โบรกเกอร์ Forex ที่ดีที่สุด 2025

ในฐานะทีมผู้เชี่ยวชาญด้าน Forex และ CFD ผมได้รวบรวมรายชื่อ โบรกเกอร์ forex ที่ดีที่สุดสำหรับการเทรดในประเทศไทย โดยพิจารณาจาก สเปรดและค่าใช้จ่าย แพลตฟอร์มการเทรด ความเร็วในการดำเนินการ และชื่อเสียงของโบรกเกอร์เป็นหลัก

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

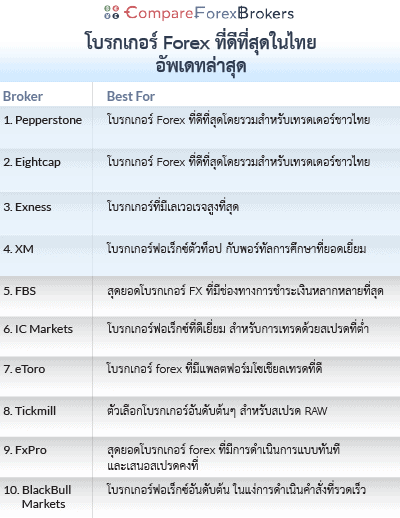

จากการรีวิวของผม นี่คือรายชื่อโบรกเกอร์ฟอเร็กซ์ที่ดีที่สุดในประเทศไทยของปีนี้:

- Pepperstone - โบรกเกอร์ Forex ที่ดีที่สุดโดยรวมสำหรับเทรดเดอร์ชาวไทย

- Eightcap - โบรกเกอร์ Forex ที่ดีที่สุดโดยรวมสำหรับเทรดเดอร์ชาวไทย

- Exness - โบรกเกอร์ที่มีเลเวอเรจสูงที่สุด

- XM - โบรกเกอร์ฟอเร็กซ์ตัวท็อป กับพอร์ทัลการศึกษาที่ยอดเยี่ยม

- FBS - สุดยอดโบรกเกอร์ FX ที่มีช่องทางการชำระเงินหลากหลายที่สุด

- IC Markets - โบรกเกอร์ฟอเร็กซ์ที่ดีเยี่ยม สำหรับการเทรดด้วยสเปรดที่ต่ำ

- eToro - โบรกเกอร์ forex ที่มีแพลตฟอร์มโซเชียลเทรดที่ดี

- Tickmill - ตัวเลือกโบรกเกอร์อันดับต้นๆ สำหรับสเปรด RAW

- FxPro - สุดยอดโบรกเกอร์ forex ที่มีการดำเนินการแบบทันที และเสนอสเปรดคงที่

- BlackBull Markets - โบรกเกอร์ฟอเร็กซ์อันดับต้น ในแง่การดำเนินคำสั่งที่รวดเร็ว

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA CySEC, SCB |

0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

96 |

ASIC, SCB FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

88 |

FCA, CySEC, CMA FSC, FSCA, FSA |

0.63 | 0.74 | 0.62 | $3.50 | 0.9 | 1.1 | 0.9 |

|

|

|

92ms | $10 | 96+ | 34+ | Unlimited | Unlimited |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.62 | 0.83 | 0.77 |

|

|

|

134ms | $0 | 61+ | 18+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

64 | FCA, CYSEC, DFSA, FSA-S, Labuan FSA | 0.1 | 0.3 | 0.1 | $3.00 | 1.6 | 1.6 | 1.6 |

|

|

|

125ms | $100 | 60+ | - | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

66 |

ASIC, CySEC FSC, CIMA |

- | - | - | - | 0.9 | 1.0 | 1.5 |

|

|

|

- | $5 | 37 | 35 | 3000:1 | 3000:1 |

|

Read review ›

Read review ›

|

44 |

FSC, CIMA ASIC |

- | - | - | - | 1.0 | 3.0 | 1.5 |

|

|

|

- | $50 | 60+ | 30+ | 30:1 | 250:1 |

|

Read review ›

Read review ›

|

43 |

FCA, FSCA CySEC, SCB, FSCM |

0.32 | 0.37 | 0.51 | $3.50 | 1.32 | 1.7 | 1.95 |

|

|

|

151ms | $0 | 69+ | 30+ | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

57 |

ASIC, FCA CYSEC, DFSA, IFSC |

0.1 | 0.4 | 0.8 | $3.50 | 1.6 | 1.9 | 1.6 |

|

|

|

148ms | $5-$100 | 57+ | - | 30:1 | 400:1 |

|

เทรด forex โบรกเกอร์ไหนดี?

ผมได้คัดเลือกโบรกเกอร์ฟอเร็กซ์ที่ดีที่สุดสำหรับเทรดเดอร์ชาวไทย โดยเปรียบเทียบผู้ให้บริการที่มีการกำกับดูแลจากหน่วยงานที่น่าเชื่อถือทั้งในประเทศและทั่วโลก โดยพิจารณาจาก 10 ปัจจัยหลัก เช่น ค่าใช้จ่ายในการเทรด แพลตฟอร์มการเทรด ความน่าเชื่อถือ ตลาดที่รองรับ เทคโนโลยี และบริการลูกค้า

1. Pepperstone - โบรกเกอร์ Forex ที่ดีที่สุดโดยรวมสำหรับเทรดเดอร์ชาวไทย

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

ทำไมเราถึงแนะนำ

ผมขอแนะนำ Pepperstone ในฐานะ โบรกเกอร์ Forex ที่ดีที่สุดสำหรับเทรดเดอร์ชาวไทย เนื่องจากโบรกเกอร์มีค่าธรรมเนียมการเทรดฟอเร็กซ์ที่ต่ำ ที่มาพร้อมความหลากหลายของแพลตฟอร์มการเทรดที่ทรงพลัง การดำเนินการที่รวดเร็ว และเครื่องมือการเทรดขั้นสูงที่มีประสิทธิภาพ โดยสรุป Pepperstone คือโบรกเกอร์ที่ส่งมอบผลิตภัณฑ์ที่ครบถ้วนและสมบูรณ์แบบ

ในฐานะหนึ่งในโบรกเกอร์ที่ดีที่สุดที่ผมเคยลองเทรดด้วย ผมให้คะแนน Pepperstone สูงสุดที่ 98/100

Pros & Cons

ข้อดี

- การดำเนินการที่รวดเร็ว

- ความหลากหลายของแพลตฟอร์มและเครื่องมือการเทรดขั้นสูง

- การบริการลูกค้าที่ยอดเยี่ยม

ข้อเสีย

- ไม่ให้บริการเทรดหุ้น

- แอป Pepperstone มีข้อจำกัดในการใช้งาน

รายละเอียดของโบรกเกอร์

Pepperstone เป็นโบรกเกอร์จากออสเตรเลียที่ก่อตั้งขึ้นในปี 2010 ได้รับการจัดอันดับสูงสุดจากผมในฐานะ โบรกเกอร์ฟอเร็กซ์ที่ดีที่สุด เนื่องจากความเร็วในการดำเนินการที่สูง เครื่องมือ Smart Trader และการบริการลูกค้าที่ได้รับรางวัลการันตี

จากประสบการณ์การเทรดของผม ผมพบว่า Pepperstone เป็นหนึ่งในโบรกเกอร์ที่น่าเชื่อถือที่สุดในอุตสาหกรรม เนื่องจากได้รับการควบคุมจากหน่วยงานสากลในหลากหลายประเทศ ไม่ว่าจะเป็น สหราชอาณาจักร, ออสเตรเลีย, สหรัฐอาหรับเอมิเรตส์, เยอรมนี, ไซปรัส, เคนยา และบาฮามาส รวมถึง SCB สำหรับเทรดเดอร์ชาวไทย นอกจากนี้ โบรกเกอร์ยังมีการจัดการเงินฝากของลูกค้าอย่างยอดเยี่ยม โดยทุกคนจะได้รับบัญชีแยกต่างหากและมีการคุ้มครองยอดติดลบ

จากประสบการณ์การเทรดของผม ผมพบว่า Pepperstone เป็นหนึ่งในโบรกเกอร์ที่น่าเชื่อถือที่สุดในอุตสาหกรรม เนื่องจากได้รับการควบคุมจากหน่วยงานสากลในหลากหลายประเทศ ไม่ว่าจะเป็น สหราชอาณาจักร, ออสเตรเลีย, สหรัฐอาหรับเอมิเรตส์, เยอรมนี, ไซปรัส, เคนยา และบาฮามาส รวมถึง SCB สำหรับเทรดเดอร์ชาวไทย นอกจากนี้ โบรกเกอร์ยังมีการจัดการเงินฝากของลูกค้าอย่างยอดเยี่ยม โดยทุกคนจะได้รับบัญชีแยกต่างหากและมีการคุ้มครองยอดติดลบ

การดำเนินการที่รวดเร็ว

เมื่อผมลองทดสอบความเร็วในการดำเนินการของโบรกเกอร์ชั้นนำ 20 ราย ผมพบว่า Pepperstone มีความเร็วในการดำเนินการที่เร็วเป็นอันดับสามโดยรวม ด้วยความเร็วเฉลี่ย 77 มิลลิวินาทีสำหรับคำสั่งแบบกำหนดราคาและ 100 มิลลิวินาทีสำหรับคำสั่งแบบราคาตลาด Pepperstone ลดความล่าช้าและลดความคลาดเคลื่อนในการเทรดของผมได้อย่างมีนัยสำคัญ

เพื่อให้เข้าใจได้ง่าย ความเร็วที่ต่ำกว่า 100 มิลลิวินาทีจะถือว่ามีความเร็วสูง และจากการทดสอบที่ครอบคลุมของเราโบรกเกอร์เพียงสามแห่งที่ทำความเร็วระดับนี้ได้ ความเร็วในการดำเนินการที่รวดเร็วของ Pepperstone ช่วยลดความล่าช้าในการวางตำแหน่งการซื้อขาย และยกระดับประสบการณ์การเทรดโดยรวมได้เป็นอย่างดี

แพลตฟอร์มการเทรดที่ดีและเครื่องมือการ copy trade

Pepperstone โดดเด่นด้วยการนำเสนอแพลตฟอร์มการเทรดที่หลากหลาย รวมถึง MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView และแพลตฟอร์มการเทรดของ Pepperstone เอง อย่างไรก็ตาม ผมมองว่า MT4 ของ Pepperstone ยังคงเป็นตัวเลือกที่น่าสนใจที่สุด

MT4 เป็นแพลตฟอร์มการเทรดที่เป็นที่นิยมที่สุดในโลกสำหรับการเทรด Forex มาตั้งแต่ปี 2007 ฟีเจอร์มาตรฐานของ MT4 ได้แก่ Expert Advisors (EAs), อินดิเคเตอร์ในตัว 30 รายการ, เครื่องมือการวิเคราะห์ 21 รายการ และกรอบเวลา 9 ช่วง

หากคุณต้องการตัวเลือกการวิเคราะห์กราฟที่มากขึ้น ให้พิจารณา MT5 ซึ่งเป็นรุ่นถัดไปจาก MT4 ซึ่งมีอินดิเคเตอร์ในตัว 43 รายการ, เครื่องมือการวิเคราะห์ 30 รายการ และกรอบเวลา 21 ช่วง โดย MT5 เป็นตัวเลือกที่ดีกว่าหากคุณอยากจะเทรด CFD หุ้น (นอกเหนือจากผลิตภัณฑ์ CFD อื่นๆ) และ MT5 ยังให้การทดสอบย้อนหลัง (Back Testing) ที่มีประสิทธิภาพมากขึ้น เนื่องจากมีการประมวลผลแบบ 64 บิตอีกด้วย

ไม่ว่าคุณจะเลือก MT4 หรือ MT5 ทาง Pepperstone ก็มีส่วนเสริม MetaTrader ที่เรียกว่า Smart Trader Tools ซึ่งช่วยยกระดับประสบการณ์การเทรดของคุณได้อย่างมาก ชุดเครื่องมือ Smart Trader Tools ประกอบด้วยแอปพลิเคชันที่ออกแบบมาเพื่อปรับปรุงการวิเคราะห์และการดำเนินการเทรด 28 ตัว ซึ่งรวมถึงอินดิเคเตอร์ขั้นสูงและ EAs สำหรับการจัดการความเสี่ยงที่ดีกว่า ช่วยให้คุณสามารถปรับปรุงและเพิ่มประสิทธิภาพกลยุทธ์การเทรดของคุณได้มากขึ้น

ผมพบว่า Mini Terminal มีความสำคัญอย่างยิ่ง ช่วยให้ผมสามารถสร้างแม่แบบคำสั่งสำหรับคำสั่งใหม่ทั้งหมด ซึ่งช่วยให้การเทรดในช่วงเวลาที่ตลาดมีความผันผวนสูงเป็นไปอย่างราบรื่น

Pepperstone ยังมีตัวเลือกการ copy trade ที่ดี รวมถึง Signal Start (เดิมเป็นส่วนหนึ่งของชุด Myfxbook), cTrader Copy, DupliTrade และแอป Pepperstone Copy Trading ที่ได้รับการพัฒนาร่วมกับ Pelican Inc หนึ่งในเครือข่ายการ copy trade ที่ดีที่สุดในตลาด ทำให้คุณสามารถเลือกใช้เครื่องมือที่เหมาะกับระดับความเสี่ยงและเป้าหมายการลงทุนของคุณได้ตรงจุดมากขึ้น

การบริการลูกค้าที่ยอดเยี่ยม

การบริการลูกค้าของ Pepperstone นั้นยอดเยี่ยม ได้รับรางวัลหลายรางวัลจากรายงาน Investment Trends ตั้งแต่ปี 2016 ถึง 2021 จากการบริการลูกค้าของโบรกเกอร์มีคุณภาพสูง ครอบคลุมและความเชี่ยวชาญ

ตัวอย่างเช่น เมื่อผมเปิดบัญชีทดลอง MT4 ผมได้รับการแนะนำตลอดกระบวนการโดยผู้จัดการบัญชีส่วนตัว ซึ่งช่วยให้ผมสามารถตั้งค่าบัญชีได้ภายในไม่กี่นาที

2. Eightcap - โบรกเกอร์ฟอเร็กซ์ที่ยอดเยี่ยม สำหรับเทรดเดอร์ FX และคริปโต

Forex Panel Score

Average Spread

EUR/USD = 0.6 GBP/USD = 0.3 AUD/USD = 0.2

Trading Platforms

MT4, MT5, TradingView, Capitalise.ai

Minimum Deposit

$100

ทำไมเราจึงแนะนำ

ผมขอแนะนำ Eightcap ในฐานะโบรกเกอร์ที่ดีที่สุดสำหรับการเทรด CFD Forex และคริปโตในประเทศไทย เนื่องจากมีคู่สกุลเงิน Forex มากกว่า 50 คู่และคริปโต 95 รายการให้เทรด ซึ่งรวมถึงเหรียญหลัก (Bitcoin, Ethereum และ Litecoin) พร้อมด้วยตัวเลือก altcoins อีกหลายตัว

Pros & Cons

ข้อดี

- นำเสนอสกุลเงินดิจิทัล 95 ตัว

- สเปรดที่ไม่น้อยหน้าใคร

- เครื่องมือการวิจัยตลาดที่มีประโยชน์

ข้อเสีย

- ไม่มีแพลตฟอร์มเฉพาะของตนเอง

- ความเร็วในการดำเนินการต่ำ

- ผลิตภัณฑ์ทางการเงินไม่หลากหลาย

รายละเอียดของโบรกเกอร์

Eightcap ก่อตั้งขึ้นในออสเตรเลีย เป็นโบรกเกอร์อันดับหนึ่งสำหรับเทรดเดอร์คริปโต เนื่องจากมีตัวเลือกคริปโตเคอร์เรนซีให้เลือกมากถึง 95 รายการ ในฐานะเทรดเดอร์ชาวไทย คุณยังสามารถซื้อขายสินทรัพย์อื่นๆ ได้อีกมากมาย ไม่ว่าจะเป็น คู่ Forex 56 คู่, โลหะ, ดัชนี เป็นต้น

นอกจากนี้โบรกเกอร์ยังเสนอแพลตฟอร์มการเทรด MT4, MT5 หรือ TradingView ที่มาพร้อมกับสเปรดที่ไม่น้อยหน้าใครอีกด้วย

นอกจากการดูแลโดย SCB แล้ว Eightcap ยังได้รับการดูแลจากหน่วยงานชั้นนำอื่นๆ เช่น ASIC, FCA และ CySEC ซึ่งหมายความว่า Eightcap เป็นโบรกเกอร์ระดับสากลที่มีความน่าเชื่อถือสูงอีกแห่งหนึ่ง

สเปรดที่แข่งขันได้

จากการวิเคราะห์สเปรดสำหรับคู่สกุลเงินฟอเร็กซ์ ผมพบว่า Eightcap มีสเปรดที่ต่ำทั้งในบัญชีประเภท Standard และ RAW

เราประทับใจกับสเปรดเฉลี่ยที่ต่ำของโบรกเกอร์ซึ่งอยู่ที่ 1.06 pips สำหรับบัญชี Standard (ที่ไม่มีค่าคอมมิชชัน) เรียกได้ว่าต่ำกว่าค่าเฉลี่ยในอุตสาหกรรมซึ่งอยู่ที่ 1.52 pips ทำให้ Eightcap ถูกจัดอันดับอยู่ในลำดับที่หกจากโบรกเกอร์ 40 แห่งที่เราได้ทำการวิเคราะห์

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

นอกจากนี้ บัญชี Raw ของ Eightcap ยังเสนอสเปรดโดยเฉลี่ยเพียง 0.06 pips สำหรับคู่สกุลเงิน EUR/USD ซึ่งสเปรดดังกล่าวมีค่าต่ำเป็นอันดับที่สองจากโบรกเกอร์ 40 แห่งที่ผมทำการวิเคราะห์ (รองจาก IC Markets เท่านั้น) และค่าคอมมิชชันของ Eightcap อยู่ที่ $3.50 ต่อล็อตเท่านั้น

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

สเปรดที่ต่ำเหมาะสำหรับเทรดเดอร์ที่มีประสบการณ์ ซึ่งต้องการใช้ประโยชน์จากการเคลื่อนไหวของราคาเล็กน้อยและการเทรดในปริมาณสูง รวมถึงผู้เริ่มต้นที่ต้องการสเปรดที่แข่งขันได้โดยไม่ต้องเสียค่าคอมมิชชันสูง

การเทรดคริปโตชั้นนำ

Eightcap โดดเด่นในฐานะโบรกเกอร์คริปโตชั้นนำ โดยเฉพาะสำหรับเทรดเดอร์ชาวไทย เนื่องจากมีตัวเลือกคริปโต CFD ที่หลากหลาย

โบรกเกอร์นี้เสนอคริปโต CFD มากกว่า 95 รายการ รวมถึงเหรียญหลักอย่าง Bitcoin, Ethereum และ Litecoin พร้อมด้วย altcoins อีกหลายตัว ความหลากหลายนี้ช่วยให้เทรดเดอร์สามารถคาดการณ์การเคลื่อนไหวของราคาของคริปโตเคอเรนซีต่างๆ และใช้ประโยชน์จากความผันผวนและสภาพคล่องในตลาดคริปโตได้

แน่นอนว่า Eightcap มีสินทรัพย์อื่นที่นอกจากคริปโต ไม่ว่าจะเป็น ฟอเร็กซ์ สินค้าโภคภัณฑ์ ดัชนี และหุ้น เป็นต้น

เครื่องมือวิจัยตลาดที่มีประโยชน์ (รวมถึง Capitalise.ai สำหรับการทำงานอัตโนมัติ)

นอกจากความแข็งแกร่งของแพลตฟอร์มการเทรดที่ Eightcap มีให้ เช่น MetaTrader 4, MetaTrader 5 และ TradingView อีกสิ่งที่ทำให้โบรกเกอร์นี้โดดเด่นคือเครื่องมือการเทรดและทรัพยากรการศึกษาเพื่อการวิเคราะห์ตลาด

ตัวอย่างเช่น Eightcap มี Capitalise.ai ซึ่งเป็นแพลตฟอร์มการเทรดอัลกอริธึมที่ช่วยให้คุณสามารถทำการเทรดอัตโนมัติ โดยไม่ต้องมีทักษะการเขียนโค้ด นอกจากนี้ยังมีเครื่องมือการวิเคราะห์ตลาด เช่น Eightcap Labs และ FlashTrader

Eightcap Labs นำเสนอแหล่งข้อมูลที่หลากหลายสำหรับเทรดเดอร์ชาวไทย รวมถึงบทความการเทรดพื้นฐาน คู่มือและ e-books ต่างๆ เพื่อช่วยในการพัฒนากลยุทธ์การเทรดของคุณ

นอกจากนี้ FlashTrader ของ Eightcap Labs ก็เป็นอีกตัวเลือกที่มีความสำคัญอย่างยิ่ง เนื่องจากมันช่วยยกระดับการจัดการความเสี่ยงและทำให้กระบวนการเทรดราบรื่น ด้วย FlashTrader คุณสามารถตั้งเป้าหมายกำไรที่หลากหลาย คำนวณขนาดตำแหน่ง และตั้งค่า Stop และ Limit ได้ด้วยการคลิกตั๋วการเทรดเพียงครั้งเดียว

และความมีประสิทธิภาพนี้ช่วยให้เทรดเดอร์ชาวไทยเช่นคุณ สามารกำหนดกลยุทธ์การเทรดของคุณได้แม่นยำมากขึ้น

3. Exness - โบรกเกอร์ที่มีเลเวอเรจสูงที่สุด

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.1

AUD/USD = 0.9

Trading Platforms

Exness Trader App, Exness Terminal, MT4, MT5

Minimum Deposit

$10

ทำไมเราถึงแนะนำ Exness

ผมอยากแนะนำ Exness ในฐานะโบรกเกอร์ที่มีเลเวอเรจสูงที่สุดสำหรับเทรดเดอร์ชาวไทย โดยเสนอเลเวอเรจที่เกือบจะไม่มีขีดจำกัด ซึ่งช่วยเพิ่มพลังในการเทรดของคุณ หมายความว่ามูลค่าการเทรดของคุณจะสูงกว่าทุนจริงของคุณ

Pros & Cons

ข้อดี

- เลเวอเรจสูงถึง 1:2000

- การดำเนินการที่ราคาตลาดและทันทีด้วยบัญชี Pro

- บัญชีไร้ค่าสวอปทั้งสองประเภท

ข้อเสีย

- สเปรดกว้างสำหรับบางผลิตภัณฑ์

- สเปรดสูงในบัญชี Standard Cent

- ตัวเลือกตลาดนั้้นมีจำกัด

รายละเอียดโบรกเกอร์

Exness ก่อตั้งขึ้นในปี 2008 และมีสำนักงานใหญ่ในไซปรัส เป็นโบรกเกอร์ Forex และ CFD ที่มีการกำกับดูแลเป็นอย่างดี ได้รับความนิยมอย่างมากในหมู่เทรดเดอร์ชาวไทยเป็นอย่างมาก

เนื่องจาก Exness มีตัวเลือกที่หลากหลายและตัวเลือกบัญชีที่มีค่าใช้จ่ายที่ไม่แพง เช่น บัญชี Exness zero และมีการเสนอผลิตภัณฑ์ให้เทรดมากกว่า 230 ชนิด พร้อมการให้บริการแพลตฟอร์มการเทรดยอดนิยม เช่น MT4, MT5 และแพลตฟอร์มเฉพาะของตัวเอง Exness Terminal

เลเวอเรจสูงไม่จำกัด

Exness นำเสนอเลเวอเรจในจำนวนสูงจนแทบจะไม่ขีดจำกัดเลย ซึ่งอาจเป็นข้อดีสำหรับเทรดเดอร์ที่ต้องการใช้ประโยชน์จากความผันผวนของตลาด แต่แน่นอนว่ายังมีความเสี่ยงสำหรับผู้ที่ไม่มีประสบการณ์ ซึ่งผมขอแนะนำให้เสี่ยงเในจำนวนที่คุณสามารถสูญเสียได้เท่านั้น

อย่างไรก็ตาม เลเวอเรจที่คุณจะได้รับขึ้นอยู่กับจำนวนเงินที่คุณฝากและประเภทบัญชีของคุณ เช่น บัญชี Exness pro ที่มักให้เลเวอเรจที่สูงกว่า ซึ่งเราได้แสดงไว้ด้านล่างนี้ โดยทั่วไปเลเวอเรจเริ่มต้นที่คุณจะได้รับคือ 1:2000 ซึ่งคุณสามารถปรับเปลี่ยนได้ตามต้องการ (หากคุณมีคุณสมบัติเหมาะสม)

การเทรดที่ปลอดค่าคอมมิชชัน

ในการทดสอบของผม ผมใช้บัญชี Standard ที่เสนอการเทรดไม่มีค่าคอมมิชชันพร้อมสเปรดลอยตัวเริ่มต้นที่ 0.2 pips อย่างไรก็ตาม ผมพบว่าสเปรดปกติใกล้เคียงกับ 1.0 pips แม้จะเป็นเช่นนั้น สเปรดยังคงดีกว่าค่าเฉลี่ยของอุตสาหกรรมและเหมาะสำหรับกลยุทธ์การเทรดที่หลากหลาย

นอกจากนี้ Exness ยังมีการฝากขั้นต่ำเพียง $200 ทำให้เข้าถึงได้สำหรับเทรดเดอร์มากมาย

แพลตฟอร์มที่เป็นกรรมสิทธิ์ที่เป็นมิตรต่อผู้ใช้

แพลตฟอร์มที่เป็นกรรมสิทธิ์ของ Exness ใช้งานง่ายและมีความหลากหลาย มีอินดิเคเตอร์ทางเทคนิคและเครื่องมือวาดกราฟมากกว่า 150 รายการ รวมถึงการกำหนดค่ากราฟที่หลากหลายสำหรับการวิเคราะห์ทางเทคนิคอย่างลึกซึ้ง

นอกจากนี้ ยังมี Trading Central ซึ่งให้ผู้ใช้เข้าถึงสัญญาณการเทรดที่สามารถดำเนินการได้โดยตรงผ่าน Exness Terminal

4. XM - โบรกเกอร์ที่มีชื่อเสียง เสนอพอร์ทัลการศึกษาที่ดีเยี่ยม

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.4 AUD/USD = 0.8

Trading Platforms

MT4, MT5

Minimum Deposit

$5

ทำไมเราถึงแนะนำ

ผมอยากแนะนำ XM ในฐานะโบรกเกอร์ที่มีทรัพยากรทางการศึกษาและการวิจัยตลาดที่ดี ซึ่งเหมาะสำหรับมือใหม่ที่ต้องการเรียนรู้เกี่ยวกับการเทรด forex

Pros & Cons

ข้อดี

- การรีโควทหรือการปฏิเสธคำสั่ง

- มีบัญชีเทรด Micro-Lot

- เลเวอเรจ 1,000:1

- เทรดแบบไร้ค่าสวอปในบัญชีทุกประเภท

- ไม่มีค่าคอมมิชชัน

ข้อเสีย

- ไม่มีบัญชีเทรดแบบ RAW

- บัญชี Standard มีสเปรดสูง (แนะนำให้เลือกบัญชี Ultra Low)

- ใช้ได้เฉพาะแพลตฟอร์ม MT4 & MT5

รายละเอียดโบรกเกอร์

นอกจากการให้ข้อมูลการวิจัยตลาดและทรัพยากรทางการศึกษาที่ดีแล้ว XM Group ยังเสนอเลเวอเรจที่สูงถึง 1:1000 และมี CFD หุ้นเกือบ 1,300 ตัว รวมถึงแอป XM Copy Trading ที่ยอดเยี่ยมของพวกเขา

เลเวอเรจสูงถึง 1:1000

XM Group และ IC Markets ล้วนเสนอเลเวอเรจที่สูงที่สุดสำหรับเทรดเดอร์ชาวไทย โดยสูงถึง 1:1,000 นั่นเพราะ XM ถูกกำกับดูแลโดย FSC-BZ ในเบลีซ ซึ่งให้ความยืดหยุ่นในการกำหนดเลเวอเรจที่มากกว่าหน่วยงานกำกับดูแลอื่นๆ

ข้อดีของการใช้เลเวอเรจที่สูงคือ คุณสามารถควบคุมขนาดต่ำแหน่งที่ใหญ่ขึ้นด้วยเงินทุนที่น้อยลง ซึ่งช่วยเพิ่มอำนาจในการซื้อของคุณได้

อย่างไรก็ตาม คุณต้องเข้าใจก่อนว่า แม้ว่าเลเวอเรจที่สูงจะสามารถเพิ่มผลกำไรที่เป็นไปได้ แต่ก็ยังเพิ่มความเสี่ยงในการขาดทุนอย่างมาก ดังนั้นผมขอแนะนำให้ทำการเทรดด้วยความระมัดระวัง และเสี่ยงเฉพาะเงินทุนที่คุณสามารถสูญเสียได้

แหล่งข้อมูลสำหรับการศึกษาและวิจัยที่ครบถ้วน

ผมพบว่าทรัพยากรด้านการศึกษาและการวิจัยตลาดของ XM นั้นมีประโยชน์อย่างยิ่ง ตอบสนองความต้องการของเทรดเดอร์ทุกระดับ ทรัพยากรถูกแบ่งออกเป็นสองหมวดหมู่หลัก คือ ส่วนการวิจัยตลาดและศูนย์การเรียนรู้ด้านการศึกษาที่ครอบคลุม ซึ่งจากประสบการณ์ของผม มีไม่กี่โบรกเกอร์ที่เสนอแหล่งข้อมูลทางการศึกษาที่ครอบคลุมเช่นนี้

คุณสมบัติที่โดดเด่นบางประการของพอร์ทัลการศึกษา ได้แก่ การสัมมนาออนไลน์รายวันในหัวข้อที่เกี่ยวกับฟอเร็กซ์ที่จัดโดยเทรดเดอร์และผู้เชี่ยวชาญในตลาด หมวดหมู่แนวคิดการเทรดที่ให้การวิเคราะห์ทางเทคนิคและข้อมูลเชิงลึกในตลาดต่างๆ และพอดแคสต์ XM ที่ให้ข้อมูลอัปเดตเกี่ยวกับแนวโน้มตลาดทั่วโลกเป็นประจำ

การรีโควทหรือการปฏิเสธคำสั่ง

XM ได้ก่อตั้งแนวคิดเกี่ยวกับการรับประกันการปฏิเสธการรีโควทหรือการปฏิเสธคำสั่ง ซึ่งเป็นไปได้เนื่องจากโบรกเกอร์นี้ใช้การดำเนินการตามราคาตลาด (market execution) แทนการดำเนินการตามราคาทันที (instant execution) นั่นหมายความว่า โบรกเกอร์สัญญาว่าจะเสนอราคาตลาดที่ดีที่สุดถ้าหากเกิดความคลาดเคลื่อนของราคาในตลาด

XM เป็นโบรกเกอร์ที่ไม่มีการจัดการคำสั่ง (no dealing desk) แทนที่จะเป็นผู้สร้างตลาด (market maker) ซึ่งช่วยยกระดับความโปร่งใสได้ เนื่องจากผู้สร้างตลาดจะเป็นคู่สัญญาของคุณ ดังนั้นจึงไม่มีทางพวกเขาจะยอมเป็นฝ่ายเสียเปรียบ

5. FBS - โบรกเกอร์ฟอเร็กซ์อันดับต้นๆ ที่เสนอเลเวอเรจสูง

Forex Panel Score

Average Spread

EUR/USD = 0.9 GBP/USD = 0.1 AUD/USD = 0.15

Trading Platforms

FBS App, MT4, MT5

Minimum Deposit

$5

ทำไมเราถึงแนะนำ

เราแนะนำ FBS ในฐานะโบรกเกอร์ที่ดีสุดที่มาพร้อมกับข้อเสนอเลเวอเรจสูง โดยเสนอเลเวอเรจสูงสุดถึง 1:3,000 สำหรับการซื้อขายฟอเร็กซ์ ถึงแม้ใน Exness จะมีเลเวอเรจสูงกว่านี้ก็ตาม (แทบจะไม่จำกัด) แต่ผมเชื่อว่า 1:3,000 ก็เพียงพอสำหรับการเพิ่มศักยภาพในการทำกำไรของคุณแล้ว

Pros & Cons

ข้อดี

- เลเวอเรจสูงถึง 1:3,000

- ช่องทางการชำระเงินไม่ต่ำกว่า 200 แบบ

- การฝากขั้นต่ำเพียง $5

- พอร์ทัลการศึกษาเกี่ยวกับ FX ที่ดี

ข้อเสีย

- ไม่มีการปกป้องนักลงทุนภายนอกสหภาพยุโรป

- ไม่มีการเทรดสินค้าโภคภัณฑ์

- การขาดสกุลเงินพื้นฐานของบัญชี

รายละเอียดโบรกเกอร์

หากคุณกำลังมองหาโบรกเกอร์ Forex ที่เสนอประเภทบัญชีการเทรดที่ไม่มีค่าคอมมิชชันและมีเลเวอเรจสูง FBS อาจเป็นตัวเลือกที่ดีสำหรับคุณ FBS ก่อตั้งขึ้นในปี 2009 และได้รับการควบคุมโดย CySEC, ASIC, FSCA และ IFSC Belize

โบรกเกอร์แห่งนี้เสนอบัญชีการเทรดให้เลือกสามประเภท พร้อมผลิตภัณฑ์ทางการเงินมากกว่า 182 รายการ และเลเวอเรจสูงสุดถึง 1:3,000 สำหรับคู่สกุลเงิน Forex

ความหลากหลายของประเภทบัญชี

ในการทดสอบจริง ผมพบว่าเทรดเดอร์ชาวไทยสามารถเลือกใช้บัญชีเทรด FBS ได้ทั้งหมดสามประเภท ได้แก่ Standard, Cent และ Pro ซึ่งแต่ละประเภทมีข้อจำกัดด้านเลเวอเรจ สเปรด และข้อกำหนดเงินฝากขั้นต่ำที่แตกต่างกัน

บัญชี Standard มีเลเวอเรจสูงสุดถึง 1:3,000 ส่วนบัญชี Cent มีเงินฝากขั้นต่ำต่ำที่สุดที่ $1 และบัญชี Pro มีสเปรดต่ำที่สุด เริ่มต้นที่ 0.5 pips

หลังจากเปิดบัญชี Standard จริงเพื่อตรวจสอบสเปรดที่เกิดขึ้นจริงสำหรับคู่สกุลเงิน EUR/USD ผมพบว่าสเปรดเฉลี่ยอยู่ที่ 0.95 pips ในช่วงเวลาลอนดอนและนิวยอร์ก และเนื่องจากบัญชีทั้งสามประเภทไม่มีค่าคอมมิชชัน สเปรดนี้จึงดีกว่าค่าเฉลี่ยของอุตสาหกรรมที่ 1.0 pips

สเปรดสูงถึง 1:3,000

ประเภทบัญชีแต่ละประเภทมีเลเวอเรจสูงมาก ตั้งแต่ 1:1,000 ถึง 1:3,000 เนื่องจากอยู่ภายใต้หน่วยงานที่ได้รับการควบคุมโดย IFSC Belize ซึ่งแตกต่างจากโบรกเกอร์ที่ควบคุมโดย CySEC และ ASIC ที่จะจำกัดเลเวอเรจสูงสุดที่ 1:30 สำหรับคู่สกุลเงินต่างๆ และนี่ถือเป็นข้อได้เปรียบสำหรับเทรดเดอร์ชาวไทย

โปรดทราบ แม้ว่าเลเวอเรจสูงจะสามารถเพิ่มผลกำไรได้ แต่ก็เพิ่มความเสี่ยงในการขาดทุนด้วย ดังนั้นการจัดการความเสี่ยงที่มีประสิทธิภาพจึงเป็นสิ่งสำคัญ

ช่องทางการฝากเงินกว่า 200 แบบ

FBS มีช่องทางฝากเงินมากกว่า 200 แบบ สำหรับบัญชีเทรดของคุณ นอกจากช่องทางทั่วไปเช่น บัตรเครดิตและบัตรเดบิต (เช่น Visa, Maestro และ MasterCard) และ eWallets เช่น PayPal โบรกเกอร์ FBS ยังรับเงินฝากผ่าน Thai QR, ธนาคารกรุงเทพ, ธนาคารกรุงศรีอยุธยา และธนาคารกสิกรไทย

เป็นที่น่าสนใจว่า การฝากเงินผ่านช่องทางเหล่านี้ไม่มีค่าใช้จ่ายและสามารถฝากได้ตั้งแต่ 350 ถึง 500,000 บาท พร้อมดำเนินการทันทีหรือภายใน 15 ถึง 20 นาทีเท่านั้น

สำหรับการถอนเงินจาก FBS โดยทั่วไปจะใช้เวลาภายใน 15 ถึง 20 นาทีหากถอนผ่านบัตร พร้อมขีดจำกัดตั้งแต่ 150,000 บาท ถึง 500,000 บาท หรือเลือกใช้ Sticpay, ธนาคารกรุงไทย, ธนาคารออมสิน และธนาคาร CIMB ไทย แต่การถอนเงินผ่านช่องทางเหล่านี้จะใช้เวลาประมาณ 20 นาที และอาจนานถึง 48 ชั่วโมงในบางเวลา

ข้อเสนอโบนัสที่หลากหลาย

FBS มีโบนัสและโปรโมชันที่หลากหลายสำหรับบัญชีทั้งสามประเภท รวมถึงโบนัสเงินฝาก 100% และเงินคืนจากการเทรด (มีให้เฉพาะเมื่อใช้ FBS Trader)

สำหรับข้อเสนอเงินคืน คุณสามารถรับเงินคืนสูงสุดถึง 5% ของสเปรดที่จ่ายไปสำหรับการเทรดที่ไม่เกิน 13 ล็อต และ 10% สำหรับ 14 ถึง 33 ล็อต และ 15% สำหรับ 34 ถึง 59 ล็อต และ 20% สำหรับ 60 ล็อตขึ้นไป

6. IC Markets - โบรกเกอร์ที่ยอดเยี่ยมพร้อมสเปรดต่ำ

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.03

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$200

ทำไมเราถึงแนะนำ

จากการทดสอบของผม IC Markets เสนอสเปรดที่ต่ำที่สุดในบัญชีการเทรดทั้งสองประเภท ซึ่งช่วยลดต้นทุนการเทรดโดยรวมได้เป็นอย่างดี

นอกจากนี้ผมยังชอบความหลากหลายของแพลตฟอร์มการเทรดของ IC Markets (MT4, MT5, cTrader และ TradingView) และความหลากหลายของเครื่องมือการ copy trade ซึ่งรวมถึง ZuluTrade, Myfxbook และ cTrader Copy

Pros & Cons

ข้อดี

- สเปรดต่ำที่สุดที่เราทดสอบ

- ตัวเลือกแพลตฟอร์มที่หลากหลาย

- ตัวเลือกการ copy trade ที่ยอดเยี่ยม

ข้อเสีย

- ความเร็วในการดำเนินการยังไม่สูงมาก

- เวลาตอบกลับการแชทสดช้า

- ไม่มีมาตรการการปกป้องนักลงทุนชาวไทย

รายละเอียดโบรกเกอร์

หากคุณกำลังมองหาโบรกเกอร์ forex สเปรดต่ำในประเทศไทย IC Markets อาจเป็นตัวเลือกที่ยอดเยี่ยม โบรกเกอร์นี้ถูกก่อตั้งขึ้นในปี 2007 และมีสำนักงานใหญ่ในซิดนีย์ ประเทศออสเตรเลีย

IC Markets ได้รับการควบคุมโดย CySEC, ASIC, SCB (สำหรับเทรดเดอร์ชาวไทย) และ FSA ของเซเชลส์ โบรกเกอร์นี้เสนอการเข้าถึงเครื่องมือทางการเงินมากกว่า 2,250 รายการผ่านแพลตฟอร์ม MT4, MT5 และ cTrader

สเปรดต่ำที่สุดจากการทดสอบ

จากการวิเคราะห์ของผมพบว่า IC Markets ให้สเปรดที่ต่ำที่สุดสำหรับบัญชีผู้ลงทุนทั่วไปทั้งสองประเภทที่ให้บริการในไทย บัญชี Standard ที่ไม่มีค่าคอมมิชชันของโบรกเกอร์นี้มีสเปรดเฉลี่ย 0.73 pips สำหรับคู่สกุลเงิน EUR/USD ซึ่งเป็นตัวเลือกที่ต่ำที่สุดในบรรดาโบรกเกอร์ชั้นนำทั้ง 20 แห่งที่เราได้ทำการประเมิน

เมื่อพิจารณาสเปรดเฉลี่ยของคู่สกุลเงินสำคัญ (AUD/USD, EUR/USD, GBP/USD, USD/CAD และ USD/CHF) ผมพบว่า IC Markets ทำได้ดีด้วยสเปรดเฉลี่ย 1.03 pips ซึ่งต่ำกว่าค่าเฉลี่ยในอุตสาหกรรมที่ 1.48 pips อย่างมีนัยสำคัญ

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

จากประสบการณ์การเทรดของผม สเปรดเหล่านี้ถือว่าต่ำมาก สเปรดเฉลี่ยสำหรับคู่สกุลเงิน EUR/USD บนบัญชีที่ไม่มีค่าคอมมิชชันมักจะอยู่ที่ประมาณ 1.0 pips ซึ่งทำให้สเปรด 0.73 pips ของ IC Markets นั้นน่าสนใจมาก

ในฐานะโบรกเกอร์ที่มีชื่อเสียงด้านความคุ้มทุน IC Markets มีสเปรดเฉลี่ย 0.32 pips สำหรับคู่สกุลเงินหลักที่คู่กับ USD บนบัญชี RAW และเมื่อเปรียบเทียบกับค่าเฉลี่ยของโบรกเกอร์ซึ่งอยู่ที่ 0.42 pips ทำให้ IC Markets อยู่ในอันดับที่สามจากการประเมินบัญชี RAW/ECN ของเรา โดยเป็นรองเพียง Fusion Markets (0.22 pips) และ City Index (0.25 pips)

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

ค่าคอมมิชชันต่ำด้วย cTrader

นอกจากนี้ ค่าใช้จ่ายในบัญชีการเทรดที่มีให้สำหรับเทรดเดอร์ชาวไทยก็มีความแตกต่างกัน ซึ่งขึ้นอยู่กับว่าคุณใช้แพลตฟอร์ม MetaTrader หรือ cTrader

สำหรับบัญชีที่มีค่าคอมมิชชัน จะมีค่าธรรมเนียม $3.50 ต่อล็อต ต่อด้าน บน MetaTrader และค่าธรรมเนียม $3.00 ต่อล็อต ต่อด้าน บน cTrader ซึ่งถือเป็นมาตรฐานในอุตสาหกรรม และอีกสิ่งหนึ่งที่ผมชื่นชอบใน IC Markets คือการไม่มีข้อจำกัดระยะการสั่งซื้อ ซึ่งทำให้คุณสามารถวางคำสั่งได้ใกล้กับราคาตลาดปัจจุบันมากๆ

7. eToro - โบรกเกอร์ forex ที่มีแพลตฟอร์มโซเชียลเทรดที่ดี

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

เหตุผลที่เราถึงแนะนำ

ไม่ใช่เพียงผมที่เชื่อว่า eToro เป็นโบรกเกอร์โซเชียลเทรดที่ดีที่สุดในตลาด แต่ยอดผู้ใช้มากกว่า 30 ล้านคนทั่วโลกเป็นเครื่องพิสูจน์ถึงความนิยมของโบรกเกอร์นี้ได้เป็นอย่างดี

นอกจากฟีเจอร์ CopyTrader ที่ใช้งานง่ายแล้ว แพลตฟอร์มที่เป็นเอกลักษณ์ของ eToro ยังมีความโดดเด่นเป็นอย่างมาก ไม่ว่าจะเป็นอินเตอร์เฟสที่เป็นมิตรกับผู้ใช้ ไม่มีค่าคอมมิชชันและมีผลิตภัณฑ์ทางการเงินที่หลากหลาย

Pros & Cons

ข้อดี

- แพลตฟอร์ม Social trade ที่ดีที่สุด

- อินเทอร์เฟสที่ใช้งานง่ายสำหรับผู้เริ่มต้น

- ตลาดการเงินมากกว่า 3,000 แห่ง

ข้อเสีย

- ไม่มี MT4 และ MT5 ให้ใช้งาน

- เครื่องมือการเทรดมีอยู่จำกัด

- ไม่มีบัญชีที่มีสเปรดเป็นศูนย์

รายละเอียดโบรกเกอร์

eToro ถูกก่อตั้งในอิสราเอลในปี 2007 โบรกเกอร์มีชื่อเสียงในด้านแพลตฟอร์ม Social trade และ copy trade ที่มีอินเตอร์เฟสที่ใช้งานง่าย และด้วยฐานผู้ใช้ทั่วโลกที่เกิน 30 ล้านคนทั่วโลก eToro ไม่เพียงแต่มีชุมชนของเทรดเดอร์ที่กว้างขวาง แต่ยังทำให้ผู้ใช้สามารถเลียนแบบกลยุทธ์ของเทรดเดอร์ที่มีประสบการณ์ได้ด้วย

eToro ถูกก่อตั้งในอิสราเอลในปี 2007 โบรกเกอร์มีชื่อเสียงในด้านแพลตฟอร์ม Social trade และ copy trade ที่มีอินเตอร์เฟสที่ใช้งานง่าย และด้วยฐานผู้ใช้ทั่วโลกที่เกิน 30 ล้านคนทั่วโลก eToro ไม่เพียงแต่มีชุมชนของเทรดเดอร์ที่กว้างขวาง แต่ยังทำให้ผู้ใช้สามารถเลียนแบบกลยุทธ์ของเทรดเดอร์ที่มีประสบการณ์ได้ด้วย

แพลตฟอร์ม Social trade ชั้นนำ

eToro มีเครือข่ายโซเชียลเทรดที่ใหญ่ที่สุดในโลก โดยผสานแพลตฟอร์มการเทรดเข้ากับชุมชนการเทรดและฟีเจอร์การ copy trade ขั้นสูง นอกจากนี้ eToro ยังมีแอพเทรด forex ที่ได้รับความนิยม ซึ่งรวมฟีเจอร์ Social trade และ CopyTrader เข้ากับการเทรดบนมือถือที่สะดวกสบายอีกด้วย

ผู้ใช้งานสามารถเข้าร่วมการ copy trade ได้โดยใช้เครื่องมือ ‘CopyTrader’ ของ eToro ซึ่งอยู่ในแพลตฟอร์มที่พัฒนาโดย eToro เอง เครื่องมือนี้ใช้งานง่าย ช่วยให้คุณสามารถค้นหาและติดตามการเทรดของเทรดเดอร์คนอื่นๆ ซึ่งจะเป็นไปตามเกณฑ์การวัดผลการดำเนินงานที่สอดคล้องกับความเสี่ยงที่คุณรับได้

ผมรู้สึกประทับใจอย่างยิ่งกับการที่แพลตฟอร์มของ eToro ทำหน้าที่ทั้งเป็นศูนย์กลางของโซเชียลเทรดและแพลตฟอร์มการเทรดที่ใช้งานง่าย โดยมีตลาดการลงทุนให้เข้าถึงมากกว่า 3,000 แห่ง ทำให้คุณสามารถกระจายพอร์ตการลงทุนผ่านสินทรัพย์หลากหลาย รวมถึง ETF จำนวน 263 รายการ และ CFD หุ้นเกือบ 3,000 ตัวอีกด้วย

สำหรับผู้ที่ต้องการกระจายการลงทุนโดยไม่ต้องการเลือกสินทรัพย์ทีละรายการ eToro ยังมี Smart Portfolios ที่ให้คุณคัดลอกธีมการลงทุนทั้งหมดซึ่งได้รับการคัดสรรจากนักวิเคราะห์ของ eToro โดยไม่มีค่าธรรมเนียมการจัดการ บางพอร์ตการลงทุนยังมีการปรับสมดุลโดยใช้เทคโนโลยี AI เป็นระยะ ซึ่งเป็นฟีเจอร์พิเศษที่ผมยังไม่เคยเจอในโบรกเกอร์รายอื่น

สเปรดที่ไม่มีค่าคอมมิชชันที่ไม่น้อยหน้าใคร

แม้ว่า eToro จะไม่ได้มีบัญชีแบบ ECN ที่มีค่าสเปรดเป็นศูนย์ แต่ก็มีค่าสเปรดที่ไม่น้อยหน้าใครในบัญชีที่ไม่มีค่าคอมมิชชัน โดยบัญชี Standard มีค่าสเปรดเฉลี่ยสำหรับคู่ EUR/USD ที่ประมาณ 1 pips ซึ่งถือว่าเทียบเคียงได้กับค่าเฉลี่ยในอุตสาหกรรมสำหรับบัญชีประเภท Standard

เพื่อสนับสนุนเทรดเดอร์มือใหม่ eToro มีบัญชีทดลองที่ให้คุณใช้พอร์ตการลงทุนเสมือนในมูลค่า $100,000 เพื่อฝึกฝนทักษะการเทรด นอกจากนี้ ผมอยากแนะนำให้คุณลองดู **eToro Academy** ที่มีคู่มือและบทเรียนที่ครอบคลุมเพื่อช่วยเสริมความรู้ด้านการเทรดก่อนที่จะเปลี่ยนไปใช้บัญชีจริง

8. FxPro - สุดยอดโบรกเกอร์ forex ที่มีการดำเนินการแบบทันที และเสนอสเปรดคงที่

Forex Panel Score

Average Spread

EUR/USD =0.2 GBP/USD = 0.21 AUD/USD = 0.31

Trading Platforms

MT4, cTrader FxPro Web Trader

Minimum Deposit

$100

ทำไมเราถึงแนะนำ

ผมอยากแนะนำ FxPro เนื่องจาก โบรกเกอร์นี้เสนอประเภทการดำเนินการเทรดหลากหลายรูปแบบ เหมาะกับความต้องการของเทรดเดอร์ชาวไทยทั้งที่ชื่นชอบสเปรดที่เปลี่ยนแปลงได้ คงที่ หรือราคาตลาด

Pros & Cons

ข้อดี

- สเปรดที่ราคาตลาด ทันที หรือ คงที่

- กลุ่มแพลตฟอร์มที่แข็งแกร่ง

- ตัวเลือกการเทรดหุ้นที่หลากหลาย

ข้อเสีย

- ไม่มี TradingView

- สเปรดอาจเปลี่ยนแปลงได้

- ข้อจำกัดการใช้งานของแอพที่เป็นกรรมสิทธิ์

รายละเอียดโบรกเกอร์

โบรกเกอร์นี้ถูกก่อตั้งขึ้นในปี 2006 และมีสำนักงานใหญ่ในลอนดอน FxPro เป็นโบรกเกอร์ Forex ที่มีชื่อเสียงในด้านความหลากหลายของประเภทการดำเนินการ ซึ่งรวมถึงการดำเนินการแบบคงที่ ตลาด และทันที FxPro ยังมีแพลตฟอร์มการเทรดและเครื่องมือที่หลากหลาย ทำให้เป็นตัวเลือกยอดนิยมในหมู่เทรดเดอร์ที่มีประสบการณ์

วิธีการดำเนินการที่หลากลาย

FxPro มีวิธีการดำเนินการหลายแบบ ได้แก่ การดำเนินการแบบตลาด (Market), การดำเนินการแบบทันที (Instant) และการดำเนินการแบบคงที่ (Fixed) ผ่านบัญชีสามประเภทของพวกเขา: Standard, Raw+ และ Elite การดำเนินการแบบตลาดช่วยให้คุณได้รับราคาที่ดีที่สุดที่มีอยู่ การดำเนินการแบบทันทีอาจมีการเปลี่ยนแปลงราคาเล็กน้อยระหว่างเวลาที่คุณวางคำสั่งและเวลาที่มันถูกดำเนินการ และการดำเนินการแบบคงที่มีสเปรดที่คงที่ไม่ว่าจะเป็นสภาวะตลาดใดๆ

ในขณะที่การดำเนินการแบบตลาดเป็นวิธีการดำเนินการเริ่มต้นสำหรับบัญชีทั้งสามประเภท คุณยังสามารถเข้าถึงการดำเนินการแบบทันทีและการดำเนินการแบบคงที่บนแพลตฟอร์ม MetaTrader 4 ได้ด้วย ผมประทับใจ FxPro ที่ให้ความยืดหยุ่นในการเลือกวิธีการดำเนินการที่เหมาะกับกลยุทธ์การเทรดของเทรดเดอร์แต่ละราย ทำให้การปรับตัวเข้ากับสภาวะตลาดและระดับความผันผวนที่แตกต่างกันนั้นง่ายยิ่งขึ้น

บัญชีของ FxPro สามารถใช้งานกับ MT4 และ MT5 หากคุณใช้ MT4 คุณจะสามารถเข้าถึงสเปรดแบบคงที่หรือการดำเนินการแบบทันที การเลือกสเปรดแบบทันที หมายความว่า จะไม่มีการเรียกเก็บราคาใหม่ ขณะที่การเลือกแบบคงที่ หมายถึงการที่คุณสามารถเทรด EUR/GBP, EUR/JPY, EUR/USD, GBP/JPY, GBP/USD, USD/CAD และ USD/JPY ได้ด้วยสเปรดแบบคงที่ และทั้งสองบัญชีนี้ไม่มีค่าคอมมิชชัน

บัญชีอื่นๆ ที่น่าสนใจ ได้แก่ FX Pro cTrader ซึ่งมีค่าคอมมิชชัน $4.5 ต่อด้านต่อล็อต และสเปรดเริ่มต้นที่ 0.2 pips และ FX Pro Platform ซึ่งไม่มีค่าคอมมิชชัน

แพลตฟอร์มการเทรดที่ครบถ้วน

เมื่อเปิดบัญชีกับ FxPro ผมพบว่าโบรกเกอร์เสนอแพลตฟอร์มการเทรดที่หลากหลายมาก ไม่ว่าจะเป็น MT4, MT5, cTrader และแพลตฟอร์มเฉพาะของ FxPro

สำหรับผู้ที่มองหาการเทรด ECN ที่มีเงื่อนไขที่ดีที่สุด ผมขอแนะนำบัญชี MT5 RAW ซึ่งเสนอสเปรดที่ต่ำที่สุด เริ่มต้นที่ 0.2 pips สำหรับ EUR/USD และรวมถึงฟีเจอร์ขั้นสูง เช่น การเทรดด้วย EA, ความลึกของตลาด (DoM) และเครื่องมือทำกราฟที่ซับซ้อน พร้อม อินดิเคเตอร์ 35 แบบ และกรอบเวลา 21 รายการ

MT4 ก็เป็นตัวเลือกที่ดี โดยเฉพาะสำหรับผู้ที่ชื่นชอบวิธีการดำเนินการแบบทันทีและมีการกระจายแบบคงที่ ในขณะที่ cTrader เหมาะสำหรับผู้ที่มองหาแพลตฟอร์มที่มีฟีเจอร์ที่ทันสมัยยิ่งขึ้น โดยเฉพาะอย่างยิ่งสำหรับการเทรดแบบอัลกอริธึม

9. Tickmill - ตัวเลือกโบรกเกอร์อันดับต้นๆ สำหรับสเปรด RAW

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.10

Trading Platforms

MT4, MT5, CQG

Minimum Deposit

$100

ทำไมเราถึงแนะนำ

ผมแนะนำ Tickmill เนื่องจากโบรกเกอร์นี้มีสเปรดแบบ RAW ที่ต่ำ เฉลี่ย 0.16 pips ในสกุลเงินหลักหลายคู่ ซึ่งจะช่วยลดค่าใช้จ่ายโดยรวมในการเทรดของคุณได้

Pros & Cons

ข้อดี

- สเปรด RAW ที่แคบ

- เลเวอเรจสูงถึง 1:1,000

- เครื่องมือ MT4/MT5 ขั้นสูง (Acuity Trader)

- เครื่องมือการศึกษาและค้นขว้าที่ครอบคลุม

- ดอกเบี้ย 3.5% สำหรับเงินที่ไม่ได้ใช้ในบัญชี

ข้อเสีย

- ไม่มี TradingView

- บัญชี Classic มีสเปรดขั้นต่ำสูง

- ฝ่ายบริการลูกค้าหยุดสุดสัปดาห์

รายละเอียดโบรกเกอร์

TickMill เป็นโบรกเกอร์ Forex ที่ได้รับการยอมรับ อยู่ภายใต้การกำกับดูแลของ DFSA โดย TickMill มีชื่อเสียงในแง่โบรกเกอร์ที่เสนอสเปรดที่ต่ำที่สุดในอุตสาหกรรม

และจากการทดสอบ ผมพบว่า โบรกเกอร์นี้ยังโดดเด่นด้วยความสามารถในการเทรดฟิวเจอร์ส แพลตฟอร์มโซเชียลเทรดของตนเอง และข้อเสนอพิเศษในการจ่ายดอกเบี้ย 3.5% สำหรับเงินที่ไม่ได้ใช้ในบัญชีของคุณ

สเปรดต่ำ เริ่มต้นที่ 0.0 pips

แม้ว่าโบรกเกอร์หลายแห่งจะโฆษณาว่าสเปรดเริ่มต้นที่ 0.0 pips แต่มีเพียงไม่กี่แห่งที่รักษาสเปรดต่ำเหล่านี้ได้อย่างสม่ำเสมอ ในการวิเคราะห์ของผมเกี่ยวกับ TickMill และโบรกเกอร์อีก 14 แห่งที่เสนอบัญชี ECN/RAW ด้วยสเปรดเริ่มต้นที่ศูนย์ พบว่า TickMill เป็นผู้นำสำหรับตัวเลือกนี้

ผมได้คำนวณสเปรดเฉลี่ยในคู่สกุลเงินหลักเพื่อกำหนดความสามารถในการแข่งขันโดยรวมของแต่ละโบรกเกอร์ โดย TickMill มีสเปรดสำหรับบัญชี RAW เฉลี่ยอยู่ที่ 0.47 pips ในคู่สกุลเงินหลักทั้งหกคู่ และ TickMill มีสเปรดเฉลี่ยที่ต่ำที่สุดสำหรับคู่ EUR/USD ซึ่งอยู่ที่ 0.15 pips เท่านั้น

นอกจากการเทรด Forex บนแพลตฟอร์มการเทรดหลักที่ TickMill เสนอ เช่น MT4 และ MT5 คุณยังสามารถใช้ TickMill Trader และ TickMill Trader App ได้ด้วย ซึ่งมีเงื่อนไขเงินฝากขั้นต่ำ 100 ดอลลาร์ และเลเวอเรจอาจสูงสุด 1:1,000 ขึ้นอยู่กับขนาดการเทรด ขนาดที่ใหญ่ขึ้นจะใช้เลเวอเรจได้น้อยลง

การเทรดฟิวเจอร์ส

TickMill ต่างจากโบรกเกอร์ส่วนใหญ่ที่มีการเทรดด้วยผลิตภัณฑ์ CFD แบบดั้งเดิม เช่น ฟอเร็กซ์ หุ้น สกุลเงินดิจิทัล และดัชนี โดยโบรกเกอร์นี้เสนอตัวเลือกการเทรดฟิวเจอร์สและออปชัน

ทั้งนี้ ฟิวเจอร์สสามารถเป็นวิธีที่ดีในการลดความเสี่ยง (ที่รู้จักกันว่า hedge) คุณสามารถนำไปเทรดสินทรัพย์ประเภทต่างๆ ไม่ว่าจะเป็น ฟอเร็กซ์ สกุลเงินดิจิทัล อัตราดอกเบี้ย ดัชนีหุ้น และสินค้าโภคภัณฑ์ เช่น พลังงานและโลหะ เป็นต้น

ราคาจะถูกกำหนดจากโบรกเกอร์ โดยมีตลาดอนุพันธ์ เช่น CME, CBOT, NYMEX, COMEX และ EUREX เป็นต้น สำหรับค่าใช้จ่ายในการเทรดจะอยู่ที่ $1.30 สำหรับสัญญามาตรฐาน และ $0.85 สำหรับสัญญาขนาดเล็ก แต่การเทรดผลิตภัณฑ์เหล่านี้ คุณจะต้องใช้แพลตฟอร์มการเทรด CQG หรือ MultiCharts และมีเงินฝากขั้นต่ำ $1,000

10. BlackBull Markets - โบรกเกอร์ฟอเร็กซ์อันดับต้น ในแง่การดำเนินคำสั่งที่รวดเร็ว

Forex Panel Score

Average Spread

EUR/USD = 0.23 GBP/USD = 0.72 AUD/USD = 0.65

Trading Platforms

MT4, MT5, TradingView, cTrader, BlackBull CopyTrader

Minimum Deposit

$0

ทำไมเราถึงแนะนำ

ผมอยากแนะนำ BlackBull Markets โบรกเกอร์ที่มีความเร็วในการดำเนินการสูงสุดเป็นอันดับหนึ่งในการทดสอบของผม ซึ่งความเร็วในการดำเนินการนี้ช่วยลดความล่าช้าในการเทรด ลดค่าใช้จ่ายในการเทรด และปรับปรุงประสิทธิภาพการเทรด อีกทั้ง โบรกเกอร์นี้ยังมีแพลตฟอร์มการเทรดและเครื่องมือการ copy trade ที่หลากหลายให้เลือกใช้งานอีกด้วย

Pros & Cons

ข้อดี

- ความเร็วในการดำเนินการสูง

- ความหลากหลายของแพลตฟอร์ม

- ผลิตภัณฑ์การเงินที่หลากหลาย

ข้อเสีย

- มีค่าธรรมเนียมการถอนเงิน

- ECN Prime มีค่าคอมมิชชันสูง

- สเปรดควรต่ำกว่านี้

รายละเอียดของโบรกเกอร์

BlackBull Markets ถูกก่อตั้งในเมืองโอ๊คแลนด์ ประเทศนิวซีแลนด์ มีความโดดเด่นด้วยการดำเนินการในความเร็วสูง และเร็วเป็นอันดับหนึ่งจากการทดสองของทีมงานของผม

โบรกเกอร์นี้ถูกกำกับควบคุมโดย FMA ของนิวซีแลนด์ และมีดูแลจากหน่วยงานในเซเชลส์สำหรับเทรดเดอร์ชาวไทย และที่สำคัญ BlackBull Markets มีแพลตฟอร์มการเทรดที่แข็งแกร่ง และเสนอรายการเทรดหุ้นมากกว่า 26,000 รายการ

การดำเนินการที่รวดเร็วที่สุด

BlackBull Markets มีความเร็วในการดำเนินการที่เร็วที่สุด เมื่อผมทดสอบความเร็วเทียบกับโบรกเกอร์ชั้นนำ 20 ราย บนแพลตฟอร์ม MT4 ผมสามารถบันทึกความเร็วในการดำเนินการได้ที่ 72 มิลลิวินาทีสำหรับคำสั่งแบบกำหนดราคา และ 90 มิลลิวินาทีสำหรับคำสั่งแบบราคาตลาด

ซึ่งทำให้ BlackBull Markets เป็นโบรกเกอร์เพียงรายเดียวที่บรรลุความเร็วในการดำเนินการต่ำกว่า 100 มิลลิวินาทีทั้งในคำสั่งแบบ limit และแบบราคา market ผมจึงจัดให้โบรกเกอร์นี้อยู่ในอันดับที่หนึ่งในด้านความเร็ว

| Broker | Overall | Limit Order Speed | Limit Order Rank | Market Order Speed | Market Order Rank |

|---|---|---|---|---|---|

| BlackBull Markets | 1 | 72 | 1 | 90 | 2 |

| Fusion Markets | 2 | 79 | 3 | 77 | 1 |

| Pepperstone | 3 | 77 | 2 | 100 | 5 |

| HugosWay | 4 | 104 | 7 | 94 | 3 |

| TMGM | 5 | 94 | 5 | 129 | 7 |

| FXCM | 6 | 108 | 8 | 123 | 6 |

| City Index | 6 | 95 | 6 | 131 | 8 |

| Axi | 8 | 90 | 4 | 164 | 16 |

| Eightcap | 9 | 143 | 12 | 139 | 10 |

| FP Markets | 10 | 225 | 20 | 96 | 4 |

| IC Markets | 10 | 134 | 10 | 153 | 14 |

| FxPro | 12 | 151 | 16 | 138 | 9 |

| Markets.com | 13 | 150 | 15 | 141 | 11 |

| GO Markets | 13 | 144 | 13 | 145 | 13 |

| Admiral Markets | 15 | 132 | 9 | 182 | 18 |

ความหลากหลายของแพลตฟอร์มการเทรด

BlackBull Markets โดดเด่นด้วยความหลากหลายของแพลตฟอร์มการเทรด รวมถึง MT4, MT5, cTrader, TradingView และแอป social trade อีกหลายรายการ เช่น ZuluTrade

อย่างไรก็ตาม แพลตฟอร์มที่เป็นกรรมสิทธิ์ของ BlackBull Markets คือสิ่งที่ทำให้เราประทับใจจริงๆ BlackBull Invest ที่อัพเดทใหม่ พร้อมด้วย BlackBull CopyTrader ที่ได้รับรางวัล ช่วยตอบสนองต่อการเทรดในรูปแบบต่างๆ ได้เป็นอย่างดี

แม้ว่า BlackBull CopyTrader จะมีความโดดเด่นในแง่การเชื่อมต่อเทรดเดอร์กับผู้จัดการกองทุนระดับแนวหน้า และเสนอฟีเจอร์การจัดการความเสี่ยงที่ล้ำสมัย แต่เรายังคงแนะนำให้ใช้หนึ่งในสี่แพลตฟอร์มภายนอกสำหรับการเทรดทั่วไป เว้นแต่คุณต้องการเทรดหุ้น ซึ่งคุณจะต้องใช้ BlackBull Invest เท่านั้น

การเข้าถึงตลาดที่หลากหลาย

BlackBull Markets มีตัวเลือกตลาดทางการเงินมากกว่า 26,000 ตลาด ครอบคลุมทั้ง ฟอเร็กซ์ หุ้น ดัชนี และสินค้าโภคภัณฑ์

และผมประทับใจกับการเทรดหุ้นที่ Blackbull Markets ผ่านแอป BlackBull Invest เป็นอย่างมาก เพราะแอพเทรดนี้อนุญาตให้ทำการเทรดหุ้นได้อย่างง่ายดาย

Ask an Expert