markets from forex to cryptocurrencies. With Pepperstone’s two account types, we believe both seasoned day traders and newcomers will find an account that resonates with their needs.

‘72.9% of retail investor accounts lose money when trading CFDs with this provider’

3. IC Markets - Best Account for Spread-Only Trading

Forex Panel Score

Average Spread

EUR/USD = 0.01 GBP/USD = 0.04 AUD/USD = 0.02

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

We liked IC Markets for its exceptional product range. Offering seven asset classes and more than 235 financial instruments gives beginner traders a diverse yet manageable selection of trading products and markets. The incredibly tight spreads on their Standard account particularly stood out to us.

Pros & Cons

- Lowest spreads from 0.6 pips

- Strong selection of trading products

- Has social trading tools like ZuluTrade available

- $200 minimum deposit

- MetaTrader and cTrader have different commissions

Broker Details

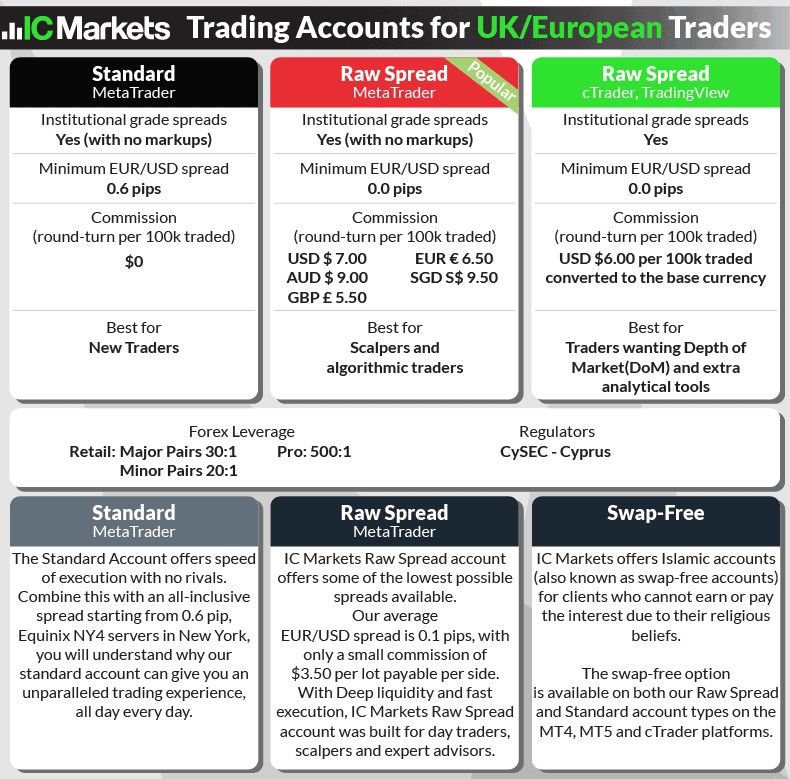

IC Markets Accounts and Spreads

With IC Markets, you have a choice between two account types: Standard and Raw spread. We recommend the Standard account for beginners, given the easy-to-calculate trading costs, and the Raw Spread if you’ve got more experience.

We were impressed when we delved into the Standard account offered by IC Markets. It allows for forex spreads inclusive of commission fees, and in our own trials, IC Markets ranked high in the list for tightest standard account spreads. We noted just 1.03 pips on average, translating to under USD 10.00 in trading costs per transaction.

For the Raw Spread account, we observed that commissions aren’t bundled into the spreads. Instead, you’re charged a flat-rate round-turn fee. We found this method unambiguous and more predictable in many scenarios. The Raw Spread account at IC Markets showcased incredibly competitive spreads, such as a mere 0.10 pips for the Euro vs. US Dollar (EUR/USD) pair. In comparison, the Standard account hovered around spreads of approximately 1.1 pips.

No matter which IC Markets account we chose, the opportunity to trade with leverage was available. While leverage can significantly boost potential returns, we must remind our fellow traders of its inherent risks. It’s a double-edged sword, offering promise and peril, especially in highly leveraged trades. Being prudent and arming oneself with knowledge is the key.

IC Markets Range of Markets

If you’re a forex enthusiast, we recommend that you consider MetaTrader 4. It was initially designed as a forex platform, which makes IC Markets MT4 option an ideal fit, especially if your focus is on currency trading.

On the other hand, if you’re looking to diversify your trading strategies and explore different asset classes, MetaTrader 5 (MT5) may be the way to go. MT5 is a multi-asset platform that offers a broader range of options, including share trading. MT5 definitely better fits your needs if you’re looking for a platform with more extensive product options. It features over 60 currency pairs, 17+ indices, 19+ commodities, and an impressive 120+ stocks and ETFs (exclusive to MT5). Plus, there are additional options like 6 bonds, 4 futures, and the tempting array of 10 cryptocurrencies.

Our Verdict on IC Markets

While we like IC Markets’ impressively tight spreads and variety of trading products, we found certain features tricky to navigate. The brokers’ sheer size – it’s one of the largest in the world – also makes for spotty customer service and inconsistent resources, depending on your region.

4. eToro - Great Social and Copy Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

We liked eToro’s distinct focus on social trading, setting it apart from other forex brokers we’ve explored. Through eToro, traders can access over 2000 assets, spanning forex, crypto, and commodities, via its dedicated social trading platform. The sheer scale of the eToro community, boasting over 10 million users across 140 countries, truly impressed us.

Pros & Cons

- Easy to use trading platform to copy trade with

- Can filter traders based on performance to choose from

- Has a good selection of markets to trade

- More expensive to trade compared to other brokers

- Does not offer other trading platforms

- Forced stop loss on your copy trades may hinder performance

Broker Details

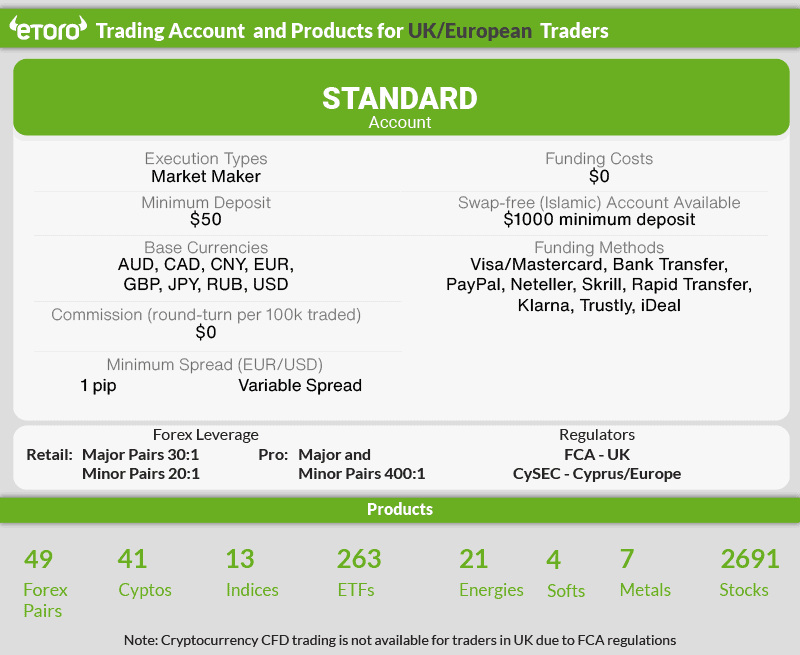

eToro’s Trading Account

Navigating through eToro, we found that the broker keeps things pretty simple. They offer just a Standard account, which comes with a minimum spread of 1.0 pips, and the great part is that there aren’t any commissions to worry about.

eToro Social Trading and Copy Trading Platforms

eToro’s social trading platform became a game-changer for us. It offers the chance to harness the expertise of seasoned traders in the community. This meant we could sidestep the nitty-gritty of technical or fundamental analysis and even bypass manual trading.

The eToro platform was more than just a place to execute trades. It is also a hub to exchange trading thoughts, obtain insights, and even automate the copying of trades from seasoned traders. But what truly caught our attention was eToro’s flagship feature – copy trading. Here, we got acquainted with two instrumental tools: CopyTrader™ and CopyPortfolios™.

eToro’s CopyTrader™

CopyTrader™ turned out to be an insightful tool. It lets us see the trading moves of others in the community and, if we like what we see, mirror their trades automatically. Moreover, CopyTrader™ came equipped with filters, helping us cherry-pick traders that resonated with risk score, assets, performance, and yearly profit.

CopyPortfolios™

While CopyTrader™ gave us the power to mimic individual traders, CopyPortfolios™ expanded that scope, letting us mirror a collection of traders. We quickly realised that banking on one successful trader, though promising, couldn’t guarantee continued success. Hence, distributing the risk over several top traders seemed a smarter move. eToro uses algorithms to find the best traders to form an index based on a range of themes. These are rebalanced regularly. And can comprise a single CFD or a mix of CFD products. CopyPortfolios™ indices include:

- Quarterly Gainers – This index is rebalanced each quarter with 50 of the platform’s best traders for the quarter

- Active Traders – This index is formed using frequent traders with a consistently positive track record.

- Trending Traders – For conservative traders, this draws on ten traders with an eToro risk rating of 7 or below.

- CopyPlus R4 – This index uses social trading to compile low-risk traders that get the most followers or copiers in the past month

- Market CopyPortfolios™ – An index focused on securities in sectors such as banks, big tech, gaming, gold, energy

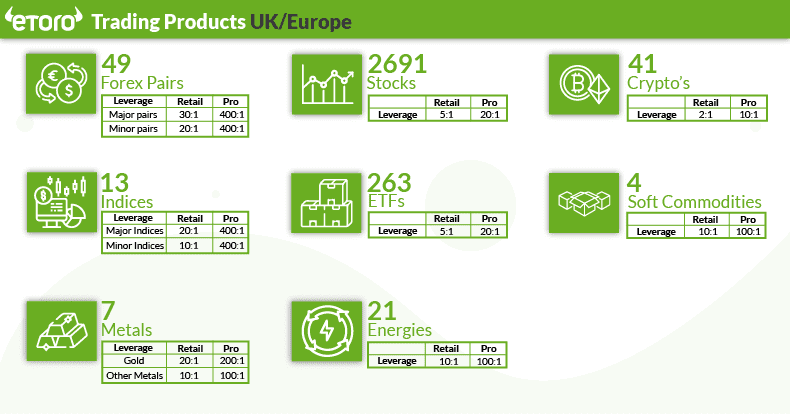

eToro Range Of Markets

In terms of market variety, eToro presented an expansive suite, all regulated by CySEC. We noted the market-maker model, which usually means higher spreads, but the silver lining is the absence of commission on trades.

Some of these markets are listed below:

- Over 40 forex CFD pairs

- Spreads start from 1 pip for EUR/USD and 1.5 pips for EUR/GBP

- Stocks have the option of being traded as a CFD (spreads starting from 0.09%) or actually owning the asset outright with no spread or commission charges

- Cryptocurrencies have the same option of purchasing either the outright asset or purchasing a CFD of the asset, both with spreads starting from 0.75% on BTC

- Access to over 30 commodity CFDs

- Spreads start from 2 pips for Copper, and 45 pips for Gold

- Binary options CySEC Leverage RegulationsMajor Forex pairsMinor forex pairs + Gold

Our Verdict on eToro

Best-in-class social trading and copy trading tools aside, the lack of diversity in account types and limited technical analysis tools make this broker a niche player in the forex game.

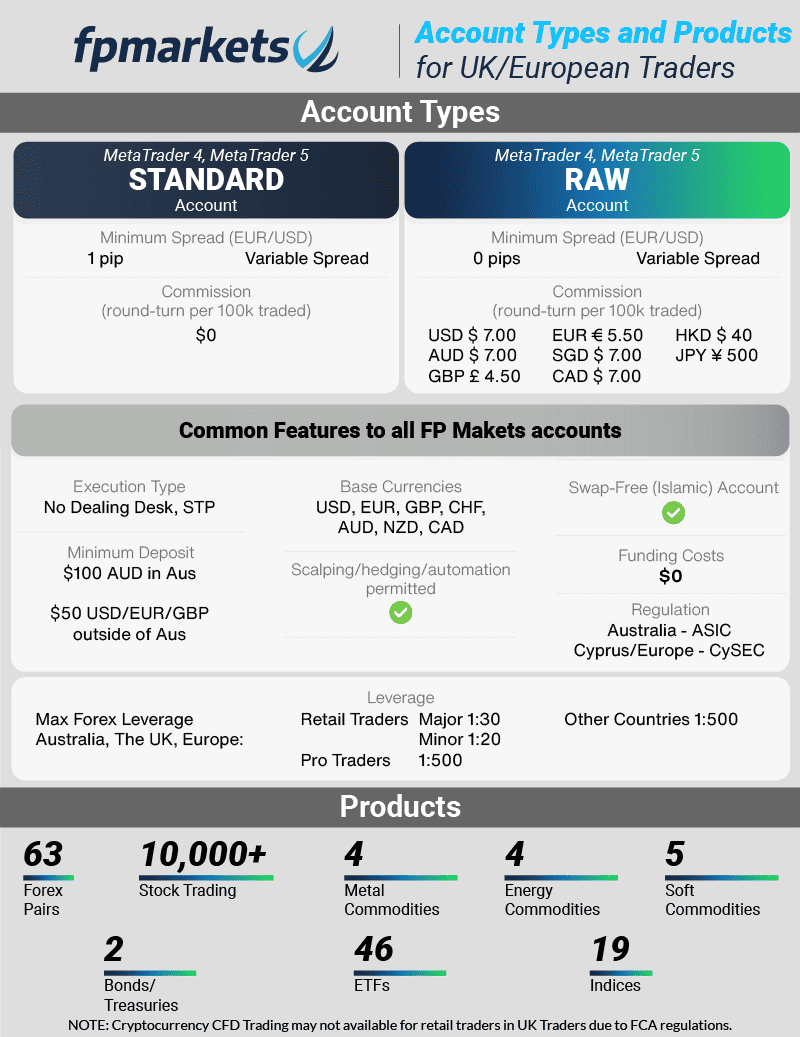

5. FP Markets - Best Forex CFD and Shares Broker

Forex Panel Score

Average Spread

EUR/USD = 0.14 GBP/USD = 0.39 AUD/USD = 0.31

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$50

Why We Recommend FP Markets

We consider FP Markets one of the best forex brokers globally, as they offer some of the lowest spreads through the ECN pricing of their RAW account. As a no-dealing desk broker (NDD), FP Markets connects you with top-tier liquidity providers using rapid execution speeds. This swift execution significantly minimizes slippage, ultimately enhancing the probability of receiving the best quotes from liquidity providers.

Pros & Cons

- Offers top trading platforms

- Provides excellent technical analysis tools

- Low trading commissions and tight spreads

- A limited selection of shares on MetaTrader 5

- Has a basic mobile trading app with limited features

- Smaller catalogue of currency pairs

Broker Details

FP Markets Accounts and Spreads

When we explored FP Markets, we found two distinct account options to select from: the Standard account and the Raw account. Both accounts offer the same features, but one has commission costs, and the other doesn’t.

FP Markets Standard Account

We enjoyed zero commission costs with the FP Markets Standard account, especially when dealing with spreads commencing from 1.0 pips for primary forex markets. Given the absence of commission charges, we reckon this account is ideal if you are new to trading and want to avoid commission costs.

FP Markets Zero Account

The second account type (and the FP Markets account we recommend) is their Raw account. Choosing this account means you will get the lowest spreads FP Markets offers but will need to $3.00 commissions per side. This account is best suited if you are a day trader who uses techniques like scalping and prefers to trade in a shorter time frame. Comparatively, the spreads under the Raw account are relatively competitive, and depending on the currency pair you’re eyeing, some spreads could be unbeatable.

FP Markets Range of Markets

Some of the markets available for trade include:

- 80+ share CFDs from around the world, including Adidas, Volkswagen, and Amazon, with leverage options up to 5:1

- 60+ Forex pairs that trade 24/5

- Gold, Silver, Oil, and Gas with leverage of up to 20:1

- 14 different indices, including the volatility index, Euro 50, and even the US dollar, with an average spread of 0.09 pips

- Trade the 3 most popular cryptocurrencies Bitcoin, Ethereum, and Litecoin

Our Verdict on FP Markets

We must tip our hats to the FP Markets Raw account – its spreads, especially the lean 0.0 pips for EUR/USD, did grab our attention. Plus, the extensive trading platform choices added another feather to their cap.

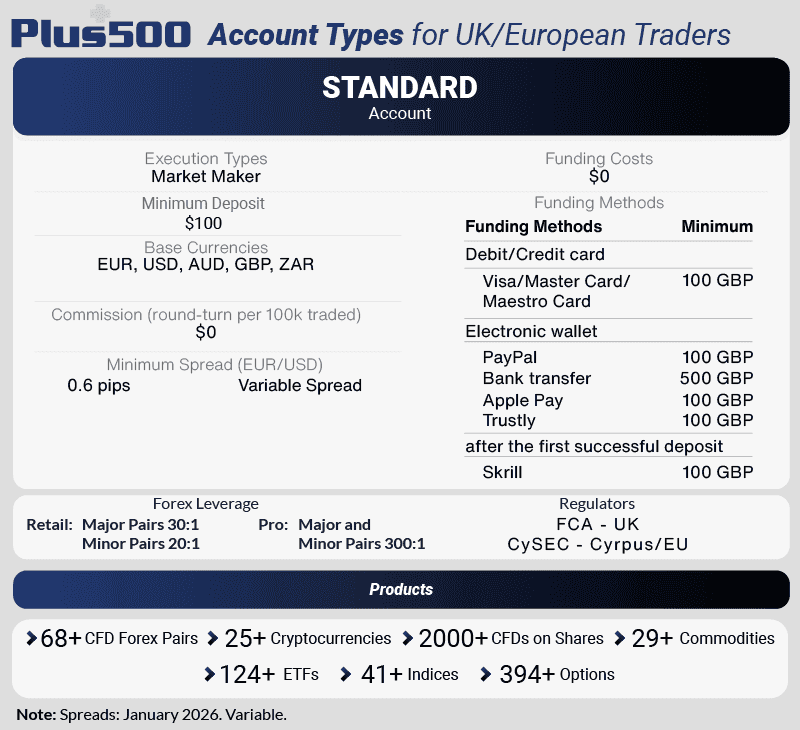

6. Plus500 - Top Platform for Charting and Technical Analysis

Forex Panel Score

Average Spread

EUR/USD = 0.9 GBP/USD = 1.6 AUD/USD = 1

Updated 06/02/2026

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Plus500 disclaimer: CFD service. Your capital is at risk. 79% of retail CFD accounts lose money

Why We Recommend Plus500

We liked Plus500’s risk management tools, like guaranteed stop-loss orders (GSLOs), and the Trading Academy, which offers eBooks, video guides, and FAQs to support all kinds of traders.

Pros & Cons

- Guaranteed stop loss order

- Has low-spread trading accounts

- Zero minimum deposit

- Does not offer MetaTrader or TradingView platforms

- Strict inactivity requirements of making one trade every three months

- No automated trading tools

Broker Details

Plus500 Accounts, Spreads and Range of Markets

This broker only offers a no commission trading account which makes getting started really easy as there is no need to choose between account types.

Moreover, we explored their range and discovered a diverse selection with over 2000 instruments available across various markets.

Our Verdict on Plus500

If you’re in the market for a versatile broker with a user-friendly trading environment, we suggest Plus500. Their platform boasts a modern and intuitive design and the broker offers an extensive range of tradable products and competitive minimum spreads.

*Your capital is at risk ‘79% of retail CFD accounts lose money’

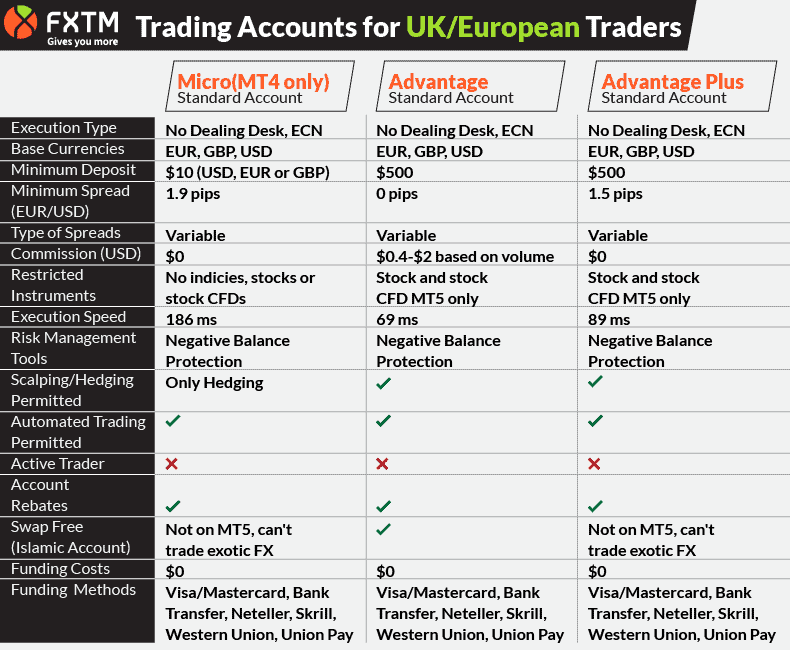

7. FXTM - Good Platform for Micro-lot Trading

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 2 AUD/USD = 0.5

Trading Platforms

MT4, MT5

Minimum Deposit

$10 - $500

Why We Recommend FXTM

We liked the flexibility FXTM offers for those keen on micro-lot trading. The conditions they offer for trading small amounts are truly among the best. Unsure about micro-lot trading? FXTM’s free demo account lets you test the waters.

Pros & Cons

- Micro account for micro-lot trading

- Has low commission costs

- Good education resources

- Only the MetaTrader 4 platform is available

- Micro accounts only have access to forex and metal markets

- Withdrawal fees for debit card and bank transfers

Broker Details

FXTM Accounts, Spreads and Range of Markets

While other brokers on this list like to keep things simple, FXTM offers you an impressive three different accounts from which to choose: Micro, Advantage and Advantage Plus.

While the spread may be slightly higher than you’re used to seeing – 1.9 pips – the micro account lives up to its name. No other broker offers a dedicated account specifically tailored to trading in lots of less than 100,000. A heads up for fellow traders, though: trading in smaller sizes can, quite paradoxically, result in lengthier execution times and reduced speeds.

Our Verdict on FXTM

If you’re interested in trading in small amounts (and not concerned by a somewhat complicated fee structure), FXTM should align with your trading goals.

Ask an Expert

Is CySEC regulation only good for Cyprus?

Cyrpus regulation means the broker can offer their trading services to clients across the European Union. This is because CySEC is part of The European Securities and Markets Authority (ESMA) which regulate financial markets across the European Union. As all financial regulators of countries within the European Union must follow guidelines set by ESMA, brokers using one of these financial regulators can also offer their trading services to other member countries of ESMA.

Is a low minimum deposit more important than execution speed?

No, the minimum deposit has not connection to your success as a trader. Exception speed however can be the difference between a successful trade and not.