Best Online Trading Platforms

We shortlisted regulated brokers in the UAE and tested their platform capabilities, execution quality, and trading costs. Our evaluation focused on platform variety, instrument selection, and features suited to different trading styles from beginner to professional.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

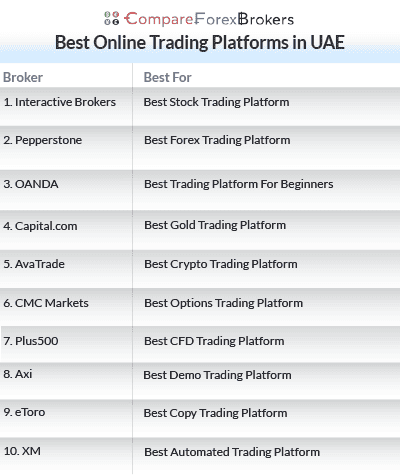

Best Online Trading Platforms

- Interactive Brokers - Best Stock Trading Platform

- Pepperstone - Best Forex Trading Platform

- OANDA - Best Trading Platform For Beginners

- Capital.com - Best Gold Trading Platform

- AvaTrade - Best Crypto Trading Platform

- CMC Markets - Best Options Trading Platform

- Plus500 - Best CFD Trading Platform

- Axi - Best Demo Trading Platform

- eToro - Best Copy Trading Platform

- XM - Best Automated Trading Platform

Which trading platform is the best in UAE?

Pepperstone offers the best trading platforms in the UAE with MT4, MT5, cTrader, and TradingView access, delivering 77ms execution speeds and spreads from 0.0 pips across 1,475 instruments. Nine additional UAE regulated brokers were shortlisted based on platform diversity, customisation capabilities, and compatibility with automated trading strategies.

1. Interactive Brokers - Best Stock Trading Platform

Forex Panel Score

Average Spread

EUR/USD = N/A GBP/USD = N/A AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

Interactive Brokers delivers the best stock trading platform in the UAE through direct access to 167 global exchanges, letting you buy and hold actual shares rather than CFDs. You receive dividends, exercise voting rights, and own the underlying asset instead of speculating on price movements through leveraged contracts.

The tiered commission structure rewards volume with rates dropping from 0.20 basis points down to 0.08 basis points as your monthly trading exceeds $5 billion.

The platform selection includes Trader Workstation (TWS) Desktop for advanced users, Mobile apps for trading on the go, and GlobalTrader for simplified access. Beyond equities, you access bonds for fixed income, over 42,000 mutual funds, and ETFs tracking every sector and region.

The iBKR Campus provides webinar-based education across 17+ investment topics, helping you understand how to use different asset classes effectively within your portfolio strategy.

Pros & Cons

- Real stock ownership, 167 exchanges

- Tiered commissions decrease with volume

- TWS Desktop, Mobile, GlobalTrader platforms

- Bonds, 42,000+ mutual funds, ETFs

- iBKR Campus education, 17+ topics

- DFSA regulation

- Steep learning curve for beginners

- Complex commission structure

- Higher minimum deposits required

- Wire transfer deposit fees apply

Broker Details

Platform Selection: Desktop, Mobile, and Web

Trader Workstation Desktop provides institutional-level tools including real-time Level II market data, Customisable workspace layouts, and advanced charting with hundreds of technical indicators like MACD, RSI, Bollinger Bands, and Fibonacci retracements.

You can arrange multiple windows showing candlestick charts, order entry tickets, watchlists tracking your favourite stocks, live news feeds from Reuters and Bloomberg, and account information to match your trading style.

The platform supports complex order types like bracket orders, algorithmic routing, and basket trading for managing multiple positions simultaneously across different markets.

The Mobile app maintains essential TWS functionality on iOS and Android devices, giving you full market access when away from your computer. GlobalTrader simplifies the interface for newer investors, removing complexity while providing access to the same global markets and investment products.

All three platforms sync seamlessly, meaning your watchlists, positions, and settings carry across desktop and mobile without manual configuration.

Global Market Coverage and Asset Classes

The 167 stock exchanges span North America, Europe, Asia-Pacific, and emerging markets, letting you invest in companies trading on NYSE, NASDAQ, London Stock Exchange, Tokyo Stock Exchange, and dozens of smaller regional markets. You trade during local market hours for each exchange, providing nearly 24-hour access to equity markets somewhere globally.

Currency conversion happens automatically when buying foreign stocks, with competitive FX rates included in the tiered commission structure.

Beyond stocks, you access thousands of ETFs covering every investment theme from broad market indices to sector-specific funds and commodity exposure. The bond selection includes government securities, corporate bonds, and municipal bonds from multiple countries with varying maturities and credit ratings.

Options trading spans stocks, ETFs, and indices with strategy builders visualizing multi-leg positions. Futures coverage includes commodities, currencies, and index contracts for sophisticated hedging and speculation strategies.

Educational Resources and Research Tools

iBKR Campus offers live webinars and recorded sessions covering stocks, options, bonds, futures, and portfolio management strategies. The education progresses from beginner concepts like order types and market mechanics through advanced topics including options strategies and risk management.

You can practice everything learned using the paper trading account mirroring live market conditions with virtual funds, tracking performance metrics identically to real trading.

Research tools aggregate fundamental data showing financial statements, valuation ratios, earnings projections, and analyst ratings for individual companies. Technical analysis includes built-in indicators, pattern recognition, and drawing tools across multiple timeframes.

Third-party research from various firms provides diverse perspectives on potential investments. Risk Navigator analyses portfolio concentration, correlation between holdings, and stress-tests scenarios showing how positions might perform during different market conditions.

2. PEPPERSTONE - Best Forex Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Pepperstone provides the best UAE forex brokers in the UAE with access to MT4, MT5, cTrader, and TradingView, covering every trading style from manual execution to fully automated strategies. The Razor Account delivers 0.0 pip raw spreads on EUR/USD with $3.50 per side commission, while execution speeds average 77ms on limit orders.

The Smart Trader Tools package enhances MetaTrader 4 with Mini Terminal for one-click execution, Correlation Matrix showing currency relationships, and Alarm Manager tracking price levels across multiple instruments.

The cTrader platform specialises in algorithmic trading with C# coding capabilities, Level II pricing, and advanced charting. TradingView integration provides 100+ indicators, Pine Script for custom tools, and social features for sharing strategies while maintaining the same tight spread pricing across all platforms.

Pros & Cons

- Five platforms

- 0.0 pips raw spreads, $3.50 commission

- 77ms execution speeds

- 1,475 instruments across all asset classes

- Smart Trader Tools enhance MT4

- $0 minimum deposit

- Standard Account 1.0 pip spreads

- $7 commission exceeds some competitors

- Cannot fund directly with AED

- No guaranteed stop-loss orders

Broker Details

Platform Variety for Different Trading Styles

MT4 suits traders wanting the largest Expert Advisor marketplace with thousands of free and paid automated strategies. The Smart Trader Tools transform standard MT4 into an institutional platform with Mini Terminal enabling preset lot sizes and stop distances for instant execution.

MT5 expands capabilities with 38 technical indicators versus MT4’s 30, increases timeframes to 21 options, and includes an integrated economic calendar displaying scheduled high-impact events.

cTrader Automate lets you build custom trading robots using C# programming language, offering superior coding capabilities compared to MT4’s MQL4. The platform displays Level II pricing showing full market depth, helping you understand available liquidity before entering positions.

TradingView provides professional charting with Pine Script for creating custom indicators, social feeds for strategy sharing, and direct trade execution without switching applications. You switch between platforms freely as all connect to the same Razor Account pricing.

Execution Quality and Infrastructure

Equinix data centre hosting in New York, London, and Tokyo ensures low-latency connections regardless of your UAE location. The infrastructure processes orders through multiple tier-1 liquidity providers, aggregating pricing to maintain tight spreads even during volatile periods.

You won’t experience requotes or order rejections during news releases when other brokers’ spreads widen significantly, as Pepperstone maintains execution consistency across market conditions.

The Active Trader Program provides three discount tiers reducing costs as your monthly volume increases. These savings apply across all platforms and instruments, meaning your MT4 forex trades, cTrader algorithmic strategies, and TradingView analysis all contribute toward volume thresholds.

Multi-Asset Trading Capabilities

You get 93 forex pairs with raw spread pricing, covering everything from EUR/USD and GBP/JPY through to exotic currencies like Turkish Lira and South African Rand. The 1,162 share CFDs let you trade Tesla, Apple, BP, and major European stocks without the complexities of owning actual shares.

When broader market opportunities arise, you can switch to index CFDs tracking S&P 500 or DAX 40 for single-instrument economic exposure.

Commodities give you inflation hedges through gold and silver, energy plays when oil prices shift, and agricultural exposure following harvest seasons. Cryptocurrency CFDs on Bitcoin and Ethereum use perpetual contracts, eliminating the hassle of rolling futures or managing expiry dates.

This range means you’re applying the same tight spreads and platform advantages whether scalping EUR/USD or building positions across tech stocks and precious metals.

3. OANDA - Best Trading Platform For Beginners

Forex Panel Score

Average Spread

EUR/USD = 0.89 GBP/USD = 1.54 AUD/USD = 1.37

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

OANDA provides the best platform to learn forex trading for beginners through their proprietary FxTrade interface delivering commission-free trading with spreads averaging 0.89 pips EUR/USD. The platform eliminates complex commission calculations while you’re learning position sizing and risk management, showing you one simple cost per trade.

The Trading Academy offers structured learning paths progressing from forex basics through advanced strategies, with educational content integrated into live market examples rather than generic theory. Paper trading functionality mirrors live account conditions exactly, letting you practice with virtual funds while tracking identical performance metrics.

The FxTrade platform integrates TradingView charts directly, providing professional-grade technical analysis without switching between applications. You trade 68 forex pairs with $0 minimum deposit and no funding fees.

Pros & Cons

- FxTrade platform

- Commission-free tradin

- Paper trading mirrors live conditions

- Trading Academy with structured curriculum

- Multi-regulator oversight

- $0 minimum deposit

- No raw spread ECN pricing

- Limited to MT4 and FxTrade (no MT5, cTrader)

- Standard spreads wider than ECN brokers

- Educational focus primarily on forex

4. Capital.com - Best Gold Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 1.3

AUD/USD = 0.6

Trading Platforms

MT4, TradingView, Capital.com Web Platform and CFD Trading App

Minimum Deposit

$50

Why We Recommend Capital.com

Capital.com stands out for gold trading platforms through their guaranteed stop-loss orders on proprietary platforms, protecting you from slippage when XAU/USD prices swing violently during geopolitical tensions or Federal Reserve announcements. You pay 0.6 pip spreads on gold with zero commission, making your total cost transparent without calculating separate fees.

You also trade across 4,500 other markets spanning commodities like silver and crude oil, stock CFDs from global companies, equity indices tracking major economies, and crypto CFDs on Bitcoin and Ethereum. The platform selection gives you MT4 and MT5 for automated strategies, TradingView for advanced charting, or Capital.com’s own web and mobile apps with built-in AI analysing your trades.

The AI flags risky behaviour like oversized positions or overtrading, helping newer traders avoid common mistakes. Starting requires no minimum deposit, and all funding methods are free.

Pros & Cons

- Guaranteed stop-losses on gold trades

- 0.6 pip spreads, zero commission

- 300:1 leverage via SCA regulation

- 4,500 markets including commodities

- AI risk management tools

- $0 minimum, free funding

- No raw spread ECN account

- Single account tier only

- GSLO only on proprietary platforms

5. AVATRADE - Best Crypto Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5,

AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

AvaTrade excels for cryptocurrency trading by offering 27 crypto CFDs including Bitcoin, Ethereum, Litecoin, and smaller altcoins through fixed spread accounts at 0.8 pips. Fixed spreads mean you pay consistent costs regardless of market volatility, unlike variable spreads that widen dramatically during crypto’s frequent price swings.

The broker operates under ADGM regulation with automatic swap-free Islamic accounts for UAE residents, keeping positions free from overnight interest charges for up to 5 days.

The unique AvaProtect feature lets you insure losing crypto positions up to $50,000 for premiums between 3-10% based on duration, essentially buying protection against Bitcoin’s notorious volatility. You access multiple platforms including MT4, MT5, AvaOptions for trading forex options, and AvaTradeGO mobile app.

AvaSocial and ZuluTrade integration enable copy trading if you prefer mirroring experienced crypto traders. The fixed spread account charges 0.8 pips with $100 minimum deposit, while Professional accounts offer 0.6 pips with $1.60 commission if you qualify for 400:1 leverage.

Pros & Cons

- 27 crypto CFDs with fixed spreads

- Automatic Islamic accounts, ADGM regulated

- AvaProtect insurance for positions

- Fixed 0.8 pips or Professional 0.6 pips

- Multiple platforms including AvaOptions

- Copy trading via AvaSocial, ZuluTrade

- Islamic accounts: fees after 5 days

- $100 minimum deposit required

- 30:1 retail leverage limit

- Professional account needs qualification

6. CMC Markets - Best Options Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 0.5 GBP/USD = 0.9 AUD/USD = 0.6

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

CMC Markets provides the best options trading platform in the UAE through their proprietary NGEN platform and MT4, giving you access to options contracts on forex pairs, indices, and commodities. The broker offers 283+ currency pairs with raw spreads from 0.7 pips EUR/USD and $2.50 per side commission, making costs competitive for active options traders.

The NGEN platform specialises in options strategies with visual builders showing profit/loss graphs for complex multi-leg positions. You access 39 cryptocurrency CFDs alongside traditional forex and equity markets with $0 minimum deposit. Execution speeds average 138ms on limit orders. Professional traders can access 500:1 leverage while retail accounts remain capped at 30:1 under standard regulations.

Pros & Cons

- Options trading on NGEN platform

- 283+ currency pairs available

- $2.50 commission per side

- Multi-regulator oversight

- 39 crypto CFDs

- $0 minimum deposit

- NGEN platform learning curve

- Standard spreads 0.5 pips minimum

- Limited to MT4 (no MT5, cTrader)

- Options availability varies by region

7. Plus500 - Best CFD Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 0.9 GBP/USD = 1.6 AUD/USD = 1

Updated 06/02/2026

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Plus500 disclaimer: CFD service. Your capital is at risk. 79% of retail CFD accounts lose money

Why We Recommend Plus500

Plus500 takes a different approach by building their own platform from scratch instead of relying on MetaTrader, which means you get a surprisingly clean interface without all the bells and whistles that often confuse newer traders.

The spreads come in at 0.9 pips on EUR/USD with zero commission, so you’re looking at one simple number for your trading cost rather than trying to work out spreads plus fees. What really stands out here are the guaranteed stop-loss orders that come built into the platform, protecting your positions from those nasty gaps that happen when markets close for the weekend.

You’re getting access to 68 forex pairs, over 25 different cryptocurrencies, and hundreds of stock CFDs, all under both DFSA and SCA regulation which gives you double the regulatory oversight. The mobile app sends you alerts when your positions hit certain levels, so you’re not glued to charts all day.

The whole design philosophy here centres on making CFD trading straightforward rather than packing in every technical indicator known to mankind. Execution runs around 140ms with a $100 starting requirement, and if you’re trading under SCA regulation you can access 300:1 leverage compared to the standard 30:1 retail limit.

Pros & Cons

- Clean interface, no complexity

- Guaranteed stops prevent slippage

- Dual DFSA and SCA regulation

- 0.9 pips, zero commission structure

- Push alerts for price movements

- 25+ crypto CFDs available

- No MetaTrader platform support

- Basic charting vs competitors

- $100 minimum to start

- No social/copy trading

8. AXI - Best Demo Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.3

AUD/USD = 1.3

Trading Platforms

MT4

Minimum Deposit

$0

Why We Recommend Axi

What makes Axi stand out isn’t just their forex demo accounts that never expires, but the fact that it actually mirrors live trading conditions.You can create multiple demo sub-accounts and run them side by side, testing whether the Standard Account with 0.6 pip spreads and zero commission works better for your style versus the Pro Account offering 0.0 pips with $3.50 per side commission

The Pro Account executes at around 90ms on limit orders, which you’ll experience in the demo rather than seeing artificially perfect fills that don’t reflect reality. You’re trading 72 forex pairs including the usual majors plus exotics like USD/TRY and EUR/ZAR, with Autochartist pattern recognition running in the background identifying potential setups across your watchlist.

The MT4 NexGen package adds institutional-grade tools like correlation matrices and sentiment indicators, all available in your demo account so you’re testing with the exact same features you’d get live. The Elite Account bumps you to 500:1 leverage with a $500 minimum if you qualify as a professional trader.

Pros & Cons

- Unlimited demo, never expires

- Multiple sub-accounts for testing

- 90ms execution speeds

- Pro: 0.0 pips, $3.50 per side

- Autochartist pattern recognition

- Elite: 500:1 leverage available

- MT4 only, no MT5 or cTrader

- Standard Account 0.6 pips

- Elite needs $500 minimum

- Limited education resources

9. eToro - Best Copy Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.0 GBP/USD = 2.0 AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$500

Why We Recommend eToro

eToro built their entire platform around the idea that you shouldn’t need to become a trading expert to participate in markets, which is why their copy trading feature lets you browse thousands of verified traders and automatically mirror their positions in your account. The platform shows you each trader’s monthly returns, risk scores, which assets they prefer, and even their trading philosophy before you commit any funds.

What’s particularly clever is how transparent the whole system is – you’re seeing real performance data rather than marketing claims, and you can filter by everything from geography to trading style to find someone whose approach matches your risk tolerance.

Spreads start at 1.0 pips on EUR/USD with zero commission, which sits higher than raw ECN pricing but makes sense given you’re accessing 932 ETFs (way more than most competitors), 65 forex pairs, extensive crypto coverage, and the entire social trading infrastructure.

The platform feeds show you what popular investors are buying in real-time, giving you market sentiment insights before you make decisions. The beginner-friendly interface removes all the complexity of traditional platforms, while the eToro Academy provides structured courses helping you progress from basics through advanced strategies.

Pros & Cons

- CopyTrader with verified performance

- 932 ETFs, extensive selection

- Social feeds show investor activity

- Beginner-friendly interface

- Instant funding available

- Structured Academy courses

- No MT4/MT5 access

- 1.0+ pip spreads vs ECN

- $100 minimum required

- Basic charting tools

10. XM - Best Automated Trading Platform

Forex Panel Score

Average Spread

EUR/USD =1.6

GBP/USD = 1.9

AUD/USD = 1.6

Trading Platforms

MT4, MT5,

XM App/Tablet

Minimum Deposit

$5

Why We Recommend XM

XM positions itself perfectly for automated trading by offering both MT4 and MT5 with absolutely zero restrictions on Expert Advisors, scalping strategies, or hedging techniques that other brokers sometimes ban.

The Ultra Low Account gives you 0.8 pip EUR/USD spreads with $1.60 commission per side. What really helps automated traders here is the $5 minimum deposit across all account types, letting you test your Expert Advisors live with tiny position sizes before scaling up to standard lots.

The MT5 platform provides 38 technical indicators versus MT4’s 30, plus it expands your timeframe options to 21 compared to MT4’s 9, giving your algorithms more data points to work with when making decisions.

You’re getting access to extensive stock CFD coverage from US, European, and Asian exchanges, commodities including precious metals and energies, equity indices with both cash and futures contracts, plus thematic indices tracking specific sectors.

The XM App integrates TradingView charts directly into the mobile interface, so you can monitor your automated strategies’ performance with professional-grade analysis tools without switching between applications. Social and copy trading features let you combine automation with mirroring other successful traders if you want a hybrid approach.

Pros & Cons

- MT4 and MT5, no EA restrictions

- Ultra Low: 0.8 pips, $1.60 commission

- $5 minimum across all accounts

- 38 indicators, 21 timeframes on MT5

- XM App with TradingView integration

- Social/copy trading available

- Standard Account 1.6 pips

- Professional needs verification

- 30:1 leverage (MENA regulation)

- Education mainly video-based

Ask an Expert