What Are The Best Trading Platforms In UAE?

Traders in UAE, such as Dubai, Abu Dhabi or Sharjah, should use a broker with DFSA, ADGM or CBUAE regulation. This review looks at the best brokers for trading based on spreads, Islamic accounts and trading platforms.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The Best DFSA regulated brokers are:

- Pepperstone - Best Trading Platform in UAE

- AvaTrade - Top Fixed Spreads Trading

- IG Markets - Great $0 Minimum Deposit UAE Trading Account

- XTB - Best Broker For All Traders in Middle East

- HF Markets - Great MetaTrader 4 & 5 Broker

- Axi - Good Broker With No Funding Fees

- HYCM - Top Broker with DFSA Regulation in UAE

- XM - Best Islamic Account

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

DFSA FCA, ASIC |

0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

51 |

FCA, DFSA, CySEC FSCBZ, CMNV, KNF |

0.9 | 0.14 | 0.13 | - | 0.9 | 1.4 | 1.3 |

|

|

|

160ms | $250 | 49+ | 16+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC,FCA ,DFSA,FMA |

0.2 | 0.5 | 0.5 | $3.50 | 1.2 | 1.3 | 1.3 |

|

|

|

90ms | $0 | 72 | 37 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

46 |

FCA, FSCA, CYSEC DFSA, CMA, FSA-S |

- | - | - | $3.00 | 1.4 | 1.6 | 1.6 |

|

|

|

$0 | 38+ | 19+ |

|

|||

Read review ›

Read review ›

|

61 |

DFSA, FCA CySEC, CIMA |

0.1 | 0.4 | 0.3 | $4.00 | 1.0 | 0.4 | 1.3 |

|

|

|

170ms | $100 | 69+ | 14+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

57 |

ASIC, FCA CYSEC, DFSA, IFSC |

0.02 | 0.24 | 0.25 | $3.50 | 1.6 | 1.8 | 2.3 |

|

|

|

148ms | $5-$100 | 55 | - | 30:1 | 400:1 |

|

1. PEPPERSTONE - Best Trading Platform in UAE

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

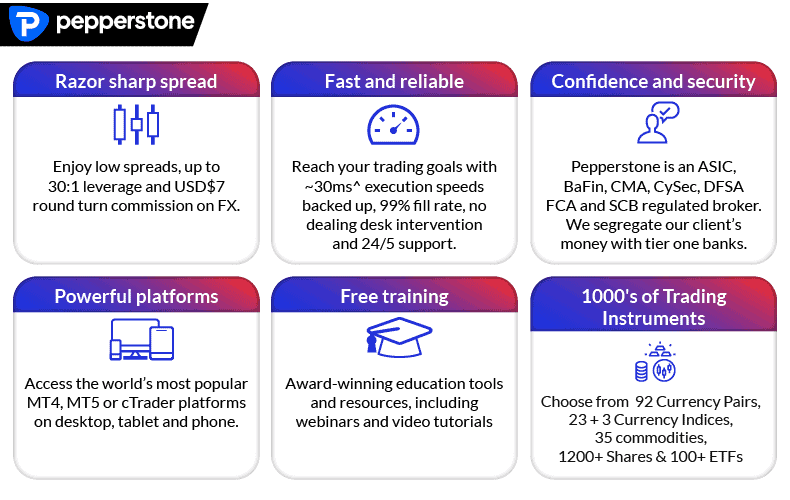

Why We Recommend Pepperstone

We liked trading with Pepperstone due to its strong reputation among many UAE traders. This platform is acknowledged by the UAE’s local regulator as the top broker, giving traders favourable terms and peace of mind.

Pros & Cons

- Good range of CFD products

- Tight ECN-like spreads

- Top third-party platforms

- CFDs only, no spot markets

- 3-5 day bank wire funding delay

- Can’t fund account using AED

Broker Details

Pepperstone is the best broker overall, operating with a local regulator in the United Arab Emirates (UAE). Licensed and regulated by Dubai’s Financial Services Authority (DFSA) with the licence F004356, Pepperstone is a trusted broker used by many UAE traders looking for competitive trading conditions.

As a no-dealing desk (NDD) broker that fills your orders by connecting you to top-tier external liquidity providers, we enjoyed the following features:

- Ultra-tight spreads and a diverse range of CFDs for trading, including cryptocurrencies and shares.

- Two account types and pricing structures – a standard account (with no commissions) and a Razor with ECN pricing and low commission costs.

- A swap-free account for Islamic traders based in certain Middle Eastern countries.

- A choice of the three best trading platforms available to retail traders – MetaTrader 4, MetaTrader 5, and cTrader.

- Award-winning customer support is available 24/5 in multiple languages, including Arabic, via live chat, phone or email.

- Minimum deposit of USD $200 (or equivalent) and the ability to deposit and withdraw funds using bank transfer, Visa debit card or Mastercard debit.

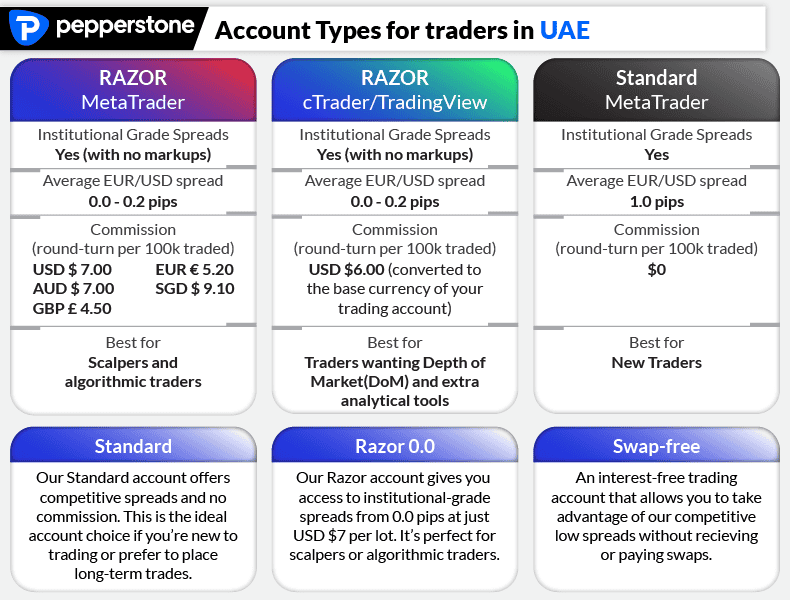

Accounts And Spreads

Two main accounts and pricing structures are offered to Pepperstone clients:

- Standard Account: No commission spreads from 1.0 pips

- Razor Account: ECN spreads from 0.0 pips + commission fee of $3.50 per side, per 100k traded

We liked that the broker’s Standard Account type offers no commission trading. This meant spreads were wider so we didn’t need additional brokerage fees. As you can see in the table below, Pepperstone offers some of the tightest commission-free spreads compared to other top brokers like HFM.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

The online broker’s second account type, the Razor Account, is popular among Dubai traders looking for an ECN-type trading environment with institutional grade spreads. ECN Pricing means no dealing desk so prices are set by liquidity providers, not Pepperstone.

While some brokers may match Pepperstone’s average spreads for major currency pairs like the EUR/USD or EUR/JPY, rarely do other brokers offer the best spreads across the board as Pepperstone does.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

Pepperstone also offers a Swap-Free Account for traders that follow Islamic finance practices in certain countries located in the Middle East. As Islamic traders cannot pay or earn interest rate-based payments in accordance with Sharia Law, Pepperstone’s swap-free pricing is like an Islamic Account type where you do not pay interest-based overnight financing fees (swap rates). Rather, you pay a flat rate admin fee if you hold a position open for 10 days.

Please note that swap-free accounts are not currently available in UAE. Only the following Middle East countries are able to apply for a swap-free pricing structure: Azerbaijan, Bahrain, Jordan, Kyrgyzstan, Kuwait, Oman, Palestine, Qatar, Tajikistan, Turkmenistan, Turkey and Uzbekistan.

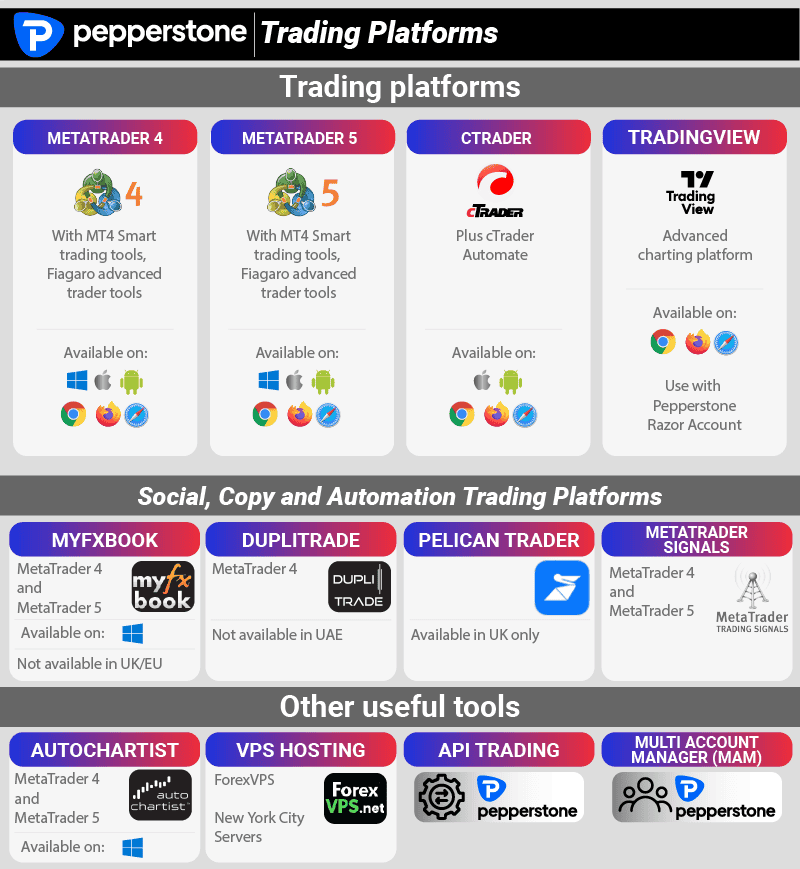

Trading Platforms – MetaTrader 4, 5 And cTrader

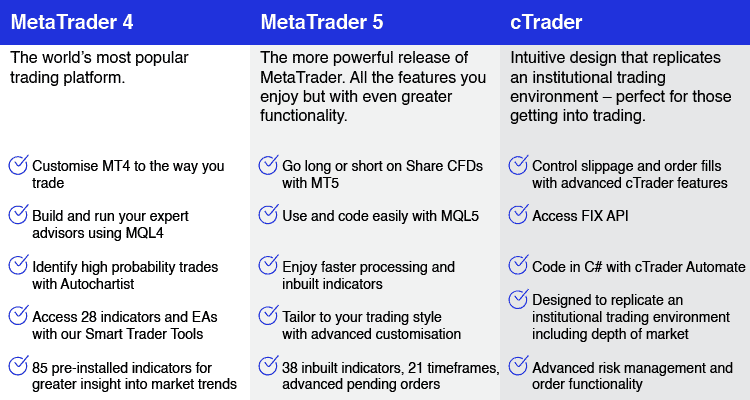

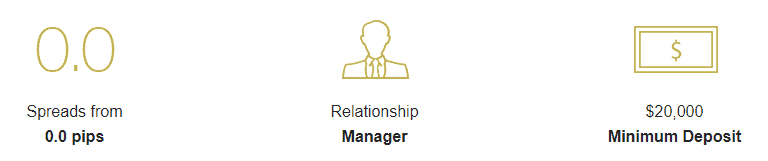

MetaTrader 4 (MT4) is the most widely recognised trading platform globally; more brokers and traders use MT4 than any other platform. So, if you are looking for the most trusted platform by reputation, then MT4 is the way to go. MT4 provides all the essential features you will need for successful trading and doesn’t hold back on features like plenty of bells and whistles available.

Key features of the MT4 platform include 30 technical indicators plus over 85 built-in indicators, 4 pending order types and 9 timeframes. You can even automate your trading through the use of Expert Advisors. To help you find the best EAs for automation and tools for charting, The only real weakness with MT4 is that it is not well designed for stock trading.

MetaTrader 5, while not as popular as MT4, offers all the features available on MT4 plus more. This includes stock trading 6 (not 4) pending order types, 38 technical indicators, 21 timeframes and unlimited symbols. If you have not used MT4 in the past, then it can be a good idea to start with MT5, given the greater range of trading tools.

cTrader, made by Spotware, is MetaQuote’s largest competitor. This trading platform offers Depth of Market (DoM), which means greater transparency, as you can see quotes provided by liquidity providers. It also offers 9 order types, 70 technical indicators, 9 chart views, plus the ability to export these charts outside the platform. You can even automate your trading with cAutomate. cTrader offers a compelling point of difference compared to the MetaTrader platforms, especially if you only intend to trade on the foreign exchange since it is not the best option for other products.

Each platform can be accessed in a selection of ways, including desktop platforms, webtrader platforms, and mobile apps for iOS and Android devices.

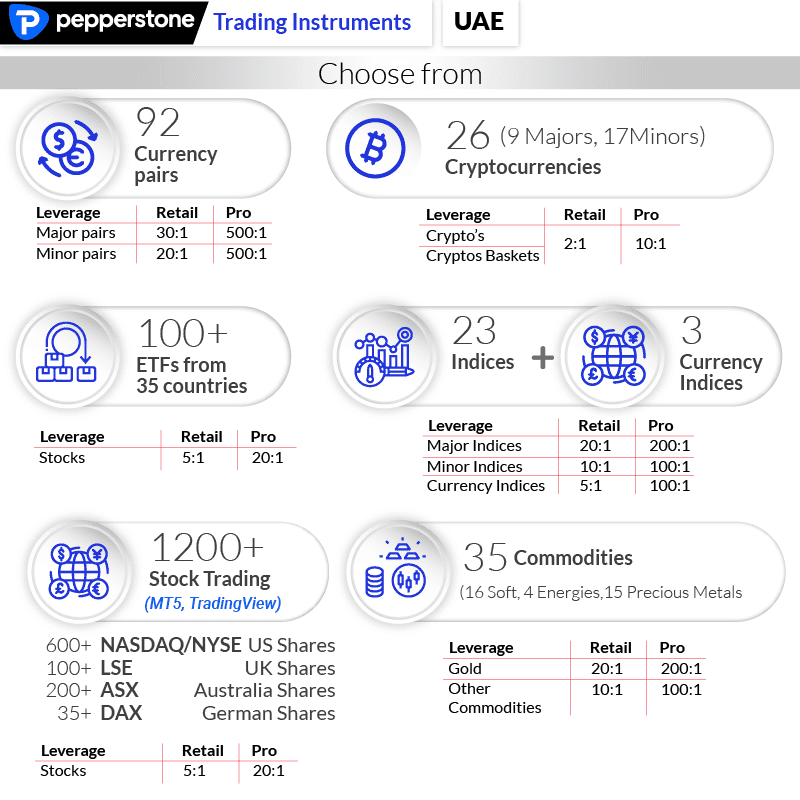

Trading Products (CFDs)

Pepperstone has no shortage of trading instruments one can trade with. Having a wide range of trading products can help you diversify your trading portfolio to protect yourself from risks. All products except for currency and shares are spread only, meaning there are no commission costs.

5 US Indices are available, including US 500, US Tech 100, US 2000, 5 Asia Pacific Indices including Japan 225, Hong Kong 50 and China 50 and 5 UK and Europe Indices such as UK 100. 12 Indices by themes are also available, including 3 crypto indices – Crypto 10, Crypto20 and Crypto30. Leverage for these products ranges from 20:1 to 10:1.

Commodities are also well covered with most metals, such as gold, silver and palladium, coming as spot prices. Energies and soft commodities such as Cocoa, Coffee and Corn are also available.

CFD Shares and ETFs are also available, covering US, UK, German, Australian stock exchanges. Commission costs for Australian shares are 0.07%, 0.10% for German shares and $0.02 per share for American stocks. All markets have leverage of 5:1.

Benefits Of DFSA Regulation With Pepperstone Include:

As Pepperstone is regulated by the DFSA, Pepperstone provides the following trading conditions:

- Leverage caps of 30:1 for major pairs, 20:1 for minor pairs, major indices and gold, 10:1 for other commodities and minor indices, 5:1 for shares and 2:1 for crypto-assets. These leverages are fixed and cannot be changed.

- 50% margin close-out rule for all retail investor accounts to reduce the high risk of trading

- Negative balance protection to eliminate the risk of ending up in debt when online trading

- Segregated bank accounts for client and company funds

Pepperstone – Best Broker Overall

With the best trading platform, top trading tools, and low spreads for both pricing structures (commission and no commission), Pepperstone is the best overall broker for traders in the United Arab Emirates (UAE). Suppose you want to try out the online broker’s different account types and trading platform combinations before you risk real money. In that case, the regulated broker offers a demo account that provides real-time trading conditions.

2. AVATRADE - Top Fixed Spreads Broker

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5,

AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

We liked how AvaTrade, as a market maker, specialises in fixed-spread trading accounts, setting it apart from many NDD brokers like Pepperstone. What this means for traders is that AvaTrade sets spreads and handles order fills using its own internal liquidity. This approach offers a degree of consistency in spreads, which can be especially valuable for traders looking for predictability in their trading costs.

Pros & Cons

- Offers fixed spread trading account

- Provides technical analysis trading tools

- Good selection of trading platforms

- MT4 doesn’t have access to all trading products

- Has high inactivity fees

- Spreads are above average

Broker Details

AvaTrade Affords Stability To Your Trades With Its Fixed Spread

AvaTrade is a top online broker that specialises in fixed-spread trading accounts. Unlike our Best Forex Brokers In UAE with NDD brokers such as Pepperstone, AvaTrade is a market maker. This means that rather than filling your orders using external liquidity sources, AvaTrade uses its own internal liquidity to determine spreads and fill your orders.

No commission fees apply when trading the online broker’s fixed spreads, as AvaTrade’s brokerage services are built into the spread. For currency pairs like the EUR/USD, fixed spreads can be as low as 0.9 pips.

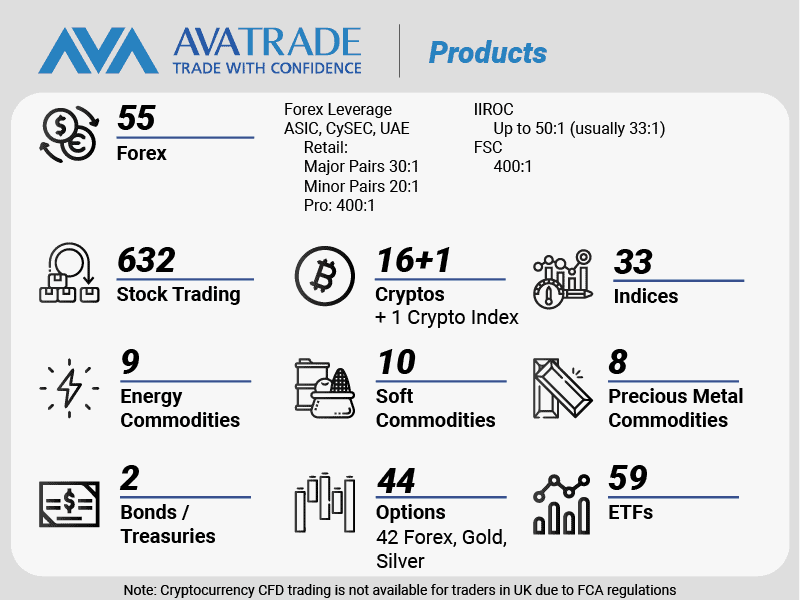

While many online traders focus on CFD markets, AvaTrade offers a range of CFDs that can diversify your trading strategies. These include:

- Stocks

- ETFs

- Commodities

- Indices

- Bonds

- Cryptocurrency

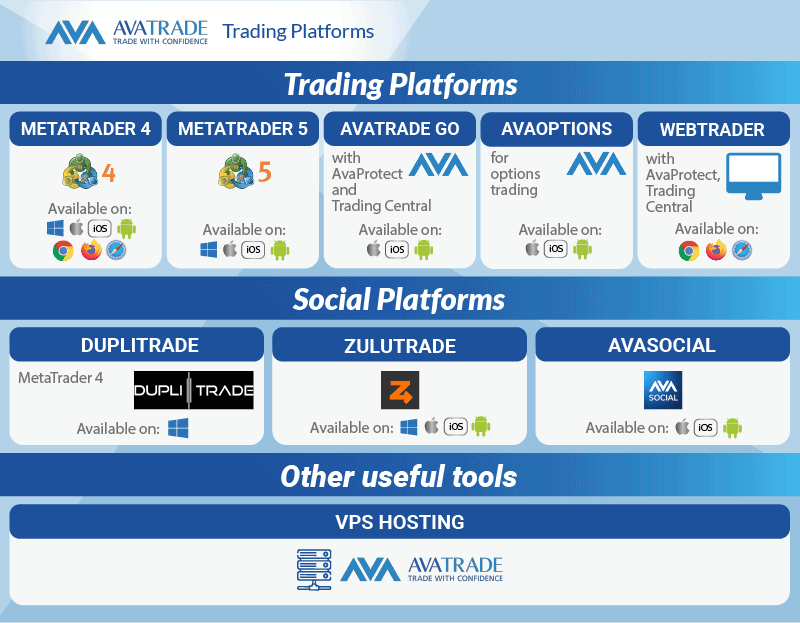

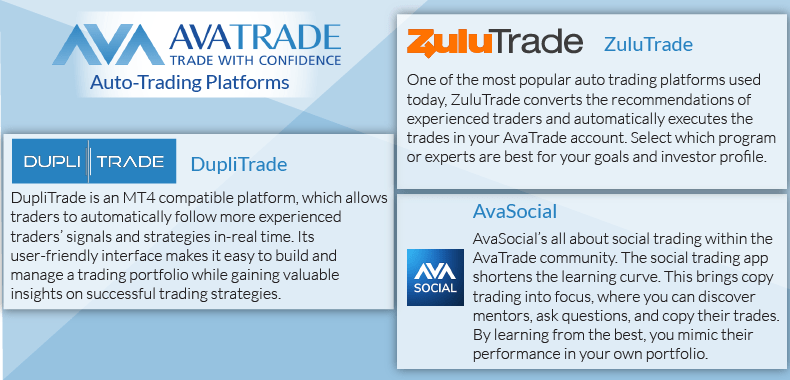

Trading Platforms

AvaTrade offers a selection of mainstream and proprietary trading platforms in addition to access to a range of financial markets. The broker’s proprietary software includes:

- A simple webtrader platform ideal for beginners

- AvaTradeGO, a mobile app for Android and iOS devices

- AvaSocial a social trading app where you can automate trading by following and copying other traders’ strategies

- AvaOptions was designed purely for trading options with risk management tools included

If you are an experienced trader looking for software with advanced technical analysis and algorithmic trading abilities, AvaTrade offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5). While AvaTrade’s proprietary trading platform options are restricted to algorithmic trading, MT4 and MT5 provide extensive automation features with trading robots known as Expert Advisors (EAs).

For those wanting to focus on social-copy trading, AvaTrade clients can choose between two top third-party accounts mirroring services:

- DupliTrade

- ZuluTrade

Given the popular eToro Social Platform is not regulated by any UAE trading regulator, AvaTrade social trading solutions are excellent alternatives.

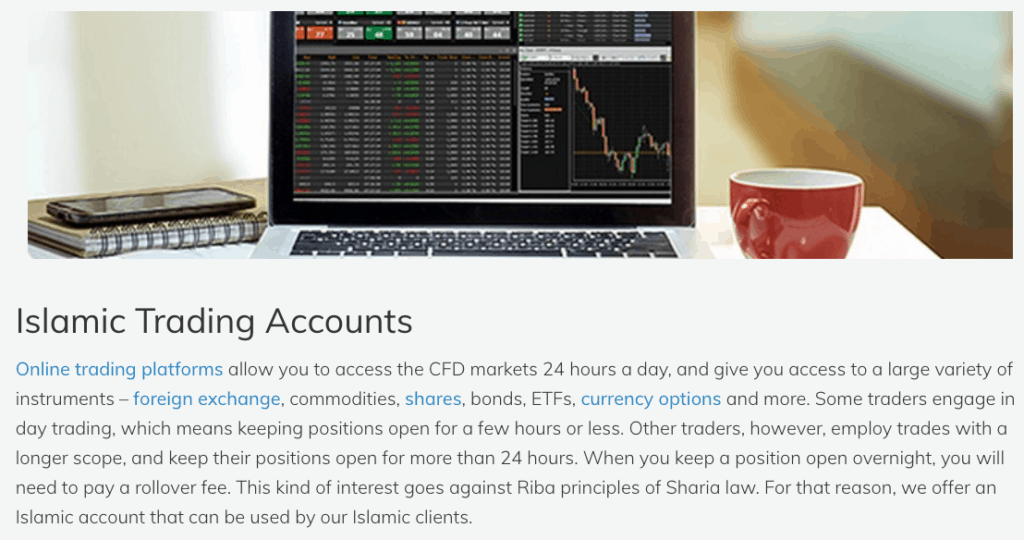

Islamic Trading Account

AvaTrade’s Islamic account allows Muslim traders to trade financial instruments without violating Sharia Law. Islamic traders can still trade CFDs with leverage, yet the account type incurs no interest-based swap charges under Islamic Finance practices.

AvaTrade’s Islamic Account comes with certain restrictions. Crypto trading is not available unless you apply to the online broker for special privileges. Currency pairs involving the ZAR, TRY, RUB, or MXN are not tradeable.

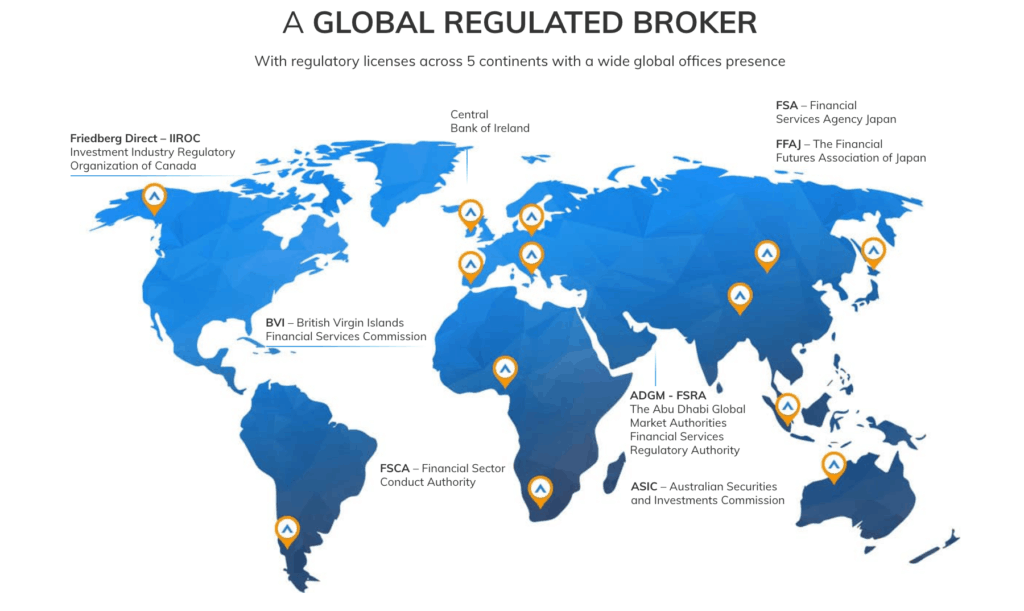

ADGM & FRSA Regulation

With oversight from the Financial Services Regulatory Authority (FSRA) of Abu Dhabi Global Markets (ADGM), AvaTrade is a top pick for traders wanting a regulated broker with a firm presence in the UAE.

AvaTrade is a trusted broker globally as well as in Dubai. The online broker holds multiple financial licenses issued by the Central Bank of Ireland, the BVI FSC (British Virgin Islands Financial Services Commission), ASIC (Australia), FSCA (South Africa), FSA (Japan), CySEC (Europe) and ISA (Israel).

3. IG GROUP - Great $0 Minimum Deposit Account

Forex Panel Score

Average Spread

EUR/USD = 1.13

GBP/USD = 1.66

AUD/USD = 1.01

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Markets

We liked how IG offers traders in the UAE a $0 minimum deposit requirement, coupled with access to hundreds of financial markets. Operating under DFSA rules ensures a secure trading environment. Since their 2015 establishment in Dubai’s financial centre, local traders have benefited from top-notch customer service. Additionally, IG provides valuable educational opportunities, including conferences and seminars, for traders looking to further their knowledge.

Pros & Cons

- Large range of markets to trade

- Has a good selection of trading platforms

- Provides DMA access

- Lacks TradingView

- MT4 has a limited selection of markets

- No social trading tools

Broker Details

IG Offers Trading With The Little or No Deposits

Thanks to no minimum deposit, thousands of financial markets, plus DFSA regulations, IG is a great option for local UAE traders. In 2015, IG opened an office in Dubai’s financial district, enabling local traders to access excellent customer service and educational events, such as seminars and conferences.

Depending on the trading platform you use, IG traders can access a staggering 17,000 financial markets. Besides major, minor, and exotic currency pairs, you can trade CFD products like cryptos, commodities, shares, ETFs, indices, knock-outs, options, bonds, interest rates, and sectors.

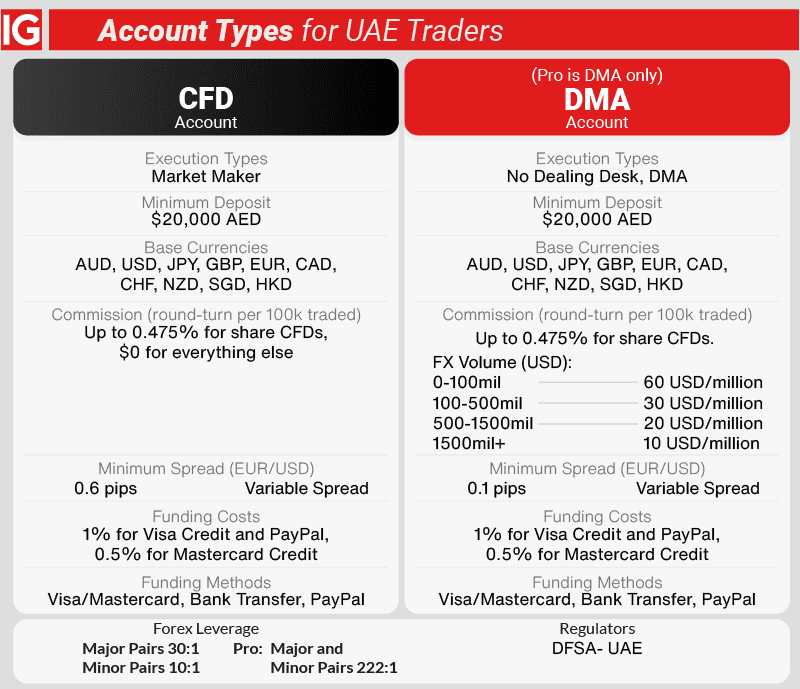

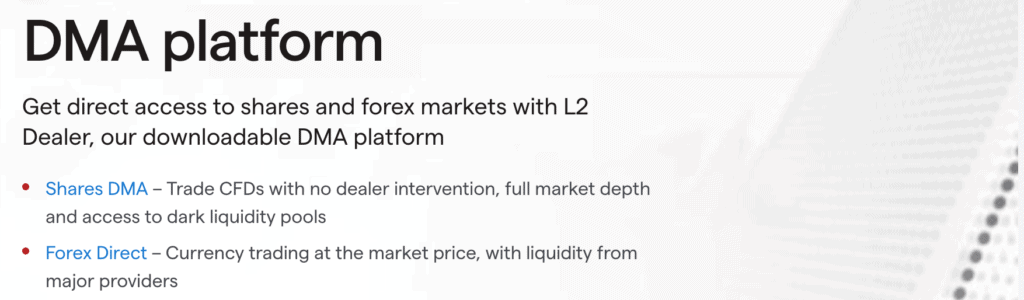

When trading with IG, you can select from two pricing structures and account types. The broker’s CFD Account offers commission-free trading, while DMA Account holders pay variable commission fees but gain direct market access.

- CFD Account: No commission CFD spreads from 0.6 pips for major currency pairs like the EUR/USD and AUD/USD.

- DMA Account: Average spreads of 0.165 pips for the EUR/USD + commission fees

As with many online CFD brokers, IG offers a choice of trading platforms that suit different styles and experience levels. Given a $0 minimum deposit, risk management features like guaranteed stop-loss orders and strong educational resources make IG a great fit for beginner traders. They also offer trading platforms suited to veteran traders.

- IG Trading Platform: the online trading platform and mobile apps are great for beginners with a clean and user-friendly design. Basic charting, fundamental analysis, and customisation are available. A fee will apply if you execute guaranteed stop-loss orders, but no minimum deposit is needed.

- MetaTrader 4: MT4 is ideal for more experienced traders looking for advanced technical analysis and automated trading features. Along with all the basic tools required to trade, MT4 allows for sophisticated technical analysis and algorithmic trading with Expert Advisors (trading robots). No minimum deposit is required.

- L2 Dealer: for advanced share traders that want access to direct market access (DMA) CFDs and share trading. A minimum deposit of $2000 is required to access L2 Dealer.

- ProRealTime: designed for those seeking advanced technical analysis tools and charting capabilities. There is no initial minimum deposit, yet, to gain free access to ProRealTime, you’ll need to make at least four trades a month. Otherwise, a $40 monthly subscription fee will apply.

As mentioned, IG is regulated locally by the Dubai Financial Services Authority (DFSA). Outside of the UAE region, the broker holds financial services licenses issued by the FCA (UK), CySEC (Cyprus), FINMA (Switzerland), FSCA (South Africa), BMA (Bermuda), CFTC (US), ASIC (Australia) and JFSA (Japan).

4. XTB - Top Broker For All Traders in Middle East

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.4

AUD/USD = 1.3

Trading Platforms

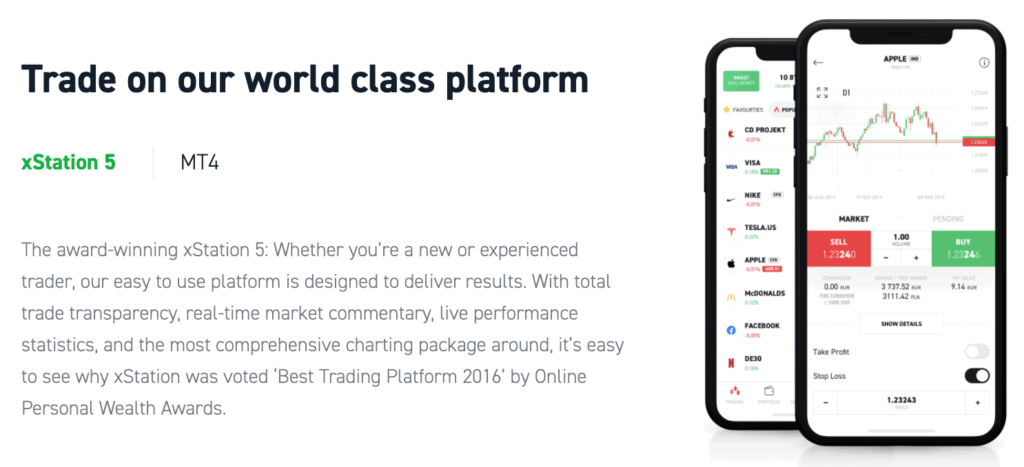

MT4, xStation 5, xStation Mobile

Minimum Deposit

$0

Why We Recommend XTB

We liked that XTB Mena offers FX and CFD trading services to UAE traders and those from Oman, Saudi Arabia, Qatar, Kuwait, and Bahrain. Their reach across Gulf Cooperation Council (GCC) member states positions them as a go-to for many traders in the Middle East. This versatility makes them a top choice for traders throughout the region.

Pros & Cons

- Solid choice of trading products

- Low minimum deposit required

- Variety of trading platforms

- Charges an inactivity fee

- Lacks crypto markets

- Doesn’t provide extra trading tools

Broker Details

XTB Provides Highly Responsive Trading Platforms And Wide Range of Products

XTB Mena has a category 3a licence from the DFSA, which means they can offer FX and CFD trading services to states that are members of the Gulf Cooperation Council (GCC). This means XTB Mena can accept traders from not just the UAE but also Oman, Saudi Arabia, Qatar, Kuwait, and Bahrain.

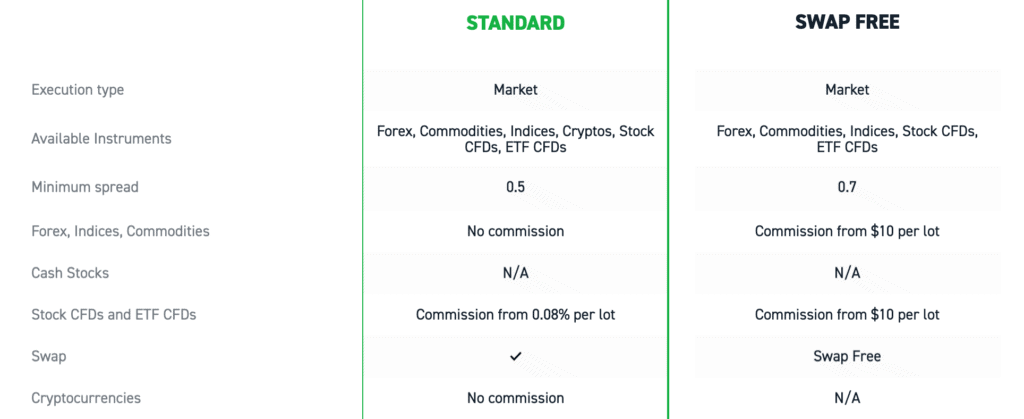

We chose XTB to access an excellent selection of CFD products that can be traded via two account types – a Standard Account and an Islamic Account. The major difference between accounts is the pricing structure:

- Standard Account: Minimum spreads from 0.5 pips with no commission fees. Swap rates apply (XTB UAE)

- Islamic Account: Spreads from 0.7 pips plus a commission fee, starting from $10 per lot. Swap-free (XTB International)

Please note, as Islamic account holders cannot pay or receive swap rates under Sharia Law, a higher commission fee is charged.

Both account types and pricing structures offer access to over 2,100 financial markets. Yet, Islamic Accounts do not have the option of trading cryptos. XTB provides CFDs derived from six key asset classes. Currencies, commodities, indices and share CFDs can be traded via XTB’s Dubai branch, but you’ll need to sign up to XTB International to access Cryptos and ETFs.

XTB United Arab Emirates

XTB United Arab Emirates

- Currency Markets: 57 major, minor and exotic pairs

- Commodities: 22 commodities, including metals and soft commodities

- Indices: 36 indices, such as the US500, UK100, AUS200 and VOLX index

- Shares: 1840 stocks from European stock exchanges like Germany, Poland and France

XTB International also offers:

- ETFs: 135 exchange-traded funds

- Crypto: 5 cryptocurrencies being Bitcoin, Bitcoin Cash, Ripple, Litecoin, and Ethereum

To access XTB’s range of financial markets, retail traders can use either a desktop trading platform, xStation 5, or the xStation mobile app for iOS and Android devices.

DFSA Regulation

XTB recently established a presence in Dubai. In the past, international traders needed to sign up at the broker’s offshore IFSC-regulated entity. XTB now has a licence issued by the Dubai Financial Services Authority (DFSA) regulatory body to operate locally in the Dubai International Financial Centre (DIFC).

However, to access Islamic account pricing, you are required to sign up for the international subsidiary. Those able to use standard pricing can trade with XTB’s UAE branch.

5. HF MARKETS - Great MetaTrader 4 & 5 Broker

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.9

AUD/USD = 1.8

Trading Platforms

MT4, MT5, HFM App

Minimum Deposit

$100

Why We Recommend HF Markets

We liked trading with HFM, as they present various account options, each tailored with its unique minimum deposit, leverage, and spread. Notably, HFM supports both MetaTrader 4 and MetaTrader 5, among the industry’s most favoured trading platforms. This versatility ensures traders have the tools to engage with the financial markets effectively.

Pros & Cons

- Access over 3,000 instruments

- Provides good technical analysis tools

- Low commission trading fees

- Above average spreads on standard accounts

- Customer service is slow

- No copy trading tools

Broker Details

HFM Allows Trading With The Most Popular Platforms – MetaTrader 4 & 5

HFM is an award-winning broker with a large worldwide presence. They have an array of accounts to choose from, all with different minimum deposits, leverages, and spreads. You can trade the financial markets from two of the most popular trading platforms in MetaTrader 4 & 5.

Account Types

HFM has the advantage of having an account to suit your every need. They offer 6 different accounts to trade the financial markets on. We have gone into more detail about the various aspects of these accounts below.

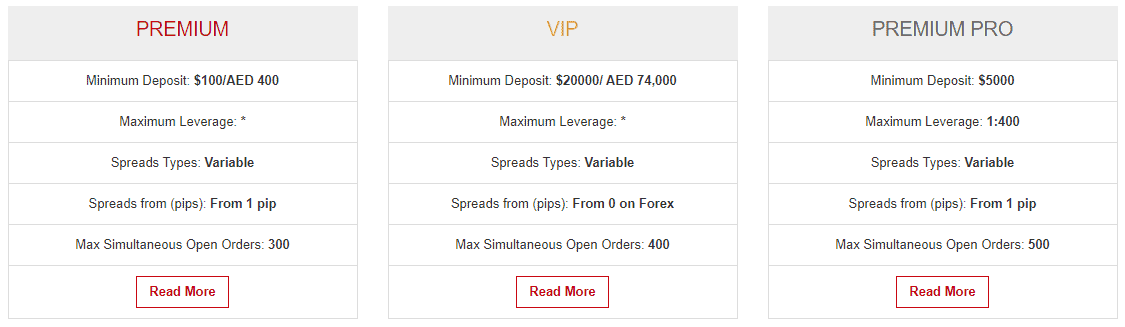

Premium Account

Designed for beginner traders who are not willing to commit a large amount of capital. The low minimum deposit and ability to trade micro-lots make this account favourable for beginners.

- Minimum deposit-$100

- Maximum leverage-1:30 for Major currency pairs

- Spreads from (pips)-1 pip

- Max simultaneous open orders-300

Premium Pro Account

The premium pro account is suited for more experienced retail traders, with the important feature of flexible position sizes from 80 lots to 0.01 lots. This account is suitable for a trader who has experience with the financial markets but may not be a professional.

- Minimum deposit-$5,000

- Maximum leverage-1:400

- Spreads from (pips)-1 pip

- Max simultaneous open orders-500

VIP Account

The VIP account is more suited as a low-cost solution for more experienced traders who prefer to scalp and trade with more volume. The key feature of the account is its minimum spread of 0 pips on pairs. This account is more suited for experienced traders as they will commit to a higher amount of capital for their trade.

- Minimum deposit – $20,000 USD

- Maximum leverage – 1:30 on major pairs

- Spreads from (pips) – 0 pips on fx

- Max simultaneous open orders – 400

Islamic Account

The Islamic account HFM offers is available with the same specifications as any of the other accounts. What makes this account unique is the absence of charges on any rollover or swaps for holding positions overnight. The currency for this account is mainly USD, which provides for telephone trading available if necessary.

Platforms – MT4 & MT5

HFM gives you the option of two of the most popular trading platforms in the world in MetaTrader 4 & 5. While being the older platform out of the two, MT4 remains the most popular trading platform in the world. The latest version of the platform is MT5, which offers a wider range of tools, indicators, and analytical graphs. We have compared the features of both platforms for you below.

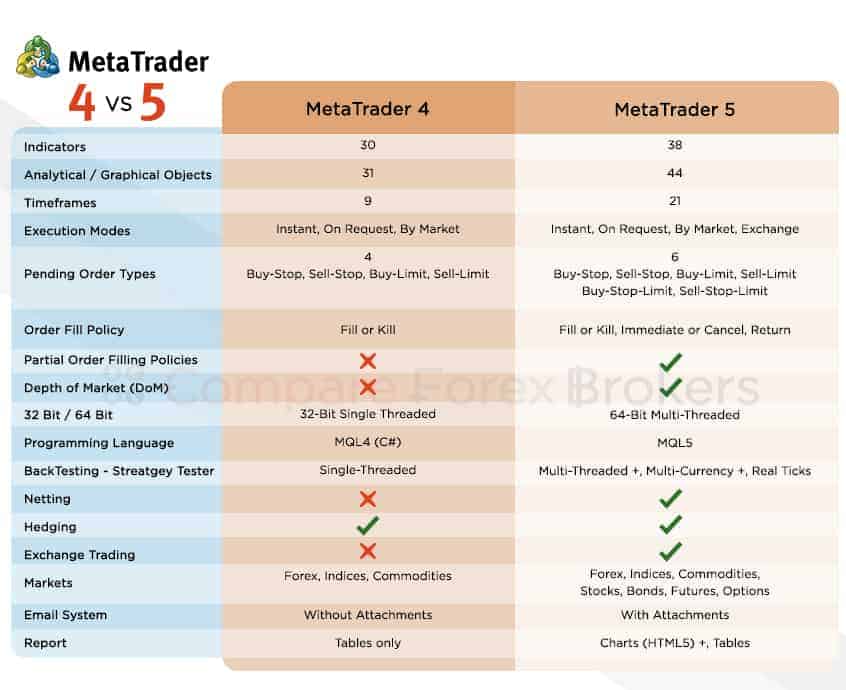

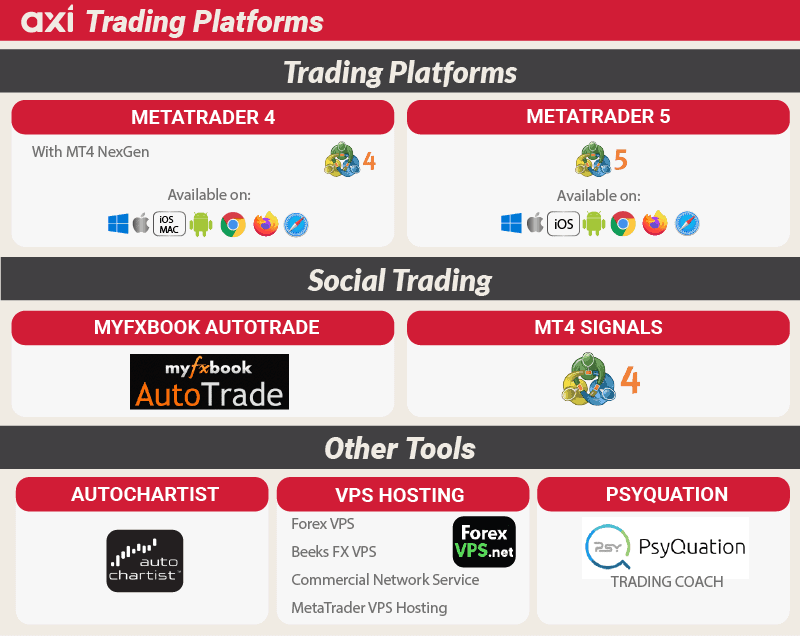

6. AXI - Good Broker With No Funding Fees

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.3

AUD/USD = 1.3

Trading Platforms

MT4

Minimum Deposit

$0

Why We Recommend Axi

We liked Axi’s transparent approach to funding, being regulated by both the DFSA in Dubai and ASIC in Australia. They provide two account types tailored to different trading experiences. For traders in the UAE wanting to avoid unnecessary funding fees, Axi stands out as a solid choice.

Pros & Cons

- Low commissions with tight spreads

- Offers cryptocurrencies to trade

- No deposit or withdrawal fees

- Limited range of trading products

- Lacks client support over the weekend

- Charges inactivity fees

Broker Details

Axi Offers Multiple Funding Methods With Zero Fees

Axi is a regulated broker overseen by the DFSA in Dubai and ASIC in Australia. Axi offers two account types and pricing structures. First, a commission-free Standard Account is available with minimum spreads from 0.4 pips suited to beginners. Second, a Pro Account designed for more experienced traders offers spreads as low as 0.0 pips plus a commission fee of USD $7 round turn.

Both account types are provided access to MetaTrader 4 (MT4) as a desktop, webtrader, or mobile trading platform. All standard MT4 features, such as Expert advisers and charting tools, are pre-installed on the platform, with the ability to integrate third-party account mirroring services like Myfxbook and ZuluTrade with your MT4 account.

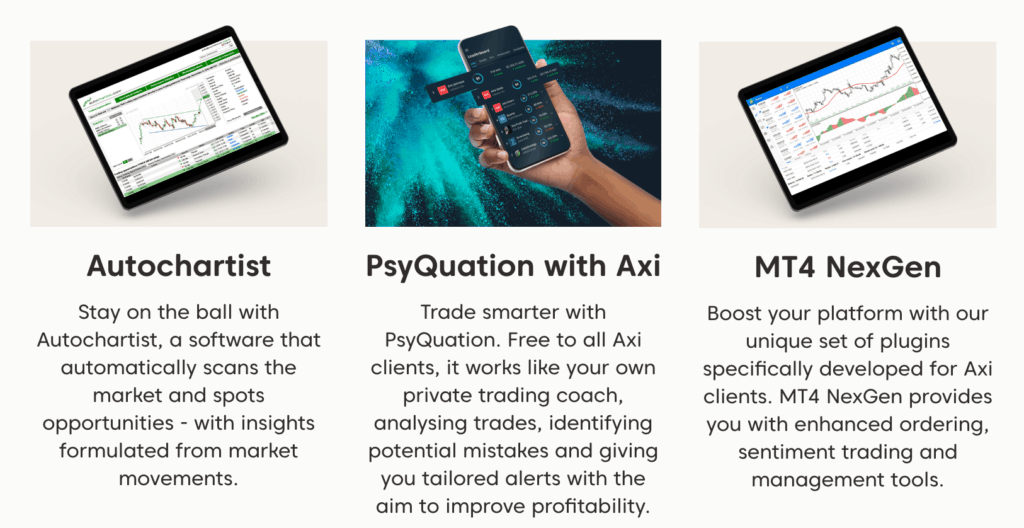

We also accessed other technical analysis and trading tools, such as:

- MT4 NextGen: Plugins to help with order management and sentiment trading

- PsyQuation: Acts like a trading coach while providing alerts and identifying potential mistakes and trends

- AutoChartist: An automatic market scanner to help you save time by identifying trading opportunities

Fee-Free Funding

While some brokers charge fees when you deposit or withdraw funds to or from your trading account, Axi offers 26 funding methods with no fees.

Fee-free deposit methods include:

- Credit card*

- Debit card*

- Skrill*

- POLi

- Bpay

- Bank wire transfers

- FasaPay

- Sofort

- Neteller

- Sofort

- Neteller

- Giropay

- IDeal

- AliPay

- Bitcoin (BTC)

*accepts AED (United Arab Emirates Dirham)

On top of the above, you can top up your trading account balance via Chinese, Thailand, Vietnamese, Indonesian, Polish, Hong Kong, Malaysian, Singapore, Peru, Chile, Costa Rica, and Mexico internet banking. Please note Paypal is not available.

When withdrawing funds, Axi will transfer your requested amount into a bank account or Neteller account. Withdrawals are processed within 1-2 business days.

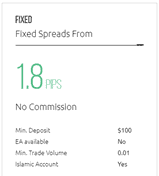

7. HYCM - Top Broker with DFSA Regulation

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.3

AUD/USD = 1.3

Trading Platforms

MT4, MT5

Minimum Deposit

$100

Why We Recommend HYCM

We noticed HYCM because of their numerous awards for having the greatest trading systems and being the best broker in Asia. They also provide both MetaTrader platforms.

Pros & Cons

- Tight spreads on the RAW account

- Provides weekly educational webinars

- Choice of variable or fixed spreads

- Standard account spreads are high

- Customer service is only 24/5

- Lacks third-party trading tools

Broker Details

HYCM Is A Multi-Regulated Financial Institutions With Swap-Free Accounts

HYCM is one of the best brokers with DFSA regulations based in Dubai. They have been given multiple awards for being the best broker in Asia and having the best trading platforms. Similar to HFM, they also offer both MetaTrader platforms but with some limitations to the markets available to trade.

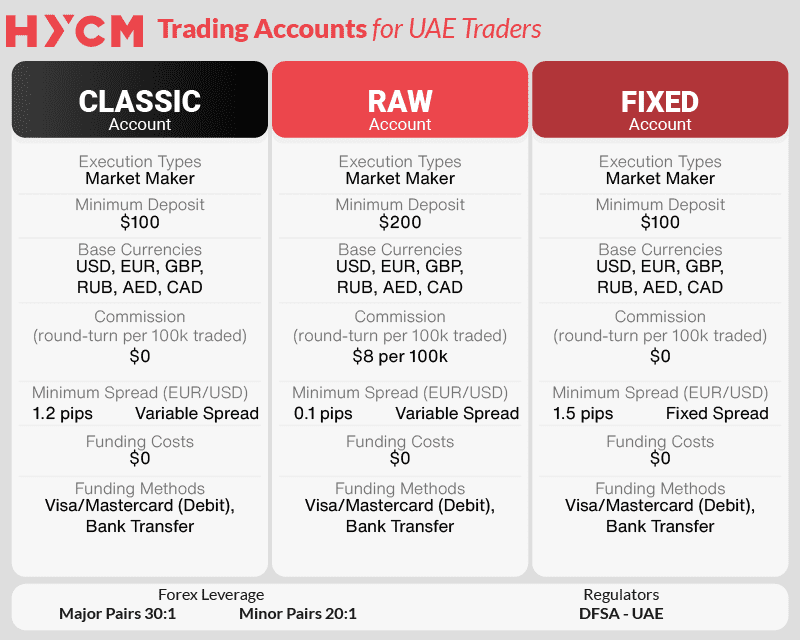

Account Types

When we used HYCM, they offered three different account types, each with benefits depending on our trading style and experience level. All the accounts are available in Islamic (swap-free) versions to comply with Sharia Law. We have gone into more detail about each of these accounts below.

Fixed Spread Account

HYCM’s fixed spread account makes calculating trading costs easy as the spreads will stay at a single amount, and there is no commission on any of the trades placed. This account is perfect for trading when there is high volatility in the market, and the spread costs are very high.

- Spreads starting from 1.80 pips (fixed)

- Minimum deposit – $100

- Minimum trading size – 0.01 lots ($1000)

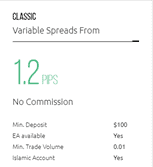

Classic Account

HYCM’s classic account is the most popular account because of its low spreads and no commission. Among our team, the traders with previous trading experience who didn’t trade high volumes preferred this account.

- Spreads starting from 1.20 pips for popular EUR/USD pair

- Minimum deposit of $100 to start the account

- Expert Advisor (EAs) trading is available through either MetaTrader 4 or 5 as automated trading strategies

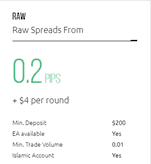

Raw Account

On the other hand, the Raw Account was perfect for our more experienced traders who preferred to trade with higher volumes because of the super-low spreads. While the spreads are very low, each trade has a commission cost of $4 per round.

- Spreads starting from 0.20 pips

- Minimum deposit of $200 needed

- Trade with Expert Advisors (EAs) and create your own automated trading strategy

Range Of Markets

HYCM has one of the most diverse ranges of markets, as we’ve had six different markets to trade with. It is one of the few brokers on this list that allows trading on the cryptocurrency markets. We have listed some of these markets below.

- 40+ different currency pairs

- Over 100 shares, including Zoom, Apple, and IBM

- 15 of the world’s most traded indices, including UK 100, US 30, and China A50

- 21 different Cryptocurrencies, including the popular BTC, ETH, and LTC

8. XM - Best Islamic Account

Forex Panel Score

Average Spread

EUR/USD =1.6

GBP/USD = 1.9

AUD/USD = 1.6

Trading Platforms

MT4, MT5,

XM App/Tablet

Minimum Deposit

$5

Why We Recommend XM

Along with traders from UAE, we liked trading with XM. They provide a large variety of tradable markets through a single account, such as different FX pairings, shares, commodities, and more.

Pros & Cons

- Extensive resources for market research

- Excellent customer service

- No commission trading

- Currency pair selection is limited

- Charges a high inactivity fee

- Lacks TradingView

Broker Details

XM Has The Best Accounts That Comply With DFSA Regulations

XM is a popular choice of brokers in the UAE because of their DFSA regulations. They offer a wide range of tradable markets, including various currency pairs, shares, commodities, and more, all through a single account.

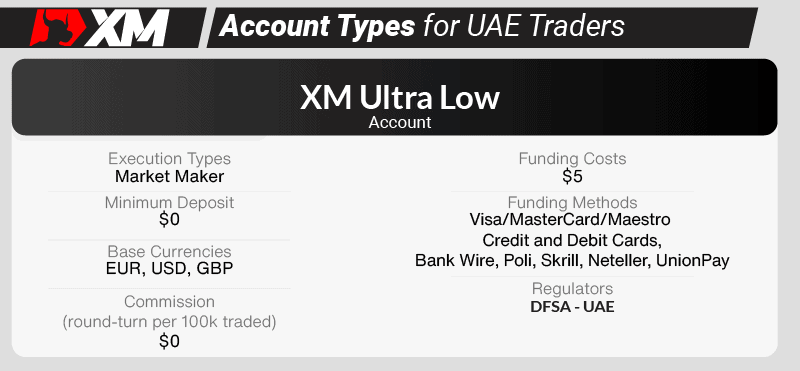

Account Types

You can choose between two accounts that comply with DFSA regulations. The first is their XM Ultra-Low account, which is a no-commission account. The second option is the Islamic version of the swap-free XM ultra-low account.

XM Ultra-Low Account

- 1 lot = $100,000

- Spreads of all major pairs are as low as 0.60 pips

- Minimum trade volume is 0.01 lots ($1,000)

- The minimum deposit amount is $5

- 200 positions per account open at one point in time

- Base currency options of EUR, USD, & GBP

- Leverage up to 30:1 according to DFSA regulation

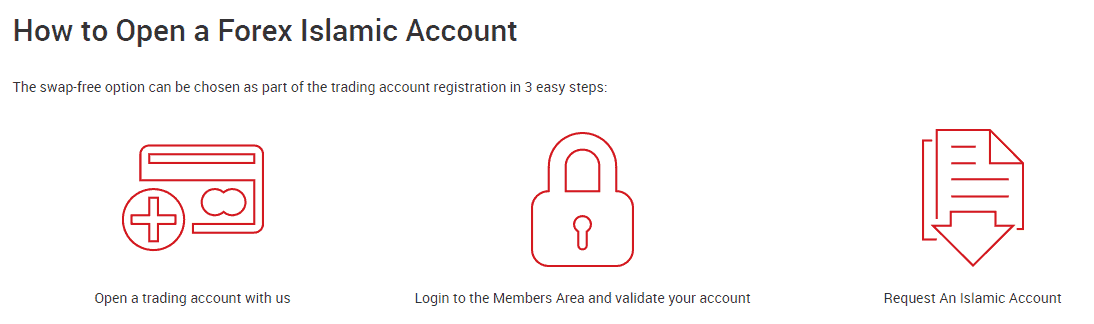

Islamic Account

XM offers an Islamic account for all clients who comply with Sharia law. These accounts are also called swap-free as they accrue no rollover interest in overnight positions. The Islamic account XM for UAE clients has the exact specifications as the Ultra-low accounts apart from the interest accruing.

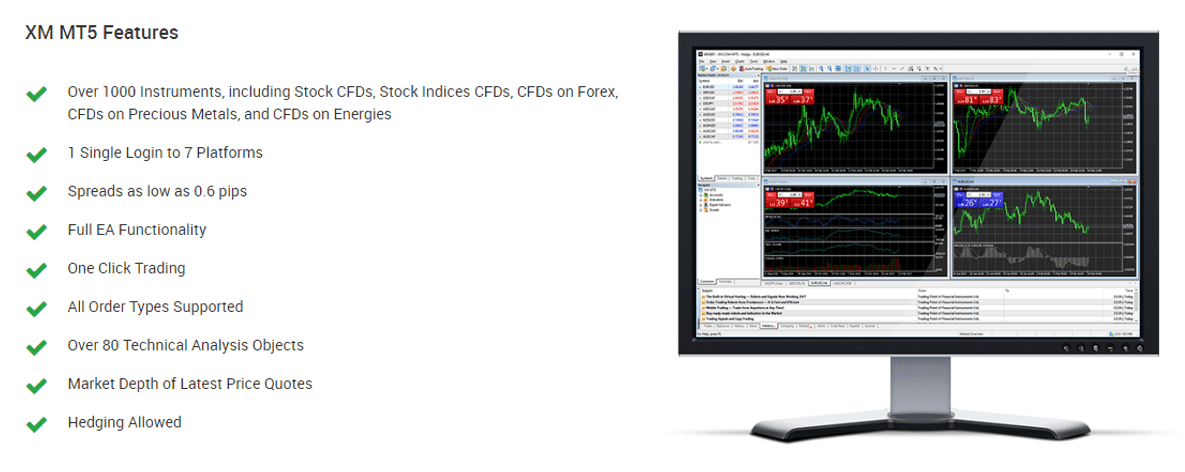

Platforms

XM offers two platforms to trade with, MT4 and MT5. As with MT4, MT5 has widely been one of the best trading platforms in the world. There are over 1,000 tradable instruments, including a wide range of CFDs.We have listed some benefits of MT5 below.

- One-click trading to make placing a position as easy as possible while looking at the charts

- Full Expert Advisor (EA) functionality with the integration of automated trading strategies, you can create or copy trade from the MQL5 community

- Over 80 different technical analysis tools to help analyse the charts and determine the best trade to make

Ask an Expert