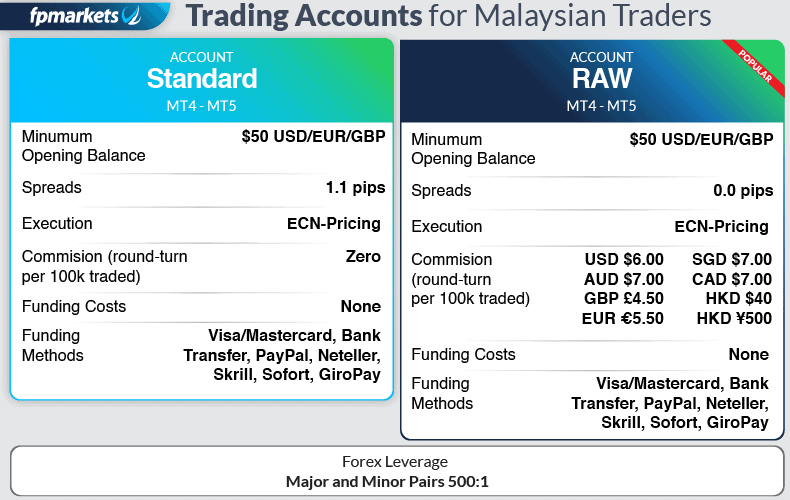

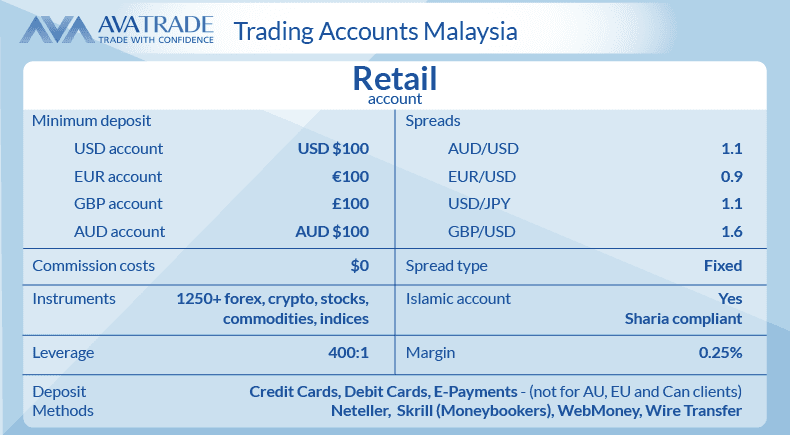

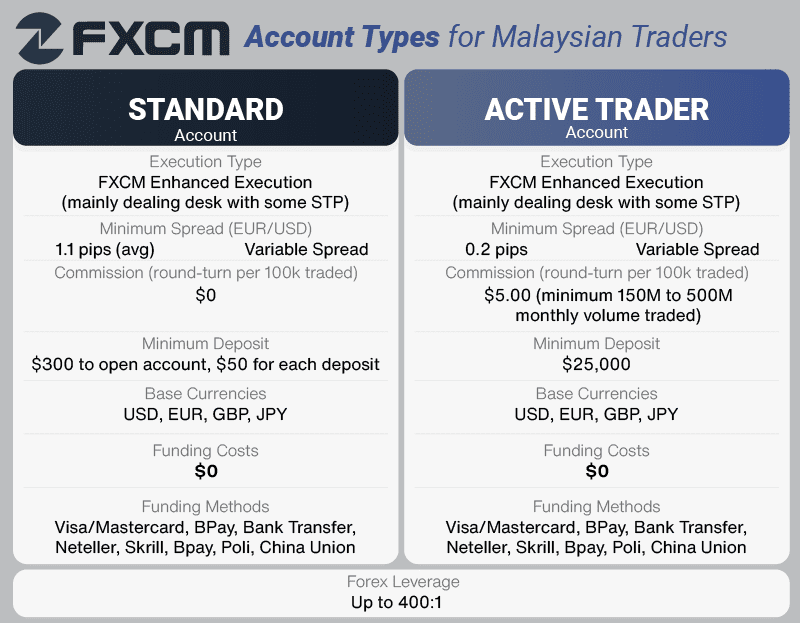

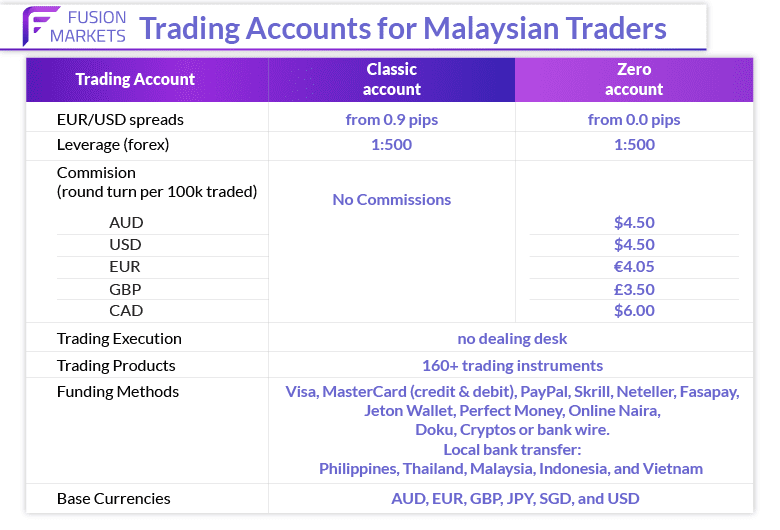

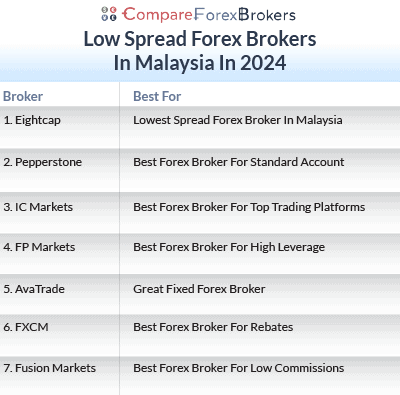

Lowest Spread Forex Broker Malaysia

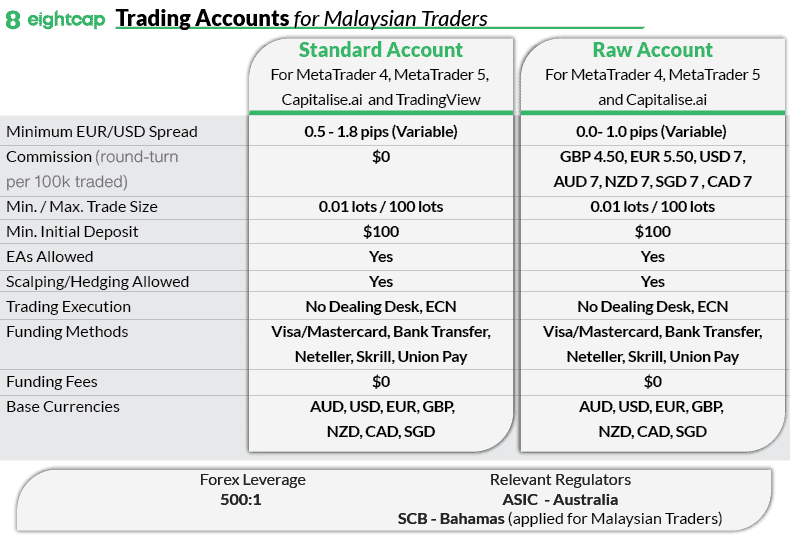

We have compared low-spread forex brokers based on their published average spreads and cross-referenced them with our own spread testing. By combining this data we were able to determine the lowest spread forex broker for Malaysian traders.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert