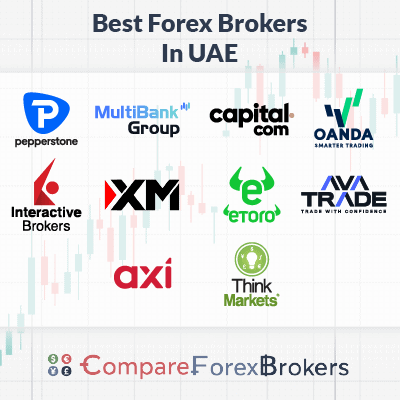

Best Forex Brokers In UAE

We compared DFSA and SCA-regulated brokers to find the best forex platforms for UAE traders. Our review focused on execution speeds, raw spreads, platform functionality, and regulatory compliance.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Our list of the top DFSA regulated brokers is:

- Pepperstone - Best Forex Broker In UAE

- Multibank Group - Lowest Spread Forex Broker

- Capital.com - Best Gold Trading Platform

- OANDA - Best Platform To Learn Forex Trading

- Interactive Brokers - Best Forex + Stock Trading Platform

- XM - Best MT5 Broker

- eToro - Best Copy Trading Broker Platform

- AvaTrade - Best Islamic Trading Account

- Axi - Best Forex Demo Account

- ThinkMarkets - Best Forex Trading App

Which broker is the best for forex trading in the UAE?

Pepperstone takes the top spot as the best forex broker in the UAE. This is because they offer raw spreads from 0.0 pips with $3.50 commissions and 77ms execution speeds, all under DFSA regulation. MultiBank Group comes second with spreads from 0.0 pips and lower $3.00 commissions under SCA regulation with 500:1 leverage.

On this page, I shortlisted ten brokers for you to consider. For each broker I highlight their strengths, such as them having low spreads, fast execution speeds, or multiple platform options.

1. Pepperstone - Best Forex Broker In UAE

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

I recommend Pepperstone as the best DFSA-regulated broker for UAE traders based on its comprehensive platform offering, competitive raw spread pricing, and proven execution infrastructure. You get four professional platforms (MetaTrader 4, MetaTrader 5, cTrader, and TradingView) plus the Pepperstone Trading Platform app, covering every trading style from manual execution to fully automated strategies.

The Razor Account delivers raw spreads from 0.0 pips on EUR/USD with transparent $3.50 per side commission. Our testing measured 77ms average limit order execution, and you access 1,475 instruments including 94 forex pairs, 1,162 share CFDs, 26 indices, 40 commodities, 31 cryptocurrencies, and 95 ETFs with no minimum deposit requirement.

Pros & Cons

- Raw spreads from 0.0 pips, $3.50 commission per side

- Five platforms: MT4, MT5, cTrader, TradingView, Pepperstone App

- 77ms execution speeds independently tested

- 1,475 instruments across all asset classes

- $0 minimum deposit, Active Trader volume discounts

- Standard Account spreads start at 1.0 pips

- Commission-based pricing on Razor/Pro accounts

- Cannot fund directly with AED

- No guaranteed stop-loss orders

Broker Details

Platform Selection for Every Trading Style

Pepperstone’s MetaTrader 4 includes Smart Trader Tools featuring Mini Terminal for one-click order management, Correlation Matrix displaying currency pair relationships, and Alarm Manager for multi-instrument price alerts. The platform supports 30 built-in indicators, 23 analytical objects including Fibonacci retracements and trend channels, and Strategy Tester for Expert Advisor backtesting across multiple timeframes.

MT5 provides 38 technical indicators versus MT4’s 30, expands timeframes to 21 options, and includes an integrated Economic Calendar showing scheduled high-impact events. cTrader specialises in algorithmic trading with cTrader Automate for building custom robots using C# code, Level II pricing displaying full market depth, and advanced charting.

TradingView integration delivers 100+ indicators, Pine Script for custom tool creation, and social features for sharing strategies with the trading community.

Comprehensive Multi-Asset Coverage

Pepperstone’s 93 forex pairs include 28 minors like EUR/GBP and AUD/NZD for diversification beyond majors, plus 37 exotics including USD/TRY and EUR/ZAR for emerging market exposure. The 1,162 share CFDs let you trade corporate earnings and sector rotations across US tech stocks, UK blue chips, and major European companies without owning the underlying shares.

Index CFDs on 26 global markets give you broad economic exposure through single instruments like S&P 500, NASDAQ 100, or DAX 40. Commodities span precious metals for inflation hedging, energies responding to geopolitical events, and soft commodities influenced by seasonal patterns.

The 31 cryptocurrency CFDs use perpetual contracts, eliminating the need to roll futures or manage expiry dates when holding Bitcoin or Ethereum positions.

Transparent Cost Structure and Volume Discounts

The Standard Account charges zero commission with spreads averaging 1.0 pips EUR/USD, 1.3 pips GBP/USD, and 1.1 pips AUD/USD. This pricing benefits traders executing under 5 lots daily where commission charges would exceed spread differentials, with full platform access including TradingView and no minimum deposit requirement.

The Razor Account offers raw spreads from 0.0 pips with $3.50 commission per 100,000 traded per side ($7 round-trip). The Active Trader Program reduces costs for high-volume traders through three discount tiers, potentially saving thousands monthly while maintaining institutional-grade execution through Equinix data centre infrastructure in New York, London, and Tokyo.

2. Multibank Group - Lowest Spread Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.5

AUD/USD = 0.4

Trading Platforms

MT4, MT5, Multibank Social Trading

Minimum Deposit

$50

Why We Recommend Multibank Group

I recommend MultiBank Group as the most cost-effective choice for active traders seeking institutional-grade ECN execution at retail pricing. The ECN account delivers $3.00 round-turn commissions combined with lowest spread forex brokers on major pairs, creating significant cost savings when you trade volumes above 5 lots daily.

MultiBank stands out with 14,000 share CFDs (the largest selection in the UAE), letting you trade global equities across US, European, Asian, and emerging markets from a single account.

The proprietary MultiBank-Plus App enhances ECN trading with 5-level market depth displays, integrated social trading to copy experienced traders, and complimentary VPS hosting. You also benefit from comprehensive education through 15 structured courses and 9 downloadable ebooks, plus convenient UAE-focused funding via MyFatoorah alongside standard payment methods.

Pros & Cons

- $3.00 round-turn commission

- 14,000 share CFDs, 40 forex pairs

- 500:1 leverage via SCA regulation

- MultiBank-Plus App with VPS and social trading

- 20% deposit bonus up to $40,000

- ECN requires $10,000 minimum deposit

- Standard Account 1.5 pip spreads

- Limited crypto CFDs (11 only)

- No Islamic account option

Broker Details

Low-Cost ECN Execution

MultiBank’s ECN account charges $3.00 round-trip commission ($1.50 per side), roughly half what most UAE brokers charge at $6-$7. Combined with raw spreads from 0.0 pips on EUR/USD, this pricing saves you significant costs when executing 5+ lots daily.

The ECN account provides direct market access to their liquidity pool without dealer intervention, meaning your orders fill at the best available prices from multiple institutional providers.

Execution transparency comes through 5 levels of market depth visible in real-time, showing you exactly how much volume is available at each price tier before you enter positions. This visibility helps you gauge potential slippage on larger orders and understand true market liquidity during volatile periods. The ECN structure eliminates conflicts of interest since the broker earns from commissions rather than trading against you.

Educational Resources and Structured Learning

MultiBank provides 15 courses covering Introduction (6 lessons), Trading Terms (5 lessons), Advanced Strategies (7 lessons), Economics (6 lessons), ECN trading (4 lessons), and MetaTrader tutorials (5 desktop, 6 mobile lessons).

You can download 9 ebooks on trading fundamentals, technical analysis, and risk management. The structured curriculum progresses from beginner concepts through advanced ECN trading strategies, helping you understand market mechanics before risking capital.

Flexible Platform Selection

MultiBank supports MetaTrader 4 with 30 built-in indicators for technical analysis and Strategy Tester for backtesting Expert Advisors across historical data. MetaTrader 5 expands capabilities with 38 indicators, 21 timeframes versus MT4’s 9, and an integrated economic calendar displaying scheduled events. Both platforms allow unrestricted hedging, scalping, and automated trading without strategy limitations.

The proprietary MultiBank-Plus App adds mobile-optimised ECN features including market depth displays, integrated social trading to browse and copy successful traders, and complimentary VPS hosting for automated strategies.

You can switch between MT4, MT5, and the MultiBank-Plus App seamlessly as all accounts support simultaneous access across platforms. The app provides institutional-grade transparency while maintaining mobile convenience for trading on the move.

3. Capital.com - Best Gold Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 0.6 GBP/USD = 1.3 AUD/USD = 0.6

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$0

Why We Recommend Capital.com

I recommend Capital.com for gold trading because they offer guaranteed stop-loss orders on their proprietary platforms, protecting you from slippage during volatile price swings that frequently occur in precious metals markets. This feature is rare among UAE brokers and particularly valuable for gold traders managing overnight exposure.

You get competitive 0.6 pip spreads on gold trading with zero commission, making the all-in cost transparent and predictable. Capital.com’s SCA regulation allows 300:1 leverage versus the 30:1 DFSA limit, letting you control larger gold positions with less capital commitment.

Beyond metals, you access 4,500 markets including extensive commodities, global share CFDs, major indices, and cryptocurrency CFDs through gold trading platforms – MT4, MT5, TradingView, and their proprietary web and mobile apps – with AI-powered risk analysis tools.

Pros & Cons

- Guaranteed stop-loss orders (GSLO)

- 0.6 pip gold spreads, zero commission

- 300:1 leverage via SCA regulation

- 4,500 markets across all asset classes

- AI risk management tools on proprietary platforms

- $0 minimum deposit, free deposits/withdrawals

- No raw spread ECN account option

- Single account tier

- GSLO only available on Capital.com platforms

- Professional account requires €500K portfolio value

4. OANDA - Best Platform To Learn Forex Trading

Forex Panel Score

Average Spread

EUR/USD = 0.89 GBP/USD = 1.54 AUD/USD = 1.37

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

I recommend OANDA for their proprietary FxTrade platform delivering commission-free trading with competitive spreads averaging 0.89 pips EUR/USD, 1.54 pips GBP/USD, and 1.37 pips AUD/USD.

The platform provides advanced order types including trailing stops, guaranteed stop-losses (with premium), and algorithmic order execution through their API. You trade 68 forex pairs with multi-regulator oversight from tier-1 authorities including Singapore’s MAS, Canada’s CIRO, Australia’s ASIC, UK’s FCA, and US regulators NFA/CFTC, giving you exceptional regulatory protection.

OANDA’s FxTrade platform integrates TradingView charts directly, providing professional-grade technical analysis without switching applications. The Trading Academy offers structured learning paths progressing from forex basics through advanced strategies, with educational content integrated into live market examples rather than generic screenshots.

You can practice using paper trading functionality that mirrors live account conditions exactly, helping you validate strategies before risking capital while tracking identical performance metrics.

Pros & Cons

- Multi-regulator oversight (MAS, ASIC, FCA, NFA/CFTC)

- FxTrade with integrated TradingView charts

- Commission-free trading, competitive spreads

- Guaranteed stop-loss orders available

- Structured Trading Academy with progressive curriculum

- $0 minimum deposit, no funding fees

- No raw spread ECN pricing option

- Standard spreads wider than ECN brokers

- Limited to MT4 and FxTrade (no MT5, cTrader)

- Educational resources focus primarily on forex

5. Interactive Brokers - Best Forex + Stock Trading Platform

Forex Panel Score

Average Spread

EUR/USD = N/A GBP/USD = N/A AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

I recommend Interactive Brokers if you want to combine forex trading with actual stock ownership rather than CFDs. The broker gives you access to 167 stock exchanges globally, letting you buy and hold real shares in US, European, Asian, and emerging market companies.

The tiered commission structure rewards higher trading volumes with rates dropping from 0.20 basis points (Tier 1) down to 0.08 basis points (Tier III) as your monthly volume exceeds $5 billion. Interactive Brokers provides multiple professional trading platforms including TWS Desktop for power users, Mobile and GlobalTrader apps for on-the-go trading, and specialised FX Trader for currency markets.

Beyond equities, you can build traditional investment portfolios with bonds for fixed income, over 42,000 mutual funds, and ETFs tracking sectors or regions. The iBKR Campus provides structured education through 17+ webinar topics covering stocks, options, bonds, and other investment products, helping you understand how to use these instruments.

Pros & Cons

- Real stock ownership on 167 exchanges

- Tiered commissions decrease with volume

- Access to bonds, 42,000+ mutual funds, ETFs

- Multiple platforms: TWS, Mobile, GlobalTrader

- IBKR Campus education with 17+ webinar topics

- Steep learning curve for beginners

- Complex tiered commission structure

- Higher minimum deposits required

- Wire transfer deposit fees apply

6. XM - Best MT5 Broker

Forex Panel Score

Average Spread

EUR/USD = 0.2 GBP/USD = 0.5 AUD/USD = 0.8

Trading Platforms

MT4, MT5, XM App/Tablet

Minimum Deposit

$5

Why We Recommend XM

I recommend XM for traders specifically seeking MetaTrader 5 brokers advanced capabilities with comprehensive multi-asset access from a single account. The platform provides 38 technical indicators versus MT4’s 30, expands timeframes to 21 options compared to MT4’s 9, and includes an integrated economic calendar showing scheduled events with historical impact data.

This makes XM ideal if you trade across multiple asset classes and need MT5’s superior order management tools for handling simultaneous forex, stock, commodity, and index positions.

You can access extensive stock CFD coverage from US, European, and Asian exchanges, commodities spanning precious metals and energies, equity indices including both cash and futures contracts, plus thematic indices tracking specific market sectors. The XM App integrates TradingView charts directly, giving you professional-grade analysis tools on mobile without switching between applications.

Pros & Cons

- MT5 with 38 indicators and 21 timeframes

- XM App with integrated TradingView charts

- Extensive stock CFDs across global exchanges

- Ultra Low Account: 0.8 pips, $1.60 commission

- $5 minimum deposit on all account types

- Social/copy trading features available

- Standard Account spreads wider at 1.6 pips

- Professional account requires verification

- 30:1 leverage limit (MENA regulation)

- Educational resources primarily video-based

7. eToro - Best Copy Trading Broker Platform

Forex Panel Score

Average Spread

EUR/USD = 1.0 GBP/USD = 2.0 AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

I recommend eToro if you want to learn by copying experienced traders rather than developing strategies from scratch. You can browse thousands of traders with verified track records showing monthly returns, risk scores, and asset allocations, then allocate funds to automatically mirror their positions in your account.

eToro provides 932 ETFs for diversified portfolio building, significantly more than competing brokers, covering every sector, region, and investment theme you might want exposure to. The social feeds let you see what popular investors are buying and read their analysis before copying trades.

You access 65 forex pairs, extensive cryptocurrency coverage, global indices, and commodities across agriculture, metals, and energies. The eToro Academy provides structured courses, guides, and tutorials helping you progress from beginner concepts through advanced strategies.

Pros & Cons

- CopyTrader with verified performance data

- Social feeds showing investor activity

- Extensive crypto and ETF coverage

- Instant funding via multiple methods

- Beginner-friendly interface

- No MT4/MT5 (proprietary platform only)

- Wider spreads vs ECN brokers (1.0+ pips)

- $50 minimum deposit

- Limited advanced charting tools

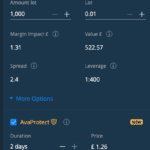

8. AVATRADE - Best Islamic Trading Account

Forex Panel Score

Average Spread

EUR/USD = 0.8

GBP/USD = 1.2

AUD/USD = 0.9

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

I recommend AvaTrade if you need a swap free brokers with automatic swap-free status on all accounts for UAE residents, eliminating separate application processes. Your positions remain swap-free for up to 5 days before administrative fees apply, giving you short-term flexibility without interest charges.

AvaTrade’s unique AvaProtect feature lets you insure losing positions up to $50,000 for a premium of 3-10% based on trade duration, essentially buying protection against adverse moves. You can also trade 44 forex options (plus gold and silver options), giving you defined-risk strategies unavailable at most UAE brokers offering only spot forex.

The broker provides multiple account types including fixed spreads at 0.8 pips for predictable costs, or the Professional account with 0.6 pips and $1.60 commission if you meet the qualification criteria for 400:1 leverage.

Pros & Cons

- Automatic Islamic account for UAE residents

- AvaProtect insurance for losing positions

- 44 forex options for defined-risk strategies

- Fixed spread account option (0.8 pips)

- Multiple platforms: MT4, MT5, AvaOptions, AvaTradeGO

- AvaSocial copy trading and ZuluTrade integration

- Islamic accounts: swap fees apply after 5-day period

- $100 minimum deposit on all account types

- Retail accounts limited to 30:1 leverage (ADGM)

- Professional account requires qualification

9. AXI - Best Forex Demo Account

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.2

Trading Platforms

MT4

Minimum Deposit

$0

Why We Recommend Axi

I recommend Axi for their Pro Account delivering raw spreads from 0.0 pips with $3.50 commission per side ($7 round-trip) and fast execution speeds averaging 90ms on limit orders. The Elite Account maintains the same commission structure but requires $500 minimum deposit, qualifying you for 500:1 leverage versus the 30:1 retail limit if you meet professional trader criteria.

You get access to 69 forex pairs including majors, minors, and exotic currencies, plus Autochartist pattern recognition software identifying technical setups across your watchlist automatically.

What sets Axi apart is their unlimited demo account letting you test these exact conditions without time pressure or expiry dates. You can create multiple forex demo accounts comparing Standard (0.6 pips, zero commission) versus Pro pricing models to see which structure suits your trading frequency.

The MT4 NexGen package enhances the platform with advanced order management, correlation matrices, and sentiment indicators, giving you institutional-grade tools to validate strategies before funding your live account.

Pros & Cons

- Pro Account: 0.0 pips with $3.50 per side commission

- 90ms execution speeds tested

- Unlimited demo with multiple sub-accounts

- Autochartist pattern recognition included

- MT4 NexGen enhancements

- Elite Account: 500:1 leverage with $500 minimum

- MT4 only (no MT5, cTrader, TradingView)

- Standard Account spreads at 0.6 pips

- Elite Account requires $500 minimum

- Limited educational resources vs competitors

10. ThinkMarkets - Best Forex Trading App

Forex Panel Score

Average Spread

EUR/USD = 0.11 GBP/USD = 0.4 AUD/USD = 0.3

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

I recommend ThinkMarkets for their proprietary best forex trading app delivering 65 technical indicators, nine chart types, and one-tap order execution that rivals desktop platforms. The app includes economic calendar integration sending push notifications 15 minutes before major data releases like NFP, FOMC decisions, and GDP announcements, helping you prepare for volatility without constantly monitoring news feeds.

You get full charting capabilities on mobile including Heikin Ashi, Renko, Kagi charts, and all standard indicators like MACD, RSI, Bollinger Bands, Ichimoku Cloud, and Parabolic SAR.

The ThinkTrader Account offers spreads from 0.6 pips EUR/USD with zero commission and $50 minimum deposit, suitable if you primarily trade from mobile devices. You access 42 forex pairs, extensive stock CFD coverage across global exchanges, indices, ETFs, and commodities including precious metals and energies.

The app also integrates TradingView charts, giving you the choice between ThinkMarkets’ proprietary interface or TradingView’s social features and advanced analysis tools.

Pros & Cons

- 65 indicators on mobile app with full charting

- Push notifications 15 minutes before major events

- TradingView integration on mobile

- 2,700+ stock CFDs across global exchanges

- Zero commission on ThinkTrader Account

- 24/7 multilingual customer support

- No MT4/MT5 in UAE (offshore entity only)

- ThinkTrader Account: 0.6 pips spreads

- Standard/ThinkZero offshore accounts not UAE-regulated

- $50 minimum deposit on ThinkTrader Account

Ask an Expert

Which one is good copy trading or normal trading?

Copy trading often comes easier for beginners, as it lets you follow and copy experienced traders. Normal trading will come as a better choice if you want full control over your trades and have trading knowledge.

I’m based in the UAE—just wondering which of these brokers has the quickest funding and withdrawal process when using a local bank?

I’d recommend Pepperstone based on your preferences. They have an excellent back office who are quick to process your requests like withdrawals, but can vary depending on when you make the request. In general, you can expect your funds to be transferred to your bank account within 1-3 business days. As for funding your account, the bank wire transfer process can take 1-3 business days.