Best Forex Trading App Canada

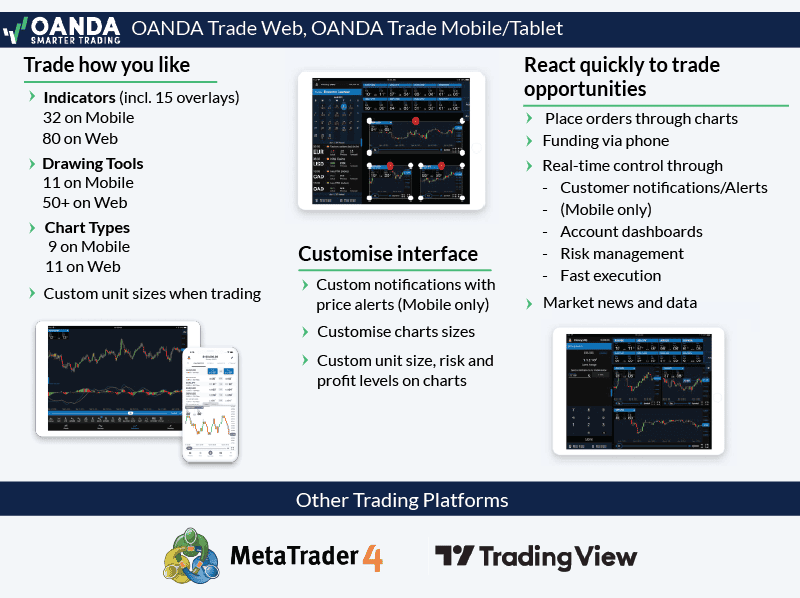

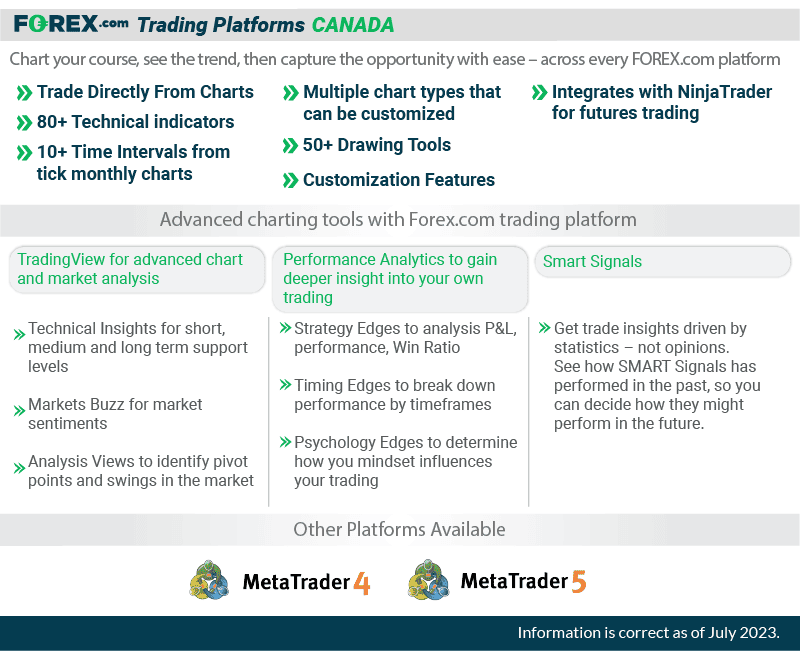

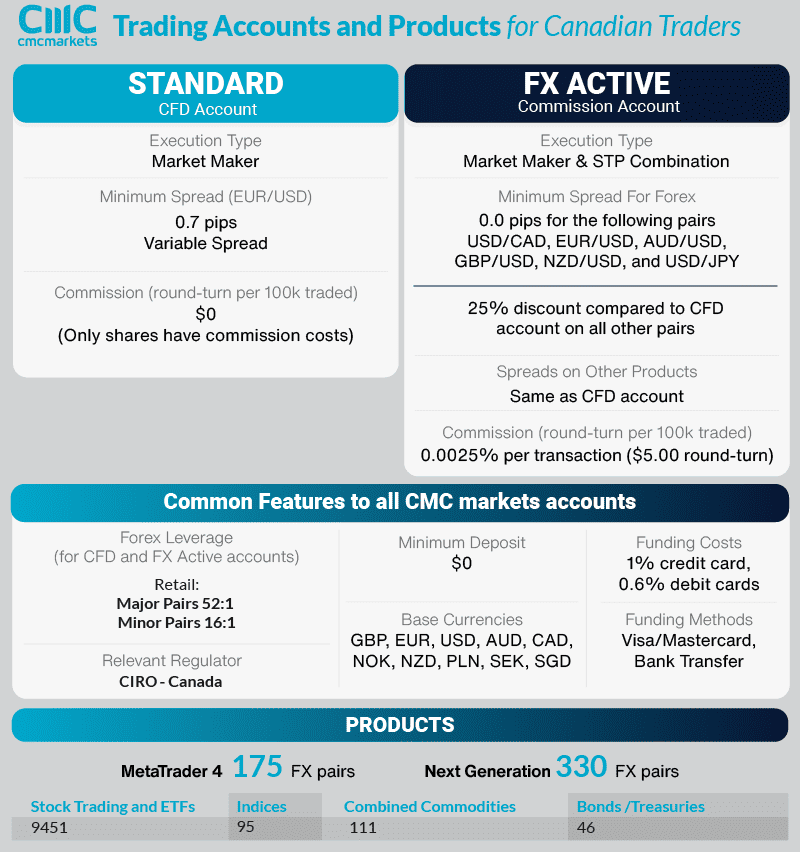

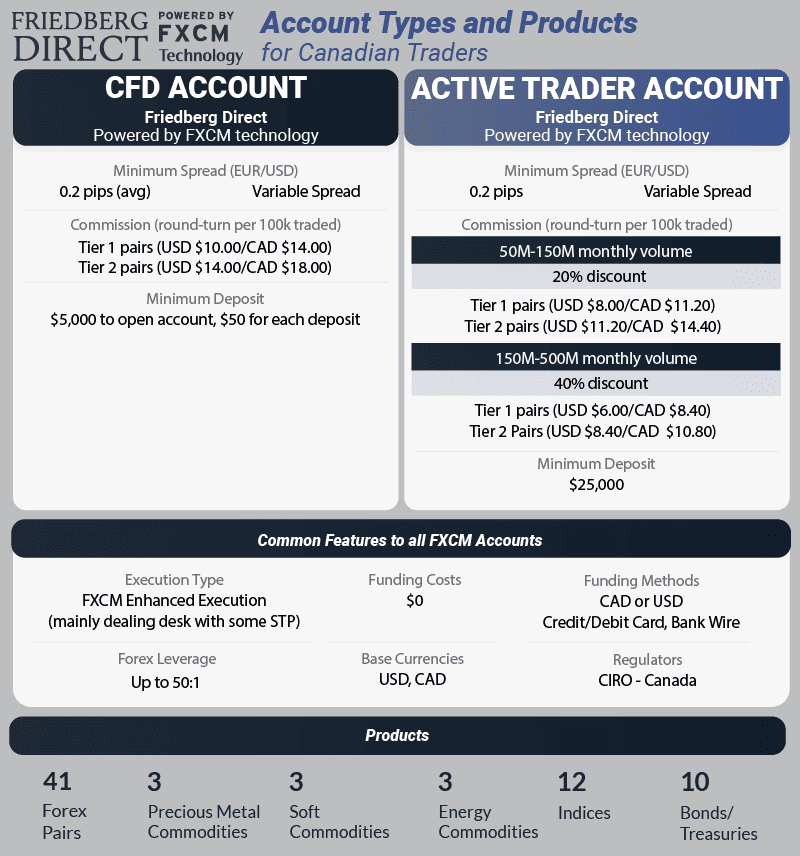

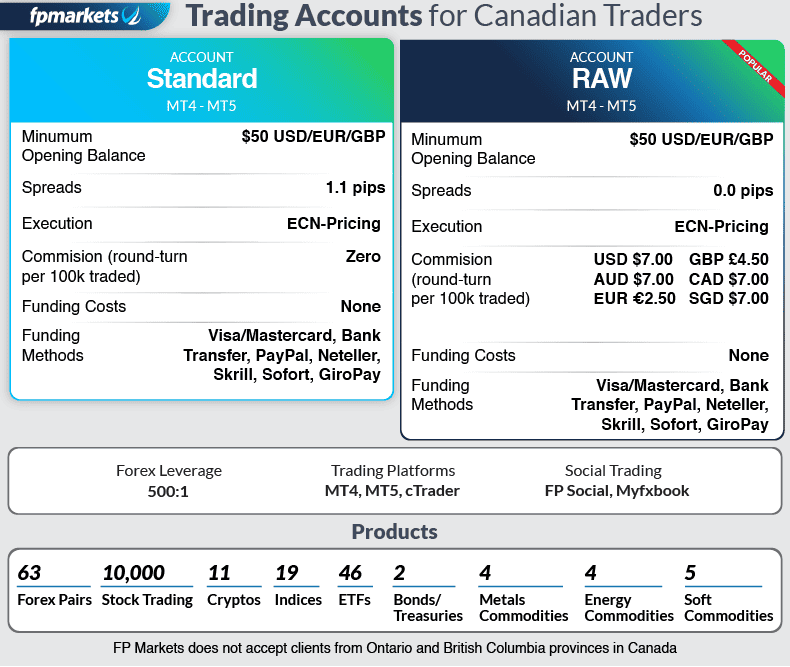

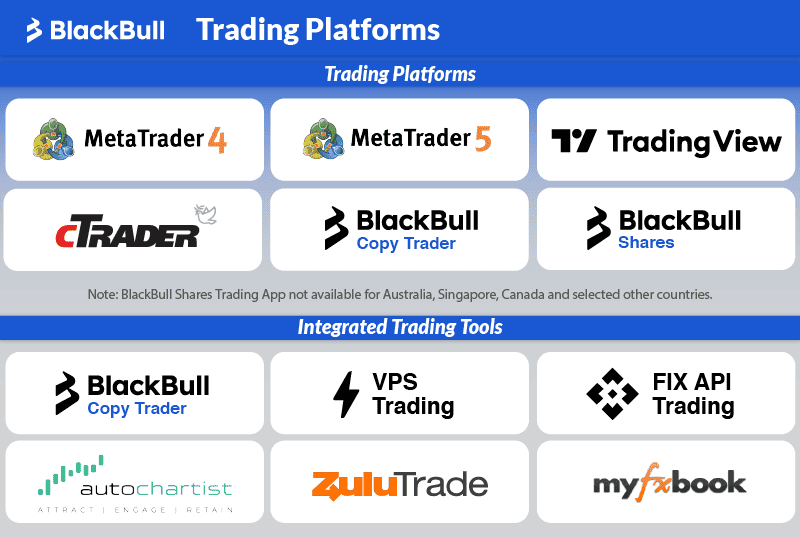

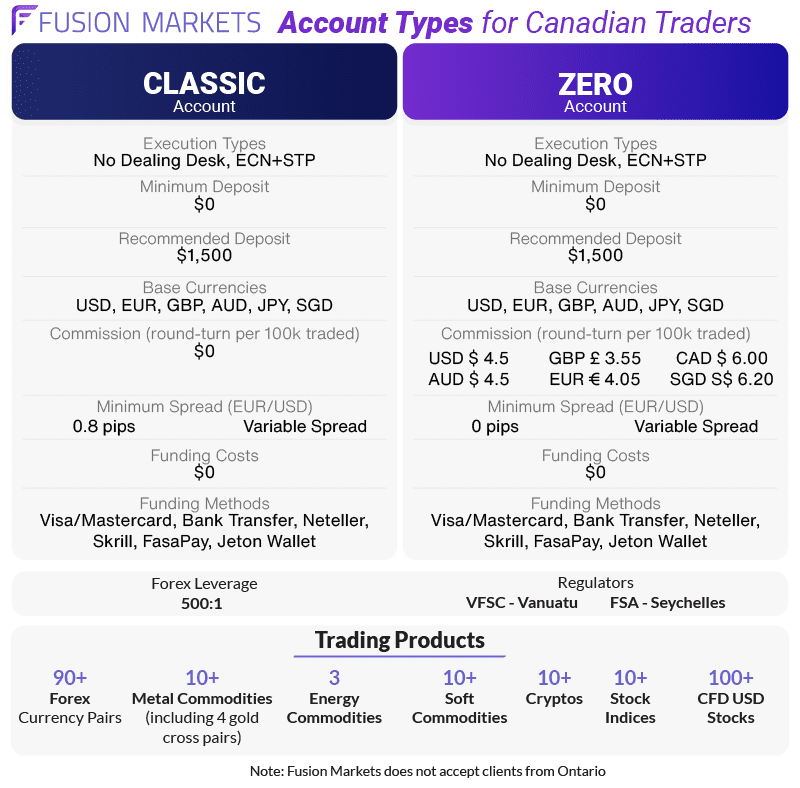

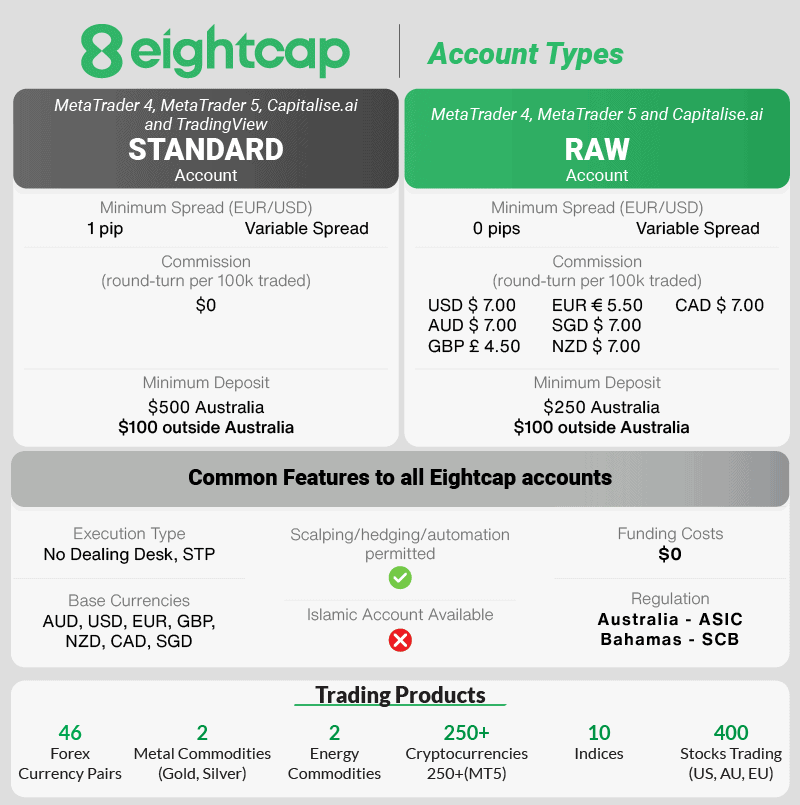

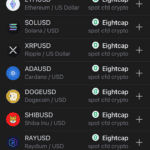

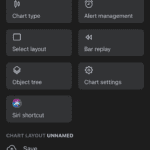

Sometimes you want to trade on the go, so we looked at the best forex trading apps in Canada. For each forex broker, We look at the key features of the mobile trading app platforms they offer along with the trading accounts and costs.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.