What Are The Best Forex Brokers In UAE?

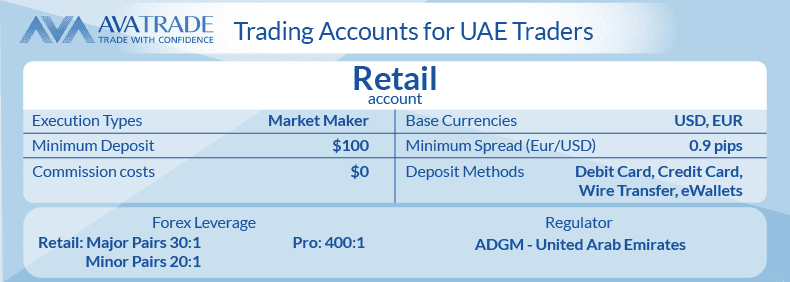

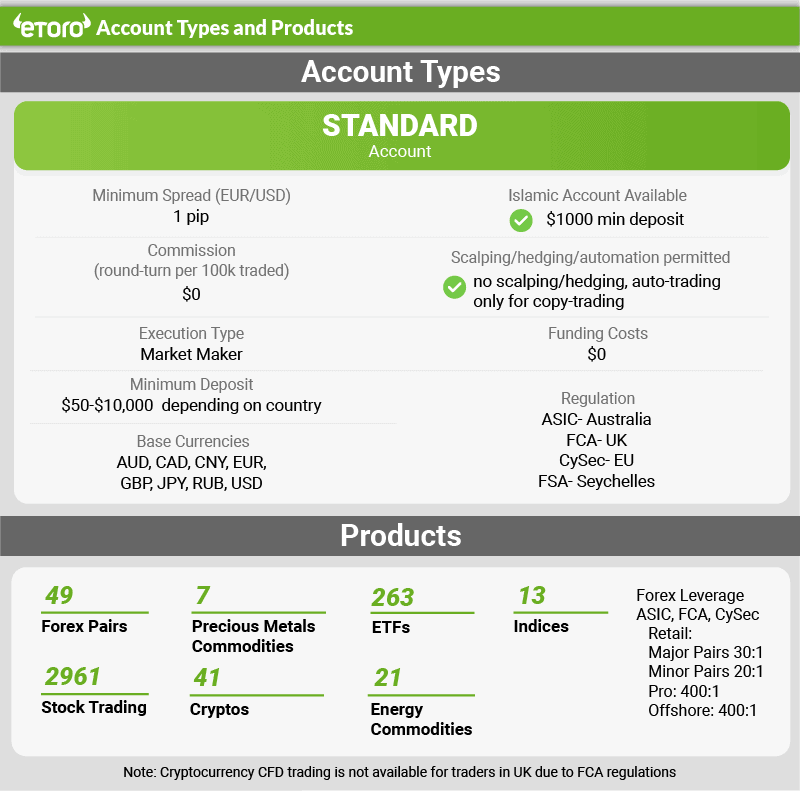

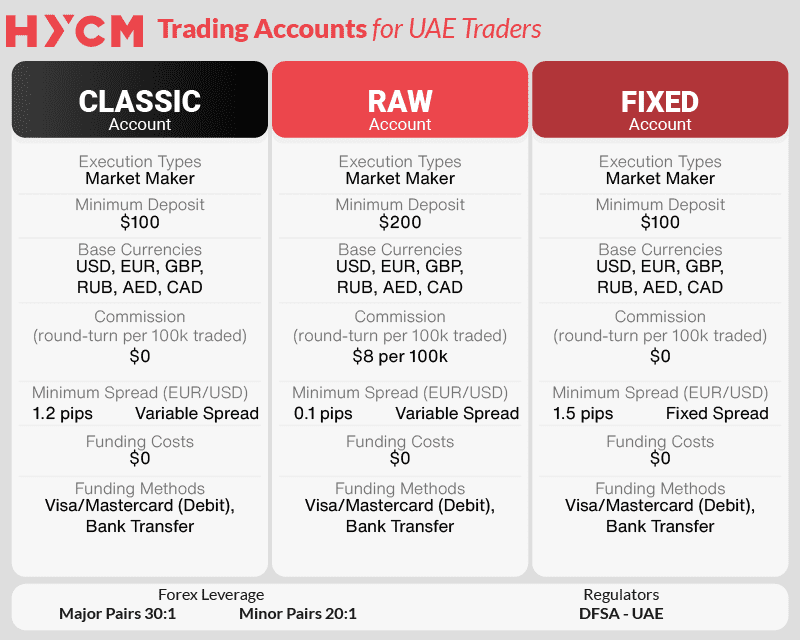

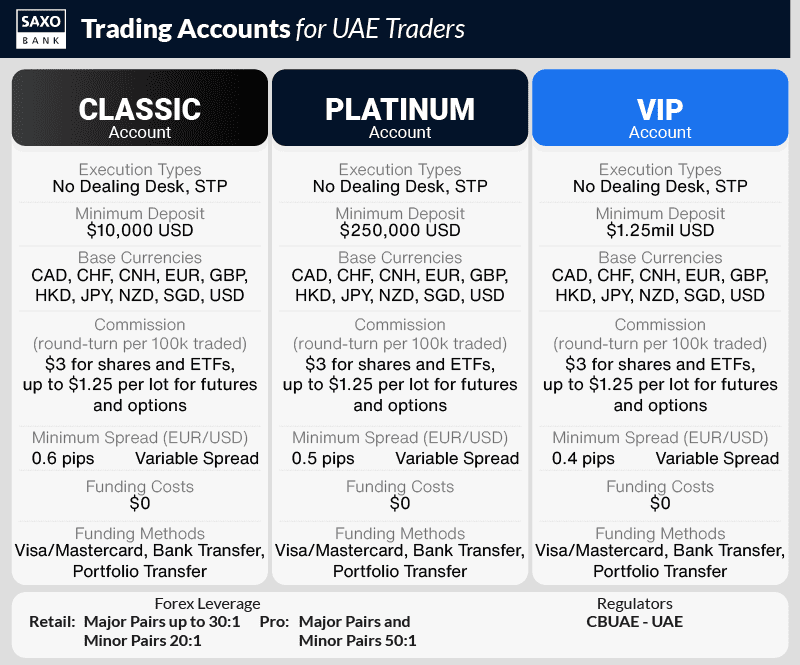

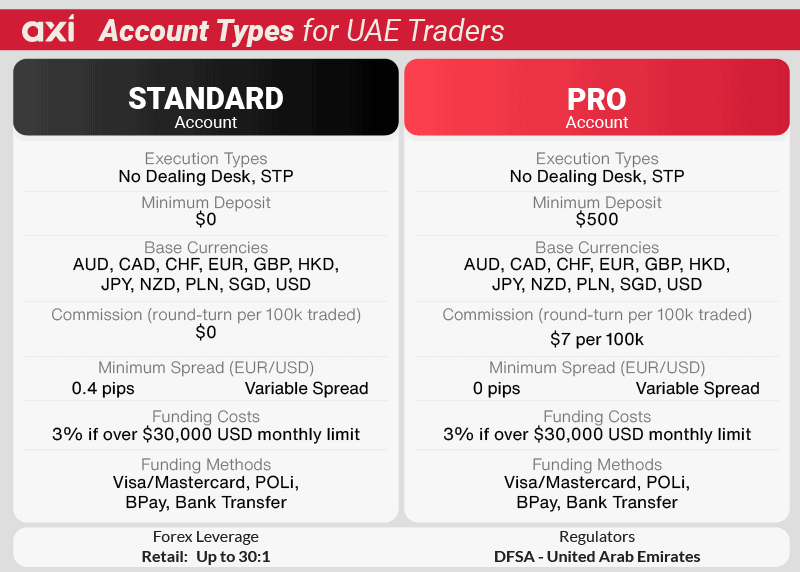

Forex trading in Dubai requires a DFSA-regulated forex broker based in the UAE. We compared the best forex brokers in Dubai including Islamic accounts based on April 2024 spreads, and trading platforms for forex.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert

Is the DFSA the only regulator in the UAE?

The UAE has a number of regulators – the DFSA is the regulator of the Dubai free trade zone, in much the same way the ADGM is the regulator of the Abu Dhabi free trade zone. Regulators on the mainland (outside the free trade zone) include the Central Bank of UAE and SCA (Securities and Commodities Authority)

Can i use DFSA regulated broker if i am in Abu Dhabi?

Yes, being in the UAE you can use a DFSA regulated broker throughout the region

I heard the DFSA are making changed later this year. Will this impact my trading conditions?

That is correct, On the 4th of December 2021, the DFSA tightened leverage conditions when trading. While retail traders could previously trade major forex pairs, gold and major indices at 50:1, it is not restricted to 20:1. Minor forex pairs and minor indices are now 10:1 after previously being 20:1. Other leverage changes include oil, now 20:1 (previously 50:1), commodities (excluding gold and oil) 10:1 (previously 20:1), shares 5:1 (previously 10:1), cryptocurrencies 2:1 (was 5:1). Bonds remain 20:1 and all other markets are now to 5:1.

All retail traders will also receive negative balance protection meaning you cannot lose more than your deposit. A margin close out will occur when the equity in your trading account drops below 50% which means traders using a guaranteed stop loss should check how margin close out rules will affect them with their broker.

I there any objection from the uae bank…for withdrawing and depositing money to forex broker ..or before starting a forex trading in UAE we have to get permission from Bank?

Hi Jamsheer, you will need to contact your local bank but technically you are not trading your money to the forex broker. If you are using a UAE regulated broker then the broker must have a segregated account in your name and this is where your money will be transferred to. This segregated account will most likely be with a UAE authorised bank. Since the account is segregated, the forex broker cannot touch the funding. Just make sure you are using a UAE regulated broker (i.e. DFSA, ADGM or CBUAE regulated).