Best CFD Brokers in the UAE

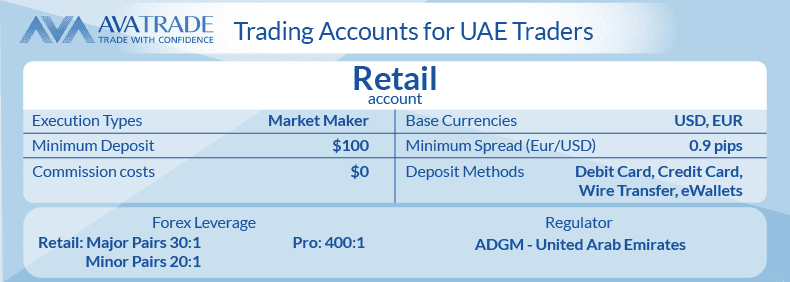

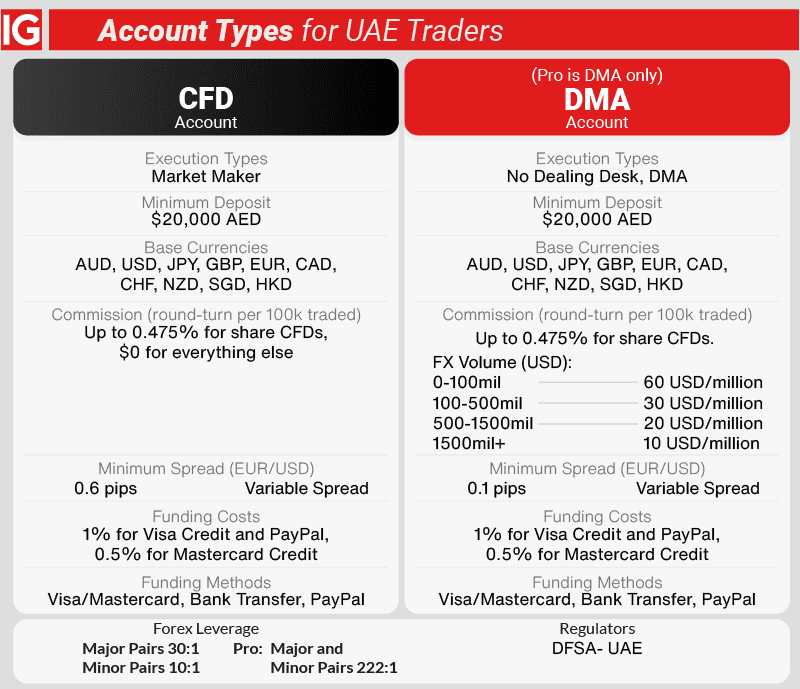

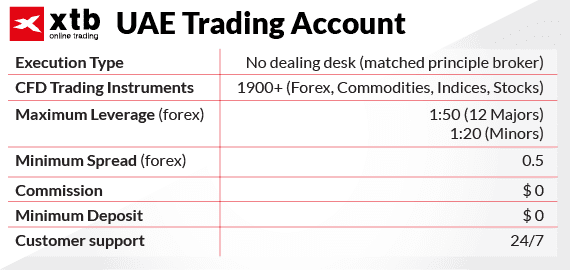

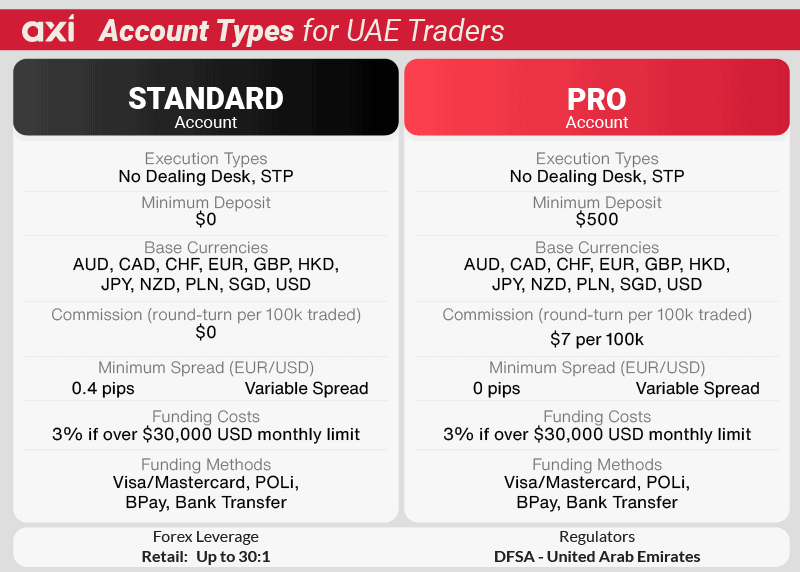

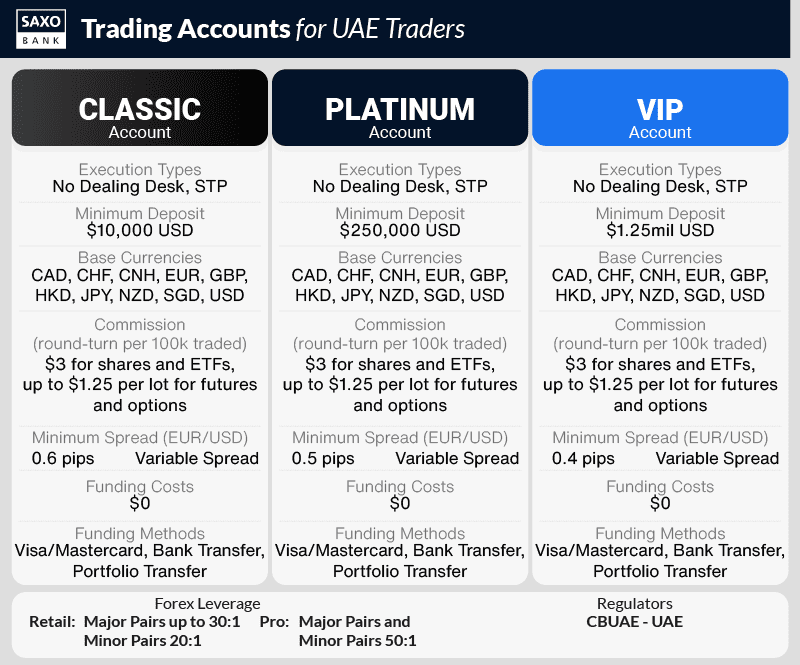

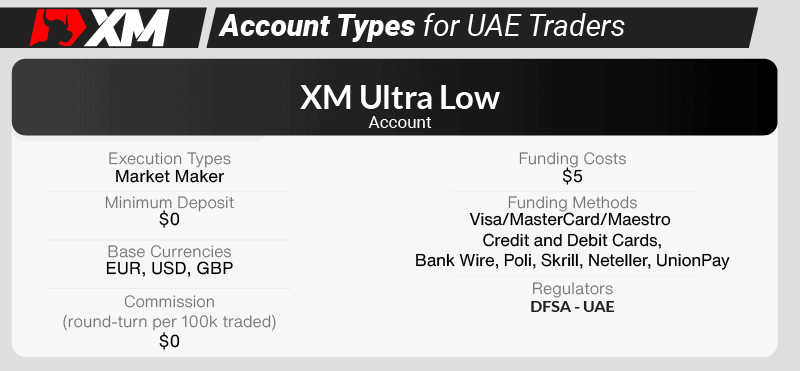

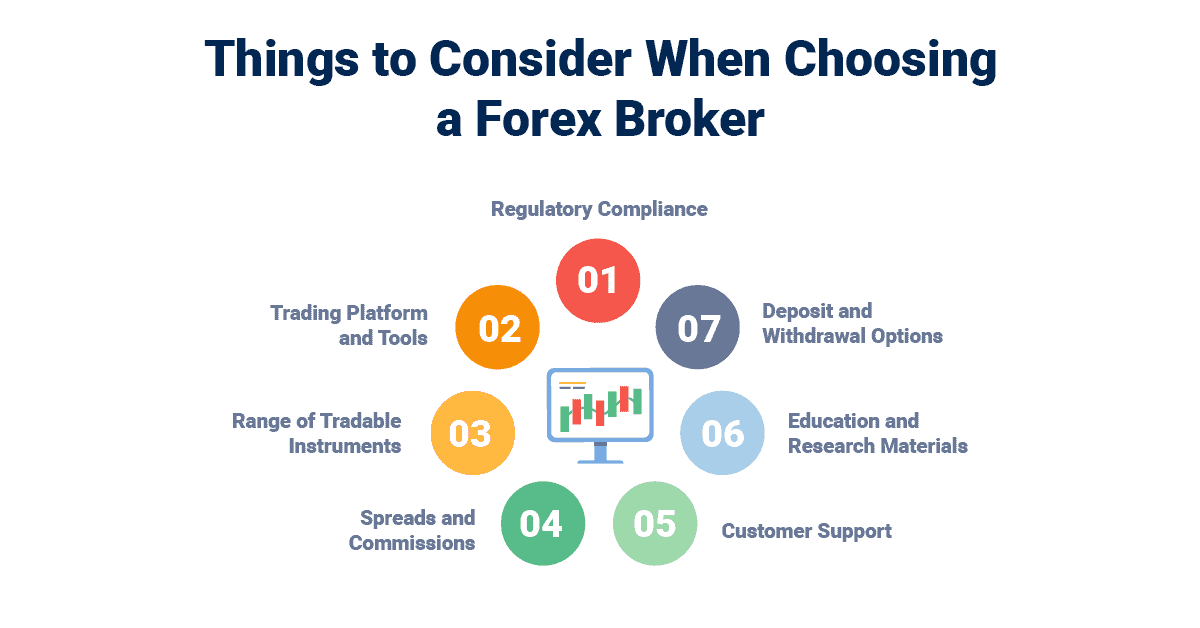

The best CFD Brokers in the UAE use one of the following 4 regulators, DFSA (Dubai), ADGM (Abu Dhabi), Central Bank of UAE, or the Securities and Commodities Authority (SCA). We look at the best-regulated forex brokers in the UAE for Forex and CFD traders.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.