Best TradingView Brokers in the UAE

I tested TradingView across different brokers in the UAE to find out which ones give you the platform’s real advantages. A lot of brokers offer TradingView integration but what matters is whether you’re getting the low spreads, extra timeframes, advanced charting, proper multi-asset access, and fast execution.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

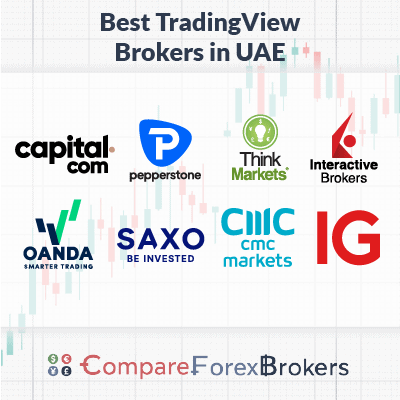

Best TradingView Brokers

- Capital.com - Best TradingView Broker For Forex Traders

- Pepperstone - Best UAE Forex Broker Offering TradingView

- ThinkMarkets - Best TradingView App Provider

- Interactive Brokers - Share + Forex Brokerage Account With TradingView

- OANDA - Best TradingView Integration Beginner Broker

- Saxo Bank - Good Automation broker With Integration

- CMC Markets - Solid CFD Broker With TradingView Connection

- IG Group - Lowest Spread TradingView Broker

What is the best broker for TradingView?

Capital.com is the best TradingView broker in my view because it combines TradingView’s advanced charting, with hundreds of indicators, drawing tools, alerts, and multi-timeframe analysis, with 0% commission trading. I like that I can trade directly from TradingView charts while paying only tight spreads (around 0.6 pips on EUR/USD), with no deposit or withdrawal fees, keeping costs clear and predictable.

1. Capital.com - Best TradingView Broker For Forex Traders

Forex Panel Score

Average Spread

EUR/USD = 0.6 GBP/USD = 1.3 AUD/USD = 0.6

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$0

Why We Recommend Capital.com

We recommend Capital.com for TradingView because it combines direct TradingView integration with competitive pricing and high leverage. Spreads start from around 0.6 pips, with zero commission, helping keep overall trading costs low when trading directly from TradingView charts.

You can analyse markets using TradingView’s advanced charting tools, indicators, and Pine Script, then execute trades without switching platforms. Capital.com also offers leverage up to 400:1, making it suitable for active traders who want flexibility, strong technical analysis, and a simple, commission-free pricing structure.

Pros & Cons

- Guaranteed stop-loss orders (GSLO)

- 0.6 pip gold spreads, zero commission

- 300:1 leverage via SCA regulation

- 4,500 markets across all asset classes

- AI risk management tools on proprietary platforms

- $0 minimum deposit, free deposits/withdrawals

- No raw spread ECN account option

- Single account tier

- GSLO only available on Capital.com platforms

- Professional account requires €500K portfolio value

Broker Details

TradingView integration and platforms

Capital.com offers direct TradingView integration, allowing you to analyse markets using TradingView’s advanced charting tools and place trades straight from the chart. You get access to 100+ indicators, drawing tools, custom layouts, and Pine Script, making this setup ideal if your trading decisions are driven by technical analysis. In addition to TradingView, Capital.com also supports MetaTrader 4, MetaTrader 5, and its own web and mobile trading platforms, giving you flexibility across different trading styles.

Pricing, leverage, and accounts

Capital.com uses a commission-free pricing model, so your trading costs are built into the spread. Spreads start from around 0.8 pips on major markets, keeping costs competitive when trading via TradingView. Leverage is available up to 400:1, providing flexibility for short-term and active trading strategies. There is no minimum deposit for retail accounts, while professional accounts require verification but retain access to the same platforms and pricing structure.

Markets available via TradingView With Capital.com

You can trade a broad range of markets with Capital.com through TradingView, including 147 forex pairs, 4,000+ share CFDs, 45 global indices, 80 commodities, and 503 cryptocurrency CFDs (availability may vary by region). This wide product range allows you to apply TradingView analysis across multiple asset classes and diversify your strategies beyond a single market.

Support and reliability

Capital.com provides 24/7 customer support via live chat, phone, email, and ticketing, with Arabic-language support available, which is useful if you need assistance quickly. The broker is well established and designed for traders who want a balance between advanced analysis tools and straightforward execution.

2. Pepperstone - Best UAE Forex Broker Offering TradingView

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We recommend Pepperstone for TradingView because it offers direct TradingView integration through its Razor (RAW) account, combined with institutional-grade pricing and a very deep product range.

When you connect a Pepperstone Razor account to TradingView, you can trade 94 forex pairs, 24 indices, 33 hard and soft commodities, 44 cryptocurrency CFDs, 95 ETFs, 38 CFD forwards (futures), and 1,384 share CFDs across major global exchanges including NASDAQ, NYSE, LSE, ASX, and DAX. This makes Pepperstone one of the most comprehensive brokers available on TradingView.

The Razor account offers RAW spreads from 0.0 pips plus low commission, which is ideal if you trade frequently or rely on precise technical execution. Combined with fast execution, deep liquidity, and full TradingView charting and order placement, Pepperstone is well suited for serious, technically focused traders who use TradingView as their primary platform.

Pros & Cons

- Five platforms: MT4, MT5, cTrader, TradingView, Pepperstone App

- 77ms execution speeds independently tested

- 1,475 instruments across all asset classes

$0 minimum deposit, Active Trader volume discounts

- Standard Account spreads start at 1.0 pips

- Commission-based pricing on Razor/Pro accounts

- Cannot fund directly with AED

- No guaranteed stop-loss orders

Broker Details

TradingView integration

I recommend Pepperstone for TradingView because it offers direct TradingView integration through its Razor (RAW) account, allowing me to analyse markets using TradingView’s advanced charting tools and place trades directly from the chart. I get access to multiple chart layouts, 90+ drawing tools, a wide range of indicators, and TradingView’s social analysis features, which makes this setup ideal when technical analysis drives my trading decisions. Pepperstone also supports MT4, MT5, and cTrader, giving me flexibility if I use more than one platform.

Trading accounts and execution speed

To use TradingView with Pepperstone, I need a Razor account, which offers RAW spreads from 0.0 pips plus low commission. I like that Pepperstone operates an agency-only execution model with no dealing desk intervention and access to top-tier liquidity providers. In execution speed testing, Pepperstone consistently delivers, Our collegue Ross Collins found their average market execution speed is 72ms and limit order is 79ms, which helps reduce slippage when I’m trading volatile markets or around major news events.

Products available

I recommend Pepperstone because it gives me access to one of the broadest product ranges available on TradingView. I can trade 94 forex pairs, 24 indices, 33 hard and soft commodities, 44 cryptocurrency CFDs, 95 ETFs, 38 CFD forwards (futures), and 1,384 share CFDs across major exchanges including NASDAQ, NYSE, LSE, ASX, and DAX. This depth lets me apply TradingView analysis across multiple asset classes, not just forex.

3. ThinkMarkets - Best TradingView App Provider

Forex Panel Score

Average Spread

EUR/USD = 0.11

GBP/USD = 0.4

AUD/USD = 0.3

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

We recommend ThinkMarkets as a top TradingView-ready broker because it pairs advanced charting integration with genuinely competitive trading conditions. ThinkMarkets supports TradingView connectivity via its ThinkTrader platform suite, so I can analyse markets using TradingView’s tools and place trades with clear, transparent pricing.

ThinkMarkets offers two main trading environments. With the ThinkZero (raw) account, spreads can be as low as 0.0 pips on major forex, and commissions are around $3.50 per standard lot per side (competitive against industry norms). CFD trading on indices, energies, cryptocurrencies, shares, and futures is commission-free, keeping overall costs lower for multi-asset traders.

If I want a simpler cost structure, the Standard account provides commission-free trading with reasonably competitive spreads (forex from ~0.4–1.2 pips and metals from ~0.25 points), which can suit less active traders or those focusing on larger timeframes.

Pros & Cons

- Fast execution speeds

- Advanced trading tools

- Smooth mobile performance

- Limited funding options

- No real share trading

- Average customer service

Broker Details

4. Interactive Brokers - Share + Forex Brokerage Account With TradingView

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

We recommend Interactive Brokers as one of the best online trading platforms with access to a shares and forex brokerage account using TradingView. The broker combines low-cost trading, global market access and seamless TradingView connectivity that suits both active and diversified traders like me.

Interactive Brokers lets you link your IBKR account directly within TradingView’s trading panel, so you can analyse and trade stocks, forex and ETFs right from the same charts you use for research.

One unique highlight I found is that the broker uses its proprietary IB SmartRouting system, which actively seeks the best available prices across exchanges and dark pools, a real plus when executing orders quickly.

Commissions start at $0 on many US stocks with low fees on other assets, and you benefit from SmartRouting for best execution and access to 170+ markets worldwide, funded in up to 29 currencies, which means more choice with competitive pricing.

Pros & Cons

- Huge market access

- Advanced trading tools

- Low trading costs

- Steep app learning curve

- Complex fee structure

- Slow customer support

5. OANDA - Best TradingView Integration Beginner Broker

Forex Panel Score

Average Spread

EUR/USD = 0.89 GBP/USD = 1.54 AUD/USD = 1.37

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

We recommend OANDA as one of the best brokers for TradingView users, especially if you value advanced charting and a streamlined analysis-to-execution workflow. OANDA is a Platinum TradingView partner, so you can link your live account and analyse markets with TradingView’s powerful charts — including 100+ indicators and drawing tools — and place trades directly from the TradingView interface.

OANDA supports TradingView alongside its OANDA Trade web/mobile platform and MetaTrader 4. While Guaranteed Stop Loss Orders (GSLOs) are available on OANDA Trade (not TradingView), you still benefit from transparent, commission-free pricing with competitive spreads from around 0.60 pips on major forex pairs.

For new traders, the combination of intuitive TradingView execution, clear pricing, and community tools makes OANDA a solid choice for learning chart-based trading.

Pros & Cons

- Multi-regulator oversight (MAS, ASIC, FCA, NFA/CFTC)

- FxTrade with integrated TradingView charts

- Commission-free trading, competitive spreads

- Guaranteed stop-loss orders available

- Structured Trading Academy with progressive curriculum

- $0 minimum deposit, no funding fees

- No raw spread ECN pricing option

- Standard spreads wider than ECN brokers

- Limited to MT4 and FxTrade (no MT5, cTrader)

- Educational resources focus primarily on forex

6. Saxo Bank - Good Automation Broker With Integration

Forex Panel Score

Average Spread

EUR/USD = 1.1

GBP/USD = 1.8

AUD/USD = 1.1

Trading Platforms

MT4, TradingView, SaxoTraderGo, SaxoTraderPro

Minimum Deposit

$0

Why We Recommend Saxo Bank

We recommend Saxo Bank as a good automation broker because it combines robust third-party connectivity, advanced APIs, and multi-asset access that make it feel more professional and flexible for my trading needs.

Saxo lets you connect your account with TradingView so you can analyse and place trades from the same charts, backed by its deep liquidity and competitive pricing.

What I personally value is Saxo’s OpenAPI and FIX connectivity, which allow you to build and run custom automated strategies or link to algorithmic tools, giving more control than many brokers.

And the integration with advanced analysis tools like Autochartist means you can receive live technical signals and actionable insights directly in your platform workflow, a feature that helps streamline decision-making without juggling apps.

Pros & Cons

- 327 forex pairs (widest selection)

- Professional platforms (SaxoTraderGO, Pro)

- Premium customer service

- Extensive research and analysis tools

- Multiple regulatory licenses

- Good for professional traders

- High minimum deposit ($2,000+)

- Spreads wider than ECN (0.9-1.1 pips)

- High inactivity fees

- Customer support not 24/7

- 50:1 leverage lower than competitors

7. CMC Markets - Solid CFD Broker With TradingView Connection

Forex Panel Score

Average Spread

EUR/USD = 0.5

GBP/USD = 0.9

AUD/USD = 0.6

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

We recommend CMC Markets as a TradingView-connected CFD broker because it combines seamless TradingView execution, clear pricing, and a very broad instrument range that works well when technical analysis drives your trading.

You can link your CMC Markets account directly to TradingView, then place, manage, and close CFD orders straight from the charts using TradingView’s advanced indicators and tools. For spreads and costs, CMC’s Standard CFD account offers competitive spreads from around 0.7 pips on EUR/USD, while the FX Active account provides tighter spreads of around 0.0 pips on major forex pairs with a low fixed commission (about $2.50 per $100,000 traded), helping keep overall trading costs efficient.

Across these accounts you can trade 12,000+ CFDs covering forex, indices, commodities and shares, making CMC Markets a dependable choice if you want wide market access through TradingView.

Pros & Cons

- Options trading on NGEN platform

- 283+ currency pairs available

- $2.50 commission per side

- Multi-regulator oversight

- 39 crypto CFDs

- $0 minimum deposit

- NGEN platform learning curve

- Standard spreads 0.5 pips minimum

- Limited to MT4 (no MT5, cTrader)

- Options availability varies by region

8. IG Group - Lowest Spread TradingView Broker

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

We recommend IG Group as the lowest spread TradingView broker because it gives traders like me very competitive pricing and seamless chart-to-trade access.

As a low spread broker, IG’s pricing structure offers spreads starting from around 0.6 pips on major forex pairs, and even raw spreads close to 0.0 pips with certain account types and liquidity setups, keeping trading costs low for frequent traders.

On top of that, IG’s official TradingView integration lets me analyse markets with hundreds of indicators and place trades directly from the same charts, which makes technical setups far easier to act on.

Plus, with access to 17,000+ markets across forex, indices, shares and commodities, competitive execution, and robust risk-management tools, IG ticks the boxes for both cost-conscious and chart-focused traders.

Pros & Cons

- Multiple gold instruments: spot, futures, options, indices

- Professional-grade trading platforms

- Decades of regulatory oversight globally

- Comprehensive market research and analysis

- Educational resources for commodities trading

- Higher minimum deposits than competitors

- Complex product range may overwhelm beginners

- Premium pricing structure

- Limited information on UAE-specific offerings