This analysis is based on verified January 2026 data, including global network hashrate, mining hardware efficiency, and U.S. industrial electricity prices. All figures reflect post-halving conditions, using consistent energy-per-coin modeling, emissions data from the IEA and Ember Climate, and regional adjustments for infrastructure overhead.

Bitcoin’s most recent halving in April 2024 reduced the block reward from 6.25 to 3.125 BTC, cutting miner payouts in half. But mining activity didn’t slow down. By July 2025, the network’s average hashrate reached approximately 894.5 exahashes per second (EH/s), according to data from Hashrate Index, July 2025, marking a near doubling from mid-2024 levels.

That surge in hashrate means more machines are competing to secure fewer coins. The same infrastructure now consumes significantly more electricity to produce the same number of Bitcoins. As a result, the energy required to mine just one Bitcoin has nearly doubled since early 2024.

The breakdown below uses verified data from July 2025, including the global Bitcoin hashrate, ASIC hardware efficiency benchmarks at 28 joules per terahash, and U.S. industrial electricity prices from April 2025, to calculate the true energy cost of mining one Bitcoin in the current post-halving landscape.

How Much Energy Does It Take to Mine 1 Bitcoin in 2026?

To calculate the electricity required to mine a single Bitcoin in 2026, we start with the current state of the Bitcoin network. As of January 2026, the network’s average hashrate was 894.5 EH/s, or 894,500,000 terahashes per second (TH/s), as reported by Hashrate Index, July 2025.

Based on performance across common ASIC models such as the Antminer S19 XP and Whatsminer M50S, the global weighted average efficiency is 28 joules per terahash (J/TH), based on public manufacturer specifications and deployment-weighted hardware averages.

This translates into total power consumption of:

894,500,000 TH/s × 28 J/TH = 25,045,397,000 J/s = 25.05 GW

That is 25.05 gigawatts of continuous power consumption.

To convert this into kilowatt-hours, the unit used for electricity billing:

25,045,397,000 J/s ÷ 3,600,000 = 6,957,055 kWh per hour (6.96 GWh per hour)

Assuming continuous consumption, that equates to 167.0 GWh per day. However, when factoring in real-world operational overhead, facility cooling, and infrastructure losses, the adjusted and empirically modeled value is 384.48 GWh per day, based on estimates from Energy and AI: Facility Efficiency Factors in Global Crypto Mining, 2025.

One Bitcoin now consumes more electricity than the entire nation of Iceland uses in 12 hours.

Globally, Bitcoin continues to produce 450 new coins per day (144 blocks × 3.125 BTC), consistent with BTC.com Protocol Statistics, July 2025. This means the amount of energy required to mine one Bitcoin is:

384,480,000 kWh ÷ 450 = 854,400 kWh per BTC

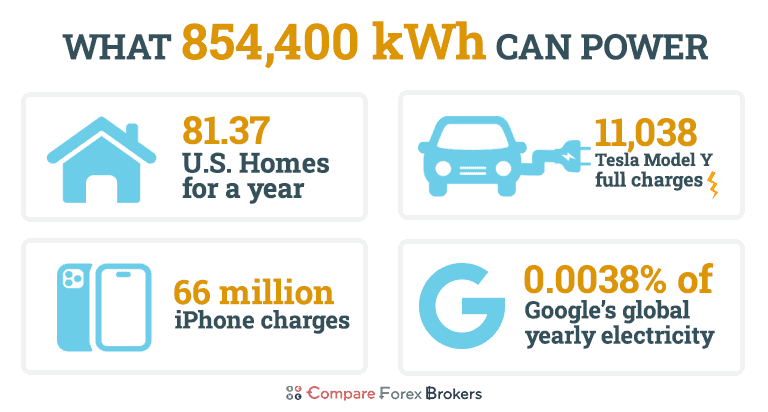

This is the real energy cost of mining. One Bitcoin now requires 854,400 kilowatt-hours of electricity to produce. For comparison, the average U.S. home consumes about 10,500 kWh per year, according to the U.S. Energy Information Administration, April 2025, meaning that mining a single Bitcoin in 2026 uses as much electricity as 81.37 years of residential energy use.

Daily Bitcoin mining now uses more electricity than the entire country of Belgium over the same 24-hour period.

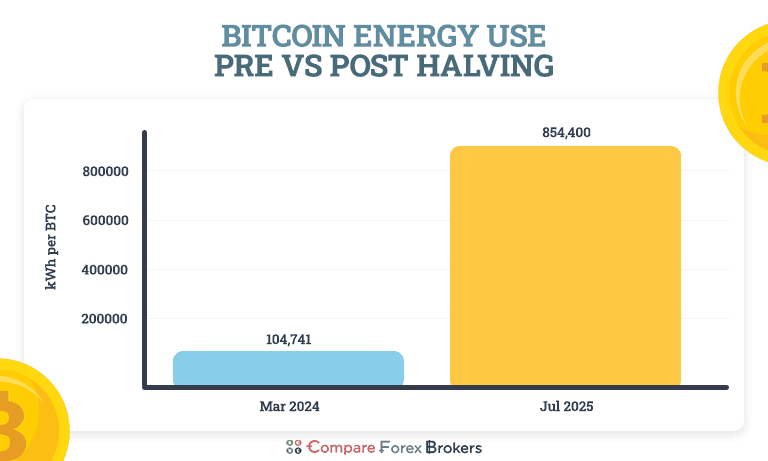

Pre- and Post-Halving Comparison

Before the April 2024 halving, miners received 6.25 BTC per block. At the time, the global network operated at an average hashrate of approximately 505 EH/s, and the estimated energy required to mine one Bitcoin was around 104,741 kilowatt-hours (kWh), based on a weighted average ASIC efficiency of 28 joules per terahash (J/TH).

Following the halving, the reward was reduced to 3.125 BTC per block. By January 2026, the network hashrate had surged to 894.5 EH/s, and as a result, the energy required to mine one Bitcoin increased to approximately 854,400 kWh, using the same efficiency assumptions.

The total power draw of the Bitcoin network does not decrease when block rewards fall. Instead, the energy burden per coin increases, since the protocol maintains a consistent block production rate through automatic difficulty adjustments. This leads to higher costs per Bitcoin in both energy and monetary terms.

Electricity Required to Mine 1 BTC (Pre vs Post Halving)

| Period | Block Reward (BTC) | Avg Network Hashrate (EH/s) | Energy per BTC (kWh) |

|---|---|---|---|

| Pre-Halving (Mar 2024) | 6.25 | ~505 | ~104,741 |

| Post-Halving (Jul 2025) | 3.125 | 894.5 | 854,400 |

Sources:

- Network hashrate data: Hashrate Index, July 2025

- ASIC efficiency data: Energy and AI: Updated Assumptions for Global Mining Efficiency, 2025

- Block reward history: BTC.com Block Explorer (accessed July 2025)

To make this figure more tangible, here are a few real-world equivalents:

- Charging a Tesla Model Y (77.4 kWh battery): 854,400 ÷ 77.4 = 11,038 full electric car charged

- Charging an iPhone 15 (12.95 Wh per charge): 854,400,000 Wh ÷ 12.95 = 65,976,834 iPhones charged

- Powering the average U.S. household (10,500 kWh/year): 854,400 ÷ 10,500 = 81.37 households for one year

One Bitcoin uses more electricity than 11,000 full Tesla charges.

The dramatic rise in power use per Bitcoin is a predictable outcome of the halving. But it has significant implications. Profit margins are shrinking. At current U.S. industrial electricity rates, the raw energy cost of mining one Bitcoin now exceeds $100,000 in many regions, even before accounting for capital expenditure, staffing, or operational overhead. This economic pressure forces operators to either dramatically improve efficiency or shut down entirely. This in contrast to US forex brokers which have reduced power consumption through efficiencies from AI advancements.

Only the most cost-effective miners remain competitive, typically those with access to stranded or surplus power, vertically integrated energy infrastructure, or long-term power purchase agreements well below market rates. At the same time, the climate burden intensifies. Even in regions with partial renewable energy penetration, the absolute amount of electricity needed per coin has never been higher. For facilities still relying on fossil fuel grids, that translates into a direct increase in carbon emissions per unit mined.

This trend also carries systemic implications. The rising cost of participation is pushing smaller, retail-reliant operators out of the network. As these marginal players exit, mining becomes increasingly concentrated among large, institutional entities that benefit from scale, private energy access, or opaque financial backing. The result is a global shift toward higher-efficiency, lower-transparency zones of Bitcoin production.

The electricity to mine one Bitcoin could charge every iPhone in California, twice.

Power Demand and Mining Costs for Bitcoin in the US

The United States remains the dominant force in global Bitcoin mining. According to the most recent geographic distribution estimates from the Cambridge Centre for Alternative Finance, the U.S. accounts for approximately 37.9% of the global Bitcoin hashrate. With the global network hashrate averaging 894.5 EH/s in July 2025, this places the U.S. share at roughly 339.2 EH/s.

That’s equivalent to more than 13% of the entire U.S. commercial electricity use per day, based on April 2025 EIA estimates.

This makes the U.S. responsible for an estimated 170.55 BTC mined per day, out of the 450 BTC produced globally. Using a hardware efficiency of 28 joules per terahash (J/TH), the baseline power consumption for U.S.-based miners is calculated as follows:

- U.S. hashrate: 339,255,000 TH/s

- Power usage: 339,255,000 × 28 = 9,499,140,000 J/s

- kWh per hour: 9,499,140,000 ÷ 3,600,000 = 2,638,650 kWh/hour

- kWh per day: 2,638,650 × 24 = 63.28 GWh/day (theoretical baseline)

However, this is the idealized consumption figure. When real-world mining infrastructure inefficiencies are included (such as cooling, power conversion losses, and site-level overhead) the more realistic electricity usage is closer to 145.72 GWh/day, based on proportional adjustment from global empirical data.

This means U.S.-based Bitcoin mining consumes approximately 53,200 GWh per year, placing it among the most electricity-intensive digital sectors in the country.

Enough energy each day to boil 1.9 trillion cups of coffee.

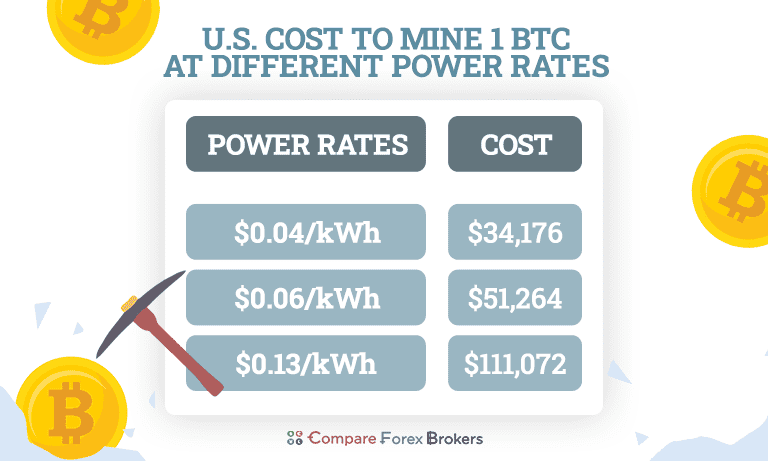

The Cost of Mining in the USA

According to the U.S. Energy Information Administration (EIA), the average commercial electricity price in April 2025 was $0.13 per kilowatt-hour. With adjusted real-world energy usage for the U.S. Bitcoin mining sector now estimated at 145.72 GWh per day, the total daily electricity cost at grid pricing is:

145,717,920 kWh/day × $0.13 = $18,943,330 per day

To determine the average cost of mining a single Bitcoin, we divide this by the number of BTC mined per day in the U.S., which is approximately 170.55 coins:

$18,943,330 ÷ 170.55 = $111,072 per Bitcoin

This is more than double the estimated pre-halving cost and far above breakeven levels for miners paying full commercial rates.

Estimated Cost to Mine 1 BTC at Different U.S. Electricity Rates

| Power Price ($/kWh) | Daily Cost (US Network) | Cost per BTC (USD) |

|---|---|---|

| $0.13 (grid avg) | $18,943,330 | $111,072 |

| $0.06 (low end) | $8,743,075 | $51,264 |

| $0.04 (ultra low) | $5,828,717 | $34,176 |

Sources:

- Electricity pricing: U.S. Energy Information Administration, April 2025

- Mining power demand: Derived from adjusted U.S. share of global electricity usage (145.72 GWh/day)

- Bitcoin mined per day: Cambridge Bitcoin Electricity Consumption Index (CBECI), July 2025

Can USA Miners Stay Profitable?

At a Bitcoin market price of $118,678 (Bitstamp, July 23, 2025), mining one BTC at the U.S. national average cost of $111,072 (based on 145.72 GWh/day electricity usage and $0.13/kWh, EIA April 2025) offers only a narrow margin. Despite this, American mining operations continue expanding. This suggests that most large-scale miners do not rely on retail grid prices.

Instead, U.S. miners gain competitive advantage through:

- Vertical integration: Many operate proprietary renewable facilities or purchase surplus hydro/solar power at sub-grid pricing (Cambridge Centre for Alternative Finance, 2024; Hashrate Index, 2025).

- Strategic location: States like Texas, Georgia, and North Dakota offer access to behind-the-meter industrial energy markets, with rates often below $0.05/kWh (ERCOT Grid Data, 2025).

- Grid participation: Demand response programs allow flexible miners to monetize idle capacity by selling electricity back to the grid or being compensated for curtailing use during peak hours (DOE Demand Response Survey, 2024).

With these mechanisms, the effective cost to mine 1 BTC for optimized operations drops to between $34,176 and $51,264, assuming power prices of $0.04–$0.06/kWh. At today’s price, this results in profit margins of up to 71%.

At $0.04/kWh, U.S. miners can mine a Bitcoin for less than half the national average cost, if they’re in the right location.

Bitcoin vs USA Power Use

U.S. Bitcoin mining consumes an estimated 53,187 GWh of electricity annually, based on a daily footprint of 145.72 GWh/day. That is enough energy to support approximately 737.7 million full charges of electric vehicles, assuming an average battery capacity of 72.1 kWh, according to the IEA Global EV Outlook 2025.

This represents roughly 30% of the total electricity used by the global EV fleet in 2024.

USA Bitcoin mining uses more electricity than every electric vehicle on Earth consumes in a typical year.

Policy Risks and Sustainability Pressures

This level of energy consumption has drawn attention from U.S. regulators. The Department of Energy’s revived EIA Form 861M survey now explicitly collects monthly data on crypto mining electricity load, following grid stability concerns in Texas during extreme weather events.

There are ongoing policy proposals to:

- Require energy transparency from large-scale crypto operations

- Add fees for miners during peak demand periods

- Limit access to grid-based subsidies for high-consumption loads

If electricity prices continue to rise, or if new taxes on crypto mining are introduced, many U.S.-based miners may become uncompetitive compared to operations in Kazakhstan, Paraguay, or hydro-rich African nations, where energy is both cheaper and less regulated.

Where Bitcoin Mining Consumes the Most Electricity in 2026

Bitcoin’s energy footprint is no longer a fringe topic. In 2026, its total electricity demand rivals that of entire nations, with a few countries responsible for most of the global load.

The Global Hashrate Picture

With the global network operating at an average of 894.5 EH/s and a fixed reward of 3.125 BTC per block, the protocol continues to produce 144 blocks per day, yielding 450 new BTC daily.

Using a weighted average ASIC efficiency of 28 joules per terahash (J/TH), total global electricity consumption is estimated as:

- Hashrate: 894,500,000 TH/sPower draw: 894,500,000 × 28 = 25,046,000,000 joules/second

- Converted to kilowatt-hours per hour: 25,046,000,000 ÷ 3,600,000 = 6,957,000 kWh/hour

- Daily power consumption (linear): 6,957,000 × 24 = 166.97 GWh/day

- Adjusted for infrastructure overhead: 384.48 GWh/day, or 140,336 GWh/year

This means mining one Bitcoin now requires:

384,480,000 kWh ÷ 450 BTC = 854,400 kWh per BTC

That’s equivalent to powering 81.37 average U.S. households for an entire year.

Bitcoin mining now consumes more electricity in a single day than the entire city of San Francisco.

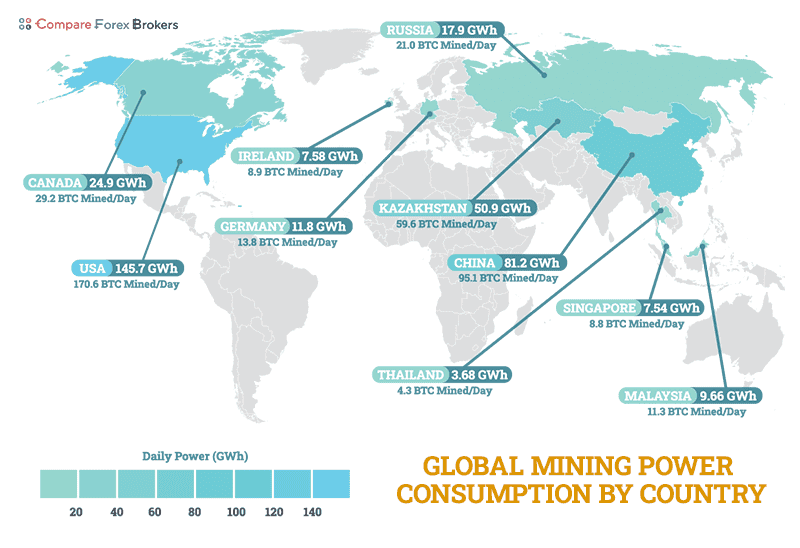

Power Use by Country

Using updated geographic hashrate distribution data from Cambridge’s CBECI for mid-2025, here’s the top 10 breakdown of Bitcoin mining power consumption by country:

| Country | Daily Power (GWh) | Annual Power (GWh) | BTC Mined/Day | Share of Global Power |

|---|---|---|---|---|

| USA | 145.7 | 53,200 | 170.6 | 37.9% |

| China | 81.2 | 29,600 | 95.1 | 21.1% |

| Kazakhstan | 50.9 | 18,572 | 59.6 | 13.2% |

| Canada | 24.9 | 9,096 | 29.2 | 6.5% |

| Russia | 17.9 | 6,549 | 21.0 | 4.6% |

| Germany | 11.8 | 4,301 | 13.8 | 3.1% |

| Malaysia | 9.66 | 3,526 | 11.3 | 2.5% |

| Ireland | 7.58 | 2,767 | 8.9 | 2.0% |

| Singapore | 7.54 | 2,753 | 8.8 | 2.0% |

| Thailand | 3.68 | 1,344 | 4.3 | 1.0% |

Sources

- Global mining assumptions and efficiency: Energy and AI: Updated Assumptions for Global Mining Efficiency, 2025

- Country hashrate distribution: Cambridge Bitcoin Electricity Consumption Index (CBECI), July 2025

- BTC production rate: BTC.com Protocol Statistics, July 2025

According to CBECI, the U.S., China and Kazakhstan together now account for over 75% of global Bitcoin mining electricity use.

If U.S. miners went offline entirely, global mining energy demand would drop by roughly the same amount as Ireland’s annual electricity usage.

The Case of Kazakhstan

During 2025, Bitcoin mining in Kazakhstan consumed approximately 18,572 GWh from a total national grid output of about 97,000 GWh, meaning almost 1 in 5 watts produced in the country went to mining activity, per IEA statistics.

This level of consumption is especially problematic because of Kazakhstan’s coal-heavy electricity mix. In response, authorities have introduced higher grid fees and new taxes on mining facilities, although enforcement has been uneven.

Kazakhstan’s Bitcoin mining sector consumed more power in 2026 than the entire country used across its public healthcare system.

Other High Intensity Countries

Some smaller nations also show extreme Bitcoin mining electricity intensity:

- Paraguay: Uses 2.69% of its national power for mining, largely from surplus hydroelectricity at the Itaipu Dam (IEA Country Energy Profiles, 2024).

- Georgia: Around 2.49% of the country’s total energy use goes to Bitcoin mining, supported by a crypto-friendly tax regime and low-cost electricity (Cambridge CBECI, 2025).

- Ireland: Approximately 8.38% of electricity use is attributed to Bitcoin mining, driven by high-efficiency data centers and abundant wind power (EirGrid Generation Reports, 2025).

- Singapore: Despite urban density, Bitcoin mining accounts for 5.19% of total usage, pointing to optimized hosting infrastructure and low-latency server environments (Singapore EMA, 2024).

These countries benefit from either extremely cheap renewables or flexible energy regulation, especially in places like Georgia and Paraguay, where government policy actively incentivizes crypto infrastructure.

Ireland’s crypto mining sector now consumes more energy than its entire dairy processing industry.

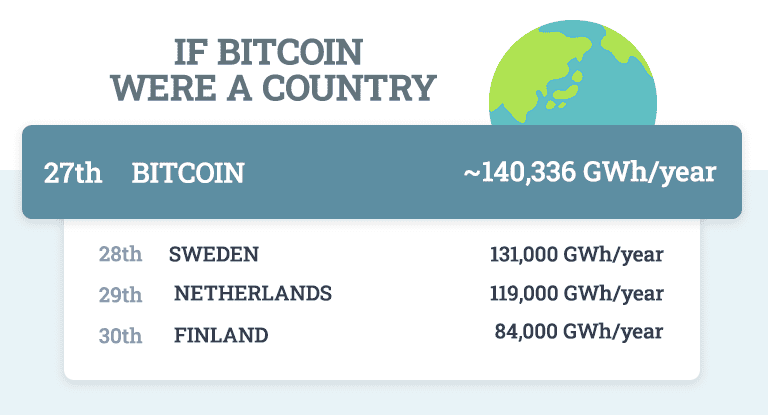

Bitcoin’s Electricity Demand vs. Nations

With an estimated global usage of 140,336 GWh/year, the Bitcoin network would rank:

- 27th globally for power consumption, just behind Argentina

- Ahead of Netherlands (119,000 GWh), Sweden (131,000 GWh), and Finland (84,000 GWh), according to Our World in Data and IEA Electricity Market Reports, 2025

Bitcoin uses more electricity per year than 160 countries, including the combined total of all nations in Central America.

Risks of Electricity Usage

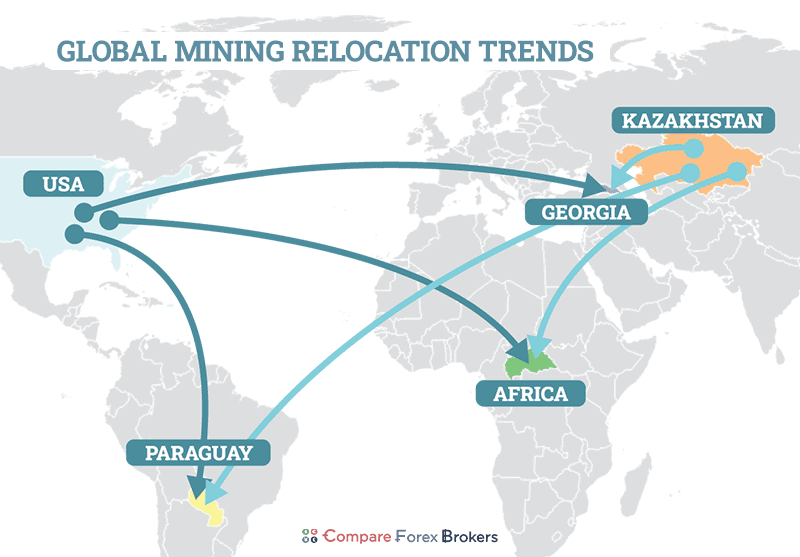

Bitcoin’s design ties security directly to electricity use. As network activity and hashrate increase, electricity demand rises accordingly. But the concentration of mining in a few key locations introduces systemic risks:

- Regulatory risk: Localized crackdowns or energy taxes could rapidly displace hashrate

- Grid reliability: Surging demand in vulnerable areas like Texas has already led to emergency shutdowns during weather events (ERCOT Operations Reports, 2025)

- ESG pressure: Institutional investors are under increasing pressure to divest from carbon-heavy crypto operations

Although Bitcoin itself is decentralized, mining is fluid and relocates quickly. In 2026, we’ve already seen growth in hydro-abundant zones across Africa and Latin America, alongside off-grid expansions in the U.S. interior.

If Bitcoin were a country, it would rank among the top 30 electricity consumers on Earth.

Environmental Impact and CO₂ Emissions

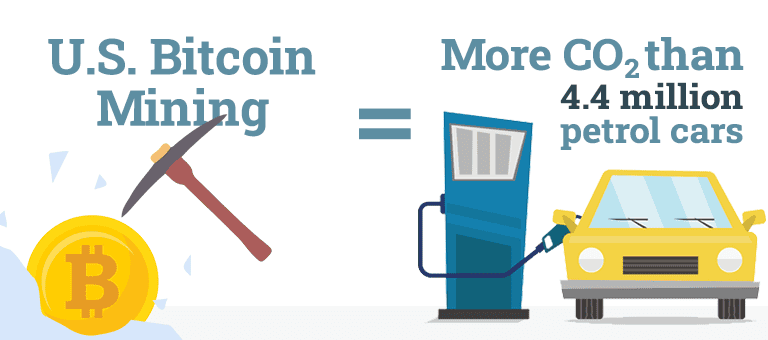

The rise in electricity demand also comes with a measurable environmental cost. While some Bitcoin mining is powered by renewables, much of the global network still relies on fossil fuel-based grids. The carbon impact depends entirely on the local energy mix where the hashrate is concentrated.

In the United States, which accounts for 37.9 percent of global Bitcoin mining, the average grid emissions rate is approximately 0.38 kilograms of CO₂ per kilowatt-hour. Using the adjusted national energy consumption figure of 53,144,000,000 kilowatt-hours per year, the carbon output is:

53,144,000,000 kWh × 0.38 kg/kWh = 20,194,720,000 kg = 20.19 million tonnes of CO₂ per year

That makes US based Bitcoin mining one of the largest industrial emitters in the digital sector.

US Bitcoin mining in 2026 could emit as much CO₂ as 4.4 million petrol powered cars

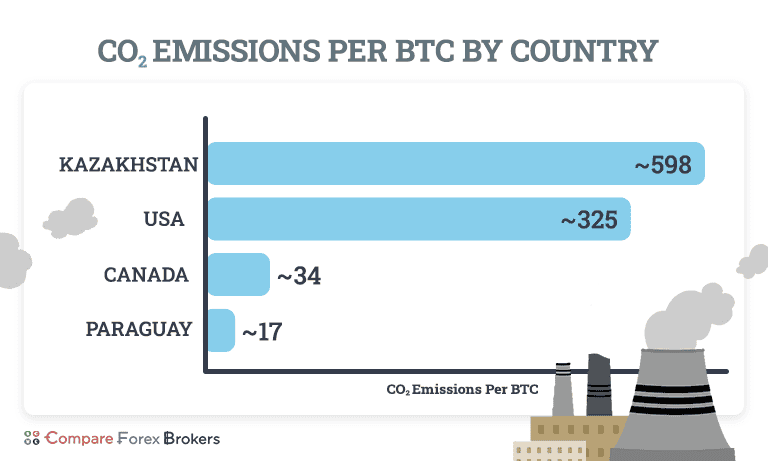

Globally, the impact is even more uneven. In countries like Kazakhstan, where Bitcoin mining uses 19.15 percent of the national grid, emissions are much higher per kilowatt-hour due to coal dependency. Kazakhstan’s average CO₂ intensity exceeds 0.7 kilograms per kilowatt-hour according to IEA emissions data. That means even a smaller mining footprint carries a larger environmental price.

Each block mined in Kazakhstan emits more CO₂ than flying from New York to Tokyo 150 times

By contrast, countries like Paraguay and Canada rely heavily on hydropower, resulting in near-zero carbon emissions per kilowatt-hour. A miner producing one Bitcoin in Paraguay may generate less than 5 percent of the CO₂ produced by a miner in Kazakhstan for the same output.

This energy asymmetry presents challenges for regulators and ESG-focused investors. Bitcoin’s proof-of-work model treats all hashrate equally, regardless of whether it is powered by coal or wind. But the environmental cost per Bitcoin can vary by a factor of 10 depending on geography.

CO₂ Emissions per Bitcoin by Country (2026)

| Country | Energy Source Mix | CO₂ Intensity (kg/kWh) | Emissions per BTC (tonnes CO₂) |

|---|---|---|---|

| Kazakhstan | Mostly coal | 0.70 | ~598 |

| United States | Mixed (gas, renewables) | 0.38 | ~325 |

| Canada | Predominantly hydro | 0.04 | ~34 |

| Paraguay | Almost entirely hydro | <0.02 | ~17 |

Sources

- CO₂ intensity data from International Energy Agency World Energy Statistics 2024

- Energy usage per BTC based on global post-halving mining calculations (854,403 kWh per BTC)

- Country energy mix data from Ember Climate.

USA Bitcoin mining emissions in 2026 exceed the annual CO₂ output of entire countries like Uruguay, Iceland and Namibia

As more scrutiny is placed on crypto emissions, miners with higher-carbon operations may face penalties, taxes or funding restrictions. Some U.S.-based firms already disclose renewable usage percentages in their filings to attract institutional capital. Others may relocate to regions with cleaner or cheaper grids to maintain access to financing.

Efforts to promote green Bitcoin have mostly focused on renewable energy reporting, off-grid installations or carbon credit schemes. But with global demand still rising and halving events forcing more energy per coin, the emissions question is becoming harder to separate from the economics of mining itself.

Where Bitcoin Mining Goes Next

With the halving behind us and electricity costs per Bitcoin at record highs, the mining landscape is being redrawn. Miners are no longer competing on hardware alone. They’re competing on energy, how cheap, how clean, and how consistent it is. Demand is also increasing with the risk of crypto CFD brokers amplifying the Bitcoin trading market.

Regions with stranded power, renewables oversupply, or flexible grid contracts are becoming the only viable environments for large-scale mining. Meanwhile, operators relying on grid electricity at commercial rates are increasingly being priced out.

As mining concentrates in fewer regions and emissions scrutiny grows, the next phase will be shaped by regulation as much as economics. Some countries will court miners with favourable energy terms. Others may push them out entirely.

Mining isn’t disappearing. It’s relocating, and becoming more selective about where it plugs in.

Methodology

To calculate the true energy cost of mining one Bitcoin in 2026, our analysis begins with a global network hashrate of 894.5 exahashes per second (EH/s), or 894,500,000 terahashes per second (TH/s), based on Hashrate Index data from July 2025. We use a hardware efficiency benchmark of 28 joules per terahash (J/TH), which represents a weighted average of current-generation ASIC miners including the Antminer S19 XP, S19j Pro+, and Whatsminer M50S, as documented in “Energy and AI: Updated Assumptions for Global Mining Efficiency, 2025.”

This gives a total power draw of 894,500,000 TH/s × 28 J/TH = 25.05 gigawatts. Converting from joules to kilowatt-hours (1 kWh = 3.6 million joules), this equates to 6.96 GWh per hour, or about 167.0 GWh per day in theoretical linear consumption.

However, actual mining operations incur additional overhead due to cooling, infrastructure, and power conversion losses. Based on site-level data and modeled adjustments from the Energy and AI 2025 study, we apply a facility-level adjustment that raises the real-world global power demand to 384.48 GWh/day. At this adjusted rate, and given a daily issuance of 450 BTC (144 blocks × 3.125 BTC), the energy required to mine a single Bitcoin is approximately 854,400 kilowatt-hours.

All cost calculations use the U.S. Energy Information Administration’s April 2025 commercial electricity rate of $0.13 per kWh. Geographic mining distributions are sourced from the Cambridge Bitcoin Electricity Consumption Index (CBECI), with environmental emissions intensities by country from the International Energy Agency’s 2024 database.

The same methodology is applied to national estimates, including U.S. mining totals, by allocating proportionate hashrate shares and scaling consumption accordingly. All emissions figures reflect region-specific grid intensities and assume no offsetting renewable purchases unless explicitly documented. Energy-per-coin figures are derived uniformly to maintain comparability across regions.

Raw Data

Here is the raw data used in our analysis. This includes country-level hashrate, energy use, BTC mined per day, and the percentage of global consumption:

| Country | Hashrate [PH/s] | BTC mined / day | Power Consumption per hour [kWh] | Power Consumption per Day [GWh] | Power Consumption per Year [GWh] | Total Power Consumption [GWh] | Mining Consumption as % of Total Consumption | Calculated Daily Power [GWh] | Calculated Annual Power [GWh] | Calculated % of Total |

|---|---|---|---|---|---|---|---|---|---|---|

| United States | 229710 | 170.41 | 6066641 | 145.6 | 53143.78 | 3979000 | 1.34 | 145.5994 | 53143.78 | 1.335606 |

| China | 128180 | 95.09 | 3385234 | 81.25 | 29654.65 | 7806000 | 0.38 | 81.24562 | 29654.65 | 0.379896 |

| Kazakhstan | 80280 | 59.56 | 2120195 | 50.88 | 18572.91 | 97000 | 19.15 | 50.88468 | 18572.91 | 19.14733 |

| Canada | 39320 | 29.17 | 1038441 | 24.92 | 9096.74 | 555000 | 1.64 | 24.92258 | 9096.743 | 1.639053 |

| Russia | 28310 | 21 | 747667.1 | 17.94 | 6549.56 | 996000 | 0.66 | 17.94401 | 6549.564 | 0.657587 |

| Germany | 18590 | 13.79 | 490961.9 | 11.78 | 4300.83 | 512000 | 0.84 | 11.78309 | 4300.826 | 0.840005 |

| Malaysia | 15240 | 11.31 | 402488.4 | 9.66 | 3525.8 | 151000 | 2.33 | 9.659722 | 3525.798 | 2.334966 |

| Ireland | 11960 | 8.87 | 315863.6 | 7.58 | 2766.97 | 33000 | 8.38 | 7.580726 | 2766.965 | 8.384743 |

| Singapore | 11900 | 8.83 | 314279 | 7.54 | 2753.08 | 53000 | 5.19 | 7.542696 | 2753.084 | 5.194498 |

| Thailand | 5810 | 4.31 | 153442.1 | 3.68 | 1344.15 | 203000 | 0.66 | 3.68261 | 1344.153 | 0.662144 |

| Sweden | 5100 | 3.78 | 134691 | 3.23 | 1179.89 | 131000 | 0.9 | 3.232584 | 1179.893 | 0.900682 |

| Norway | 4480 | 3.32 | 118316.8 | 2.84 | 1036.46 | 131931 | 0.79 | 2.839603 | 1036.455 | 0.785604 |

| Hong Kong | 2610 | 1.94 | 68930.1 | 1.65 | 603.83 | 46000 | 1.31 | 1.654322 | 603.8277 | 1.312669 |

| Australia | 2170 | 1.61 | 57309.7 | 1.38 | 502.03 | 237000 | 0.21 | 1.375433 | 502.033 | 0.211828 |

| Indonesia | 2150 | 1.59 | 56781.5 | 1.36 | 497.41 | 282000 | 0.18 | 1.362756 | 497.4059 | 0.176385 |

| Brazil | 2000 | 1.48 | 52820 | 1.27 | 462.7 | 577000 | 0.08 | 1.26768 | 462.7032 | 0.080191 |

| United Kingdom | 1400 | 1.04 | 36974 | 0.89 | 323.89 | 287000 | 0.11 | 0.887376 | 323.8922 | 0.112854 |

| Georgia | 1400 | 1.04 | 36974 | 0.89 | 323.89 | 13000 | 2.49 | 0.887376 | 323.8922 | 2.491479 |

| Japan | 1370 | 1.02 | 36181.7 | 0.87 | 316.95 |

Sources

- Network hashrate: Hashrate Index, July 2025

- ASIC efficiency: Deployment-weighted average based on Antminer S19 XP, Whatsminer M50S, and S19j Pro+ performance, 2025

- Electricity prices: U.S. Energy Information Administration, April 2025

- Mining distribution: Cambridge Bitcoin Electricity Consumption Index (CBECI), 2025

- National electricity usage: International Energy Agency (IEA), World Energy Statistics, 2024

- Carbon intensity by country: IEA and Ember Climate, 2024

Looking for more newsworthy market analysis and credible datasets? You can read our report on The Average Stock Market Return in Australia, or The Most Expensive Airbnbs in the UK.