Best Crypto CFD Brokers – 2025

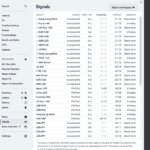

I compared 40+ forex trading brokers to find which ones were the best for cryptocurrency CFD trading. I tested account opening processes, available crypto markets, average spreads, supported trading platforms, and overall trading conditions for each broker.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

These are the best CFD brokers for trading cryptos:

- Eightcap - Best Broker For Cryptos Overall With 95+ Markets

- Pepperstone - Great Crypto Trading Platforms, Including MT4

- IC Markets - Good Crypto Trading With MT5

- XTB - Top Range Of Crypto Crosses

- eToro - Best For Copy And Social Trading With Crypto

- IG Trading - Good Weekend Trading With Cryptocurrencies

- Plus500 - Strong Range of Cryptocurrencies

- FP Markets - Good Broker For Scalp Trading With Crypto

- AvaTrade - Great Choice For Day Trading Cryptos

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

51 |

FCA, DFSA, CySEC FSCBZ, CMNV, KNF |

0.9 | 0.14 | 0.13 | - | 0.9 | 1.4 | 1.3 |

|

|

|

160ms | $250 | 49+ | 16+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.2 | 0.29 | 0.21 | $3.00 | 1.2 | 1.4 | 1.3 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

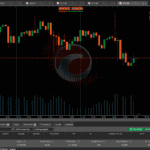

What Are The Best Crypto CFD Trading Platforms?

In early 2025, I updated my list of the best forex brokers in Australia, but only a few offered cryptocurrency CFD trading. With the rise in cryptocurrency’s popularity, I decided to create a crypto-focused list.

Below, I’ve shortlisted brokers who offer a strong crypto CFD platform. Then, I’ve gone into more detail, finding the best brokers across several different criteria – such as spreads, features and customer service.

1. Eightcap - Best Broker For Cryptos Overall With 95+ Markets

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.73

AUD/USD = 0.27

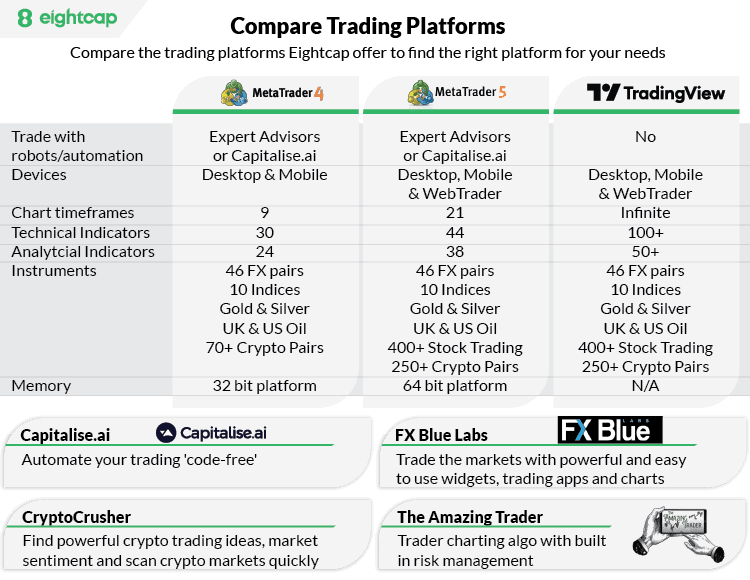

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

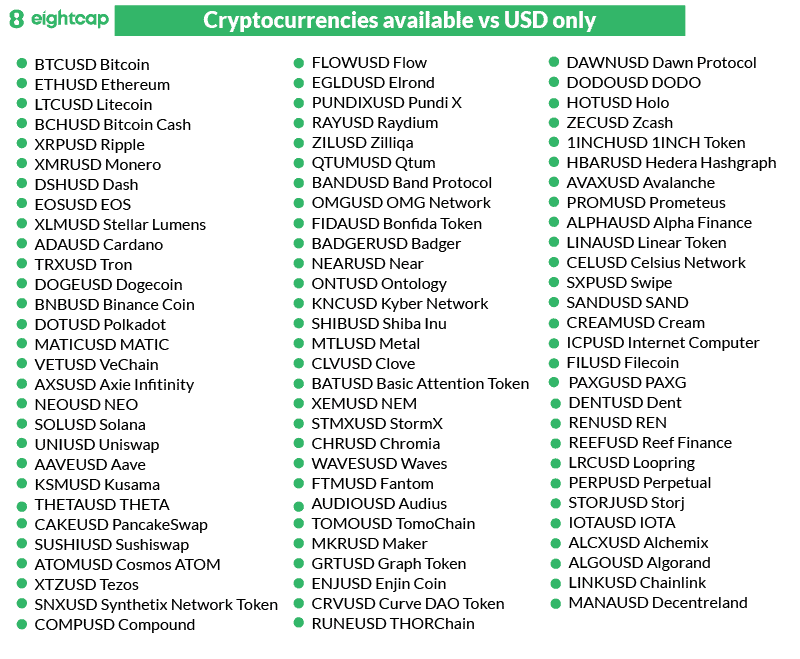

Eightcap is my top pick for the best crypto CFD broker, due to its selection of 95+ cryptocurrencies – the largest I’ve tested. I was impressed to find the broker gave access to both Bitcoin and altcoin markets.

I awarded Eightcap 96/100 overall. My score was influenced by several key features, like tight spreads from 0 pips on its Raw account. I was also impressed by the support for platforms like TradingView, MT4, and MT5.

The broker offers Capitalise.ai, which is the best automation tool for crypto in my opinion. You can build your strategies using the tool’s easy interface, so you can enjoy custom automations even if you have no coding background.

This broker also holds licenses with two Tier-1 regulators: the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC).

Pros & Cons

- Tight forex spreads

- Fast and easy account opening process

- Over 95+ cryptocurrency CFDs to trade

- MT4, MT5 and TradingView platforms

- MT4 does not support all the broker’s crypto instruments

- Minimum deposit required to open an account

- Customer support is not 24/7

Broker Details

Largest Collection of Cryptocurrencies

I found Eightcap provides 95+ cryptocurrencies for you to trade using CFDs. This is the largest selection out of the 39+ brokers I’ve tested. You can trade highly liquid markets like Bitcoin and Ripple, and also altcoins like SHIB and Dogecoin.

Altcoin markets offer extra volatility, which is good for more risk-focused traders.

| Broker | Crypto Markets Available |

|---|---|

| Eightcap | 95+ |

| eToro | 79 |

| AvaTrade | 27 |

| IC Markets | 23 |

| Pepperstone | 20 |

| IG Trading | 14 |

| FP Markets | 11 |

| XTB | 10+ |

As Eightcap is regulated by Tier-1 authorities like ASIC, FCA, and CySEC, it’s one of the most secure trading platforms for trading cryptocurrencies, in my opinion.

In addition to crypto markets, Eightcap supplies a decent choice of other assets too. You’ve got 56 currency pairs, 150 shares, 15 indices, and 10 commodities, allowing you to capture trading opportunities across multiple markets with one account.

Good Selection of Trading Platforms

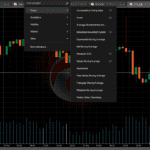

To help you trade the markets on Eightcap, the broker supports most of the main platforms, including MT4, MetaTrader 5, and TradingView. However, I did notice that you don’t have access to Eightcap’s full list of markets on MT4. So I recommend choosing TradingView or MT5 for the best multi-asset experience.

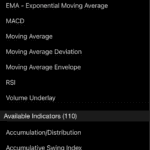

I personally like trading with TradingView as I prefer the modern layout, and the platform is fantastic when it comes to technical analysis. You get 110+ indicators, including things like moving averages, which is already better than most other platforms.

On top of this, TradingView is constantly updating with new indicators. Additions like auto trend lines and Fibonacci tools make analysis faster.

No-Code Automation Tool With Capitalise.AI and MT4/MT5

If you’re more into automated trading, then MetaTrader 4 and MetaTrader 5 are the better options. With the Capitalise.ai integration, you don’t even need coding knowledge to program MetaTrader’s Expert Advisors. You just describe your strategy to the tool, and it will take care of the rest for you.

If you want to find the right trading platform, my team has developed a quick questionnaire. Try it out below:

2. Pepperstone - Great Crypto Trading Platforms, Including MT4

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Pepperstone supports the largest range of trading platforms of any broker on this list. In total, you’ve got cTrader, MT4, MT5, TradingView, and Pepperstone Trading Platform available – all of which support crypto trading.

I found that the broker provides additional tools like Smart Trader and signal provider tools from Autochartist to boost MetaTrader 4’s features. Across the broker’s 27 crypto instruments, I found consistently fast execution speeds and tight spreads, starting from 0 pips on the Razor account.

Pros & Cons

- Powerful trading tools, particularly for MT4

- MT5, TradingView and cTrader platforms

- Fast execution speeds – 77ms for limit orders

- The demo account expires after 30 days

- 24/5 customer support

- A limited selection of cryptocurrencies

Broker Details

Best Broker For Choice Of Trading Platforms

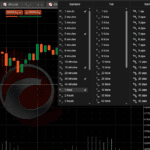

For its choice of trading platforms, I rated Pepperstone 10/10. The selection includes Pepperstone’s own Trading Platform, as well as MetaTrader 4, MT5, cTrader, and TradingView.

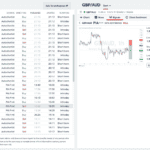

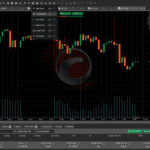

While testing the Pepperstone broker, I used MetaTrader 4. I was hugely impressed with this platform, and its decent choice of 30+ indicators, 3 chart types, and 9 timeframes. The availability of automated trading through MetaTrader’s Expert Advisors is also a big plus-point.

I thought Pepperstone was the best match for MT4 because of its Smart Trader Tools. This suit of tools extends the capabilities of MT4 by adding 28 extra indicators and Expert Advisors. I particularly like the addition of Pivot Points – highly valuable if you use price action when you trade.

Excellent Trading Conditions With Fast Execution Speeds

I was impressed with Pepperstone’s snappy trading conditions – in fact, I didn’t experience a single requote or price slippage in my tests. This was backed up by my analyst, Ross Collins, when he tested the broker’s execution speeds. He found they averaged 77ms for limit orders and 100ms for market orders.

Ross performed his technical test using MT4 with the ExTest_ForExpat and Broker Latency Tester EAs to get the average speeds. As you can see from his results, Pepperstone is the fastest broker on the list.

| Broker | Overall Speed Ranking | Limit Order Speed (ms) | Limit Order Rank | Market Order Speed (ms) | Market Order Rank |

|---|---|---|---|---|---|

| BlackBull Markets | 1 | 72 | 1 | 90 | 5 |

| Pepperstone | 3 | 77 | 2 | 100 | 10 |

| IC Markets | 17 | 16 | 134 | 22 | 153 |

| Eightcap | 16 | 19 | 143 | 17 | 139 |

| IG | 23 | 26 | 174 | 19 | 141 |

| FP Markets | 25 | 31 | 225 | 8 | 96 |

| Avatrade | 29 | 32 | 235 | 21 | 145 |

Trade Crypto On MetaTrader 4

Pepperstone offers access to 27 crypto CFD markets. Although this is not the largest selection I’ve tested, it’s still a comprehensive one. You’ve got access to top currencies like Bitcoin, Ripple, and DOGE on the MT4 platform.

I like that Pepperstone offers three crypto indices for analysing market movements. Other things I liked include Pepperstone’s status as a real multi-asset broker. You can benefit from the broker’s great trading conditions on 1,500 financial instruments – these include 91 forex pairs and 1,170+ share CFDs.

3. IC Markets - Good Crypto Trading With MT5

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

I rated IC Markets 93/100. Standout features include its ECN execution method, excellent crypto trading conditions, and average spreads of 0.19 pips on the Raw account. You can trade a solid range of 23 crypto CFDs, covering both highly-liquid markets like Bitcoin, and altcoins like Dogecoin. All this is available through the MetaTrader 5 platform.

Trading Central provides professional technical analysis across its 2,250+ markets (including crypto), which is useful for finding trading ideas.

Pros & Cons

- Excellent trading conditions with MetaTrader 5

- Solid selection of financial instruments to trade

- Tight spreads from 0.19 pips

- Market research tools need improvement

- Licensed by only two Tier-1 regulators: ASIC and CySEC

- cTrader-based mobile app only available for Android

Broker Details

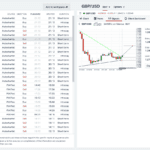

Trade Crypto With MetaTrader 5

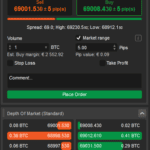

When you trade with IC Markets through the MT5 platform, you benefit from the platform’s Depth-of-Markets tool. This means you can look at the liquidity provider’s open order book, gaining a snapshot of where the buying and selling pressure is.

This helps gauge market sentiment on cryptos, and gives real-time supply and demand information so you can time your trades more accurately.

I also found a decent choice of 38+ indicators by default, and over 20+ drawing tools. These features are going to be very helpful in your technical analysis.

IC Markets Has Tight Spreads

My analyst, Ross Collins, tested the Raw account to see how it performed against other brokers using his MT4 platform with IceFX SpreadMonitor EA to capture the average Raw spreads.

Ross found that IC Markets achieved the overall tightest Raw spreads out of the crypto brokers tested, averaging 0.32 pips across 6 majors. Top performers include EUR/USD averaging 0.19 pips, AUD/USD averaging 0.23 pips, and USD/JPY averaging 0.24 pips. All three outperformed the industry average.

| BROKER | EUR/USD |

|---|---|

| IC Markets | 0.02 |

| Fusion Markets | 0.13 |

| ThinkMarkets | 0.1 |

| FP Markets | 0.1 |

| FXTM | 0 |

| TMGM | 0.1 |

| HYCM | 0.1 |

| XM | 0.1 |

| GO Markets | 0.2 |

| Industry Average | 0.22 |

4. XTB - Top Range Of Bitcoin and Ethereum Crosses And Fiats

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 0.14

AUD/USD = 0.13

Trading Platforms

MT4, xStation 5, xStation Mobile

Minimum Deposit

$0

Why We Recommend XTB

If you like to trade Bitcoin and Ethereum against other cryptos, I found XTB to be the best broker. It offers 9 Bitcoin and 3 Ethereum crosses – the most of any broker I’ve tested. Outside of these crosses, the broker offers more than ten cryptocurrencies. You can trade all these on the proprietary XTB Trading Platform.

In my tests, I scored XTB 51/100. While this is not the highest score, I did find the broker to be decent overall. There are more than 1,900 markets, and low Standard account spreads averaging 0.90 pips on EUR/USD. It was the limited trading platform selection that let the broker down, as this restricts the ways in which you can trade.

Pros & Cons

- No minimum deposit

- Decent standard account spreads

- Best broker for Bitcoin and Ethereum crosses

- Inactivity fees charged

- Lacks choice of trading platforms

- Live chat responses can take up to 15 minutes

Broker Details

Trade Bitcoin and Ethereum Crosses

During my tests, I found that XTB offers an impressive selection of cryptocurrency markets. One of the most impressive aspects was its nine Bitcoin crosses – including DSH/BTC, IOTA/BTC, and LTC/BTC – and its 3 Ethereum crosses (ETH/BTC, TRX/ETH, and EOS/ETH).

These crypto crosses allow you to potentially hedge your trades, or exploit price divergences. In other words, you have more ways to profit in the crypto markets. However, compared to trading against fiat currencies, the risk will be higher. The spread will also be much wider due to the asset’s higher volatility and lower liquidity.

XTB is a multi-asset broker which offers more markets than just crypto. I found that you have access to 48 forex markets, so you can transition between traditional and cryptocurrency trading with a single trading account.

In addition to forex markets, you can take advantage of 1,848 share CFDs, 30 indices, and 23 commodities. This is a solid range of markets to explore and trade.

Low Standard Account Spreads On XTB

My tests uncovered competitive spreads on the Standard account. I found an average spread of 0.90 pips on EUR/USD – 25% lower than the industry average.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

XTB’s overall average spread for the top 5 major pairs was 1.36 pips – this is below the industry average of 1.52 pips.

| Top 5 Most Traded Average Spread | |

|---|---|

| BROKER | Major Pair Average Spread |

| XTB | 1.36 |

| IC Markets | 0.76 |

| Eightcap | 1.06 |

| Go Markets | 1.08 |

| ThinkMarkets | 1.22 |

| Axi | 1.24 |

| FP Markets | 1.30 |

| IG | 1.38 |

| Pepperstone | 1.40 |

| Blackbull Markets | 1.42 |

| Industry Average | 1.52 |

5. eToro - Best For Copy And Social Trading With Cryptos

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

I chose eToro as the best broker for copy trading, where you can copy trade 79 cryptocurrencies with the broker’s intuitive CopyTrader platform. You have a choice of over 2 million copy traders, who can be filtered based on your trading needs.

eToro offers the cheapest copy trading platform. You’ll get spreads starting from 1 pip with no commissions – including on share CFDs. This is great for keeping your costs simple, right across more than 6,000 financial markets.

Pros & Cons

- Copy trading on over 6,000 products

- A platform designed for social trading

- Easy-to-use portfolio features for casual traders

- Small withdrawal fees

- Does not support algorithmic trading strategies

- Not an ECN broker

Broker Details

Crypto Copy Trade with CopyTrader

In my experience, there aren’t many copy trading platforms that specialise in crypto trading. This is why I think eToro is a great broker in this category – it offers more than 6,000 markets, including crypto instruments.

eToro makes 79 cryptocurrencies available to copy traders. A word of warning here, though: you do not have direct control over the markets you trade in, as this is decided by the trader you are copying.

That said, you can filter your copy trading candidates, and find one whose trading style best suits your own objectives.

Top Copy Trading Tools

The CopyTrader platform is excellent as it provides 14 metrics for customising your searches. This makes it much easier to find the right traders to follow. I found I could filter my searches according to the type of market, current profit-and-loss, and number of followers.

Another metric I found really useful was follower growth. This is a big indicator of current performance. If the trader is performing well, you’ll see a surge in followers. If they are losing followers, this suggests they are underperforming.

After choosing your traders to copy, you can simply mirror their trades This means you will either profit from their expertise, or experience their losses. I think this can be a good way to gain exposure to high-risk assets like crypto if you don’t have a strong background in the market.

Low Copy Trading Costs

What also impressed me was that the eToro Standard account was spread-only, so you can trade on spreads starting from 1 pip on EUR/USD, with no commission.

This is actually quite notable. I’ve found that copy trading platforms normally put a larger markup on their spreads, so finding competitive spreads while also avoiding commissions is quite a big deal.

6. IG Trading - Good Weekend Trading With Cryptocurrencies

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Trading

I chose IG Trading as my top choice if you want to trade all week, as the broker offers weekend markets for its cryptocurrencies using the IG Trading Platform. The broker supports you with 24/7 customer service, so you’ll be able to contact the broker over the weekend for immediate assistance.

The broker achieved 78/100 in my broker reviews, thanks to low spreads starting from 1.13 pips on its Standard account. You can access 17,000 markets, including 14 cryptocurrencies and 110 currency pairs, giving you a decent variety of markets for day trading.

Pros & Cons

- Licensed in ten jurisdictions

- The largest selection of assets to trade

- Competitive spreads on the Standard account

- Far fewer tradable assets on MT4 than on the proprietary platform

- Customer service is limited over weekends

- No social trading tools

Broker Details

Trade Crypto CFDs Over The Weekend

As crypto is a 24/7 market, accessing the markets even over the weekend is important. This can be a problem for forex brokers, as they mostly offer only 24/5 assistance. I was impressed that IG Trading bucks this trend, offering weekend markets on Bitcoin, Ethereum, and the Crypto 10 Index (IG’s index of top 10 cryptocurrencies).

As well as crypto, I found IG Trading offers an impressive range of more than 17,000 instruments across lots of different types – the most I’ve seen from a forex broker. These markets include 110 currency pairs, 13,000+ share CFDs, 130 indices, 41 commodities, and 13 cryptocurrencies.

Low Spreads With IG Trading

When opening my account with IG, I found that it only provides a Standard account. This means you are only paying for the spreads – the trades are commission-free.

While trading I monitored EUR/USD spreads averaging 1.13 pips, which is better than the industry average. I also tested Bitcoin’s spreads, and found these averaged about 40 pips – competitive for this type of market.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| IG Group Average Spread | 1.13 | 1.12 | 1.66 | 1.01 | 1.98 | 1.71 | 2.27 | 2.06 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

Excellent Trading Platforms with IG Trading

IG Trading offers a wide range of platforms to execute your trades, including MetaTrader 4 and ProRealTime – both excellent for technical analysis. However, I found myself enjoying the IG Trading Platform. While this is a web platform, it has many features that compete with desktop platforms like MT4 and TradingView.

The platform includes 40 indicators, which can be applied to your charts. You can also customise the settings to tailor your strategy, which many other web platforms don’t allow.

I also found that the platform had advanced charting tools such as the Signal Centre. This is very useful for generating new trade ideas, using solutions from Autochartist and PIA First.

Although the IG Trading Platform is excellent for executing and analysing, I did find it lacks the ability to automate trades. This might be a negative aspect for you if you are a big fan of automation.

7. Plus500 - Bitcoin Plus 18 Cryptos With This Top CFD Provider

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why We Recommend Plus500

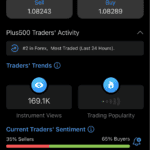

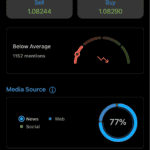

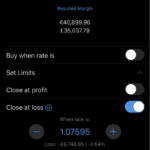

I gave Plus500 61/100 in my broker analysis. The broker scored highly for its Plus500 trading platform and 11,000+ markets, which cover everything from crypto to share CFDs. I was impressed by the Plus500 platform’s “+insights” tool. This helped me find which cryptos were popular, and view the percentage of long and short trades in each market.

Of the brokers tested, I felt that Plus500 was best suited for beginners. This is because the interface is user-friendly, and it offers guaranteed stop-loss orders (GSLOs) to protect your open trades from price slippage.

Pros & Cons

- Excellent trading platform with +Insights tool

- Solid selection of financial instruments beyond crypto CFDs

- Has guaranteed stop-loss orders

- Limited education content and market analysis tools

- Proprietary platform may not meet the needs of active traders

- High trading fees

Broker Details

Beginner-Friendly Trading Platform

I think Plus500 is the most beginner-friendly trading platform when it comes to trading cryptocurrencies. Although it only offers its proprietary trading platform, I was impressed by the features available to help with your market analysis.

I found the app’s charting tools were similar to those of TradingView, which is a big plus in my books. It offered over 100 indicators with 13 chart patterns, so I could set up my charts how I wanted.

+Insights Tool Provides Sentiment Analysis

The standout feature I found on the platform was “+insights”, which is Plus500’s sentiment analysis tool. I like that it aggregates all client positions and shows you what asset is trending, breaking it down further to show the split between buyers and sellers.

I like that the tool also shows which assets have generated the most profits for its clients over the previous day, week, and month. I think this can help you find potential new markets to trade based on the recent success of other traders.

Decent Range of Crypto Markets For Beginners

After opening my Plus500 Standard account, I found that the broker offers 18 cryptocurrency markets, including major coins like Bitcoin, XRP, and Ethereum.

While not an extensive selection compared to something like Eightcap, this range covers the most liquid and popular cryptocurrencies. This should be enough for you to capitalise on opportunities in the crypto market, through a well-regulated CFD provider.

8. FP Markets - Good Broker For Scalp Trading With Crypto

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

I chose FP Markets as the best scalping broker, because of its industry-leading market order execution speed – 96 ms. This provides excellent scalping conditions.

With FP Markets offering cTrader, I found this to be the top option for scalping crypto thanks to its one-click trading and access to Depth-of-Markets tools. The broker doesn’t have the largest selection of crypto markets – only 11 – but it does cover major pairs like Bitcoin and Ethereum. You’ve also got more volatile options like Solana.

Pros & Cons

- Offers most 3rd-party trading platforms

- Low spreads and commissions

- Excellent collection of cryptocurrencies

- The mobile app has limited features

- A limited selection of markets on MT4 vs. other platforms

- Time-limited demo accounts

Broker Details

Fast Market Order Execution Speeds For Scalping

In his execution speed tests, Ross found that FP Markets had one of the fastest market execution speeds, averaging 96ms. This is achieved because FP Markets is an ECN broker, and matches your orders with other market participants. This gives you faster execution speeds and tighter spreads – perfect for scalping.

Execution speed is a key factor when you’re scalping. You need quick speeds to ensure your trades are filled at the price you request, without being requoted – this is why I highly recommend choosing brokers with fast execution speeds.

FP Markets has 11 crypto markets. These include the main markets like Bitcoin and Etherium, as well as alternatives like Solana and Litecoin for you to scalp.

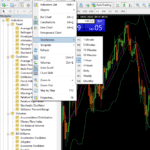

FP Markets Offers Multiple Scalping Platforms

I found FP Markets’ range of trading platforms are all viable for scalping. These include cTrader, MetaTrader 5, and TradingView.

After testing the platforms, I felt that cTrader was the top choice for scalping. It came preloaded with 67 indicators, 10 chart types, and 130 timeframes. I was particularly impressed with the tick charts, as these help you achieve accurate scalping opportunities.

I think the one-click trading setting is my standout scalping feature on cTrader. By reducing the time to place an order, you can capture your scalps faster and maximise profit margins.

The Depth-of-Market tool is also very useful. This shows you where the buying and selling pressure lies in the crypto markets, so you can place scalping trades with higher rates of probability.

9. AvaTrade - Great Choice For Day Trading Cryptos

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

AvaTrade is my choice for day trading cryptos thanks to its fixed spreads from 0.90 pips. It also offers a strong range of 180+ markets, including 17 cryptocurrencies. All this contributed to a respectable enough overall score of 68/100.

The fixed spreads mean you always know what the cost is going to be, regardless of market conditions. This offers valuable stability, especially when you consider how volatile crypto can be.

On top of fixed spreads and range of markets, I found the AvaTradeGO platform useful for day trading with 90+ indicators and market sentiment indicators to help gauge market direction.

Pros & Cons

- Excellent fixed spreads

- Solid trading platform with AvaTradeGO

- Decent range of markets

- Market analysis resources are lacking

- High inactivity fees

- Limited educational resources

Broker Details

Trade Crypto With Fixed Spreads

AvaTrade’s fixed spreads stand out in my tests. They can provide some stability while you are day trading the volatile crypto markets.

You might find this helps you reduce the cost of your trading, when compared with variable spread markets. But bear in mind this won’t always be the case.

On Bitcoin for example, I found that AvaTrade charges a spread of 0.10% of the asset’s value regardless of the market volatility. This works out around 92 pips at the time of writing, which is more expensive than other brokers like Eightcap and Pepperstone that offer variable spreads.

However, based on my experience, these variable spreads can widen to 100+ pips. This can happen at any point during the day, with no warning. I’ve seen other brokers’ spreads triple during macroeconomic announcements, so the stable 92 pips is still an appealing option for day trading in my opinion.

Competitive Fixed Spreads

If you want to trade other markets, AvaTrade provides more than 180, including 55 forex pairs. These forex pairs offer true fixed spreads.

With AvaTrade’s Standard account, the fixed spreads on EUR/USD are 0.90 pips. This is better than the industry average, and even beats many variable spread brokers.

| Broker | Avg. EUR/USD Spread (Standard Account) | Fixed/Variable Spreads |

|---|---|---|

| IC Markets | 0.82 | Variable |

| AvaTrade | 0.90 | Fixed |

| XTB | 0.90 | Variable |

| Eightcap | 1.00 | Variable |

| eToro | 1.00 | Variable |

| FP Markets | 1.10 | Variable |

| Pepperstone | 1.10 | Variable |

| IG Trading | 1.13 | Variable |

| Plus500 | 1.20 | Variable |

Advanced Trading Tools With AvaTradeGO

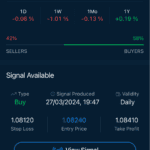

In addition to ideal trading conditions, I found the AvaTradeGO platform offered all the resources day traders need. These include 90+ indicators like the MACD, as well as a market sentiment indicator.

The market sentiment indicator is excellent for day trading as it provides a top-down view of where AvaTrade clients are going long or short on a particular asset. I believe tools like this can be really helpful for day traders, as they offer a quick and easy way to gauge the overall feeling in the wider market.

Ask an Expert

what cryptocurrencies are available for me to trade on MT4 with FP markets?

FP Markets offers 12 different cryptocurrencies for trading when using either MT4 or MT5. This consists of the most popular cryptos such as Cardano, Bitcoin, Bitcoin Cash, Dogecoin, Polkadot, EOS, Ethereum, Chainlink, Litecoin, Ripple and Stellar. For most traders, this range is adequate however you can find brokers with more cryptos. Eightcap for example offers 250 cryptocurrencies.

What is the best cfd crypto broker I can use in the USA?

Unfortunately, US regulations stipulate that you cannot trade CFD products. As a result, you are not allowed to trade crypto CFDs.

You can however trade real crypto using spot prices

What is the best NZ crypto CFD broker?

We consider BlackBull Markets and TMGM to be the best brokers for trading within New Zealand. Both brokers are regulated by the FMA.

What the best platform to select from the broker to trade crypto CFDs?

MetaTrader 5

How long can I hold a CFD?

You can hold CFDs ss long as you wish but you will get overnight charges (also called rolling fees) if you hold you position overnight (5pm New York time). Keep in mind overnight charges are not always a cost, sometimes you can earn interest from them.

Where is CFD trading banned?

CFD trading is banned in the US by the Securities and Exchange Commission (SEC) as part of their Dodd Frank Act. The SEC is responsible for protecting investors and have concerns with risks associated with leverage trading and transparency.