Best Forex Trading App Canada

Sometimes you want to trade on the go, so we looked at the best forex trading apps in Canada. For each forex broker, We look at the key features of the mobile trading app platforms they offer along with the trading accounts and costs.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

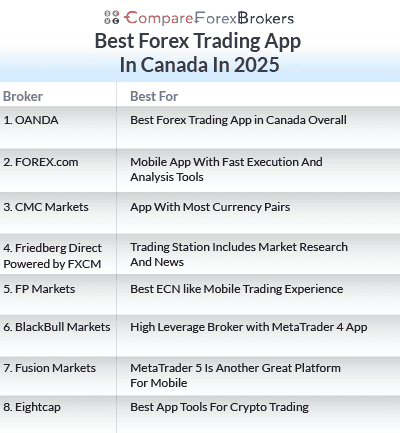

These brokers have the best mobile trading platforms

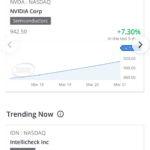

- OANDA - Best Forex Trading App in Canada Overall

- FOREX.com - Mobile App With Fast Execution And Analysis Tools

- CMC Markets - App With Most Currency Pairs

- Friedberg Direct Powered by FXCM - Trading Station Includes Market Research And News

- FP Markets - Best ECN like Mobile Trading Experience

- BlackBull Markets - High Leverage Broker with MetaTrader 4 App

- Fusion Markets - MetaTrader 5 Is Another Great Platform For Mobile

- Eightcap - Best App Tools For Crypto Trading

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

91 |

FCA, CIRO, ASIC FSC-BVI, NFA, CFTC MAS, JFSA, KNF |

- | - | - | - | 1.4 | 2 | 1.4 |

|

|

|

120ms | $0 | 69+ | - | 50:1 | - |

|

Read review ›

Read review ›

|

84 |

FCA, CIRO, NFA/CFTC CySEC, JFSA, CIMA |

0.17 | 0.29 | 0.3 | $6.00 | 1.5 | 1.8 | 1.5 |

|

|

|

30 ms (May 2023) | $100 | 91 | 8 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

69 |

ASIC, FCA MAS, CIRO |

0.5 | 0.9 | 0.6 | $2.50 | 1.12 | 1.30 | 1.64 |

|

|

|

138ms | $0 | 339+ | - | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

64 |

CIRO, FSCA ADGM, CBI |

- | - | - | - | 0.90 | 1.5 | 1.1 |

|

|

|

160ms | $100 | 37+ | - | 33:1 | 33:1 |

|

Read review ›

Read review ›

|

92 | ASIC, VFSA, FSA-S | 0.11 | 0.24 | 0.12 | $2.25 | 0.83 | 1.42 | 1.12 |

|

|

|

79ms | $0 | 84 | 14 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

71 |

FMA, VFSC ASIC |

0.20 | 0.30 | 0.10 | $3.50 | 1.20 | 1.20 | 1.0 |

|

|

|

94ms | $100 | 61 | 12 | 30:1 | 200:1 |

|

Mobile trading is different from desktop or web trading, with specific features that are important for an excellent mobile experience. These include a user-friendly and intuitive interface, fast execution speed, and helpful trading tools. This review lists the brokers with the best forex trading apps for Canadian traders.

1. OANDA - Best Forex Trading App in Canada Overall

Forex Panel Score

Average Spread

EUR/USD = 1.4

GBP/USD = 2

AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

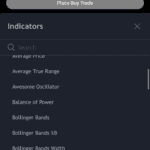

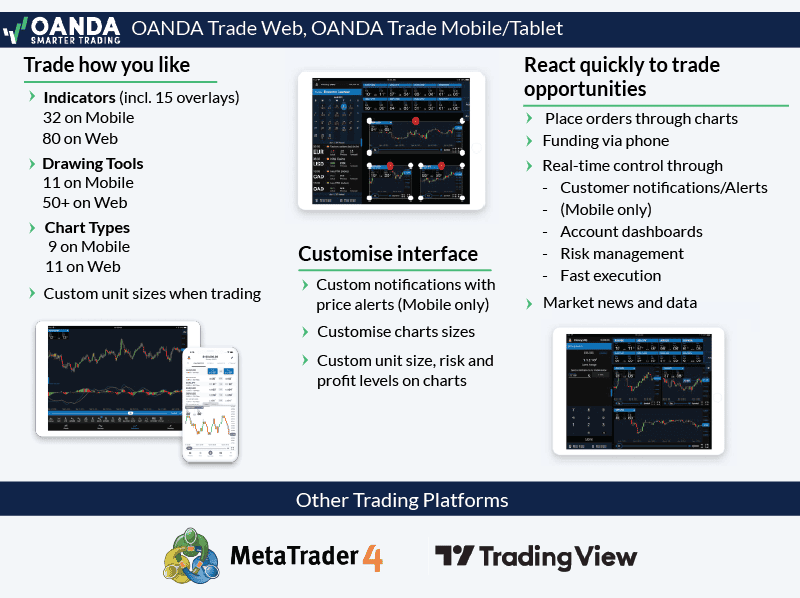

We recommend the OANDA Trade App because it’s user-friendly and offers 50+ technical indicators.

The OANDA Trade App is an intuitively designed trading app with a range of core features such as a price alert system that notifies you when the price has hit a certain level. OANDA Trade App should be your choice if you are a swing trader who uses price alerts to react to the markets quickly.

As a broker, we rated OANDA highly, scoring it 71/100. In our findings, OANDA scored highly on our trading platforms (7/10) and customer service (9/10) tests.

Pros & Cons

- Intuitive mobile trading app

- Mobile price alerts

- Over 120+ trading products

- Low spreads from 0.6 pips and no commission

- Very few alternative funding options.

- No customer support on weekends.

- No Islamic account and no fixed spread account.

Broker Details

OANDA Trade is the best forex trading app in Canada for us. You get integrated TradingView charting, granting access to advanced charting tools like 100+ indicators, drawing tools, and seamless chart syncing across mobile and desktop platforms. We’re a fan of the idea that you can tailor the app to your preferences by changing the charts, colour schemes, and layout and saving them as a template that will apply to all your devices.

During our tests, we discovered hidden gems like trading with lower position sizes (as low as 1 unit), giving you better control over trade sizes instead of fixed lots. We think this is attractive for beginners as you can transition from a demo account to live trading without being forced to trade larger lot sizes.

We also liked the default trade size, which allowed us to pre-define position size, stop loss, and take profit levels for all future orders. Although a tutorial could better highlight these features for beginners, we think they offer valuable flexibility and risk management capabilities, especially if you are new to forex trading.

We used the OANDA Standard account and found the spreads competitive, especially considering you do not pay commission with this account. The average 1.2 pip spread on EURUSD is lower than the industry average, one of the lowest we’ve tested for a CIRO-regulated forex broker.

2. FOREX.COM - Mobile App With Fast Execution And Analysis Tools

Forex Panel Score

Average Spread

EUR/USD = 0.8

GBP/USD = 0.8

AUD/USD = 1.7

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

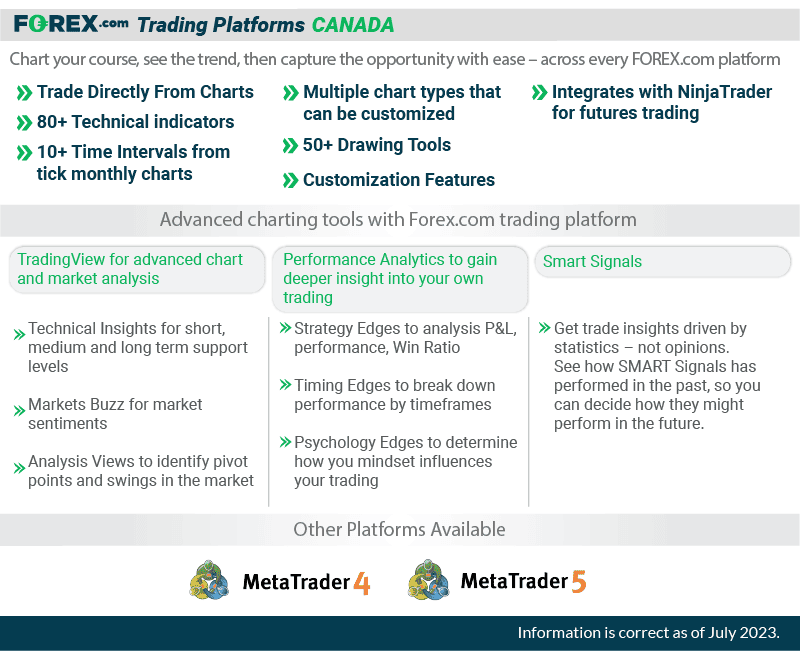

We recommend the FOREX.com mobile app not only because it is easy to use with a fluid interface, but also houses a useful suite of additional tools such as Trading Central.

From a trading point of view, you can easily search for any instrument while also utilising one-swipe trading. Additionally, you can use more advanced order customisation including OCOs (one-cancels-the-other), trailing stops and a button to ‘close all’ positions at once.

The charting features are robust too, with 80 indicators, personalised watch lists and a huge range of drawing tools.

What we appreciate is that Forex.com have combined with ‘Chasing Returns’ to create performance analytics tools exclusive to Forex.com clients. Tools include Strategy edges to review P&L, trading performance and win ratio.

Pros & Cons

- Allows you to trade directly from the charts.

- 50+ drawing tools.

- Integrates with NinjaTrader for Futures trading.

- The raw account requires a minimum deposit of $2500

- High standard spreads.

- Does not accept PayPal payments.

Broker Details

FOREX.com has a good selection of trading apps to take advantage of its services, but we feel that FOREX.com’s Mobile app stands out when it comes to execution and analysis tools.

While using the app, we liked how it integrates TradingView’s charts with 50+ drawing tools and 80+ indicators. This provides the same charting experience on a mobile device as their Web Trader platform, so we found having access to advanced charting capabilities on the go incredibly valuable.

The app’s Performance Analytics tool gave us insightful details on our trading patterns we wouldn’t have noticed otherwise, like the best times of day for our strategies. This allowed us to identify strengths and weaknesses to improve our overall trading, which is something we think everyone can work on.

The SMART Signals tool was also useful for quickly finding potential trade opportunities across different markets with its pattern recognition scanner. Covering multiple markets allowed us to receive new ideas as soon as a pattern emerged, and it notified us so we could quickly check it out and validate ourselves. We think this tool is excellent if you day trade, as it can find markets with potential opportunities that you may never have considered.

For our testing, we opened a RAW ECN account, one of the few offered by a CIRO-regulated broker. In our fee tests, we found the broker offering spreads from 0.0 pips spread with a $7 commission per lot traded, which aligns with our experience with other CIRO brokers.

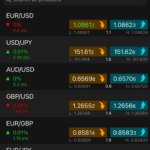

3. CMC Markets - App With Most Currency Pairs

Forex Panel Score

Average Spread

EUR/USD = 0.5

GBP/USD = 0.9

AUD/USD = 0.6

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

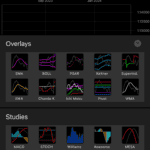

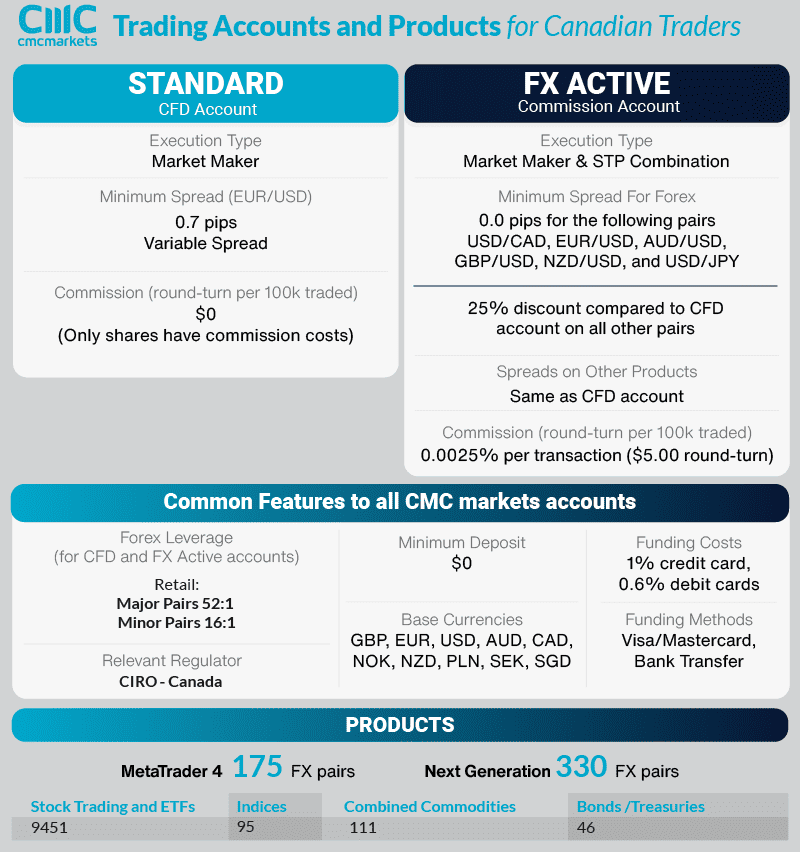

We love CMC Markets’ NGEN trading app because of its massive selection of over 12,000 tradeable instruments, CMC Markets’ Next Generation platform features innovative trading tools and quality research for CFD trading.

While the powerful charting is a massive plus, with mobile-optimised charts, 35 technical analysis indicators and customisable dashboards, the research tools are where the Next Generation mobile app really stands out.

Like OANDA, we found the mobile app to have a similar feel to that of its web counterpart, while also being cleanly designed and easy to use. This is best showcased by

Pros & Cons

- High number of trading instruments.

- No minimum deposit requirement.

- Mobile-optimised charts.

- Slow execution speeds.

- Charges a deposit fee.

- Average customer support.

Broker Details

CMC Markets is one of the largest brokers and offers a large catalogue of 12,000+ financial products from fixed income to stock indices.

One thing CMC Markets excelled in was providing over 330+ currency pairs covering various markets, from major pairs like EUR/USD to exotic pairs like USD/THB. We think having such a diverse range of currency pairs is excellent, as it allows you to diversify your trading strategies and capitalize on opportunities across multiple currency markets.

Furthermore, we were impressed to find that CMC Markets’ NGEN platform offers advanced charting tools, including 75+ technical indicators, even on its mobile app.

What stood out for us and is unique to its mobile app is the Analysis tab, which aggregates all news that impacts an asset price. While trading, we looked at the news that just hit Bitcoin, and it showed other assets that would be impacted by the news, which is useful for idea generation.

During our testing, we discovered that CMC Markets’ FX Active account offers tight spreads and low commissions on major forex pairs like GBP/USD, AUD/USD, CAD/USD, and EUR/USD. With a commission of only $2.50 per lot traded, which we think is one of the lowest among CIRO-regulated brokers, and average spreads of 0.44 pips on EUR/USD, you can benefit from competitive pricing, especially if you trade these major pairs frequently.

| EURUSD | Average Spread |

|---|---|

| Fusion Markets | 0.16 |

| IC Markets | 0.19 |

| Pepperstone | 0.19 |

| FP Markets | 0.2 |

| EightCap | 0.2 |

| CMC Markets | 0.44 |

| Blackbull Markets | 0.46 |

4. Friedberg Direct Powered by FXCM - Trading Station Includes Market Research And News

Forex Panel Score

Average Spread

EUR/USD = 0.3

GBP/USD = 0.9

AUD/USD = 0.4

Trading Platforms

MT4, TradingView, Trading Station

Minimum Deposit

$50

Why We Recommend FXCM

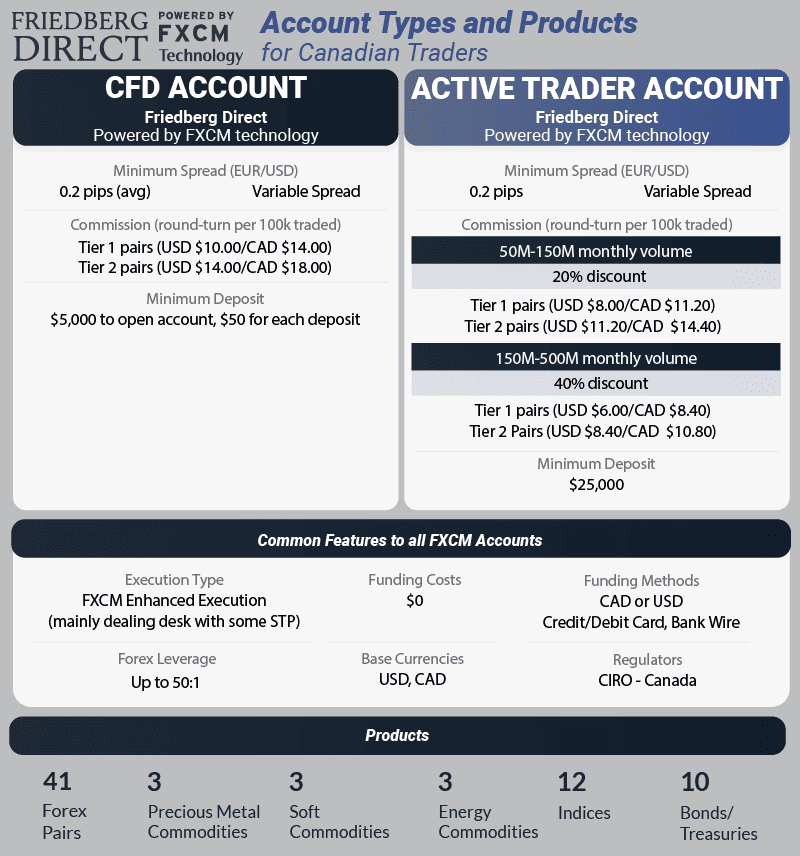

We find the most useful feature for trading through FXCM’s mobile app is the FXCM app store. In this store, you can find 46 indicators, 16 automated trading strategies, 1 alert and other 7 add-ons to enhance your trading. 38 of these apps are free (mostly indicators) but otherwise range from $25 to $199.

Additionally, the mobile offers the following great features:

- Trade with 56 forex currency pairs

- Wide range of charts and timeframes

- Chart Indicators

- Trend Lines

- Real-time Market News

- Economic Calendar

- Range of Order Types

Pros & Cons

- Easy funding options are available.

- Good customer support with a dedicated account manager.

- Regulated by the CIRO.

- High standard and raw spreads.

- High commission of $4 per side per lot.

- No MT5 trading platform.

Broker Details

While testing FXCM’s Trading App, we found the Research tool impressive, aggregating market news from 22 reputable sources, such as Investing.com, Bloomberg, and Reuters, into one condensed tab. We think this feature is incredibly valuable, as it allows you to stay informed about market developments from multiple credible sources without navigating between different websites or apps.

The Technical Analyser tool also provides potential trade ideas with market commentary and technical analysis for your selected markets. We feel this can be a helpful resource for identifying new trading opportunities and gaining insights from expert analysis.

Another aspect we liked was the app’s integration with TradingView’s SuperCharts package, offering clean and responsive charts. However, we noticed that the app lacks the full range of features available on TradingView, providing access to only 50+ indicators and three chart types, significantly lower than what TradingView and other trading apps offer.

During our tests on FXCM’s standard account, which is commission-free (you only pay the spreads), we found the broker to be competitive in terms of spreads. Our tests revealed an average spread of 1.3 pips on EUR/USD, slightly higher than the industry average of 1.24 pips. While not the tightest spreads available, we think this pricing is still reasonable, especially considering the research and analysis tools provided by the platform.

| Broker | EUR/USD |

|---|---|

| OANDA | 0.6 |

| IC Markets | 0.62 |

| Fusion Markets | 0.93 |

| Admirals | 0.6 |

| Eightcap | 1 |

| Go Markets | 1 |

| OctaFX | 0.9 |

| TMGM | 1 |

| ThinkMarkets | 1.1 |

| Axi | 1.2 |

| City Index | 0.7 |

| HYCM | 1.2 |

| eToro | 1 |

| FP Markets | 1.1 |

| Trading.com | 1 |

| CMC Markets | 1.12 |

| Exness | 1 |

| XTB | 0.9 |

| IG | 1.13 |

| Pepperstone | 1.12 |

| Blackbull Markets | 1.2 |

| HugosWay | 0.9 |

| Blueberry Markets | 1.2 |

| Saxo Markets | 1.2 |

| AccuIndex | 1.40 |

| MultiBank Group | 1.5 |

| Vantage FX | 1.4 |

| FXCM | 1.3 |

| Tickmill | 1.6 |

| FxPro | 1.32 |

| Forex.com | 1.2 |

| Fair Markets | 1.30 |

| XM | 1.6 |

| HF Markets | 1.2 |

| Markets.com | 1.6 |

| Plus500 | 1.7 |

| Swissquote | 1.7 |

| FXTM | 1.90 |

| Industry Average | 1.24 |

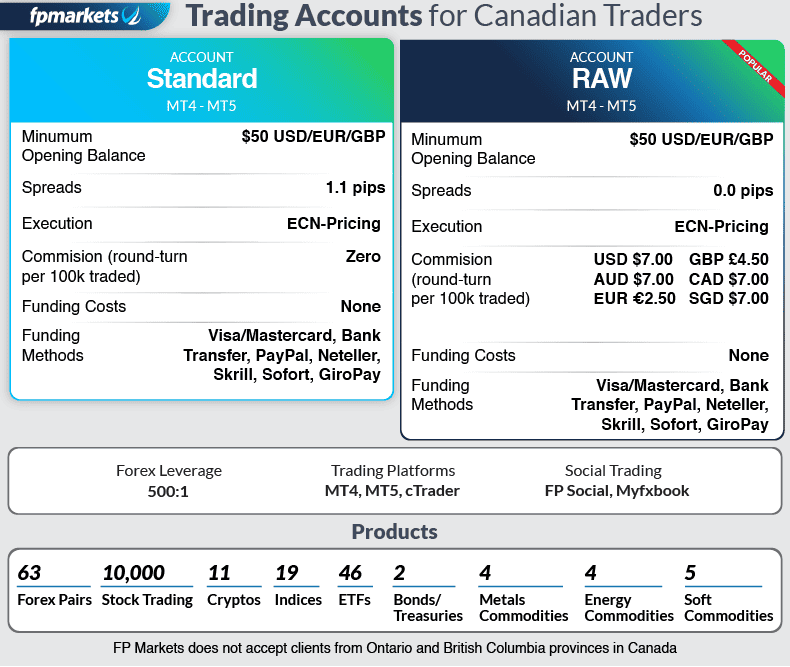

5. FP Markets - Best ECN-like Mobile Trading Experience

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

FP Markets is our top non-CIRO-regulated broker due to its low-cost, ECN-like trading conditions. You can trade with tight spreads and low commissions using FP Markets’ proprietary trading app, or the MetaTrader platforms.

In addition, you’ll be able to trade with fast execution speeds on market orders which is perfect for mobile trading. This is in addition to a great range of platform features including the MetaTrader enhancement, ‘Traders toolbox.’

Major features we like include Trader Toolbox Connect, where you can gain instant platform access to daily news feeds, an automated alarm manager for risk management purposes and the Trade Terminal, which assists you in identifying market volatility and leveraging it through day trading.

Pros & Cons

- Low-cost mobile trading.

- Good range of trading apps.

- Fast market order execution speeds.

- Excellent customer service.

- Commission of $3.00 per side

- No fixed spread account

- Low limit order execution speed.

Broker Details

We like it when brokers provide ECN-style services, meaning they directly connect buyers and sellers and have direct access to liquidity providers. This model offers several benefits, including tighter spreads, faster execution speeds, and a more transparent trading environment without dealer intervention.

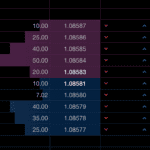

Speaking of execution speeds, our analyst Ross Collins tested FP Markets’ market order execution speed using their ECN model. The broker achieved an average speed of 96 milliseconds, which we found to be one of the fastest among the brokers we tested for market execution (instant) speed. This is crucial, especially for scalpers relying on lightning-fast execution when using instant market orders.

Additionally, we were pleased with the competitive spreads offered by FP Markets. The spreads averaged 0.1 pips on EUR/USD on the RAW account we tested. These tight spreads, combined with the broker’s direct access to liquidity providers through their ECN model, ensure you receive highly competitive pricing without any markup from the broker.

| Broker | EUR/USD |

|---|---|

| Tickmill | 0.1 |

| IC Markets | 0.02 |

| Fusion Markets | 0.13 |

| ThinkMarkets | 0.1 |

| FP Markets | 0.1 |

| FXTM | 0 |

| TMGM | 0.1 |

| HYCM | 0.1 |

| XM | 0.1 |

| GO Markets | 0.2 |

| Eightcap | 0.06 |

| LQDFX | 0.1 |

| HF Markets | 0.1 |

| IG | 0.16 |

| City Index | 0.07 |

| Global Prime | 0.18 |

| MultiBank Group | 0.1 |

| Blackwell Global | 0.4 |

| XTB | 0.09 |

| ATC Brokers | 0.3 |

| VT Markets | 0 |

| Pepperstone | 0.1 |

| London Capital Group | 0.2 |

| Blueberry Markets | 0.2 |

| FxPro | 0.32 |

| RoboForex | 0.1 |

| BD Swiss | 0.3 |

| Admirals | 0.1 |

| Axiory Nano | 0.3 |

| Fair Markets | 0.3 |

| Axi | 0.44 |

| FXCM | 0.3 |

| BlackBull Markets | 0.23 |

| Tradersway | 0.5 |

| AMarkets | 0.5 |

| Fibo Group | 0.3 |

| CMC Markets | 0.5 |

| Dukascopy | 0.28 |

| OctaFx | 0.9 |

| FlowBank | 0.6 |

| Industry Average | 0.22 |

In our testing, we found that FP Markets offered several platforms, including its own FP Markets Mobile App, cTrader, MetaTrader 4, and MetaTrader 5, all of which have their mobile apps. We found that FP Markets pushed using MetaTrader 5 as the mobile app for their platform, which, in our eyes, is a solid pick with its 38+ indicators and depth of market tools.

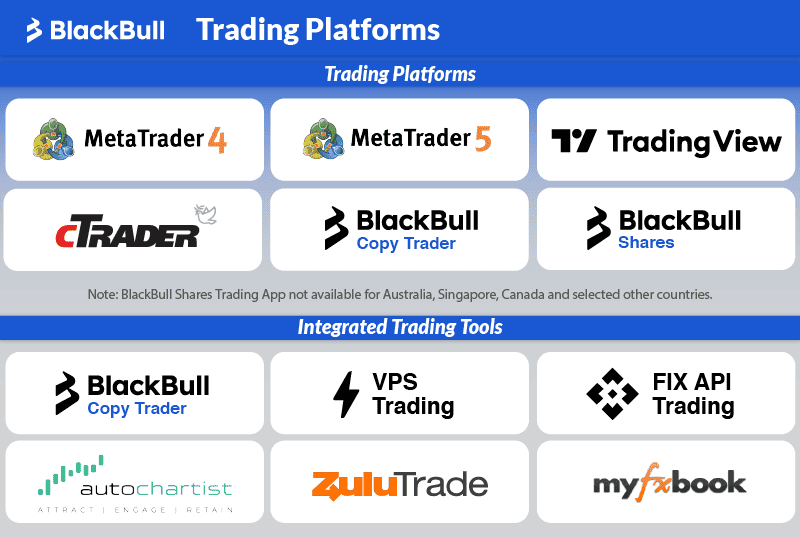

6. BlackBull Markets - High Leverage Broker with MetaTrader 4 App

Forex Panel Score

Average Spread

EUR/USD = 0.23

GBP/USD = 0.72

AUD/USD = 0.65

Trading Platforms

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlackBull Trade

Minimum Deposit

$0

Why We Recommend BlackBull Markets

BlackBull Markets is our top choice for brokers that offer the MT4 as a mobile trading platform. It has the main features you get with the desktop version, such as customizable charts and 30+ technical indicators and drawings, but we noticed that it lacks the ability to use your Expert Advisors on the mobile trading app.

However, if you have your EAs running on the desktop version, you can see the open and closed positions the EA has made in your account settings. The mobile version of the MT4 is easy to navigate, and we like that you are just one tap away from placing your trades.

Pros & Cons

- A large community of MT4 app users.

- A large marketplace of third-party tools.

- Easily migrate to other brokers that also offer the MT4 trading app.

- Offers higher leverage than CIRO-regulated brokers.

- $2000 minimum deposit for opening a Raw account.

- $4.5 commission per side per lot.

- No FAQs knowledge base.

Broker Details

As experienced traders, we understand higher leverage offered by brokers like BlackBull Markets can be appealing, especially if you have a smaller starting balance. For Canadian traders, the broker provides leverage up to 1:500, significantly higher than the 1:30 maximum imposed by CIRO.

The ability to access such high leverage can potentially magnify trading profits. However, it’s crucial to note that while BlackBull Markets is not directly regulated by CIRO, they operate under the Financial Services Authority in Seychelles (FSA), which may have different regulatory standards.

Moving on to the trading platform, we like that BlackBull Markets offers the MetaTrader 4 app, a mobile version of the popular desktop platform. While a stripped-down version without support for expert advisors or custom indicators, it still provides a decent choice of 30 built-in indicators, including useful tools like Ichimoku and Bollinger Bands.

We highly value brokers that offer fast execution speeds, as this can significantly impact our trading performance, especially for time-sensitive strategies.

Our analyst, Ross Collins, specifically tested BlackBull Markets’ execution speed on their ECN Prime account using the MetaTrader 4 platform, comparing the results against 14 other brokers. Impressively, BlackBull Markets emerged as the clear winner, providing the fastest overall execution speeds for both limit orders (79 ms) and market orders (77 ms). We think fast execution is crucial, as it minimizes the risk of slippage and ensures our orders are filled at the intended price, especially in volatile market conditions.

| Broker | Overall Speed Ranking | Limit Order Rank | Limit Order Speed (ms) | Market Order Rank | Market Order Speed (ms) |

|---|---|---|---|---|---|

| Blackbull Markets | 1 | 1 | 72 | 5 | 90 |

| Fusion Markets | 2 | 3 | 79 | 1 | 77 |

| Pepperstone | 3 | 2 | 77 | 10 | 100 |

| OANDA | 4 | 5 | 86 | 2 | 84 |

| Octa | 5 | 4 | 81 | 6 | 91 |

| Exness | 6 | 10 | 92 | 3 | 88 |

| Blueberry Markets | 7 | 6 | 88 | 7 | 94 |

| FOREX.com | 8 | 13 | 98 | 4 | 88 |

| Global Prime | 9 | 7 | 88 | 9 | 98 |

| Tickmill | 10 | 9 | 91 | 11 | 112 |

| TMGM | 11 | 11 | 94 | 13 | 129 |

| City Index | 12 | 12 | 95 | 14 | 131 |

| Trading.com | 13 | 14 | 98 | 15 | 138 |

| FBS | 14 | 17 | 135 | 12 | 118 |

| Axi | 15 | 8 | 90 | 25 | 164 |

| Eightcap | 16 | 19 | 143 | 17 | 139 |

| IC Markets | 17 | 16 | 134 | 22 | 153 |

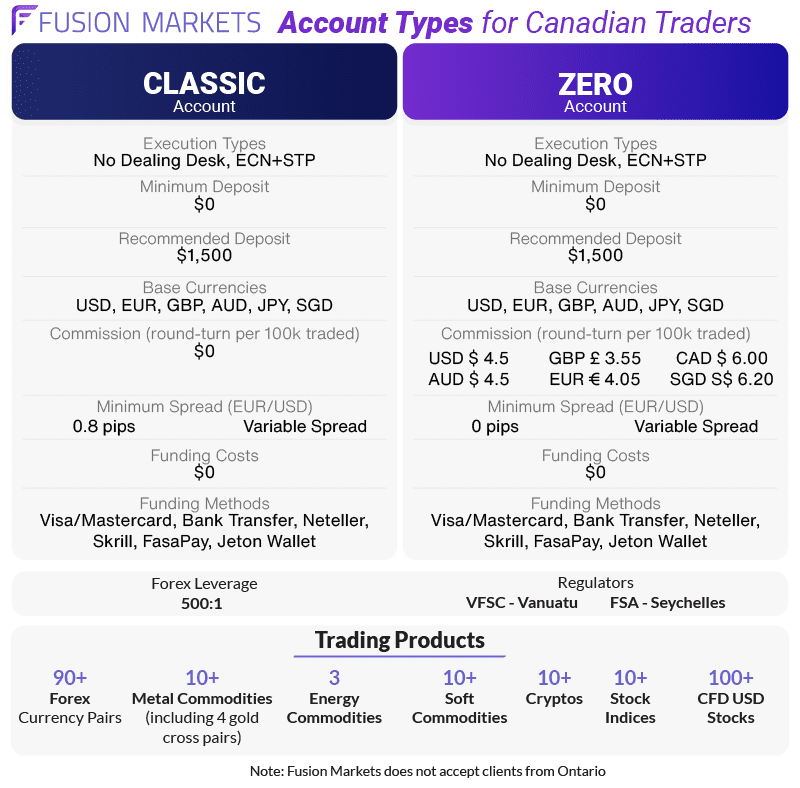

7. Fusion Markets - MetaTrader 5 Is Another Great Platform For Mobile

Forex Panel Score

Average Spread

EUR/USD = 0.13

GBP/USD = 0.21

AUD/USD = 0.12

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why We Recommend Fusion Markets

We recommend Fusion Markets as the best MT5 mobile broker. In our view, MT5 is basically an upgraded version of MT4.

Not only does MT5 have added timeframes (21), chart indicators (44) and technical analysis objects (over 80), the platform also has a faster procession rate (64-bit), depth of market features and MQL5 programming language, which is 20 times faster than MQL4 (that MT4 uses).

Similar to MT4, MT5 is available for Windows, Mac OS and Android or iOS apps.

Pros & Cons

- No minimum deposit.

- Very low standard and raw spreads.

- Very low commission.

- High execution speeds

- Not regulated by CIRO

- No swap-free or fixed spread account.

- Does not accept PayPal payments.

Broker Details

While the broker offers a suite of trading apps, including cTrader and TradingView, we found the MetaTrader 5 app impressive.

The MetaTrader 5 mobile app is an excellent trading platform, offering trading and analysis tools on the go. It provides a user-friendly interface for Android and iOS devices, allowing traders to place trades, monitor the market, and access a wide range of features similar to the desktop version.

During our testing, we found 38 indicators, 20 drawing tools, and the valuable Depth of Market tool, which is directly accessible on the app. The Depth of Market tool is a valuable addition, providing a visual representation of the order book with available buy and sell orders at different price levels. We think this feature can be useful for scalpers and day traders, helping gauge market sentiment and identify potential supply and demand levels.

One aspect that stood out to us was Fusion Markets’ competitive commission structure. We found that the broker charges only $2.25 per lot traded, significantly lower than the industry average. We think this low commission rate is excellent, especially if you execute a high volume of trades, as it can help minimize trading costs and potentially enhance overall profitability.

| Broker | USD |

|---|---|

| Tickmill | $2.00 |

| RoboForex | $2.00 |

| FXTM | $2.00 |

| Fusion Markets | $2.25 |

| London Capital Group | $2.25 |

| CMC Markets | $2.50 |

| BD Swiss | $2.50 |

| AMarkets | $2.50 |

| Fair Markets | $2.50 |

| Go Markets | $2.50 |

| City Index | $2.50 |

| VT Markets | $3.00 |

| FIBO Group | $3.00 |

| Admirals | $3.00 |

| Blackbull Markets | $3.00 |

| FP Markets | $3.00 |

| HF Markets | $3.00 |

| Axiory Nano | $3.00 |

| MultiBank Group | $3.00 |

| Tradersway | $3.00 |

| ATC Brokers | $3.00 |

| FlowBank | $3.25 |

| Pepperstone | $3.50 |

| EightCap | $3.50 |

| Axi | $3.50 |

| IC Markets | $3.50 |

| ThinkMarkets | $3.50 |

| Dukascopy | $3.50 |

| Global Prime | $3.50 |

| TMGM | $3.50 |

| Blueberry Markets | $3.50 |

| FxPro | $3.50 |

Furthermore, we tested the broker’s RAW account spreads to evaluate their competitiveness. Our testing found that Fusion Markets provided tight RAW spreads, averaging 0.16 pips on EUR/USD. This level of pricing is truly excellent, as you benefit not only from low commissions but also from extremely tight spreads.

| EURUSD | Average Spread |

|---|---|

| TMGM | 0.15 |

| Tickmill | 0.15 |

| Fusion Markets | 0.16 |

| IC Markets | 0.19 |

| Pepperstone | 0.19 |

| FP Markets | 0.2 |

| EightCap | 0.2 |

| Admiral Markets | 0.21 |

| City Index | 0.22 |

| ThinkMarkets | 0.22 |

| Blueberry Markets | 0.27 |

| Go Markets | 0.38 |

| Axi | 0.43 |

| CMC Markets | 0.44 |

| Blackbull Markets | 0.46 |

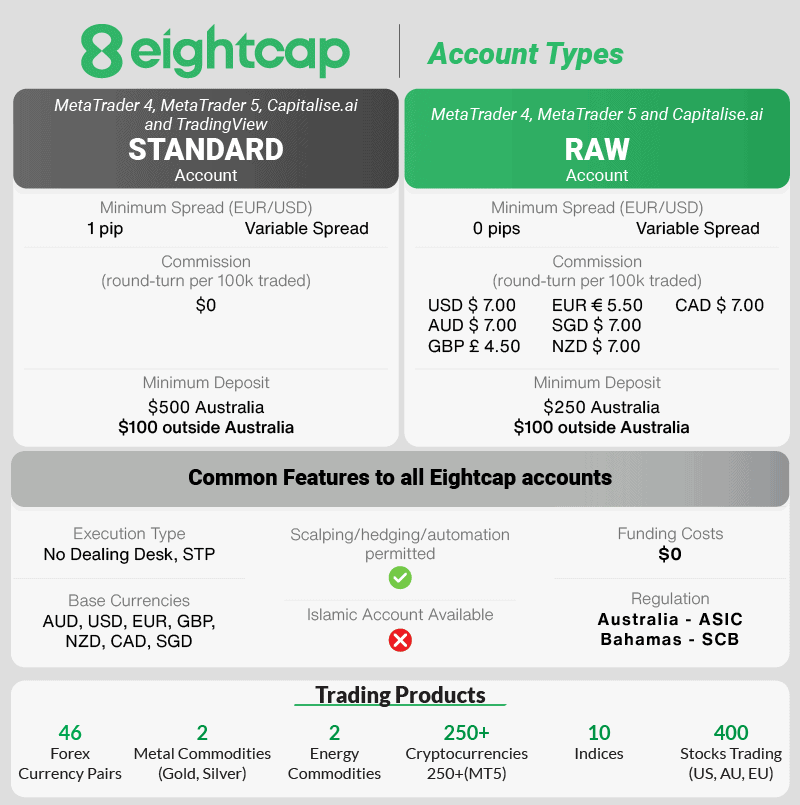

8. Eightcap - Best App Tools For Crypto Trading

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.73

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

We recommend Eightcap primarily because they offer the largest range of cryptocurrency instruments at 95.

You can trade these 95 cryptos, and all of Eightcap’s products via MT4, MT5 and TradingView. We love using these platforms because they are versatile apps that can be used for algorithmic and copy trading and are available via the Apple or Play Store for Android.

Pros & Cons

- Wide range of cryptocurrency products.

- Both MT4 and MT5 are available.

- Tight Raw and Standard spreads.

- Commission of $3.5 per side.

- Very high minimum deposit.

- No swap-free accounts or fixed spread accounts.

- No proprietary trading app.

Broker Details

We found Eightcap’s market selection impressive. It offers 56 currency pairs, 586 shares, 16 indices, 8 commodities, and 95 crypto markets. Out of all the brokers we’ve tested, Eightcap has the largest choice of crypto markets, which we think is ideal for traders seeking exposure to volatile crypto markets while still being able to trade traditional assets.

| Broker | No. of Crypto Markets |

|---|---|

| Eightcap | 95 |

| CMC Markets | 14 |

| BlackBull Markets | 11 |

| FP Markets | 11 |

| Fusion Markets | 10 |

| FOREX.com | 8 |

| FXCM | 7 |

| OANDA | 4 |

When we opened our Eightcap RAW account, we were pleased to find that we had access to various platforms, including MetaTrader 4, MT5, and TradingView. We appreciate having this choice, as different traders may prefer specific platforms based on their trading styles or analytical needs.

Speaking of TradingView, we think it’s one of the best platforms for traders who rely heavily on technical analysis to identify trading opportunities. The platform offers an impressive selection of 110+ indicators, which are frequently updated, and new indicators are regularly added to the catalogue at no additional cost.

Thanks to its integrated search bar, accessing the crypto markets through the TradingView app was as simple as entering the name of the cryptocurrency we wanted to trade. The charts loaded fast, and all of the personalization, like trading indicators and colour schemes, was automatically applied to the chart, allowing you to get straight to analyzing the asset.

When we opened our RAW Account with Eightcap to test the spreads, we found them highly competitive, averaging 0.2 pips on EUR/USD, lower than the industry average.

| EURUSD | Average Spread |

|---|---|

| TMGM | 0.15 |

| Tickmill | 0.15 |

| Fusion Markets | 0.16 |

| IC Markets | 0.19 |

| Pepperstone | 0.19 |

| FP Markets | 0.2 |

| EightCap | 0.2 |

| Admiral Markets | 0.21 |

| City Index | 0.22 |

| ThinkMarkets | 0.22 |

| Blueberry Markets | 0.27 |

| Go Markets | 0.38 |

| Axi | 0.43 |

| CMC Markets | 0.44 |

| Blackbull Markets | 0.46 |