Best Copy Trading Platform

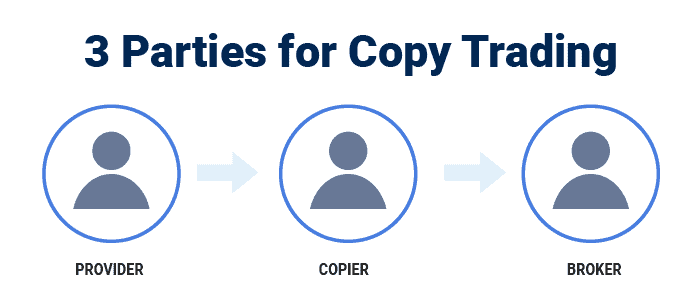

Copy trading (and social trading) with Forex brokers is mostly possible via MQL5 trading Signals when using MetaTrader 4 or MetaTrader 5 trading platforms. We look at the brokers that offer this along with their key features.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Our list of the top US copy trading brokers is:

- eToro - Best Copy Trading Platform In USA

- OANDA - Top Broker For MT4 Copy Trading

- Trading.com - Great Copy Trading Demo Account With MT5

- FOREX.com - Good ECN Copy Trading Style Broker

- Tastyfx - Best Copy Trading Platform For Beginners

What Is The Best Copy Trading Software?

eToro is the best copy trading platform with the largest community allowing users to automatically copy real trader portfolios with transparent performance data and built in risk controls. Other copy trading platforms were shortlisted based on strategy availability, ease of use and advanced features.

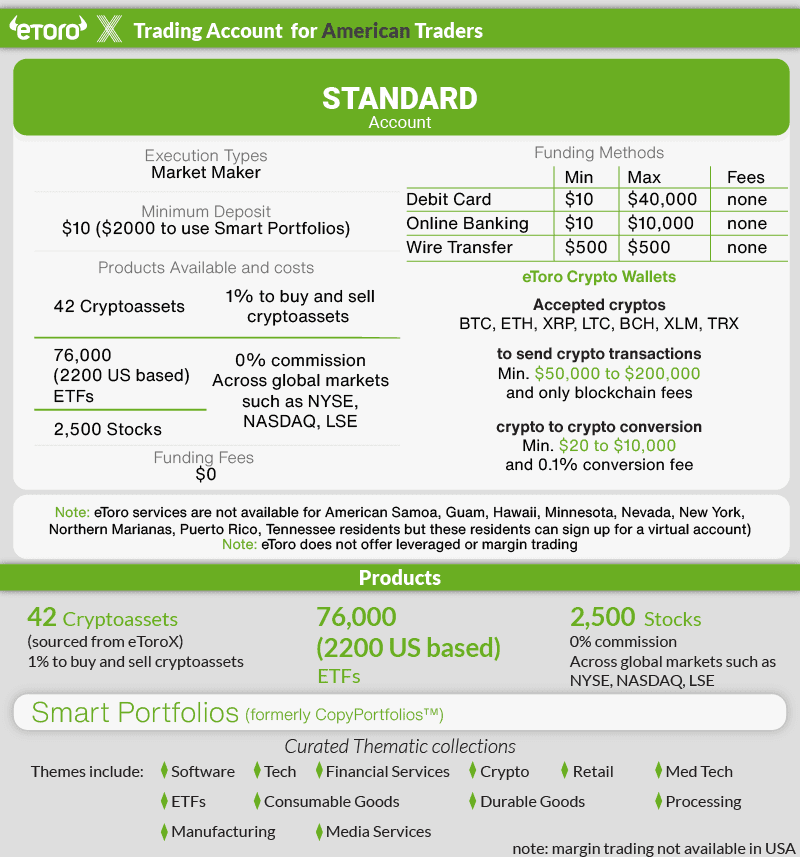

1. eToro - Best Copy Trading Platform In USA

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

eToro is a popular social trading platform that revolutionized the way traders interact and copy each other’s trades.

With eToro’s CopyTrader feature, you can browse through a vast selection of top-performing traders, assess their performance metrics, and choose to replicate their trades with a simple click.

eToro also offers a wide range of financial instruments, including cryptocurrencies, making it a versatile choice for copy-trading enthusiasts.

Pros & Cons

- Copy trading specialist

- User-friendly platforms

- ETFs available

- No forex trading for US traders

- Spreads could be tighter

- No MT4 or MT5

Broker Details

eToro stands out with its huge social trading community (+30 million users) and easy-to-use proprietary trading platforms, eToro, CopyTrader and SmartPortfolios.

When testing the eToro platform, we liked the wall-style feed of comments, tips and suggestions from eToro’s ‘community’ of investors. The platform is designed for copy trading, making it unique amongst other brokers that simply offer social trading as an afterthought.

We particularly liked how eToro’s CopyTrader complemented the eToro platform with a simplified “matching” tool where you can select the “big picture” metrics, to better match with a trader you want to copy.

The one downside we found is that eToro doesn’t offer forex market trading to US customers, you can social trade crypto and shares as a U.S. resident with commission-free spreads as low as 1 pip.

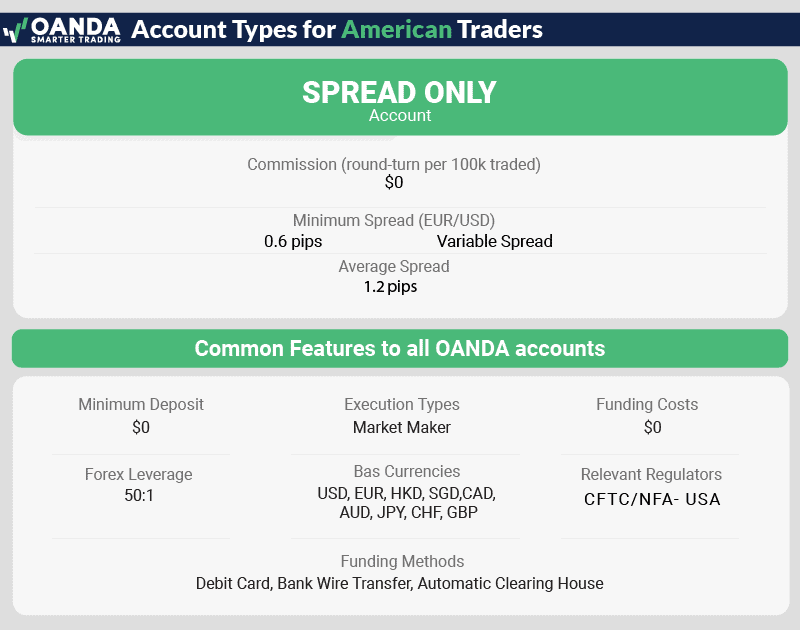

2. OANDA - Best Broker For MT4 Copy Trading

Forex Panel Score

Average Spread

EUR/USD = 0.89 GBP/USD = 1.54 AUD/USD = 1.37

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

As a well-established broker known for its user-friendly trading platforms and robust copy-trading features, OANDA is our number 1 forex broker for U.S. traders. With over 70 currency pairs and competitive commission-free spreads, we think OANDA offers you the opportunity to engage in copy trading with ease, low costs and with a trusted broker.

Pros & Cons

- Highly Trusted Broker

- User-friendly platforms

- Competitive 0 commission spreads

- Discount with the Elite Trader program

- Limited products outside forex

- No ECN-style account

- No guaranteed stop-loss

Broker Details

OANDA offers our favorite copy trading experience for U.S. trades, combining a trusted brand, user-friendly platforms and the Lowest Spread Forex Brokers.

Firstly, aside from the NFA/CFTC in the U.S., OANDA is regulated by several tier-1 regulators such as ASIC in Australia and the FCA in the UK. That, combined with OANDA’s excellent reputation (established in 1996) is why we gave the broker a perfect 100/100 trust score.

While testing OANDA’s user-friendly platforms – MetaTrader 4, OANDA Trade, and TradingView- we particularly enjoyed the combination of intuitive interface and advanced trading tools. As an example, opening a trade ticket window is easy within the charts and you can quickly adjust your stop-loss and limit order levels by dragging and dropping.

We also like some of the third-party tools OANDA provides like NinjaTrader for Futures trading and MultiCharts for Advanced traders. We set up MultiCharts 14 using API to connect to OANDA’s network and found the high-definition charts allowed us to view the charts in impressive detail. For example, the indicator lines and tick marks clearly to our eyes are more clear than with competing platforms. Other features include PowerLanguage which is derived from EasyLanguage used with TradeStation and good is for automation.

For the best use of TradingView integration, we recommend using the WebTrader or Desktop version of OANDA Trade, which gives you access to 100+ technical indicators, 50+ drawing tools, 11 chart types and 9 timeframes. We think this is more analysis tools that you are likely to need so we are impressed.

You can copy trade using MT4; to do so, you must sign up with MQL5 Trading Signals, a 3rd party tool also made by MetaQuotes. SIgnals has a list of signal providers you can copy from. Two additional benefits of using MT4 with OANDA include a premium upgrade, with a whole range of advanced trading tools, and Open Order Indicators, allowing you to clearly see stop loss clusters ahead of time and prepare accordingly.

You can access competitive commission-free spreads from 0.6 pips for EUR/USD using OANDA’s Spread-Only (Standard) account, the tightest we’ve seen for a Standard account type but more likely to be closer to 1.2 pips.

Combining user-friendly trading platforms, competitive spreads and advanced platform features, we think OANDA is suited for copy traders of all levels.

Exclusive 10% Cashback Offer Available (Terms and Conditions Apply)

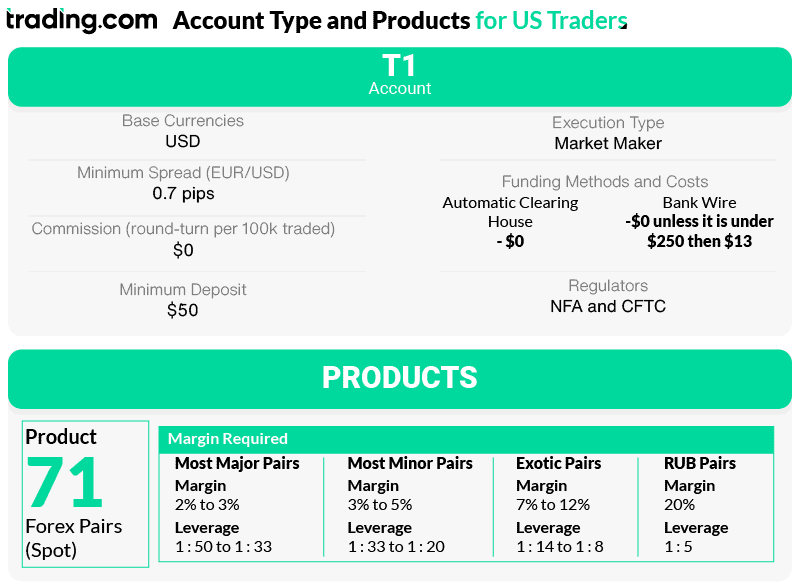

3. Trading.com - Best Copy Trading Demo Account With MT5

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 1.6

AUD/USD = 1.2

Trading Platforms

MT5

Minimum Deposit

$50

Why We Recommend Trading.com

Combining innovative trading solutions and cutting-edge technology, we think Trading.com offers the best MT5 copy trading service. With both MT5 and the broker’s proprietary platform, you can access a wide range of trading strategies from experienced investors and automate your trading activities with ease.

Offering commission-free trading and user-friendly platforms, we recommend Trading.com for beginners wanting to start their copy trading journey.

Pros & Cons

- Zero-commission spreads

- MT5 offered

- User-friendly platforms

- No MT4

- Only Forex in U.S.

- Bank wire may incur costs

Broker Details

Trading.com offers spreads in line with the industry standard, averaging 1 pip for EUR/USD for its T1 account.

While Trading.com offers an excellent proprietary app, we think the broker stands out in its MT5 platform experience. With this platform, you can copy trade the broker’s 71 forex pairs using mirror trading, which acts much like AI trading, given intelligent decisions are made for you. Like MT4’s Signals, you can choose a particular investor to follow, ‘mirroring’ his or her positions with the help of a trading program.

Trading.com’s platform is also a very intuitive platform from our testing, you can customize your trading experience with personalized watchlists and an adjustable dashboard. Before committing real capital, you can test strategies risk-free using their best forex demo accounts, which offers full MT5 functionality with virtual funds.

What we also like is Trading.com’s written trading agreement which states that a retail customer’s trades are only offset by other retail customers’ trades and/or by hedging in the interbank market.

This means that Trading.com is as close to a DMA (Direct Market Access) broker as you’re likely to get in the U.S.

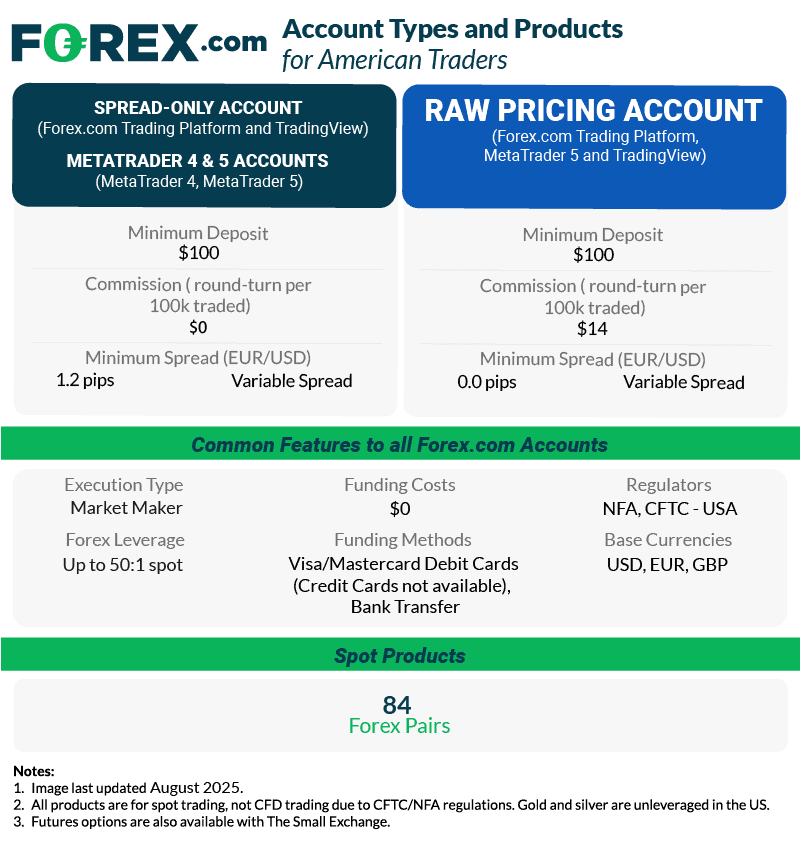

4. FOREX.com - Best ECN Copy Trading Style Broker

Forex Panel Score

Average Spread

EUR/USD = 0.21 GBP/USD = 0.23 AUD/USD = 0.17

Trading Platforms

MT4, MT5, TradingView, FOREX.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

We recommend FOREX.com as another highly trusted name in the forex industry, offering a comprehensive copy trading experience catering to both novice and experienced traders.

With access to diverse trading strategies and a user-friendly interface, FOREX.com provides a great combination of advanced tools and robust trading platforms to succeed in copy trading.

Pros & Cons

- TradingView charts with FOREX.com Platform

- Trusted – Listed on NASDAQ

- Top education tools

- Has MT5

- Could have more video content

- Minimum deposit (albeit small)

- Slow account verification process

Broker Details

Given that the U.S. regulating body, CFTC, put FOREX.com as the number 1 U.S. broker based on client assets in their Retail Forex Obligations report, we found it hard to disagree.

We thought FOREX.com is unique in that they are the only NFA or CFTC Regulated Broker we have come across to offer a Standard account (spreads from 1.2 pips) and zero-spread RAW Pricing account (commission of $7 per side). The ECN-style RAW Pricing account on the best ECN brokers provides institutional-grade execution with direct market access, though outside the US, RAW pricing accounts are popular. However, since commissions with this account are $14 per round-turn trade, we think the Standard account is better value, even with spreads starting from 1.20 pips.

For social trading, FOREX.com offer MetaTrader 4, MetaTrader 5 and TradingView, all solid choices.

With MT4 and MT5, you can use social trade via their 3rd party Trading Signal service. For MT5, you will need to sign up for MQL5, especially if you want to trade all FOREX.com’s 84 Forex pairs. With a community of 50 million users, TradingView is an emerging trading platform in the industry and quickly becoming one of our favourites.

When testing TradingView’s social networking features, we found it was a rich source to learn and share ideas, featuring public chatrooms, private messaging and live streaming, but we couldn’t copy other traders specifically.

*Your capital is at risk up to ‘76% of retail CFD accounts lose money with FOREX.com’

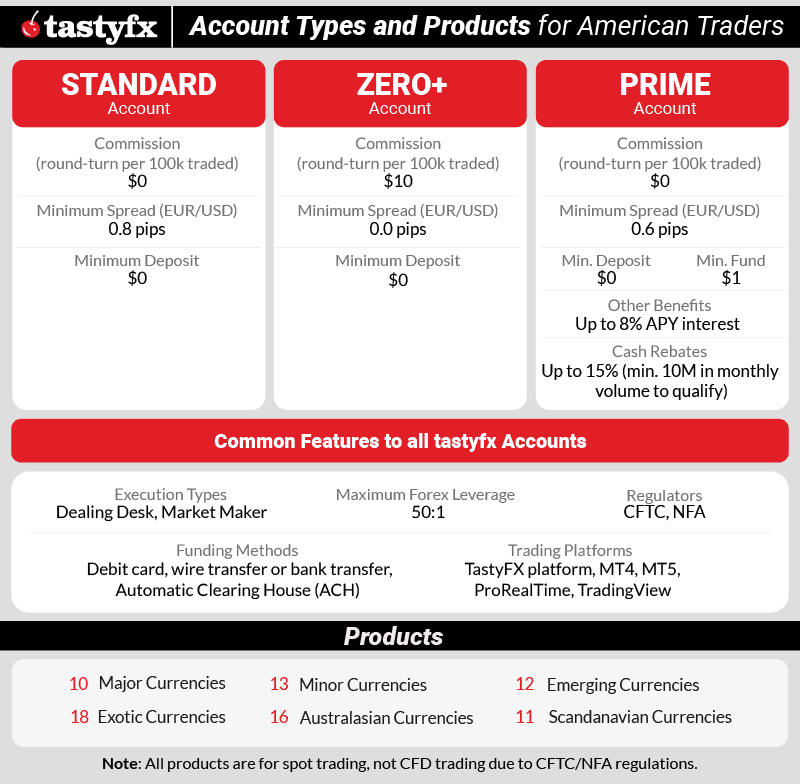

5. Tastyfx - Best Copy Trading Platform For Beginners

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, tastyfx Web Platform, tastyfx Mobile App, ProRealTime

Minimum Deposit

$250

Why We Recommend Tastyfx

Tastyfx, formerly known as IG Market before its rebranding, was originally founded in the UK in 1974 and launched in the US in 2019. As one of the oldest and largest brokers globally, Tastyfx is a trusted name in the industry.

While Tastyfx does not have a dedicated copy trading platform, you can use MetaTrader 4 (MT4) and MQL5 Trading signals to follow and replicate other traders’ strategies. With its wide range of markets and competitive pricing, Tastyfx offers the tools needed for effective copy trading.

Pros & Cons

- Diverse range of platforms

- ProRealTime for advanced analysis

- MT4 mirroring available

- One of world’s largest brokers

- Less Comprehensive MetaTrader 4 Offering

- Limited Deposit Options

- High Minimum Deposit Requirement

Broker Details

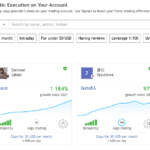

Tastyfx offers a variety of trading platforms, including the well-known MetaTrader 4 (MT4), its own advanced Tastyfx Trading Platform, and the third-party ProRealTime for sophisticated charting and automation. For social trading, you can use MT4 Signals to copy trades across the 80 currency pairs available on Tastyfx.

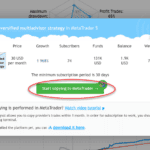

Download and Install MT4 (if you don’t have) and create an active MT4 account Sign up for a MQL5.com Find your Signals and click subscribe (you might need to deposit funds if the signal is not free) Once done, click “Start copying in MetaTrader” At this stage the trading terminal will open and you will need to confirm you will copy the provider.

We found getting started with Tastyfx to be straightforward and hassle-free. The platform offers excellent execution speed, with an average time of just 17 milliseconds between placing an order and its completion. For beginner traders, the combination of user-friendly interfaces and educational resources makes the learning curve manageable.

Our tests showed that Tastyfx’s spreads start at 0.8 pips with the Standard account, though the typical spread for EUR/USD is 1.12 pips, which is slightly wider than the industry average. High-volume traders who qualify as premium clients can benefit from cash rebates of up to 15% and receive a VPS for use with MT4.

While we would like to see a broader range of products, Tastyfx stands out as one of the better brokers available, offering competitive features and trading conditions.

Ask an Expert