Contracts for differences (CFDs) and spread betting are derivatives to speculate on price movements of financial markets. While neither leveraged product involves ownership of the underlying instrument, CFDs involve the purchase of a contract while spread betting does not. For this reason, spread betting is more akin to gambling so has no capital gains tax.

On this page, I’ll explain the products, cover their differences with examples and highlight which might be best for you.

| Feature | Spread Betting | CFDs |

|---|---|---|

| Availability to traders | UK and Ireland only | Worldwide (except the US) |

| Tax | No capital gains tax | Pays capital gains tax |

| Base currency of the asset | GBP (UK) & EUR (Ireland) only | The same currency of the CFD |

| Trading structure | Stake size per point | No. of contracts |

| Profit and loss calculation | Calculated with a negotiated dollar rate at time of bet | Owe or owing money at end of trade period |

| Trading costs | Spreads and swap fees | Spreads, commissions, & swap fees |

| Offset taxes with your losses | No | Yes |

| Expiration | Fixed expiry date | Fixed expiry (but can be renewed/extended if both parties agree) |

| Orders | Over the counter via a broker | Directly via the market |

| Trading hours | 24/7 | During market hours |

What Is Spread Betting?

In financial trading, spread betting is a type of derivative that allows you to speculate on the price movements of financial markets with the aim of making a profit without owning the underlying asset. Since there is no exchange of assets or contracts involved, spread betting is considered closer to gambling than trading, meaning there are no taxes on profits and purchases.

Like all derivatives, spread betting allows you to take advantage of rising and falling markets by going long or short on the underlying asset you speculate on. When spread betting, you simply stake how much you want to risk per point of the asset rising or falling. By placing a spread bet on an asset, you can profit (or lose) based on how many points the underlying market has moved in your favour (or against you).

Benefits of Spread Betting

Some of the key benefits of spread betting are:

- No capital gains

- No stamp duty tax

- A wide range of financial and sports markets

- Trading 24 hours a day during the trading week

- Bet using GBP, meaning no currency conversion fees

- Leverage is available

- Commission-free trading

- Can bet on a rising and falling financial market

Example Of A Spread Bet Trade

You can spread bet on a range of markets, and in this example, we will look at how to spread bet on the FTSE 100. After analysing the markets, your technical analysis indicates that the FTSE 100 will reverse and trade lower. To benefit from this analysis, you place a spread bet and sell the FTSE 100 at 7660 with a stake of £50 per point.

A few days later, the FTSE 100 has traded lower in your favour and is at 7600, giving you a 60-point drop. You decided to close the position and take the profit off the table.

In this trade, you made £50 for every 1 point that moved in your favour, and because the markets moved lower by 60 points, you would have made £50 x 60 points. Therefore, you will have made £3,000 profit before costs (like spreads and swaps).

I like the simplicity of spread bet trades because you enter the stake size per point moved, making it easier to understand in my head. Meanwhile, with CFDs, you have to open a number of contracts, which you must then manually calculate the value of each point.

What Is CFD Trading?

A contract for difference (CFD) is a derivative product that lets you speculate on whether an asset’s price will rise or fall in the short term. When CFD trading, you are not purchasing the underlying asset but instead taking out contracts (sold to you by the broker) at a specific price (based on the underlying instrument’s price.

With each CFD, you set the size of the contract and how many units of the underlying asset you want to buy or sell. Each unit is expressed as a lot (which is 100,000) and sometimes as mini lots (10,000) or micro lots (1000).

When closing the trade, you sell the contracts back to the broker. Your profit (or loss) is the difference in price between the open and closed price of the underlying asset, hence the name “contract for difference”.

You can develop trading strategies that include CFDs derived from various asset classes, ranging from forex trading to shares and commodities. Until recently, UK brokers could offer cryptocurrency CFDs like Bitcoin, yet the Financial Conduct Authority (FCA) recently banned retail traders from accessing cryptos due to the high risk and volatility.

Benefits of CFDs

Some of the key benefits of CFD trading are:

- Can write off losses to reduce your capital gains tax liability

- Trade on an extensive range of financial markets without having to own the asset

- Can trading using leverage

- Can go long and short the markets with CFDs

Example Of A CFD Trade

You’ve analysed TESCO (TSCO) and think they could have an uplift in sales in the next quarter. You want to purchase 10,000 shares of TSCO at 200p (£2 per share), which has a nominal value of £20,000. CFDs offer you 1:10 leverage, allowing you to open this betting position using £2,000 in margin.

A couple of weeks pass, and TESCO shares are now worth 240p (£2.40 per share), giving you a 40p profit per share. You are happy with the profit and feel you’ve captured most of the trend, so decide to close the position.

In this example, you have made 40p x 10,000 TESCO shares, which is £4,000 profit. Thanks to leverage, this price movement has had a 200% ROI on your initial investment of £2,000 before costs and taxes.

I think this example also highlights the benefits of CFDs because if you bought the shares outright, you would have had to spend £20,000 to get £4,000 profit, netting a 20% return before paying stamp duty and capital gains tax.

What Are The Similarities Between Spread Betting And CFD Trading

CFDs and spread betting have much in common, so most traders find it challenging to choose whether to trade CFDs or spread bet. Below are the main similarities:

- Leveraged trading

- No stamp duty tax

- A wide range of financial markets

- Both pay and receive dividends (for shares)

- You can go long and short

- No physical ownership of the underlying asset

What Are The Difference Between CFD And Spread Betting

Perhaps the main reason spread betting is a popular alternative to CFD trading is because there are no tax liabilities on profits. With CFDs, you must pay capital gains tax on profits, while spread betting is exempt from this requirement. Conversely, you can offset your losses against taxes with CFDs but not with spread bets.

While the appeal of no capital gains tax when spread betting is the main reason many choose spread betting over CFD trading, other differences are worth noting. One of these (and it’s a subtle one, but one I think is no less crucial if you are a serious trader) is that you trade all assets in GBP with spread betting. This lets you avoid currency fluctuation (aka currency risk) when betting on international financial markets.

For example, if the dollar strengthens against the GBP while I am trading AAPL shares, the value will be lower when converted back to GBP, meaning I’d make less profit. Below is a summary of the main differences:

A second difference is that spread bets have a fixed expiry, unlike CFDs, which can be held indefinitely since they do not expire. The exception to this is CFD futures, and even these can be renewed if both parties agree to this.

Another difference is that spread betting using financial markets is only legally available in the UK and the Republic of Ireland. Financial regulators outside this region do not recognise (or permit) spread betting, while most do recognise CFD trading (except in the US).

The last point of difference I should note is that some of the terminology between CFD trading and spread betting may differ. With a CFD, you speculate on the movement in the price of the underlying financial instrument for a defined contact size (usually done in ‘lots’). At the same time, a spread bet entails betting on a price-per-point basis (i.e. a ‘pip’).

Is spread betting or CFD trading right for me?

By now, you’ll know that there are advantages of spread betting and CFD trading, but if you are undecided, I’ve provided thoughts on what I believe each product is more suitable for:

1. Spread Betting Is Best For Beginners

I think that spread betting is best for beginners because it has the most straightforward execution and management of trading. Understanding how much you will profit or lose through the staking system is easier.

I like how you just put in how much you want to stake for every 1 point the asset moves, which is how much you will profit or lose. Compared with CFDs, you input how many lots you want to trade, which can be confusing if you have just started.

In addition, you don’t have to worry about tax liabilities because spread betting profits are exempt from CGTs. Nor do you have to worry about currency risk when trading international products because you trade all international products in GBP/EUR, protecting you from currency fluctuations.

No matter which product you choose, you can use the same strategies with spread betting and CFDs.

2. CFD Trading Is Best For Tight Spreads

I find that CFDs are best if you prefer to control your trading fees, as you can get much tighter spreads with low commissions by trading CFDs, especially if you are a high-volume trader. Alternatively, if you use Direct Market Access (DMA) to trade order flows, CFDs are the obvious choice, as these are not available with spread betting products.

If you are worried about paying the extra tax, don’t forget you can offset your CFD losses, reducing your tax liability.

Are taxes applied differently for CFDs and Spread Betting?

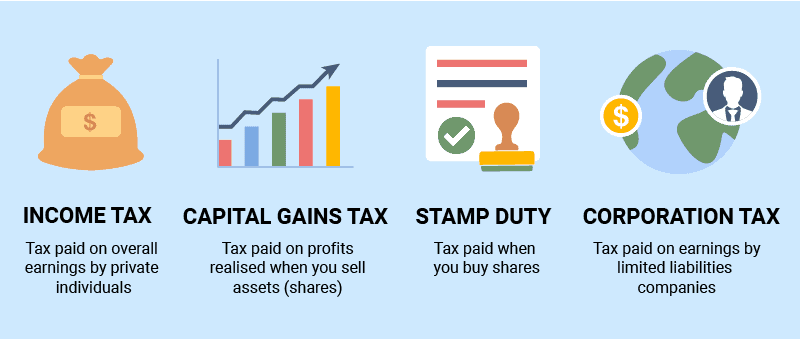

CFDs have capital gains tax applied to the profits, which you will be liable for when completing your tax returns. Depending on your income, you’ll be charged up to 20% of the profits as tax – however, you can offset this liability with your losses.

There is no tax on spread betting because it is classified as a gambling product by the HMRC. Therefore, no capital gains tax will be applied to the winnings, saving you money.

Both CFDs and spread betting are exempt from stamp duty tax, which is paid on any physical investments like gold and unleveraged products like shares.

Which Broker Is Best For Spread Betting?

Most brokers that offer spread betting also offer CFD trading, so you can easily do both. Pepperstone and OANDA are good spread betting brokers to consider, as they offer a large range of financial products with tight spreads.

FAQ

Are CFD Trading And Spread Betting The Same Thing?

CFDs and spread betting products are both derivatives that allow you to speculate on the financial markets but have different benefits. CFDs are accepted in many countries, with the USA being a notable exception, while spread betting is only available in the United Kingdom. Spread betting lowers trading fees for successful bettors as you do not pay capital gains tax.

Is It Better To Spread Bet Or CFDs?

Spread betting can be a better choice due to its tax exemptions and staking in GBP, helping reduce overall trading costs. CFDs are a good alternative as some brokers offer zero-spread trading accounts with small commissions, making it cheaper to enter a trade, you can also declare tax losses should you need to.

Are CFDs or Spread Betting Riskier?

Both CFDs and spread betting risks are the same; however, I can argue that CFDs are slightly riskier if you trade international and currency markets. This is because you are exposed to currency price fluctuations that could negatively impact your profit and loss when converting back to your base currency.

Does Leverage Work Differently In Spread Betting And CFDs?

No, leverage works exactly the same for both spread betting and CFD trading. Most spread betting companies offer CFD accounts and share the same maximum leverage (up to 1:30) and margin rate (the minimum margin required to open a betting position).

Can I Use A Stop Loss In Spread Betting And CFB Trading?

Yes, you can use a stop loss in spread betting and CFD trading; these are market orders given to the broker to execute, independent from spread betting and CFDs. You’ll find stop losses available on all spread betting platforms.

What Are DFBs?

DFBs is an abbreviation for Daily Funded Bets and is the more popular type of spread bet available. It’s called a daily funded bet because the product is rolled over each night, and interest is charged. DFBs are typically used for short-term trades with lower spreads but higher rollover fees. If you want to trade longer periods, you can bet the quarterly or forward bets with wider spreads but cheaper rollover fees.

Why Do Spread Betting And CFD Forex Prices Look Different?

Depending on what broker you bet with, the prices may look different to make it easier to read the prices. CFDs are priced just like the underlying assets you are trading, so forex CFDs are quoted in the same pricing structure (1.0500), while spread betting may be displayed as 10500. These are the same prices, but the spread betting price is displayed in points vs actual price to help see price-per-point movements.

To learn more about how spread betting works, you should check out my spread betting guide.

Can I Use The Same Strategies For Spread Betting And CFD Trading?

Yes, you can use the same spread betting strategies with CFD trading. The difference may be the price feed is slightly different because the spreads charged by the broker could be wider on CFDs, meaning entry prices would slightly differ.

Key Learnings From This Page

- You will have learned the difference between CFDs and financial spread betting, understanding which may be most suitable for you.

- Understand what spread betting is, its tax benefits, and its risks.

- You’ll have learned what CFD trading is and its risks

- Developed an understanding of risk management strategies you can use for both derivatives.

Ask an Expert