Octa Review in 2025

I opened an Octa trading account and tested the broker’s spreads, trading conditions, and platforms to see how they performed against 20 other brokers. In this Octa Review, I’ll go through my findings helping you decide if Octa is a broker you should consider.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Octa Summary

| 🗺️ Regulation | CySEC (EU only), FSCA, FSC, MISA (non EU) |

| 📊 Trading Platforms | MT4, MT5, OctaTrader |

| 💰 Minimum Deposit | $50 |

| 💰 Deposit/Withdrawal Fees | $0 |

| 🎮 Demo Account | Yes |

| 🛍️ Instruments Offered | CFDs (Forex, Indices, Metals, Energies) |

| 💳 Funding Methods | Visa, Mastercard, Skrill, Neteller, Crypto |

Why Choose Octa

I think Octa is a solid option as it provides excellent features that I think will appeal to a variety of traders. Firstly, Octa uses ECN technology so you get excellent execution speeds with tight spreads of 0.90 pips and is commission-free, which is rare for ECN brokers.

The other feature I liked was that you do not pay swap fees on your CFD positions, saving you money should you keep your trades open longer than 24 hours. This makes Octa an attractive option for stock trading CFDs as you won’t need to worry about swap fees cancelling any day’s profits, so you can keep the positions open.

Octa Pros and Cons

- No swap fees on any trading account

- Tight spreads from 0.90 pips

- ECN/STP broker

- OctaTrader has technical analysis services

- Limited range of financial markets

- Can only trade share CFDs on MetaTrader 5

- No guaranteed stop-loss order

The overall rating is based on review by our experts

Trading Fees

As an ECN (Electronic Communications Network) broker, Octa delivers tight spreads and fast execution speed by matching your order with the best offer from another trader on the network. This plays well into your hands as you will always receive the best available price from the network, leading to cheaper trading fees and better profit potential.

Spreads

Unlike most ECN brokers, Octa only provides spread-only Standard accounts (i.e. a commission-free account).

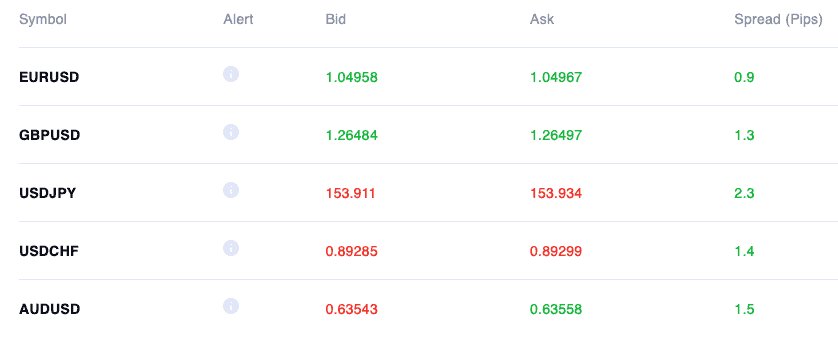

I opened an MT5 Trading Account to test the broker’s trading conditions and I was impressed with the spreads Octa supplied. The broker offers EUR/USD from 0.90 pips which is some of the tightest spreads for a Standard account I’ve tested.

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

0.90 | 1.70 | 1.60 | 1.40 | 2.30 |

|

0.82 | 0.83 | 1.27 | 1.03 | 0.94 |

|

1.20 | 1.40 | 1.40 | 1.50 | 1.40 |

|

0.80 | 0.90 | 1.20 | 1.20 | 1.30 |

|

1.20 | 0.90 | 1.50 | 1.80 | 1.80 |

|

1.50 | 1.50 | 1.60 | 1.80 | 1.80 |

|

0.90 | 1.54 | 1.52 | 1.78 | 1.90 |

|

1.20 | 1.30 | 1.20 | 1.30 | 1.30 |

|

1.70 | 1.60 | 1.70 | 2.00 | 1.60 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

The spreads on the MT5 account were stable in my tests during the New York and Asian trading sessions. While monitoring the spreads the broker’s EUR/USD spread fluctuated between 0.80 and 0.90, which is slightly more than the minimum advertised.

Even at 0.90 pips, I found it’s roughly 18% cheaper than my industry average tests of 1.11 pips for EUR/USD, positioning Octa as a low-spread broker.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| Octa Average Spread | 0.9 | 1.8 | 1.2 | 1.5 | 1.9 | 1.7 | 1.9 | 2.3 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

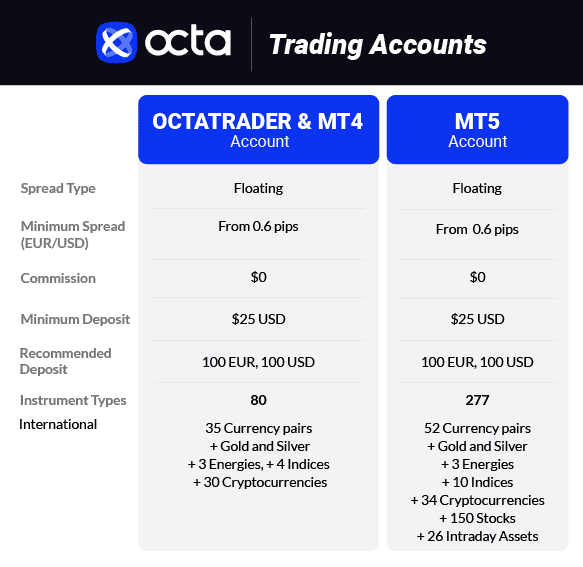

Account Comparison

When choosing my account the broker offers three options which are essentially the same Standard account but used for different trading platforms. Below I’ve included a comparison of each trading account.

| Feature | OctaTrader | MetaTrader 5 | MetaTrader 4 |

|---|---|---|---|

| Spread from | 0.6 pips | 0.6 pips | 0.6 pips |

| Spread Type | Variable spreads | Variable spreads | Variable spreads |

| Trading Commission | $0 | $0 | $0 |

| Deposit/Withdrawal Fees | No deposit or withdrawal fees | No deposit or withdrawal fees | No deposit or withdrawal fees |

| Min Deposit | $25 | $25 | $25 |

| Financial Instruments | 80 | 277 | 80 |

| Currency Pairs | 35 | 52 | 35 |

| Gold and Silver | Yes | Yes | Yes |

| Energies | 3 | 3 | 3 |

| Indices | 10 | 10 | 6 |

| Cryptocurrencies | 30 | 34 | 34 |

| Stocks | 0 | 150 | 0 |

As you can see from the above table all the accounts offer the same regarding trading costs, the only difference is the trading platform. If you want to trade all markets Octa provides, I found your only option is the MetaTrader 5 account.

If you want to see how Octa’s spreads compete with other Malaysian brokers, I created a simple trading cost tool that you can use. Check out the tool below to compare the brokers with Octa.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Swap-Free Account Fees

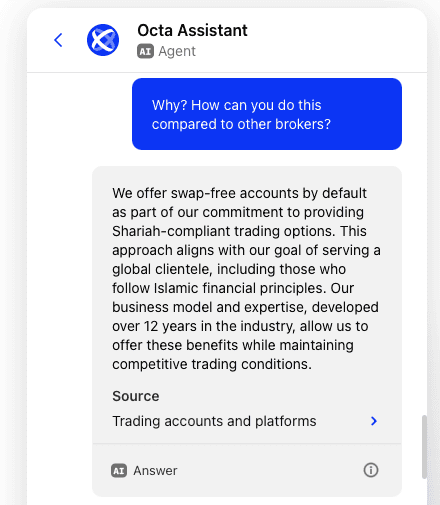

One of Octa’s impressive features I found was the no swap fees on all of its accounts. This means you can hold CFD positions overnight without being charged interest or fees like non-Islamic accounts do, making the broker a solid pick if you trade stocks.

This is the first time I’ve seen swap-free accounts for all traders, regardless of location and beliefs, making Octa a truly low-cost broker by avoiding these fees.

I was curious to know why they offer this as other brokers are not so generous when it comes to absorbing the swap costs. Octa said that offering swap-free accounts aligns with its business goal of serving a global clientele.

Its worth commenting that unlike other brokers which have swap-free trading, Octa does not

- Replace the swaps with an admin fee,

- Widen the spread

- Restrict the length of time you can hold a swap-free position open

- Limit the products available as swap-free

In this sense, Octa offers swap-free trading in its purest form.

My Verdict on Octa’s Trading Fees

During my tests, I felt that Octa provided stable spreads ranging from 0.80-0.90 pips on EUR/USD through its ECN service with the benefit of being commission-free.

The big takeaway from my time with Octa is that it doesn’t charge swap fees on any of its accounts which are usually reserved for swap-free Islamic trading accounts. Not only does this reduce your trading costs for longer-term positions but it won’t force you to close a position before being charged a swap.

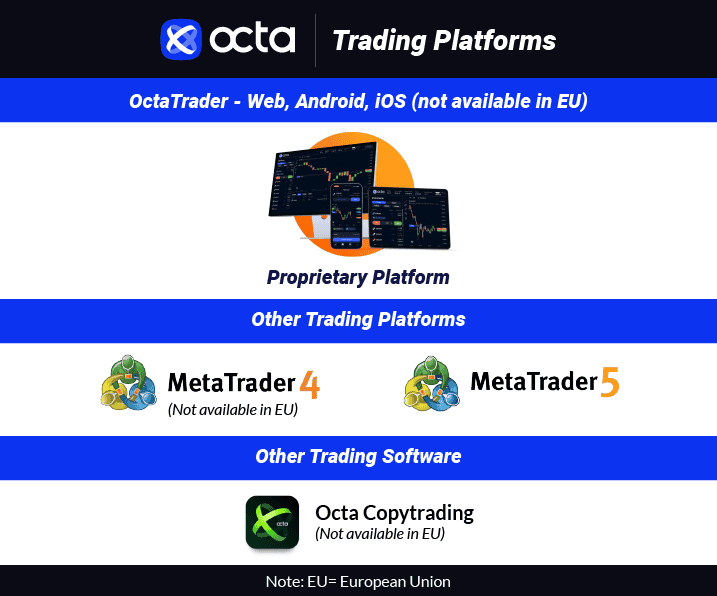

Trading Platforms

MetaTrader 5, and OctaTrader giving you a decent choice for personalising the way you can trade with the broker.

In addition to traditional platforms, I did find that copy trading is available through the Octa Copy platform giving you an alternative approach to leveraged products like forex and gold.

You can open a demo account with unlimited funds and no expiration giving you ample time to test each platform to see which suits you best. The demo account provides real-time price feeds like a live account but gives you virtual funds to trade in a risk-free environment.

Out of the options available, I think MT5 is the best option with Octa as it has the most technical features while also offering all of the broker’s financial products.

| Trading Plaform | Available With Octa |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

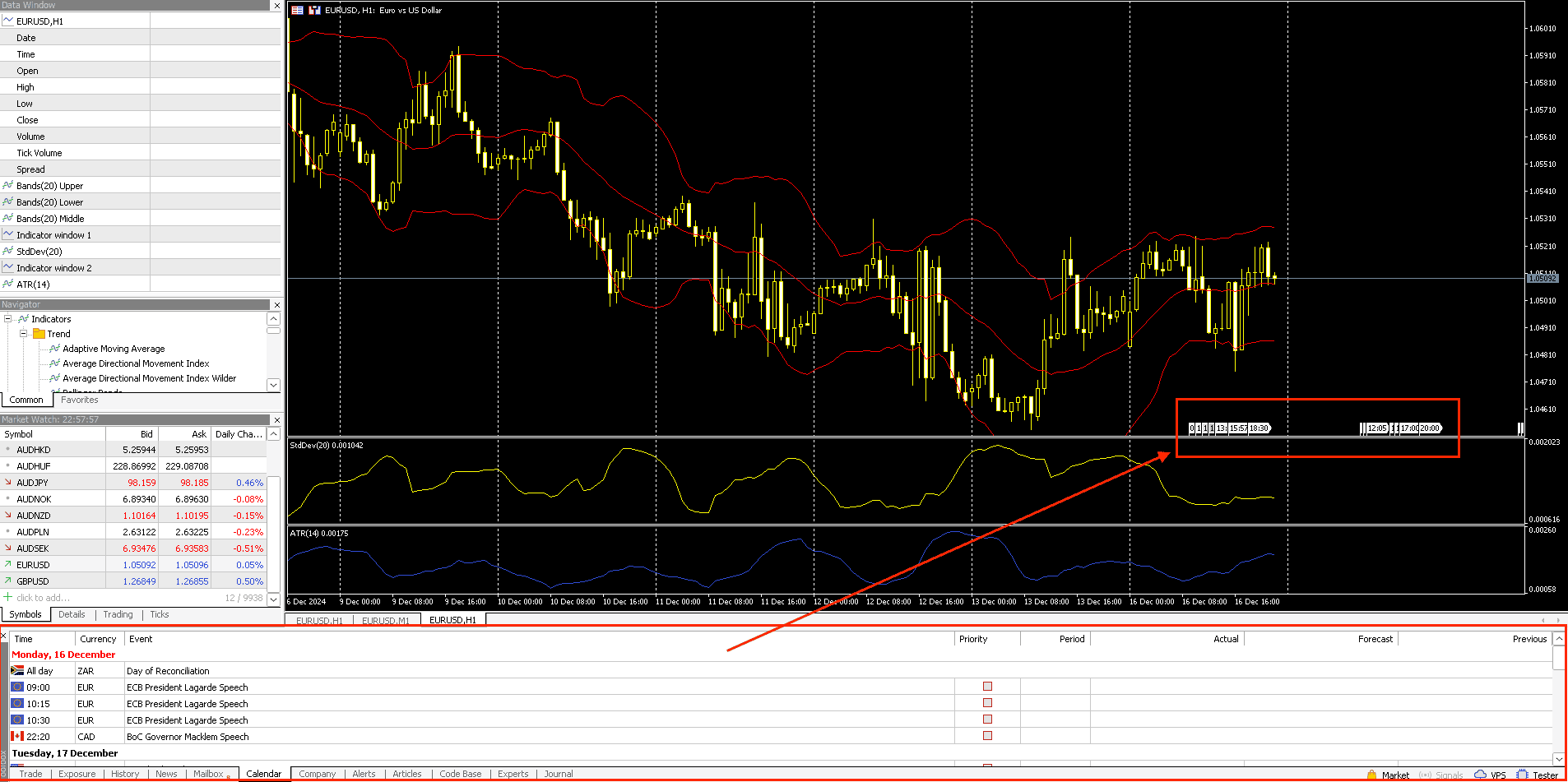

MetaTrader 4

It’s good to see Octa offer MetaTrader 4 as it is one of the most recognised trading platforms for retail forex traders in Malaysia thanks to its advanced charting tools. I like that out of the box you have access to 30+ technical indicators from moving averages to Bollinger bands and 24 analytical objects making on-chart technical analysis simple.

I find MT4 makes it easy to customise your charts with 9-time frames from day to tick charts and 3 chart types including bar, candlestick and line. This lets you adapt your charts depending on your strategy, whether you use multi-time frame analysis or are a scalper with tick charts you’ll find it easy to switch on MT4.

MetaTrader 4 is a great option if you use custom indicators or strategies as it provides the MQL4 library which you can use to create bespoke strategies. If you lack the programming skills, the MetaQuotes Marketplace provides a library of 10,000+ custom indicators from the MT4 community you can use.

One of the key highlights for MetaTrader 4 I like is the option to automate your trades using Expert Advisors (EAs) which is allowed on your Octa account. You can develop EAs to 100% automate your strategy from analysis to execution, or set up risk management EAs to manage your risk on open positions automatically.

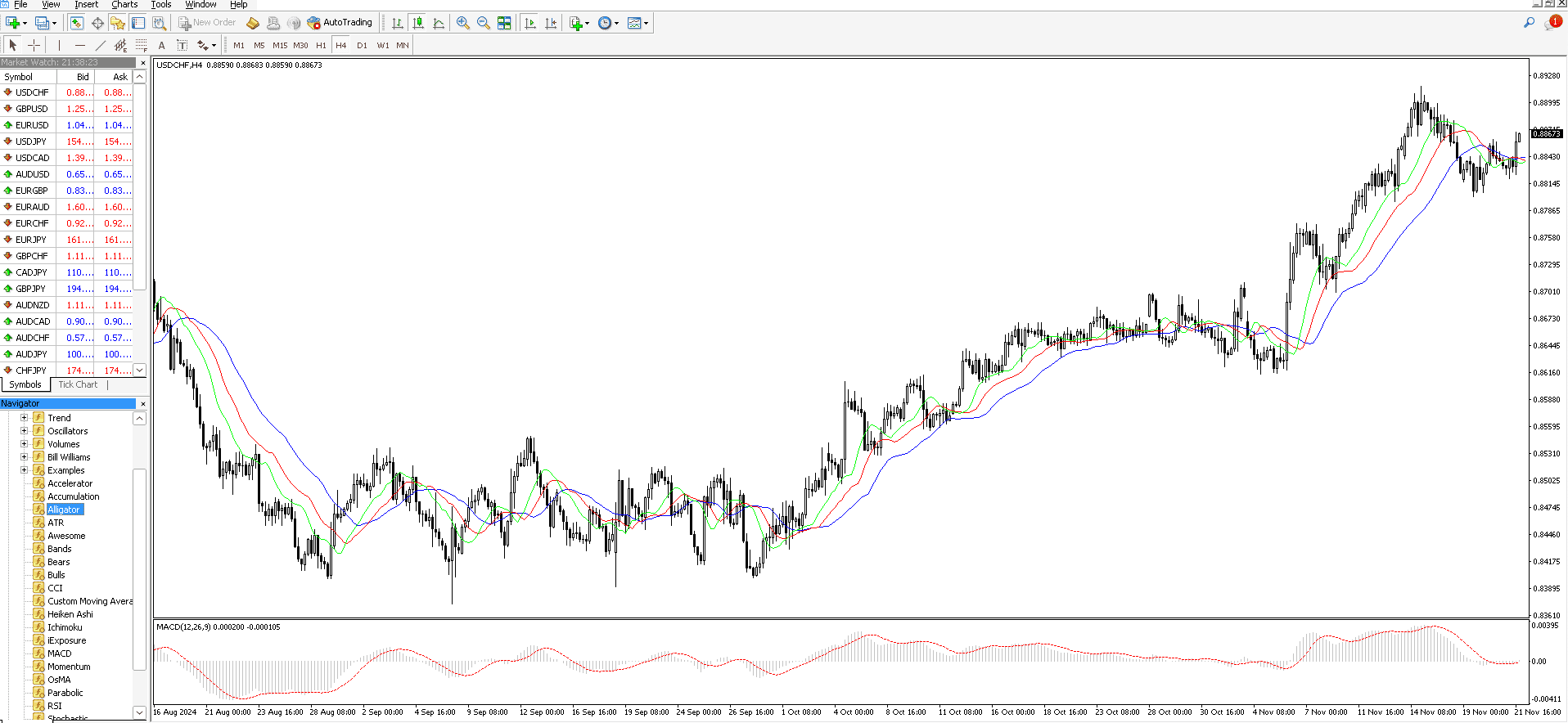

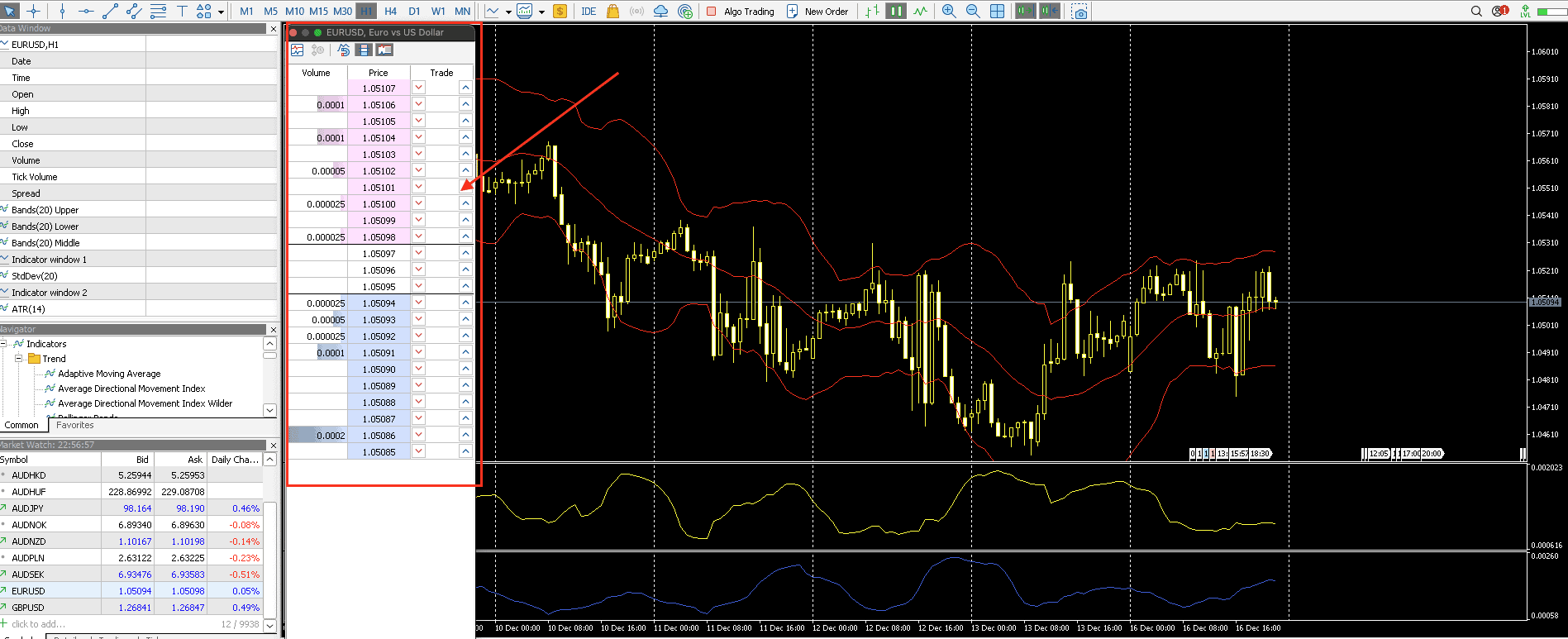

MetaTrader 5

Out of the platforms available, I believe MT5 is your best option overall as it allows you to trade all asset classes and improves on the features of the MT4. For example, the MT5 is faster thanks to being rebuilt using 64-bit architecture which means your execution times and price feeds are faster, and now allows you to trade stocks.

The platform also has 38+ indicators featuring Ichimoku and RSI, while increasing the number of timeframes to 21 for better customisation. Additionally, you have excellent drawing tools for price action analysis like Fibonacci or Gann tools which I couldn’t find on the OctaTrader platform.

With Octa being an ECN broker, I found MetaTrader 5 can utilise its advanced features like depth of markets tool for you to analyse market order flow. This is a great tool if you scalp or day trade as you can use the data to find hidden support or resistance while helping you spot breakout trading opportunities.

Another decent addition I found on MT5 is the native economic calendar which shows the times of upcoming economic announcements that can impact your trades. I like that it updates in real-time and displays on your charts which I found useful to avoid opening trades during high-impact announcements like US GDP or Non-farm Payrolls.

Amongst the new features and platform improvements, you can still automate your trades with MetaTrader 5 and Expert Advisors. If you are interested in automating share CFDs, MT5 is the only platform on Octa to provide this.

If you’re unsure which platform is for you, I’ve created this 5-step questionnaire that will match your answers to help find the best forex trading platform for your trading style.

OctaTrader

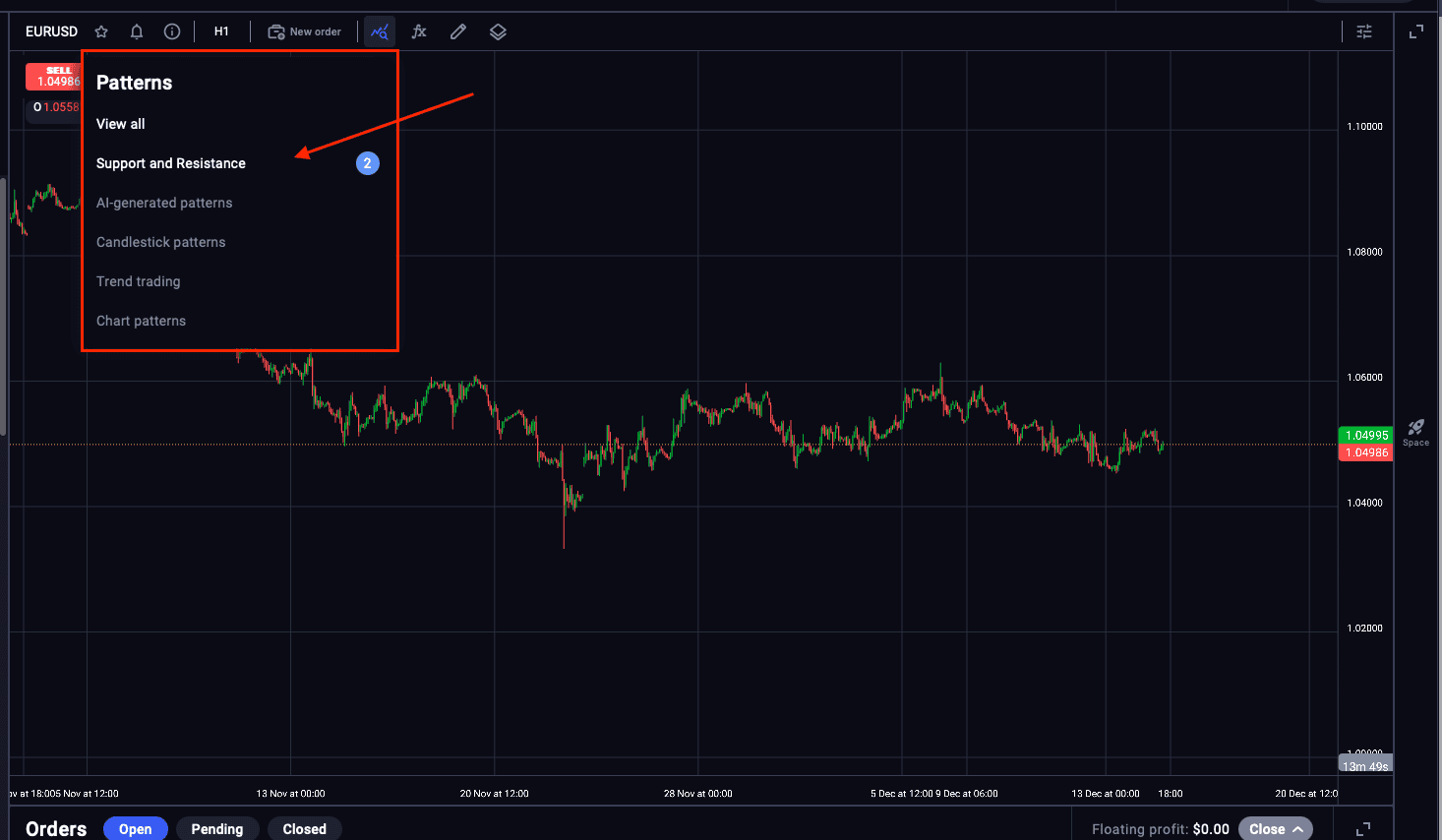

OctaTrader is the most basic option but best for beginners out of the three platforms in my opinion with an attractive user interface. In particular, it has a Pattern tool that lets you apply a variety of technical analysis on your charts automatically which is useful if you are new to forex trading.

The OctaTrader has the least options for technical analysis too with 19 indicators, 11 drawing tools, and 7 timeframes. However, after testing I found the platform covered the top indicators like volume and moving averages along with Fibonacci retracement tools.

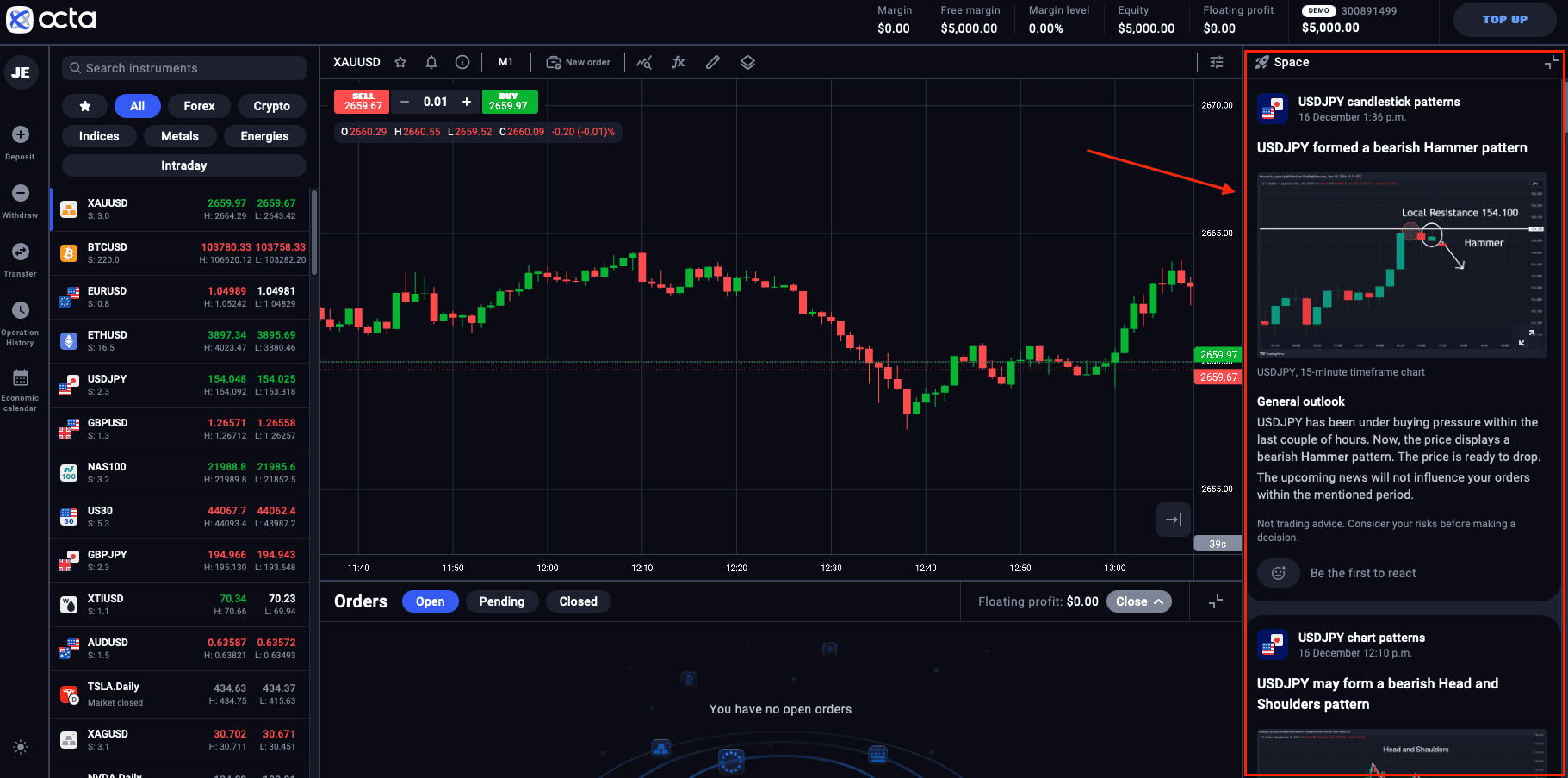

I also found an interesting feature called Spaces where you can customise an area with trading alerts and real-time news announcements.

You have a selection of alerts you can receive, so I set it up to show all trading signals like candlestick patterns and chart patterns such as head and shoulders. I found the signals to clearly demonstrate the trading idea and the market commentary is a nice touch to help explain the move.

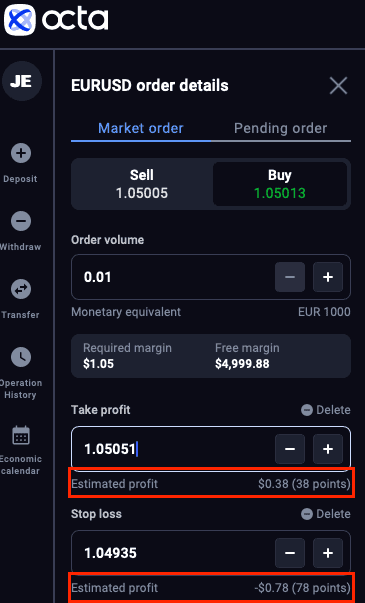

A nice feature I liked was the order ticket showing your potential profit and loss in monetary value compared to just in pips like other platforms. This is a useful feature if you’re new to trading as you’ll know your monetary risk instead of guessing with a pip conversion which could lead to mistakes and over-risking your trades.

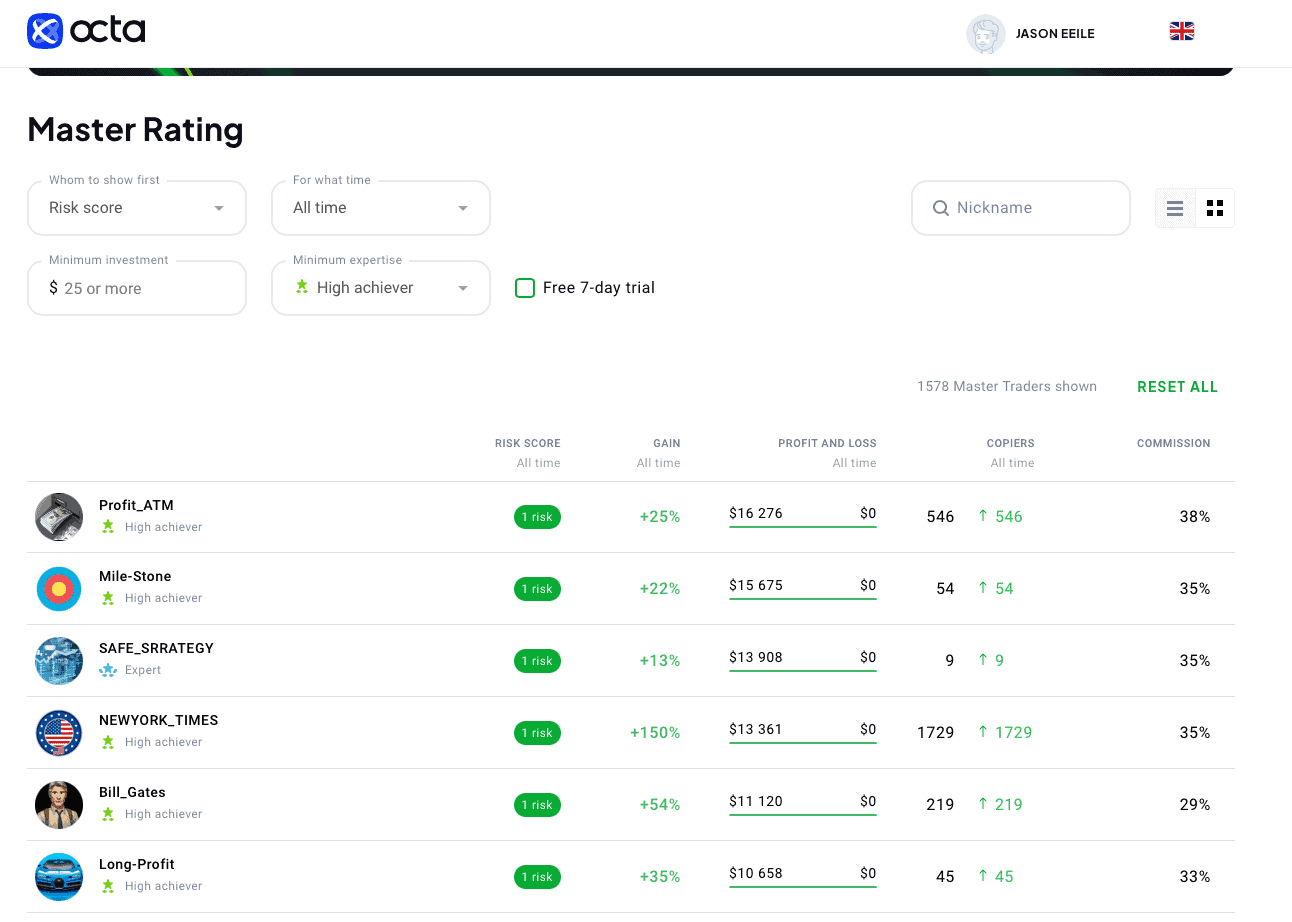

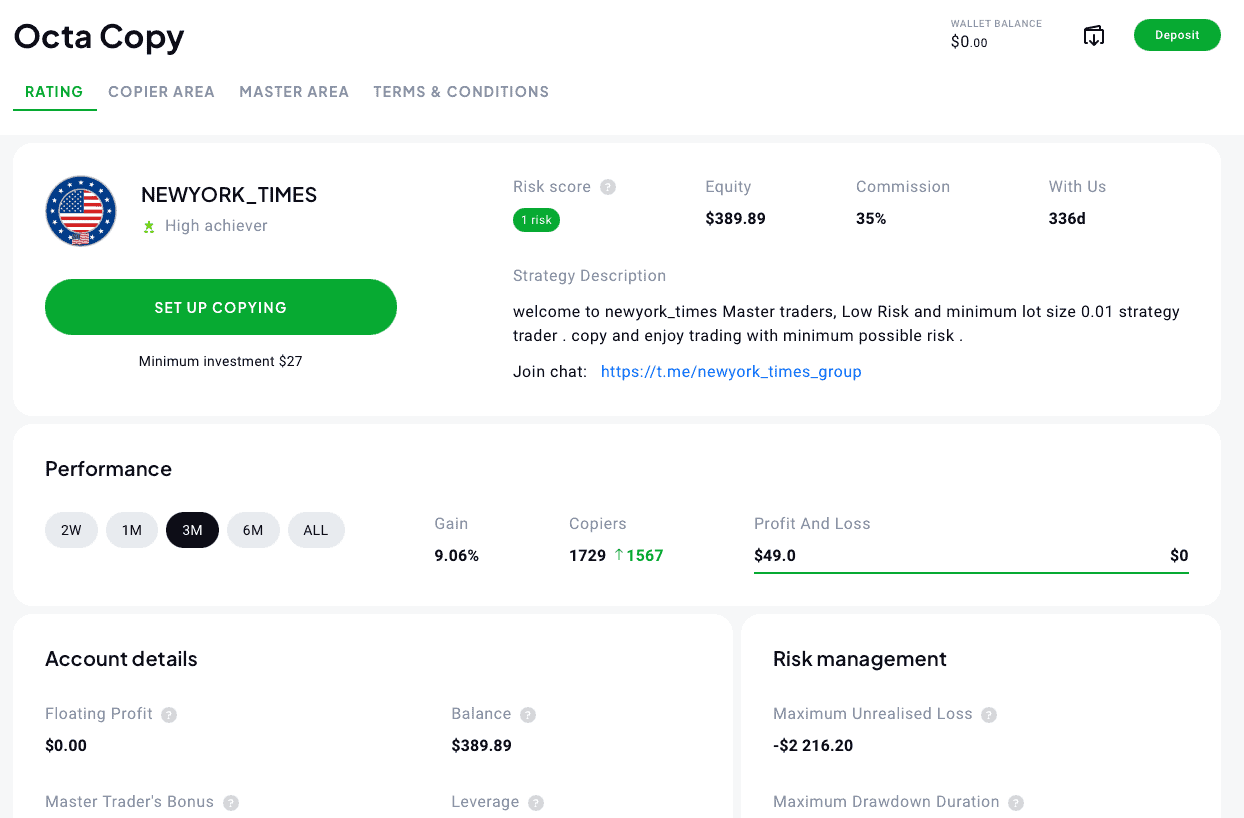

Social and Copy Trading Apps

Octa offers Octa Copy for copy trading giving you access to 1,500+ copy traders on Octa. Searching for the right trader to mirror was a little basic as you only had 4 options to narrow down the 1,500+ traders which include:

- risk score,

- minimum investment,

- timeframe,

- expertise rating.

The profile for each trader was more detailed showing profit and loss, drawdown, and copy follower growth which I like to use as a leading indicator of trader performance. You also have a track record of the trader’s order history, giving you a transparent insight into the trader’s performance.

I think having Octa Copy is a good alternative for beginners or those who don’t want to invest their time in learning how to trade. At least this way, you can copy an experienced trader and benefit from leveraged products such as forex, crypto or commodities like gold.

Mobile Trading Apps

I found all platforms Octa offers provide mobile trading apps on your iOS or Android device, which can be downloaded directly from the broker’s website.

The mobile apps for each platform include:

- MetaTrader 4

- MetaTrader 5

- OctaTrader

- Octa Copy

My Verdict on Octa’s Trading Platforms

I like that Octa provides a variety of trading platforms that all trading styles can use, making the broker a versatile option to benefit from the lower trading costs. Whether you’re a beginner with OctaTrader’s market analysis tools, automate your trades with MT4’s EAs, or day trade with depth of markets tools on MT5 there is something for everyone.

The copy trading platform is also a bonus, which is the perfect opportunity to mirror the trades of 1,500 traders and leverage their experience to profit from leveraged markets.

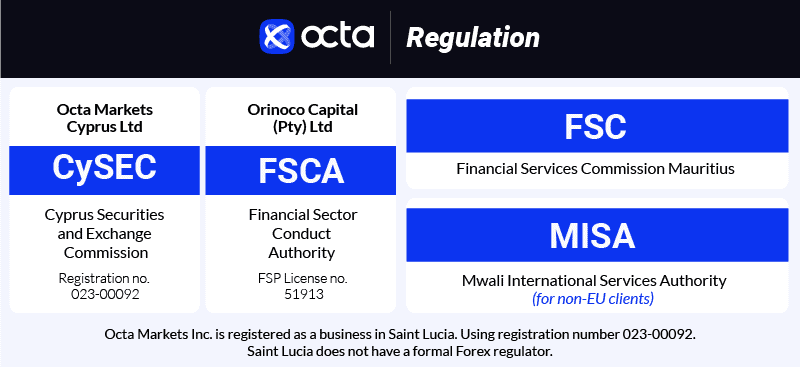

Is Octa Safe?

Yes, based on my research I found Octa is safe. It is regulated by the FSC in Mauritius, the Mwali International Services Authority (MISA), and CySEC for European traders. The broker has also been operating for 12 years, which is a strong signal of safety in my book.

Regulation

I found that Octa is regulated by the Cyprus Securities and Exchange Commission (CySEC) for European traders under its Octa Markets LTD entity based in Cyprus.

Additionally, Orinoco Capital (Pty) Ltd. holds a Financial Service Provider (FSP) license number 51913 from the Financial Sector Conduct Authority (FSCA) in South Africa. It is also regulated by the Financial Services Commission Mauritius (FSC) and Mwali International Services Authority (MISA) for non-EU clients.

These are two offshore regulators that allow Octa to provide secure financial services in 180 countries.

The FSC is deemed “offshore” as they are an authority that accepts clients from multiple countries like Malaysia, Singapore, or Australia without being directly regulated by the country’s financial authority.

For example, because Octa is regulated by FSC, it means you can benefit from the broker offering 1:1000 leverage which other authorities like ASIC do not allow.

I prefer seeing a broker regulated by multiple authorities, especially local regulators where clients are accepted such as CySEC. However, I would like to see other Tier-1 regulators like the Australian Securities and Investments Commission (ASIC) or the Monetary Authority of Singapore (MAS).

This is because you will receive better protection and service from your local regulator should you need to enforce a complaint. However, in my experience with regulators like MAS, they are very professional and helpful so this is by no means a poor regulator.

Reputation

Octa has been offering retail trading services since 2011, servicing over 40 million trading accounts in 180+ countries which is an impressive achievement considering how competitive the forex industry is.

While doing my background check on the company I found that Octa won 60+ awards for multiple categories such as:

- Best Proprietary Trading Platform 2024 from FX Scouts

- Best Islamic-friendly Broker in Indonesia 2024 from Finance Derivative

- Most Reliable Broker Global 2024 from Global Forex Awards Retail

- Best Trading Conditions in Africa 2024 from Finance Magnates

Reviews

As part of my review, I like to check third-party platforms like Trustpilot to see how real clients of Octa feel about the broker. Their TrustPilot score is an impressive 4.4 / 5 based on 8,000+ reviews which is impressive considering how many traders have left a review.

My Verdict on Octa’s Trust

Octa scored highly in my trust test with 12 years of industry experience and licences from CySEC, MSC, and MISA delivers a secure and transparent forex broker. I think the broker’s trust is supported by its 60+ awards from the forex industry and 8,000+ positive TrustPilot reviews demonstrating that its clients are happy with its operations.

How Popular Is Octa?

Octa (formerly OctaFX) shows strong visibility in the online trading landscape. With approximately 201,000 monthly Google searches, it ranks as the 14th most popular forex broker among the 65 brokers analyzed. Web traffic data positions it somewhat lower, with Similarweb reporting 748,000 global visits in February 2024, placing Octa as the 24th most visited broker.

Founded in 2011, Octa has built a substantial global presence over its years of operation. The broker reported serving over 12 million trading accounts across more than 150 countries, with particularly strong penetration in Asia, Africa, and Latin America. Octa processes more than $9 billion in monthly trading volume and has executed over 920 million trades since its inception, according to company data. These substantial operational metrics match the broker’s strong positioning in search visibility.

| Country | 2024 Monthly Searches |

|---|---|

| India | 60,500 |

| Malaysia | 27,100 |

| Indonesia | 22,200 |

| Nigeria | 12,100 |

| Pakistan | 9,900 |

| South Africa | 8,100 |

| Singapore | 5,400 |

| United States | 3,600 |

| Philippines | 2,400 |

| United Arab Emirates | 2,400 |

| Mexico | 1,900 |

| United Kingdom | 1,300 |

| Kenya | 1,300 |

| Canada | 1,000 |

| Brazil | 1,000 |

| Bangladesh | 1,000 |

| Ghana | 880 |

| Germany | 720 |

| Thailand | 720 |

| Saudi Arabia | 720 |

| France | 590 |

| Australia | 590 |

| Colombia | 590 |

| Netherlands | 480 |

| Italy | 480 |

| Spain | 480 |

| Vietnam | 480 |

| Turkey | 480 |

| Sri Lanka | 480 |

| Peru | 480 |

| Japan | 390 |

| Morocco | 390 |

| Cambodia | 390 |

| Bolivia | 390 |

| Argentina | 320 |

| Ethiopia | 320 |

| Egypt | 260 |

| Tanzania | 260 |

| Botswana | 260 |

| Poland | 210 |

| Ecuador | 210 |

| Uganda | 210 |

| Algeria | 210 |

| Dominican Republic | 210 |

| Venezuela | 210 |

| Hong Kong | 170 |

| Chile | 170 |

| Cyprus | 170 |

| Jordan | 170 |

| Taiwan | 140 |

| Sweden | 110 |

| Switzerland | 110 |

| Portugal | 90 |

| New Zealand | 90 |

| Uzbekistan | 90 |

| Ireland | 70 |

| Greece | 70 |

| Mongolia | 70 |

| Costa Rica | 70 |

| Austria | 50 |

| Mauritius | 50 |

| Panama | 40 |

2024 Average Monthly Branded Searches By Country

India

India

|

60,500

1st

|

Malaysia

Malaysia

|

27,100

2nd

|

Indonesia

Indonesia

|

22,200

3rd

|

Nigeria

Nigeria

|

12,100

4th

|

Pakistan

Pakistan

|

9,900

5th

|

South Africa

South Africa

|

8,100

6th

|

Singapore

Singapore

|

5,400

7th

|

United States

United States

|

3,600

8th

|

Philippines

Philippines

|

2,400

9th

|

United Arab Emirates

United Arab Emirates

|

2,400

10th

|

Deposit And Withdrawal

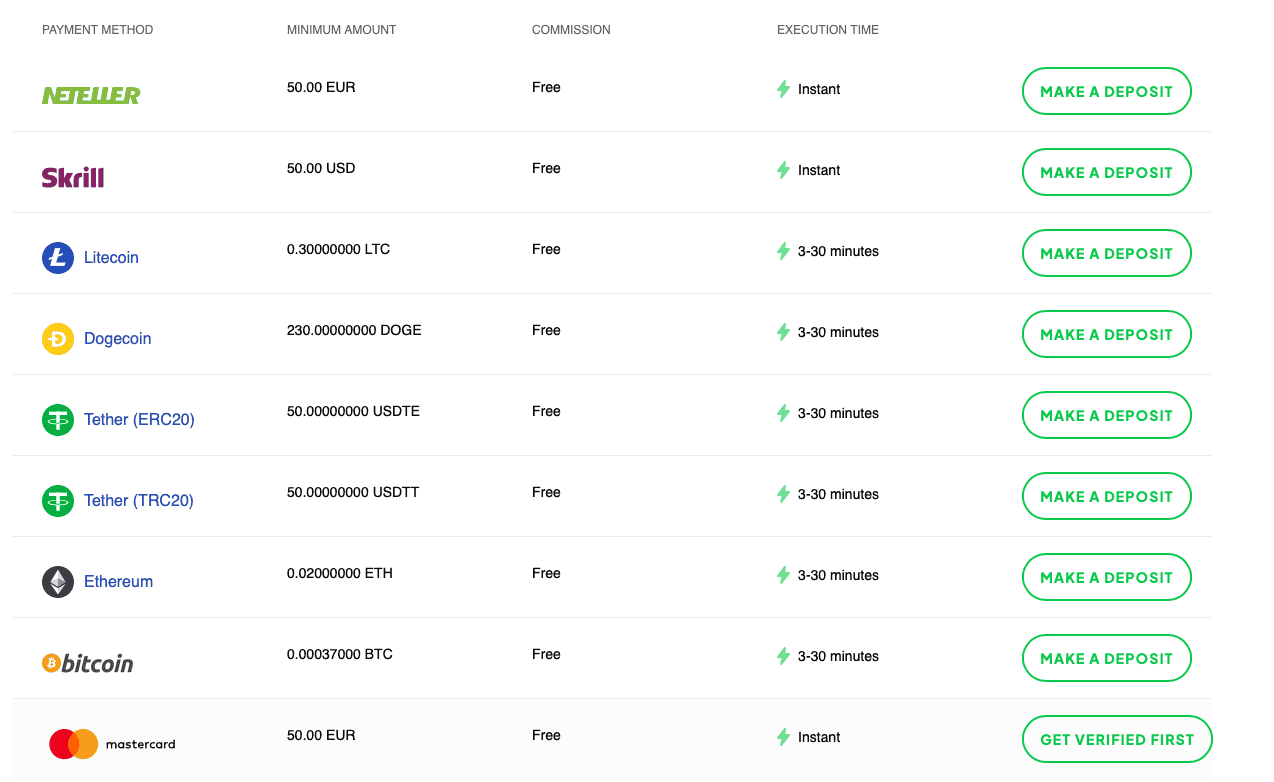

Octa offers the basic options when it comes to funding your account through traditional methods and some crypto options. The broker offers reasonable times to process your deposit and withdrawals.

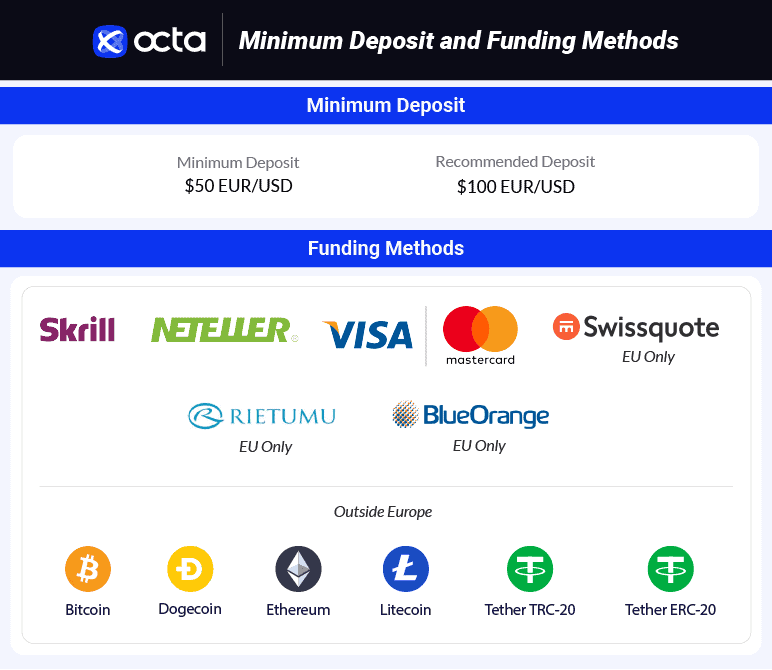

What is the minimum deposit at Octa?

When opening my trading account the minimum deposit was $25 which is enough to open a position if you use the 1:1000 leverage available. However, the broker does recommend funding your account with $100 to begin with.

Account Base Currencies

When opening my account I was given the option of only using USD as the account base currency. Although you can deposit with your local currency, it gets converted to USD regardless.

Deposit Options and Fees

The deposit options with Octa are decent, giving you multiple ways to fund your account with no deposit fees. The only traditional method available was Mastercard (debit card) which I used to fund my account and was instantly applied to my trading account after making my deposit.

I’d like to have seen an option for bank transfers as I feel most secure about this process. However, Octa has e-wallet options through Neteller and Skrill were also a positive as they also provide instant funding like the Mastercard option.

Crypto is the slowest to deposit with 3-30 minutes which is still extremely fast in my books as some brokers can take 24 hours to credit your account.

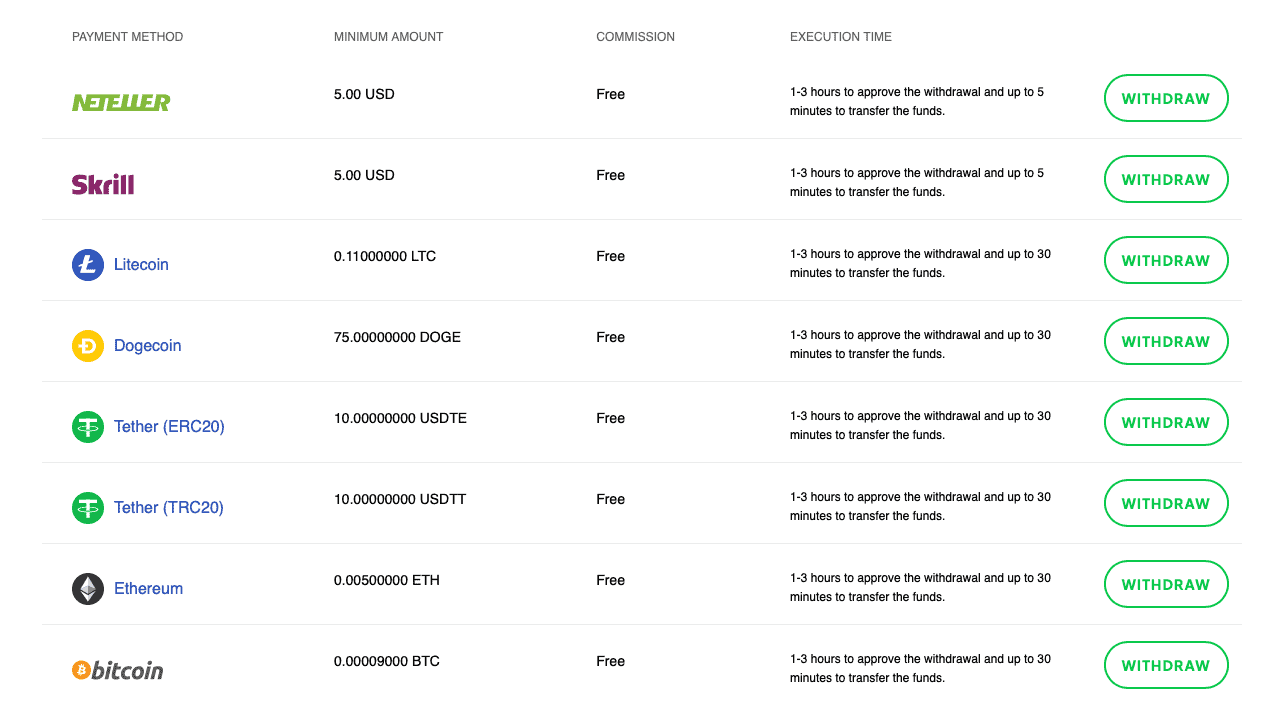

Withdrawal Options And Fees

Withdrawing from my account was also fast, according to my account manager each withdrawal takes roughly 2 hours to get approved. Once approved you can expect the funds to be in your bank account/wallet within 30 minutes which is extremely good service in my opinion.

Ease To Open An Account

I found the account opening process to be rather straightforward where you complete an application filling your personal details and choose the platform you wish to work with. In my case it was the MetaTrader 5 platform, however, I found that once your account is open you can select different platforms from within the dashboard.

Overall, the account opening process took 3 minutes which is the fastest application I have completed for opening a live trading account.

My Verdict on Octa’s Deposit and Withdrawal Services

I was impressed with the efficiency and low-cost approach to depositing and withdrawing with Octa. The range of deposit methods is decent, covering traditional, e-wallet and crypto, giving you a great choice of how to deposit (and withdraw) with no fees.

The broker offers excellent deposit and withdrawal speeds that are fulfilled within the same business day during the week. This allows you to start trading faster with instant deposits and receive your funds faster through the same-day withdrawals.

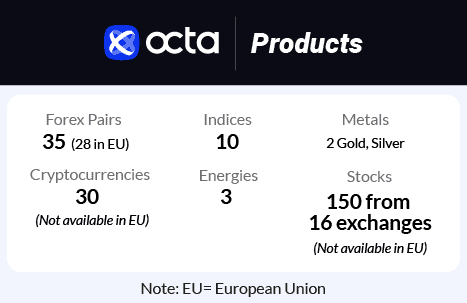

Product Range

While exploring the broker’s watchlists I found that they offered 300 financial products for CFD trading with access to its high leverage up to 1:1000 for retail traders. Although the range is limited compared to most brokers, you don’t pay swap fees saving you additional costs if you hold positions longer than 24 hours which is a bonus.

Here is a quick overview of trading products for each platform:

| OctaTrader | MetaTrader 4 | MetaTrader 5 | |

|---|---|---|---|

| Total Trading Instruments | 80 | 80 | 277 |

| Currency Pairs | 35 | 35 | 52 |

| Gold and Silver | Yes | Yes | Yes |

| Energies | 3 | 3 | 3 |

| Indices | 10 | 6 | 10 |

| Cryptocurrencies | 30 | 34 | 34 |

| Stocks | 0 | 0 | 150 |

CFDs

Octa has 52 forex pairs for CFD trading including forex majors like USD/JPY, AUD/USD, and EUR/USD as well as minor and exotic pairs. I did find that you can only access all 52 pairs using the MetaTrader 5 platform, while the OctaTrader and MT4 only offer 32 pairs.

The broker offers its full 1:1000 leverage on its forex major pairs, allowing you to trade 1 lot of EUR/USD with a $100 margin.

Indices

The broker covers 10 major indices on its OctaTrader and MT5 platform covering Asia, Europe, and US markets, while MT4 offers 6 indices including the S&P 500, and FTSE 100.

I found Octa offers generous leverage with 1:400 on its indices which is some of the largest I’ve tested on a retail trading account.

Commodities

I found that Octa provides 5 of the major commodities which include gold, silver, Brent oil, WTI oil, and US natural gas. You can trade all of these assets on each platform and receive up to 1:400 leverage, making the broker a good option for day-trading commodities.

Cryptocurrencies

Octa has a decent selection of 34 cryptocurrencies covering Bitcoin, Ethereum, Ripple, and Litecoin which is a healthy selection of highly liquid crypto markets. If you prefer to trade less liquid and higher risk assets you also have access to altcoins like Dogecoin to speculate on.

As a bonus to squeeze out the risk potential, Octa offers 1:200 leverage across its cryptocurrency range. I think this large leverage on crypto makes it a decent pick for experienced traders looking to scale their trading as most brokers limit leverage on crypto to 1:10.

Share CFDs

The bulk of the broker’s financial products are from its 150 share CFDs across 16 exchanges in the US, UK, Europe, Japan, Singapore and Australia. Some of the companies I found you can trade include Tesla, Amazon, and Apple giving you access to top stocks which are highly liquid.

You can also benefit from the broker’s 1:40 leverage on share CFDs, which is 2 times more than most brokers I’ve tested. Unfortunately, I found that the stock CFDs are limited to the MetaTrader 5 platform only.

My Verdict on Octa’s Product Range

With 300 markets I found Octa provides the major financial instruments most traders would focus on such as forex majors, gold, stocks like Tesla, or cryptocurrencies like Bitcoin. I think this is a sweet spot for the majority of traders unless you are seeking less popular markets or specific stocks to trade.

Customer Service

Customer service at Octa is through live chat or a support email address, which is a slight letdown as I prefer when companies offer phone support for urgent questions.

The live chat is 24/7 which is great to see, but the experience I’d say is a mixed bag. I like that you don’t have to fill out a questionnaire for support, you are taken directly to help in the form of AI.

Normally, I think AI support is useless, but you can tell Octa has invested in this area as the AI responses are comprehensive and answered my questions accurately.

You can request a human agent who was surprisingly not as helpful as the AI with canned answers and no depth of product knowledge. This was frustrating when asking questions about their services and trading accounts as I felt they didn’t answer the question.

Alternatively, you can use email if you require more technical responses.

My Verdict on Octa’s Customer Service

My experience with Octa’s customer service was largely positive thanks to its 24/7 customer support and impressive AI live chat service. I felt that when I was passed to human agents on live chat it was hit and miss as basic questions were not answered, while other times they were.

Research and Education

The broker provides a decent research service through its Space feature on the OctaTrader platform which provides a range of technical analysis ideas on the platform for free. The analysis includes:

- Candlestick patterns

- Chart patterns

- Support and Resistance breakouts

- Volume breakouts

- Volatility spikes

- Trend and Channel opportunities

- News announcements

This is an impressive feature if you’re new to trading due to the constant flow of trading ideas with detailed market commentary that will help you learn in real time. Plus, you can fine-tune the Space by choosing specific instruments only to receive these ideas from – in my instance, I chose USD/JPY, gold, and EUR/USD.

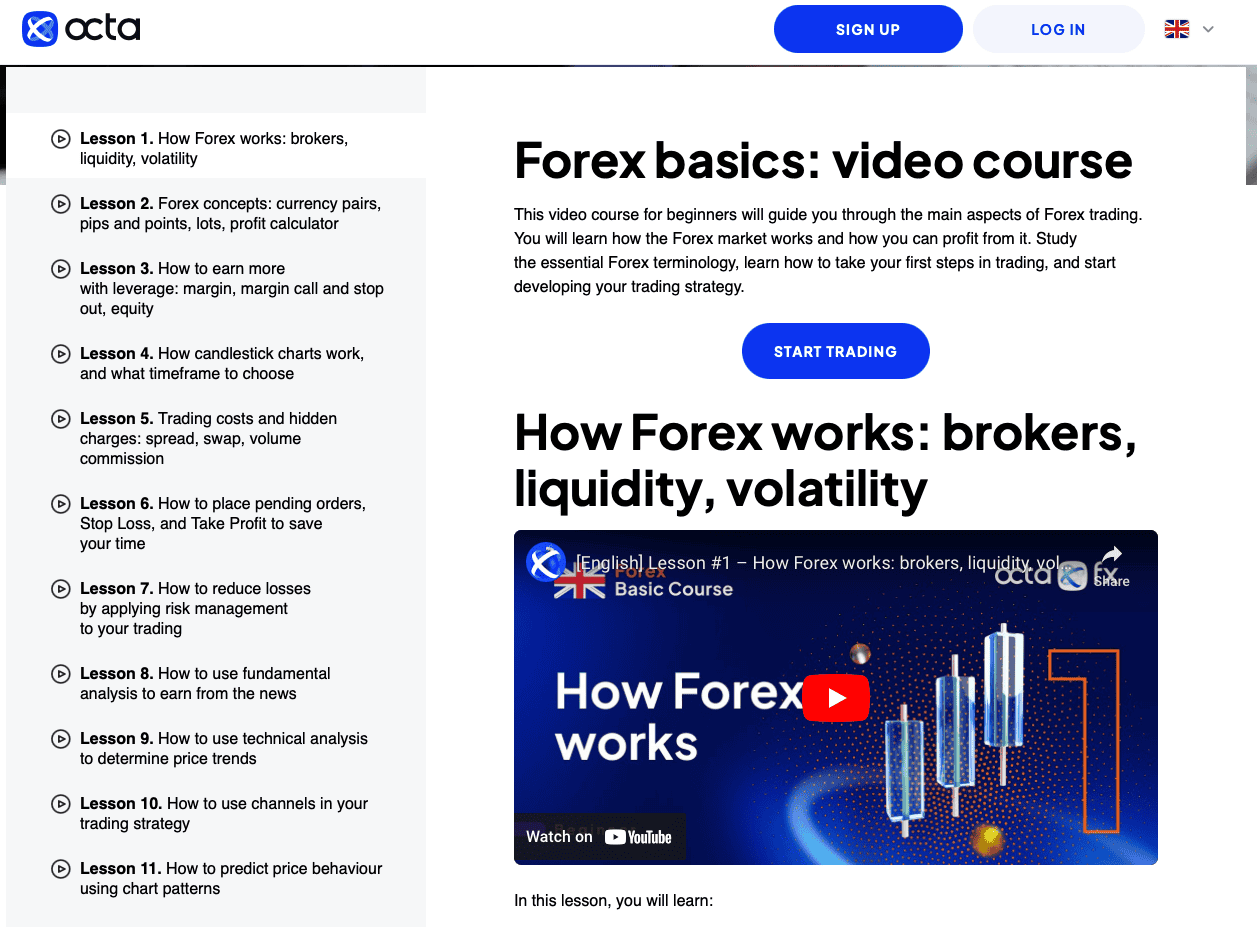

As for education, I found Octa provides a consistent stream of webinars with professional traders through a live trading session aimed at all levels. You can experience an “over the shoulder” session with a trader which is helpful to get professional feedback on current market events.

The educational material is decent too. There are 12 extensive educational articles covering the forex basics but what stood out for me was the free forex trading course. In this course, I had access to 11 video lessons that lasted roughly 5-10 minutes but went into detail about how to trade forex.

For experienced traders, or beginners looking to develop further, Octa also provides resources to learn 12 trading strategies including chart patterns like wedges and candlesticks like the hammer.

My Verdict on Octa’s Research and Education

I thought the research provided by Octa was decent as they offered chart and candlestick patterns like doji candlesticks and wedges, or highlighting support and resistance levels to trade. The analysis was well presented on the charts and the commentary was easy to understand and follow, even if you’re new.

As for education, I thought Octa did a good job at presenting the basic concepts of forex trading through an online video course. I liked the daily webinars with professional traders that let you learn while trading in a live environment to experience how traders analyse the markets in real time.

Final Verdict On Octa

My experience with Octa has been largely positive thanks to its excellent ECN trading conditions giving me low spreads that averaged 0.80 pips on EUR/USD with no commissions.

I was impressed that Octa doesn’t charge swap fees on overnight positions, which allowed me to trade stocks over longer-term periods to capture more profit without paying extra. You also have generous leverage if you have an account outside of the CySEC entity with 1:1000 leverage on forex and 1:400 on commodities and indices.

The broker’s range of forex trading products is limited to MT4, MT5, and OctaTrader but still provides a service to every trading style thanks to the MetaTrader options. I was surprised most by the OctaTrader which is limited in comparison to MetaTrader but offered a unique technical analysis service which impressed me with the expertise of the analysis.

As for account management, I found the deposit and withdrawal services to be fast with same-day funding and withdrawals with no fees.

Octa's FAQs

Which Country Is Octa From?

Octa is based in Saint Lucia but has multiple entities outside of Saint Lucia to provide financial services to clients in 180+ countries. Depending on where you are from, you can open an account with a different entity that is regulated by either CySEC, MAS, or FSC.

This could include opening an account with Octa Markets Cyprus Ltd, or Uni Fin Invest which is Octa’s Mauritius entity.

What Demo Account Does Octa Offer?

Octa offers a demo account for all of its platforms such as OctaTrader, MetaTrader 4, and MetaTrader 5. The demo account is unlimited in funds as you can top it up should you need more virtual currency, and has no expiration date.

The demo account lets you test the platforms while practising trading in a risk-free trading environment using virtual currency.

What Leverage Does Octa Offer?

If you live in countries outside of the EU such as Malaysia, Singapore or Australia Octa offers leverage up to 1:1000. If you are a European trader, your leverage is capped to 1:30 on forex if you have a retail investors account. Professional traders can access higher leverage up to 1:500.

How Long Does Octa Withdrawal Take?

Octa provides a fast service for its withdrawals by sending your funds within 30 minutes after being approved. Approval of the funds can take from 1-3 hours depending on when you make a request.

Is Octa legal?

Yes, Octa is legal and regulated across multiple jurisdictions covering the EU and Asia. For the EU, it is regulated by CySEC which is a Tier-1 authority and for the rest of the world you will be regulated by MAS or MISA. By being regulated across multiple jurisdictions it allows Octa to provide retail financial services to traders across 180 countries.

Compare Octa Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research

Ask an Expert