TD Ameritrade Review Of 2025

Our team evaluated TD Ameritrade based on the range of accounts, trading costs, leverage, platforms, funding methods, and more. If you are a US resident, this broker is reliable and safe with regulation from top-tier US regulatory bodies.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

TD Ameritrade Summary

| 🗺️ Regulation | CFTC, SEC, FINRA |

| 💰 Trading Fees | Low spreads |

| 📊 Trading Platforms | ThinkorSwim |

| 💰 Minimum Deposit | $0 |

| 💰 Withdrawal Fees | $0 |

| 🛍️ Instruments Offered | ETFs, Stocks, Mutual Funds, Forex, Bonds, Crypto |

| 💳 Credit Card Deposit | No |

Why Choose TD Ameritrade

TD Ameritrade’s primary specialty is stock trading however you can also trade other products such as ETFs, mutual funds, forex, bonds, options, futures, and cryptocurrency. It only accepts account applications from US residents, so this broker is not suitable if you are located outside the USA.

Note: In Nov 2019, Charles Schwab acquired TD Ameritrade for $26 billion. Current accounts are in the process of being transferred to Charles Schwab, and this process will be finished by 2024.

TD Ameritrade Pros and Cons

- Low Trading Fees

- Excellent Customer Support

- Great Desktop Trading Platform

- Steep Learning Curve with Educational Materials

- Only Accepts US clients

The overall rating is based on review by our experts

Fees

TD Ameritrade offers commission-free, no-minimum pricing through their several types of accounts: Standard, Retirement, Education, and Specialty.

Standard Account Types Offered By TD Ameritrade

There are several types of Standard accounts, including:

- Individual account – there is only one owner of this brokerage account

- Joint Tenants with rights of survivorship – there are two or more owners of the account and every one of them has an undivided interest in the account’s assets

- Tenants in Common – there are two or more owners of the account and every person owns a particular percentage of the account’s assets

- Guardianship or Conservatorship account – account holders are usually minors or persons who are unable to manage their assets. Therefore, those assets are managed by a court-appointed guardian or conservator.

| Client Profiles | Electronic Funding Minimum | Margin or Option Privileges | |

|---|---|---|---|

| Individual | Cash, Cash and Margin, Cash and Option, Cash, Margin and Option | $50 | $2,000 |

| Joint Tenants with Rights of Survivorship (JTWROS) | Cash, Cash and Margin, Cash and Option, Cash, Margin and Option | $50 | $2,000 |

| Tenants in Common | Cash, Cash and Margin, Cash and Option, Cash, Margin and Option | $50 | $2,000 |

| Community Property | Cash, Cash and Margin, Cash and Option, Cash, Margin and Option | $50 | $2,000 |

| Tenants by the Entireties | Cash, Cash and Margin, Cash and Option, Cash, Margin and Option | $50 | $2,000 |

| Guardianship or Conservatorship | Cash, Cash and Option | $50 | None |

Retirement Account Types

The retirement brokerage account has some restrictions but offers some great tax advantages. US clients can open individual retirement accounts (IRA), including:

- Traditional IRA

- Roth IRA

- Rollover IRA

- Simplified Employee Pension Plan (SEP) IRA

- Savings Incentive Match Plan for Employees (SIMPLE) IRA

- Pension or Profit Plan accounts

Education Account Types

Education Account Types

TD Ameritrade offers education accounts for US clients to save for college or pay qualified expenses, with tax benefits available through the 529 Plan or Coverdell Education Savings Account.

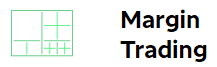

Margin Account

TD Ameritrade offers a margin account with leverage up to 1:50, depending on the traded asset class. Furthermore, TD Ameritrade provides the option to engage in margin trading across all their trading platforms. The margin account has the following limitations and restrictions:

- Requires a minimum deposit of $2,000

- Minimum equity requirements – 30% of the account value

- Only available for stocks, ETFs, options, futures and forex trading

- Pattern day trader rule or the PDT Rule – according to FINRA rules you need to have an account minimum of $25,000 for day trading stocks.

Other Account Types

TD Ameritrade also offers several Specialty accounts such as Trust, Limited Partnership, Limited Liability, Sole Proprietorship, Investment Club, or Corporate.

Additionally, the brokerage firm offers several types of managed portfolios overseen by TD Ameritrade Investment Management LLC:

Additionally, the brokerage firm offers several types of managed portfolios overseen by TD Ameritrade Investment Management LLC:

- Essential Portfolios – the minimum investment amount is $500. Clients can access 5 portfolios of Index ETFs.

- Selective Portfolios – the minimum investment amount is $25,000. Clients can access a wider range of portfolios comprised of Mutual Funds or ETFs.

- Personalised Portfolios – the minimum investment amount is $250,000. Clients can use portfolio planning and investment advice from a dedicated financial consultant.

| Essential Portfolios | Selective Portfolios | Personalized Portfolios | |

|---|---|---|---|

| Minimum Investment | $500 | $25,000 | $25,000 |

| Advisory Fees | 0.30% | Between 0.75% - 0.90% | Starts from 0.90% |

| Designed for Investors Seeking | Low-cost diversified portfolios | More sophisticated strategies & Portfolio recommendation | Personalized portfolios by professionals |

| Key Investment Features | Low-cost ETFs and automated strategies | ETFs and Mutual funds | Tailored portfolios |

Verdict

In this category, based on our star scoring system, TD Ameritrade scored 7 points out of 10 points.

Trading Platforms

TD Ameritrade offers its proprietary platform: Thinkorswim. This includes:

TD Ameritrade Mobile Trader

TD Ameritrade Mobile Trader- ThinkOrSwim Desktop

- ThinkOrSwim Web

- ThinkOrSwim Mobile

All TD Ameritrade platforms have advanced features, with ThinkOrSwim Web being the only trading platform that does not grant access to Level II Price Quotes on Shares and Options.

| Trading Platform | TD Ameritrade |

|---|---|

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | Thinkorswim |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

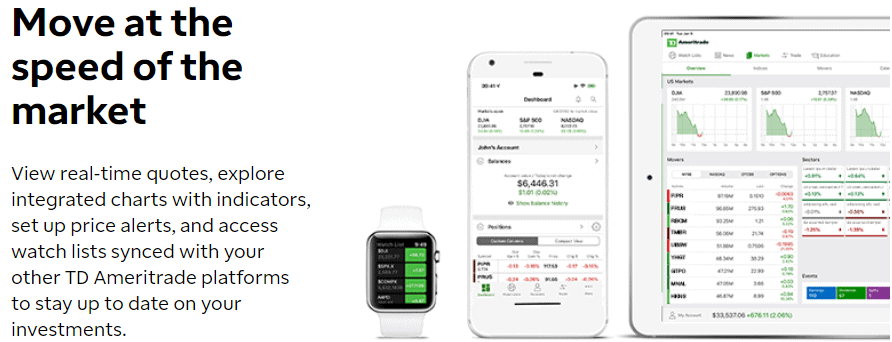

Mobile Trading With TD Ameritrade App

TD Ameritrade Mobile is a trader app, which gives clients the basics to manage their TD Ameritrade account. The mobile app is equipped with advanced charts, real-time quotes, watchlists, alerts, and technical indicators and it can be synchronised with the desktop platform.

This user-friendly app is compatible with Android smart devices and iOS-based devices including Apple Watch.

Additional capabilities include access to constant market news, analyst reports, daily updates, third-party research, and e-documents (tax documents in PDF format for the past seven years and statements for the past ten years).

The ThinkOrSwim Desktop Platform

TD Ameritrade’s ThinkOrSwim offers elite-level trading tools, market insights, and a load of unique features, all of which bring trading experience to a higher level.

TD Ameritrade’s flagship trading platform ensures clients will benefit from the most sophisticated tools including:

- Access to a huge amount of economic data (more than 400,000 economic indicators from six continents)

- Access to In-App Chat option and Chat Rooms

- Ability to set custom alerts and synchronise alerts, trades, or charts across all client devices

- Access to a full suite of technical analysis tools – over 400 indicators and 20 drawing tools are available, while clients are also able to create algorithms of their own with the thinkScript tool

- Access to Options Statistics – clients can view implied and historical volatility of underlying assets or the current day’s option volume

- Access to Company Profile – a third-party research tool that provides insight into revenue drivers of a particular company

- Access to Live-Streaming Media content – clients can receive news feeds directly from CNBC and TD Ameritrade Network

- Access to other unique tools such as Strategy Roller, Market Maker Move, Stock Hacker, and Market Monitor

ThinkOrSwim Mobile App

Designed and optimised for Android- and iOS-based devices, TD Ameritrade’s ThinkOrSwim mobile app brings the power of the desktop platform to your mobile phone.

Having a customisable interface, the mobile app allows traders to:

- Analyse the potential profitability and risk of their positions and stress test their portfolios with an innovative analyse feature

- Scan multi-touch charts with an array of technical studies

- Get access to live news and market insights with TD Ameritrade Network and CNBC

- Master a trading strategy without risking real money with a paperMoney account with $100,000 in virtual funds

- Receive live support on specific matters by chatting with a trading specialist

Trade Experience

When you submit an order for stocks, penny stocks, ETFs, currency pairs, or any other financial instrument, TD Ameritrade ensures fast speeds of 70ms. In the stock market, the fast order speed can lead to price improvement savings of around $2.11 for every 100 shares traded.

Verdict

Based on our star scoring system, TD Ameritrade scored 6.5 points out of 10 points.

While the platform offering of TD Ameritrade is excellent, they do not offer MetaTrader 4 (MT4). If you wish to trade with MT4, have a look at the Best MT4 Brokers for US traders.

Is TD Ameritrade Safe?

Yes, TD Ameritrade is safe with a trust score of 64/100.

Regulation

Regulation

TD Ameritrade is a trademark, co-owned by TD Ameritrade IP Company, Inc. and the Toronto-Dominion Bank. TD Ameritrade complies with strict regulatory standards imposed by:

- The Financial Industry Regulatory Authority (FINRA)

- The Securities and Exchange Commission (SEC)

- The Commodity Futures Trading Commission (CFTC)

It’s important to note that unlike FCA and CySEC-regulated brokers which must offer Negative Balance Protection to retail clients, TD Ameritrade does not offer this.

| TD Ameritrade Safety | Regulator |

|---|---|

| Tier-1 | CFTC SEC FINRA |

| Tier-2 | X |

| Tier-3 | X |

Reputation

TD Ameritrade has been in the forex industry for a long time, having been established in 1971, with headquarters in Omaha, Nebraska.

With such a mileage in the industry, it is only fitting that they’re quite popular with traders, reaching around 1,830,000 Google hits monthly.

Reviews

Despite its popularity, they have a low TrustPilot score of 1.5 out of 5 from 281 reviews.

Verdict

TD Ameritrade can be considered safe with its strong regulation and banking background.

How Popular Is TD Ameritrade?

While TD Ameritrade no longer exists as an independent entity after being fully acquired by Charles Schwab, its brand name continues to generate exceptional search interest. With approximately 2,300,000 monthly Google searches, it ranks 1st among the 65 brokers we have studied with most of these in the USA. This is no surprise given TD AmeriTrade was a significant brand name in the USA financial space, not just online but with physical stores for all kinds of security investments.

This dominant position is mirrored in web traffic data, with Similarweb reporting an enormous 88,270,000 global visits in February 2024, also placing it 1st in visibility.

Charles Schwab completed the $22 billion acquisition of TD Ameritrade in October 2020 and has since fully integrated its operations. All TD Ameritrade accounts now operate under the Schwab ecosystem, which reported 35.8 million active brokerage accounts and $9.0 trillion in client assets as of Q1 2024. TD Ameritrade’s continued exceptional visibility in search metrics demonstrates the enduring strength of its brand recognition, even after full integration into Charles Schwab.

| Country | 2024 Monthly Searches |

|---|---|

| United States | 246,000 |

| Taiwan | 6,600 |

| Canada | 3,600 |

| Colombia | 3,600 |

| India | 2,900 |

| Mexico | 1,900 |

| Peru | 1,900 |

| Singapore | 1,600 |

| Argentina | 1,600 |

| United Kingdom | 1,300 |

| Brazil | 1,300 |

| Hong Kong | 1,000 |

| Germany | 880 |

| Nigeria | 880 |

| Spain | 720 |

| Malaysia | 720 |

| Australia | 720 |

| Indonesia | 720 |

| Japan | 590 |

| Philippines | 590 |

| Saudi Arabia | 590 |

| South Africa | 480 |

| France | 480 |

| Pakistan | 480 |

| Chile | 480 |

| Turkey | 390 |

| Vietnam | 390 |

| Thailand | 390 |

| Italy | 320 |

| United Arab Emirates | 320 |

| Netherlands | 320 |

| Dominican Republic | 320 |

| Cambodia | 320 |

| Costa Rica | 320 |

| Ireland | 260 |

| Morocco | 260 |

| Switzerland | 260 |

| Egypt | 260 |

| Ecuador | 260 |

| Uzbekistan | 260 |

| Poland | 210 |

| Kenya | 210 |

| Portugal | 210 |

| Venezuela | 210 |

| Bangladesh | 170 |

| Sweden | 140 |

| Greece | 140 |

| Algeria | 140 |

| New Zealand | 140 |

| Ghana | 110 |

| Panama | 110 |

| Austria | 90 |

| Sri Lanka | 90 |

| Jordan | 90 |

| Bolivia | 90 |

| Cyprus | 50 |

| Uganda | 50 |

| Ethiopia | 50 |

| Mongolia | 40 |

| Tanzania | 40 |

| Mauritius | 30 |

| Botswana | 20 |

2024 Average Monthly Branded Searches By Country

United States

United States

|

246,000

1st

|

Taiwan

Taiwan

|

6,600

2nd

|

Canada

Canada

|

3,600

3rd

|

Colombia

Colombia

|

3,600

4th

|

India

India

|

2,900

5th

|

Mexico

Mexico

|

1,900

6th

|

Peru

Peru

|

1,900

7th

|

Singapore

Singapore

|

1,600

8th

|

Argentina

Argentina

|

1,600

9th

|

United Kingdom

United Kingdom

|

1,300

10th

|

Deposit And Withdrawal

TD Ameritrade does not have a minimum deposit requirement for trading on a Standard brokerage account (cash account). However, it is worth noting electronic funding does have a minimum requirement of $50.

Account Base Currencies

Another specific circumstance to note is that the only base account currency the brokerage allows includes the US Dollar. Funding with other currencies will be subject to a conversion fee.

Deposit Options And Fees

| Electronic Bank Deposit (ACH) | Wire Transfer | Account Transfer from Another Firm | Check | Physical Stock Certificates | |

|---|---|---|---|---|---|

| Standard Completion Time | 5 mins | 1 business day | 1 - 3 business days | About a week | 1 business day |

| Deposit Limits | $50 - $250,000 | No limit | No limit | No limit | No limit |

| How to Start | Set up online | Contact your bank | Use mobile app or mail in | Set up online | Mail in |

There are several account funding options available with TD Ameritrade:

- Electronic Bank Deposit (ACH) – the transfer is completed within 5 minutes, while the minimum and maximum deposit amounts are $50 and $250,000 respectively

- Wire Transfer – the transaction is completed within 1 business day and there are no deposit limits,

- Account Transfer from Another Firm – clients can transact stocks, options, ETFs, or other assets to their TD Ameritrade account from another brokerage. The transfer could take up to one week, while there are no deposit limits.

- Funding by Check – clients can send a check for deposit into a new or existing account with the broker. The transaction completes within 1-3 business days, while no deposit limits are imposed.

- Clients can also deposit physical stock certificates in their name into an individual brokerage account. The transaction is completed within 1 business day.

Withdrawal Options and Fees

TD Ameritrade does not charge any fees with deposits and withdrawals. The only exception is fund withdrawal via wire transfer, in which case the corresponding bank charges a $25 fee.

Verdict

TD Ameritrade is good in this category, especially with its no minimum deposit requirement.

Product Range

TD Ameritrade offers a huge selection of over 80 trading instruments, ranging from Forex to Indices. It is important to note you are trading the actual products, not contracts for different products (CFDs) that are not available in the US.

| Stocks | ETFs | Mutual Funds | Forex | Bonds | Options | Futures | Cryptocurrency | |

|---|---|---|---|---|---|---|---|---|

| Trading Cost | $6.95 for non-US listed stocks | 0$ | $49.99 | $10.6 per side | $1.0 | $0.65 per options contract | $2.25 per contract | $2.25 per contract |

Commission-Free ETFs And Stock Trading

In 2019, TD Ameritrade (like many other stockbrokers) in the United States waived commission charges on online Stocks and ETFs listed on US exchanges. Over-the-counter (OTC) stocks not listed on a US exchange incur a $6.95 commission rate.

The brokerage firm allows access to several US stock exchanges and some OTC markets, including the NYSE, NASDAQ, AMEX, OTCBB, etc. On this front, it matches the offerings of some of its competitors, such as E-Trade and Fidelity.

TD Ameritrade offers about 2,300 ETFs and these along with Equities are available on the broker’s Web platform or ThinkOrSwim desktop platform with no subscription or platform fees. Active traders will find that TD Ameritrade’s ThinkOrSwim platform offers more advanced trading tools, comprehensive charting, market screeners, and more valuable features for trading stocks and ETFs.

Trading Mutual Funds

The broker offers more than 13,000 Mutual Funds from 740 fund providers and a wide range of no-transaction-fee funds. TD Ameritrade only charges $49.99 brokerage commissions for mutual funds trades. However, the broker also allows commission-free trading on approximately 4,000 mutual funds.

A $49.99 trading commission is charged if clients sell those free funds within 180 days of purchase.

TD Ameritrade clients can also access powerful independent third-party screeners like Compare Funds, Mutual Fund Screeners, Focus List, and Morningstar Instant X-Ray, allowing investors to buy only the best mutual funds.

Forex Trading

With TD Ameritrade (TDA), clients can choose from over 70 currency pairs traded in increments of 10,000 units commission-free. The broker’s compensation is reflected in the bid-ask spread. In comparison, market competitors like E-Trade and Schwab do not offer Forex pairs in their product list.

The average EUR/USD spread is 1.06 pips during peak market hours, resulting in an average trading cost of $10.6 per side for every 100,000 units traded.

Experienced traders who seek reliable technology to implement their strategies will probably find the broker’s advanced ThinkOrSwim platform appealing. It comes with a full suite of technical analysis tools to bring Forex trading to a higher level.

Traders can also access ‘Paper Money,’ a tool enabling you to experiment with advanced order types and test new trading strategies using real market data without risking real money.

Bond Trading

40,000 fixed-income instruments from over 100 dealers are available with TD Ameritrade. These US government bonds are available with no commission. However, in the case of corporate bonds, the brokerage firm will charge a $1 fee per bond on secondary transactions.

Options Trading

TD Ameritrade grants access to eight options markets: AMEX, BOX, CBOE, C2, ISE, NASDAQ, NYSE BATS, and PHLX.

Online options trading with this brokerage is associated with a contract fee of $0.65 per options contract, which is similar to fees at competitors such as E-Trade and Charles Schwab.

By offering unique features such as Options Statistics, Options Probabilities, and the Analyze Tab, the broker’s ThinkOrSwim desktop platform and ThinkOrSwim mobile app allow you to make better-informed options trades.

Futures Trading

TD Ameritrade grants access to five Futures exchanges, including CME, CFE, LIFFE, ICE, and ICE EU. Some 70 Futures products are available with a $2.25 fee per contract plus exchange & regulatory fees. Underlying assets include Energies, Metals, Currencies, Stock Indices, Interest Rates, Soft Commodities, Grains, Live Stock and Bitcoin.

Exchange fees depend on the Futures exchange and product, while regulatory fees, assessed by the National Futures Association (NFA), currently equal $0.02 per contract.

Cryptocurrency Trading

TD Ameritrade Holding Corp has invested in ErisX, which provides access to spot Cryptocurrency contracts and Crypto Futures contracts on one exchange. At present, experienced traders can take advantage of Bitcoin Futures offered by TD Ameritrade.

The main disadvantage is the high account minimum requirement ($25,000) to start trading Bitcoin futures.

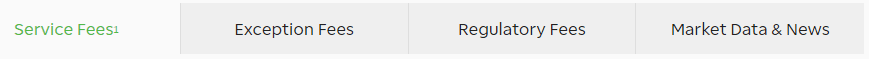

Non-Trading Fees

As for TD Ameritrade’s non-trading fees, we should note that the broker does not charge an inactivity fee or an account fee. However, there are service fees, exception fees, regulatory fees, and market data & news fees that you need to be aware of.

Verdict

In this category, based on our star scoring system, TD Ameritrade scored 4.5 points out of 10 points.

Customer Service

TD Ameritrade offers outstanding customer support service available 24/7, which means they are open even during weekends. Client support is carried out via several channels:

- Live chat

- Email and Fax

- Social media platforms – Facebook Messenger, Twitter or text messages

- Over the phone – phone support line is available in three languages (English, Spanish, and Chinese)

The broker’s phone support and live chat options met our expectations, as we received relevant answers to our inquiries – an agent got in touch with us within several minutes. Additionally, TD Ameritrade has a virtual agent (“AskTed”), which directed us to a relevant FAQ page.

Verdict

We scored TD Ameritrade an 8 out of 10 in this category for their prompt response time and several support channels.

Research and Education

The broker’s online educational resources bring into a single place various trading materials tailored for all types of investors. TD Ameritrade probably has the most extensive collection of free online educational resources.

New investors can access online training, how-to-do lessons, articles, video tutorials, webcasts, and real-time market insights from industry experts via TD Ameritrade Network. The education offerings include the following key resources:

- Immersive Curriculum is broken down into step-by-step trading lessons and trading strategies used by savvy investors

- Insightful Articles covering a range of topics, including market news, investing, trading, retirement, personal finance, tools, and thinkMoney magazine

- Webcasts that can be accessed on-demand on various topics (education onboarding, active trader, portfolio management, investing, and platform demos)

- In-person workshops and conferences – provides the perfect place to network with other fellow-minded traders

- TD Ameritrade Network – a streaming broadcast service that rivals Bloomberg TV and long-time cable news CNBC. The most relevant live shows include Weekend Trader, Futures with Ben Lichtenstein, Morning Trade Live, Fast Market and Real Talk.

When it comes to research, TD Ameritrade has The Ticker Tape portion of their website. It shows up-to-date news on relevant issues regarding financial matters. The segments include Market News, Daily Market Update, Morning Futures Briefing, Portfolio Strategy, Retirement Planning, and Investing Basics.

Verdict

TD Ameritrade offers traders a good selection of news, articles and educational materials.

Final Verdict on TD Ameritrade

Based on our TD Ameritrade review, the US-based brokerage firm is one of the most reputable online brokers, regulated by top-tier financial authorities. It now has no charges on Equity and ETF trades, in line with the introduction of commission-free trading within the industry last year, but on the downside, it has high financing rates for margin trading and does not allow certain funding methods (Debit/Credit Cards, Electronic Wallets).

On the other hand, it offers an award-winning, market-leading desktop trading platform, a professional customer support service and a variety of account types to accommodate any financial objective or strategy.

However, it’s important to note that TD Ameritrade’s range of trading platforms has a steep learning curve and that TD Ameritrade only accepts clients from the United States.

TD Ameritrade FAQs

What is the Minimum Deposit at TD Ameritrade?

TD Ameritrade has a $0 minimum deposit requirement. However, if you use electronic funding, there may be a minimum of $50.

What Demo Account Does TD Ameritrade Offer?

TD Ameritrade offers a demo account on its ThinkorSwim trading platform. It is completely free and you can use the trading tools with no risk.

Is TD Ameritrade a Safe Broker?

TD Ameritrade is a safe broker with its strong regulation and banking background, scoring 64/100.

What Leverage Does TD Ameritrade Offer?

With TD Ameritrade, clients can open a margin account in order to access leverage in support of their trading strategies. In other words, they can borrow money from the broker to trade but have to pay interest.

The broker’s margin requirements depend on the respective current base rate (8.25% since Nov 20th 2020) and clients’ debit balance.

Can I use TD Ameritrade for day trading?

Yes, TD Ameritrade offers two main account options for day trading: Cash account and margin account.

Compare TD Ameritrade Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Go to TD Ameritrade Website

Visit Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research

Ask an Expert

Is TD Ameritrade good for beginner investors?

TD Ameritrade accommodates the needs of beginners and advanced traders. Many traders fine the thinkorswim trading platform to have a good UX for beginners since it has customization so you can set up your screen to your preference and include good charting and analytical tools. TD Ameritrade also comes with a large range of learning materials that will help you learn to trade.