Best Automated Crypto Trading Platform

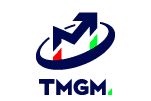

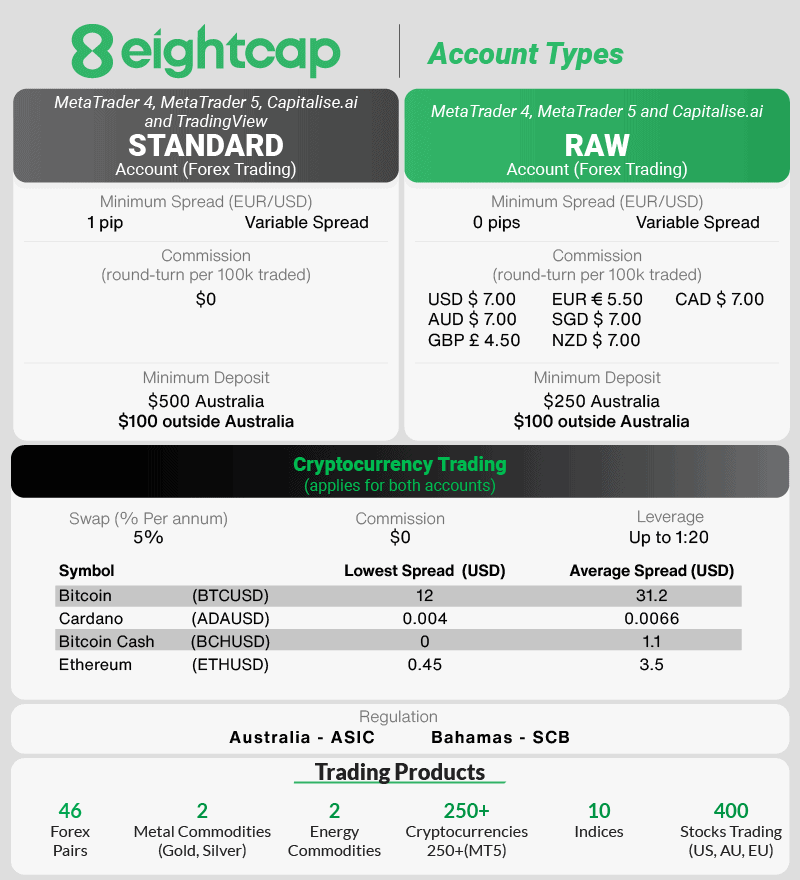

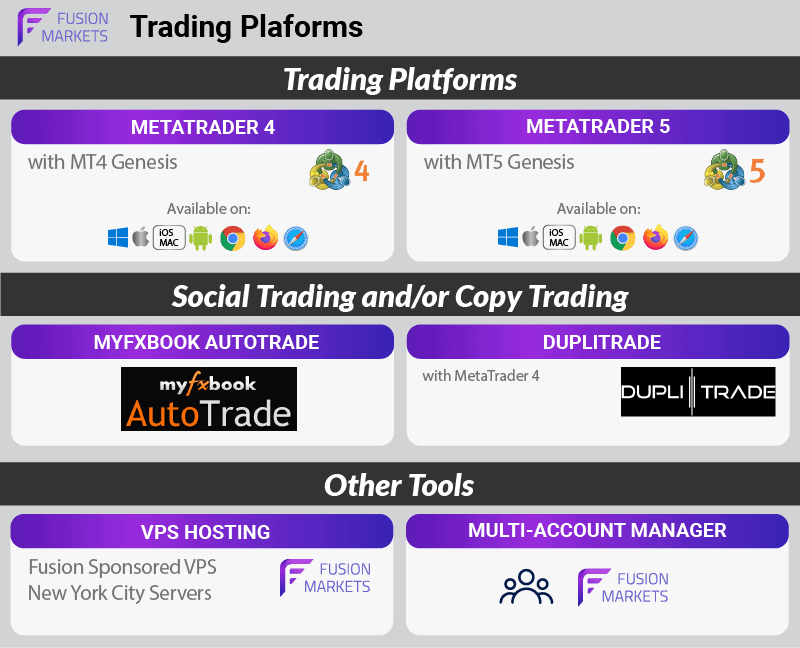

The best automated crypto trading platforms allow you to trade using algorithms such as bots or expert advisors. Trading can be done with a CFD broker or via an exchange. Popular platforms include MetaTrader 4 and captailise.ai

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.