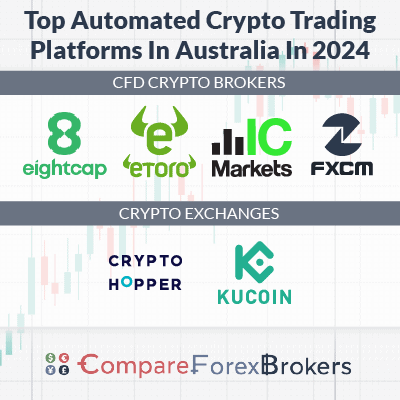

Best Automated Crypto Trading Platform Australia Analysis

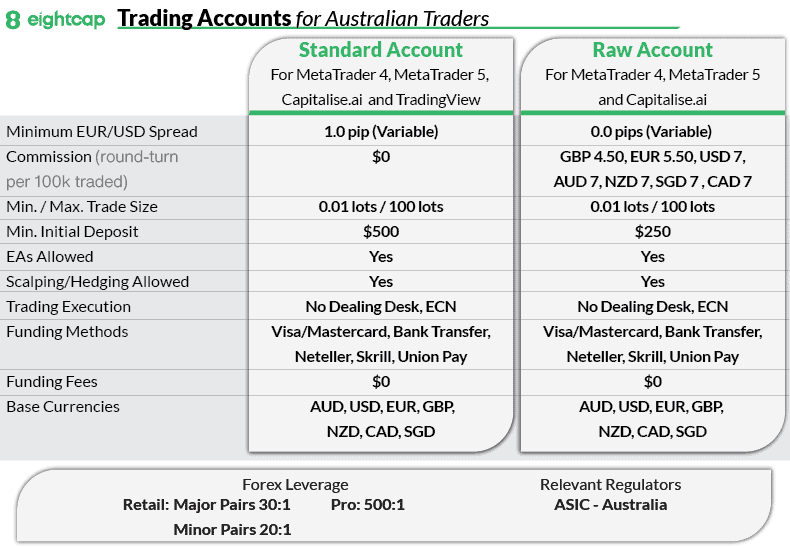

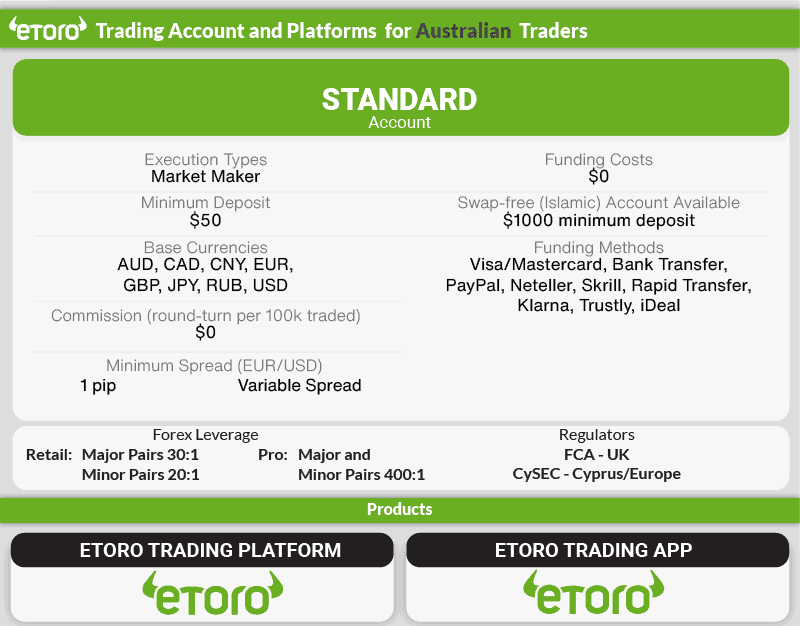

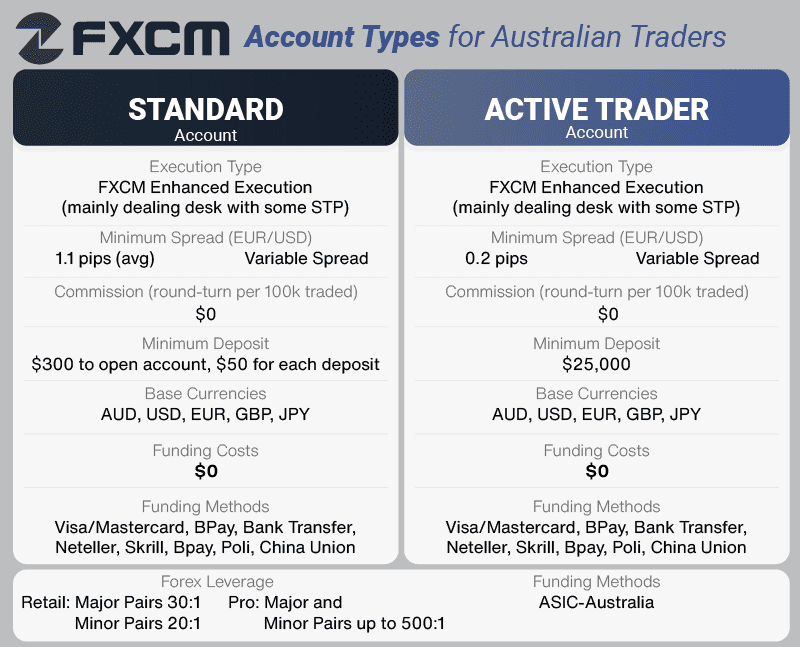

To automate cryptocurrency trading, an Australian trader must select a CFD broker with access to a crypto exchange. We compared the best-automated crypto trading platforms in 2024 based on software features and brokerage.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.