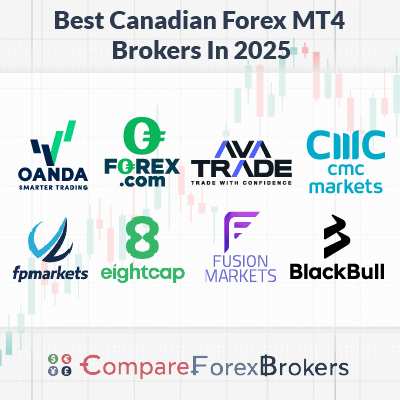

Best MT4 Brokers In Canada [2025 Fees + Features]

MetaTrader 4 is one of the most popular forex trading platforms for retail traders. I looked at the best Canadian Forex Brokers supporting MT4, along with key features such as spreads, trading accounts, and financial products.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The best brokers offering MetaTrader 4 to Canadian traders for 2025 are:

- OANDA - The Best MT4 Broker In Canada

- FP Markets - The Lowest Cost MetaTrader 4 Broker

- FOREX.com - Great Trading Tools For MetaTrader 4

- Eightcap - Good Choice For Trading Crypto With MT4

- Fusion Markets - The Lowest Commissions With MT4

- AvaTrade - Good Option For Day Trading

- CMC Markets - The Largest Range Of Currency Pairs

- BlackBull Markets - The Fastest Execution Speed

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

91 |

FCA, CIRO, ASIC FSC-BVI, NFA, CFTC MAS, JFSA, KNF |

- | - | - | - | 1.4 | 2 | 1.4 |

|

|

|

120ms | $0 | 69+ | - | 50:1 | - |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.2 | 0.29 | 0.21 | $3.00 | 1.2 | 1.4 | 1.3 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

84 | CIRO, FCA, NFA, CFTC, MAS, JFSA, CIMA | - | - | - | $7.00 | 1.2 | 1.5 | 1.4 |

|

|

|

30 ms (May 2023) | $100 | 80+ | - | 33:1 | 33:1 |

|

Read review ›

Read review ›

|

96 |

FCA, ASIC CySEC, SCB |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

92 | ASIC, VFSA, FSA-S | 0.09 | 0.28 | 0.14 | $2.25 | 0.89 | 1.11 | 0.95 |

|

|

|

79ms | $0 | 84 | 14 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

64 |

CIRO, FSCA ADGM, CBI |

- | - | - | - | 0.90 | 1.5 | 1.1 |

|

|

|

160ms | $100 | 37+ | - | 33:1 | 33:1 |

|

Read review ›

Read review ›

|

69 |

ASIC, FCA MAS, CIRO |

0.5 | 0.9 | 0.6 | $2.50 | 1.12 | 1.30 | 1.64 |

|

|

|

138ms | $0 | 339+ | - | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Who Are The Best MetaTrader 4 Brokers For Canadian Traders?

I’ve tested 30+ Canadian MT4 brokers to find which ones are the best overall. To select these brokers, I’ve tested their trading conditions, execution speeds, trading costs, and trading tools for maximising the MT4 trading experience. I also made sure these brokers provide solid customer service and a great range of markets to use on the platform.

1. OANDA - The Best MetaTrader 4 Broker In Canada

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 0.9

AUD/USD = 0.7

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

OANDA is my top pick for Canada after they scored 91/100 in my broker tests. The broker offers one of the most secure trading environments I’ve seen on the MetaTrader 4 platform.

The broker’s Standard account recorded low spreads across the majors, averaging 1.50 pips for these instruments. It also offers 28 premium MT4 tools, improving the MT4 experience further.

I found you can lower your costs by 34% with the Elite Trader program for high-volume traders. On MT4, you have access to a decent range of 68 forex markets, along with a collection of indices and commodities like gold.

Pros & Cons

- Wide range of trading products

- Premium MT4 plugins

- Automated trading with MT4

- No share CFDs

- No STP

- No guaranteed stop-loss

Broker Details

Most Trusted Forex Broker With Low Spreads

OANDA is one of the most trusted brokers in my testing, scoring 100/100 in this category. It also provides an excellent trading environment for the MetaTrader 4 platform. The broker’s MT4 account is spread-only, simplifying your trading costs without the need to worry about commissions.

During my time trading on the OANDA Standard account, I found the spreads ranged from 1.4 to 1.6 pips – competitive for Canadian-regulated brokers. Interestingly, out of the major pairs, I found AUD/USD traded at consistently the lowest spread – averaging 1.2 pips.

| EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | |

|---|---|---|---|---|---|

| OANDA | 1.5 | 1.5 | 1.5 | 1.2 | 1.7 |

Reduce Trading Costs With Elite Trader Program

I found the Elite Trader program was a top option if you trade at high volumes. You’ll be able to reduce your costs further, potentially saving up to 34%. Joining the program requires you to trade at least $10,000,000 (notional value) per month, which I think is manageable for most traders.

OANDA’s Top Trading Tools For MT4

With OANDA, you can access MT4 Premium Indicators, which gives you 28+ new Expert Advisors and indicators that you can download for free. I found EAs like the Trade Terminal and Mini Terminal great for managing and executing trades more easily, while new indicators like Pivot Points help identify breakout opportunities.

For trading forex, OANDA’s MT4 platform provides market access to 68 currency pairs, including majors, minors, and exotics. I think this is a solid range. If you want to trade outside of forex, you have 20+ commodities, including gold/silver crosses, and 15 indices.

2. FP Markets - The Lowest Cost MetaTrader 4 Broker

Forex Panel Score

Average Spread

EUR/USD = 1.1

GBP/USD = 1.3

AUD/USD = 1.3

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

FP Markets’ Raw account provided 0 pip spreads 100% of the time in our testing. The broker also charges $3.00 per lot as a commission – one of the lowest for Canadian traders. This made FP Markets my pick for the lowest-cost MetaTrader 4 broker and contributed to the broker’s overall 86/100 rating in my review.

I found the broker provides excellent trading conditions for MT4 with its 96ms execution speed, making it an ideal broker for scalping. You have access to excellent customer service, with 24/7 support through live chat and email support.

Pros & Cons

- Low-cost MT4 trading

- MT4 add-on ‘Traders Toolbox’

- Fast market execution speeds

- Lacks advanced trading tools

- Very basic proprietary mobile app

- Average standard account spreads

Broker Details

Zero-Pip Spreads On The Raw Account

Our analyst, Ross Collins, ran tests with FP Markets and 14 other Canadian ECN brokers to find which ones offer zero pip spreads on their raw accounts. In his zero pip test, he found FP Markets offers 0 pips on EUR/USD 100% of the time outside of rollover, giving you the best spreads for a Raw account.

FP Markets almost scored a perfect 100% in the tests, but USD/CHF let it down. The table below shows that the other major pairs offered spreads at 0 pips or minimum advertised spreads 100% of the time.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY | Grand Total |

|---|---|---|---|---|---|---|---|

| FP Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% | 97.83% |

Lower spreads provide cheaper trading costs and better trading conditions, as it’s easier to cover the spread before breaking even or making a profit. This is one of the reasons I find Raw accounts better for scalpers.

With the Raw account, you pay $3.00 per lot traded in commissions. This is almost 70% cheaper than CIRO-regulated brokers at $7.00 per lot.

Fast Execution Speeds For Scalping

One of the reasons I like FP Markets for scalping is that it has one of the fastest market order execution speeds in our tests, achieving an average of 96ms. Pairing this execution speed with MT4’s one-click trading feature gives you the fastest combination for scalping, in my opinion.

I like that the broker offers the MT4 plugins for its Autochartist service, so you can get the automated technical analysis service directly within your platform. The plugin provides the same full analysis as its web version, accelerates trade execution, and allows you to overlay analysis on the charts.

Broker Screenshots

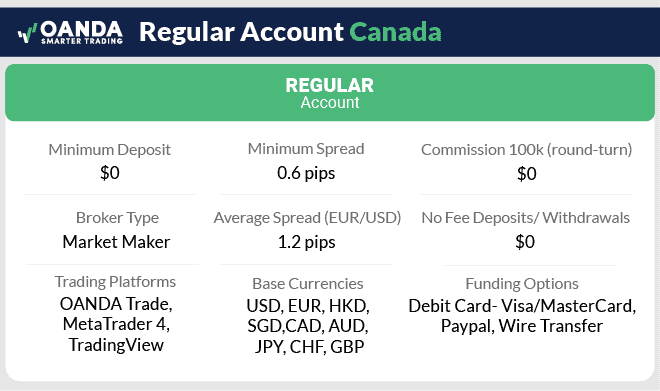

3. FOREX.com - Great Trading Tools For MetaTrader 4

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.6

AUD/USD = 1.4

Trading Platforms

MT4, MT5, TradingView, FOREX.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

I found FOREX.com to be a top CIRO-regulated MT4 broker with the best choice of trading tools for MetaTrader 4. You can access FX Blue Expert Advisors, which provide a suite of Expert Advisors, advanced analytics, and better trade management tools.

Another solid tool is Capitalise.ai. This tool is a no-code solution for automating your trading strategies, and opens algorithmic trading up to beginners. FOREX.com offers a Standard account with competitive spreads from 1.0 pip. Meanwhile, its Raw account gives tighter spreads and commission-based pricing on its 91 forex pairs.

Pros & Cons

- Large range of Forex pairs

- Active Trader Program discounts

- Solid FOREX.com platform tools

- Wider spreads than average

- Limited MT4 instruments

- No TradingView

Broker Details

Top Trading Tools For MT4

I found FOREX.com boosted MT4 with the most additional tools – the FX Blue Expert Advisors and Capitalise.ai were my highlights.

The FX Blue Expert Advisors is a package of 9 expert advisors that improve your trade management and advanced technical analysis tools. While testing the app, I found the following additional EAs:

-

- Alarm Manager

- Correlation Matrix

- Correlation Trader

- Market Manager

- Mini Terminal

- Sentiment Trader

- Session Map

- Tick Chart Trader

- Trade Terminal

As a day trader, I like to use the Correlation Trader EA. This allows me to find divergences between markets, and makes it easier to trade directly off the chart.

Capitalise.AI Makes Automating Trading Beginner-Friendly

Even though MT4 has its own automated trading features, I like that Capitalise.ai is available on FOREX.com. Capitalise.ai is a no-code program for developing automated trading strategies.

I like using this tool as I can simply type my trading rules directly into the solution. The AI creates my strategy in seconds, ready to deploy on your live MT4 account.

Competitive Spreads on FOREX.com

The spreads were also decent on the Standard Account, averaging 1.2 pips on EUR/USD with no commissions. This is slightly lower than most CIRO-regulated brokers I’ve tested, who average 1.4 pips on this pair.

| EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | |

|---|---|---|---|---|---|

| FOREX.com | 1.2 | 1.5 | 1.7 | 1.7 | 3.2 |

When you open a Raw pricing account, your spreads start from 0 pips on EUR/USD. There is a commission charge of $7.00 per lot traded, but this is in line with other CIRO-regulated brokers I’ve tested.

If you’re a high-volume trader, I’d say this Raw account is going to work out cheaper, even after the commission.

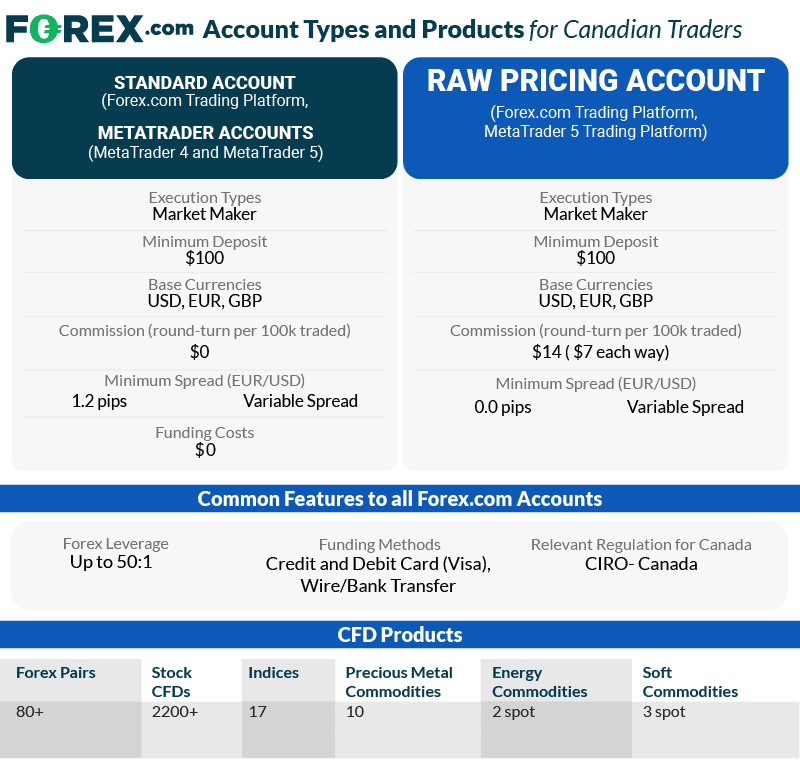

4. Eightcap - Good Choice To Trade Crypto With MT4

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 1

AUD/USD = 1.2

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

Eightcap is my standout pick for crypto trading. It offers 95+ crypto CFDs – the most I found. The multi-asset broker was one of my top performers in my tests, receiving a score of 96/100 for its range of markets and low trading costs.

The Raw account averages 0.20 pips on the EUR/USD, while the Standard account average is 1 pip on this pair. This makes the broker one of the cheapest in Canada. I also like that it offers helpful trading tools like FlashTrader for better trade management, and Capitalise.ai.

Pros & Cons

- 95+ crypto products

- Good automation trading platforms

- Competitive MT4 spreads

- Not CIRO-regulated

- Limited education library

- The product range could be bigger

Broker Details

Trade 95+ Cryptocurrencies With Eightcap

Eightcap isn’t CIRO-regulated, but does accept Canadian brokers. This means you have access to 95+ cryptocurrencies, which is the most out of all the brokers I’ve tested. Through Eightcap, you can trade Bitcoin, Ripple, and Ethereum. I also like that the broker extends its markets to altcoins like Tron and Solana, giving you a solid variety.

| Broker | Cryptocurrency Markets |

|---|---|

| Eightcap | 95 |

| CMC Markets | 19 |

| FriedBerg Direct Powered by AvaTrade | 17 (+ Crypto10 Index) |

| BlackBull Markets | 16 |

| FP Markets | 12 |

| Fusion Markets | 14 |

| FOREX.com | 8 |

| OANDA | 4 |

As you can see, Eightcap is the leader for crypto trading through forex brokers. For me, this is great as Eightcap is regulated by ASIC – the Tier-1 regulator in Australia. This ensures the broker delivers a secure and transparent trading environment.

However, ASIC won’t cover you as a Canadian trader. Instead, your trading is regulated by the Securities Commission of the Bahamas (SCB).

For me, this regulation makes brokers like Eightcap better than using an exchange to invest in crypto. You have more protection just in case things go wrong.

If you use the MetaTrader 4 platform, Eightcap limits its crypto range to 79 – 16 fewer than on TradingView or MT5. However, this is still a huge array of markets, and way more than you’d usually get from a broker.

For markets other than crypto, Eightcap offers a solid choice of 55 forex pairs, 150 share CFDs, 10 commodities (soft and metals), and 15 indices.

Eightcap Has Standard and Raw Accounts

I found Eightcap offers two trading accounts, giving you a choice between spread-only and Raw pricing. If your sole focus is on cryptocurrencies, then I’d recommend choosing the Standard account. This is because cryptos aren’t included in the zero pip spreads on the Raw account.

If you want to trade all markets, the Raw account is best. Its EUR/USD spreads average 0.20 pips. Even with a $3.50 per lot commission, this should still work out better than the Standard account’s 1 pip average.

5. Fusion Markets - Lowest Commissions With MT4

Forex Panel Score

Average Spread

EUR/USD = 0.93

GBP/USD = 1.08

AUD/USD = 0.92

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

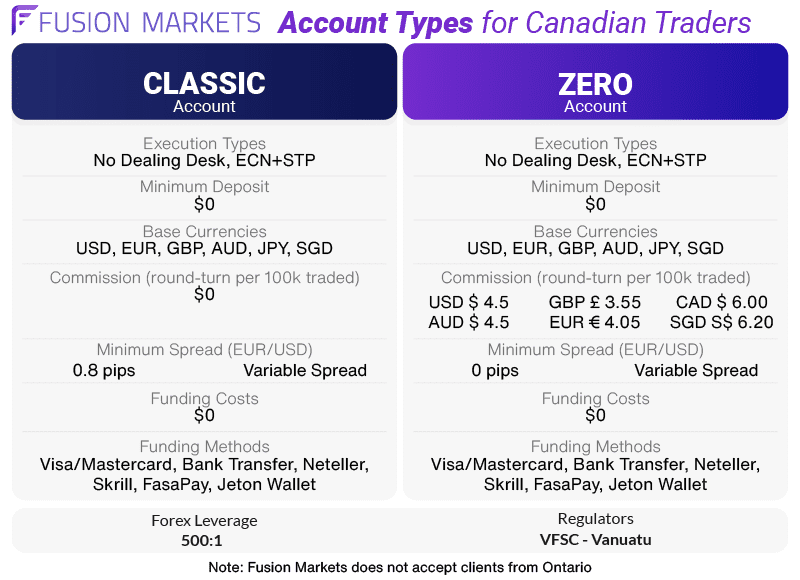

Why We Recommend Fusion Markets

Fusion Markets offers the lowest commissions of anyone on my list. At $2.25 per lot traded, this is almost $5 cheaper than most CIRO-regulated brokers. The Zero account also produced tight spreads averaging 0.16 pips, making it one of the lowest spread trading accounts I’ve used.

The broker supports copy trading with MT4 Signals and DupliTrader, and offers more than 200 financial instruments. These factors contributed to Fusion Markets’ overall score of 92/100 in my tests – one of the highest scores in 2025.

Pros & Cons

- Lowest Commission with MT4

- 90+ Forex Pairs For Trade

- Fast MT4 execution speeds

- Not regulated in Canada

- Education very limited

- Inactivity fee applies

Broker Details

Fusion Markets Has The Lowest Trading Costs Tested

Fusion Markets has the cheapest commissions at $2.25 per lot traded from my testing, claiming first place. You’re saving 68% compared to the CIRO-regulated broker average of $7.00.

You can see the results from my findings below:

| Broker | Per Lot Traded | Per Round Trip | CIRO Regulated? |

|---|---|---|---|

| Fusion Markets | $2.25 | $4.50 | No |

| CMC Markets | $2.50 | $5.00 | Yes |

| FP Markets | $3.00 | $6.00 | No |

| BlackBull Markets | $3.00 | $6.00 | No |

| Eightcap | $3.50 | $7.00 | No |

| FOREX.com | $7.00 | $14.00 | Yes |

As you can see, Fusion Markets is the clear winner if you want to lower your trading costs – especially when you compare Fusion Markets with another broker like FOREX.com. You are saving almost $10 per round trip, and you get essentially the same service – the downside is just that Fusion Markets is not CIRO-regulated.

Tightest Raw Spreads On The Zero Account

Our analyst also ran tests with Fusion Markets and 14 other Canadian ECN brokers to find which ones had the lowest spreads using the IceFX SpreadMonitor tool on his MT4 platform. In his tests, Fusion Markets produced some of the tightest spreads with EUR/USD averaging 0.16 pips, beating the industry-tested average by 40%.

The broker performed better with USD/CAD, averaging spreads of 0.23 pips to beat the 0.62 industry average. Even better was GBP/USD, with its 0.21 pip average, compared to the 0.54 pips industry average.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

CopyTrading Tools On MT4

I think Fusion Markets will appeal to a broad range of traders, mainly due to their lower trading costs. Another attractive feature is the availability of copy trading services through MT4 with DupliTrade.

DupliTrade has 13+ market-proven strategies that range from single-currency strategies to scalping approaches. You can select one or all of these strategies, and automatically mirror the performance of your chosen trader.

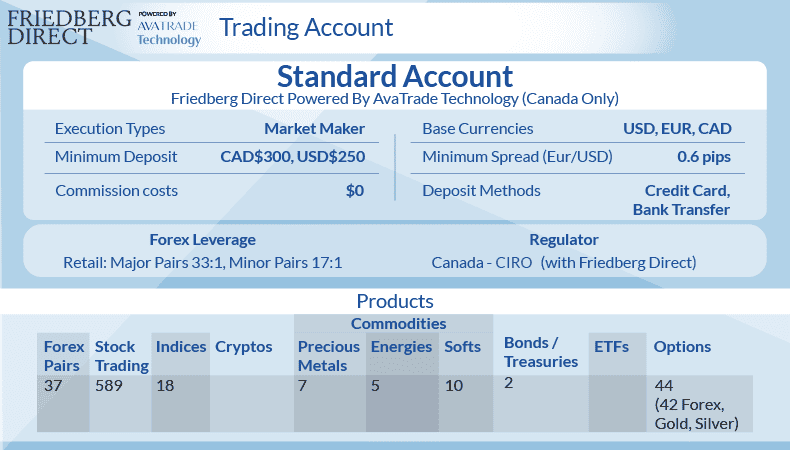

6. Friedberg Direct Powered By AvaTrade - Good Option For Day-Trading

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

AvaTrade’s fixed spreads make it a solid pick for day trading, in my opinion. These fixed spreads are cheap compared to many variable spread brokers, providing the EUR/USD at 0.70 pips. What’s more, you get stable trading costs even during volatile periods.

The broker gives you a decent variety of trading products, covering everything from forex to ETFs on its platforms. Alternatively, if you want to trade with volatility, you can use the American-style AvaOptions on forex and gold markets as another day trading product.

Pros & Cons

- Stable spreads

- Forex Options Trading With AvaOptions

- Automation And Social Trading Permitted

- High C$300 minimum deposit

- Only 37 forex pairs to trade with

- The desktop platform is outdated

Broker Details

AvaTrade Offers Fixed Spreads On MT4

I found AvaTrade’s fixed spreads to be competitive, or even a little cheaper, than most variable-spread brokers. AvaTrade’s EUR/USD is fixed at 0.70 pips, which is not only cheaper than my industry-tested average of 1.11 pips, but also cheaper than Fusion Markets’ average of 1.01 pips.

| Broker | Spreads | Fixed/Variable |

|---|---|---|

| AvaTrade | 0.70 | Fixed |

| Fusion Markets | 1.01 | Variable |

| CMC Markets | 1.10 | Variable |

| Eightcap | 1.16 | Variable |

| FP Markets | 1.19 | Variable |

| Forex.com | 1.20 | Variable |

| BlackBull Markets | 1.34 | Variable |

| OANDA | 1.50 | Variable |

This places AvaTrade in a top position for day trading. Variable spreads widen during market announcements like ISM and NFP reports, but AvaTrade’s fixed spreads generally won’t – except in very rare extreme circumstances.

As a day trader, or even an algo trader, these fixed spreads can be very welcome. You’ll know your costs upfront, and can execute trades around news events without paying a wider spread. This means you can trade all day without worrying about price spikes.

Decent Range of Markets On MT4

I found AvaTrade’s range of markets decent for day trading too. You have access to 55 forex pairs, 33 indices, 59 ETFs, 27 commodities, and 632 stocks, although the stocks are not available on the MT4 platform.

If you want to day trade and benefit from the intraday volatility, the AvaOptions trading platform lets you open options on 42 forex pairs, gold, and silver markets. I like this product as your risk is fixed. You don’t have to worry about adding a stop-loss, and there is no limit to the potential upside.

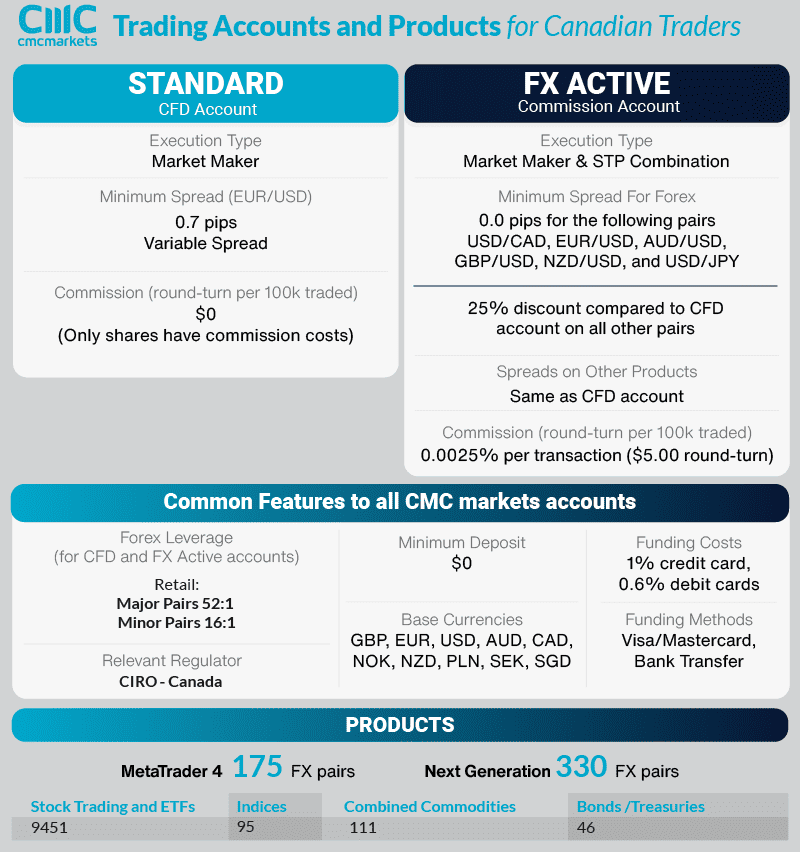

7. CMC Markets - Largest Range Of Currency Pairs

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.3

AUD/USD = 1.64

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

I chose CMC Markets as my top choice for forex trading as it offers the largest range of currency pairs. There are over 175 pairs on MT4, and 330 on NGEN. The FX Active account is a solid choice. This account gives you zero pip spreads on majors, 25% cheaper spreads on other pairs. There’s a low $2.50 commission per lot on this one.

The broker provides decent technical analysis through Autochartist and its own CFA analysts, offering expert-level forex market analysis. If you fancy dabbling with non-forex instruments, CMC Markets has more than 13,000 – the widest selection on my list.

Pros & Cons

- 175 forex pairs with MT4

- Low commissions of $5 round-turn

- Competitive MT4 spreads

- No MT5 or TradingView

- Slower execution speeds

- Limited funding methods

Broker Details

CMC Markets Has The Most Currency Pairs

In my review, CMC Markets offers the most currency pairs with 338 unique markets – almost three times as many as its competitors. I found this variety lets you trade unique crosses, and gain exposure to higher volatility markets. At the same time, you still have access to traditional majors, minors, and exotics.

With that said, I could only access 175 pairs on MT4. For the full catalog, you’ll need to use the CMC Markets Next Generation platform.

FX Active Reduces Your Forex Trading Costs

One of the reasons I rated CMC Markets for forex trading is their FX Active account. I found it to be one of the best accounts for forex trading. You have zero-pip spreads on major pairs like EUR/USD and 25% discounted spreads on minors and exotic pairs. Overall, it’s one of the lowest spread accounts.

The account also charges a commission of $2.50 per lot. I think this is worth it to access those spreads, especially as some brokers charge $3.50+ per lot with wider spreads.

Trade 13,000+ Financial Instruments With CMC Markets

In my tests, CMC Markets had the largest range of financial markets out of the MT4 brokers in Canada, with more than 13,000. This range covers 10,000+ stock CFDs, 124 commodities, and 82 indices, which for me, makes CMC Markets one of the best brokers for multi-asset trading.

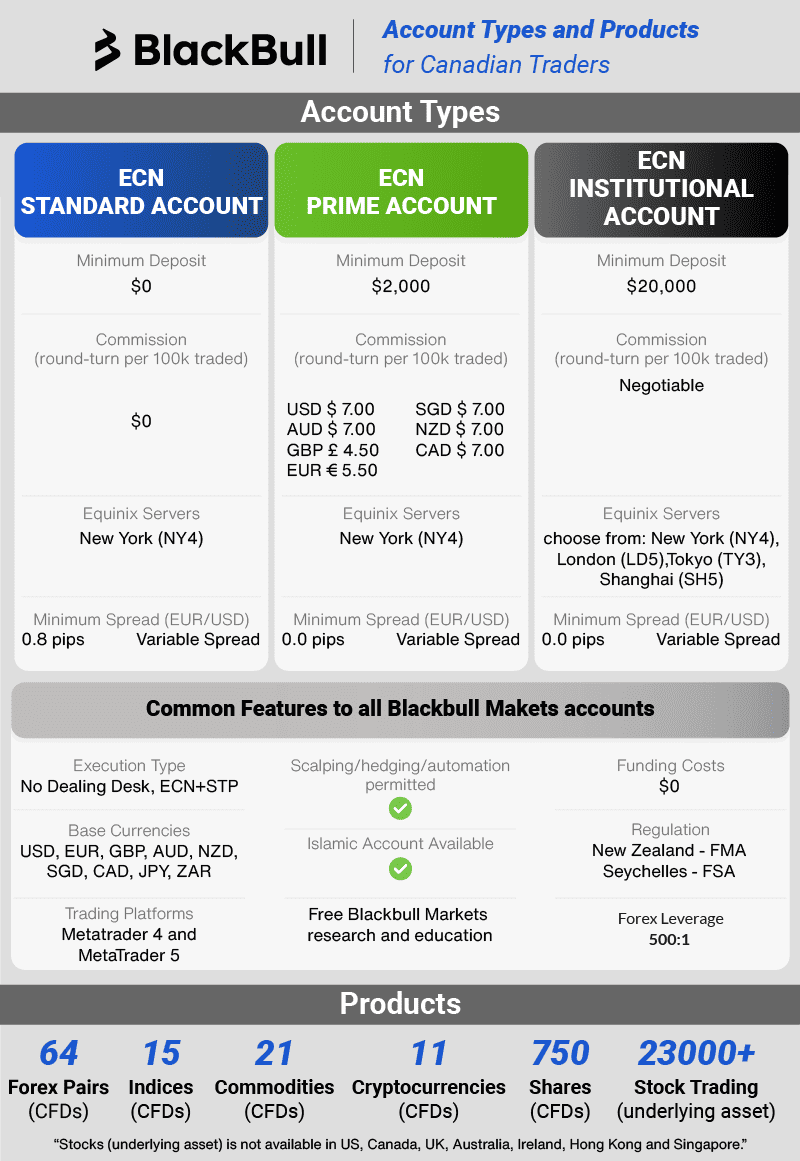

8. BlackBull Markets - Fastest Execution Speed

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.4

AUD/USD = 1.7

Trading Platforms

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlackBull Trade

Minimum Deposit

$0

Why We Recommend BlackBull Markets

BlackBull Markets achieved the fastest execution speeds with the MT4 platform, averaging as low as 72ms, which is near instant. These are top trading conditions that will lower your chance of slippage. The ECN Prime account is the ideal choice, as it offers tight spreads from 0.1 pips and low trading commissions.

An added bonus is that you can use 1:500 leverage, because BlackBull Markets is regulated by the FSA, not CIRO. This makes the broker an ideal pick if you are looking to scale your trading without increasing your trading capital.

Pros & Cons

- Fastest MT4 execution speeds

- Competitive commissions

- Great trading platform variety

- Wider-than-average spreads

- Limited regulations

- Narrow educational content

Broker Details

BlackBull Markets Has The Fastest Execution Speeds

In my analyst’s (Ross Collins) execution speed tests, BlackBull Markets performed the best overall, beating 36 brokers to the top spot. Ross tested all 36 brokers using his MT4 platform. With the ExTest_ForExpat and Broker Latency Tester, he recorded the average limit and market order speeds.

BlackBull Markets tested at 72ms for its limit order speed, and 90ms for the market order execution. Both were under my gold standard of 100ms, which is a solid achievement.

| Broker | Overall Speed Ranking | Limit Order Speed (ms) | Limit Order Rank | Market Order Speed (ms) | Market Order Rank |

|---|---|---|---|---|---|

| BlackBull Markets | 1 | 72 | 1 | 90 | 5 |

| Fusion Markets | 2 | 79 | 3 | 77 | 1 |

| Pepperstone | 3 | 77 | 2 | 100 | 10 |

| OANDA | 4 | 86 | 5 | 84 | 2 |

| Octa | 5 | 81 | 4 | 91 | 6 |

| Exness | 6 | 92 | 10 | 88 | 3 |

| Blueberry Markets | 7 | 88 | 6 | 94 | 7 |

| FOREX.com | 8 | 98 | 13 | 88 | 4 |

| Global Prime | 9 | 88 | 7 | 98 | 9 |

| Tickmill | 10 | 91 | 9 | 112 | 11 |

| TMGM | 11 | 94 | 11 | 129 | 13 |

| City Index | 12 | 95 | 12 | 131 | 14 |

| Trading.com | 13 | 98 | 14 | 138 | 15 |

| FBS | 14 | 135 | 17 | 118 | 12 |

| Axi | 15 | 90 | 8 | 164 | 25 |

| Eightcap | 16 | 143 | 19 | 139 | 17 |

| IC Markets | 17 | 134 | 16 | 153 | 22 |

| FxPro | 18 | 151 | 23 | 138 | 16 |

| Go Markets | 19 | 144 | 20 | 145 | 20 |

| Markets.com | 20 | 150 | 22 | 141 | 18 |

| EasyMarkets | 21 | 155 | 24 | 155 | 24 |

| Admirals | 22 | 132 | 15 | 182 | 28 |

| IG | 23 | 174 | 26 | 141 | 19 |

| CMC Markets | 24 | 138 | 18 | 180 | 26 |

| FP Markets | 25 | 225 | 32 | 96 | 8 |

| VantageFX | 26 | 175 | 27 | 154 | 23 |

| XM | 27 | 148 | 21 | 184 | 29 |

| FXCM | 28 | 108 | 28 | 189 | 30 |

| Avatrade | 29 | 235 | 33 | 145 | 21 |

| ThinkMarkets | 30 | 161 | 25 | 248 | 36 |

| Tradersway | 31 | 198 | 29 | 214 | 33 |

| Swissquote | 32 | 258 | 37 | 198 | 31 |

| FXTM | 33 | 248 | 36 | 210 | 32 |

| Libertex | 34 | 215 | 31 | 244 | 35 |

| ATC Brokers | 35 | 238 | 34 | 241 | 34 |

| HYCM | 36 | 241 | 35 | 268 | 37 |

As you can see, the limit order speed is the lowest tested, and this is great to see as it impacts how fast your stop-loss and take-profit orders are triggered. This reduces the chance of negative price slippage, protecting you from unexpected trading costs.

Highest Leverage Broker For Canadian Traders

In addition to fast execution speeds, I found that BlackBull Markets offers 1:500 leverage for Canadian traders, allowing you to maximize smaller trading accounts with the broker.

BlackBull Markets can offer this as they are not CIRO-regulated. Instead, they allow Canadian traders to open an account through the Financial Services Authority (FSA) entity in the Seychelles.

Higher leverage lets you open trades with a smaller margin. Therefore, you can start with a smaller trading account. This is supported by the fact that BlackBull Markets apply no minimum deposit requirements.

Broker Screenshots

Ask an Expert