This guide focuses on what matters to you as a Canada-based forex trader: what forex is, how CFDs work, key terms, market hours, available products, regulation, and how broker options differ between Canadian and offshore providers.

A Quick Look at the Basics – What Forex Is and Why You May Want to Try It

Before you place your first trade, it helps to understand how forex works and how risks appear. Many people jump in without preparation, and that usually leads to avoidable losses. Taking time to learn the basics and practising with a demo account removes that pressure.

Forex, short for foreign exchange, is the market where you trade one currency against another. Every position involves two currencies, and your result comes from how their exchange rate changes after you open your trade.

When I take a position, I am not trying to own the currencies. I am aiming to capture price changes, often over short or medium time periods. If the price moves in my favour and I close the trade at the right level, I make a profit. If it moves the other way, I take a loss.

One way to trade Forex is by using CFDs (Contracts for Difference) and this is what CompareForexBrokers.com focuses on. With CFDs, you do not receive any currency or underlying asset; you simply trade the difference between the entry and exit price. Using CFDs has the added flexibility of allowing you to take long or short positions in the same market.

CFDs also use leverage. With leverage, you can control a larger exposure with a smaller deposit. In Canada, retail forex leverage is capped at around 1:50 (or 2% margin as more commonly expressed in Canada) on major pairs but this can change. This limit reduces risk but also restricts position size compared to offshore brokers that offer higher leverage.

Before comparing brokers, it helps to understand the key terms you will see:

- Spread: The cost created by the gap between the buy and sell price. This is one of the most important considerations when choosing a broker, as it saves on trading costs.

- Pip: The smallest unit of price movement, usually the fourth decimal place.

- Lot: The standard trade size of 100,000 units, though smaller lot sizes exist.

*Bid/Ask: The bid is the price buyers accept; the ask is the seller’s price. - Base/Quote: The base is the first currency in the pair, the quote is the second.

- Commission: A trading fee charged by some brokers. Many Canadian brokers include this cost in the spread.

- Leverage: Lets you open larger positions but increases potential losses and gains.

On CompareForexBrokers.com, you will find tables comparing spreads, commissions, platforms, and leverage policies. This helps you match your trading needs to the right broker.

Canada’s Forex Market at a Glance

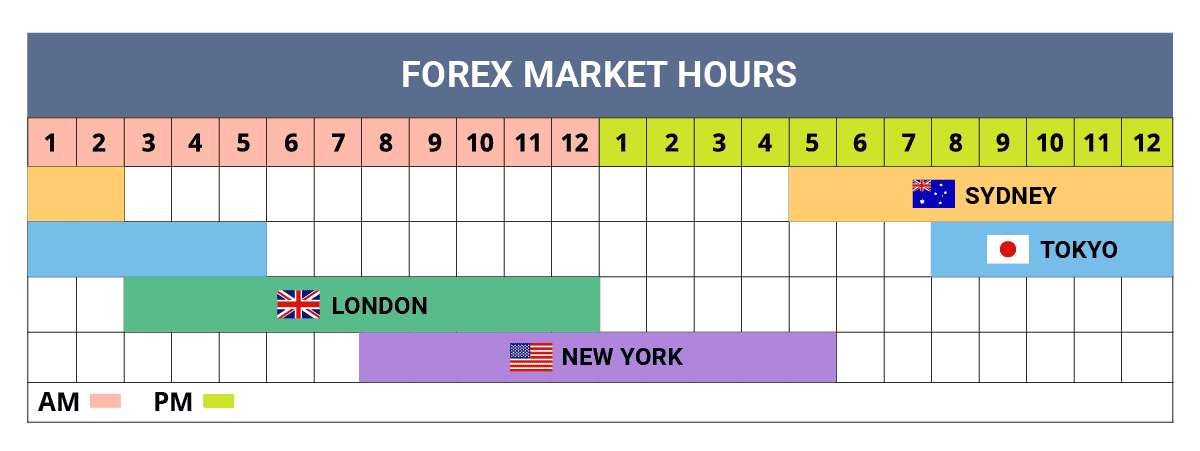

Canada has a well-developed financial sector and easy access to global liquidity. You can trade during any major session because forex operates across four primary hubs: Sydney, Tokyo, London, and New York. Each market opens at a different time, so there is always an active session from Monday to Friday.

Canadian traders often follow pairs linked to local economic events. USD/CAD, EUR/CAD, and GBP/CAD are popular because they react strongly to oil prices and Bank of Canada announcements.

Regulation and Client Protection in Canada

Canadian Investment Regulatory Organization or CIRO for short (formerly IIROC) is the main regulator for forex and CFD brokers in Canada. To accept Canadian clients, a broker must hold CIRO approval and meet its capital, reporting, and conduct requirements. CIRO brokers must also be members of the Canadian Investor Protection Fund (CIPF).

While CIRO operates as the national self-regulatory organization, financial regulation in Canada is ultimately handled at the provincial level. CIRO exists through cooperation among the provincial securities regulators rather than as a single federal authority. This means brokers must comply with CIRO standards and the requirements set by each province.

Because provinces apply their own licensing rules, disclosure obligations, and derivatives policies, some areas are more complex or costly for brokers to serve. As a result, many CIRO-regulated brokers (and even some offshore brokers) do not accept clients from certain provinces. These provinces include Alberta, Manitoba, and Newfoundland & Labrador, and occasionally Québec.

For many brokers, the extra compliance work or stricter local rules simply isn’t commercially worthwhile. With this in mind, before signing up with a broker, check that the broker will accept traders from your province or territory.

| Regulator / Organization | Province / Territory (If Applicable) |

|---|---|

| National-Level Financial Body | |

| Canadian Investment Regulatory Organization (CIRO) | Canada |

| Provincial Financial Bodies (Provincial and Territorial Securities Regulators) | |

| Alberta Securities Commission (ASC) | Alberta |

| BC Securities Commission (BCSC) | British Columbia |

| Manitoba Securities Commission (MSC) | Manitoba |

| Financial and Consumer Services Commission (FCNB) | New Brunswick |

| Office of the Superintendent of Securities, Service NL | Newfoundland & Labrador |

| Nova Scotia Securities Commission (NSSC) | Nova Scotia |

| Ontario Securities Commission (OSC) | Ontario |

| PEI Office of the Superintendent of Securities | Prince Edward Island |

| Autorité des marchés financiers (AMF) | Québec |

| Financial and Consumer Affairs Authority (FCAA) | Saskatchewan |

| Securities Office – Department of Justice | Northwest Territories |

| Nunavut Securities Office | Nunavut |

| Office of the Yukon Superintendent of Securities | Yukon |

Other conditions I notice with CIRO include:

All CIRO-regulated brokers must offer CIPF protection. CIPF is only applied if a CIRO-regulated broker becomes insolvent; it does not cover market losses.

Canadian regulation is strict about product access. Many CIRO-regulated brokers do not offer crypto CFDs. Copy trading and social trading tools are also rare under Canadian rules. Retail leverage for Forex is capped at about 1:50 (2% margin), which is lower than many international markets.

Because of these limitations, some traders prefer to make use of offshore brokers (i.e. those based outside Canada and without a CIRO licence/restriction. Such brokers are usually regulated in Caribbean areas like the Bahamas, Belize, and British Virgin Islands, or in Seychelles and Mauritius. Just make sure the broker is not unregulated.

If you are in Alberta or other provinces CIRO brokers won’t accept, then these brokers might be your best bet.

Other reasons you might choose an offshore broker include:

- They often provide higher leverage (1:500 or 1:1000)

- Crypto CFDs trading

- Copy trading, Social Trading and Mirror trading

Other advantages can include:

- More account types

- Tighter spreads

- Lower commissions on RAW accounts.

The main thing to note is should you choose to go down this path, you need to be aware of the risks. CIRO can only protect you if you are with a CIRO-regulated broker. This is done by providing operational conditions that the broker must follow. For example:

- Keep segregation of clients’ funds

- CIPF membership (in the event of insolvency)

- Minimal capital requirements

- Execution and pricing controls

- Include a document dispute resolution process

List of Brokers Not Regulated by CIRO that Accept Canadian Traders

| Broker | Offshore Regulator(s) / Entity |

|---|---|

| Eightcap | Bahamas (SCB), Seychelles (FSA) |

| PU Brokers (PU Prime) | Seychelles (FSA) |

| TMGM | Vanuatu (VFSC), Seychelles (FSA), Mauritius (FSC) |

| FP Markets | Saint Vincent & the Grenadines (SVG) |

| Fusion Markets | Vanuatu (VFSC), Seychelles (FSA) |

Trading Products

Canadian brokers offer several CFD markets. These allow you to trade price movements without owning the asset.

- Forex CFDs: Major, minor, and CAD-based pairs.

- Share CFDs: Selected companies, depending on the broker.

- Index CFDs: Global benchmarks such as the S&P 500, FTSE 100, and DAX 40.

- Commodity CFDs: Metals like gold and silver, plus energy markets such as oil.

Note: Crypto CFDs: Often restricted under CIRO, but available offshore.

CIRO and the provincial regulators consider CFD crypto to be a high-risk product, so they place tight conditions that deter most brokers from offering this product. The conditions include a ban on offering leverage for crypto trading, which removes any appeal in trading CFD cryptos.

Choosing a Forex Broker in Canada

Your choice of broker should depend on regulation, spreads, platform quality, and available products. CIRO brokers offer strong client protection but tighter limits. Offshore brokers offer wider features but lack Canadian regulatory coverage.

CompareForexBrokers provides detailed broker comparisons, platform assessments, and spread tables. These help you see how each broker performs, side by side, before committing to an account.

Spreads are one of the most important considerations; a tight spread means lower costs. To help you, CompareForexBrokers.com compares the spreads of brokers to help you decide which broker to go with.

Most brokers in Canada have spread-only trading, meaning there are no commissions. While spreads with RAW style accounts can have 0 pips spreads, the commissions you would pay generally cancel out any savings. This is the reverse of markets outside Canada and the USA, where RAW accounts are cheaper, possibly cause there is more competition.

CompareForexBrokers.com collect the average spread from brokers so you can compare their costs. Most comparisons will have a spreads module like you see below.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

You will also want to choose a trading platform, such plans are what you use to action your trade and analyse markets. Nearly all brokers offer MetaTrader 4 (MT4) but other popular platforms are MetaTrader 5 (MT5) and TradingView.

Generally speaking MT4 offers all the charts you need for technical analysis as well as customization capability and automation. MT5 is a more advanced version of MT4, with even more charts, more powerful processing (helpful for backtesting), and the ability to trade CFD stocks. TradingView is best for chart trading. Some brokers have their own proprietary platform with their own unique features.

Just one thing to note: social trading, copy trading, and mirror trading is not readily available for Canadian traders from CIRO brokers. Should you wish to engage with these types of traders, you will need an offshore broker.

Testing a demo account is a practical step. It lets you confirm platform stability, pricing, and execution before risking real funds.

The market for CFD trading is far smaller than in Europe and Australia, while I’m not sure why this is the upshot is that there are very few CIRO brokers to choose from.

Below is a list of CIRO-regulated brokers I’m aware of.

- OANDA (Canada) Corporation

- Forex.com

- CMC Markets

- AvaTrade

- Interactive Brokers Canada

- Admirals (Friendberg Direct )

- FXCM (Friendberg Direct )

- Fortrade Canada

- Plus500

- Questrade

Taxes on Forex Trading in Canada

Forex results fall under capital gains or business income, depending on how you trade. Frequent, high-leverage, or structured trading often counts as business income. Occasional trading may be recorded as capital gains. Tax rules differ by province, so checking with a qualified accountant is essential.

Final Steps

Canada offers a secure and regulated environment for forex and CFD trading, though product limits and leverage caps are stricter than many global markets. Understanding these differences helps you choose the right path.

If you want clear comparisons of spreads, pricing, platforms, and account types, CompareForexBrokers gives you structured data to support your decisions while you build your trading approach.

Ask an Expert

Can traders living outside Canada allowed to trade with a CIRO regulated broker?

No and even if you could, there is no good reason to.

Is it ok to deal with provexgrowth. I have already started and am concerned

I’ve never heard of this broker. While I wont comment on this broker, we only recommend regulated Forex Brokers.