Best Unregulated Forex Brokers

The best offshore forex brokers for US traders allow you to trade forex CFDs instead of spot trading. They also have leverage of up to 1:500, or even more in some cases. Most brokers offer the MetaTrader 4 trading platform and crypto markets like Bitcoin.

While the brokers in my list accept traders in the US, they are not regulated by the CFTC or NFA. I created this page based on a demand for offshore brokers and their unique features, but I personally recommend considering locally-regulated brokers first.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

List of offshore forex brokers for US clients is:

- Hugo's Way - Best Unregulated Forex Broker

- Plexytrade - Best Customer Service

- MidasFX - Best Deposit Bonus Broker

- CedarFX - Zero Commission Broker

- LQDFX - Best Range Of Trading Accounts

What Is The Best Offshore Forex Broker That Accepts US Clients?

Hugo’s Way is the best offshore forex broker for US clients, offering high leverage, RAW spread accounts, and fast execution through MetaTrader 4 under offshore regulation. We strong recommend using an onshore CFTC regulated broker which offers stronger protection when trading forex.

1. Hugo’s Way - Best Unregulated Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.7

AUD/USD = 1.3

Trading Platforms

MT4

Minimum Deposit

$10

Why We Recommend Hugo's Way

I chose Hugo’s Way because you get offshore broker privileges that are on par with onshore-regulated brokers. I found they deliver the best trading environment with fast execution speeds of around 100ms.

There are also solid spreads starting from 0.20 pips on EUR/USD. Plus, the broker offers 1:500 leverage – this is ten times the amount US brokers can offer.

You get the PRO4 (MetaTrader 4) platform, where you can use the broker’s services and access all their 150+ CFD markets. The platform also offers custom indicators and automation tools. Meanwhile, the broker provides solid 24/7 support through live chat, so you can get help over weekends, which is a bonus.

Pros & Cons

- Wide variety of funding methods

- Excellent selection of cryptos

- Scalping and hedging permitted

- Unregulated broker

- Limited selection of currency pairs

- Only one trading platform

Broker Details

Competitive Spreads With High Leverage

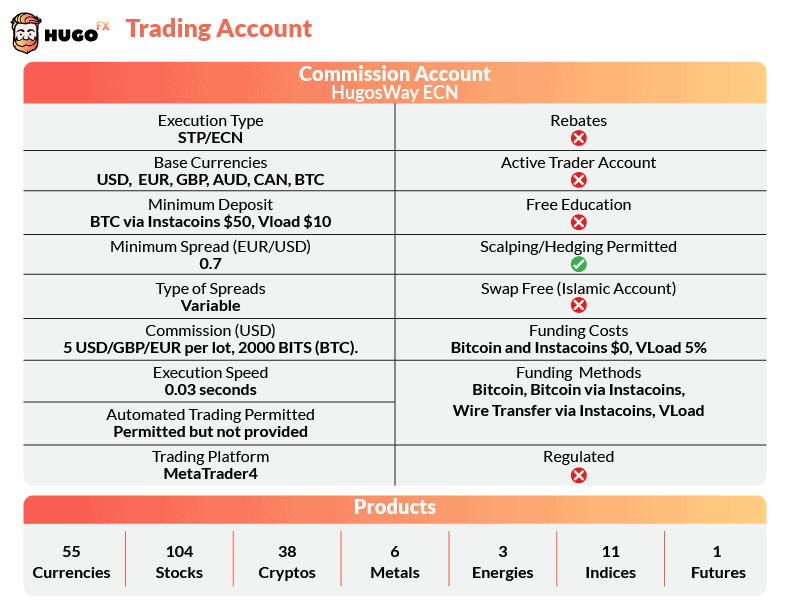

Hugo’s Way only offers its PRO4 trading account only, so you don’t get the choice most other brokers offer. It’s not a bad option though – while using the account, I found EUR/USD spreads from 0.20 pips. However, it can also reach 0.90 pips, which is expensive.

In addition to spreads, you’ll pay $5 per lot traded in commission, equalling $10 roundturn. This is slightly more expensive than other offshore brokers, who average $3.50 per lot.

However, not many offshore brokers can compete with Hugo’s Way for leverage. You can get 1:500 leverage on forex majors and 1:100 on cryptocurrencies, much better than the 1:50 leverage cap for US-regulated forex brokers.

Fast Execution Speeds

Hugo’s Way is a straight-through processing/electronic communication network (STP/ECN) style broker. This means the broker passes your order directly to the liquidity provider to be matched with a buyer or seller.

I generally prefer ECN brokers as they provide faster execution speeds than other broker types. Based on my analyst’s findings, Hugo’s Way performs solidly in this area.

My analyst (Ross Collins) tested Hugo’s Way and 49 other brokers using the ExTest_ForExpat EA for limit orders and Broker Latency Tester EA for market orders. This helped him record their average execution speeds.

As you can see from the table below, Hugo’s Way achieved fast speeds with 94ms on market orders, and 104ms on limit order. I find fast execution speeds have a major impact on your trading, as they reduce the chances of requotes and slippage.

| Execution Speed Testing | ||

|---|---|---|

| Broker | Limit Order Speed (ms) | Market Order Speed (ms) |

| OANDA | 86 | 84 |

| FOREX.com | 98 | 88 |

| IG Group | 174 | 141 |

| Trading.com | 114 | 138 |

Decent Range of Markets

The range of markets with Hugo’s Way is better than what you’ll find from US brokers. The broker offers 55 forex pairs, 73 stocks, six commodities, ten indices, and 38 cryptos.

2. Plexytrade - Best Customer Service

Forex Panel Score

Average Spread

Trading Platforms

Minimum Deposit

Why We Recommend Plexytrade

Plexytrade is my second pick, for its range of account types that allows you to choose your pricing structure. The broker offers both spread-only pricing with no commissions, and Raw pricing with $2 commissions. You can access 120+ markets, from forex to commodities with no swap fees, making them ideal for multi-day trading.

The broker supports MetaTrader 4 and MT5, allowing for advanced technical analysis. These platforms also give you access to virtual private server (VPS) services, which are very useful for automated trading. Trading signals are provided through Trading Central.

Pros & Cons

- Multiple account types

- Negative balance protection

- Solid selection of forex pairs

- Unregulated broker

- Wider-than-average spreads

- Only offers MT4 trading platform

Broker Details

Solid Selection Of Trading Accounts

After Plexytrade recently merged with LQDFX, I found the broker’s selection of trading accounts gives you great options to optimize your trading costs. The broker has 4 trading accounts – two standard account types and two commission-based accounts.

- Micro Account: This account requires the lowest minimum deposit at $50, with 1:2000 leverage for its smaller trade sizes, and no commissions. Instead, it’s a spread-only account with spreads from 0.70 pips. This account type has swaps (overnight fees on open positions).

- Silver Account: This account lets you trade larger positions, but lowers the leverage to 1:500 to compensate for this. You get the same tight spreads and zero commission on trades, but also 7-day swap-free trading. This allows you to hold positions up to a week for free, which is great for swing traders.

- Gold Account: Trade with 0 pip spreads and low commissions at $2 per lot trade. This is much cheaper than the $3.50 typical commission. Like the Silver account, you get seven days of swap-free trading, and 1:500 leverage.

- Platinum Account: Has the highest deposit requirement at $10,000, but you get cheaper commissions of just $1 per lot traded. This will save you 50% on the Gold account. The 0 pip spreads make this a good account for high-volume traders.

Large Choice of Forex Pairs

Plexytrade provides 41 currency pairs, covering all the major and minor pairs, plus some exotics. You can use high leverage on all forex pairs. The broker also offers 15 indices, 11 commodities, 48 stocks, and 8 crypto markets – including Bitcoin, Ethereum, and Ripple – on all accounts.

3. MidasFX - Best Deposit Bonus Broker

Forex Panel Score

Average Spread

Trading Platforms

MT4, MT5

Minimum Deposit

Why We Recommend MidasFX

I rated MidasFX as the best option for MetaTrader 4 thanks to its ECN-style execution services that pair well with the platform – especially if you scalp or automate trades.

The broker’s ECN account offers low spreads from 0.70 pips on EUR/USD with up to 1:1000 leverage, making it ideal if you’re an experienced trader looking to scale up your positions.

Pros & Cons

- Choice of MT4 and MT5 platforms

- Competitive trading fees

- Offers high leverage 1:1000

- Low level of regulation (Saint Lucia FSRA)

- Limited deposit methods

- Can only withdraw funds once per day

Broker Details

MidasFX has MetaTrader 4 and 5

In testing, MidasFX offers two popular trading platforms: MetaTrader 4 and MetaTrader 5, which I think are excellent platforms that work with any trading style.

Unlike broker-owned proprietary platforms, MT4 and MT5 let you customize your trading experience. You can change the look of the platform, use custom indicators, or set up your own Expert Advisors (EAs) for automated trading.

With MetaTrader 4, you can use 30+ indicators out of the box, buidling trading strategies with Bollinger Bands or moving averages without third-party indicators. If you do require bespoke indicators, you can develop them through MQL4, which requires coding knowledge.

Alternatively, you can search the MetaQuotes Marketplace, where you’ll find tens of thousands of EAs and indicators.

I also find MT4 brokers good for scalping, as you can activate one-click trading and set your lot size. This is a faster way to open trades, as you don’t have to go through the order ticket.

No-Dealing Desk Broker With Tight Spreads

MidasFX is a no-dealing desk broker, so all your trades are matched directly with other market participants through their Electronic Communications Network (ECN). I prefer these execution styles as they get the best price, making order filling near-instant and reducing the chance of requotes/slippage.

For their Standard account, MidasFX applies a competitive spread of 0.7 pips on the EUR/USD. There are also no commissions on this account. The MidasFX ECN account has tighter spreads from 0.0 pips, but you pay a $5 commission per lot traded. This commission is average for non-US-regulated brokers, according to my findings.

24/5 Customer Support

The broker offers solid customer support through their live chat, giving you instant access to a human agent who can help resolve your issue. Support is available 24/5, meaning they’ll be available during all market trading hours.

4. CedarFX - Zero Commission Broker

Forex Panel Score

Average Spread

Trading Platforms

Minimum Deposit

5. LQDFX - Best Range Of Trading Accounts

Forex Panel Score

Average Spread

Trading Platforms

Minimum Deposit

Ask an Expert

Can you use copy trading with offshore brokers?

Yes you can.