7 Best Lowest Spread Forex Brokers in the USA [Updated 2025]

I tested and compared CFTC-regulated forex trading account to find the best lowest spread forex brokers for USA traders. To do this, I opened an account, ran trades through an Expert Advisor trading bot, and then compared the spreads I found.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

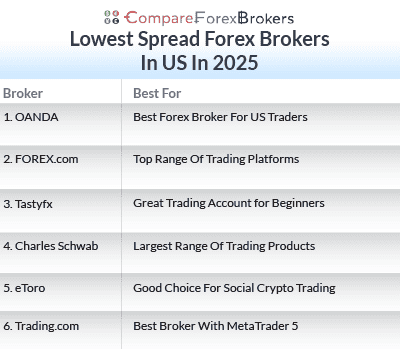

This helped me put together my lowest spread forex broker USA list for 2025:

- OANDA - Best Forex Broker For US Traders

- FOREX.com - Top Range Of Trading Platforms

- Tastyfx - Great Trading Account for Beginners

- Interactive Brokers - Top Forex Broker With Lowest Trading Fees

- Charles Schwab - Largest Range Of Trading Products

- eToro - Good Choice For Social Crypto Trading

- Trading.com - Best Broker With MetaTrader 5

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

91 | NFA/CFTC | - | - | - | 1.4 | 2 | 1.4 |

|

|

|

120ms | $0 | 68+ (Spot) | - | 50:1 | 100:1 |

|

|

Read review ›

Read review ›

|

84 |

NFA/CFTC FCA,CIRO |

0.0 | 0.2 | - | $7.00 | 1.50 | 1.5 | 1.4 |

|

|

|

30 ms (May 2023) | $100 | 80+ (Spot) | - | 50:1 |

|

|

Read review ›

Read review ›

|

71 | NFA/CFTC | - | - | - | $6.00 | 1.2 | 1.9 | 1.4 |

|

|

|

174ms | $450 | 80+ (Spot) | - | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

58 |

NFA, CFTC, CBI ASIC, FCA, MAS CIRO, JFSA |

- | - | - | 0.08%-0.2% | - |

|

|

|

110ms | $0 | 117 | 4 | 30:1 | 500:1 |

|

||

Read review ›

Read review ›

|

43 |

SEC, NFA/CFTC FINRA |

- | - | - | - | 1.4 | 1.3 | 1.2 |

|

|

|

110ms | $2000 | 70+ (Spot) | 1 | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

43 |

ASIC, FCA CYSEC |

- | - | - | - | - | - | - |

|

|

|

120ms | $10 | - | 24 (Spot) |

|

||

Read review ›

Read review ›

|

50 | NFA/CFTC | - | - | - | - | 1.2 | 1.8 | 1.2 |

|

|

Who Are The Best Lowest Spread Forex Brokers In USA?

I tested US forex brokers, analysing their trading accounts during typical market conditions to see which has the lowest spreads. My findings are in the list below, where I also highlight each broker’s top features.

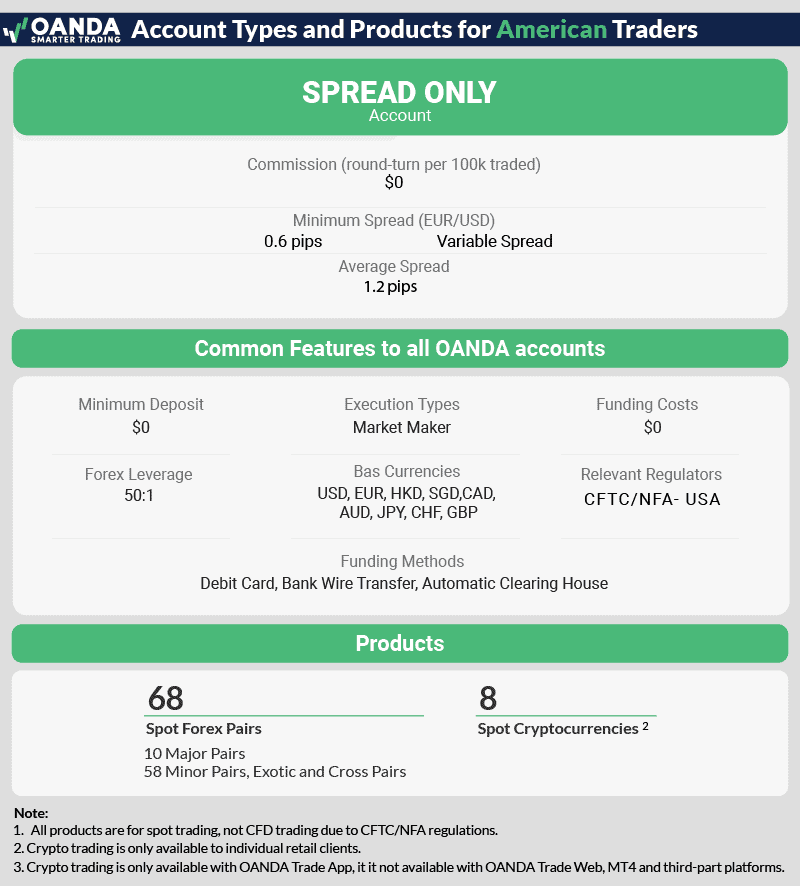

1. OANDA - Best Forex Broker For US Traders

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 0.9

AUD/USD = 0.7

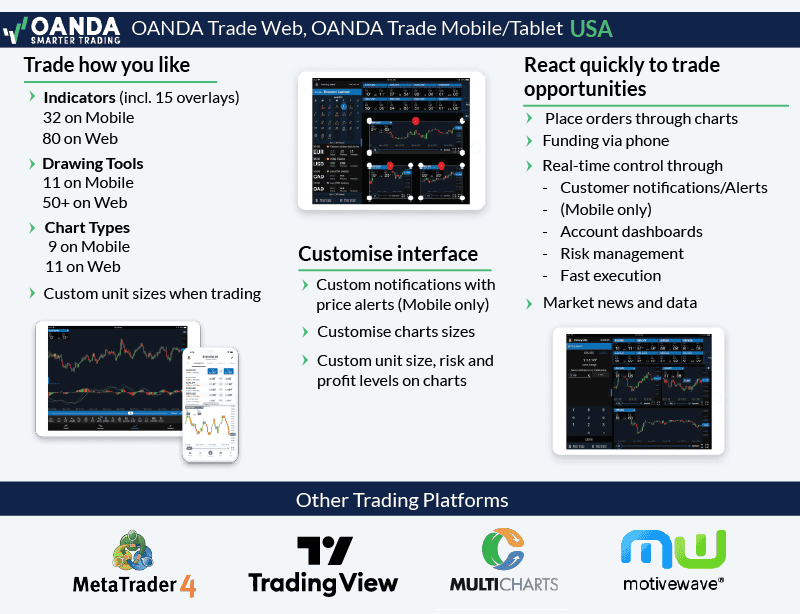

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

I rated OANDA as the best broker overall, scoring it 91/100 in my broker review. The Standard account has low spreads of 1.40 pips on the EUR/USD, and provides the fastest execution speeds in the USA. This translates to excellent trading conditions for all trading styles.

OANDA is also the most trusted broker from my tests, as it is licensed by 10 major regulators. The range of 68+ forex pairs is one of the best I’ve seen in the industry.

For platforms, you have a choice of TradingView, MT4, and OANDA Trade. All these platforms provide top trading tools. In particular, I like OANDA Trade, with its Open Order indicator for volume-based technical analysis.

Pros & Cons

- OANDA Trade has TradingView charts

- Tight spreads with Standard account

- Volume-based rebates on Elite trader program

- Customer support is not 24/7

- Withdrawal and inactivity fees apply

- No price alerts on the OANDA Trade platform

Broker Details

Lowest Spreads With The Standard Account

With my OANDA account, I tested the EUR/USD spreads to see how much they cost during New York trading sessions. On average, I was getting between 1.40 and 1.50 pips, with little variation. This means the broker’s spreads are quite stable, which is good to see.

If a broker can’t offer me this stability, it makes trading difficult – there’s too much uncertainty in the costs.

Here’s how the average spreads measure up on EUR/USD:

| Broker | EUR/USD Spreads |

|---|---|

| OANDA | 1.40 |

| Tastyfx | 0.80 |

| eToro | 1.1 |

| Trading.com | 1.20 |

| Forex.com | 1.4 |

| Charles Schwab | 1.4 |

OANDA’s competitive spreads can improve your overall trading costs, especially when you factor in the lack of commission on the Standard account.

Fast Execution For Better Trading Conditions

OANDA provides solid trading conditions. Ross’ results found OANDA was the fastest execution broker in the USA. Market orders were filled at 84 ms, while limit orders executed as fast as 86 ms.

| Broker | Limit Order Speed | Market Order Speed |

|---|---|---|

| OANDA | 86 | 84 |

| FOREX.com | 98 | 88 |

| Trading.com | 114 | 138 |

As a Market Maker broker, OANDA’s execution speeds are fast, reducing the chances of slippage with your limit orders. In other words, your stop-loss orders are executed at the exact price you set.

OANDA Trade Is A Top Trading Platform

OANDA supports multiple trading platform options, including TradingView and MetaTrader 4. However, I think the OANDA Trade platform is a top all-rounder for both beginner and experienced traders.

I use OANDA Trade because it includes TradingView charting. This means I get the top technical indicators – for example, there’s an excellent Order Book indicator I use to gauge market sentiment.

If you want custom indicators or automated trading features, I recommend using TradingView or MetaTrader 4. The OANDA Trade platform, unfortunately, doesn’t offer these.

Exclusive 10% Cashback Offer Available (Terms and Conditions Apply)

2. FOREX.com - Top Range Of Trading Platforms

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.6

AUD/USD = 1.4

Trading Platforms

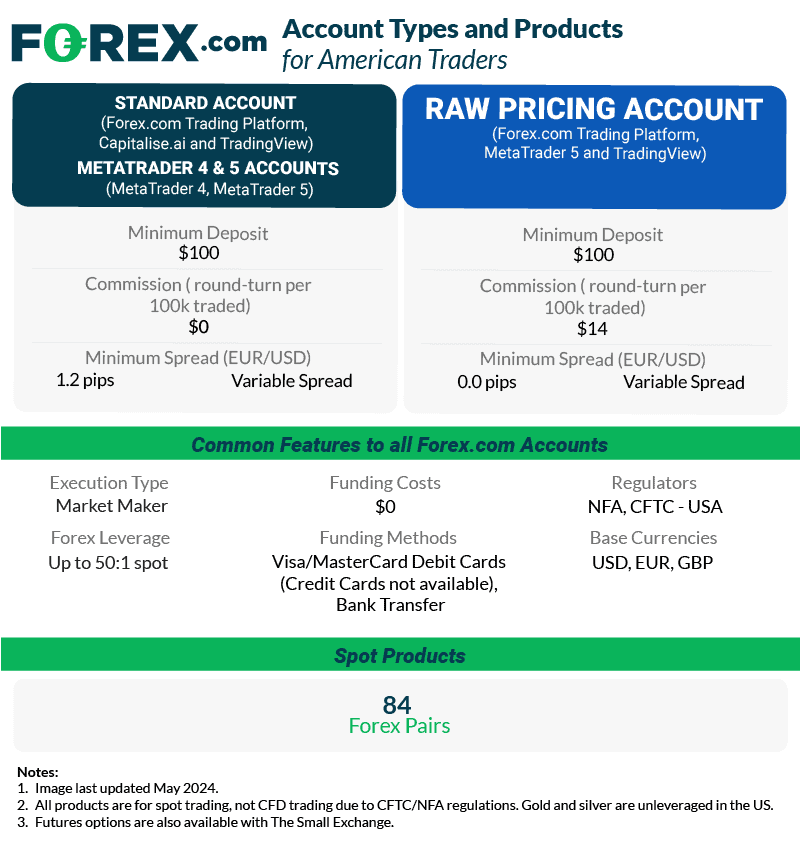

MT4, MT5, TradingView, FOREX.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

I chose FOREX.com as my number 2 pick. Its wide choice of trading platforms includes MetaTrader 4, MT5, TradingView, and FOREX.com’s proprietary platform. You can trade 91 forex pairs on these platforms.

You get access to Trading Central, for professional technical analysis. I found this really valuable for my day trading strategy, as I got a consistent stream of new trading ideas. Also included is Performance Analytics, which monitors and suggests trading improvements. On top of this, I found client sentiment tools that can be used across all four platforms.

The broker is one of a few in the U.S. that offers a Raw account, giving you spreads from zero pips with commissions of $7 per lot traded. This is an appealing option for traders of all types, but especially scalpers.

Pros & Cons

- Deep liquidity for low spreads

- Over 90 Forex pairs

- Top educational resources

- US$100 minimum deposit

- Demo account expires after 90 days

- No third-party copy trading, except for MT4 signals

Broker Details

Choose From Four Forex Trading Platforms

FOREX.com provides you with several trading platforms. These include TradingView, MetaTrader 4, MT5, and FOREX.com’s own Web Trader platform.

I personally like using the full version of TradingView, as you have complete access to the platform’s top features. This includes market scanning tools and thousands of pre-built and community-built indicators. For example, I like to use Volume Profile indicators – available as default on TradingView but hard to find on other platforms.

However, MT4 and MT5 are my choices for automated trading, thanks to their Expert Advisors. If you know how to code them, you can automate all of your trading and risk management strategies with these EAs.

Capitalise.Ai Makes Automated Trading Accessible For Everyone

In fact, even if you don’t know how to code, you can still use EAs on MT4 and MT5. This is because FOREX.com supports Capitalise.ai.

I like Capitalise.ai, as I can just type my trading rules into the solution. Within minutes, it will generate my automated strategy, ready for deployment on the MT4 or MT5 platform.

You can even backtest the strategy on the platform, then use this data to optimise it before deploying on a live account.

Tightest Spreads On The Raw Account

In testing, I found the broker has tight spreads on its Raw account. These spreads average around 0.1 pips on the EUR/USD during the London and New York trading sessions.

Depending on volatility, I did find I could get zero pip spreads on EUR/USD and GBP/USD, which is decent if you’re scalping or automating your trade. That said, FOREX.com’s commission on the Raw account is $7.00 per lot traded – paying this is the only way to get such tight spreads.

3. TastyFx - Great Trading Account for Beginners

Forex Panel Score

Average Spread

EUR/USD = 1.13

GBP/USD = 1.66

AUD/USD = 1.01

Trading Platforms

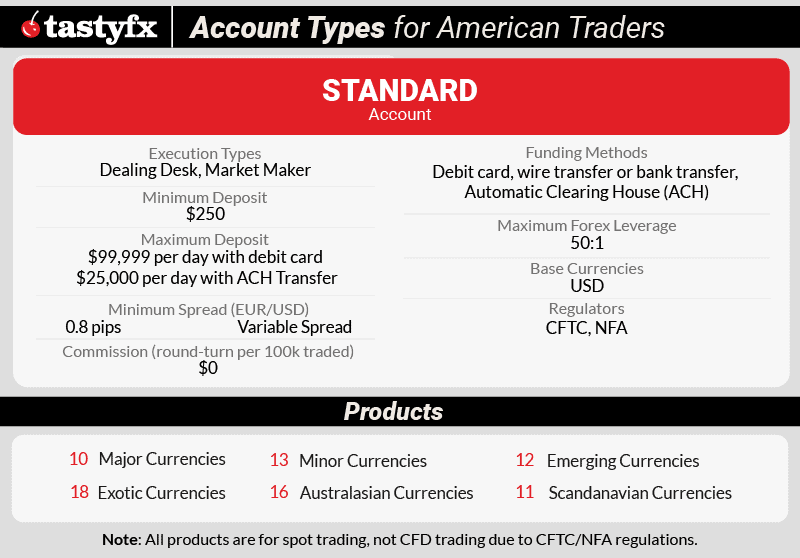

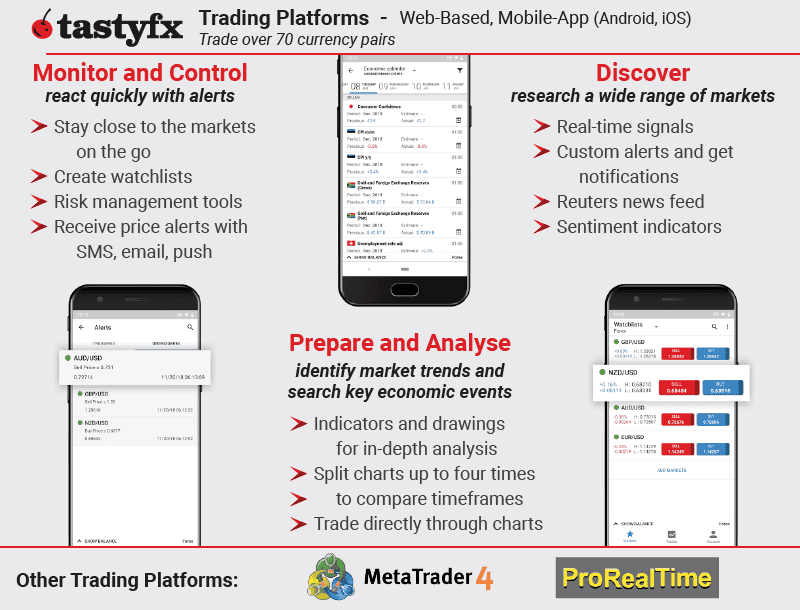

MT4, tastyfx Web Platform, tastyfx Mobile App, ProRealTime

Minimum Deposit

$250

Why We Recommend Tastyfx

The Tastyfx Web Platform provides you with a solid range of features, like trading indicators and trading signals that help traders improve their skills. Signal Center provides professional trading signals across the broker’s 80+ forex markets, allowing you to easily copy trades.

Its Standard account is commission-free, with competitive spreads starting from 0.80 pips on EUR/USD. This positions Tastyfx as one of the lowest-spread brokers on the list. For educational resources, Tastyfx delivers a solid range of online lessons, which go into detail on subjects like learning how to trade forex.

Pros & Cons

- Global reputation for trust

- Competitive trading spreads

- Powerful charting with ProReal Time and Tastyfx WebTrader

- No copy trading (MT4 Signals aside)

- Lacks MetaTrader 5

- Customer support sometimes lags

Broker Details

Top Trading Platform For Beginners

The Tastyfx Web Platform has a simple interface that is customizable to your liking, hiding news modules if you find them distracting. I found the platform comes with 25+ indicators, including moving averages and Ichimoku Cloud. There are also 17 drawing tools, so you can perform solid technical analysis.

I found the Signal Center really helpful. It scans the 80+ currency pairs to find new trading opportunities using chart and candlestick patterns. You can then set up alerts based on this, and even learn how to trade, as each alert features professional commentary.

Tastyfx also supports MT4, TradingView, and ProRealTime. I prefer these three to the Tastyfx platform. Each one offers more technical analysis tools and automated trading features than the proprietary software.

Tight Spreads On Standard Account

I found Tastyfx’s spreads to be low, starting from 0.80 pips on EUR/USD with no commissions. They also remain stable. The spreads I encountered remained around the minimum during the New York session, which should help you keep your costs low.

You can trial the broker’s spreads and trading platform through their demo account. Here, you’ll receive $10,000 in virtual funds to practice with.

Excellent Educational Resources

Tastyfx has 20+ online lessons, where you can learn the basics of forex trading. I felt the lessons were decent, each going into detail with plenty of images to help reinforce the points. Although I was disappointed there were no videos.

4. Interactive Brokers - Top Forex Broker With Lowest Trading Fees

Forex Panel Score

Average Spread

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

I chose Interactive Brokers for its cheap trading fees. The broker’s commissions are $2.00 per lot traded, or even just $1 for professional traders, while the spreads start at 0.10 pips.

The broker is best for trading large lot sizes. This is because the $2.00 commission is the minimum trading cost – so it’s a bit more expensive if you’re trading positions smaller than one lot.

There are eight trading platforms altogether, but the main one is the IBKR Trade Workstation. This gives you professional analysis tools and level II pricing.

I found that IB is a truly multi-asset broker, as they offer a broad range of products. This includes more than 50,000 bonds and treasuries, 4,000+ ETFs, 43 indices, and four cryptocurrencies. Of course, this is on top of their 117 forex pairs – which is a good selection itself.

Pros & Cons

- Lowest commissions in the US

- Wide range of trading platforms

- Access to professional analysis

- Expensive if you trade less than 1 lot

- Trading platforms have steep learning curves

- Lacks third-party platform choice

Broker Details

Lowest Trading Fees For Experienced Traders

Interactive Brokers has the lowest trading commissions out of the brokers I’ve tested. Fees start from only $2.00 per lot traded, around 70% better than FOREX.com.

The lower commissions make trading far cheaper than other US brokers, and can save you a fortune. This is especially true for high-volume traders, as you can get a discount based on your monthly trading volume. With this discount, you could get commissions as low as $1.00 per lot.

An issue I found with the typical commission was that $2.00 is the minimum cost. So, if you trade anything less than 1 lot, you’ll still pay the full-lot minimum, which becomes expensive.

But overall, the costs are very good. All spreads on the Interactive Brokers account start from 0.10 pips on EUR/USD, so it definitely qualifies as a low-spread broker.

Solid Trading Platforms For Advanced Users

You have a selection of 8 platforms to choose from with IBKR. Each has different interfaces and settings depending on your trading objective.

The core IBKR Trade Workstation is their desktop platform with multiple technical indicators ranging from MACD to VWAP, allowing for advanced volume-based technical analysis. You can get real-time access to top research houses like Morningstar and Zacks, providing the best fundamental analysis tools.

Large Selection Of Markets

Interactive Brokers has one of the broadest product selections, providing 50,000+ tradable assets across their full range of asset classes. This range means you can trade everything from major forex pairs to niche markets off the Russell 3000 – a broad array of new opportunities daily.

5. Charles Schwab - Largest Range Of Trading Products

Forex Panel Score

Average Spread

N/A

Trading Platforms

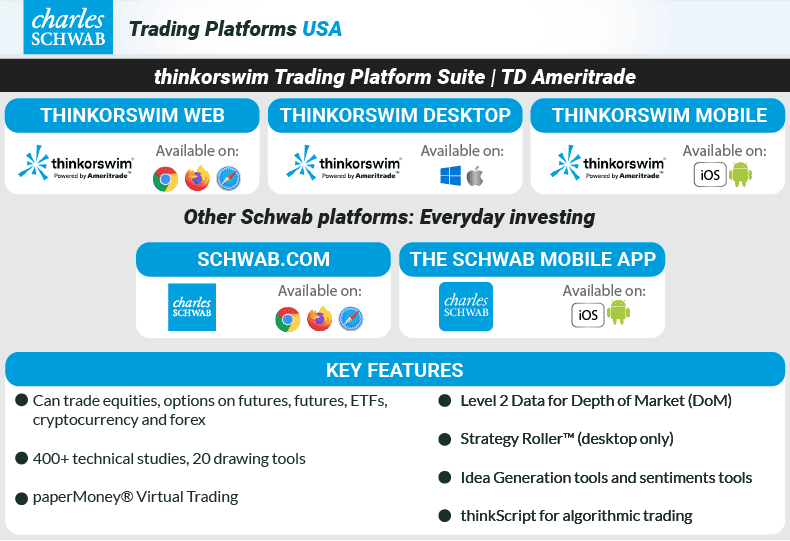

thinkorswim desktop, thinkorswim web, thinkorswim mobile, Schwab.com, Schwab Mobile

Minimum Deposit

$0

Why We Recommend Charles Schwab

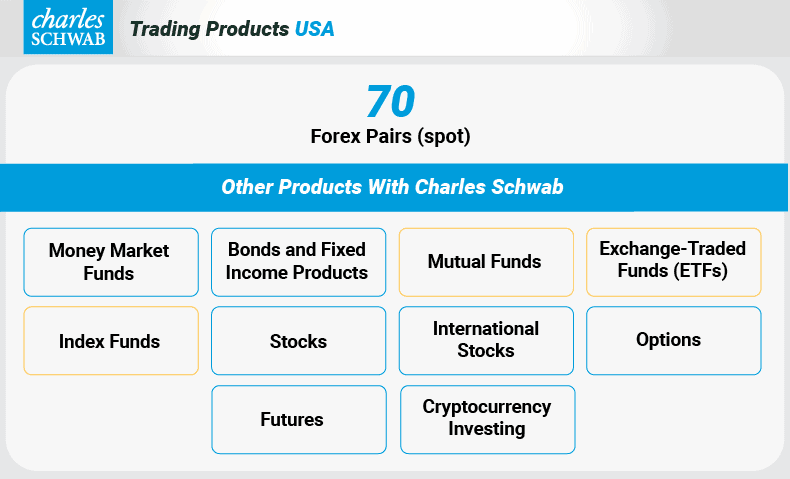

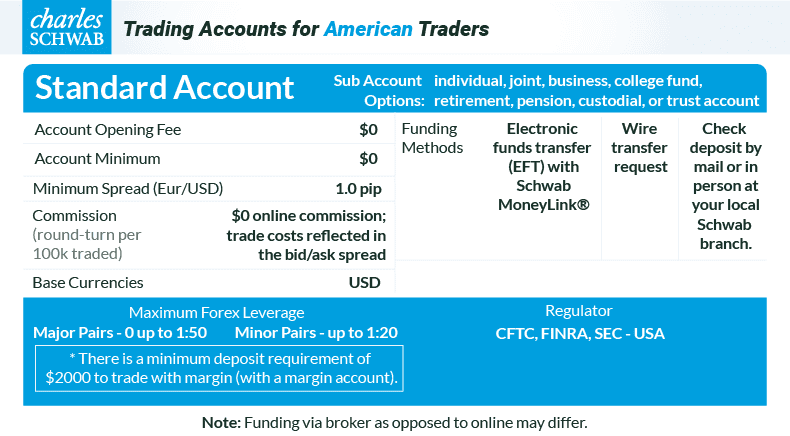

I picked Charles Schwab for its large range of trading products. You can trade 60,000+ markets, including 65+ forex pairs and other markets like crypto. The spreads for Charles Schwab are slightly wider than the industry standard, averaging 1.4. But I found this is offset by the convenience of the broker – you get so many asset types on a single account.

The Thinkorswim platform provides excellent technical analysis tools, including market scanners and over 400 indicators. You also have access to Charles Schwab’s expert analysis across all markets, keeping you in the loop with key events.

Pros & Cons

- Largest range of trading products of all CFTC forex brokers

- thinkorswim is well-received

- Trading fees are average

- Limited account funding options

- Customer service delays

Broker Details

Large range of markets

With 60,000+ markets, Charles Schwab has one of the largest collections of markets available to trade. This range includes 65+ forex pairs, two crypto futures, and 8 options exchanges.

I found that you can only trade North American stocks like NYSE, NASDAQ, and OTC. They do not offer UK, European, or Asian stocks, which limits your portfolio diversity.

Access Charles Schwab’s Expert Analysis

Part of the appeal of choosing Charles Schwab is that you can tap into the knowledge of their experts. You’ll get professional commentary on indices, sectors, and breaking news, as well as regular market reports.

They also have the Schwab Trading Activity Index (STAX), which gives you sentiment-based insights based on the real-time trading behavior of their users. I found this useful, as I could see if other traders were bullish or bearish on the markets I wanted to trade.

Thinkorswim Trading Platform

Available on desktop, web, and mobile, I found thinkorswim includes many features similar to MetaTrader 4. However, I did enjoy some added benefits, like Depth of Market views and more trading tools.

The thinkorswim desktop platform provides a variety of analysis options, including simulations, and volatility and probability analyses. I also liked having access to the Economic Data indicator, and options back-testing.

For technical analysis, you can benefit from over 400 studies, advanced charts like Monkey Bars and Renko, and up to 20 drawing tools. There are also eight Fibonacci tools to enhance your trading strategies.

However, I did find that the broker relies quite heavily on thinkorswim. It doesn’t offer much in the way of third-party integrations, and doesn’t support the best social trading platforms.

6. eToro - Good Choice For Social Crypto Trading

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

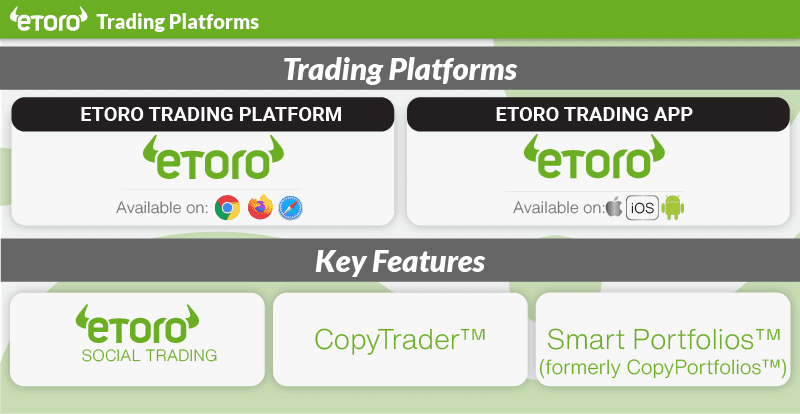

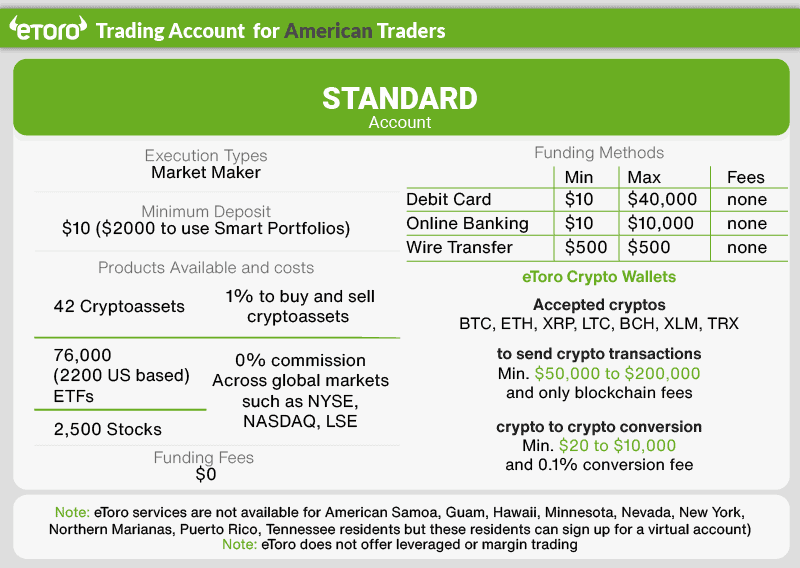

I found eToro to offer the best copy trading platform for crypto trading. Its CopyTrader platform allows you to mirror and socially trade with eToro’s 2 million+ traders. A key feature for me was how user-friendly the CopyTrader platform is. This is thanks to its filter system and automated risk management tools, which make it a top platform for beginners.

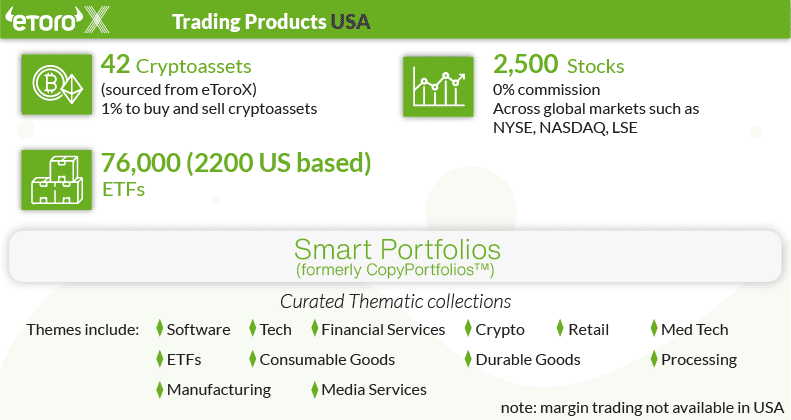

The broker provides 100+ crypto markets, the largest range on the list. There are other markets too, like ETFs and 3,500+ US stocks. This should be plenty as you seek to diversify your copy trading portfolio. eToro’s Standard account provides a commission-free experience with competitive spreads from 1 pip on EUR/USD.

Pros & Cons

- Social trading is a point of difference

- Good trading features in mobile

- Top range of cryptos to trade

- No crypto-to-crypto pairs

- eToro is not available in all states

- Customer support could be better

Broker Details

CopyTrader Is The Best Copy Trading Platform

I found eToro’s CopyTrader platform makes this type of trading straightforward, and also provides risk management tools. All you have to do is choose your copy trader, and the platform does the rest – it’s a great platform for beginners.

eToro is incredibly popular. There are around 2 million copy traders to mirror, so the filter tool is a must as you tailor your search. You can filter by metrics like PnL, trade volume, and risk appetite, to find the right candidate for you.

One advantage of using eToro is its transparency. eToro is both the broker and the trading platform, so the trading history of all copy traders is recorded and verified by eToro, greatly reducing the likelihood of scams.

Copy Trade 100+ Crypto Markets

If you want to leverage the expertise of crypto-copy traders, you can get exposure to over 100 cryptocurrencies without having to do the analysis yourself. eToro provides popular markets like Bitcoin, and Ethereum, as well as altcoins. Altcoins tend to be more volatile, and so can offer higher rewards as well as higher risk.

Invest In Managed SmartPortfolios

If you want a more hands-off approach, eToro has SmartPortfolios that focus on specific market themes like green energy companies or crypto. The goal of these portfolios is to give you managed exposure to a specific sector. eToro’s analysts handle everything from choosing assets and taking profits, to guarding against losses.

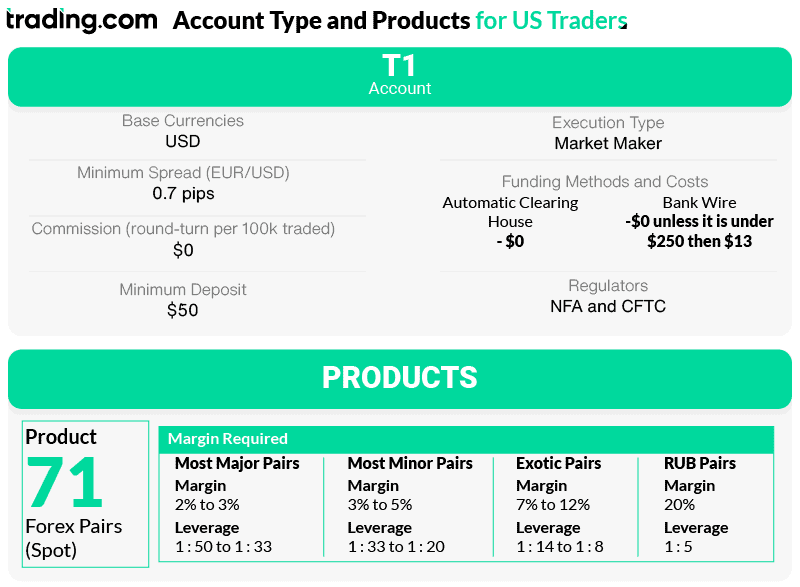

7. TRADING.COM - Best Broker With MetaTrader 5

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.8

AUD/USD = 1.2

Trading Platforms

MT5

Minimum Deposit

$50

Why We Recommend Trading.com

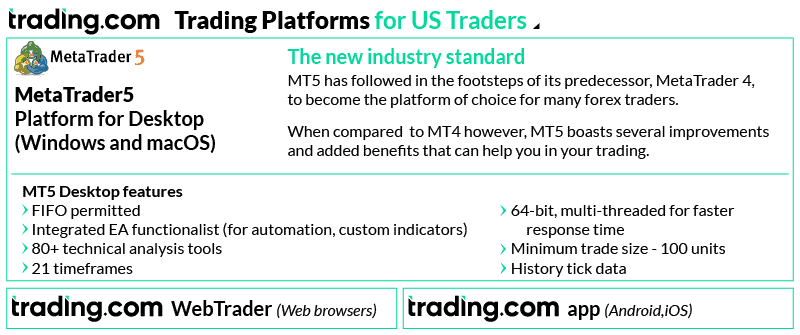

I picked Trading.com as the best broker for MetaTrader 5, as I found the broker’s trading conditions complemented the platform’s advanced tools, like automated trading and Depth of Markets. With MT5, you can trade all of the broker’s 71 forex pairs, and fund your account with only a $50 minimum deposit.

The T1 account has some of the lowest spreads – averaging 1.20 pips on EUR/USD. There are also no commissions, and leverage is available up to 1:50. So you can make trades without putting so much of your own capital down.

Pros & Cons

- One of few brokers in the US to have MetaTrader 5

- Decent trading education library

- USD is the only base currency options

- No MetaTrader 4

- Some negative reviews online

Broker Details

Trading.com Has MT5

Trading.com is one of the few brokers in the US that supports MT5. I think MetaTrader 5 is a solid trading platform, with access to 35+ technical indicators like RSI and Bollinger Bands. I also like the top technical analysis tools like Fibonacci and Elliott Wave.

It has improved features like the Depth of Markets tool. By using this tool to view the liquidity providers’ order flow, you can gauge hidden support or resistance levels. The native economic calendar is a nice touch too; it overlays upcoming data releases, helping you avoid entering the markets before periods of potential volatility.

MetaTrader 5 is one of the best algorithmic trading platforms. Expert Advisor trading bots are designed to follow specific trading rules. So the EA can scan for opportunities based on your entry requirements, enter itself the position, and manage risk without your input.

Not sure what trading platform is best for you? Use my forex trading platform tool to find which software suits your trading style:

Trading Accounts and Products

The T1 account is the broker’s Standard account, with spreads starting at 0.90 pips on EUR/USD. However, while using the T1 account during the New York session, I found EUR/USD averaged 1.20 pips. This is a typical spread for US-regulated forex brokers.

Trading.com has a low minimum deposit requirement of $50, while providing leverage of 1:50 for forex majors, allowing you to trade with smaller margins.

I found that Trading.com only provides forex trading. You can access a range of 71 currency pairs, including major, minor, and exotic combinations. If you wish to trade other markets, like indices or gold, I recommend trying FOREX.com.