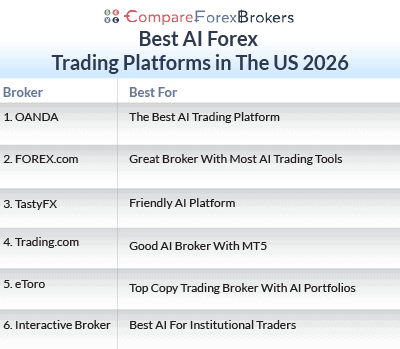

Best AI Forex Trading Platforms

AI’s ability to analyzing data, spot trading opportunities, and automating trades has had a big impact on how people trade forex. This guide explores top AI tools for US traders, tailored to various styles like swing or algorithmic trading. Learn how brokers like OANDA integrate AI and discover key insights, pitfalls, and limitations from real experience.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Here are the Best Forex Brokers in 2026:

- OANDA - The Best AI Trading Platform

- FOREX.com - Great Broker With Most AI Trading Tools

- TastyFX - Friendly AI Platform

- Trading.com - Good AI Broker With MT5

- eToro - Top Copy Trading Broker With AI Portfolios

- Interactive Broker - Best AI For Institutional Traders

What AI Trading Software Is Best For Forex Trading?

OANDA offers the best AI Forex Trading Platform, supporting automated strategies through MetaTrader 4 expert advisors and API based trading with reliable execution. Other CFTC regulated AI trading brokers were shortlisted based on automation flexibility, execution stability and suitability for data driven and algorithmic forex strategies.

1. OANDA - Best AI Forex Trading App

Forex Panel Score

Average Spread

EUR/USD = 0.89 GBP/USD = 1.54 AUD/USD = 1.37

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why I Recommend OANDA

I awarded OANDA 92/100 in my tests, scoring them top marks for their platform range, trading tools, and low trading fees.

OANDA’s spreads are competitive, averaging 1.50 pips on EUR/USD while its execution speed (sub-90ms) provides unmatched trading conditions in the US.

With its OANDA Trade platform, you can access Autochartist for its automated AI-generated technical analysis. AutoChartis will help you with the analysis of 200+ markets (including crypto and forex) that OANDA offers.

OANDA also offers TradingView (my preferred platform for technical analysis) and MetaTrader 4 (which is good for automation). Overall, OANDA is a versatile choice for US traders.

Pros & Cons

- Advanced AI indicators and charting with TradingView.

- Tight spreads on the Standard account (no commissions).

- Elite Trader program rewards high-volume traders with rebates.

- Customer support is only 24/5 (no weekends).

- Withdrawal and inactivity fees apply.

- No price alerts on the OANDA Trade platform.

Broker Details

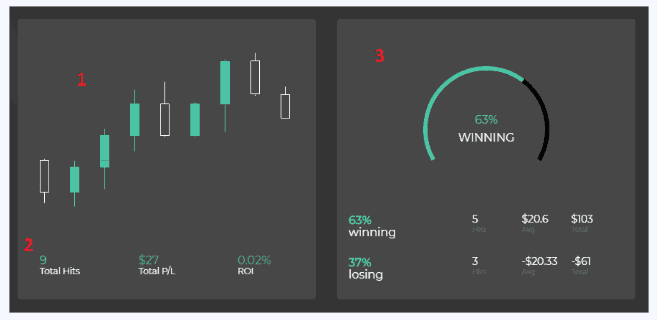

OANDA has Autochartist for AI Analysis

The broker’s proprietary platform; OANDA Trade, comes with Autochartist, a powerful technical analysis tool.

Autochartist automatically scans OANDA’s 200+ markets to find trading opportunities using price action tools like Candlestick and chart patterns. Examples of chart patterns that help include double tops, wedges, and engulfing patterns.

I found Autochartist helpful as a day trader because you can have scanners open in the background, sending you alerts on multiple markets from indices to currency pairs.

One of the features that made it more useful is that you can adjust the filters to focus on specific markets or signal types (like Fibonacci, chart, or candlestick patterns).

Although it reduces the number of signals you receive, it’s well worth it, as it allows you to focus on the markets (and analysis) you find most profitable.

Great Range of Trading Platforms

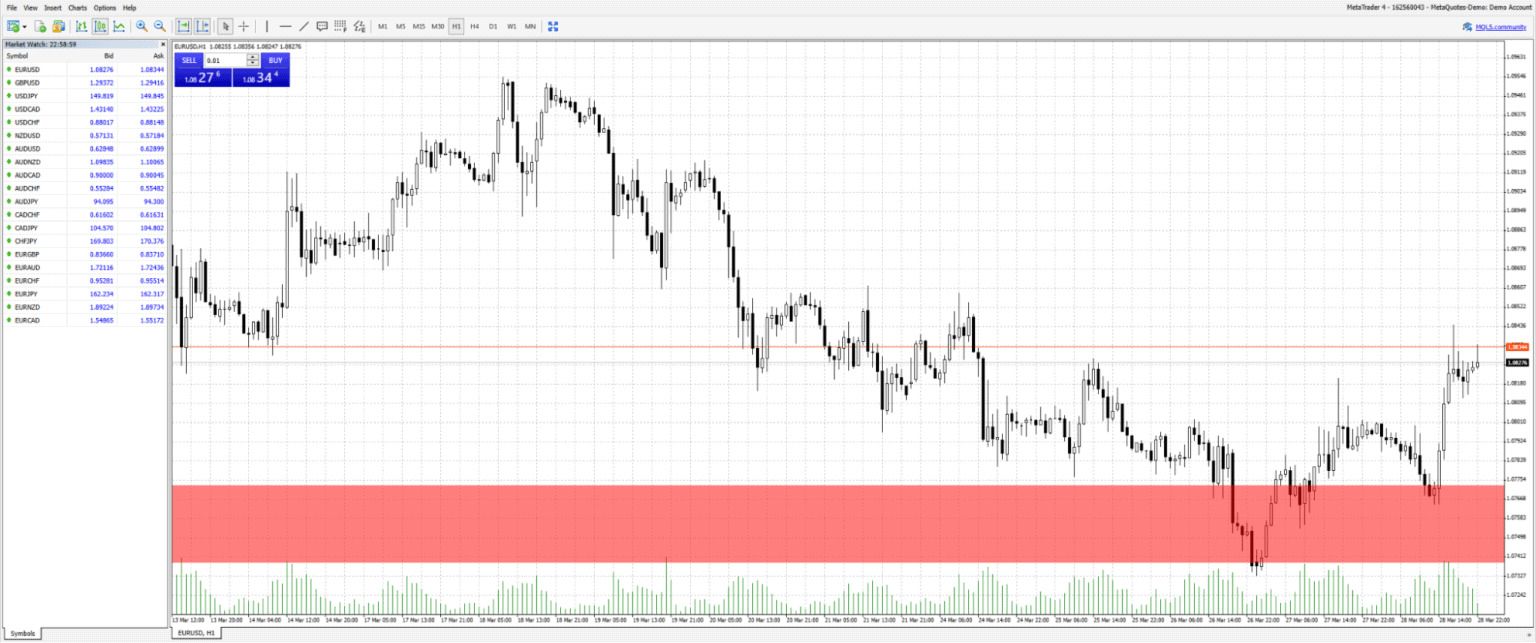

During my tests, I found that OANDA offers a decent selection of trading platforms. TradingView and MetaTrader 4 are the standout options with access to advanced charting and tools. OANDA Trade also has great features if you’re new to trading.

Of the available platforms, I think TradingView is the better option for technical analysis. With TradingView you have 110+ indicators, including automated pattern recognition tools if you rely on price action. These indicators include wedge patterns and candlesticks like hammers and dojis.

The last option is MetaTrader 4, the only option OANDA offers for automated trading. MetaTrader 4 allows you to utilize AI to create Expert Advisors based on your trading instructions. These trading bots will help you find and execute the trades, and manage the risk hands-free.

Commission Free Trading Account

While using my OANDA Standard account, I found the spreads average 1.5 pips on EUR/USD, which is competitive for US-regulated forex brokers.

The benefit of the Standard account is that it has no commissions, so all your direct trading costs are paid upfront when opening a trade. I find this type of account easier to track your open P&L as I can see which positions are in the green meaning I know I have covered the costs and am in profit.

| Broker | EUR/USD Spreads |

|---|---|

| OANDA | 1.50 |

| FOREX.com | 1.9 |

| Tastyfx | 0.80 |

| Trading.com | 0.90 |

| eToro | 1.00 |

2. FOREX.com - Best ECN Style AI Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.21 GBP/USD = 0.23 AUD/USD = 0.17

Trading Platforms

MT4, MT5, TradingView, FOREX.com Trading Platform

Minimum Deposit

$100

Why I recommend FOREX.com

As FOREX.com gives you the most AI trading tools, I scored them highly.

One AI tool I like is ‘Performance Analytics’ which highlights your strengths and weaknesses and uses this data to give you feedback and improve your trading performance.

The FOREX.com Raw account has tight spreads from 0.0 pips with $7.00/lot commission.

This gives high-volume traders like scalpers a decent opportunity to lower their trading costs.

Pros & Cons

- Myfxbook AutoTrade copies top-performing AI trading strategies.

- Robust educational resources for algorithmic trading.

- Performance Analytics improves trading performance

- Higher spreads on the Standard account (1.0+ pips).

- Limited CFD trading options compared to competitors.

- No social trading features.

Broker Details

Tighter Spreads with the RAW Account

On FOREX.com, you have a choice of two trading accounts: a Standard account (which has variable spreads and no commissions) and a Raw account with tight spreads and commissions from $7/lot.

I recommend the Raw account as I prefer the transparency of commissions. These commissions are fixed (even in the most volatile markets). The best ECN brokers on the Raw account ensures you get institutional-grade spreads.

As for the spreads, they are much lower, averaging 0.5 pips on EUR/USD, which is 75% lower than the Standard accounts’ 2-pip spread.

Use AI To Analyse Your Performance

With FOREX.com’s live accounts, you can access Performance Analytics (powered by Chasing Returns). The exclusive feature to FOREX.com uses AI to monitor your trading history and gives real-time advice to improve your performance.

An example of this is ‘PlayMaker’. This tool reviews every trade you have placed and scores it against your trading plan to see how disciplined you are. For me, this is a great way to reduce your mistakes as you can review your actions in real-time thereby helping you to adjust your trades quickly and stick to your strategy.

*Your capital is at risk up to ‘76% of retail CFD accounts lose money with FOREX.com’

3. TastyFX - Beginner AI Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.13 GBP/USD = 1.66 AUD/USD = 1.01

Trading Platforms

MT4, tastyfx Web Platform, tastyfx Mobile App, ProRealTime

Minimum Deposit

$250

Why I Recommend Tastyfx

Tastyfx is my top choice for beginner forex traders thanks to its easy-to-open trading account, low spreads and solid customer support.

Standard spreads start at 0.8 pips, while the customer support is 24/7 – two of the most impressive showings in each category.

Out of the 4 platforms available, Tastyfx’s proprietary option is the best for beginners thanks to its user-friendly design. Despite the intuitive interface, the platform is still advanced enough to perform solid technical analysis through its 25+ indicators.

There are 20+ online lessons available on the platform, and a strong Signal Centre – I found this to be plenty of educational resources as you learn how to trade.

Pros & Cons

- Clean, intuitive platform for quick trades

- AI-driven technical analysis tools

- No withdrawal fees

- Limited to forex markets in the US

- Lacks copy trading features

Broker Details

Automated Technical Analysis with ProRealTime

The ProRealTime platform blends TradingView’s charting with MT4’s automated trading features. This mix of technical indicators and automation means ProRealTime will appeal to most traders but you may need to pay to access some of these more advanced features.

For technical analysis, ProRealTime’s 100+ indicators cover most of the indicators you’ll need to develop your strategy. Some of the indicators include Bollinger Bands and moving averages.

One indicator I liked the most was the ProRealTrend. The indicator plots key trend lines, support and resistance levels, and channels. By AI, ProRealTime can plot these trends using multi-timeframe analysis. This helps beginners by making it easier to analyze charts for breakout trades.

With this ProRealTrend indicator, I feel that beginners can benefit from the accuracy, making it easier to analyze charts for breakout trades. For those new to forex trading, Tastyfx’s combination of AI-driven tools and educational resources makes it stand out among forex brokers for beginners.

Largest Range of Forex Markets

During my tests, I found that Tastyfx offers the largest collection of currency pairs. The broker has 81 pairs, almost 10 more than its nearest competitor (FOREX.com), which offers 872.

With Tastyfx, you can trade:

- 11 majors including EUR/USD

- 16 minor pairs like EUR/GBP

- 12 Australasian with NZD and AUD crosses like AUD/JPY

- 14 Scandinavian currencies including USD/SEK

- 21 exotic pairs like USD/MXN

- 7 emerging currencies, including USD/CNH (Chinese Renminbi)

Low Spreads With No Commissions

Tastyfx’s Standard account has spreads starting from 0.8 pips on EUR/USD and USD/JPY with no commissions. The broker also offers a Zero+ account with spreads from 0.0 pips and a $5 commission per lot for active traders, plus a Prime account for traders with $50K+ deposits featuring spreads from 0.6 pips and up to 8% APY on cash.

This simplifies your trading costs as you pay the fee up front (when you open the trade). The P&L column includes costs, so you get a true reflection of whether you are in a profit or loss. This makes it easier for beginners to track and can prevent exiting early by mistake.

During the New York market open, I found Tastyfx’s spreads were stable at 0.8 pips, with the odd rise to 1.1 pips (still cheap vs. industry). Giving you their lowest spreads for the majority of a trading session is a big plus in my book.

4. Trading.com - Best MetaTrader AI Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.2 GBP/USD = 1.8 AUD/USD = 1.2

Trading Platforms

MT5

Minimum Deposit

$50

Why I Recommend Trading.com

Trading.com is unusual in that they are the only broker to offer MetaTrader 5 without also offering MetaTrader 4.

The T1 account is commission-free with low spreads from 0.90 pips on EUR/USD. Trading.com’s account also offers 1:50 leverage for advanced traders looking to scale on the MT5 platform.

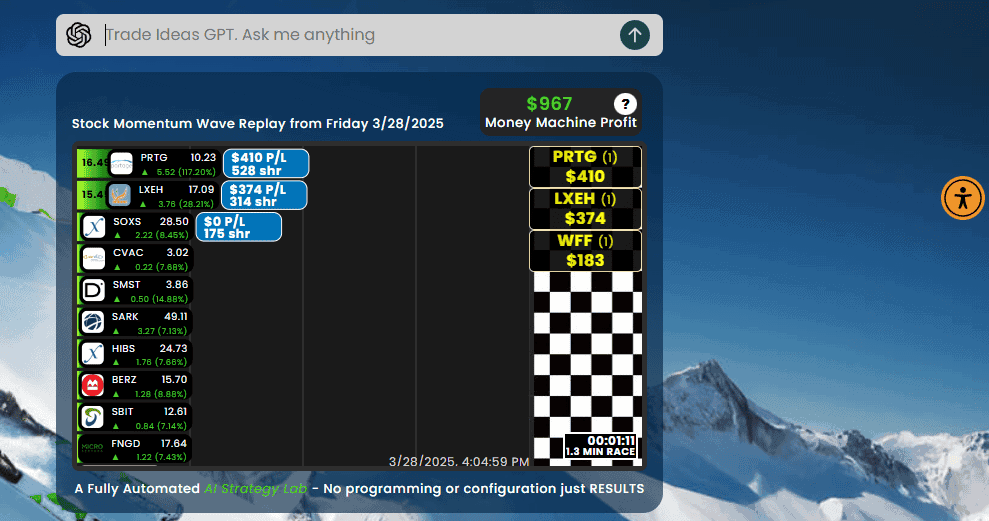

If you prefer manual trading, Trading.com has AI-generated trading signals on its web platform. These signals are provided by two of the industry’s best analysts: Trading Central and Analyzzer.

The analysts combine price action and swing patterns to find trading opportunities on the broker’s 69 forex pairs.

Pros & Cons

- Full MT5 integration for algorithmic trading

- Low spreads on major pairs

- Offers 1:50 leverage

- No MT4 or TradingView support

- Limited educational resources

- Fewer trading tools compared to rivals

Broker Details

Automate Trades on MetaTrader 5

With Trading.com’s MetaTrader 5 platform, you can set up AI-driven expert advisors. These advisors automate your trades and control your trading account based on your instructions.

MetaTrader 5 has a solid, multi-threaded backtesting platform. You can test your expert advisors with previous data (up to 15 years) to see if they perform or not.

MT5 is a solid pick as you get access to depth-of-market tools, giving you Level 2 price data that is useful for finding order blocks to trade.

Trading.com has its own web platform that is available on all devices, providing a decent “no-frills” backup to MT5 if you want to trade manually.

Free Trading Signals on 69 Forex Markets

When opening a T1 account, you can access a range of technical analysis tools. These tools include free trading signals that are powered by two top services: Trading Central and Analyzzer.

The signal providers offer two different takes on technical analysis. Trading Central focuses on candlesticks and chart patterns (ideal for breakout trading). Analyzzer, on the other hand, focuses on market swings, which I think is a solid variety for intraday signals.

Better yet, the signals work across the broker’s 69 forex markets. This allows you to trade multiple pairs without having to scan for opportunities manually.

Spread-Only Trading With The T1 Account

You don’t get a choice of account types with Trading.com like you do with FOREX.com. Instead, they only offer the T1 account.

This is the broker’s Standard account with a spread-only pricing model and no commissions. I find these types of accounts are ideal for all trading types, especially beginners due to the straightforward pricing.

In my tests, I found the broker averaged 1.20 pips on EUR/USD during the New York session. This spread is slightly higher than their advertised minimum of 0.9 pips.

At 1.20 pips spreads, Trading.com’s fees are similar to the rest of the US-regulated forex brokers I’ve tested.

| Broker | EUR/USD Spreads (Average) |

|---|---|

| Tastyfx | 0.80 |

| eToro | 1.00 |

| Trading.com | 1.20 |

| OANDA | 1.60 |

| FOREX.com | 1.9 |

5. eToro - Best Copy Trading AI Platform

Forex Panel Score

Average Spread

EUR/USD = 1.0 GBP/USD = 2.0 AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why I Recommend eToro

eToro is my top pick for copy trading, especially for its AI, which makes it easier to find copy traders tailored to your trading criteria.

Alternatively, I found eToro’s Smart Portfolios an excellent option if you want hands-off investing. With Smart Portfolios, you let eToro’s professionals manage your money through specific industries like AI chip makers or crypto.

The trading costs are low (from 1 pip on forex) with no management or admin fees. This makes eToro a great value considering your investments will be managed by copy traders or professionals through the Smart Portfolios.

Pros & Cons

- Professional trading through Smart Portfolios

- 2,000,000+ copy traders to choose from

- Large choice of cryptocurrencies

- No 3rd-party trading platforms like MT4

- Has a withdrawal fee ($5)

- Not available in all US states

Broker Details

Copy Trade From 2,000,000 Traders

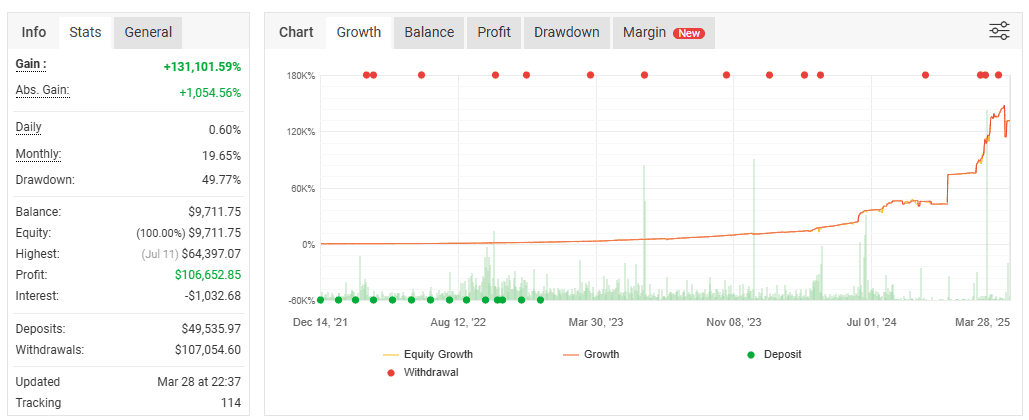

I find eToro makes copy trading simple thanks to their CopyTrader platform. The platform lets you find potential copy traders using a filter system and automatically follows their trades. Top help with your copy trading, a wide range of social trading tools are also included so you can interact with other signal providers and traders in the community.

The AI’s Risk Score calculates the copy trader’s performance against risk, profit, and trade frequency. I found this score to provide a quick snapshot of the trader’s risk, helping you avoid traders that the AI deems high (or too low) risk.

eToro’s CopyTrader platform will automate your trading and replicate every copy trader instantly. This helps you match the trader’s performance.

I also like that it gives you control of the risk by setting a maximum drawdown. Essentially, this is a hard stop loss on the trader’s performance and stop copying the trader should they underperform.

AI Managed Smart Portfolios

eToro incorporated AI into their products through Smart Portfolios. These offer a decent alternative to copy trading, especially if you have no trading experience.

You can choose Smart Portfolios tailored to different industries, such as AI, crypto, or electric vehicles. Each portfolio contains a basket of assets (like stocks and ETFs) within that industry. The goal of these portfolios is to track the industry, while outperforming benchmarks like the S&P 500.

What I like about Smart Portfolios is that your money is invested with eToro’s professional analysts instead of individuals. The analysts will do the research, execute the trades, and manage the risk while sticking to a clear strategy.

After the portfolio has made profits (or losses, AI will rebalance the portfolio. This helps maintain growth while protecting your downside.

Large Range of Markets For Copy Trading

eToro has a decent collection of 3,500+ markets. This allows for true multi-asset copy trading. With my eToro account, I found that you have access to the following markets:

- 55 forex pairs

- 90 cryptocurrencies (one of the largest for US-regulated brokers)

- 19 indices

- 600+ ETFs

- 42 commodities including gold and oil

- 3,000+ stocks

6. Interactive Broker - Best AI For Instituational Traders

Forex Panel Score

Average Spread

EUR/USD = N/A GBP/USD = N/A AUD/USD = N/A

Trading Platforms

"IBKR Workstation, IBKR Global Trader, IBKR Mobile"

Minimum Deposit

$0

Why I Recommend Interactive Brokers

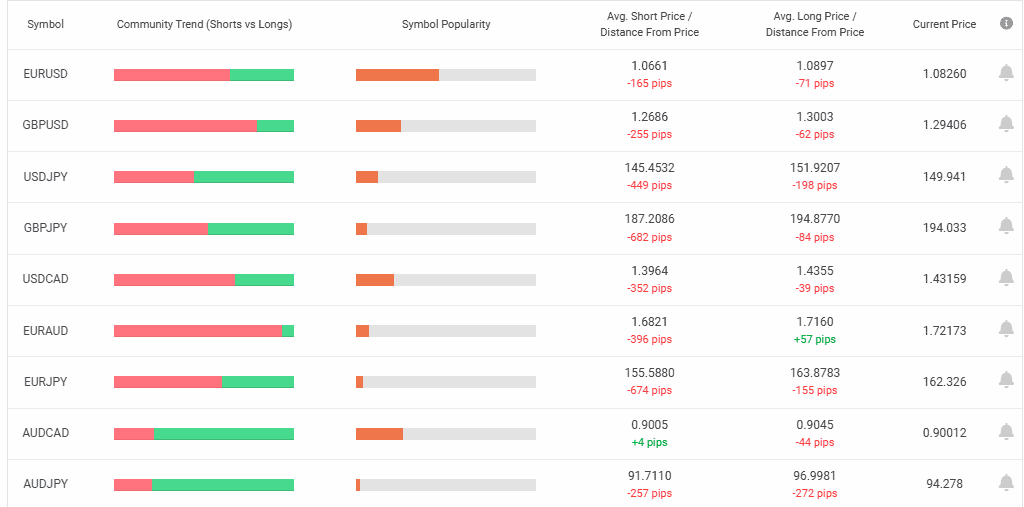

I picked Interactive Brokers for AI traders who need serious API infrastructure, institutional forex brokers and the absolute lowest trading costs. If you’re running algorithmic strategies, IBKR’s commission structure beats everyone – $2 per lot minimum, dropping to $1 if you hit the volume tiers.

The broker pulls pricing from 17 FX dealers, giving you spreads from 0.2 pips on EUR/USD. Combined with those low commissions, your all-in costs are unmatched if you’re trading full lots or larger positions.

What sold me on IBKR for AI trading is their FIX protocol connectivity and REST API endpoints. You can code custom strategies in Python, C++, or Java and connect directly to your account. For high-frequency AI strategies, that low-latency execution is non-negotiable.

Pros & Cons

- Lowest commissions in the industry

- API access with FIX protocol for custom AI integration

- 105+ currency pairs with institutional liquidity

- Level 2 pricing and depth-of-market data for AI models

- $2 minimum makes micro-lots expensive

- Complex platforms means steep learning curve

- No MetaTrader support

Broker Details

Best API Infrastructure for Custom AI Strategies

Interactive Brokers built their platform for algorithmic trading from the ground up. Their API lets you connect proprietary AI software directly to your trading account using REST endpoints or FIX protocol connectivity.

I’ve run machine learning models on IBKR’s infrastructure, and the execution quality is solid. When your AI generates a signal, you need fills in milliseconds, any delay kills the edge on pattern recognition strategies or order flow analysis.

The broker doesn’t support MetaTrader, but if you’re building serious AI systems, you’re likely coding in Python or C++ anyway. Their API documentation is comprehensive, and you can backtest strategies using historical data going back years.

Institutional Liquidity Across 105+ Pairs

IBKR connects to 17 major liquidity providers, meaning you get institutional-grade order books even as a retail trader. This matters when your AI is executing high-frequency strategies – you need deep liquidity to avoid slippage on rapid-fire orders.

Their SmartRouting technology scans available liquidity providers and routes your order to the best price automatically. It’s essentially AI-powered execution built into their infrastructure.

I tested spreads on EUR/USD during the New York session and consistently saw 0.2 pips. That’s tight. Combine that with $2 commissions per lot, and your total trading cost is around 0.4 pips all-in, which is way better than most US brokers.

Commission Structure Built for Volume

Here’s the catch with IBKR: that $2 minimum commission applies regardless of position size. If you’re trading 0.1 lots (10,000 units), you’re still paying $2, which makes it expensive compared to spread-only brokers.

But if you trade standard lots or larger, IBKR wins hands down. At higher volumes (over $1 billion monthly), commissions drop to $1 per lot. For AI strategies executing dozens of trades daily, those savings add up fast.

In my tests, the $2 commission plus 0.2 pip spread beat the 1.2+ pip spreads most US brokers charge on Standard accounts. You just need to trade meaningful size to make the math work.

Multi-Asset Access for Complex AI Strategies

IBKR gives you access to way more than just forex. You can trade stocks on 90+ exchanges, futures on 30+ markets, and options across multiple underlyings, all from one account with one API connection.

If your AI strategy trades correlations between EUR/USD and S&P 500 futures, IBKR handles both seamlessly. The depth-of-market tools show you Level 2 pricing, which is valuable data for training machine learning models on order flow patterns.

The platform also provides tick-by-tick data and historical archives, essential if you’re backtesting AI strategies or training neural networks on market microstructure.

Ask an Expert