Best Forex Demo Account

Opening a demo account with a forex broker lets you practice trading without risking real money. I tested demo accounts from 12 US-regulated brokers and matched them to different trading needs based on platform features, virtual funds, spread accuracy, and time limits.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

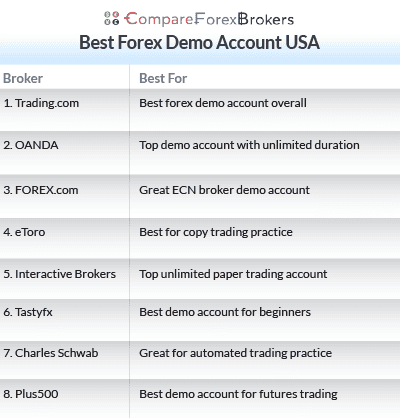

Best Forex Demo Accounts

- Trading.com - Best Forex Trading Demo Account

- OANDA - Great Demo Forex Trading App

- Forex.com - Top ECN Broker Demo Account

- eToro - Good Copy Trading Demo Account

- Interactive Brokers - Best Unlimited Paper Trading Account

- Tastyfx - Top Practice Account For Beginner Traders

- Charles Schwab - Good For Demo Account With Automation

- Plus500 - Great Test Account For Future Trading

What is the best demo account for forex trading?

Trading.com offers the best forex demo account with a $0 minimum deposit, providing unlimited virtual funds and full access to the trading platform. Other US-regulated brokers were shortlisted based on their flexibility in demo accounts, ease of use, and suitability for traders’ testing strategies.

1. Trading.com - Best Forex Trading Demo Account

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.8

AUD/USD = 1.2

Trading Platforms

MT5

Minimum Deposit

$50

Why We Recommend Trading.com

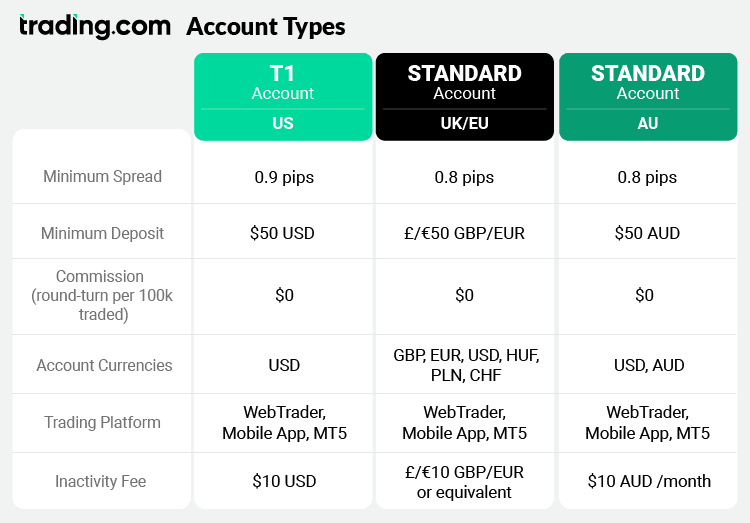

Trading.com is a well regulated broker (CFTC/NFA) offering you only spot forex trading with no commissions and a low minimum deposit ($50). They have a single T1 account, which is good if you are a beginner trader. You get to trade 69 currency pairs on MetaTrader 5, WebTrader, and their Trading.com mobile app. You get variable spreads that are competitive but typically wider than the very lowest-cost US brokers.

There are also no RAW/ECN accounts, which is a slight downside if you are an advanced trader. They also don’t offer Pro, Islamic, or copy-trading account options. You also get up to 50:1 leverage on major pairs, which is the highest as per US regulation.

Pros & Cons

- Unlimited demo account

- MT5 platform with advanced charting

- Realistic spread conditions

- 79 forex pairs for spot trading practice

- Spreads average 1.2 pips on EUR/USD

- No MT4 platform option

- Single spread-only account type

- No copy trading or social features

Broker Details

Trading.com offers you a focused portfolio. For US-based clients, you get access strictly to Spot Forex (69 pairs). I found their market-making model has high liquidity and execution speeds, with over 99% of orders processed in under a second.

Their average spread on major pairs like EUR/USD is impressive, starting from 1.0 pips, but is higher for pairs like USD/ JPY at 1.50 pips. The lack of per-trade commissions simplifies your cost calculations as a newer trader.

US traders can utilize leverage up to 1:50 on major pairs, the regulatory maximum. You also get the bonus of added security via negative balance protection and built-in educational content.

| Currency Pair/Spread | Trading.com UK | Trading.com US | Average Trading.com US |

|---|---|---|---|

| EUR/USD | 1.8 | 1.1 | 1.0 |

| GBP/USD | 2.0 | 1.6 | 1.6 |

| USD/CAD | 2.8 | 1.9 | 1.8 |

| USD/CHF | 1.9 | 1.5 | 1.8 |

| USD/JPY | 2.5 | 1.6 | 1.5 |

| NZD/USD | 2.8 | 2.4 | 2.5 |

| EUR/GBP | 1.7 | 1.5 | 1.6 |

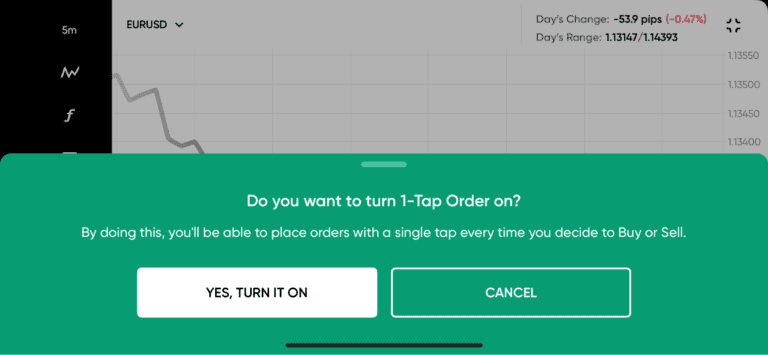

The platform choice is limited, as you get access to only MT5 and their proprietary apps. Their WebTrader is rather good, utilizing TradingView tools with over 90 technical indicators and 50 drawing tools. Their mobile app has some nice features such as Face ID security and a few different order types with advanced stop-loss.

You also get access to their one-click trading feature alongside real-time account dashboards. The demo account provides a 90-day risk-free window to explore these tools, which makes it stand out.

2. OANDA - Great Demo Forex Trading App

Forex Panel Score

Average Spread

EUR/USD = 0.89 GBP/USD = 1.54 AUD/USD = 1.37

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

OANDA’s demo account stands out with truly unlimited duration and $100,000 in starting virtual funds that you can adjust anytime. You’ll never hit an expiration date, giving you permanent access to practice trading without pressure to fund a live account.

The broker’s demo spans three platforms: OANDA Trade (proprietary web and mobile), MetaTrader 5, and TradingView integration. This multi-platform approach lets you test each interface to find which suits your trading style before committing real money.

Pros & Cons

- Unlimited demo account

- $100,000 starting balance

- Three platform options

- Multiple sub-accounts in different base currencies

- 68 currency pairs

- API access for automated trading development

- Elite Trader rebate program

- Core Pricing is $10,000 minimum for tighter spreads

- MT4 limited to 90 days

- Average spreads 1.54 pips without Core Pricing

- Limited educational content

Broker Details

Unlimited Practice and Multiple Sub-Accounts

OANDA lets you create multiple demo sub-accounts within your main account hub. Each sub-account can use different base currencies including USD, EUR, GBP, JPY, CAD, AUD, CHF, and others. This feature helps you practice trading in your preferred currency without conversion confusion.

When you exhaust your virtual funds, contact customer support to add up to $100,000 more. You can also reduce your balance to as low as $2,000 if you want to practice with more realistic position sizes. This flexibility helps you simulate actual account conditions you’ll face when trading live.

The demo tracks profit and loss exactly as a live account would, helping you identify which strategies generate consistent returns versus those that rack up losses. Account statements are generated daily, giving you detailed trade history and performance metrics.

Platform Options and Trading Tools

OANDA Trade provides over 100 technical indicators and 32 overlay studies. The mobile app includes real-time streaming charts with 11 drawing tools and nine chart types. OANDA’s mobile platform ranks as one of the best trading apps in the USA. Price alerts let you monitor specific levels without watching screens constantly.

MT5 access gives you Expert Advisor support for algorithmic trading. You can code, test, and refine automated strategies using MQL5 before deploying them with real money. The platform’s strategy tester uses historical data spanning multiple years for thorough backtesting.

TradingView integration delivers their advanced charting package with community indicators and strategy scripts. The social features let you follow other traders’ ideas, though you’ll need separate TradingView credentials. This combination gives you professional-grade analysis tools in demo mode.

68 Currency Pairs and Competitive Spreads

OANDA offers 68 forex pairs including all majors, minors, and a strong exotic selection. Demo spreads match live account conditions, averaging 1.54 pips on EUR/USD. Spread-only pricing means no separate commissions unless you opt for Core Pricing.

Core Pricing requires $10,000 minimum deposit and charges $5 per $100,000 traded per side ($10 round trip). This brings average costs down to around 1.4 pips all-in on EUR/USD. Demo mode lets you test both pricing models before deciding.

The Elite Trader program offers rebates from $5 to $17 per million traded for high-volume accounts. While not available in demo mode, you can calculate potential rebate benefits based on your simulated trading volume.

3. Forex.com - Top ECN Broker Demo Account

Forex Panel Score

Average Spread

EUR/USD = 0.21 GBP/USD = 0.23 AUD/USD = 0.17

Trading Platforms

MT4, MT5, TradingView, FOREX.com Trading Platform

Minimum Deposit

$100

Why We Recommend Forex.com

FOREX.com provides $50,000 in virtual funds with 90-day demo access on their proprietary platform (90 days for MT4). As one of the best ECN brokers in the US, the demo showcases their ECN execution model with spreads as low as 0.0 pips plus $7 ($14.00 round-turn) commission per $100,000 on RAW Pricing accounts.

If you’re a US trader, FOREX.com gives you access to spot forex pairs and futures trading. Their proprietary platform integrates TradingView charts with over 80 technical indicators, while Performance Analytics (powered by Chasing Returns) uses AI to analyse your trading patterns and provide real-time improvement suggestions.

Standard demo accounts show typical spreads around 1.2 pips on EUR/USD without commission. You practice with full access to 80+ currency pairs and futures contracts.

Pros & Cons

- RAW Pricing with 0.0 pip spreads

- 80+ forex pairs

- Performance Analytics

- TradingView and MT4/MT5 platform options

- 90-day limit on proprietary platform demos

- Renewal not available after expiration

- RAW Pricing requires larger account size

- Some advanced features require live account

4. eToro - Good Copy Trading Demo Account

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

eToro automatically credits $100,000 in virtual funds to every account’s Virtual Portfolio. The standout feature is practicing copy trading with fake money. You can follow experienced traders and replicate their strategies without risk.

If you’re a US trader, eToro specializes in stocks and cryptocurrencies. Forex trading isn’t available to US customers. The platform operates as a social trading network where you can learn from other traders’ portfolios and strategies.

The CopyTrader system lets you allocate funds to multiple traders simultaneously, automatically replicating their positions in proportion to your investment. Smart Portfolios bundle multiple assets into managed investment strategies across different market themes like technology, healthcare, or renewable energy.

The demo never expires and lets you request additional virtual funds through customer support with a maximum $100,000 addition. You can switch between real and virtual portfolios instantly, testing strategies with stocks and crypto before committing capital.

Pros & Cons

- $100,000 virtual funds

- Copy trading available in demo mode

- Instant switching between real and virtual portfolios

- Crypto and stocks

- Can request additional virtual funds

- Analysis and News features locked in demo

- Platform pushes toward live account upgrades

- Limited advanced charting vs competitors

- Copy trading commissions not charged in demo

5. Interactive Brokers - Best Unlimited Paper Trading Account

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

Interactive Brokers provides unlimited paper trading with $1,000,000 in virtual funds through Trader Workstation. You need to open a live account first (no funding required). The paper environment supports all TWS trading platforms including desktop, web, and mobile.

As one of the largest US brokers with over $426 billion in client equity, Interactive Brokers delivers institutional-grade infrastructure to retail traders. You access 150 markets across 33 countries trading stocks, options, futures, forex, bonds, funds, and structured products.

Paper trading mirrors live conditions with realistic execution simulation, 100+ order types, and full IB API access for algorithmic development. Professional tools include Options Analytics for volatility analysis, Risk Navigator for portfolio stress testing, and PortfolioAnalyst for performance attribution – all available in demo mode.

Pros & Cons

- $1,000,000 starting balance

- Unlimited duration with no expiration

- Full TWS platform with advanced tools

- API access for algo trading development

- Multi-asset practice across 150 markets

- Daily paper account statements generated

- Requires live account opening first

- Complex platform has steep learning curve

- Market data subscriptions disabled in paper mode

- Some execution differences vs live trading

6. Tastyfx - Top Practice Account For Beginner Traders

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, tastyfx Web Platform, tastyfx Mobile App, ProRealTime

Minimum Deposit

$250

Why We Recommend Tastyfx

Tastyfx delivers a straightforward demo with $10,000 in virtual funds. The platform is specifically designed for beginner traders with simplified interfaces and educational content integrated throughout. In addition to tastyfx, you can also trade with MT4, MT5, TradingView and ProRealTime.

The platform offers three account tiers: Standard (0.8 pips commission-free), Zero+ (0.0 pips with $5/lot commission), and Prime (0.6 pips for $50K+ accounts with up to 8% APY on cash). Their Volume Based Rebate program returns up to 15% of spreads for active traders, while the Trade Analytics dashboard tracks performance metrics helping you identify profitable patterns.

You automatically receive demo access when opening an account (no funding needed). The proprietary platform includes Signal Center for professional trading signals, 33 technical indicators, 19 drawing tools, and seamless integration with TradingView, MT4, and ProRealTime for advanced charting needs.

Pros & Cons

- Clean interface

- Signal Center with professional trade ideas

- 80+ currency pairs available

- MT4 demo also available

- 20+ online lessons for learning

- Only $10,000 in virtual funds

- More basic platform vs competitors

- Limited technical indicators (33 available)

- Smaller instrument selection overall

7. Charles Schwab - Good For Demo Account With Automation

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

thinkorswim desktop, thinkorswim web, thinkorswim mobile, Schwab.com, Schwab Mobile

Minimum Deposit

$0

Why We Recommend Charles Schwab

Charles Schwab’s paperMoney runs inside thinkorswim with $100,000 in virtual funds (fully adjustable). The platform excels for automated trading with thinkScript support for coding custom strategies, indicators, and studies.

Beyond forex, you access stocks, options, futures, bonds, and ETFs across US and international markets. The thinkorswim platform includes 400+ technical studies, sophisticated options analysis with Probability Analysis and Greeks calculations, and the Trade Flash tool showing real-time unusual options activity.

Their research center provides third-party reports from Morningstar, CFRA, Market Edge, and proprietary Schwab equity ratings.

Two access methods exist: Schwab clients get unlimited paperMoney access, while non-clients can use the Guest Pass for 30-day trials without opening an account. Both options provide full thinkorswim functionality across desktop, web, and mobile platforms including scanners that filter thousands of securities by custom criteria.

Pros & Cons

- $100,000 adjustable virtual balance

- thinkScript for automated strategy coding

- Guest Pass available without account opening

- Multi-asset (forex, futures, options, stocks)

- Advanced scanning and analysis tools

- Guest Pass limited to 30 days

- Complex platform overwhelming for beginners

- Futures and forex have specific requirements

- No MT4/MT5 platform options

8. Plus500 - Great Test Account For Future Trading

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.6

AUD/USD = 1

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why We Recommend Plus500

Plus500 focuses on futures with an unlimited demo account featuring $50,000 in virtual funds. The balance auto-replenishes when dropping below $200, ensuring uninterrupted practice. You can access 60+ futures contracts spanning forex, indices, commodities, interest rates, and cryptocurrencies.

The proprietary web platform includes 114 technical indicators, advanced charting, and risk management tools like trailing stops. Demo conditions closely replicate live trading with real-time pricing and execution simulation.

Pros & Cons

- Unlimited duration with auto-replenishing balance

- $50,000 starting virtual funds

- 60+ futures contracts across asset classes

- 114 technical indicators included

- No platform fees or data charges

- Futures-only focus (no spot forex)

- Proprietary platform only (no MT4/MT5)

- Limited educational content vs competitors

- Guaranteed stop orders incur fees (in live)