Top CFTC Regulated Forex Brokers

In 2025 the number of US regulated forex brokers grew to seven. We compared them all to determine the top brokers based on spreads, trading experience and the platforms used.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Our list of the top CFTC brokers offering forex trading are:

- OANDA - Best Overall Forex Broker

- FOREX.com - Great Tight Spread Forex Broker

- Tastyfx - Best For Beginner Traders

- Charles Schwab - Great Range of CFD & Trading Products

- Interactive Brokers - Low Fee CFD Broker In USA

- Nadex - Best Broker for Forex Options

- Trading.com - Best US MetaTrader 5 Forex Broker

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

91 | NFA/CFTC | - | - | - | 1.4 | 2 | 1.4 |

|

|

|

120ms | $0 | 68+ (Spot) | - | 50:1 | 100:1 |

|

|

Read review ›

Read review ›

|

84 |

NFA/CFTC FCA,CIRO |

0.0 | 0.2 | - | $7.00 | 1.50 | 1.5 | 1.4 |

|

|

|

30 ms (May 2023) | $100 | 80+ (Spot) | - | 50:1 |

|

|

Read review ›

Read review ›

|

71 | NFA/CFTC | - | - | - | $6.00 | 1.2 | 1.9 | 1.4 |

|

|

|

174ms | $450 | 80+ (Spot) | - | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

43 |

SEC, NFA/CFTC FINRA |

- | - | - | - | 1.4 | 1.3 | 1.2 |

|

|

|

110ms | $2000 | 70+ (Spot) | 1 | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

52 | NFA/CFTC | 0.2 | 0.4 | 0.3 | 0.08%-0.2% | - |

|

|

|

120ms | $0 | 105+ (Spot) | - | 30:1 | - |

|

||

Read review ›

Read review ›

|

50 | NFA/CFTC | - | - | - | - | 1.2 | 1.8 | 1.2 |

|

|

Who Are The Best CFTC Regulated Forex Brokers?

We compared the best forex brokers in USA and ranked them based on our testing. All brokers recommended are locally regulated by the National Futures Association (NFA) and the Commodities Futures Trading Commission (CFTC).

1. OANDA - Best US Regulated Broker Overall

Forex Panel Score

Average Spread

EUR/USD = 1.4

GBP/USD = 2

AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

We recommend OANDA because it offers the best overall trading experience for Americans. We consider it the number one choice for US-based forex traders due to its combination of competitive spreads, excellent selection of trading platforms and comprehensive collection of currency pairs.

OANDA also holds licenses from seven Tier-1 regulators and provides award-winning customer support, which earned it the top spot for Trust among brokers we reviewed.

Pros & Cons

- Top trading platforms

- Large range of Forex pairs

- Crypto available

- Top research

- Regulated and Trusted

- Customer support is not 24/7

- No MetaTrader 5

- No account protection

- Some ancillary fees

Broker Details

OANDA is our Top CFTC-Regulated Broker

OANDA provides an extensive range of currency pairs (and cryptos) with low trading costs via its Standard account. When trading with this account, you can choose from 3 core trading platforms (OANDA Trade, MT4 and TradingView) and 3 third party platforms (MultiCharts, CQG FX and Motivewave) meaning they have solutions if trading style leaves to analysis, charting or automation.

Our team put OANDA through our comprehensive methodology to review the broker, which includes going through our thorough 80-point check to score each broker based on their services. From this test, we scored OANDA, a strong score of 71/100. This is an excellent score, placing them in the top ten brokers worldwide and number in North America, making it an obvious choice to recommend.

Key Strengths:

- Excellent third-party trading tools, including AutoChartist, for free

- Low spreads from one pip

- 6 trading platforms available

- Crypto trading is available

Exclusive 10% Cashback Offer Available (Terms and Conditions Apply)

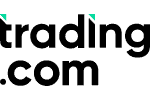

OANDA Offers a Simple Trading Account

Most brokers make you choose between trading accounts, which can be confusing for beginners. OANDA removes some of the difficulty by limiting your options to a single, spread-only Standard account. Spreads start as low as 0.6 pips, with the average for major currency pairs hovering around 1.2. When you take into account that you pay only the spread to execute each trade and aren’t required to put down a minimum deposit, these are competitive compared to the other brokers in this guide. When I tested OANDA, the lowest currency pair was EUR/USD at 1.4 pips and USD/AUD at 1.2.

What I like about the standard account is that it simplifies your trading costs because all you pay is the one-off spread when entering a trade. The standard account is an ideal trading account if you are a beginner because you don’t have to worry about paying extra commissions.

Trade Forex and Cryptocurrency with OANDA

OANDA allows you to trade with 68 currency pairs – an extensive range that includes majors, minors, and exotic pairs. This gives you a solid choice of forex pairs if you want to trade other pairs outside of the majors. If you prefer to trade Cryptos, OANDA has a partnership with PAXOS that gives you access to the PAXOS ItBit crypto exchange. Here, you can access popular tokens like Bitcoin, Ethereum, and Litecoin.

OANDA also allows you to enlarge your positions with leverage – you can trade at 50:1 if you’ve got the mettle for it.

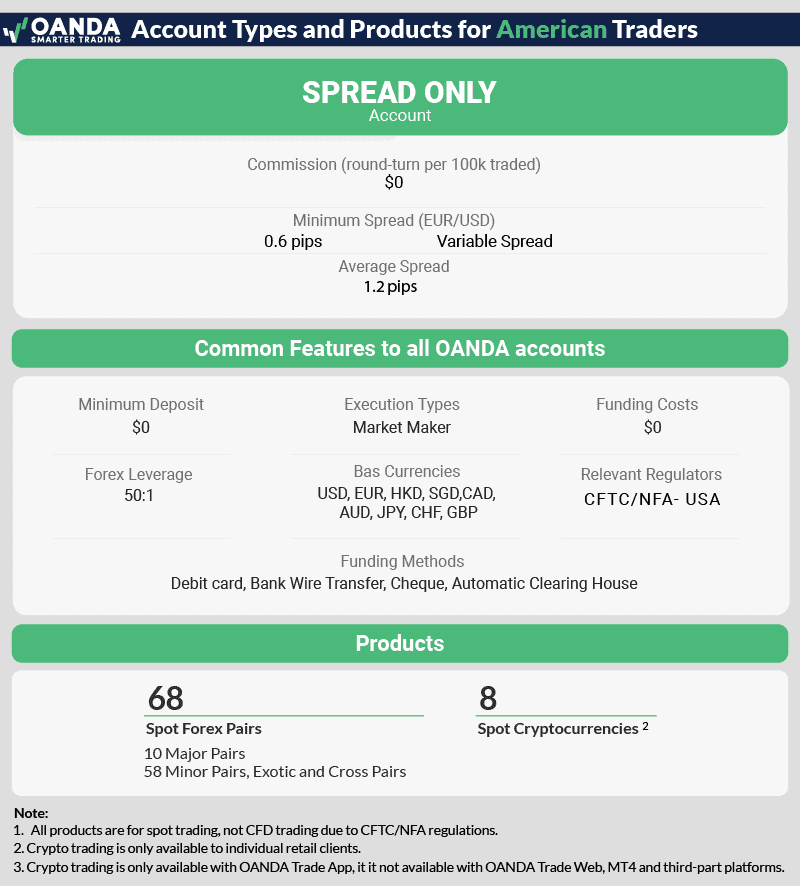

Reduced Trading Costs with Elite Trader Program

If you’re a high-volume forex trader, then you’ll benefit from OANDA’s Elite Trader Program. This program offers a range of benefits, such as a dedicated relationship manager, discounted TradingView subscriptions, and invites to VIP events.

However, the standout benefit of joining the Elite Trader Program is that they provide a rebate based on your trading volume. This can save you up to 34% in trading costs. So if you trade on volume, then this program will make OANDA one of the lowest-cost brokers in our list.

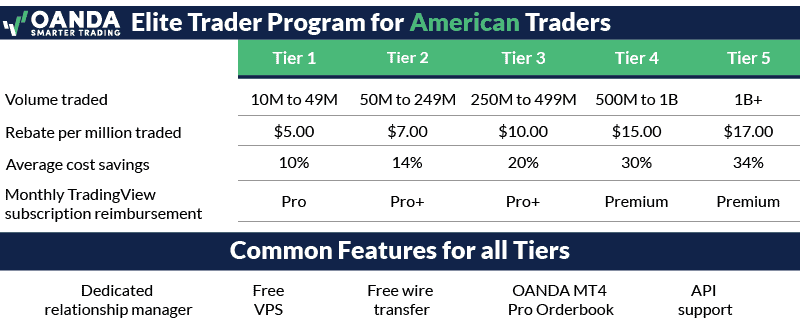

OANDA Trade is Best For Third-party Tools

OANDA Trade is the broker’s proprietary trading platform and an excellent choice if you’re just starting out with trading. It has a user-friendly interface, which makes it easy to navigate and execute your trades. Other features, you’ll appreciate regardless of your level of trading experience include the broker’s tutorials and guides on how to develop a strategy and manage your risk.

If you like analytical tools, you’ll find a lot to like with the charting functionality of TradingView third-party tools like AutoChartist and Technical Analysis. I like the AutoChartist tool because it scans the markets frequently to find trades for you automatically, then alerts you if a potential trade is upcoming based on chart formations.

TradingView is Great for Forex Screeners

TradingView is known for its industry-leading charting package. With over 110+ trading indicators and advanced drawing tools, it has everything you could possibly want to plot your trades.

Personally, I like TradingView for its technical analysis scanner. You can use it to scan the forex market based on any technical analysis metric, and it will filter the currency pairs based on whether they match your criteria or not. This is useful if you use candlestick patterns to trade, because you can search forex pairs based on candlesticks that have formed. This makes analyzing the markets much faster.

MetaTrader 4 Is the Most Popular Trading Platform

Given that MetaTrader 4 the worlds most popular trading platform, there is a good reason we consider the platform to be a solid choice.

With this platform you will more than enough tools for successful trading: features include 23 analytical objects, 30 built-in technical indicators and 9 timeframes. If this isn’t enough, you can create you own indicators and even algos for automation via Expert Advisors (EAs).

To ensure you have the richest possible trading experience with MT4, OANDA gives you access to their order book with the premium Open Order Indicator. I think this is an excellent tool because it shows where the highest concentration of OANDA clients’ orders are, giving you areas of liquidity to trade within.

Third-party Trading Tools

OANDA offers MotiveWave, which is a useful tool if you use Eliott Waves to time your trades. This package contains automatic Eliott Wave analysis on your charts, making finding the next wave simple.

Other third-party tools include CQG FX which provides professional-level charting (10 chart types), analytics (100+ indicators) and fast order execution tools. And Multicharts, which has backtesting, automation and charting features other platforms are missing.

Our Verdict on OANDA

The combination of competitive pricing, advanced trading platforms, and versatile trading tools is why OANDA tops our list of the best forex brokers in USA. Just be mindful that the range of markets is somewhat limited as discussed earlier and they only offer a spread-only account. If you’re looking for an ECN account then look at the next broker review below.

Exclusive 10% Cashback Offer Available (Terms and Conditions Apply)

2. FOREX.com - Great Tight Spread Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.8

GBP/USD = 0.8

AUD/USD = 1.7

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

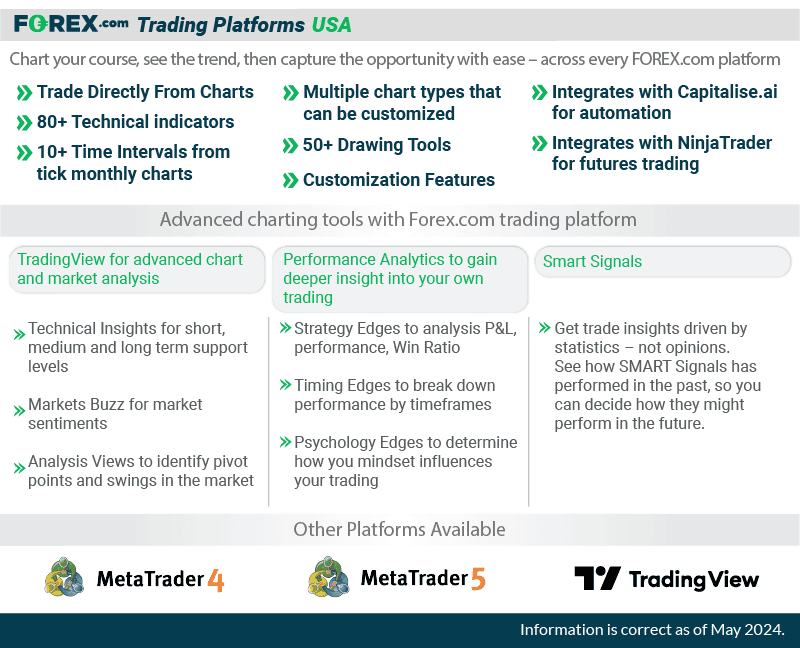

We recommend FOREX.com for its tight spreads and competitive trading costs. Based on our independent analysis, this broker averages 1.66 pips on its Standard Account and spreads for the RAW Spread Account can drop as low as 0.0 pips.

Another feature We like is FOREX.com’s collection of trading platforms and tools, which includes TradingView, Advanced Charting, SMART Signals and personalized performance analytics.

Pros & Cons

- Good rebate program

- TradingView charts on FOREX.com platform

- Good research and education

- 80 Forex pairs

- No account protection

- No negative balance protection

- The website could be better designed

- No copy trading tools

Broker Details

FOREX.com has Tight Spreads on 80+ Forex Pairs

We like FOREX.com for its range of 80+ forex pairs with competitive spreads with two different types of trading accounts – one with commission costs and one with spreads only. To help you trade, the broker allows you to choose from an impressive range of trading platforms complemented with free trading tools.

Key Strengths

- Automated trading with Capitalise.ai (with FOREX.com account)

- Free trading ideas generators with SMART Signals and Trading Central

- Low trading fees

- 80+ forex pairs to trade from

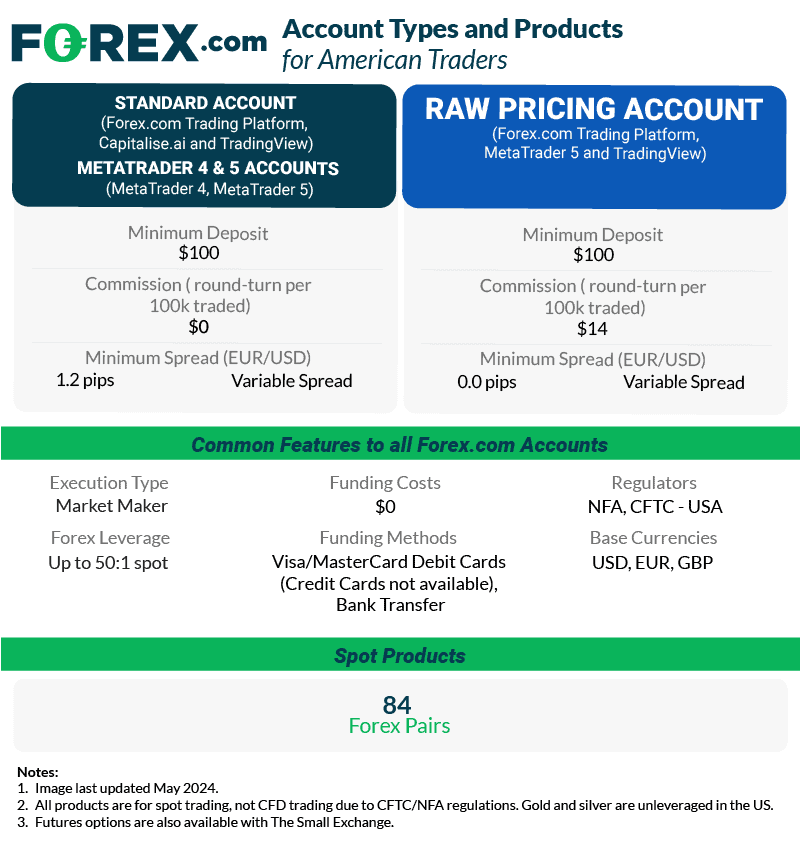

FOREX.com Offers Two Tight Spread Accounts

Different trading accounts suit different types of trading styles so we think it is good that FOREX.com allow you to choose the account for your trading strategy.

Standard and MetaTrader Accounts

The standard account is a solid option if you’re looking for a straightforward forex trading experience. This account has competitive spreads starting from 1.2 pips on EUR/USD, and you won’t need to pay a commission in addition to the spread.

To use this account you will need to choose between the FOREX.com, TradingView, MetaTrader 4 and MetaTrader 5 trading platforms.

RAW Pricing Account

On the other hand, if you’re an active trader seeking tight spreads, then the Raw Pricing account may be a better fit. Spreads start from 0.0 pips on EUR/USD forex pair, but you’ll pay a commission of $14 round-turn per lot traded. This account is only available with FOREX.com trading platform.

Since you pay the commission separately to the spread, you get greater transparency with this account and this is one of the reasons it is popular with scalpers.

Regardless of which FOREX.com account you choose, you’ll have access to all of its trading products. This broker has an impressive range of currency pairs, with over 80 crosses available. In fact, it’s one of the top brokers in terms of the variety and quantity of forex pairs. You also get access to the unleveraged gold and silver markets.

Both trading accounts also benefit from the 1:50 leverage provided by FOREX.com. However, if you want to use less leverage, you can request FOREX.com to lower it on your account.

You Get Excellent Free Trading Tools and Platforms with FOREX.com

We’re impressed with what FOREX.com offers in terms of trading platforms and tools. The broker’s own platform makes executing trades directly on FOREX.com simple and intuitive with a user-friendly interface. Alternatively, scalpers can trade with old standby MetaTrader 4 (and MetaTrader 5)and its on-chart one-click execution feature. If you want an extensive range of trading indicators and drawing tools, there’s TradingView. Lastly, we should mention the availability of Capitalise.ai which allows you to automate your trading without knowing any code.

FOREX.com also shines when it comes to free trading tools that enhance your trading experience. If you are a day trader, finding consistent opportunities can be challenging, so you could benefit from FOREX.com’s SMART Signals and Trading Central. Both tools scan the markets, finding price action patterns that are ready to trade when they appear in the dashboard.

Our Verdict on FOREX.com

Overall, FOREX.com has some of the tightest spreads available in the United States from 0.0 pips. In addition, you can choose from a generous range of trading platforms and access free tools to help you find trades faster. All in all, this makes FOREX.com my top pick for tight spreads.

3. Tastyfx - Best Broker For Beginner Traders

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, tastyfx Web Platform, tastyfx Mobile App, ProRealTime

Minimum Deposit

$250

Why We Recommend Tastyfx

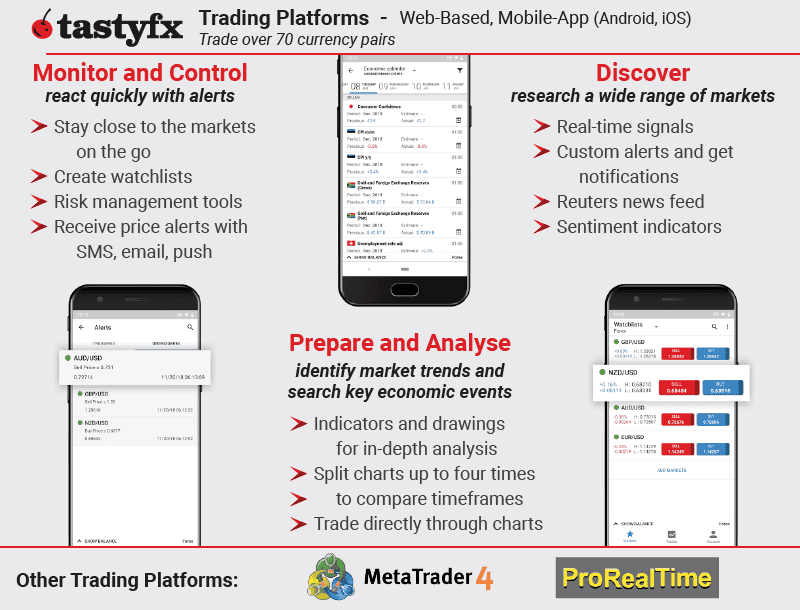

We recommend TastyFX for beginner traders due to its user-friendly trading platform and comprehensive educational resources. Formerly known as IG Markets, TastyFX offers a simple environment that’s easy for newcomers to navigate. The platform features a drag-and-drop interface for setting stop-loss and limit orders and includes a trade ticket that shows risk-reward ratios.

TastyFX also provides a variety of educational materials, such as webinars, tutorials, and how-to guides, to help traders build their skills and confidence.

Pros & Cons

- Worlds largest broker

- High trust

- Top range of trading platforms

- No RAW account

- Lacks live chat support

- Only spot Forex products

Broker Details

Tastyfx has an easy-to-use Trading Platform

The forex trading platform developed by tastyfx is ideal for beginners. It has all the basics without distractions in a visually appealing platform, with built-in trading signals to help find new trade ideas. They also set up the Learn Center, which can help you find step-by-step instructions on trading forex, navigating markets, and managing your risk. With all of the novice-friendly offers, it makes tastyfx an easy choice as our top choice for beginner traders.

Key Strengths:

- Simple trading platform with fast executions

- Competitive spreads from 0.8 pips

- Low minimum deposit

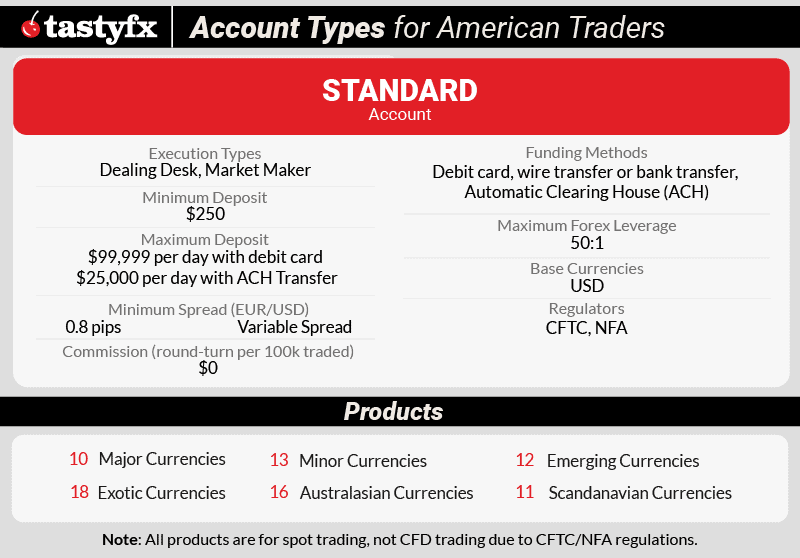

Simplified Trading Accounts and Products from tastyfx

Tastyfx only has one standard currency trading account. This has a spread-only pricing model, which means you do not pay any commission on tastyfx. Spreads start as low as 0.8 pips on EUR/USD. However, I noticed they averaged around 1.2 pips on the tastyfx platform. This account is ideal for beginners because all the trading costs are in the one-off spread when entering the markets. This makes tracking your trading fees simple, which is helpful when you are just starting.

The NFA regulates tastyfx in the United States, which allows them to provide 1:50 leverage on their majors and 1:20 leverage on their minor pairs.

They also offer a wide range of forex pairs. With over 80+ currency pairs to trade, tastyfx is a popular choice for forex traders who like to trade outside the major pairs. I found it unusual that they only offered forex markets, so no commodities, futures, or options. It would be nice if they provided more markets.

Tastyfx’s Platforms are User-Friendly

Tastyfx’s proprietary forex trading platform is very well-designed and easy to use. Although it doesn’t have the most advanced technical indicators and drawing tools, it does have the most popular ones. For example, Fibonacci retracement tools and moving averages (MAS). You’ll find over 30 indicators and 20 drawing tools on the platform – so it is by no means a basic platform.

What I like about the platform is they have their in-built Trading Signals on the platform. AutoChartist and PIAFirst provide these signals, and both have decades of experience providing trading signals. Which is helpful if you are a beginner to watch and read these signals so you can learn how the professionals do it in real time.

Our Verdict On Tastyfx

Tastyfx has low trading costs, specialist trading tools, and a user-friendly trading platform. This makes Tastyfx an excellent choice if you are a novice trader. If your still unsure of which broker is right, then view our Best Forex Brokers For Beginners page created for Traders new to CFDs.

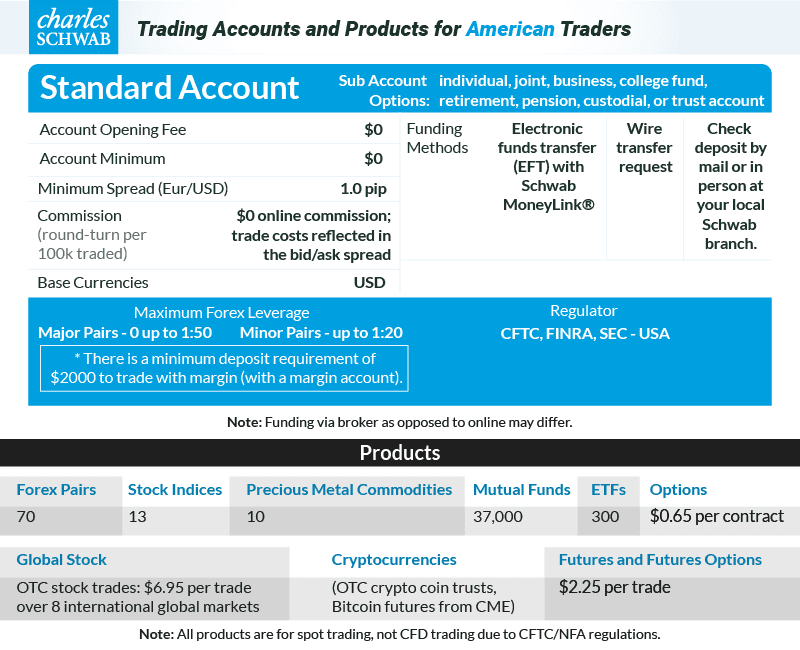

4. Charles Schwab - Great Forex Broker for Range of Trading Products

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

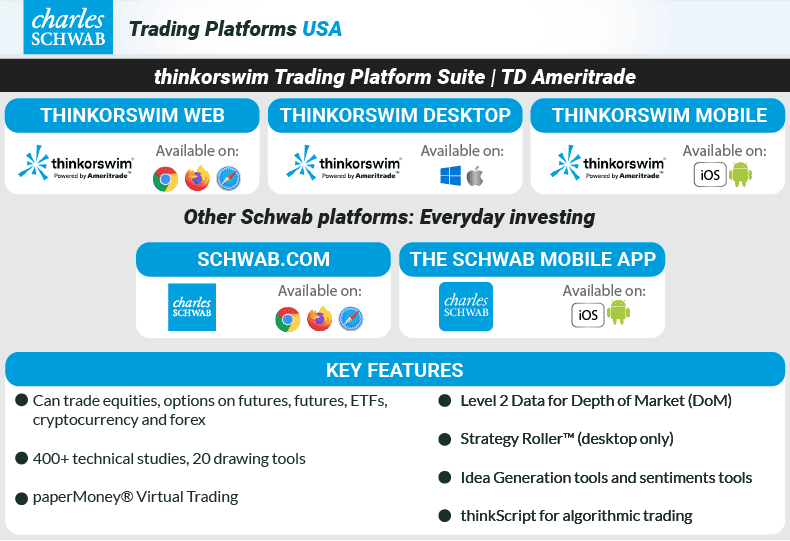

Trading Platforms

thinkorswim desktop, thinkorswim web, thinkorswim mobile, Schwab.com, Schwab Mobile

Minimum Deposit

$0

Why We Recommend Charles Schwab

We recommend Charles Schwab for its wide range of trading products available to residents, which exceeds the offerings of other brokers we reviewed. This broker, a subsidiary of the prominent American financial services firm Charles Schwab, provides access to a variety of financial markets that international brokers may not cover.

Charles Schwab’s product lineup includes ETFs, money market funds, bonds, mutual funds, index funds, stocks, international stocks, forex, cryptocurrencies, options, and futures. This extensive selection ensures that traders and investors can find diverse opportunities to suit their financial goals.

Pros & Cons

- Impressive range of markets

- Good customer support

- Free in-depth research

- Fewer international investment options

- thinkorswim®’s advanced features can overwhelm beginners

- Confusing range of account types

Broker Details

Charles Schwab has an extensive range of markets

Charles Schwab (now including TD-AmeriTrade) is a smart choice if you trade multiple assets and want a centralized account to trade from. Unlike others on this list, Charles Schwab provides access to various markets, from forex to stocks. Giving you an excellent opportunity to take advantage of opportunities across different asset classes. Making it a great forex broker if you want access to a large range of markets.

Key Strengths:

- Excellent range of trading products

- High-quality trading platforms

- Commission-free trading online

Charles Schwab has Low-Cost Trading Accounts and Products

Charles Schwab offers a Brokerage account for trading in the currency market, providing commission-free Forex trading where trade costs are built into the bid/ask spread.

Charles Schwab offers a wide range of financial instruments to trade through their Brokerage account, giving you access to a diverse selection of assets:

- ETFs

- Money market funds

- Bonds and fixed income products

- Mutual funds

- Index funds,

- Stocks

- International stock

- Forex,

- Cryptocurrencies

- Options and Futures

Charles Schwab has Professional Trading Platforms

With a range of products that are so diverse, it’s good that Charles Schwab provides a trading platform that has all the features to trade in any market. Their proprietary trading platform is called Thinkorswim.

Now at Schwab, the award-winning thinkorswim® platforms offer powerful features and real-time insights, combining the best of MetaTrader 4 and TradingView with numerous trading indicators for options, futures, stocks, and forex—all in one place.

Our Verdict On Charles Schwab

Charles Schwab delivers outstanding service, especially for multi-asset traders who value low trading costs across various asset classes. The integration of the award-winning thinkorswim® platforms provides advanced trading tools and professional insights within a single account. For anyone interested in trading a wide range of assets in the U.S., Charles Schwab stands out as a top choice due to its extensive offerings and state-of-the-art trading features.

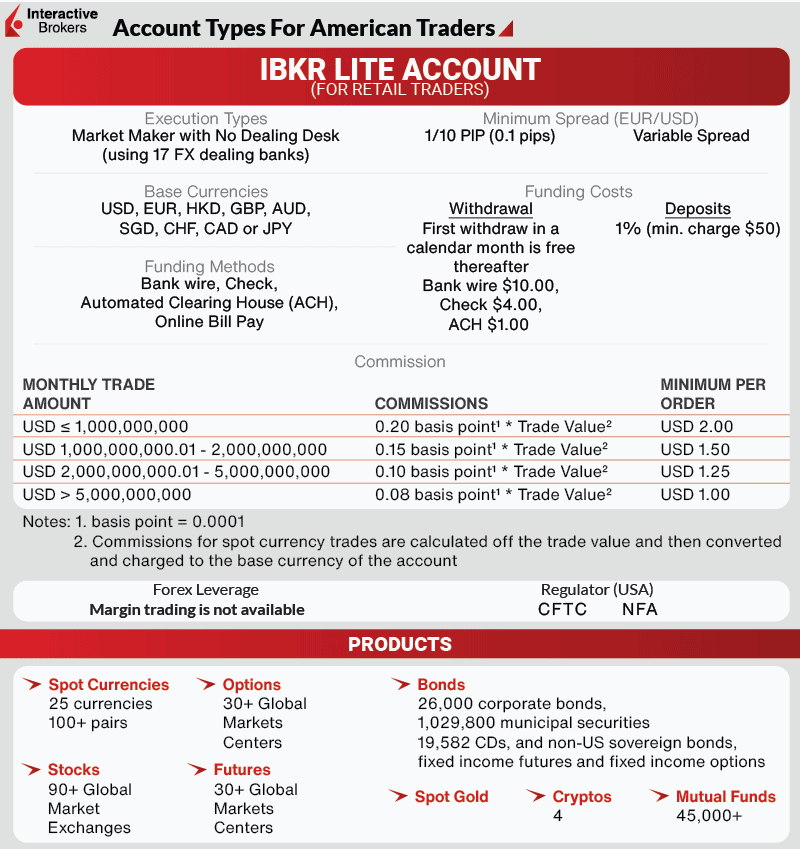

5. Interactive Brokers - Low Fee Trading Broker

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

We recommend Interactive Brokers for its exceptionally competitive trading costs, from tight spreads to low commissions. The IBKR Lite Account sources liquidity from 17 different providers, which allows the broker to offer exceptionally tight spreads.

Our tests found that this account type averaged 0.1 pips for the EUR/USD currency pair, for example. Commissions are likewise competitive and based on volume. The amount you pay will vary depending on the size of your trade – the larger your position, the lower your commission.

Pros & Cons

- A large range of markets

- Trading platform has tools for Professionals

- Best research tools

- Complex account opening process

- Trading platforms can be confusing to new traders

- Customer support could be better

Broker Details

Interactive Brokers Offers Low Trading Fees for Active Traders

Interactive Brokers provides a sophisticated trading service that would suit an experienced trader who wants low trading fees. They can access a wide range of markets with low commissions, making Interactive Brokers our standout low-fee trading broker.

Key Strengths:

- Large selection of assets to trade

- Top financial market research and educational tools

- Low trading costs

Interactive Brokers has low fee Trading Accounts

The IBKR Lite account is Interactive Brokers’ “standard” account for retail traders. Interactive Brokers gets its pricing from 17 FX dealers, so you’ll enjoy the benefits of low spreads from 0.1 pips on the EUR/USD. You have to pay a commission with each trade, which is between 0.08 to 0.20 basis points. What you pay depends on your trading volume.

You should choose Interactive Brokers if you are a trader that trades large positions (at least one lot or more). The reason is that there is a minimum of $2.00 commission per trade on the forex market. So if you want to trade micro-lots or mini-lots, you’ll be paying $2 at each entry and exit ($4 per round-turn), making it expensive. However, if you trade one lot or more, then they provide one of the lowest fees, so you should take advantage of this.

With the low fees, you can take advantage of the markets that Interactive Brokers offer. IB offers over 100 currency pairs, trade options on over 30+ markets, invest in stocks in 90+ markets, and trade futures in 30+ global markets.

Our Verdict On Interactive Brokers

Our Verdict On Interactive Brokers

Interactive Brokers provides an excellent service overall with an extensive range of trading products and an institutional-grade trading platform. They make an Ideal choice for experienced traders who trade one lot and above to get the best from the low fees.

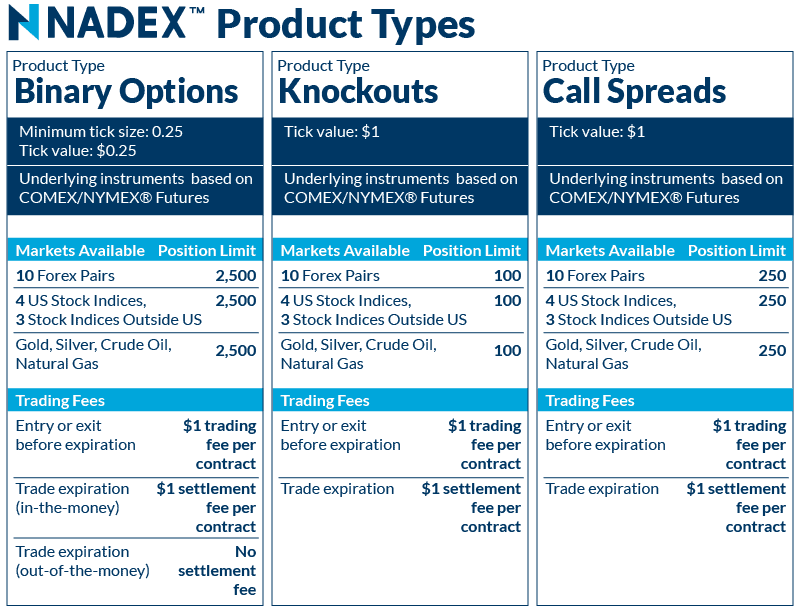

6. Nadex - Best Broker for Forex Options

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

NADEX Trading Platform

Minimum Deposit

$0

Why We Recommend Nadex

We recommend Nadex for any American traders interested in exploring forex options. Strictly speaking, Nadex is an exchange, not a broker, which means it matches buyers and sellers directly rather than through a liquidity provider. This leads to lower trading costs – commissions are fixed at US $2.00 regardless of the size of your trade.

We also appreciate the built-in risk management tools included in the Nadex platform, such as the ability to exit an option contract while profitable and prior to the expiration.

Pros & Cons

- Operated as an exchange, not a broker

- Good education content

- Binary, knock-out and call options

- No mobile app

- Minimum deposit requires

- Only has options, no spot products

Broker Details

NADEX Delivers a Range of Options Trading Products

As a CFTC-regulated exchange, NADEX provides retail traders with various derivatives options and is the only regulated exchange to offer binary options. If you want a simplified approach to trading forex, then NADEX provides a solid range of derivative products with binary options, knock-outs, and call spreads. These derivatives attract beginners because they offer short-term contracts and limited risk. Making NADEX an excellent choice for forex options.

Key Strengths:

- Regulated binary options exchange

- Low trading fees

- Low minimum deposit

Nadex Makes Trading Simple with Their Options Products

NADEX is not a fx broker but an exchange. This means they match buyers and sellers directly and not through third-party liquidity providers. NADEX offers a range of tools to simplify forex trading with their binary options, call spreads, and knockouts. You should use NADEX if you are a beginner and want risk management built into your products.

For example, binary options have limited risk and a capped profitable outcome. This means that when you use a binary option to trade, you just have to speculate on the price being higher or lower than where the market is during the time frame. If you are correct, you get paid $100. If you are wrong, you simply lose the funds you invested.

The profit is the difference between the $100 and how much you paid for the binary option. Trading can only get as simple as this. As a bonus, you are not locked into the option, so if you are profitable within the timeframe – you can exit the option at a profit before it expires.

The trading fee with NADEX is simple and fixed. It’s just $2 per contract round-trade. Making it a low-cost trading option if you are a new retail trader.

Our Verdict On Nadex

NADEX does a great job at providing option derivatives through their exchange. Due to their built-in risk management and profit levels, they offer a low-cost trading solution with ideal trading products if you are a novice trader.

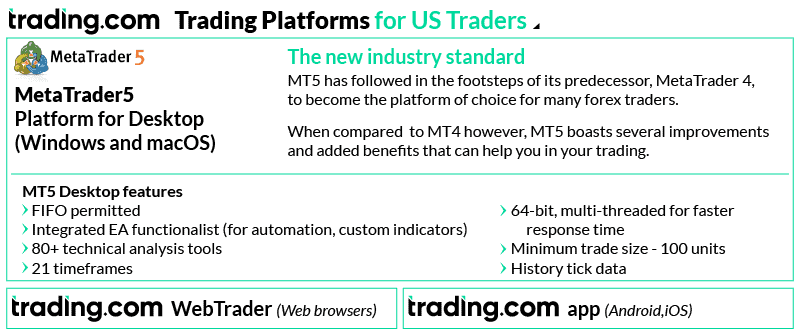

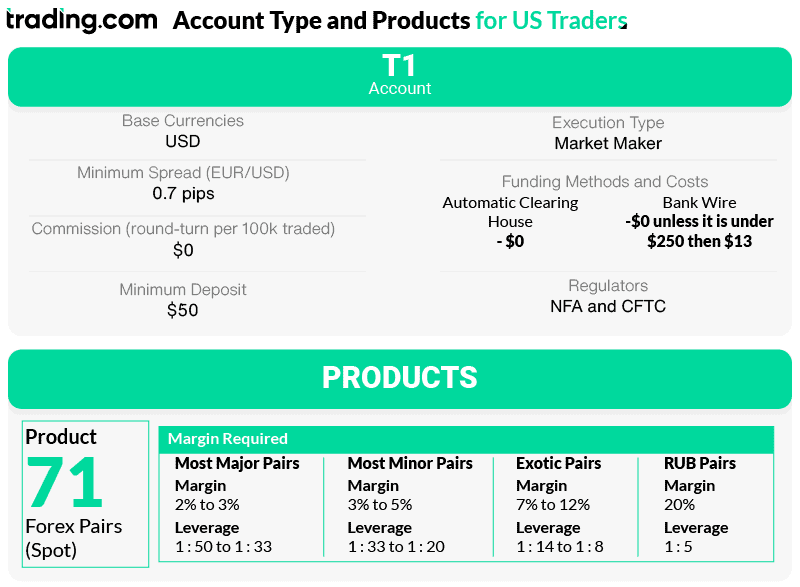

7. Trading.com - Best MetaTrader 5 Broker

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 1.6

AUD/USD = 1.2

Trading Platforms

MT5

Minimum Deposit

N/A

Why We Recommend Trading.com

We recommend Trading.com for its comprehensive MetaTrader 5 offering, which includes great support for automated trading. If you’re interested in trading with bots, you can either code your own using MQL5 or purchase one from the 3,500 available on the MetaTrader marketplace.

We also like that this broker offers competitive trading costs and the option to trade micro lots. If you’re an algorithmic trader, you can test your strategies in live markets with minimal financial exposure.

Pros & Cons

- Has MetaTrader 5

- Commission-free trading

- Relatively newer broker

- No MetaTrader 4

- Not the tightest spreads

- No 3rd party social trading

Broker Details

Trading.com Delivers an Excellent Platform for Algo Traders

You should choose Trading.com if you want access to automated trading features through MetaTrader 5. They offer low spreads and have over 1,250+ markets available to trade. In particular, I like that they have the lowest trade sizes (100 units) available, so you can test your automated strategies in a live environment without risking too much capital.

Key Strengths:

- Straightforward trading environment

- Small trade sizes of 100 units vs. 1,000 (micro-lot)

- Over 70 currency pairs are available

Automate your trades on MetaTrader 5 with Trading.com

If you are looking for an NFA-regulated broker with low spreads and allows automated trading, then Trading.com is an excellent choice. The MetaTrader 5 platform supports automated trading through expert advisors. These are programmed algorithms that can execute your trades based on your strategies.

Alternatively, if you are not a programmer but still want to automate your trades, you will find over 3,500 EAs available on the MT5s EA marketplace for you to use.

I like that Trading.com offer lower minimum trade sizes compared to most brokers. On the MT5 platform, you can trade as low as 100 units (0.001 lot). This makes it an excellent choice if you are an algo trader because you can forward test your EAs in a low-cost environment, enabling you to test how your EA performs truly.

Low Spread Standard Account with Trading.com

Trading.com offers spreads from 0.7 pips on EUR/USD with no commission, so it’s relatively competitive to automate your trades with Trading.com. With them being NFA-regulated, you can trade with leverage of up to 1:50.

Our Verdict On Trading.com

Trading.com is an excellent low-cost broker with the MetaTrader 5 if you want to automate your trades. With low spreads from 0.7 pips and the ability to trade smaller lot sizes (0.001), you can test your EAs in a live environment with lower capital requirements and competitive spreads. For these reasons, I recommend Trading.com if you want to automate your trades and use MetaTrader 5.

Ask an Expert