OANDA Review Of 2025

OANDA is a global multi-asset CFD Forex Broker with USD 10.7 billion in average daily transaction volumes. The broker offers spreads from 0.60 pips with no commission and platforms like MT4, OANDA Trade, and TradingView. Key features include GSLO on OANDA Trade and maximum leverage of 30:1 for UK traders and 20:1 for Singapore traders.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

OANDA Summary

| 🗺️ Tier 1 Regulation | NFA/CFTC, MAS, CIRO, FCA, ASIC |

| 🗺️ Tier 2 Regulation | JFSA, KNF, MFSA |

| 💰 Trading Fees | Low Spreads |

| 📊 Trading Platforms | OANDA Trade; MetaTrader 4; TradingView |

| 💰 Minimum Deposit | $0 |

| 💰 Funding Fee | $0 |

| 🛍️ Trading Products Offered for Americans | Forex and cryptocurrencies* |

*Note: Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA.

About This OANDA UK and Singapore Review

This review will focus specifically on OANDA for traders in the UK and Singapore, this means I will review OANDA Europe Limited, based in the UK and OANDA Asia Pacific Pte Ltd (“OAP”) based in Singapore. While both entities fall under the OANDA Corporation umbrella, there are some differences to note.

My review will break down the features such costs, tradable assets, account types and trading platforms and I will make sure I highlight any differences between the UK and Singapore

My Findings with OANDA UK & Singapore

What I like about OANDA is their choice of trading platforms which all allow trading with no commission. In particular, I like the OANDA Trade platform which has stand out features for risk management, technical analysis (including advanced charts by TradingView) and speedy execution. Other platforms include MT4 which has expert advisors for automation and Tradingview for technical analysis.

OANDA has some of the lowest spreads in the industry for its 68 currency pairs, with the minimum spread starting at 0.6 pips with no commissions or 0 pips with commission on its Singaporean core pricing. Even with highly traded pairs like the EUR/USD, you’ll be able to enjoy spreads under 1.0 pips during typical trading hours.

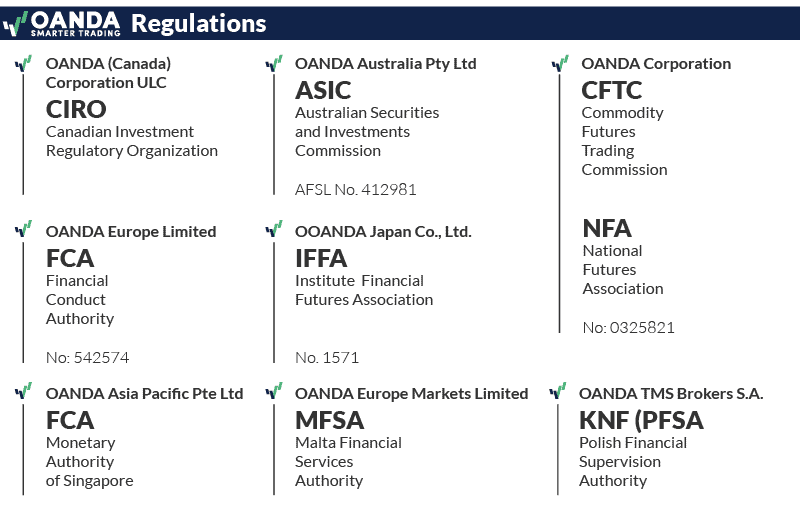

One last feature worth noting is OANDA reputation when it comes to trust. As a UK trader, the broker is regulated by the FCA and for Singapore by the MAS. Outside these regions OANDA is regulated by notable bodies such as ASIC (Australia), CFTC/NFA for USA, CIRO (Canada), KNF (Poland/Europe) and BVIFSC for the rest of the world. This review does not cover these regions, only UK and Singapore.

The only downside I’ve found with OANDA is its lack of copy trading facilities. This is a minor issue in the bigger picture as the broker lets you hedge, and automate your trades, letting you trade your way without restrictions.

OANDA Pros and Cons

- GSLO guarantee (with OANDA Trade)

- Zero minimum deposit

- Access to MT4 premium toolkit

- Automated trading supported (with MT4)

- STP-style trading with the Elite Trader Account

- Highly trusted broker

- Copytrading not available

- No swap-free/Islamic accounts

- Could have more educational resources

- No RAW account for UK traders

Open Demo AccountOpen Live Account

Affiliate receives a commission for accounts opened through the link on this page

The overall rating is based on review by our experts

Account Types

What Account Types Are Available For UK Traders?

OANDA UK offers a Standard account only, which offers spread-only pricing meaning no commissions in addition to the spread. In my opinion, this keeps trading simple since your final order can be determined by the spread. Spreads with this account start from 0.7 pips and no minimum deposit is required to commence trading.

| FX pair | Spread only |

|---|---|

| AUD/USD | 0.7 |

| EUR/GBP | 0.8 |

| EUR/JPY | 0.9 |

| EUR/USD | 0.6 |

| GBP/JPY | 1.3 |

| GBP/USD | 0.9 |

| NZD/USD | 0.9 |

| USD/CAD | 0.7 |

| USD/CHF | 0.8 |

| USD/JPY | 0.6 |

If you are an elective professional, you can request a professional account with OANDA, which grants you less consumer protection than retail traders get under the FCA. Still, you can access higher leverage and dedicated client relationship manager support. To become an elective professional, you have to meet 2 out of 3 criteria, which includes:

- Trading history of 10 traders in the last four quarters of £50,000 or more trade sizes

- Have a portfolio north of £500,000

- Worked in the financial services section in a professional position requiring CFD knowledge

What Account Types Are Available For Traders WIth OAP OANDA Singapore?

If you’re a Singaporean trader, you have the option to open a Standard, Premium, or Premium Plus account.

Standard Account With and Without Core Pricing

Unlike most brokers which strictly keep their Standard account commission free, OAP OANDA lets you choose between Standard Account and Core Pricing account.

There isn’t much difference between the Standard account in the UK and Singapore. Spreads with this account start from 0.7 pips. This account has no commission in addition to the spread (you will still need to pay any swap fees for overnight positions).

The Core pricing account has spreads from 0.0 pips (much lower than the Standard account) and has a commission of USD 3.00 per lot each way (but you can lower this with a Premium or PremiumPlus account).

Regardless which account you choose, there is no minimum deposit.

Features with Standard accounts include The OANDA orderbook refresh frequency is 20 minutes, giving you timely updates of real-time trading and popular assets on OANDA to aid your strategizing.

OAP OANDA SG Retail vs Core Pricing

| FX pair | Spread only | Core pricing |

|---|---|---|

| AUD/USD | 0.6 | 0.0 |

| EUR/GBP | 1.1 | 0.1 |

| EUR/JPY | 0.7 | 0.0 |

| EUR/USD | 1.3 | 0.0 |

| GBP/JPY | 0.8 | 0.0 |

| GBP/USD | 1.7 | 0.1 |

| NZD/USD | 1.1 | 0.1 |

| USD/CAD | 1.1 | 0.0 |

| USD/CHF | 1.0 | 0.3 |

| USD/JPY | 0.6 | 0.0 |

Premium Accounts

To qualify for and maintain a Premium OANDA account, you’ll need a minimum deposit of S$20,000 or have a notional trade volume of upwards US$30 million within 3 months. I also like that they reimburse your bank wire fees and offer volume-based rebates at US$4/million, both of which minimize your total trading costs.

On Premium, OAP OANDA orderbook speeds are increased 75%, with data refresh frequency at 5 minutes, thanks to VPS. This way, you’ll have near real-time updates of the hotly traded assets and commodities as well as their current trade volumes, helping you refine your strategies based on market conditions.

Another feature that may appeal is the dedicated accounts manager feature. This feature can help you manage all your OANDA trading activities, saving you time to focus on your trade strategies instead.

Premium Plus Account

To use the Premium account you will need an initial deposit of $100,000 or trade a minimum of US$200 million in 3 months. Naturally for this increased requirement, you get all the same benefits as the Premium account plus a few other benefits.

These benefits include a 20% deduction on admin fees, subsisdised subscription and extra volume based rebates (up to USD 6 million. Premium Plus Account holders also have One interesting feature is personal 1 on 1 access to OANDA’s market analyst who can provide insights on market updates and outlooks.

Other Accounts – Demo

A demo account with any platform you choose and test out OANDA’s real-time spreads with virtual funds before opening a live account with real funds.This account is free and does not have an expiry period.

Spreads & Commission

Trading Cost: 7.10/10

OANDA UK

With OANDA UK, the Standard account is very competitive. Its variable spreads start at 0.60 pips on EUR/USD with no commission, one of the lowest I’ve seen for this type of account.

Minimum Spreads on Standard

| Minimum Spreads - Standard Account | |||||

|---|---|---|---|---|---|

| Broker | EURUSD | AUDUSD | GBPUSD | USDCAD | USDJPY |

| OANDA | 0.6 | 0.7 | 0.9 | 0.7 | 0.6 |

| Pepperstone | 1.00 | 1.00 | 1.00 | 1.10 | 1.00 |

| IC Markets | 0.8 | 0.8 | 0.8 | 0.8 | 0.8 |

| Eightcap | 1 | 1.2 | 1 | 1 | 1.1 |

| ThinkMarkets | 1.1 | 1.1 | 1.3 | 1.2 | 1.4 |

| XM | 0.8 | 1.6 | 0.9 | 1.5 | 0.9 |

Our analyst, Ross Collins, tested OANDA’s spreads to determine how cheap the broker is during typical trading conditions and compared them against 40 other brokers. His tests found that OANDA’s spreads average 1.06 pips on EUR/USD, slightly lower than the industry average of 1.11 pips.

|

Standard Spreads Tested By Ross Collins

|

|||||

|---|---|---|---|---|---|

|

1.06 | 1.00 | 1.86 | 1.55 | 1.75 |

|

0.73 | 0.82 | 1.15 | 1.09 | 1.00 |

|

1.21 | 1.24 | 1.50 | 1.55 | 1.60 |

|

1.34 | 1.69 | 1.78 | 2.00 | 1.82 |

|

1.01 | 1.02 | 1.23 | 1.27 | 1.17 |

|

1.16 | 1.07 | 1.77 | 1.74 | 2.30 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

OANDA gets its forex pricing from major liquidity providers such as Citibank, UBS, and JP Morgan, so you get some of the lowest spreads on the Standard account.

OAP OANDA Singapore

Singapore traders can choose to trade on one of two types of spreads on all accounts – retail or core pricing:

Retail Spreads

The retail spreads with OAP OANDA Singapore are on par to that of UK, with the minimum starting at 0.6 pips for the EUR/USD pairs. The ideal combination of low spreads and no commissions can supercharge your tradinge profits by significantly minimizing cost and capital needed to execute a trade, especially at high volumes.

Core Pricing

The lower, core pricing with individual commissions start at as low as 0 pips with the EUR/USD pair.

Nearly all major trading pairs also offer spreads under 1.0 pips, enhancingmaximizing your profit and ability to trade on these liquid and volatile forex CFDs assets.

However, unlike the retail rates, you’ll be charged a commission per lot in your base currency.

The commissions with OANDA’s core pricing are as below:

Commissions table for Singapore Traders

| Broker | Account Types | Commission ((USD) |

|---|---|---|

| OANDA | Core | $4.00 (Premium/Premium Plus)[9] |

| Eightcap | Raw | $3.50 |

| Pepperstone | Razor | $3.50 |

| IC Markets | RAW | $3.50 |

| FP Markets | Raw | $3.00 |

| CMC Markets | FX Active Trader | $2.50 |

| BlackBull Markets | ECN Prime, ECN Institutional | $3.00 |

Leverage & Margin

Leverage differs for UK traders and Singapore traders due to regulatory requirements sent by each broker’s respective regulators (FCA and MAS).

What leverage can UK traders trade with

With OANDA UK, you have a maximum of 30:1 as a Forex retail trader, so you must place a 3% margin requirement to open a trade. For elective professionals, the broker allows a maximum leverage of 100:1, allowing you to open a Forex position with a 1% margin requirement.

According to the FCA regulations, OANDA offers a maximum 20:1 for minor pairs and leverages of 10:1 and below for commodities and other individual equities.

What Leverage can Singapore traders trade with

On OANDA Singapore, the maximum retail leverage is 20:1. In contrast, elected professional traders on Premium and Premium Plus accounts can leverage up to 50:1 with Forex CFD pairs — with a respective margin of 5% and 2% as required by the MAS. In line with the local trading policies under MAS, minor pairs are offered with a 10:1 leverage and 4:1 for exotic pairs.

Trading Platforms

Score: 7/10

OANDA UK and Singapore offer the same trading platforms: MetaTrader4, TradingView, OANDA Web, and OANDA Mobile.

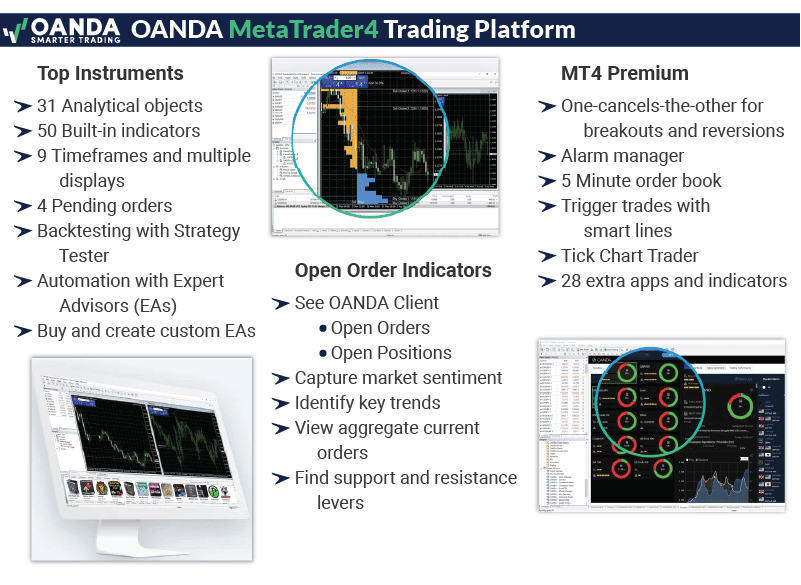

MetaTrader 4

MetaTrader 4 is the most popular trading platform available in the market. Being one of the first really usable platforms for retail traders like you are I has allowed the platform to gain a strong reputation for reliability and ease of use. When trading with this platform, you will find its appeal lies in the fact it offers the essential features needed for trading efficiency and minimum of stuff you don’t need.

The platform contains 3 execution modes, 9 timeframes, and 23 analytical objects and 30+ technical indicators. Not as many as some platform but everything you really need to trade with. You can also program custom indicators through the MQL4 language or develop expert advisors to automate your trades. MT4 is OANDA only automated trading offer.

To help you make the most of MT4, OANDA includes premium trading tools package like 28 additional plugins and technical indicators.

One of the tools that stood out for me was the Mini Terminal EA, which allowed me to automatically append stop loss and take loss orders to my instant trades. This feature is a great quality-of-life upgrade as your risk management will always be included with each trade, limiting the chances of making a mistake or forgetting to add a stop-loss completely.

OANDA Trade

The OANDA Trade is another good option, this platform includes range of personalized, intuitive chart types with 100+ different indicators, risk management and strategy instruments.

What stood out to me is the Depth of Market (DoM) pricing this platform has for the EUR/USD pair. It promises you tighter spreads with typically traded lot sizes of the EUR/USD cross, further increasing liquidity and volatility, subsequently your chances of raking in a profit.

Advanced charting is available on your OANDA web account with additional overlay of technical tools through the TradingView API.

Alternatively, you can use your OANDA account with TradingView for high-precision market and sentiment analysis instruments for your Forex trades – including automated charting and trend extraction via Autochartist.

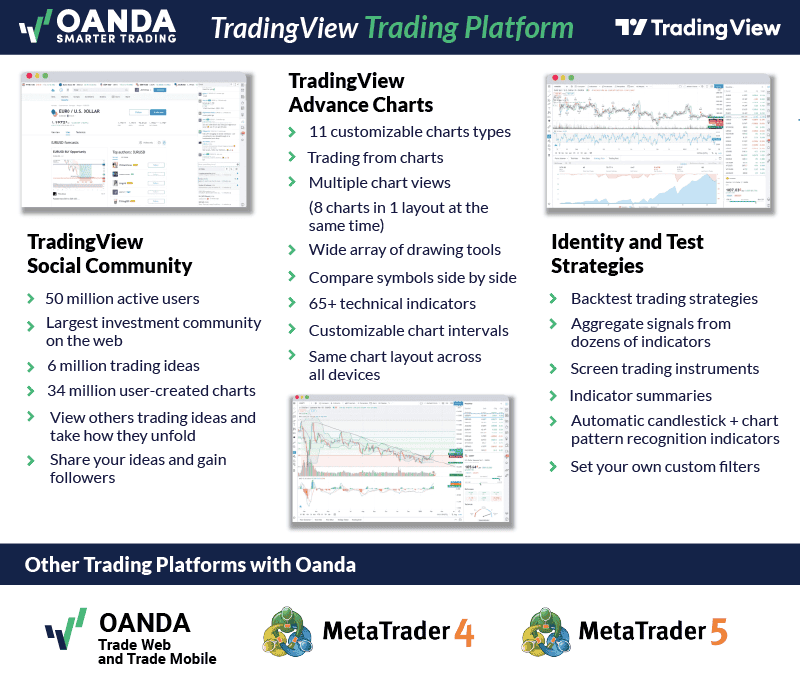

TradingView

TradingView is a high-volume charting system with 400+ built-in indicators and 10+ smart drawing tools.

You can customize your trading display by adding up to 16 charts per tab and individualize your indicator lineup from their library of over 100,000+ custom indicators. This way, your trading chart display will always be optimized for your portfolio and trading style.

What I particularly like is the Auto Chart Patterns feature, which can instantly extract trends and market direction at one-click. It even includes candlestick pattern recognition, helping you identify trends without needing extensive analysis knowledge.

Using Pine Script, TradingView’s scripting language, you can create and share your own trading strategies. The platform also offers social trading features, letting you follow and interact with other traders.

Whether on web browser or mobile app, TradingView provides seamless cross-device access and integrates with different brokers for direct trading. This makes it easier to trade on-the-go, regardless of your device.

Mobile Trading

The OANDA mobile app is available for smartphones and tablets running iOS and Android. It has a customisable and clean interface, easy-to-access market watchlists, and multiple technical indicators and drawing tools on its charts.

While testing the OANDA mobile app, I liked the price alert notifications, which trigger when the market reaches a price you set. This is a great feature as it can alert you when a new trading idea you’ve prepared is ready to review, so you’re not watching the charts all day.

Alternatively, you can access the MetaTrader4 mobile app for iOS and Android. The MT4 mobile trading app uses your MT4 trading account, allowing you to manage your open trades on the go with access to 30+ MT4 trading indicators and drawing tools. However, you cannot access your expert advisors in my tests, so running and managing your EAs is limited to the desktop version.

Is OANDA Safe?

OANDA has a trust score of 96, based on its regulation, reputation, and reviews.

Regulation For Singapore Traders

For traders in Singapore, OANDA holds a Capital Markets Services licence under f the Monetary Authority of Singapore (MAS) as OANDA Asia Pacific Pte. Ltd. (OAP). As a regulated broker, OAP must put in place controls in areas such as anti-money laundering, cybersecurity, risk management, amongst other to ensure compliance with regulatory requirements in Singapore.

As a regulated broker, OAP is also required to ensure clients’ funds are properly handled and are bound by best execution principles in providing fair and transparent trading conditions.

| OANDA US Safety | Regulator |

|---|---|

| Tier-1 | NFA/CFTC MAS CIRO FCA ASIC |

| Tier-2 | JFSA KNF MFSA |

| Tier-3 | FSC-BVI |

Reviews

They have a TrustPilot score of 3.6 out of 5 from 497 reviews.

How Popular Is OANDA?

OANDA demonstrates strong visibility in the online trading landscape. With approximately 550,000 monthly Google searches, it ranks as the 6th most popular forex broker among the 65 brokers analyzed. Web traffic data positions it somewhat lower but still strong, with Similarweb reporting 4,647,000 global visits in February 2024, placing OANDA as the 11th most visited broker.

Founded in 1996, OANDA is one of the forex industry’s pioneering online brokers. While the company doesn’t publicly disclose its exact client numbers, industry estimates suggest it serves hundreds of thousands of traders globally, with particularly strong penetration in North America, Europe, and developed Asia-Pacific markets. OANDA’s trading volumes reportedly reach several billion dollars daily, reflecting its established position as one of the industry’s institutional-grade retail forex brokers. The company’s acquisition by CVC Capital Partners in 2018 positioned it for further expansion beyond its traditional markets.

| Country | 2024 Monthly Searches |

|---|---|

| United States | 49,500 |

| Germany | 40,500 |

| India | 33,100 |

| United Kingdom | 33,100 |

| Spain | 22,200 |

| France | 22,200 |

| Switzerland | 22,200 |

| Italy | 18,100 |

| South Africa | 12,100 |

| Canada | 12,100 |

| Japan | 12,100 |

| Colombia | 9,900 |

| Philippines | 9,900 |

| Singapore | 9,900 |

| Portugal | 9,900 |

| United Arab Emirates | 6,600 |

| Brazil | 6,600 |

| Australia | 6,600 |

| Mexico | 6,600 |

| Malaysia | 6,600 |

| Nigeria | 6,600 |

| Netherlands | 6,600 |

| Austria | 5,400 |

| Turkey | 4,400 |

| Sweden | 4,400 |

| Argentina | 4,400 |

| Cyprus | 4,400 |

| Hong Kong | 4,400 |

| Thailand | 4,400 |

| Kenya | 4,400 |

| Poland | 3,600 |

| Indonesia | 2,900 |

| Taiwan | 2,900 |

| Ireland | 2,900 |

| Egypt | 2,900 |

| Ghana | 2,900 |

| Pakistan | 2,400 |

| Bangladesh | 2,400 |

| Saudi Arabia | 2,400 |

| Vietnam | 2,400 |

| Peru | 2,400 |

| Greece | 2,400 |

| Mauritius | 2,400 |

| Morocco | 1,900 |

| New Zealand | 1,600 |

| Chile | 1,600 |

| Algeria | 1,600 |

| Jordan | 1,600 |

| Tanzania | 1,600 |

| Sri Lanka | 1,300 |

| Dominican Republic | 1,300 |

| Uganda | 1,300 |

| Ecuador | 1,000 |

| Costa Rica | 1,000 |

| Panama | 1,000 |

| Ethiopia | 880 |

| Venezuela | 880 |

| Bolivia | 720 |

| Cambodia | 590 |

| Botswana | 480 |

| Uzbekistan | 390 |

| Mongolia | 70 |

2024 Average Monthly Branded Searches By Country

United States

United States

|

49,500

1st

|

Germany

Germany

|

40,500

2nd

|

India

India

|

33,100

3rd

|

United Kingdom

United Kingdom

|

33,100

4th

|

Spain

Spain

|

22,200

5th

|

France

France

|

22,200

6th

|

Switzerland

Switzerland

|

22,200

7th

|

Italy

Italy

|

18,100

8th

|

South Africa

South Africa

|

12,100

9th

|

Canada

Canada

|

12,100

10th

|

Range of Markets

Score: 6/10

While using my OANDA account, I feel that the range of markets on OANDA is tailored for forex trading. The broker offers 68 currency pairs, including seven majors, and the rest are a blend of 61 minors and exotics, giving you plenty of options to trade.

I also found the broker offered a decent selection of markets, with 19 indices, 10 commodities, 21 metals, and six bonds covering every major market with a single OANDA account.

Interestingly, the broker offered gold and silver in different currencies, allowing you to find volatility in crosses like GOLD/HKD, which I haven’t seen with other brokers.

| OANDA Trading Products | ||

|---|---|---|

| UK | Singapore | |

| Currency Pairs | 68 | 68 |

| Indices | 16 | 16 |

| Energies (oil, gas) | 3 | 3 |

| Metals (gold, silver) | 5 Note: Gold vs 10 cross fiats Silver vs 10 cross fiats | 5 |

| Soft Commodities (coffee, rice) | 4 | Note: Gold vs 10 cross fiats |

| Bonds/Treasuries | 4 | Silver vs 10 cross fiats |

| Shares | 0 | 4 |

*Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA.

Funding Options

Score: 5/10

Funding Options For UK Traders

For OANDA UK, you can deposit using supported credit and debit cards, CHAPS wire transfer, SWIFT wire, SEPA credit transfer (SCT), or GBP-only Internet banking via faster payments. Although OANDA doesn’t charge deposit fees, your respective financial providers may charge your bank account for making the transfer.

OANDA UK supports transfers to credit and debit cards and local and global bank accounts for withdrawals.

For card payments, OANDA offers one free withdrawal to your credit or debit card per calendar month. Additional withdrawals incur fees based on your account currency.

UK bank transfers incur a small fee, which varies depending on your withdrawal frequency

Funding Options for Singapore Traders

When looking at OAP’s payment methods, I noted that it had a healthy balance of local and global deposit options with zero deposit fees. You can fund your OANDA trading accounts using local methods like DBS Bill Pay, PayNow / QR Pay, or the FAST network for instant deposits to your trading accounts via your banking providers.

Alternatively, there is Bank/Wire Transfers. While DBS Bill Pay and PayNow have no provider fees, you may have to pay a small token when using the FAST network or Bank/Wire Transfers.

Withdrawals from your Singaporean trading account are only available via Bank/Wire Transfers.

For wire transfers, SGD to SGD transfers are free. Non-SGD transactions incur SG$ 25 for the first withdrawal of the calendar month and SG$ 35 for subsequent withdrawals

I like that OANDA doesn’t require a minimum deposit for Singapore or UK clients. This allows you to start trading with what you are comfortable with instead of being forced into a higher minimum deposit than other brokers impose.

Customer Service

Score: 9/10

In terms of trader support, Singapore is much the same as in the UK. You reach out to customer support via email, live chat and via phone.

On the UK front, you’ll be redirected to a dedicated domain with an indexed library of FAQs on how to manage your account and trading taxes, funding your account, troubleshooting and securing your personal and financial data.

What’s great is that this information library is presented to you in various languages – English, Dutch, Spanish, French, Portuguese, and Italian.

Here, you can also access their 24/7 live chat feature. You’ll be met with a fairly decent, impersonal chatbot at first contact but you can always request for human assistance if that doesn’t work out.

The transfer from bot to human agents takes less than a minute with the friendly, chat support staff providing detailed answers to quell your trading questions.

Alternatively, you can go the email route and send a message customer support.

Research and Education

Score: 7/10

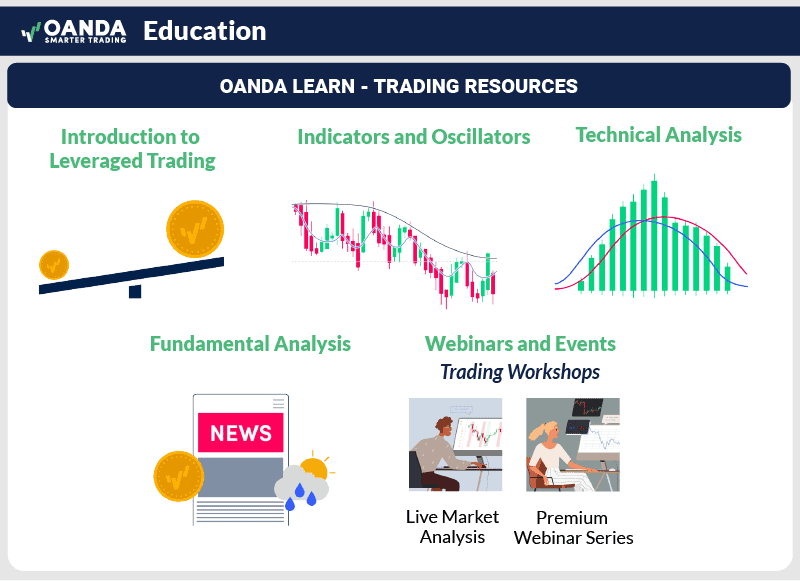

In both the UK and SG OANDA website, you will find a devoted section to trading education called “Learn”. Far as I could tell both websites have the same (or nearly the same offering).

The ‘Learn’. Education suite is made up beginner, adept, and experienced Forex trading resources. This includes blogs about Forex topics like leverage, videos, even high-quality, comprehensive webinars detailing each and every aspect of Forex financial markets at any level. What I personally liked is the careful interlinking between resources, which allow you to explore more information based on your skill levels.

On top of that, you’ll find special, weekly Masterclass content by OANDA’s very own financial analysts, who will guide you step-by-step on topics like market cycles, analysis, plotting pivot points, reading candlestick patterns, and strategy creation. It’s what I would consider a goldmine for newer traders breaching into forex and CFD trading, and can serve as a refresher course for experienced

Great Market Research

OANDA offers a broad range of research for forex traders. To start with, the broker’s MarketPulse site has an excellent selection of articles organized by category, with multiple updates published each day, including news headlines on both MT4 and the OANDA Trade platform.

There is also a decent range of written educational materials and webinars, including an online course that teaches the basics of fundamental and technical analysis.

Topics covered include getting starts, fundamental analysis, technical analysis and capital management.

Final Verdict on OANDA

Based on my testing, I think OANDA is one of the best forex brokers, thanks to its relatively low spreads, decent trading conditions, and choice platforms. I found the broker’s spreads to be amongst the lowest across its impressive 68 currency pairs, making OANDA a top pick for forex and CFD trading.

After using OANDA and processing the test results, I give OANDA a final score of 81/100, excelling in my categories for trust, customer service, and trading platform choice.

The Singaporean platform offers a robust, learning-centered trading environment with competitive retail spreads, low core pricing, and decent commission rates. Plus, it’s locally regulated by MAS. Discount financing and volume-based rebates on Premium range accounts are good ways to cut your costs further.

In the UK, OANDA offers low, commission-free spreads starting at a minimum of 0.8 pips, even with major traded pairs. Plus, all UK accounts come with negative balance protection, thanks to its Tier-1 regulation with the FCA in Europe—a regulatory body on par with the NFA/CTFC in the USA or ASIC in Australia

Open Demo AccountOpen Live Account

Affiliate receives a commission for accounts opened through the link on this page.

About the Review

The forex trading comparison on Compare Forex Brokers was made by experienced individuals who have worked with financial services companies. They understand how hard it is to compare forex brokers and have developed criteria from spreads to leverage traders to find the best forex broker for them.

If you see any issues with any of our forex broker comparison tables or this OANDA review, please contact the owners using the contact form and changes will be made promptly to ensure all forex trading elements are correct.

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Go to OANDA Website

Visit Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research

Ask an Expert