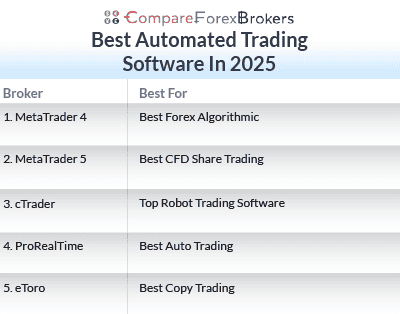

What Is The Best Automated Trading Software?

The best 2025 automated trading software was based on trading platform features, execution speeds, and UAE broker spreads and fees. The 5 algorithmic trading software packages short-listed were the most popular in the UAE with advanced tools.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The Best Automated Trading Software For UAE Traders:

- MetaTrader 4 - Automated Trading Platforms

- MetaTrader 5 - Best CFD Share Trading

- cTrader - Top Robot Trading Software

- ProRealTime - Best Auto Trading

- eToro - Best Copy Trading

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

59 |

FCA, FSCA CySEC, SCB, FSCM |

0.45 | 0.52 | 0.57 | $3.50 | 1.46 | 1.76 | 2.06 |

|

|

|

151ms | $100 | 69 | 28 | 30:1 | 200:1 |

|

1. METATRADER 4 - Best Forex Algorithmic

Forex Panel Score

Average Spread

N/A

Trading Platforms

MetaTrader 4

Minimum Deposit

$0

Why We Recommend MetaTrader 4

We recommend MetaTrader 4 for traders pursuing algo trading due to its massive marketplace of Expert Advisors and active community. The most popular trading platform worldwide with over 40 million active users, MT4 offers access to an extensive range of pre-built and custom-coded trading bots.

Pros & Cons

- Most popular trading platform

- Allows you to automate your strategies

- Has backtesting and optimisation tools

- Outdated user-interface

- Limited product access like stock CFDs

- No longer supported after MT5 release

Platform Details

MetaTrader 4 (MT4) is the most popular trading platform offered by forex brokers globally. We’ve highlighted our 5 favourite MT4 features below:

- FLEXIBLE AND CONVENIENT TRADING with three execution modes, as well as two market and stop orders.

- ANALYTIC FUNCTIONS with interactive and customisable charts, nine timeframes, and 30 technical indicators.

- EXPERT ADVISORS trading robots called Expert Advisors (EAs) automatically execute orders based on predetermined rules and market conditions.

- ALERTS AND FINANCIAL NEWS to alert traders of targeted events that impact financial markets while establishing potential trading opportunities.

- A FREE DEMO ACCOUNT to practice trading with virtual funds on a range of markets, with full access to the platform’s trading tools to develop trading strategies and backtest trades against historical data.

EXPERT ADVISORS

PROS OF MT4

- MQL4 Programming Language: MT4 uses MetaQuotes Language 4 (MQL4) which is similar to the C programming language. Once you learn the MQL4 language, it is simple to create and develop your own Expert Advisors (EAs).

- Large MT4 Marketplace: MT4 offers one of the most extensive collections of EAs, algorithmic tools, and technical indicators including over 1,700 trading robots and over 2,100 technical indicators

- Backtesting Expert Advisors: MT4 offers a Strategy Tester feature for backtesting which is an excellent tool for backtesting

CONS OF MT4

- Low-Quality Expert Advisors in Marketplace

- No Customer Support for MT4

- Limited CFDs available

- Lack of centralised trading (I.E. can’t trade physical stocks)

THE BEST MT4 BROKER FOR EXPERT ADVISORS

IC Markets

IC Markets

We recommend IC Markets as one of the best MT4 Expert Advisor brokers. The three main reasons for this include:

- Low spreads are good for scalpers using automation

- Choice of MetaTrader 4 and cTrader for Automation

- Automation with social trading – MyFXBook, ZuluTrade

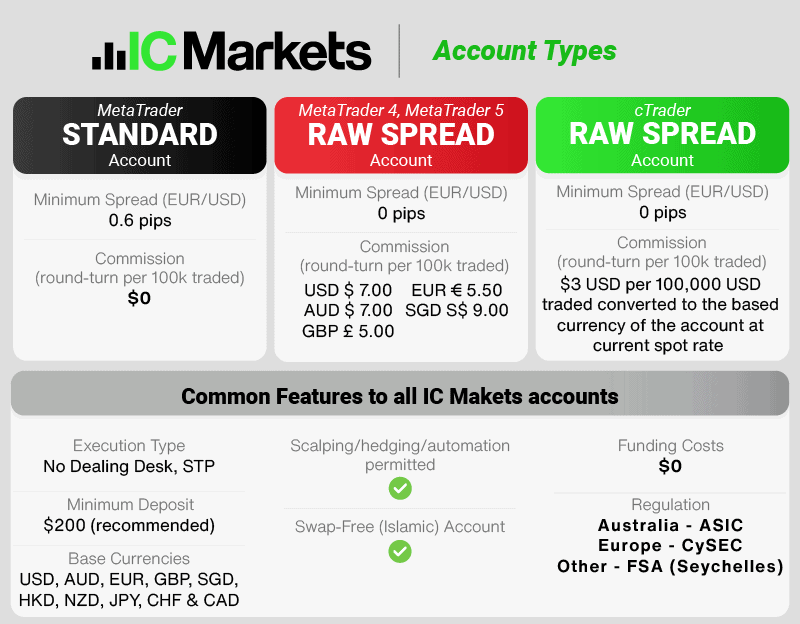

LOWEST SPREADS FOR MT4 AUTOMATION

IC Markets had the lowest spreads overall when combining commission-free and commission-based accounts based on our spread testing of various top brokers using MT4.

For the broker’s Standard account, IC Markets averaged 1.03 pips across the 5 major currency pairs, putting it at number 1 overall. IC Markets averaged 0.32 pips for its RAW Spread account, which was the third lowest overall just behind Fusion Markets (0.22 pips) and City Index (0.25 pips).

IC Markets’ tight spreads kept our trading costs low while scalping using MT4’s EAs.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

GREAT TRADING PLATFORMS FOR AUTOMATION

Aside from MT4’s EAs, IC Markets has a great range of third-party tools for automation including AutoChartist and Myfxbook. You can also use ZuluTrade and MetaTrader Signals as copy trading options, a form of algorithmic trading. We also liked cTrader’s cAlgo for automated trading and Trader Copy for social copy trading.

Perhaps the biggest highlight for us, however, is MT4’s Advanced Trading Tools upgrade. The platform comes with a whole host of advanced tools to enhance your trading experience, including indicators, EAs (Expert Advisors), and order customisation tools.

Out of all the advanced trading tools, we think the Trade Terminal adds the most value. We liked that you can open a chart for any trading symbol on MT4 and add the Trade Terminal EA to that chart.

Being able to maximise our screen space with a market watch, while having our account summary and order list available at a click glance, enhanced our ability to trade successfully.

2. METATRADER 5 - Best CFD Share Trading

Forex Panel Score

Average Spread

N/A

Trading Platforms

MetaTrader 5

Minimum Deposit

$0

Why We Recommend MetaTrader 5

We recommend MetaTrader 5 for traders interested in assets on centralised exchanges, such as stocks, indices, commodities and cryptocurrencies. This trading platform will meet your needs if you want a balanced portfolio or to venture beyond forex and CFDs. While the market for trading bots is slightly smaller for MT5 than for MT4, it offers pre-built and custom-coded tools and indicators.

Pros & Cons

- Allows access to trading stock CFDs

- Direct market access tools

- Allows customisable technical indicators

- No customer support from MetaQuotes

- Lacks backward capability to MT4

- No supported on all brokers

Platform Details

MetaTrader 5 (MT5) is an upgrade from MetaTrader 4 (MT4) in terms of market access to more asset classes, a simpler coding language, and improved backtesting capabilities. Unlike MT4, MT5 is a multi-asset platform meaning users can trade derivatives that require access to centralised exchanges like shares and futures.

The MetaTrader 5 platform offers the following features:

- 4 execution modes and 6 pending order types.

- 46 analytical indicators, 21 timeframes, and 38 technical indicators.

- Full or partial order fills.

- An integrated economic calendar, market news regarding economic events, and social indicators.

- Depth of market.

PROS OF EXPERT ADVISORS WITH MT5

- MQL5 Programming Language: MT5 uses MetaQuotes Language 5 (MQL5) based on the C++ programming language, which is better quality than MQL4.

- Access to Marketplace: MT5 has an inbuilt Marketplace tab on the platform, unlike MT4, making it easier to find EAs.

- Contracts for Difference Trading (CFD): You can trade centrally exchange-traded assets on MT5, giving you greater market access including futures and stock trading.

- 64-bit memory: MT5 can handle Expert Advisors that are both 32-bit and 64-bit meaning you can improve overall platform performance, resulting in faster-automated trading.

- Multi-Threaded Backtesting: MT5 can test multiple financial instruments at one time which will help if you have EAs performing many trades or if you are backtesting a strategy against multiple currency pairs.

- Faster Trading Speed: MT5 uses 64-bit memory and 4 servers (trading, access, backup and history servers) allowing for faster trading capabilities than MT4.

CONS OF EXPERT ADVISORS ON MT5

- Trading Community: MT5 community is not as large as MT4’s, but it is growing and likely to overtake MT4. Such growth should lead to an increase in available MQL5 EAs.

- MT5 Marketplace: As the MT5 community is smaller than the MT4 community, the marketplace is also not as extensive. Since MetaTrader has discontinued support for the older versions of MT4, the MT5 marketplace is growing.

PEPPERSTONE IS THE BEST MT5 BROKER FOR AUTOMATION

We recommend Pepperstone as the best MT5 broker due to its fast execution speeds, diverse range of platforms and excellent automated trading systems and technical analysis tools.

FAST EXECUTION SPEEDS

When testing execution speeds, Pepperstone was the third fastest broker overall, and fastest on this list. For limit orders, Pepperstone achieved speeds of 77ms and for market orders the broker had speeds of 100ms.

This put Pepperstone at number 2 and 5 for limit and market orders respectively, putting it at number 3 overall (behind Fusion Markets and BlackBull Markets).

While we used MT4 for our testing, MT5 has faster execution speeds due to its 64-bit memory so will almost certainly achieve better results.

DIVERSE RANGE OF PLATFORMS

Pepperstone offers a diverse range of platforms including MT4, MT5, cTrader, Capitalise.ai and TradingView.

While you can automate your trading with MT4 (EAs), cTrader (cBots), Capitalise.ai (code-free trading) and TradingView (via bots), MT5 is where Pepperstone stands out.

We highly recommend using the Strategy Tester to test EAs, particularly when testing multi-currency strategies. What we found particularly useful was utilising ‘arbitrary delay’ mode, while testing EAs to give a more accurate reflection of live market conditions.

3. CTRADER - Top Robot Trading Software

Forex Panel Score

Average Spread

N/A

Trading Platforms

cTrader

Minimum Deposit

$0

Why We Recommend cTrader

We recommend cTrader for algorithmic traders interested in automations and copy trading. cTrader Copy, the platform’s custom tool, offers several innovative features. Traders can review the profiles of experienced traders, known as Strategy Providers, and assess their success rates before opting to copy their positions. Additional risk control comes in the form of pre-set entry and exit points for mirroring.

Pros & Cons

- Fast execution speeds

- Program cBots to automate trading strategies

- Excellent Depth of Market access

- Not supported by many brokers

- Fewer custom options compared to MT4

- Does not support all asset classes

Platform Details

cTrader offers cTrader Automate for automation and cTrader Copy for copy trading, which includes in-depth strategy profile tools to assist with safer copy execution. For this review, we’ve focussed on cTrader Copy.

KEY FEATURES OF CTRADER COPY INCLUDE:

- RISK MANAGEMENT: cTrader Copy comes with tools to help manage your risks when mirroring other trades. These include equity stop-loss, forced stop-loss/take-profit per position, volume percentage, and mirroring direction.

- COPYING CONTROL: Real-time controls on when the commencement and exit of the mirroring process occurs.

- TRANSPARENT: Ability to see a Strategy Provider’s profile, trading history, and positions open.

- ANALYTICAL TOOLS: In-depth charts such as ROI, Balance and Equity, and trading success statistics.

FXPRO IS THE TOP CTRADER BROKER

We recommend FxPro for cTrader as the broker offers a great platform experience, solid range of markets and a diverse range of execution methods (fixed, instant and variable spreads).

GREAT CTRADER EXPERIENCE FOR AUTOMATION

While FxPro offers a great selection of trading platforms (MT4, MT5, cTrader, FxPro app), it is the broker’s cTrader offering that stood out for us.

When testing, we found cTrader not only user-friendly, with a simple window display to easily navigate between ‘copy’ and ‘automate’ trading, the platform also provided sample cBot APIs to get started with.

We recommend using cTrader’s backtesting functionality to test multiple products on the same cBot using historical data before trading live.

DIVERSE RANGE OF EXECUTION METHODS

FxPro offers instant, market and fixed execution modes, which gives you versatility when testing EAs in MT4/MT5. For the cheapest costs, however, we recommend using cTrader.

The reason for this is you’ll pay commissions of $3.50 per side (the industry standard) but obtain spreads from as low as 0.2 pips. You’ll also obtain extra charting tools compared to MT4/MT5 including 55 indicators, 26 timeframes and advanced take profit and break-even stop orders.

4. PROREALTIME - Best Auto Trading

Forex Panel Score

Average Spread

N/A

Trading Platforms

ProRealTime

Minimum Deposit

$0

Why We Recommend ProRealTime

We recommend ProRealTime for experienced or professional traders looking for a powerful platform with a sleek, easy-to-navigate interface. We particularly like this platform for its extensive backtesting, which incorporates more historical data than comparable trading solutions.

Pros & Cons

- Advanced charting and analysis tools

- Offers automated trading

- Wide range of risk management tools

- Subscription-based platform

- Limited broker support

- Steep learning curve

Platform Details

ProRealTime is designed for traders requiring advanced technical analysis capabilities with features including:

- 100+ technical indicators.

- Eight types of orders – market, limit, stop, trailing stop, one cancels the other, one triggers the other, triple orders and oblique orders.

- Unlimited timeframe selection.

- State-of-the-art market scanning tools to identify securities that match your investment criteria.

- 20 drawing tools.

ProOrder is the ProRealTime tool for automatic trading and backtesting. The forex trading platform is only available via a web browser with an internet connection. The trading platform allows for automation via three main methods – Wizard, Code, and via the ProRealTime Marketplace.

Along with NinjaTrader, Thinkorswim, and eSignal, ProRealTime is dedicated more to professional traders who want direct access to several asset classes, including stock markets.

PROORDER AUTOMATION

What we enjoyed most about ProOrder’s wizard was that it allowed us to create and define our own trading requirements without the need to write code. Using the wizard, we were able to define conditions, objectives and stop orders with easy drop-down menus. Once defined, a code generator compiled the code we needed to meet our objectives and parameters.

You can also write your own automation using the ProBuilder language. ProBuilder is very similar to Visual Basic. However, keep in mind that the ProRealTime community is not as large as other communities such as MT4 so you may face difficulty when finding the right resources for your development needs.

The last two benefits we enjoyed were the ability to backtest against historical data to test strategies with live market data and being able to use trade offline given ProOrder operates via its own server.

WE RECOMMEND IG GROUP FOR PROREALTIME

IG Group is one of the few brokers to offer ProOrder (via ProRealTime), alongside its own excellent IG platform, MT4 and L2 Dealer (for shares trading). The broker also has a huge range of over 12,000 markets to trade, the largest on this list and is a highly trusted broker.

5. ETORO - Best Copy Trading

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

We recommend eToro for discretionary traders who prefer social and copy trading to technical analysis. For those who lack the time or the inclination to develop a comprehensive trading strategy or are new to online trading, the accessible, gamified format makes copy trading straightforward. We particularly like the CopyPortfolios feature, which allows users to mimic an experienced trader’s entire trading experience in a single click.

Pros & Cons

- Tight standard account spreads

- Good trading platforms for beginners

- Solid range of CFD products

- Tight standard account spreads

- Good trading platforms for beginners

- Solid range of CFD products

Platform Details

eToro provides a range of unique copy trading platforms combined with the biggest social trading network in the world. This is because all of eToro’s trading platforms are specifically designed for social/copy trading.

KEY FEATURES OF THE ETORO PLATFORM

- The world’s largest social trading network (30 million users in over 100 countries).

- User-friendly copy-trading platform

- Great range of over 3000 assets (including forex, share CFDs, indices, commodities, and cryptocurrencies)

BEST COPY TRADING WITH ETORO

Using the eToro trading platform feels similar to using social media platforms like Facebook, Twitter and Instagram. The social trading aspect of the platform is probably the highlight for us and suits beginner traders who want to connect with other like-minded traders.

For a start, there is a dedicated news feed (like a Facebook news feed) that lets you benefit from the trading insights of other eToro users. You can even create a profile and share your own insights, either publicly or through a private profile.

We particularly liked that when you searched for a particular stock (like Tesla), you can see people’s discussions on whether it is over or undervalued.

Alongside the social trading features, we loved the simplicity and intuitive nature of the eToro platform. This is no more evident than in its copy trading features.

When searching for traders to copy, you can click, ‘copy people’, which comes up with an ‘Editor’s Choice’ of successful, seasoned investors that eToro recommends.

Lastly, having over 3000 products to trade, including 76 crypto assets, proved to us that eToro is as much about traditional trading as it is copy and social trading.

SMARTPORTFOLIOS

Smart Portfolios lets you invest in a pre-selected collection of assets to diversify your portfolio holdings.

When testing, we liked the focus on specific of a certain theme. For example, some portfolios focus on specific industries such as technology or crypto, while others are composed with a type of investment strategy in mind.

POPULAR INVESTOR PROGRAM: EARN ADDITIONAL INCOME

eToro offers a Popular Investor program that incentivises you to earn additional income if you are a profitable trader. You can get paid up to 1.5% of the value of assets under copy, if you get copied by other investors on the eToro platform.

This further demonstrates eToro’s focus as primarily a social/copy trading platform.

Ask an Expert

what is the best path to go down when experimenting with auto trading

This depends on the broker you are with (or considering) and the products and trading platforms they offer. Given most brokers offer MetaTrader 4 and 5 and the relative ease of setting up an Expert Advisor for automated trading, this might the path to go down. The best part is that most brokers do have a demo account for MetaTrader so you can test out the platforms first