Eightcap Review Of 2025

Eightcap offers CFDs on over 360 financial instruments across multiple sectors such as forex, commodities, etc. We liked being able to trade on popular platforms including MT4, MT5, and TradingView, with low spreads across raw and standard accounts.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

EightCap Summary

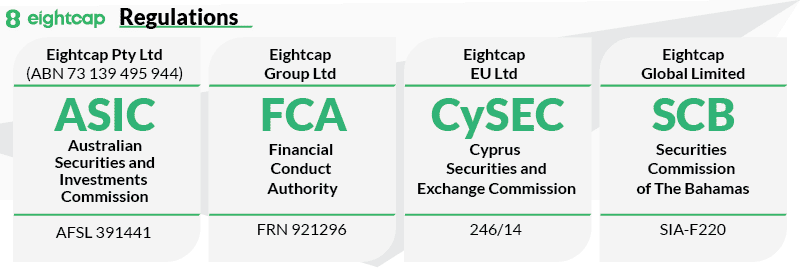

| 🗺️ Regulation | ASIC, FCA, CySEC, SCB |

| 💰 Trading Fees | Low Spreads |

| 📊 Trading Platforms | MT4, MT5, TradingView |

| 💰 Minimum Deposit | $100 |

| 💰 Withdrawal Fees | $0 |

| 🛍️ Primary Markets | CFDs, Forex, Crypto, Shares, Indices, Commodities |

| 💳 Credit Card Deposit | Yes |

Why Choose Eightcap

The primary reason to choose Eightcap is its wide range of markets including exotic currency pairs, shares and especially cryptocurrency CFDs, where they have nearly 100 coins to choose from. Eightcap offers these trading instruments all with competitive spreads which is why I think the broker will appeal to you.

During hands-on testing, I also found that Eightcap overall had one of the lowest fees for their ECN account (raw account) and a great selection of trading platforms, offering the best in the market. This can be combined with Capitalise.ai for code-free trading automation.

Eightcap Pros And Cons

- Low fees

- No deposit and withdrawal fees

- Easy account opening

- High conversion fee

- Limited products

Open Demo AccountVisit Website

The overall rating is based on review by our experts

Trading Fees

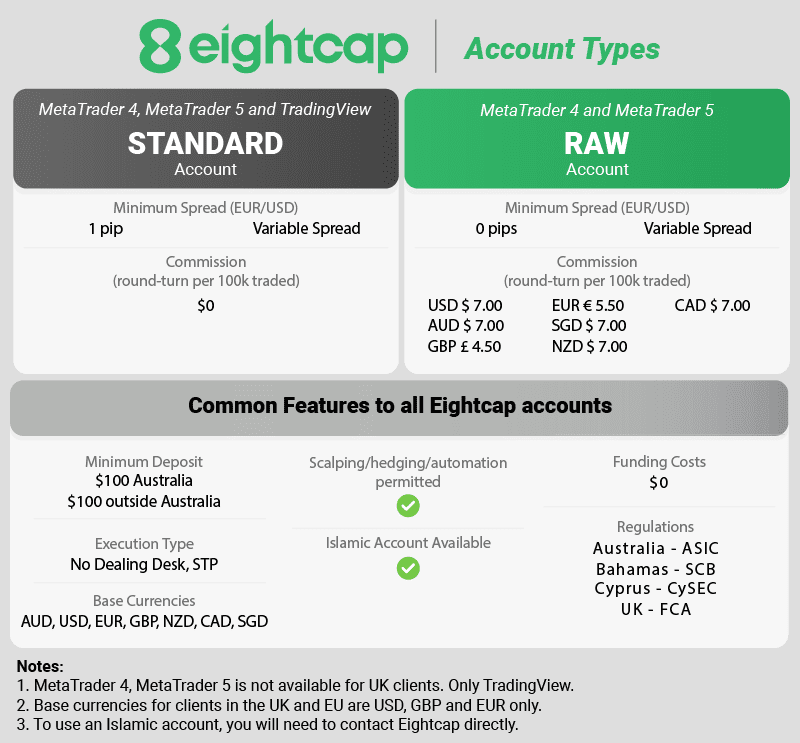

After trading on both Eightcap’s Standard and Raw accounts, I can confidently say their pricing structure caters to different trading styles, but each has its trade-offs. Standard spreads without commission fees, accessible on MetaTrader and TradingView, and tighter raw spreads accompanied by commission fees, available exclusively on MetaTrader platforms.

1. Raw Account Spreads

Eightcap offers tight raw spreads, with their lowest spread being 0.06 pips for the USD/JPY pair and 0.20 pips for the USD/CAD pair. This account type is best suited in my opinion for high-volume traders, as even scalps can benefit from the low spreads offered by Eightcap.

Comparing these to other top brokers in the table, Eightcap’s raw spreads remain competitive, particularly in the USD/JPY and EUR/USD pairs, where they are among the lowest in the market.

|

ECN Broker Spreads

|

|||||

|---|---|---|---|---|---|

|

0.20 | 0.06 | 0.30 | 0.23 | 0.49 |

|

0.40 | 0.10 | 0.30 | 0.30 | 0.50 |

|

0.40 | 0.10 | 0.20 | 0.10 | 0.90 |

|

0.30 | 0.20 | 0.40 | 0.20 | 0.50 |

|

0.18 | 0.09 | 0.14 | 0.13 | 1.70 |

|

0.25 | 0.02 | 0.27 | 0.03 | 0.50 |

|

0.86 | 0.45 | 0.70 | 0.57 | 0.98 |

|

0.50 | 0.20 | 0.50 | 0.50 | 0.70 |

|

N/A | 0.17 | 0.54 | 0.30 | N/A |

|

0.15 | 0.10 | 0.70 | 0.60 | 0.14 |

|

0.60 | 0.10 | 0.60 | 0.50 | 0.70 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Eightcap offers lower spreads for the nine most traded currency pairs than the industry average.

| Raw Account Spreads | Eightcap | Average Spread |

|---|---|---|

| Overall | 0.42 | 0.72 |

| EUR/USD | 0.06 | 0.28 |

| USD/JPY | 0.23 | 0.44 |

| GBP/USD | 0.23 | 0.54 |

| AUD/USD | 0.27 | 0.45 |

| USD/CAD | 0.2 | 0.61 |

| EUR/GBP | 0.3 | 0.55 |

| EUR/JPY | 0.59 | 0.74 |

| AUD/JPY | 0.49 | 0.93 |

| USD/SGD | 1.37 | 1.97 |

2. Raw Account Commission Rate

For Raw Accounts, Eightcap charges a commission of $7 for every standard lot roundturn. This account type is designed to keep spreads low and accurate to the quotes provided by liquidity providers, maintaining an STP or ECN-like pricing model.

With this account, traders pay $7 per standard lot round turn, equating to $3.50 to enter the trade and another $3.50 to exit. Despite the commission, this setup often results in lower overall costs due to the reduced spreads.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| Eightcap Commission Rate | $3.50 | $3.50 | £2.25 | €2.75 |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

Many traders transition to Raw Accounts once they gain confidence in their trading abilities.

3. Standard Account Fees

Eightcap offers competitive standard spreads, starting at 1 pip for EUR/USD, EUR/GBP, and GBP/USD, making it a great option for those wanting low commission-free spreads. Compared with other top brokers, Eightcap maintains its competitiveness across various currency pairs with lower average spreads than Pepperstone, OANDA, and Plus500.

I believe that the Standard Account is ideal for beginners or low-frequency traders who prefer simplicity over ultra-tight spreads.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| Eightcap Average Spread | 1 | 1.2 | 1.2 | 1.2 | 1.2 | 1.1 | 1.2 | 1.2 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

To ensure precise analysis of spreads, we conduct thorough research and analysis of top brokers’ forex spreads. This entails examining average spreads for popular currency pairs, which are updated monthly to reflect changes in brokers’ offerings and market conditions.

4. Swap-Free Account Fees

For traders adhering to Islamic Sharia law, Eightcap offers a Swap Free account, also known as an Islamic account, which exempts you from overnight fees. Instead of an interest-based payment, Islamic traders

To access this account, simply reach out to Eightcap’s customer service and request it. Depending on requirements, proof of your Muslim faith may be necessary for eligibility.

5. Other Fees

At Eightcap, there is a $10 EUR/GBP/USD monthly account inactivity or maintenance fee is incurred in case of inactivity for 3 months or more.

You will also have overnight funding fees, which are incurred for positions left open after 24:00 GMT+2. It’s worth noting that these fees are standard across most brokers and are not unique to Eightcap.

Use the calculator below to compare Eightcap’s trading costs with competitors such as Pepperstone, IC Markets and CMC Markets, adjusting for trade size, currency pair, and base currency.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Verdict on Eightcap Fees

Eightcap caters to different traders by providing two pricing options, commission-free standard spreads and low raw spreads with a commission. For its excellent low spreads and good commission rates, I give Eightcap a score of 9.0/10 for trading costs.

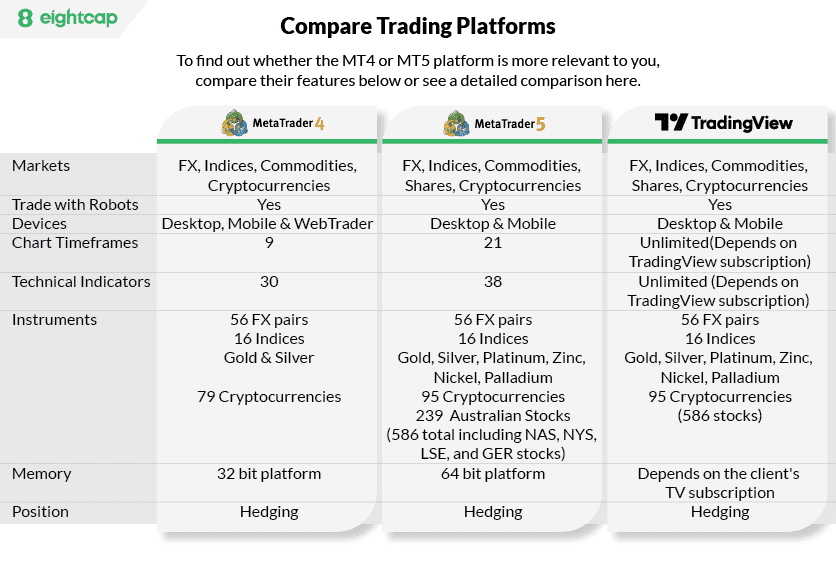

Trading Platforms

Eightcap offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView for Australian traders and those registered with its international branch, excluding the UK and Europe.

| Trading Plaform | Available With Eightcap |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| TradingView | Yes |

| cTrader | No |

| Capitalise.AI | Yes |

| Flash Trader | Yes |

| Proprietary Platform | No |

My team has prepared a trading platform selector, so you can work out what software best matches your trading needs. We suggest that you complete our short 5-step questionnaire to determine your most suitable forex platform and then read the relevant section about how Eightcap performs in terms of that software.

For clients in the United Kingdom, only TradingView is available, whereas in Europe, MetaTrader 4 is not available.

| EightCap Branch | MetaTrader 4 | MetaTrader 5 | TradingView |

|---|---|---|---|

| Australia (ASIC) | ✔️ | ✔️ | ✔️ |

| United Kingdom (FCA) | ✘ | ✘ | ✔️ |

| Europe (CySEC) | ✘ | ✔️ | ✔️ |

| Global (SCB) | ✔️ | ✔️ | ✔️ |

Furthermore you could also use Capilise.AI and Flash Trader, based on which region your account is registered from.

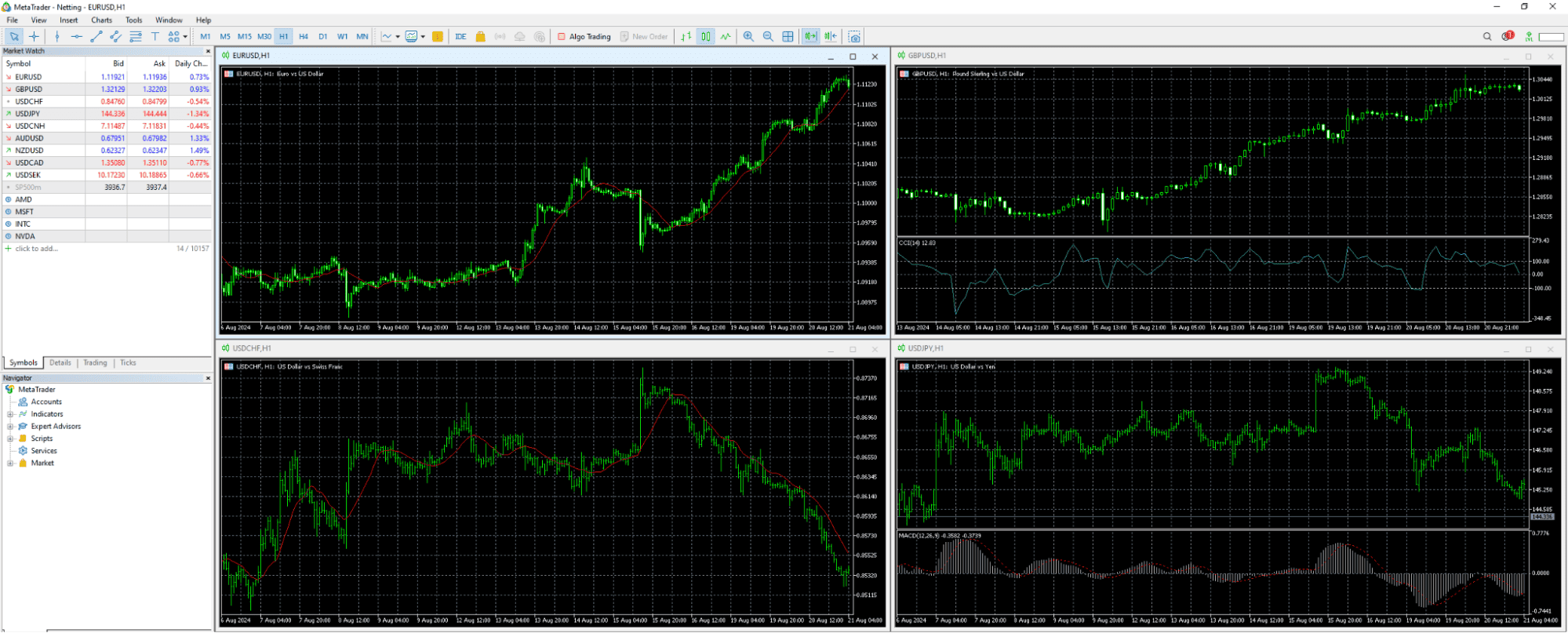

MetaTrader 4 (MT4)

Having traded over 1,000 forex scalps on MT4 since 2021—and even coding my own Bollinger Band squeeze EA—I can confidently say MT4 remains my go-to for forex simplicity. But after attempting to trade ASX200 shares on it last year, I quickly realized its limitations.

Who Should Use MT4?

- Forex Beginners:

Forex Beginners: When I first started trading AUD/USD, MT4’s drag-and-drop interface let me set stop-losses in seconds, no overwhelming menus. - EA Coders: My custom “Trend Rider” EA (built using MQL4) ran flawlessly for months, executing trades even while I slept.

- Technical Analysts: The 30 built-in indicators (like RSI and MACD) are all I need for daily chart patterns.

Who Should Avoid MT4?

- Equity Traders: Trying to trade Tesla shares? Forget real-time earnings data or dividend calendars.

- Multi-Asset Scalpers: No trailing stops hurt during this year’s gold volatility spike; I manually adjusted orders 12 times in an hour.

What I Actually Use MT4 For:

- 24/7 Forex Automation: My EUR/JPY EA has placed 83 trades this month alone, exploiting Asian session gaps.

- Backtesting: Testing a 2010-era “Fibonacci Scalper” strategy took 10 minutes, no coding, just historical data.

- Security Peace of Mind: After a phishing scare on another platform, MT4’s SSL encryption kept my Eightcap account untouched.

Where MT4 Frustrated Me:

- No News Alerts meant I missed the 2023 Fed rate decision because MT4 lacks native news feeds, I now use TradingView alongside it.

- Clunky Order Types – During the GBP flash crash, I couldn’t set a “close on touch” conditional order, losing 2% of my position

In brief, I think MT4 is perfect for forex-focused traders like me who prioritize speed and automation over bells and whistles. But if you’re trading shares, commodities, or need advanced order types, MT5 or TradingView will save you time (and frustration).

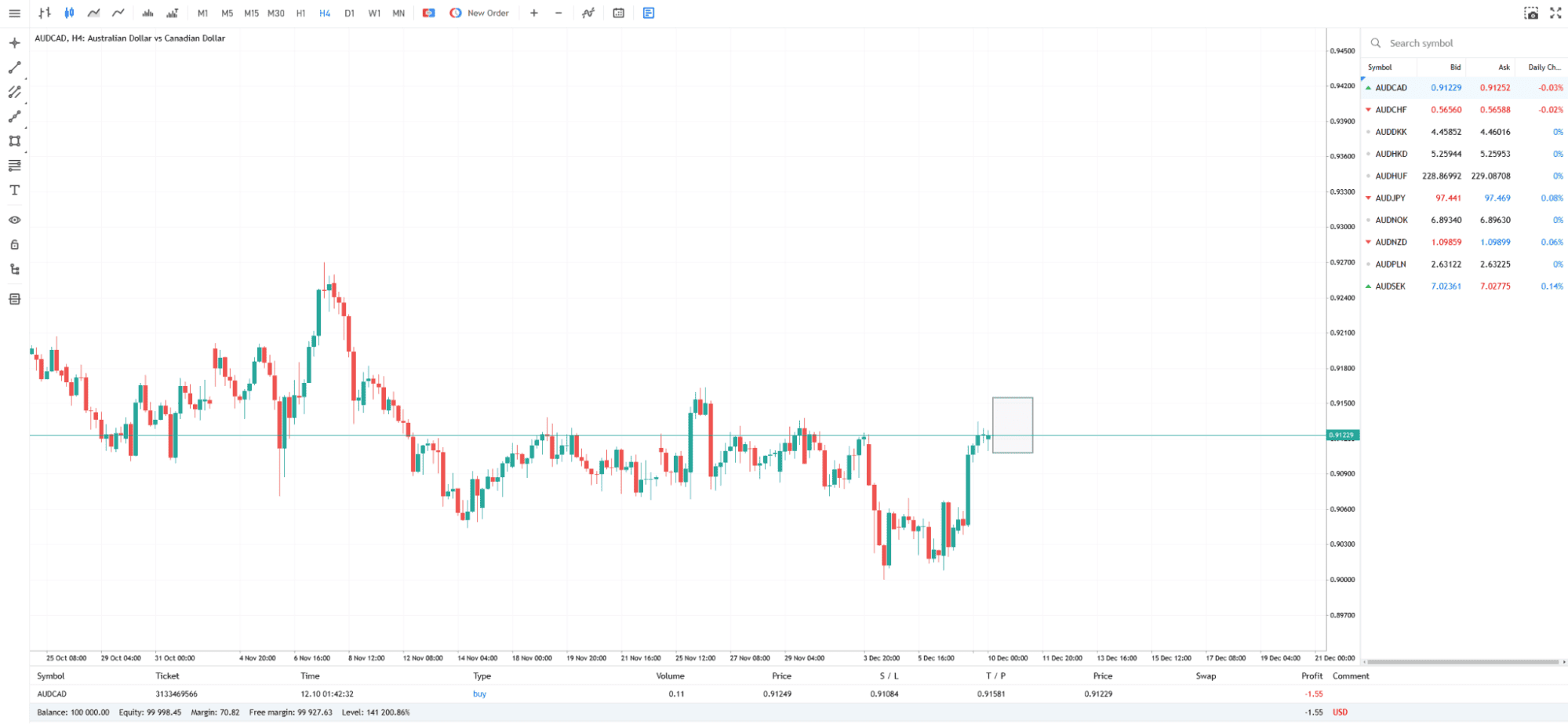

MetaTrader5 (MT5)

While MT4 excels for forex and basic charting, MT5 is my go-to for hybrid strategies that blend centralized markets (like NASDAQ stocks) with decentralized ones (e.g., crypto CFDs on PancakeSwap). During my testing, I used MT5 to simultaneously trade gold futures and Ethereum CFDs, a flexibility MT4 lacks.

Here’s why I prefer MT5 for advanced trading:

- Centralized + Decentralized Access: Unlike MT4, MT5 lets you trade assets like crypto CFDs tied to decentralized exchanges (DEXs). For example, I opened a Litecoin position on Eightcap that routed through a DEX’s liquidity pool, ensuring tighter spreads during volatile hours.

- Scalping Efficiency: The 21 timeframes saved me hours when scalping USD/JPY, I could track minute-by-minute swings on one chart while monitoring weekly trends on another.

- MQL5 Wizard: I automated a trend-following strategy using plain English commands (no coding!), which took half the time it would’ve on MT4.

But it’s not perfect:

- Learning Curve: It took me three weeks to master MT5’s depth-of-market tool, a frustrating process compared to MT4’s simplicity.

- Missing Indicators: My favorite MT4 custom indicator (a volatility scanner) didn’t work on MT5, forcing me to rebuild it from scratch.

Who Should Choose MT5?

I think that MT5 is best suited if you are a trader needing decentralized exchange access (e.g., crypto, DeFi-linked CFDs).

Furthermore, it’s a great fit for multi-asset scalpers requiring 100+ charts and advanced order types and if you like automating trades with MQL5’s AI-like tools.

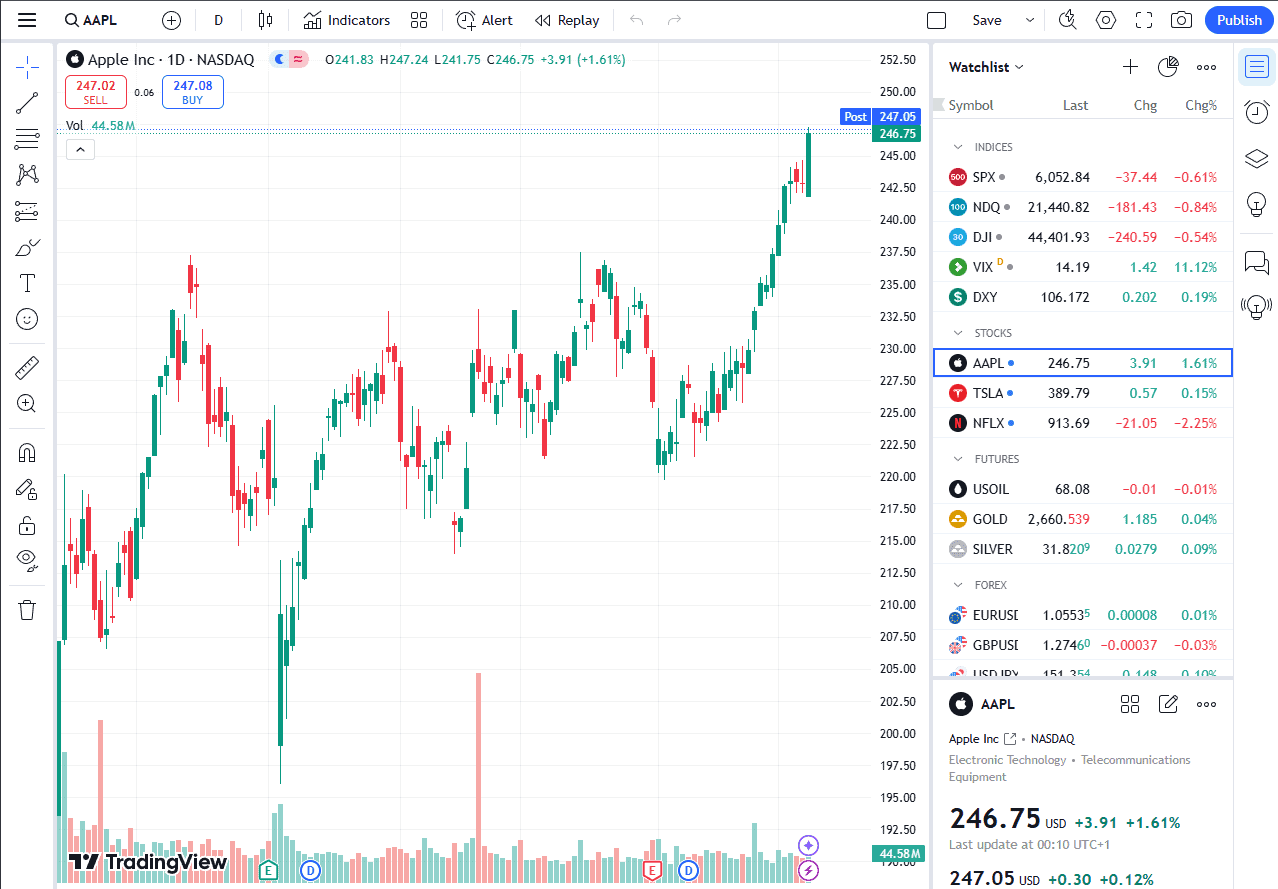

TradingView

As someone who spends 4-5 hours daily analyzing charts, TradingView has become my ultimate technical analysis hub. But after using it to scalp EUR/USD last month, I realized it’s not a one-size-fits-all solution.

Who Should Use TradingView?

- Charting Enthusiasts: When I needed to compare Bitcoin’s Renko chart with Ethereum’s Heikin-Ashi, TradingView’s 15+ chart types made it effortless.

- Social Traders: I’ve saved over 20 strategies from the community, including a Pine Script scalping tool that boosted my win rate by 15%.

- Multi-Market Analysts: Monitoring NASDAQ futures and gold prices on one screen saved me hours during last week’s Fed announcement.

Who Should Avoid TradingView?

- High-Frequency Scalpers: During the USD/JPY volatility spike, the 0.5-second delay cost me 3 pips, MT5’s execution was far faster.

- Automation-Focused Traders: While Pine Script is powerful, it can’t match MT4’s Expert Advisors for 24/7 trade execution.

What I Actually Use TradingView For:

- Custom Alerts: My “RSI Divergence” alert has caught 12 winning trades this month, even while I was offline.

- Community Insights: A user’s “Volume Profile” script helped me spot a key resistance level in gold, leading to a 2% profit.

- Multi-Chart Layouts: I track 8 currency pairs simultaneously, each with unique indicators like Ichimoku Clouds and Bollinger Bands.

Where TradingView Frustrated Me:

- Execution Speed: Placing a manual trade during the GBP flash crash took 3 clicks too many, I missed the entry by 10 pips.

- Doesn’t Always Offer Direct Broker Integration: I still need MT5 to execute trades, which adds an extra step to my workflow.

My Verdict on TradingView:

TradingView is perfect if you are a trader who prioritizes charting and social learning over execution speed. But if you’re scalping or automating trades, platforms like MT5 or cTrader will better suit your needs.

MobileApps

If you wish to trade CFDs on the go, then Eightcap offers you great flexibility for mobile trading, as they have plenty of apps compatible with both Android and iOS devices.

The mobile apps you can use with Eightcap include the following:

- MetaTrader 4

- MetaTrader 5

- TradingView Mobile

- Capitalise.ai

As usual, I recommend you do your trading on a desktop/laptop workstation setup, and use the mobile apps to check your trades, or in a pinch.

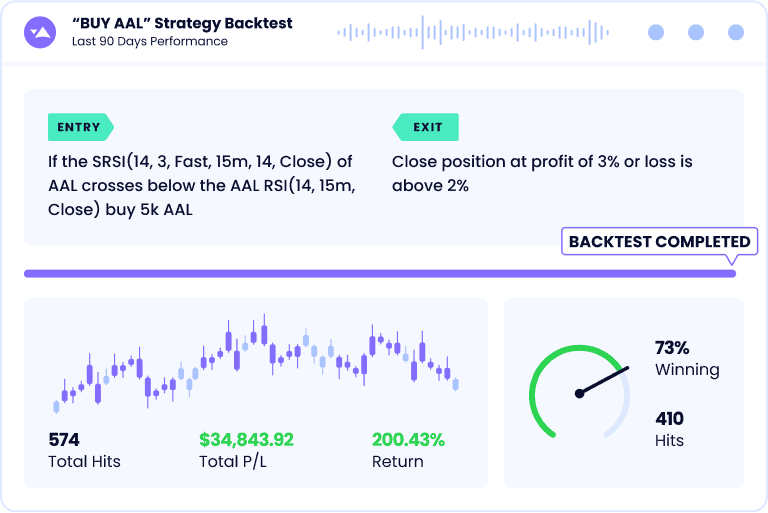

Capitalise.ai

As someone who’s tested over a dozen automation tools, Capitalise.ai stands out for its no-code simplicity. Last month, I automated a gold trading strategy using plain English, no coding required, and it executed flawlessly during the Fed rate decision. But it’s not without its quirks.

In my view, it is the perfect tool to simplify complex strategies and keep ahead of the pace in CFD trading. Getting started with Capitalize.ai is easy: just remember that you first need to open an Eightcap MT4 account, verify the details, and connect it to Capitalise.ai for immediate automation (and you can also use it on a mobile platform).

Here’s why Capitalise.ai stands out:

- Take away the emotional part of trading by depending on pre-set conditions and automated strategies.

- 24/7 Market Scanning to help you find strategies that will continuously scan the markets for triggers so that you can never miss an opportunity even when you are offline.

- Non-Coders: When I wanted to automate a “Buy on RSI < 30” strategy, I simply typed, “If RSI is below 30, buy 0.1 lots of gold”, no MQL4 headaches.

- Smart Notifications so you are updated with custom alerts based on market scenarios or your trading strategies. Get updates in real-time to react fast to market changes.

- Backtesters: I refined my “MACD Crossover” strategy using 5 years of historical data, all within 10 minutes.

I had lots of fun configuring custom trades using the plain English to code feature, and Capitalise.ai set it surprisingly accurately. Just make sure to review the details after you write out your instructions, as it can sometimes

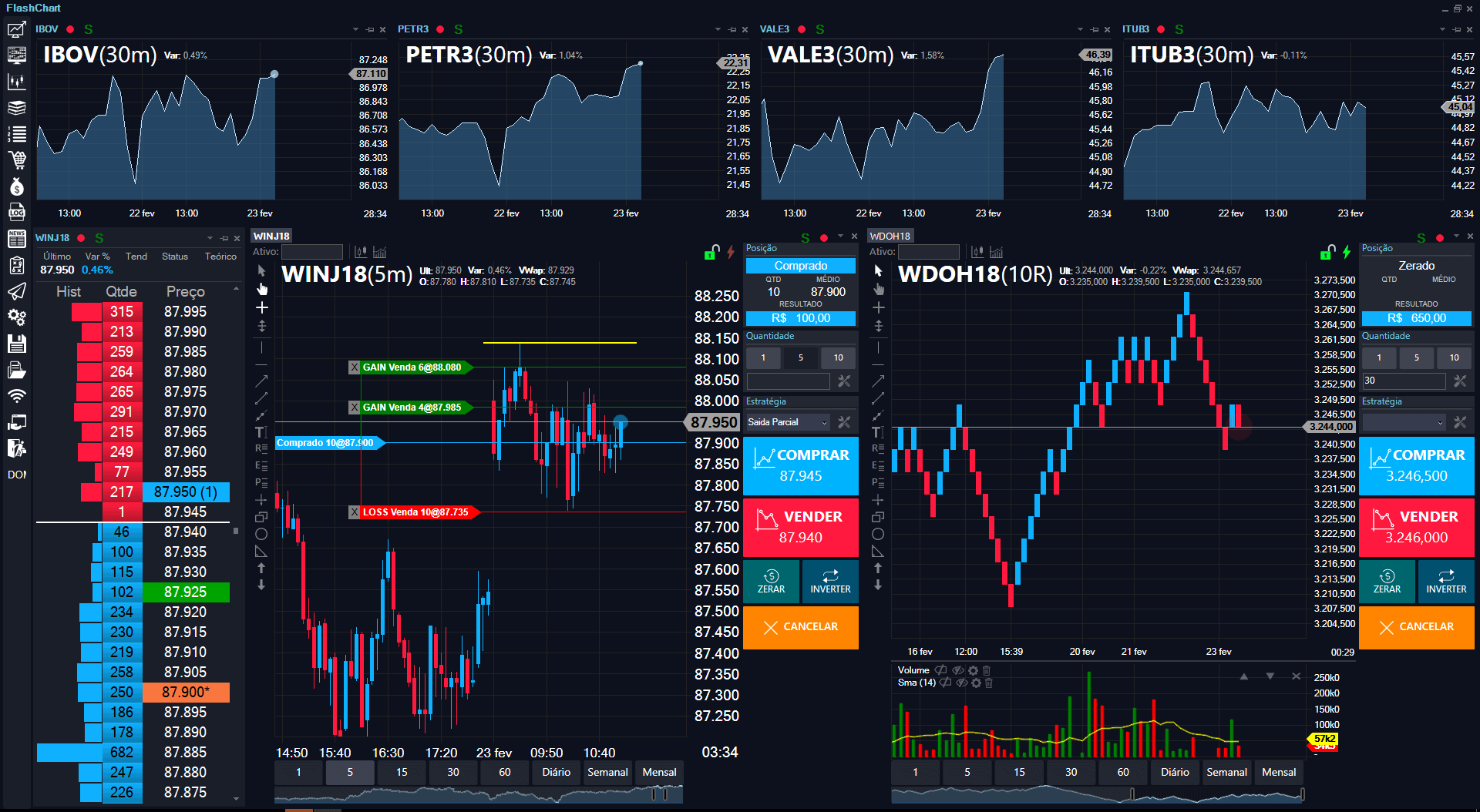

FlashTrader

As a trader, I’ve found Eightcap’s FlashTrader quite impressive, as it fits specific trading styles. It has built-in features like automatic position sizing and one-click order executions.

Since I used scalping quite frequently, these are all features I enjoyed using.

Who I recommend FlashTrader for:

- Scalpers: Ideal for lightning-fast trade execution.

High-Frequency Traders: Perfect for quick, multiple entries and exits. - Automated Risk Managers: Sets instant profit targets and stop-losses. This includes taking profit on half positions, then moving stops to break-even.

- MT5 Users: Seamlessly integrates with MetaTrader 5.

Who it might not be suitable for:

- Long-Term Investors -Its speed benefits won’t be fully utilised.

- Not Suitable for Swing Traders

- Beginner Traders: High-speed strategies carry higher risk; learn basics first.

- Less fitting if you want meticulous manual trade setups.

- Non-MT5 Users (Since it’s exclusively designed for the MetaTrader 5 platform.

Verdict on Eightcap Trading Platforms

Eightcap provides MetaTrader 4, MetaTrader 5, and TradingView for Australian and international clients, with restricted platform access in the UK and Europe. Despite offering a range of trading tools, its execution speeds are slower compared to industry leaders, which may impact traders dependent on fast execution.

For the great range of trading apps I give Eightcap a rating of 9.5/10 for the category of Trading Platforms.

Open Demo AccountVisit Website

Trade Experience

Eightcap’s execution speeds for limit and market orders stand at 143 milliseconds (ms) and 139 ms, respectively, which are closely aligned with the industry average of 143 ms for limit orders and 149 ms for market orders.

Our team’s methodology for assessing these execution speeds involved a comprehensive testing process across the 36 brokers, ensuring a fair and accurate comparison by executing identical trades under similar market conditions across all platforms.

Compared to industry leaders for execution, like BlackBull Markets and Fusion Markets, Eightcap’s execution speeds are significantly slower, with limit orders about 98.6% and 81% slower, respectively, and market orders 54.4% slower than BlackBull’s but 80.5% faster than Fusion’s.

Such differences in speed may affect traders relying on quick execution, like scalpers or high-frequency traders, where milliseconds matter for trade profitability.

Beyond execution speed, Eightcap’s trade experience is enhanced by its brokerage model and execution method. Operating on a Straight Through Processing (STP) model, Eightcap offers direct market access with no dealing desk intervention.

Verdict

Eightcap provides MetaTrader 4, MetaTrader 5, and TradingView for Australian and international clients, with restricted platform access in the UK and Europe. Despite offering a range of trading tools, its execution speeds are slower compared to industry leaders, which may impact traders dependent on fast execution.

For these reasons, I have awarded Eightcap a score of 9.5/10 for their stellar trading experience during my testing and use.

Is Eightcap Safe?

Eightcap is deemed a safe broker with an overall trust score of 71. This rating is derived from its performance in three key areas: regulation, reputation, and client reviews.

Regulation

EightCcp is overseen by tier 1 regulators including the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA) in the UK, and the Cyprus Securities and Exchange Commission (CySEC).

If you are located outside of these areas, you can register with the broker’s global branch regulated by the Securities Commission of The Bahamas (SCB).

If you are located outside of these areas, you can register with the broker’s global branch regulated by the Securities Commission of The Bahamas (SCB).

| Eightcap Safety | Regulator |

|---|---|

| Tier-1 | FCA CySEC ASIC |

| Tier-2 | X |

| Tier-3 | SCB |

Reputation

Since its establishment in 2009 in Melbourne, Australia, Eightcap has maintained a clean slate with no regulatory infringements, cementing its strong reputation domestically.

While its global recognition is growing, evidenced by 27,100 monthly Google searches, it remains more prominent within the Australian market.

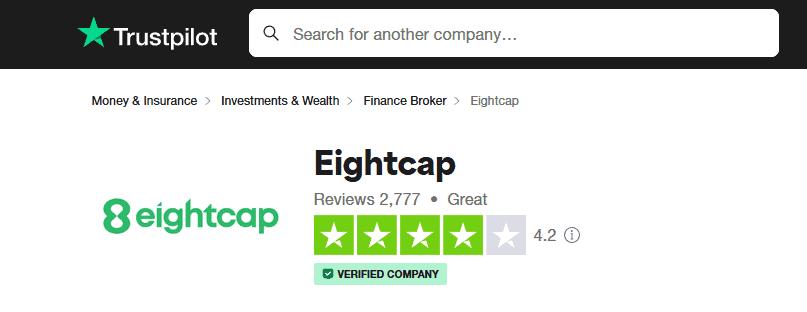

As of 2025, Eightcap’s score is 4.2 out of 5 stars (dropping by 0.1 point compared to 2024), but still retains a “Great” or high overall score on Trustpilot. With over 2770 reviews, many traders express that they are generally happy with their execution speeds, deposit and withdrawal process.

My Verdict on Eightcap Safety

Considering EightCap’s strong regulation, solid reputation since inception, and positive client reviews, it stands as a trustworthy broker for traders seeking a secure trading environment.

However, its global presence is still expanding, suggesting potential for wider recognition in the international trading community. Due to these factors, Eightcap gets a score of 8.0/10 in terms of trust for my review.

How Popular Is Eightcap?

Eightcap shows a moderate presence in the global forex brokerage landscape. With approximately 40,500 monthly Google searches, it ranks as the 29th most popular forex broker among the 65 brokers analyzed. Web traffic data positions it somewhat lower, with Similarweb reporting 259,000 global visits in February 2024, placing Eightcap as the 45th most visited broker.

Founded in 2009 and headquartered in Melbourne, Australia, Eightcap has expanded its regulatory footprint to include oversight from authorities in Australia, the UK, the Bahamas, and beyond. While the broker doesn’t publicly disclose its exact client numbers or trading volumes, it has reported serving traders in over 100 countries. Eightcap’s mid-range positioning in both search and traffic metrics suggests a growing but not yet dominant global presence.

| Country | 2024 Monthly Searches |

|---|---|

| Thailand | 9,900 |

| Canada | 2,400 |

| Australia | 2,400 |

| United States | 1,900 |

| United Kingdom | 1,600 |

| India | 1,300 |

| Germany | 1,000 |

| Brazil | 1,000 |

| Malaysia | 880 |

| France | 720 |

| Spain | 720 |

| Colombia | 720 |

| Italy | 590 |

| Indonesia | 590 |

| Argentina | 590 |

| South Africa | 480 |

| Netherlands | 480 |

| Nigeria | 390 |

| Singapore | 390 |

| Mexico | 320 |

| Dominican Republic | 320 |

| Pakistan | 320 |

| Sweden | 320 |

| Poland | 260 |

| Morocco | 210 |

| Philippines | 210 |

| United Arab Emirates | 210 |

| Portugal | 210 |

| New Zealand | 210 |

| Vietnam | 170 |

| Kenya | 170 |

| Switzerland | 170 |

| Hong Kong | 170 |

| Japan | 140 |

| Bangladesh | 140 |

| Peru | 140 |

| Chile | 140 |

| Austria | 140 |

| Taiwan | 140 |

| Turkey | 110 |

| Venezuela | 110 |

| Ireland | 110 |

| Ecuador | 110 |

| Algeria | 110 |

| Cyprus | 90 |

| Egypt | 90 |

| Greece | 90 |

| Uzbekistan | 90 |

| Cambodia | 90 |

| Ghana | 70 |

| Saudi Arabia | 70 |

| Uganda | 70 |

| Mongolia | 70 |

| Sri Lanka | 50 |

| Ethiopia | 30 |

| Costa Rica | 30 |

| Tanzania | 30 |

| Botswana | 30 |

| Jordan | 30 |

| Bolivia | 30 |

| Panama | 20 |

| Mauritius | 20 |

2024 Average Monthly Branded Searches By Country

Thailand

Thailand

|

9,900

1st

|

Canada

Canada

|

2,400

2nd

|

Australia

Australia

|

2,400

3rd

|

United States

United States

|

1,900

4th

|

United Kingdom

United Kingdom

|

1,600

5th

|

India

India

|

1,300

6th

|

Germany

Germany

|

1,000

7th

|

Brazil

Brazil

|

1,000

8th

|

Malaysia

Malaysia

|

880

9th

|

France

France

|

720

10th

|

Deposit and Withdrawal

EightCap requires a low initial minimum deposit to open a trading account, with a range of fee-free funding methods available.

What is the minimum deposit at Eightcap?

Eightcap minimum deposit is $100. This applies to both their standard account and raw account in all jurisdictions. This is one of the lowest requirements of the global brokers making trading more accessible.

| Currency | Minimum Deposit | |

|---|---|---|

| Australian Dollar | AUD | 100 AUD |

| US Dollar | USD | 100 USD |

| Euro | EUR | 100 EUR |

| British Pound | GBP | 100 GBP |

| NZ Dollar | NZD | 100 NZD |

| Canadian Dollar | CAD | 100 CAD |

| Singapore Dollar | SGD | 100 SGD |

Account Base Currencies

EightCap supports seven base currencies for trading accounts, including AUD, USD, EUR, GBP, NZD, CAD, and SGD.

Deposit Options and Fees

EightCap offers a variety of deposit methods to accommodate the preferences of traders worldwide. These include traditional options like Visa/Mastercard and Wire Transfer, as well as e-wallets such as PayPal, Skrill, and Neteller.

EightCap ensures most deposit methods are fee-free. However, fees can vary, especially for Wire Transfers, where the bank may impose its own charges.

| Payment Method | Australia (ASIC Regulated) | Europe (CySEC Regulated) | UK (FCA Regulated) | Global (SCB Regulated) | Fees | Available Currencies |

|---|---|---|---|---|---|---|

| Visa/Mastercard | ✔️ | ✔️ | ✔️ | ✔️ | $0 | AUD, USD, GBP, EUR, NZD, CAD, SGD |

| PayPal | ✔️ | ✔️ | ✖️ | ✔️ | $0 | AUD, USD, GBP, EUR, NZD, SGD |

| Wire Transfer | ✔️ | ✔️ | ✔️ | ✔️ | Variable | AUD, USD, GBP, EUR, NZD, CAD, SGD |

| Bpay | ✔️ | ✖️ | ✖️ | ✖️ | $0 | AUD |

| Skrill | ✔️ | ✔️ | ✖️ | ✔️ | Variable | USD, EUR (EEA clients), CAD |

| Neteller | ✔️ | ✔️ | ✖️ | ✔️ | Variable | USD, EUR (EEA clients), CAD |

Withdrawing Options and Fees

Withdrawing funds from your EightCap trading account is streamlined and user-friendly. Traders can initiate a withdrawal request anytime via the Client Portal, with EightCap committed to processing these requests within 24 business hours.

Ease to Open An Account

Opening an account with Eightcap was relatively easy. It asked me for some personal data, but I was able to create an account fast. We scored them a 12 out of 15, given how convenient and quick it was.

My Verdict on Eightcap Funding Options

EightCap combines low minimum deposits, diverse, fee-free deposit options, and swift withdrawal processes, offering a streamlined trading account funding. For the great selection of payment options, I have to give Eightcap a score of 9.0/10 for its funding options.

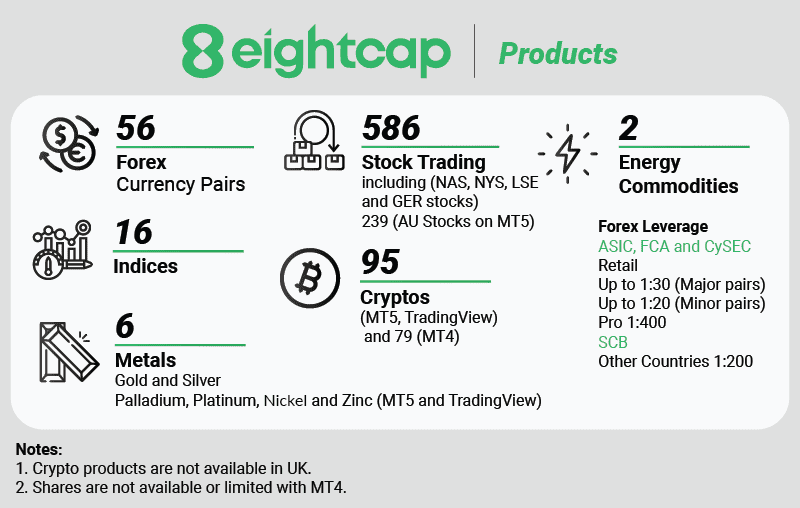

Product Range

EightCap offers a comprehensive range of over 360 CFD products spanning across forex, commodities, indices, shares, and cryptocurrencies.

| Asset Class | Total CFDs | Australia | UK | Europe | Global |

|---|---|---|---|---|---|

| Forex | 56 | ✔️ | ✔️ | ✔️ | ✔️ |

| Energy Commodities | 2 | ✔️ | ✔️ | ✔️ | ✔️ |

| Metals | 6 | ✔️ | ✔️ | ✔️ | ✔️ |

| Indices | 16 | ✔️ | ✔️ | ✔️ | ✔️ |

| Cryptocurrencies | 95 | ✔️ | ✘ | ✔️ | ✔️ |

| Equities/Shares | 586 | ✔️ | ✔️ | ✔️ | ✔️ |

CFDs

This diverse portfolio ensures traders have access to a wide array of financial instruments globally, including major forex pairs, key commodities like gold and oil, popular indices such as the US30 and UK100, a broad selection of shares from top companies like Google and Facebook, and leading cryptocurrencies including Bitcoin, Ripple, Ethereum, and Litecoin.

While cryptocurrency trading is available to Australian and global clients, it is not offered to those in the UK .

My Verdict on Eightcap’s Range of Markets

EightCap’s extensive selection of over 360 CFD products across various asset classes, including forex, commodities, indices, shares, and cryptocurrencies, caters to a broad spectrum of trading preferences, albeit with regional restrictions on cryptocurrency trading.

With one of the best CFD product offerings across brokers, I give Eightcap a flawless 10/10 score for their Range of Markets.

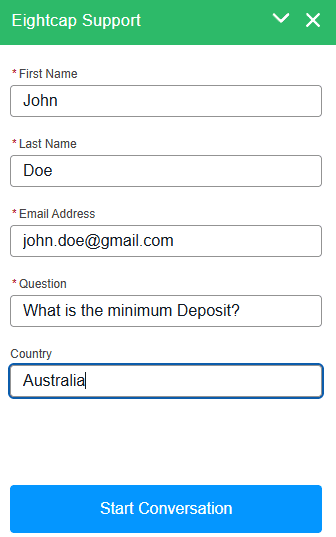

Customer Service

I recently tested Eightcap’s customer support by reaching out via live chat during their operating hours to ask about the minimum deposit requirement. Within seconds, their support agent responded clearly, confirming the threshold and even guiding me to the fee-free deposit options, a seamless experience that showcased their efficiency.

Their 24/5 availability (Monday 8 am to Saturday 5 am Melbourne time) proved convenient for my Australian-based trading schedule, though a follow-up email I sent late Sunday night wasn’t addressed until Monday morning, highlighting the time zone limitations for international traders.

What stood out was the absence of chatbots; every interaction, whether during sign-up or troubleshooting a withdrawal query, connected me directly to knowledgeable staff like James, who resolved my issue in under three minutes. While their responsiveness is commendable, non-Australian traders might find the support window restrictive, a trade-off for such personalized service.

My Verdict on Eightcap Customer Support

Eightcap’s customer support, while highly rated and accessible through multiple channels, offers hours that are optimal for Australian traders but may limit real-time assistance for those in other time zones.

However, all other factors, such as response time and accuracy from their support agents were fantastic during my hands-on testing. Because of their high uptime, availability, channels and quick responses, Eightcap gets a perfect 10/10 score for this category from me.

Research and Education

Eightcap provides essential research tools and educational resources, addressing both the analytical requirements and learning preferences of traders.

Research Tools

Eightcap enriches traders’ strategies with its comprehensive Trade Zone, designed to offer a deep dive into upcoming market dynamics:

- Economic Insights: Weekly insights provide a look ahead into market trends, data releases, and key economic indicators, helping traders navigate through economic events.

- Market Analysis: Regular updates on Asian and Australian trading sessions, including strategic trading moves and analysis of major assets like Bitcoin and Oil, offer traders actionable insights.

- AI-Powered Economic Calendar (details not retrieved): Expected to leverage artificial intelligence to forecast economic events and their potential market impacts accurately.

These tools collectively aim to arm traders with the necessary information for informed decision-making and spotting new trading opportunities through detailed market analysis.

Educational Resources

Eightcap’s commitment to trader education is evident through its advanced educational platform, Eightcap Labs, which goes beyond basic trading education offered by most brokers:

- Comprehensive Trading Guides: Offers in-depth guides on both technical and fundamental analysis, catering to traders at all levels.

- Diverse Trading Concepts: Covers a wide range of trading concepts, including scalping and trading precious metals, providing traders with a broad knowledge base.

- Actionable Trading Ideas: The Eightcap Trading Zone not only educates but also delivers actionable trading ideas and market outlook information, enhancing traders’ market awareness.

My Verdict on Eightcap’s Educational Content

Eightcap’s dedication to providing extensive educational content and research tools demonstrates its commitment to supporting its clients’ growth and success in the trading world.

I have to give Eightcap a solid 9.0/10 due to its good educational resource selection, well-thought-out guides and more interactive tools such as special events.

Final Verdict on Eightcap

Eightcap’s standout feature is its Lowest Spread Forex Brokers and commissions, large range of crypto produce and choice of trading platforms.

If you’re looking for somewhere you can start trading instantly, easily, and without spending too much money on charges, you’d struggle to find somewhere better.

We also liked the in-house trader education platform, if you’re a beginner trader, it’s a great thing to look into. All up, this is a user-friendly, reliable broker worth serious consideration.

We should however note that only MT5 is available for clients in the EU and TradingView in the UK. Some may consider this to be a weakness but they are excellent trading platforms in their own right and with MT4 likely to be phased out in future, now is a good time to start using an alternative platform.

Overall, in my review, Eightcap achieves an outstanding total score of 96/100, evaluated across nine key categories including Trading Costs, Trading Experience, Trust, Trading Platform, and more, solidifying its position as a top-tier broker with competitive spreads, diverse crypto offerings, and versatile platform access.

FAQs

Does Eightcap offer a demo account?

Yes, Eightcap provides demo accounts for MetaTrader 4 and MetaTrader 5 platforms, although TradingView is not available for demo trading. These demo accounts are initially valid for a 30-day trial period, but there is an option to request an extension or to make the account permanent if needed. Each demo account is equipped with $50,000 in virtual currency, which can be adjusted based on the user’s preferences to better suit their trading strategy experiments.

The demo accounts offer a simulation of real-time trading conditions, complete with unlimited virtual funds. This setup is ideal for users looking to explore trading strategies and familiarise themselves with the MT4 and MT5 features without the inherent high risk of losing real money.

From our experience, registering for an Eightcap demo account is more thorough than with other online brokers, needing details like email, address, and trading intentions, but not payment information.

What leverage does Eightcap offer?

Eightcap offers different leverage levels depending on the regulatory region: in Australia, the UK, and Europe, the maximum forex leverage is 30:1, as mandated by ASIC, the FCA, and CySEC. For clients outside these regions, higher leverage options are available up 200:1.

Here’s a comparison of leverage limits across different asset classes and regulatory areas:

| Asset Class | Max Leverage (Australia, UK, Europe) | Max Leverage (Global) |

|---|---|---|

| Forex Pairs | 1:30 | 1:200 |

| Gold | 1:20 | 1:200 |

| Commodities (except Gold) | 1:10 | 1:100 |

| Indices | 1:20 | 1:200 |

| Cryptocurrencies | 1:2 | 1:20 |

| Equities | 1:5 | 1:5 |

For EightCap Global traders, all accounts are set to a leverage of 100:1 by default, but clients can adjust this setting. The table above outlines the specific leverage restrictions designed to help traders manage risk effectively.

About This Review Of Eightcap

This review of Eightcap was carefully compiled by gathering data from Eightcap’s official resources, engaging with its trading platforms, and evaluating its customer service responsiveness. We also conducted a comparative analysis with industry benchmarks and peer offerings to ensure a balanced perspective. Regulatory statuses were verified through official channels to confirm Eightcap’s adherence to financial standards and security measures.

Our aim was to provide an objective and up-to-date evaluation, focusing on the aspects most relevant to traders, including platform usability, product range, regulatory compliance, and educational resources. This approach ensures that our review offers valuable insights for traders considering Eightcap as their broker.

Eightcap Alternatives

Article Sources

Eightcap’s FCA regulated entity

Eightcap Group Ltd is FCA authorised and regulated, offering CFD trading on over 600 markets across forex, indices, commodities, and shares. Eightcap’s UK entity is the only dedicated, specialist TradingView broker in the UK, providing a tailored product experience to get the most out of trading via TradingView

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Signup with Eightcap

Visit Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research

Ask an Expert

what cryptocurrencies can i trade if i use mt4?

MT4 can only handle crypto pairs that operate through a central exchange. There are too many coins to list here but if you take a look at the crypto section of this review, you can find the list.

Do I have to pay for Eightcap tools like Capitalise.ai?

MetaTrader 4, 5, Capitalise.ai are completely free along with FX Blue Labs, you will however need to pay to use The Amazing Trading. The first 28 days are free, thereafter you must maintain an account balance for $500 or more

How much is the eightcap fee per lot?

If using the Eightcap RAW account, you will be charged USD $3.00 plus the spread for each lot you trade.