The UAE has become one of the world’s most attractive destinations for forex trading, thanks to its regulatory oversight, tax-free profits, and access to globally recognised brokers.

I’ll walk you through everything you need to know about forex trading in the UAE – from choosing regulated brokers and understanding leverage limits to mastering risk management and developing effective trading strategies.

What Do Forex Traders Need To Know In the UAE?

Forex trading in the UAE operates under a well-established regulatory framework designed to protect retail traders while providing access to global markets. Whether you’re based in Dubai, Abu Dhabi, or anywhere else in the Emirates, understanding the requirements and opportunities will help you trade with confidence.

1. Forex Market Access

You can access global forex markets 24 hours a day, five days a week from anywhere in the UAE. You’ll trade major currency pairs like EUR/USD and GBP/USD, minor pairs such as EUR/GBP and AUD/NZD, plus exotic pairs including USD/TRY and EUR/ZAR. The market never sleeps. When Asian markets close, European markets open, followed by North American sessions, giving you constant trading opportunities.

The best trading times for UAE-based traders are during the London/New York session overlaps, roughly 4:30 PM to 8:30 PM UAE time, when liquidity peaks and spreads tighten. Major economic announcements from the US Federal Reserve, European Central Bank, and Bank of England typically occur during these windows, creating price movements and trading opportunities.

Most UAE brokers provide access to over 60 currency pairs, though the exact number varies by platform. Interactive Brokers offers 117 currency pairs, while specialised forex brokers like XM provide 55 pairs with tight spreads optimised for active trading.

2. Forex Broker Regulation

You can open accounts with brokers regulated by the SCA (Securities and Commodities Authority), DFSA (Dubai Financial Services Authority), or FSRA (Financial Services Regulatory Authority in Abu Dhabi Global Market). All three regulatory authorities enforce strict standards around client-fund protections, leverage limits, disclosures, and firm conduct.

SCA regulates brokers operating across the UAE mainland with leverage up to 50:1 for retail clients. DFSA oversees brokers in Dubai’s International Financial Centre, capping retail leverage at 30:1 for major forex pairs and 20:1 for minors. ADGM’s FSRA regulates Abu Dhabi-based operations with similar 30:1 retail caps, though professional traders can access up to 500:1 at some brokers.

UAE forex brokers are required to segregate client funds in separate bank accounts, ensuring your capital remains protected even if the broker faces financial difficulties.

Negative balance protection prevents you from losing more than your account balance during extreme market volatility. This is a critical safeguard during flash crashes or unexpected events.

When choosing a broker, verify their regulatory status directly on the regulator’s website. DFSA-regulated brokers appear on the DFSA’s public register, while SCA-licensed firms are listed on the SCA website. Never trade with unlicensed offshore brokers promising unrealistic returns or unusually high leverage.

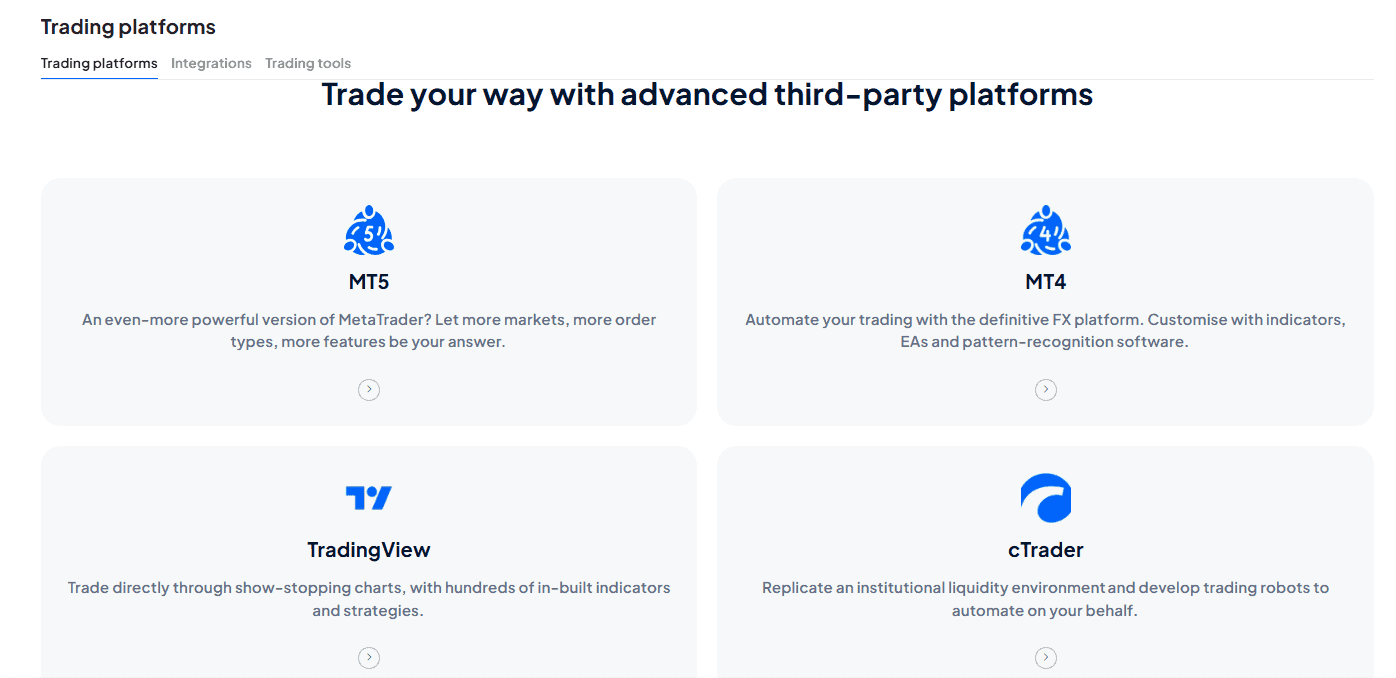

3. Trading Platforms

The platform you choose determines your trading experience, from chart analysis and order execution to automation capabilities. MetaTrader 4 and MT5 dominate the UAE market trading platforms with approximately 80% of brokers offering one or both platforms.

MT4 suits traders wanting the largest Expert Advisor marketplace for automation, while MT5 provides superior multi-asset capabilities with 38 indicators and 21 timeframes.

TradingView has emerged as the best overall platform for technical analysis, offering 100+ indicators, Pine Script for custom tools, and social features for sharing strategies. Pepperstone, Capital.com, XM, and OANDA all integrate TradingView directly, letting you execute trades within charts without switching applications.

cTrader excels for algorithmic traders using C# programming, providing Level II pricing that shows full market depth and helping you gauge liquidity before entering positions. The platform’s cTrader Automate feature lets you build custom trading robots with advanced debugging capabilities unavailable on MetaTrader.

Proprietary platforms like OANDA’s FxTrade, eToro’s web platform, and ThinkMarkets’ ThinkTrader offer streamlined interfaces designed specifically for their brokerage services. These platforms often include unique features. OANDA provides guaranteed stop-losses, eToro specialises in social trading, and ThinkMarkets delivers 65 indicators on mobile.

4. The Importance Of Low Spreads & Fees

Spreads and commissions directly impact your profitability, especially if you’re an active trader executing multiple positions daily.

Interactive Brokers offers some of the lowest forex spreads in the UAE, with an average spread of just 0.25 pips on EUR/USD when using their tiered commission structure. Pepperstone and Multibank Group also deliver ultra-tight spreads from 0.10 pips on major pairs through their ECN accounts.

The difference between 0.10 pips and 1.0 pips might seem trivial, but it compounds significantly over time. If you trade 10 standard lots daily on EUR/USD, a 0.90 pip spread difference costs you $90 per day (that’s $1,800 monthly).

Commission structures vary across brokers. Raw spread accounts typically charge $3.00 to $3.50 per side, meaning $6.00 to $7.00 round-turn, but offer spreads from 0.0 to 0.2 pips. Standard accounts include broker markup in the spread, usually 1.0 to 1.6 pips, with zero commissions, simplifying cost calculations for beginners who prefer seeing one number per trade.

The crossover point depends on your trading frequency. If you execute fewer than 5 lots daily, Standard accounts with 1.0 pip spreads and no commissions often cost less than raw spread accounts where you pay $7 per round-turn. Above 5 lots daily, raw spreads with commissions save money despite the transaction fees.

We’ve created a handy forex profit calculator to give you a quick glimpse into how forex trading works. Give it a try below:

Your Profit

Profit in pips:

Profit in Pips Calculation

= ( Close Price - Open Price ) / 0.0001 x Trade size

= ( - ) / 0.0001 x Profit in Pips Calculation

= ( Open Price - Close Price ) / 0.0001 x Trade size in lot

= ( - ) / 0.0001 x

Profit/Loss Calculation:

Profit/Loss in Calculation

= Profit in Pips x Pip value

=

What Are the Best Forex Brokers In UAE?

Best Dubai forex brokers significantly impacts your trading success, costs, and overall experience. Forex trading accounts vary in terms of fees, spreads, and leverage offered by different brokers.

Pepperstone is the best forex broker in the UAE, providing raw spread pricing with transparent commission structures and institutional-grade execution speeds. You get access to multiple professional platforms including MetaTrader, cTrader, and TradingView, letting you trade over 1,400 instruments across forex, stocks, indices, commodities, and cryptocurrencies with zero minimum deposit requirements.

The Razor Account delivers raw spreads from 0.0 pips on EUR/USD with transparent $3.50 per side commission and 77ms average execution speeds.

MultiBank Group offers the lowest spread forex broker option with ECN account spreads from 0.0 pips and $3.00 round-turn commissions, roughly half what most UAE brokers charge at $6-$7. You get access to 14,000 share CFDs, the largest selection in the UAE, alongside 40 forex pairs with 500:1 leverage via SCA regulation.

Capital.com suits gold traders with guaranteed stop-loss orders on their proprietary platforms, protecting you from slippage during volatile price swings. You get competitive 0.6 pip spreads on gold trading with zero commission and 300:1 leverage via SCA regulation across 4,500 markets.

OANDA provides the best platform for learning forex trading through their proprietary FxTrade platform delivering commission-free trading with competitive spreads averaging 0.89 pips EUR/USD. The Trading Academy offers structured learning paths progressing from forex basics through advanced strategies, with paper trading functionality that mirrors live account conditions exactly.

Saxo Markets is recognised for having one of the best platform suites and research offerings among forex brokers in the UAE. Their SaxoTraderGO and SaxoTraderPRO platforms deliver professional-grade charting, multi-asset capabilities, and comprehensive market analysis. You get access to 327 forex pairs, though the $2,000 minimum deposit is not great for beginners.

Understanding Leverage & Margin

Leverage limits for retail traders in the UAE are typically around 1:50 for major forex pairs under SCA regulation, while DFSA caps retail leverage at 30:1 for major pairs and 20:1 for minors. ADGM limits retail leverage to 30:1 for major forex pairs, with qualified professionals accessing up to 50:1 leverage subject to FSRA approval.

If you open a trade with 30:1 leverage, every dollar of your margin controls $30 of market exposure. A $1,000 account with 30:1 leverage gives you $30,000 buying power on EUR/USD. This magnifies both gains and losses by 30 times.

Professional traders can access higher leverage, typically 400:1 to 500:1 at brokers like Pepperstone, Axi, MultiBank, and AvaTrade. Qualification requirements include meeting certain criteria demonstrating trading experience and financial resources.

Forex trading is risky due to high liquidity and volatility in the market. Retail traders in the UAE typically trade under leverage caps similar to other well-regulated jurisdictions, often around 1:50 for major forex pairs.

Use leverage judiciously and ensure you have a solid risk management strategy in place. Many successful traders use far less leverage than their broker offers to reduce catastrophic loss risk during volatile periods.

Type Of Forex Trading Accounts

UAE brokers offer several account types suited to different trading styles and experience levels.

Standard Accounts charge zero commission with spreads averaging 1.0 pips EUR/USD or higher. Pepperstone’s Standard Account offers 1.10 pips, Capital.com provides 0.60 pips, and OANDA delivers 0.89 pips, all commission-free with straightforward pricing.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

ECN/Raw Accounts deliver spreads from 0.0 to 0.2 pips with commissions usually $3.00 to $3.50 per side. MultiBank Group charges $3.00 commission with 0.0 pip spreads, Pepperstone offers $3.50 with 0.0 pips starting, and Axi provides $3.50 with 0.0 pips. These accounts benefit active traders executing 5+ lots daily.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Islamic (Swap-Free) Accounts comply with Shariah principles by eliminating overnight interest charges. AvaTrade provides automatic swap-free status for UAE residents with positions remaining interest-free for up to 5 days before administrative fees apply. This works for swing trading strategies but not long-term holds.

Forex demo accounts let you practice with virtual funds. OANDA and Axi offer unlimited demo access, while Pepperstone provides demos that mirror live trading conditions. Axi’s demo account shows the same 0.0 pips starting spreads you’ll see in the live Pro account.

Professional accounts provide higher leverage, 400:1 to 500:1, for traders meeting qualification criteria. These accounts reduce margin requirements but increase risk.

Strategies When Trading Global Markets

The forex market is open 24 hours, five days a week, and is closed on weekends. Optimal trading times are during the London/New York session overlaps for higher volume, roughly 4:30 PM to 8:30 PM UAE time when liquidity peaks.

Swing trading strategies involve pinpointing swing highs and lows to determine entry and exit price levels. You might hold positions for days or weeks, targeting larger price movements using technical analysis like support and resistance, trend lines, and Fibonacci retracements.

Day trading strategies open and close positions within the same trading session, avoiding swap fees charged for holding positions overnight. This strategy requires constant market monitoring and quick decision-making.

Scalping strategies execute many trades daily, capturing small movements. Scalpers need ultra-tight spreads from 0.0 to 0.3 pips, fast execution speeds under 100ms, and brokers allowing high-frequency trading.

The forex market is influenced by multiple factors such as interest rates, economic data, geopolitical events, and market sentiment. Major central bank decisions often trigger significant moves in major pairs. GDP reports, inflation data, and employment figures create volatility when results deviate from forecasts.

Using Automation In Forex

Automated trading removes emotional decision-making by executing strategies based on predetermined rules. Expert Advisors (EAs) on MetaTrader platforms monitor markets 24/7, opening positions when conditions match your programmed criteria.

MetaTrader 4 dominates automated trading with the largest Expert Advisor marketplace globally, hosting over 1,700 trading robots and 2,100+ technical indicators. The MQL4 programming language works like C, making it accessible for traders with basic coding knowledge. The Strategy Tester lets you backtest EAs across 10+ years of historical data.

MetaTrader 5 provides 64-bit memory handling both 32-bit and 64-bit EAs for improved overall platform performance and faster automated trading. Multi-threaded backtesting uses all CPU cores simultaneously, testing 10,000 parameter combinations in 30 minutes instead of MT4’s 6-hour single-threaded approach. The platform provides 46 analytical indicators and 38 technical indicators across 21 timeframes.

cTrader dominates for algorithmic traders through C# programming language giving you the full power of .NET framework. You build custom robots called cBots using professional development tools with advanced debugging capabilities and fast execution speeds.

VPS hosting keeps your EAs running 24/7 with 99.9% uptime. MultiBank, Pepperstone, and XM offer free VPS when maintaining minimum account balances. The servers sit physically close to broker data centers, reducing execution delays critical for scalping strategies.

Trading Forex Pairs Vs CFDs

In a forex pair, the base currency is the first currency listed, and the quote currency is the second. You can trade over 60 major, minor, and exotic currency pairs with various brokers.

Majors include EUR/USD, GBP/USD, USD/JPY, and AUD/USD, offering the tightest spreads and highest liquidity. Minors like EUR/GBP and AUD/NZD don’t include USD but involve other major currencies. Exotics pair major currencies with emerging market currencies, carrying wider spreads due to lower liquidity.

CFDs let you speculate on price movements across forex, indices, commodities, shares, and cryptocurrencies without owning the underlying asset. You trade the price difference between entry and exit points, profiting whether markets rise or fall.

Forex CFDs typically use higher leverage, 30:1 to 50:1 retail, compared to other asset classes. Equity indices might cap at 20:1, individual shares at 5:1, and cryptocurrencies at 2:1 under DFSA regulation.

Getting Started Trading Currency Pairs

Forex trading requires an intermediate to advanced understanding of how the market works, which tends to put beginners at a disadvantage. Start by learning fundamental concepts before risking real capital.

Open a demo account testing strategies with virtual funds. OANDA and Axi provide unlimited demo access. Practice with realistic capital amounts matching your planned live deposit. Spend time on demo trading, executing enough trades to validate your strategy’s effectiveness.

Develop a trading plan specifying which currency pairs you’ll trade, timeframes, and entry/exit signals. Your plan should include risk management rules like setting stop-losses on every position and maintaining proper risk-reward ratios.

Choose a few currency pairs initially rather than trying to track dozens simultaneously. EUR/USD offers the tightest spreads and reliable patterns, GBP/USD provides higher volatility, and USD/JPY responds to US interest rate expectations.

Start live trading with minimal capital once you’ve proven consistent profitability on demo. Many brokers like XM allow $5 deposits and 0.01 micro lots, letting you experience real market psychology with minimal financial risk.

Should Forex Traders Choose MT4 or MT5?

MetaTrader 4 remains the most popular platform globally with 40 million users and the largest Expert Advisor marketplace. MT4 suits traders wanting access to thousands of pre-built trading robots, extensive community support, and a simple interface.

MetaTrader 5 brokers provides superior capabilities for multi-asset traders. The platform offers 38 technical indicators versus MT4’s 30, expands timeframes to 21 options compared to MT4’s 9, and includes an integrated economic calendar.

Key differences include order types (MT4 supports 2 pending orders while MT5 provides 6), backtesting speed (MT5 uses multi-threaded processing), market depth (MT5 displays Level II pricing), and programming language (MT4 uses MQL4, MT5 uses MQL5 based on C++).

Choose MT4 if you prioritise the massive Expert Advisor marketplace or focus exclusively on forex trading. Choose MT5 if you need multi-asset capabilities, faster backtesting, or advanced order types.

FAQs

What are the most popular currency pairs?

EUR/USD is the most traded currency pair globally, offering the tightest spreads and highest liquidity. GBP/USD provides greater volatility, USD/JPY responds to US interest rate expectations, and AUD/USD correlates with commodity prices. These major pairs account for the majority of global forex trading volume.

Can you trade Swap Free in the UAE?

Yes, swap free brokers are widely available. AvaTrade provides automatic Islamic status for UAE residents with positions remaining interest-free for up to 5 days. XM, Capital.com, and Pepperstone offer swap-free accounts upon request, complying with Shariah principles.

Why are spreads higher on exotic currency pairs?

Exotic pairs carry spreads of 10-50 pips compared to lower spreads on majors due to significantly lower trading volumes and liquidity. When fewer market participants trade a pair, the bid-ask spread widens. Exotics also experience higher volatility and political risks in emerging markets.

What is the most popular trading platform?

TradingView is the most popular platform overall with 100+ indicators, Pine Script for custom tools, and social features. It integrates with Pepperstone, Capital.com, XM, and OANDA. MetaTrader 4 remains popular for automation with 40 million users and the largest Expert Advisor marketplace.

Can you trade gold with a forex broker?

Yes, gold trading platforms is available at most UAE forex brokers as a CFD. Capital.com offers tight spreads ideal for gold trading. Gold often rises during inflation fears and political instability. You trade gold using similar leverage as forex, typically 20:1 under DFSA regulation.

Is Copy Trading allowed in Dubai?

Yes, copy trading is legal in Dubai and the UAE when using regulated brokers. eToro provides CopyTrader functionality, Pepperstone and XM offer MT4/MT5 Signals integration, and AvaTrade provides AvaSocial. All operate under UAE regulatory oversight.

Disclaimer: Seek Independent Investment Advice

The information on this page is not intended as financial or investment advice. You are advised to seek advice from a licensed financial advisor before you invest or trade in the forex market. Forex and CFD trading is always high risk, and investors and traders are in danger of losing money rapidly.

Ask an Expert

Is it safe to trade with modmount or should we prefer a SCA/DFSA/ADGM/CBUAE registered broker. Please propose 3 names of registered brokers in UAE

I can’t comment on modmount specificallly but it always best to trade with a broker regulated in the UAE, if this is where you are based.