MT4 Crypto Brokers

MT4 crypto brokers offer cryptocurrency trading via MetaTrader 4. The best cryptobrokers for Australian traders are those with low spreads, good range of crypto coins and other CFD products and ASIC regulation.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

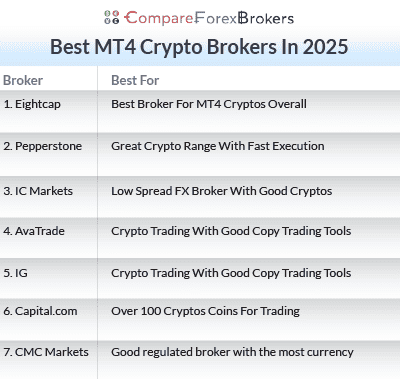

The best MT4 crypto brokers:

- Eightcap - Best Broker For MT4 Cryptos Overall

- Pepperstone - Great Crypto Range With Fast Execution

- IC Markets - Low Spread FX Broker With Good Cryptos

- AvaTrade - Crypto Trading With Good Copy Trading Tools

- IG - Crypto Trading With Good Copy Trading Tools

- Capital.com - Over 100 Cryptos Coins For Trading

- CMC Markets - Good regulated broker with the most currency

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

96 |

FCA, ASIC CySEC, SCB |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

ASIC, FCA CySEC, SCB |

- | - | - | - | - | - | - |

|

||||||||||

Read review ›

Read review ›

|

73 |

ASIC, MAS, FCA CIRO, FMA, BaFin |

0.5 | 0.9 | 0.6 | $2.50 | 1.3 | 1.5 | 1.5 |

|

|

|

138ms | $0 | 338 | 19 | 30:1 | 500:1 |

|

Top MT4 Crypto Brokers for Australian Traders

If you’re in Australia and want to trade crypto using MT4, I’ve found several brokers worth considering. Of the brokers that offer crypto trading with the MetaTrader 4 trading platform, I like Eightcap and Pepperstone the most.

All the brokers in this list offer the usual features found in MetaTrader 4 such as automation with expert advisors, scalping and mobile trading. The brokers also have a decent range of CFD cryptos to trade at good prices, plus other useful features like other CFD financial instruments, customer services and fast execution.

1. Eightcap - Best Broker For MT4 Cryptos Overall

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.23

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView, Capitalise.ai

Minimum Deposit

$100

Why I Recommend Eightcap

With 79 crypto coins with MT4 to choose from and with low spreads, to my mind, Eightcap is the standout broker for trading cryptocurrencies with the MetaTrader 4 trading platform. This range of cryptos far exceeds what most brokers offer, and as a bonus, you can also automate your trading with Capitalise.ai integration.

Beyond MT4 and cryptocurrecnies, Eightcap provides the TradingView and MetaTrader 5 platforms and Capitalise.ai for automation. Other useful features I like with Eightcap include CFD financial instruments such as 56 Forex pairs and top customer services and Forex and crypto education.

Pros & Cons

- Tight spreads and low trading costs

- Streamlined account setup

- Over 95 cryptocurrency CFDs to trade

- AI-Enhanced Economic Calendar: Acuity Trading

- Minimum deposit required to open an account

- Limited educational resources for beginners

- No cTrader

- No 3rd party copy trading tools

Broker Details

Eightcap is an Australian broker that started in 2009 and now has over 80,000 clients on board. While crypto trading with this broker is definitely the brokers strength, Eightcap is also a good range of other CFD instruments. These include:

- Forex Pairs – 56 (with RAW spreads avg. of 0.6 pips for EUR/USD and $3.50 commission)

- Energies – 2

- Metals – 6

- Indices – 16

- Shares – 500+

- Cryptocurrencies – 79 (MT4), 95 (MT5, TradingView)

If trading Forex, you can choose between the RAW account and the Standard account.

- The RAW spread account has ECN trading with spreads of 0 pips and avg. spreads of 0.6 pips for EUR/USD (plus $3.50 commission)

- The Standard Account has spreads from 1.0 pips but no commissions.

Eightcap Has The Best Range of Crypto

In my experience, Eightcap offers one of the best ranges of cryptocurrencies for trading. With the MT4 trading platform, you can choose from 79 pairs and 95 with MT5 and TradingView. Naturally, the most popular pairs such as Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Cardano, and Solana are available but also rarer alt-coins like Dogecoin, Shiba Inu and NEO.

Below, I have compiled a list of some of the most popular cryptocurrency pairs, along with their spreads and liquidity levels:

| Cryptocurrency Pair | Spread (pips) | Liquidity Level | Market Cap |

|---|---|---|---|

| BTC/USD | 170 | High | 1.37T |

| ETH/USD | 20 | High | 331B |

| ADA/USD | 5 | Medium | 12.83B |

| SOL/USD | 200 | Medium | 79.44B |

| XRP/USD | 30 | Medium | 31.06B |

| DOT/USD | 25 | Medium | 6.95B |

| LTC/USD | 15 | Medium | 5.59B |

| BCH/USD | 50 | Medium | 7.31B |

Compared to most brokers, Eightcap clearly has the largest choice of cryptocurrencies to choose from. The below table compares the range of cryptocurrencies offered by fellow top Forex brokers. You will see that 20-30 cryptocurrencies is around the standard with maybe 2 or 3 brokers having over 30.

No. Crypto coins with ASIC regulated brokers

| Broker | Number of Currencies | Broker | Number of Currencies |

|---|---|---|---|

| Eightcap | 79 (MT4) / 95 (MT5, TradingView) | AvaTrade | 18 |

| Pepperstone | 26 | Capital.com | 111 |

| IG | 14 | Axi | 10 |

| Fusion Markets | 13 | Admirals | 27 |

Eightcap Has Good 3rd Party Tools for Crypto Trading

I like that Eightcap provides 3rd party tools to help you get the most out of your trading experience. While I’ve seen some brokers use third-party copy trading tools, Eightcap provides you with automation and analytics tools.

The first tool is Capitalise.ai. This tool can integrate with MT4 and MT5, allowing for a simpler option for automation than with MT4 Expert Advisors. Capitalise.ai allows you to automate your trading without needing to know any code; instead, you create your parameters using filters. These filters will then monitor markets and even activate trades 24/7 when conditions are met.

The second most notable tool is Flash Trader. FlashTrader provides you with advanced analytics so you can better manage your risk. Features include stops, dynamic take profits and one-click trading.

Good Customer Service and Customer Support

While customer support is 24/5 rather than 24/7, what I like is that the live chat uses a human customer agent rather than a chatbot. I found these agents to have good Forex or crypto knowledge meaning Eightcap support systems can handle a greater range of issues than a chat bot. I also liked that the wait time when using live chat was minimal.

Other features I like include Education via Eightcap Labs, TradeZone and Webinars.

- Eightcap Labs is a Forex and Crypto education suite that will teach you fundamentals, trading strategies and e-book and guides. I like how the fundamentals sections teach you how to trade Forex crosses such as JPY, USD, and GBP.

- TradeZone consists of news research by the head of research at Eightcap, Joe Jeffries. These are usually done as live podcasts once a week and have some good trade ideas.

- Webinars – Joe Jeffries leads webinars discussing a range of Forex and Crypto topics to help you learn.

2. Pepperstone - Great Crypto Range With Fast Execution

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why I Recommend Pepperstone

With 9 of the major crypto coins and 17 minor coins, Pepperstone’s range of cryptos for trading is solid. Features I like with Pepperstone include their extensive choice of trading platforms: MT4, MT5, TradingView, cTrader and Pepperstone Trading App and 3rd party copy trading tools.. My tests also found Pepperstone has impressive execution speed and low spreads.

Pros & Cons

- Fast Execution Speeds

- Zero Pip Spreads

- MT5, TradingView and cTrader platforms

- Fast execution speeds — 77ms for limit orders

- No Minimum Deposit

- 24/5 customer support

- Slightly limited selection of crypto options

- Education tools could be better

Broker Details

I consider Pepperstone to score high for trust as they are regulated in 7 jurisdictions. With a daily trading volume of US$12.55 billion and 400,000 clients, it seems many other traders share this trust.

Should you wish to trade Forex, you can choose between Pepperstone Razor Account and Standard Account. The Razor account has three types all with spreads from 0 pips (and 0.1 pips average EUR/USD) plus:

- Razor MT4/MT5 – Spreads from 0 pips (or 0.1 pips EUR/USD) on average plus AUD or USD $3.50 commission

- Razor TradingView/Pepperstone Trading Platform with USD $3.50 commission converted to USD (if account is not in USD at exchange rates)

- Razor cTrader with USD $3.00 commission converted to USD (if account is not in USD at exchange rates)

Pepperstone Has The Best Cryptos For Trading

Pepperstone provides 26 cryptocurrency markets on all their trading platforms. This includes 9 majors like Bitcoin and Ethereum vs USD, EUR, GBP and AUD and 17 minors like Ripple(XRP) and Polkadot (DOT). Beyond individual cryptocurrencies, Pepperstone also offers Crypto10, Crypto20, and Crypto30 indices, providing options for broader crypto market exposure.

| Symbol | Razor Min Spread | Razor Avg Spread | Symbol | Razor Min Spread | Razor Avg Spread |

|---|---|---|---|---|---|

| BTCUSD | 13.00 | 18.84 | BCHUSD | 5.0 | 11.4 |

| BTCEUR | 51.00 | 63.48 | ADAUSD | 4.0 | 4.0 |

| BTCGBP | 45.00 | 55.02 | LINKUSD | 2.9 | 3.2 |

| BTCAUD | 110.00 | 132.59 | DODGEUSD | 10.7 | 11.0 |

| ETHUSD | 3.00 | 3.01 | DOTUSD | 3.0 | 4.1 |

| ETHEUR | 4.60 | 5.15 | XRPUSD | 2.0 | 2.7 |

| ETHGBP | 4.40 | 4.82 | XLMUSD | 1.2 | 1.2 |

| ETHAUD | 7.00 | 7.89 | UNIUSD | 7.0 | 7.0 |

| LTCUSD | 2.5 | 2.7 |

Pepperstone Has Copy Trading MT4 tools

Pepperstone allows you to choose Copy Trading by Pepperstone and cTrader Copy for Copy Trading. While the latter is only available with cTrader, the former is a standalone app available on iOS and Android that can integrate with your MT4 trading account.

Developed in partnership with Pelican Exchange Ltd, a major player in the copy trading industry, this app allows you to access a large range of signal providers to copy. I like how this app is so easy to set up – you just download it from the app store and link the software to your trading account. Once this is done you choose the broker server and if you want to copy or be copied.

There is some terminology you will need to be familiar with such as Mirror Master Size, high watermark and balance max or max drawdown, but they are easy to learn. When you are ready to trade, you will need to set your parameters for risk such as position sizes and drawdown limits but overall the has good risk control for real-time protection.

Pepperstone Has 92 Forex Pairs With Fast Execution

Crypto isn’t the only CFD derivative Pepperstone offers for trading. Other financial instruments include:

- 92 Forex Pairs

- 15 Precious Metals

- 23 Indices

- 100+ ETFs

- 1200+ Stocks

- 16 Soft Commodities

- 4 Energy Commodities

Of particular note is that you can trade Gold vs 9 fiats and Silver vs 4 fiats. These fiats include USD, GBP, EUR, AUD and CAD. The other feature I take note of is the large range of Forex pairs at 92. These pairs consist of 6 Major, 7 minor, 14 crosses, 58 exotics, and 7 NDFs.

To help you get the best spreads when trading Forex pairs, Pepperstone uses a no-dealing desk ECN model. With this in mind, it’s important the broker has fast execution to ensure you get your order price and avoid slippage due to quick price movements.

Execution speed testing done by my colleague Ross Collins found Pepperstone to have some of the fastest execution speeds in the industry.While BlackBull is faster than Pepperstone at 77 ms for limit orders and 100 ms for market execution, they are not ASIC regulated, Fusion is also a touch faster but their crypto range is poor.

| Broker | Overall Speed Ranking | Limit Order Execution Speed (ms) | Market Order Execution Speed (ms) |

|---|---|---|---|

| BlackBull Markets | 1 | 72 | 90 |

| Fusion Markets | 2 | 79 | 77 |

| Pepperstone | 1 | 77 | 100 |

| IC Markets | 2 | 134 | 153 |

| CMC Markets | 3 | 138 | 180 |

| Eightcap | 4 | 143 | 139 |

| IG | 5 | 174 | 141 |

3. IC Markets - Low Spread FX Broker With Good Cryptos

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.03

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$200

Why I Recommend IC Markets

While IC Markets’ range of 21 cryptos is smaller than some other brokers, the broker makes up for it thanks to their overall product offering. Of particular note is their low spreads for trading 62 Forex pairs with their Standard and RAW spread accounts using MT4, MT5, TradingView and cTrader. So if you want a low cost broker to trade FX and Crypto, IC Markets could be a good choice.

Pros & Cons

- Low spreads on forex and cryptocurrencies

- Advanced platforms (MT4, MT5)

- Wide selection of cryptocurrencies

- High liquidity with substantial trading volume

- Minimum deposit required for account opening

- Limited educational resources for beginners

- Variable response times for customer support

Broker Details

IC Markets was founded in 2007 and serves over 180,000 clients worldwide. The broker is actually the largest in the world by trading volume. You will find The broker offers a variety of trading instruments including:

- Forex – 61

- Energy Commodities – 3

- Precious Metal Commodities – 4

- Soft Commodities -17

- Indices – 25

- Futures – 4

- Bonds/Treasuries – 9

- Stocks – 2100+

OF particular note is that Gold can be traded against 6 fiats, including Japanse Yen and Swiss Franc.

IC Markets Range Of Crypto

IC Markets provides 21 cryptocurrencies to trade including Bitcoin, Ethereum, and Litecoin, as well as several smaller, emerging altcoins.

Trading Pairs:

- Crypto-to-Fiat: You can exchange cryptocurrencies against major fiat currencies like USD, EUR, and JPY, allowing for flexible trading strategies.

- Crypto-to-Crypto: The platform also enables trading between different cryptocurrencies, giving users the opportunity to diversify their portfolios.

While the overall range is on the low side, the broker makes up for it with lower competitive costs:

- BTC/USD: Approximately 42.036 pips

- ETH/USD: Approximately 11.605 pips

- LTC/USD: Approximately 42.036 pips

Here’s a comparison of spreads (in pips) for popular cryptocurrencies across different brokers:

| Broker | BTC/USD | ETH/USD | SOLUSD |

|---|---|---|---|

| IC Markets | 42.036 | 11.605 | - |

| Pepperstone | 21.17 | 3.03 | 2.5 |

| AvaTrade | 67.40 | 4.06 | - |

| EightCap | 170 | 20 | 200 |

| CMC Markets | 80 | 4.5 | 20 |

IC Markets Offer Low Spreads For Forex Trading

Low costs with IC Markets’ also extend to Forex trading. My tests done by colleague Ross Collins found that IC Markets have the most competitive spreads for their Standard Account and very competitive spreads with their RAW spread account.

This CFD broker supports two account types:

- Raw Spread Account: The average EUR/USD spread is just 0.1 pips, with a small commission of $3.50 per lot per side. Designed for day traders, scalpers, and those using trading bots, this account has deep liquidity and quick execution.

- Standard Account: Spreads start at 0.8 pips, no commission fees, high leverage up to 1:30, and access to liquidity from 25 providers. The account has quick execution, making it a fair choice for all sorts of trading strategies.

The table below shows that IC Markets average 1.03 pips for the Standard account, when I combine the average spreads results for EUR.USD, AUD/USD and GBP/USD. This is an impressive result as it is better than all the brokers we tested with only CMC Markets coming close.

Its a similar story for the RAW account, IC Markets finished near the top, with 0.32 pips for the same tests. This is second only to Fusion Markets, with Pepperstone being a close 3rd.

| Average Spread Test Results For Standard and Raw Accounts | ||||||||

|---|---|---|---|---|---|---|---|---|

| Broker | Average Spread Standard (EUR/USD) | Average Spread Standard (AUD/USD) | Average Spread Standard (GBP/USD) | Combined Average Standard Spread | Average Spread RAW (EUR/USD) | Average Spread RAW (AUD/USD) | Average Spread RAW (GBP/USD) | Combined Average Raw Spread |

| IC Markets | 0.73 | 0.82 | 1.15 | 1.03 | 0.19 | 0.23 | 0.27 | 0.32 |

| Pepperstone | 1.21 | 1.24 | 1.5 | 1.46 | 0.19 | 0.19 | 0.41 | 0.36 |

| BlackBull Markets | 1.34 | 1.69 | 1.78 | 1.82 | 0.46 | 0.85 | 0.96 | 0.94 |

| FP Markets | 1.19 | 1.28 | 1.42 | 1.47 | 0.2 | 0.31 | 0.31 | 0.41 |

| CMC Markets | 0.8 | 0.77 | 1.08 | 1.11 | 0.44 | 0.68 | 0.9 | 0.73 |

| Eightcap | 1.16 | 1.34 | 1.49 | 1.51 | 0.2 | 0.48 | 0.44 | 0.5 |

| Axi | 1.45 | 1.59 | 1.83 | 1.79 | 0.43 | 0.67 | 0.95 | 0.73 |

4. AvaTrade - Crypto Trading With Good Copy Trading Tools

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why I Recommend AvaTrade

Like IC Markets, AvaTrade’s crypto range is on the small side with just 16 plus crypto10 index, but the broker provides a range of platforms for trading. These platforms, including MT4, MT5, WebTrader, and the AvaTradeApp which are all available with iOS and Android mobiles and Windows desktops.

One feature with AvaTrade I particularly like is their choice of copy trading tools for crypto trading. You can choose between DupliTrade and AvaSocial – both apps have good functionality for mirror trading, making AvaTrade a good choice for beginners.

Pros & Cons

- User-friendly interface for crypto trading

- Copy trading tools (DupliTrade and AvaSocial)

- Integration with MetaTrader 4

- Variety of cryptocurrencies available

- Limited educational resources for beginners

- Higher spreads compared to some other brokers

Broker Details

Founded in 2006, AvaTrade’s point of difference is the ability to trade options via their AvaOptions apps. Options include 42 Forex options, plus gold and silver, but you can also trade traditional CFD markets like Forex.

Key Features:

- Regulation: Regulated by multiple authorities, ensuring security for crypto traders

- Trading Platforms: Trade cryptocurrencies on MT4, MT5, WebTrader, and the AvaTradeApp

- Automated Trading: Tools like DupliTrade and AvaSocial for replicating trades and social trading

- Educational Resources: Offers materials to enhance cryptocurrency trading knowledge

Copy Trading With AvaTrade

16 cryptos and 53 Forex pairs are available with AvaTrade along with commodities, stocks and indices for Copy trading with DupliTrade and AvaSocial. To use these tools you will need an MT4 or MT5 account, though neither app actually integrates with MT4 itself.

- DupliTrade: DupliTrade allows you to automatically copy trades from expert cryptocurrency traders in your AvaTrade account. With a minimum deposit of $2,000, you can access a selection of vetted strategy providers and diversify your portfolio.

- AvaSocial: AvaSocial connects you with a community of expert traders, allowing you to replicate their strategies. Everyone can share insights and strategies, enhancing collaboration and learning within the trading community.

5. IG Group - Top Range Of Markets With MT4 Including Cryptos

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, IG Trading Platform, L2 Dealer, ProRealTime, TradingView

Minimum Deposit

$0

Why I Recommend IG

IG Group is one of the world’s largest and most regulated brokers. While they provide 11 cryptocurrencies, 2 crypto crosses and crypto 10 indices, it is unique product like options, futures, spot trading, interest rates and sectors that make IG Group interesting.

Pros & Cons

- Extensive range of trading products

- Regulated and reputable broker

- User-friendly MT4 platform

- Good educational resources

- Limited number of cryptocurrencies compared to some competitors

- Spreads may vary based on market conditions

Broker Details

IG was founded in 1974 in London and is one of the worlds largest brokers, with operations in 19 countries. The broker’s core offering is leverage trading, but they also have shares trading, so chances are IG offers the financial instrument you wish to trade. Trading platforms include MT4, ProRealTime and IG trading platform with most products being commission-free.

The cost to trade crypto CFDs on IG

There is no commission for trading the 11 crypto CFDs with IG Group. To trade these cryptos, you can use leverage of 2:1, which is the same as 50% margin. Overall I would say there are better brokers for trading cryptocurrencies but IG Group is still worth considering given the quality of their overall product.

Here is a summary of costs and margins for ten cryptocurrencies:

| Cryptocurrency | Minimum Spread (pips) | Retail Margin Required |

| Bitcoin | 36 | 50% |

| Bitcoin Cash | 2 | 50% |

| Ether | 5.4 | 50% |

| Litecoin | 7 | 50% |

| EOS | 1.3 | 50% |

| Stellar | 0.2 | 50% |

| Cardano | 1.4 | 50% |

| Polkadot | 9.1 | 50% |

| Dogecoin | 0.1 | 50% |

| Chainlink | 7.8 | 50% |

IG has the largest range of trading instruments

Besides a wide range of cryptocurrency choices, IG offers a diverse selection of trading instruments, making it suitable for various trading strategies and preferences. Here’s an overview:

- Share Trading: Invest in individual stocks like Apple (AAPL) or Tesla (TSLA) to directly hold a portion of these companies.

- Share CFDs: Trade CFDs on shares like Amazon (AMZN) or Microsoft (MSFT), allowing you to speculate on their price movements without owning the underlying asset.

- Forex: Trade currency pairs such as EUR/USD or GBP/JPY, enabling you to capitalise on fluctuations in exchange rates.

- Indices: Trade major indices like the S&P 500 or FTSE 100, giving you exposure to a broad range of companies within those markets.

- Commodities: Invest in commodities such as gold (XAU/USD) or crude oil (WTI), allowing you to profit from price changes in these essential resources.

- Other Markets: Access cryptocurrency trading with options like Bitcoin (BTC) or Ethereum (ETH), as well as exchange-traded funds (ETFs) for diversified investment strategies. Other markets include:

- Interest Rates

- Spot Trading

- Futures Trading

- OptionsTrading

- Weekend Markets

6. Capital.com - Over 100 Cryptos Coins For Trading

Forex Panel Score

Average Spread

EUR/USD = 1.0 GBP/USD = 1.5 AUD/USD = 1.5

Trading Platforms

Capital.com Web Platform, Mobile and Tablet App

Minimum Deposit

$20

Why I Recommend Capital.com

Capital.com is a solid choice for cryptocurrency trading due to its extensive range of over 143 cryptocurrencies and user-friendly features. The ability to sort cryptocurrencies by various metrics, such as volatility and trading volume, allows traders to make informed decisions quickly. Additionally, the platform provides essential charting and risk management tools, making it suitable for both new and experienced traders.

Pros & Cons

- Trade over 100 cryptocurrencies

- Sort crypto based on volatility and trading volume

- Provide professional market insights

- Comprehensive tools and risk management features

- There is a learning curve for the platform

- Limited advanced tools

- Market Risks: Trading CFDs carries the risk of significant losses

Broker Details

Capital.com – Extensive Crypto Trading Options

Capital.com offers CFD trading for 143 cryptocurrencies, Given the the number of alt-coins available, you can be certain this broker offers your preferred crypto coin. What I like is that their website makes it easy to find which coins are the top risers and top fallers and which digital currencies are the most traded or most volatile.

This table provides an overview of selected cryptocurrency pairs, showing their spread and the distribution of sellers and buyers:

| Pair | Spread | Sellers (%) | Buyers (%) |

|---|---|---|---|

| SRM/USD | - | 99.53 | 0.47 |

| BTS/BTC | - | 95.19 | 4.81 |

| INJ/USD | 6.5 | 88.89 | 11.11 |

| XLM/BTC | 0.71 | 97.02 | 2.98 |

| NEO/BTC | -1.9 | 86.67 | 13.33 |

| OG/USD | 5.91 | 0 | 0 |

| WAVES/USD | - | 97.83 | 2.17 |

| STORJ/USD | -4.6 | 100 | 0 |

| GRT/BTC | -0.81 | 94.12 | 5.88 |

| CVC/USD | -1.65 | 100 | 0 |

Other trading products with Capital.com include:

- Shares CFD – 3400+

- Forex – 125

- Indices – 39

- Commodities (hard and soft)- 49

7. CMC Markets - Good regulated broker with the most currency

Forex Panel Score

Average Spread

EUR/USD = 0.5 GBP/USD = 0.9 AUD/USD = 0.6

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why I Recommend CMC Markets

CMC Markets is one of the most regulated brokers globally, with oversight from authorities such as ASIC, FCA, BaFin, FMA, CIRO, MAS, and DFSA. They provide a trustworthy environment for crypto traders and offer a comprehensive selection of trading tools and platforms, including advanced options beyond MetaTrader 4.

Pros & Cons

- Highly regulated, ensuring a trustworthy trading environment

- Extensive range of trading tools and platforms

- Access to 19 cryptocurrencies

- Three crypto indexes: All Crypto, Major Crypto, and Emerging Crypto

- Strong educational resources and research support

- Learning curve for beginners

- Limited advanced features for experienced traders

- May have higher spreads compared to some competitors

Broker Details

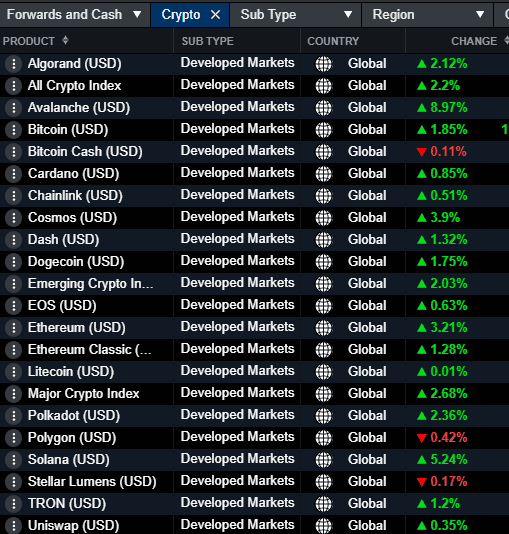

CMC Markets offer 19 Cryptos and 3 Crypto Indexes

CMC Markets offers a selection of 19 cryptocurrencies alongside three crypto indexes: the All Crypto Index, the Major Crypto Index, and the Emerging Crypto Index. This diverse range allows traders to explore different assets and market segments.

CMC Markets Have Top Education and Research

CMC Markets call its education and research section their “knowledge hub”. As an MT4 crypto trader, you will appreciate that they have an MT4 academy to help you learn all aspect of using the platform,other features include CFD knowledge hub and trading guides so you can learn about aspects of trading. What i like is that the guide has filters so you can search for information by topics.