What Are The Best Forex Broker In USA?

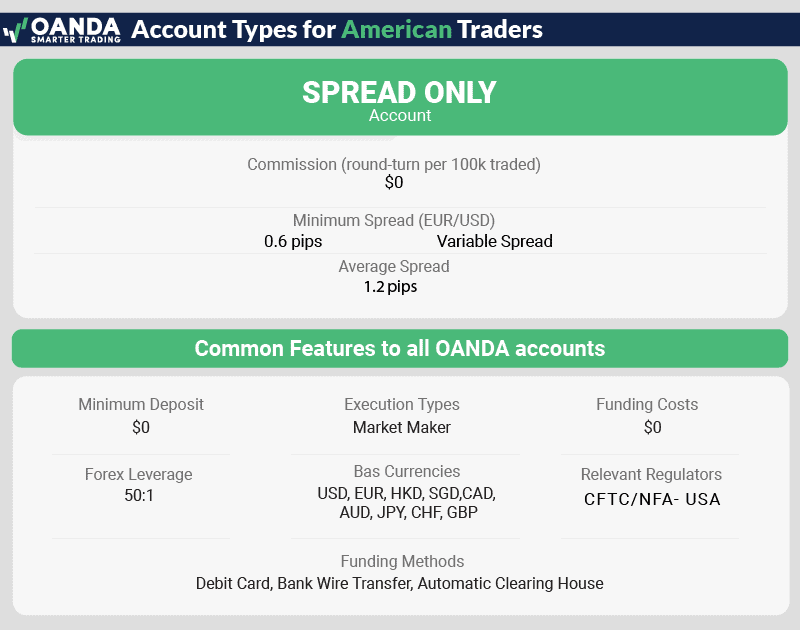

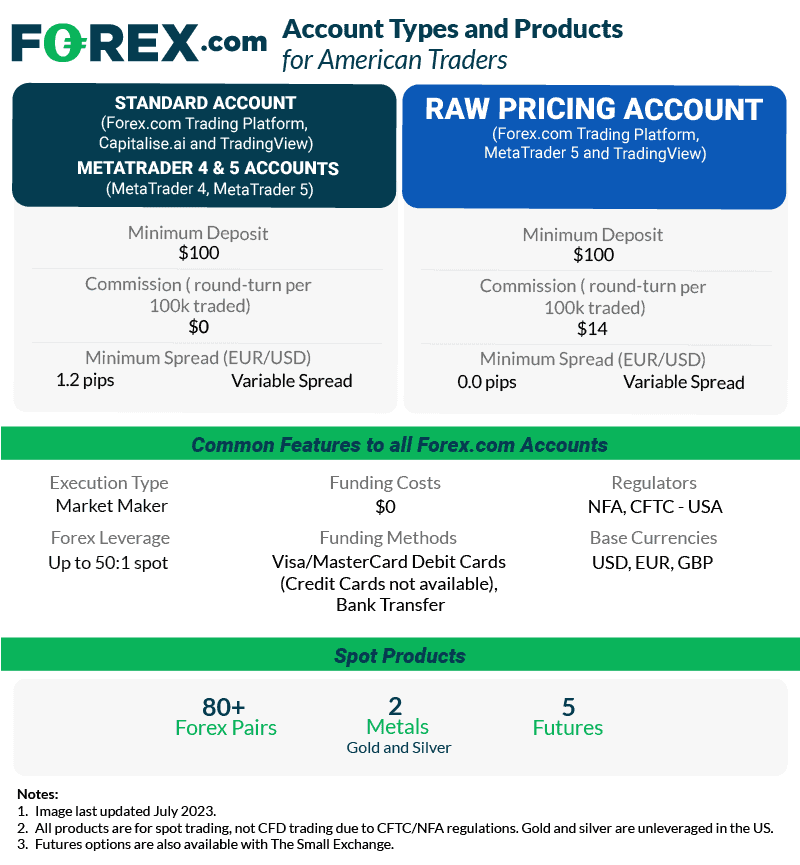

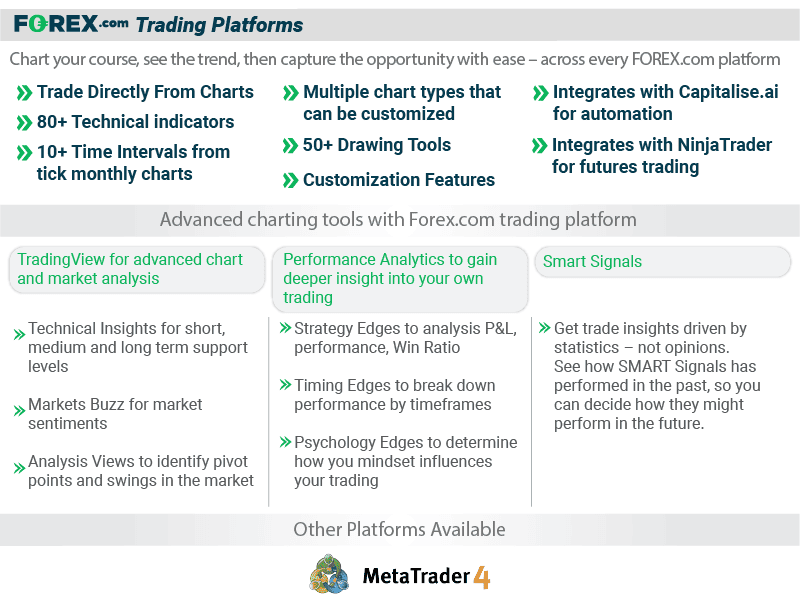

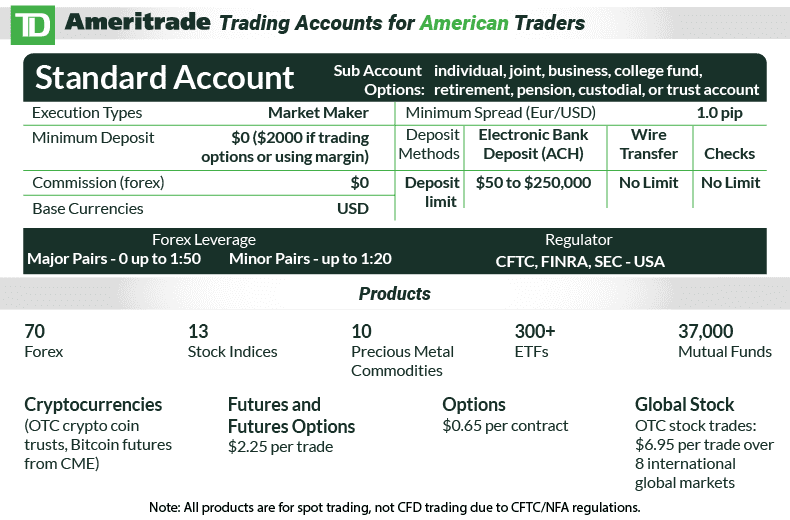

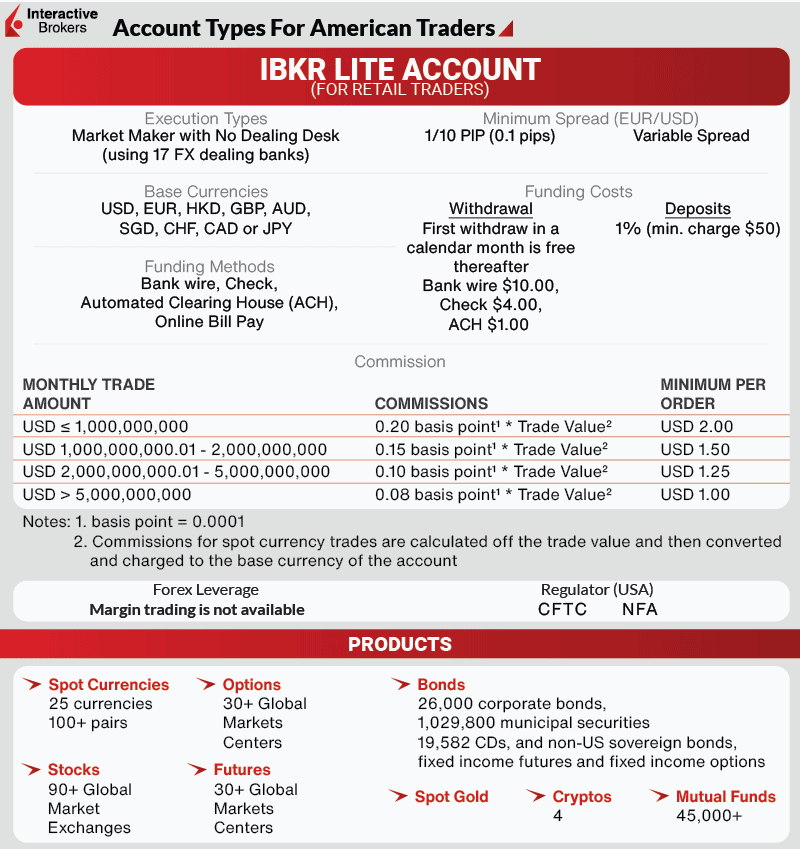

If you’re a US resident and wish to start Forex trading, you should choose a broker that CFTC and NFA regulate to protect your capital. Select from the best brokers like OANDA, Forex.com (Gain Capital), TD Ameritrade and Interactive Brokers.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Our Verdict On OANDA

Our Verdict On OANDA

Ask an Expert

I noticed that other sites list a lot more forex brokers for US traders compared to this list. Why is that?

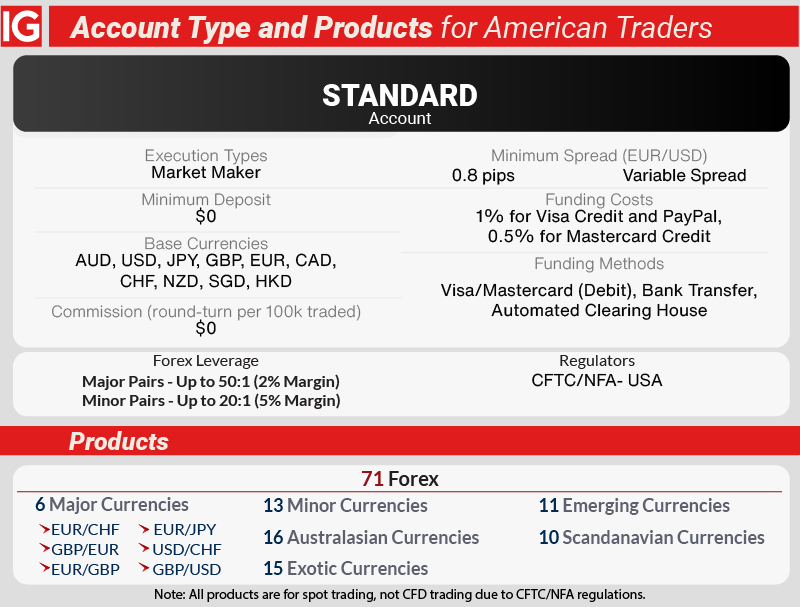

If you are in the USA, then you must choose a forex broker that is regulated by the Commodity Futures Trading Commission (CFTC) or the National Futures Association (NFA). Residents of the USA cannot legally trade with a broker that does not have this regulation. Most likely these other websites are including brokers that are not regulated by the CFTC or NFA, so cannot legally offer their services to US residents.

Can you trade Contracts for difference in the USA?

Hi Kelsey – The regulators in the USA- the NFA and NFTC forbid the trading of CFDs. You can trade using spot prices however

What is the maximum leverage for trading in the USA

If you are forex trading with a broker regulated by NFA or NFTC (the main regulators in the USA) then you can trade with a maximum leverage of 1:50 when trading spot forex

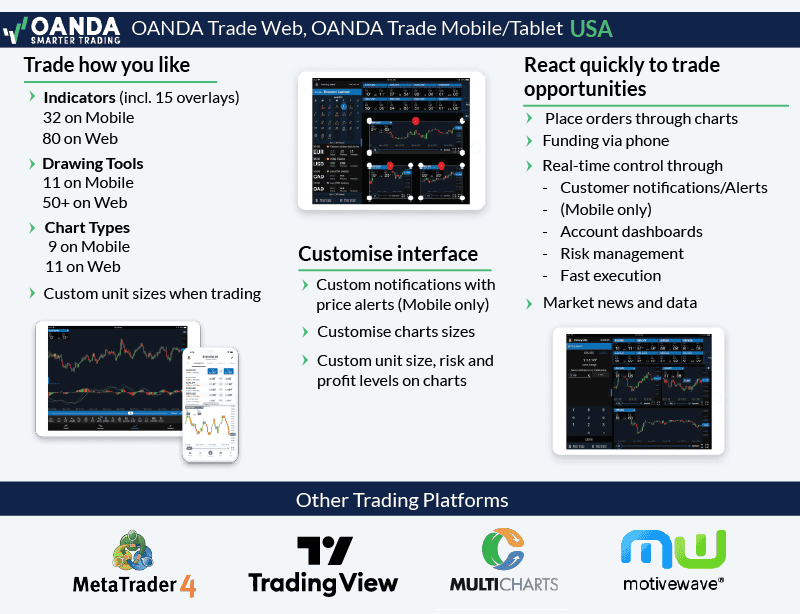

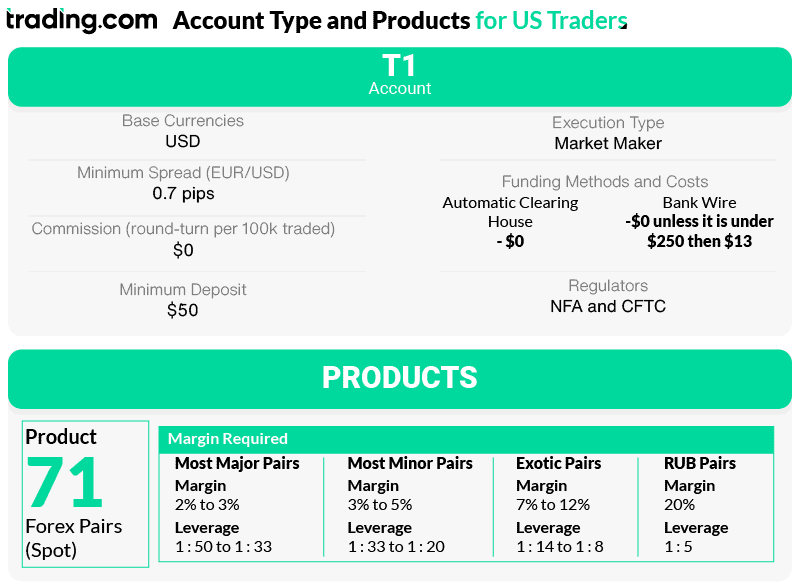

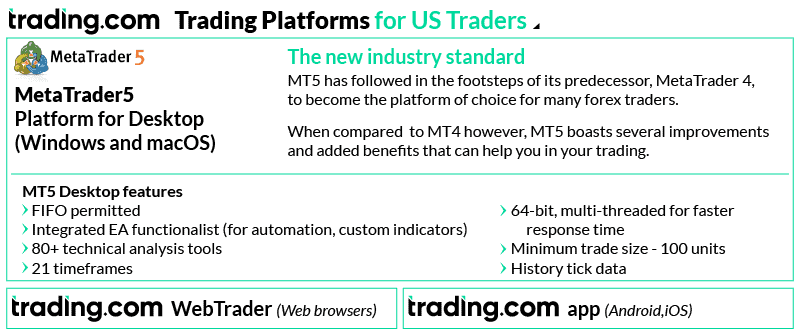

Excellent broker comparison analysis. Do you have any background info regarding trading.com which launched its NY operation around February 2022 and is one of the few Forex brokers supporting the MT5 trading platform?

Hi Pepi, that’s a great question. At this time we don’t intend to do a full review about Trading.com but we are planning to start adding them to some of our American review pages. Trading.com at first glance appears to be a decent broker and MetaTrader 5 is an excellent platform. Keep an eye on our US pages over next few weeks as we add the,

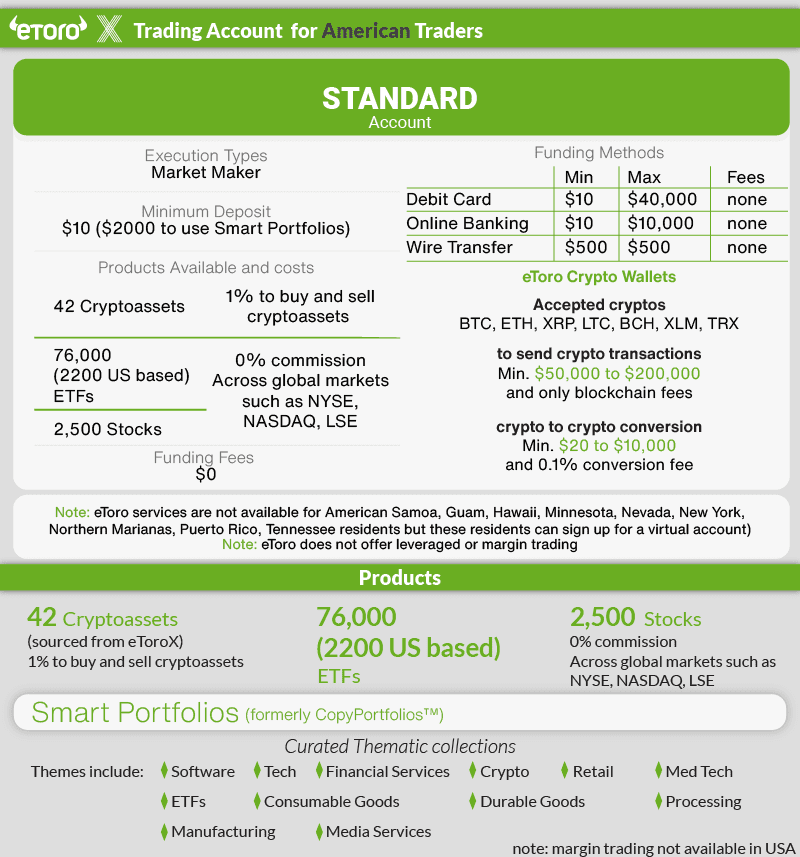

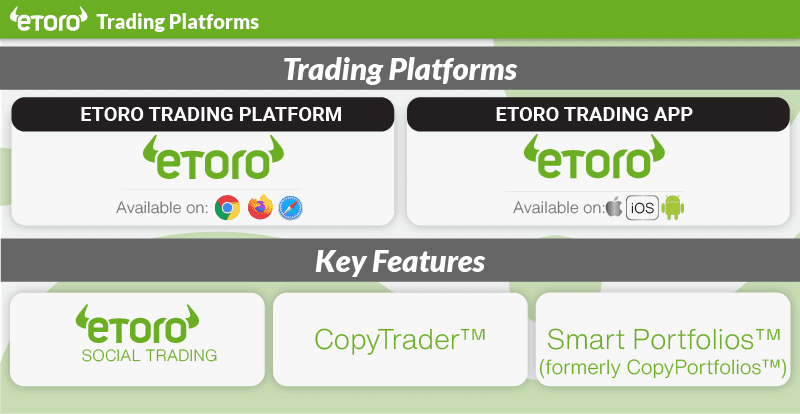

Hi Justin, – thank you for the comparison. Which of the above brokers can I use to trade stocks?

The following brokers offer share trading – Forex.com, eToro and TD-AmeriTrade

Who is the biggest forex broker in the US?

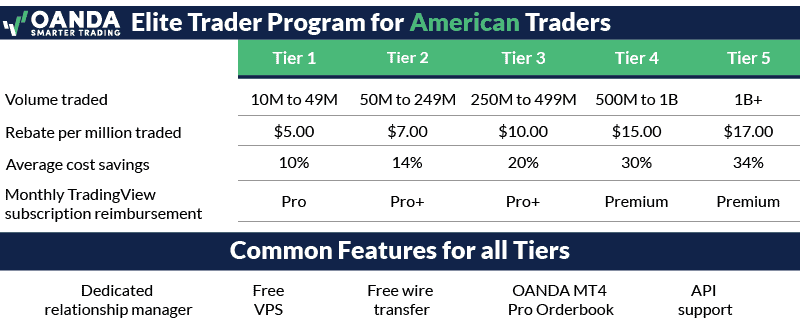

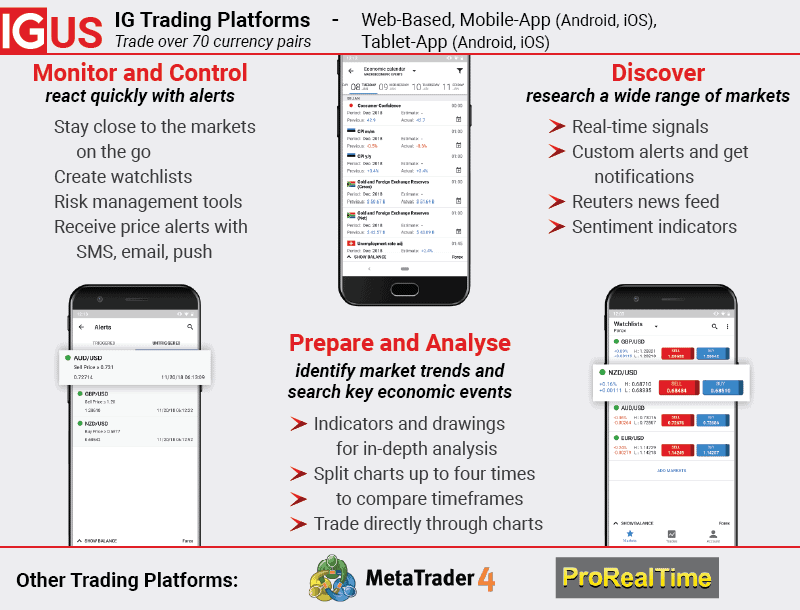

Not sure who is the biggest but OANDA, FOREX.com and IG would be among the largest and the ones we recommend