This guide focuses on what matters most to you as a Singapore-based trader: what is Forex, currency, market hours, broker selection, platform tools, and the regulatory framework.

A quick look at the basics – What is Forex and why you might want to try it

Before you start trading, you will obviously need to educate on all things related to Forex. While it might be tempting to throw yourself right in, this is a sure way to lose money quickly. For this reason it is wise to invest time learning Forex and practicing with a demo account, these accounts use virtual funds so you don’t need to risk your own funds).

To get you started and to make the process less overwhelming, I have covered some of the basics.

Forex, short for foreign exchange, is the global market for trading currencies through specialised brokers. Every trade involves two currencies, one bought, one sold, and your profit or loss comes from how their exchange rate changes over time.

When you open a forex position, you’re speculating on how one currency will perform against another. The goal isn’t to own the currencies themselves but to capture price movements, often over short time frames. If you can correctly predict the price movement and sell at the right time, you can make profits.

Most forex brokers today offer access through CFDs (Contracts for Difference). With CFDs, you don’t take delivery of any currency. Instead, you agree to exchange the price difference between the point you enter and exit the trade. This flexibility allows you to profit whether the market rises or falls, depending on your position.

CFD trading also involves leverage, which lets you control larger positions with a smaller deposit. For example, with 20:1 leverage, the typical retail limit under MAS regulation, a 500 SGD margin gives you control of a 10,000 SGD position. It’s a powerful tool, but it also means losses can grow just as quickly as gains.

Before comparing brokers, it helps to know the key terms you’ll see on every platform:

- Spread: The small gap between the buy (ask) and sell (bid) prices — your immediate trading cost.

- Pip: The smallest unit of price movement, usually the fourth decimal place in a forex quote.

- Lot: The standard trade size; one lot equals 100,000 units of the base currency. Some brokers also offer mini or micro lots for smaller trades.

- Bid/Ask: The bid is what buyers are prepared to pay, while the ask is what sellers are offering.

- Base/Quote: In a pair like EUR/USD, the base is EUR and the quote is USD — showing how much of the quote you need for one unit of the base.

- Commission: Some brokers charge a set fee per trade; others include it in the spread.

- Leverage: Allows you to open larger positions than your capital would otherwise permit — but also increases potential losses.

Singapore-based brokers and global firms serving local clients typically offer the same trading structure, just under MAS regulation for client protection. On CompareForexBrokers, you’ll find detailed comparisons of spreads, commissions, leverage policies, and trading platforms to help you choose the best fit for your strategy.

Singapore’s Forex Market at a Glance

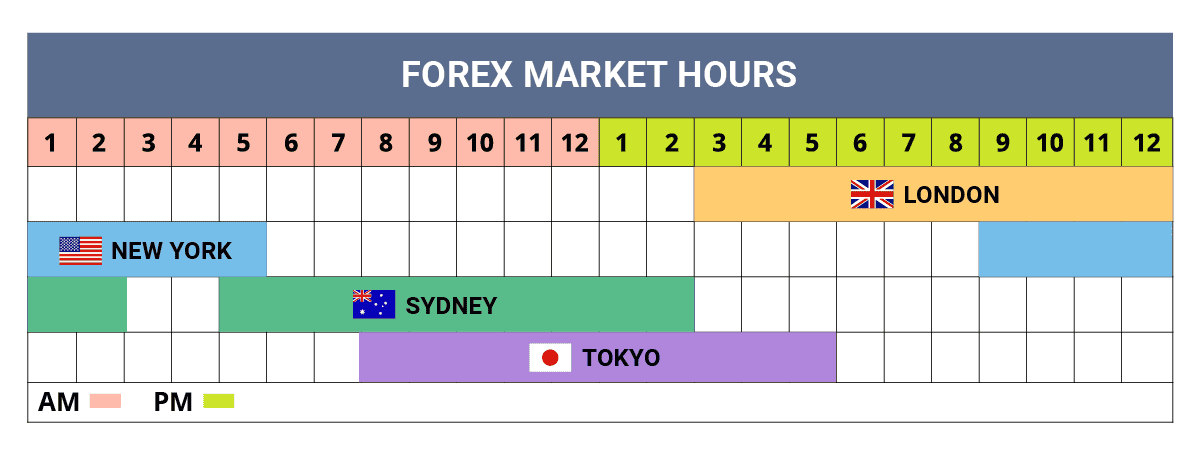

Forex trading in Singapore is highly liquid. The market operates during overlapping Asian and European sessions, meaning liquidity peaks between 8 a.m. and 11 a.m. Singapore time and again around 3 p.m. when London opens. The global forex market runs across four main trading centres: Sydney, Tokyo, London, and New York, each opening at different times. Because these sessions overlap, you can trade virtually any hour of the working week.

Compared to other Asia-Pacific hubs, Singapore is one of the top three global forex centres by volume, behind London and New York. That gives you access to tight spreads, deep liquidity, and smooth order execution.

Choosing Brokers and Platforms

When selecting a broker in Singapore, regulation is your first checkpoint. Strictly speaking brokers must be licensed by the Monetary Authority of Singapore (MAS) to accept clients from Singapore.

Other factors you should check include:

- Account currency: SGD is preferred to avoid conversion fees.

- Spreads (and commissions if applicable) – How much you will pay to trade. Lower spreads and costs will increase your profits

- Available trading product – You want to be sure the broker actually offers the financial instruments you want to trade

- Execution type: ECN or STP models often deliver faster fills.

- Platform options: Most brokers support MetaTrader 5, MetaTrader 4, cTrader, or proprietary systems.

- Support and localisation: Customer service in English with regional responsiveness improves your trading experience.

Platform Trends and Tools

To carry out your trades, you will need software known as a trading platform. When it comes to trading forex and other types of CFDs products, there are 4 mainstream platforms to choose from – these are MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView and cTrader.

While all four are excellent platforms, each has its own strengths and weaknesses. MT4 and MT5 are great for automation (using expert advisors), TradingView is best for chart trading and cTrader is great ECN and scalp trading.

Features to look for in platforms include copy or social trading capability, automation capability, range of charts and technical indicators, pending order types and risk management tools.

Web-based platforms are growing in popularity, offering instant access without installation. These are convenient for traders who move between devices or trade from different locations.

Mobile trading adoption exceeds 70% among Singapore-based clients. Ensure any broker’s app provides full functionality, not limited features, including charting and order types.

Copy trading and social trading platforms are permitted under MAS rules, provided clear risk disclosures are given. I track these developments to show which platforms deliver real trading value.

Regulation and Client Protection

In Singapore, the Monetary Authority of Singapore (MAS) regulates forex and CFD trading. Brokers offering leveraged products to retail clients must hold a Capital Markets Services (CMS) licence under the Securities and Futures Act.

MAS requires that client funds are held in segregated accounts, separate from the broker’s operational capital, ensuring your deposits remain protected. Brokers must also provide clear risk disclosures and conduct suitability checks before offering leveraged products.

As a trader in Singapore, you should trade with a MAS regulated broker. Using a MAS regulated broker the regulator can help you if you have a dispute with the broker.

Retail leverage when trading Forex is generally capped at around 20:1 for major currency pairs, though limits vary by broker and product. Professional clients may be offered higher leverage, but with reduced regulatory protections compared to retail clients.

All MAS-regulated brokers are subject to ongoing supervision, including audits, reporting obligations, and advertising oversight, creating a secure trading environment for Singapore residents.

While MAS regulated brokers are the preferred choice, some traders may prefer an offshore broker. While these brokers offering is generally the same, they may have other features like higher leverage, different funding methods (like crypto) or different products. If you go down this path, make sure you understand any risks involved and definitely don’t choose an unregulated broker.

Risk Management and Tax Considerations

Trading forex carries risk, and leverage can amplify both gains and losses. I advise keeping leverage moderate and using stop-loss orders to protect capital.

Singapore does not tax retail forex capital gains. However, if trading is considered a business activity, the Inland Revenue Authority of Singapore (IRAS) may treat gains differently. Keep accurate records and check with a professional if your activity is high-volume.

MAS ensures brokers comply with anti-money laundering rules, conduct audits, and maintain transparency. You will be asked to verify identity and residence, standard in Singapore-regulated accounts.

Trading Products

While this website is mostly focused on Forex trading with CFDs, there are other Financial instruments you can trade CFDs with. Trading a range of CFDs is a good way to diversify your portfolio.

CFDs (Contracts for Difference): instruments that let you trade price movements without owning the asset. You can go long or short, use leverage, and access multiple global markets.

Forex CFDs cover major, minor, and exotic pairs, including USD/SGD and EUR/SGD, offering deep liquidity and tight spreads.

Share CFDs track listed companies, while Index CFDs follow benchmarks such as the S&P 500, FTSE 100, and ASX 200.

Commodity CFDs include hard assets like gold, silver, and oil, plus soft commodities such as coffee and wheat. Some brokers also offer Bond and Crypto CFDs, expanding your options for variety.

Indices and ETFs are like a grouping or basket of shares often based on a theme. The idea is to diversity so that if some shares go down, they are balanced with other shares going up.

Cryptocurrencies are possibly the most volatile of all the CFD products you can trade. While definitely risky, they are also a way to make quick profits if you can stomach the volatility.

Other products you will commonly see with online brokers include bonds, treasuries, options, futures and sometimes binaries.

CompareForexBrokers.com Services

CompareForexBrokers simplifies your broker selection. You’ll find:

- Broker reviews tested and verified for Singapore residents.

- Comparison tables highlighting spreads, account currency, platform features, and MAS/EU regulation.

- Platform analysis for MetaTrader 5, cTrader, and proprietary platforms.

- Listicles such as “Best Brokers for Singapore-Based Traders” and “Top Platforms for SGD Accounts in 2026.”

I update the data regularly so you can rely on accurate spreads, platform performance, and regulation information when making your choice.

Next Steps

Singapore provides a stable, well-regulated environment for forex and CFD trading. MAS oversight ensures protection, segregation of funds, and transparent trading conditions.

Choose a broker with verified regulation, low spreads and, reliable execution, and a platform that suits your trading style.

My role at CompareForexBrokers is to help you evaluate these brokers efficiently, compare platforms, and make informed decisions. When ready, explore the Singapore section for broker reviews, comparisons, and platform analyses designed to support you.

Ask an Expert

I usually use MT4, but just thinking — any of these brokers got platforms with better charting or maybe some risk tools built in?

MT4 is a solid choice because of its versatility. That said, if you want something more visually appealing with better technical analysis, I’d recommend trying TradingView on OANDA.

What’s the smartest way to size my trades so I don’t lose too much if things go wrong?

Risk only 1–2% of your account per trade, set a stop-loss first, then size your position so a loss only costs that fixed amount.

That way, no single trade can wipe you out.