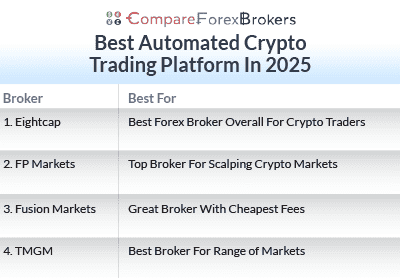

Best Automated Crypto Trading Platform

The best automated crypto trading platforms allow you to trade using algorithms such as bots or expert advisors. Trading can be done with a CFD broker or via an exchange. Popular platforms include MetaTrader 4 and captailise.ai

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

These brokers have platforms to trade crypto using algos

- Eightcap - Best Forex Broker Overall For Crypto Traders

- FP Markets - Top Broker For Scalping Crypto Markets

- Fusion Markets - Great Broker With Cheapest Fees

- TMGM - Best Broker For Range of Markets

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

96 |

FCA, ASIC CySEC, SCB |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

71 |

FMA, VFSC ASIC |

0.20 | 0.30 | 0.10 | $3.50 | 1.20 | 1.20 | 1.0 |

|

|

|

94ms | $100 | 61 | 12 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

92 | ASIC, VFSA, FSA-S | 0.11 | 0.24 | 0.12 | $2.25 | 0.83 | 1.42 | 1.12 |

|

|

|

79ms | $0 | 84 | 14 | 500:1 | 500:1 |

|

What Are The Best Brokers For Crypto Traders?

The brokerages we reviewed below were chosen specifically for the depth of their cryptocurrency offerings, variety of automation and trading platforms and accessibility across provinces to Canadian traders.

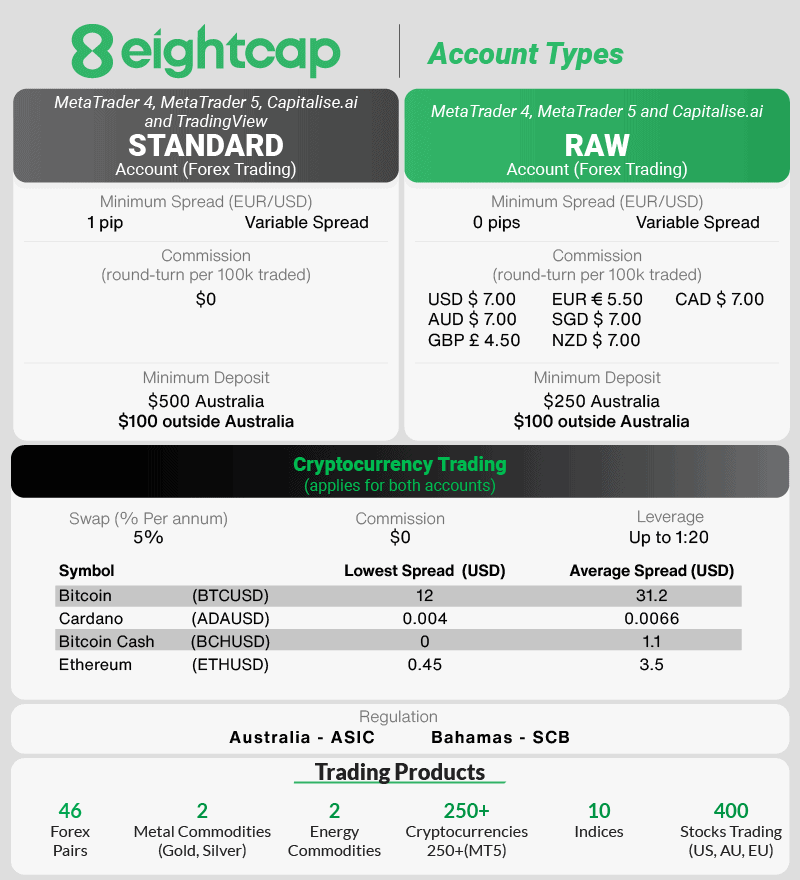

1. Eightcap - Best Forex Broker Overall For Crypto Traders

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.73

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

Eightcap is the top broker for crypto traders because of its wide selection of 90+ coins, including Bitcoin, XRP, and Ethereum, providing you with extensive choices. The broker’s automation tools like Capitalise.ai simplify the creation of automated strategies using AI to generate your strategies for MT4 without coding experience.

These tools integrate with MT4 to enhance your crypto trading. With extensive crypto choices and easy automation, Eightcap has everything crypto traders need.

Pros & Cons

- Offers the most cryptocurrencies in Canada

- Low average RAW spreads

- Excellent strategy automation tools

- Limited range of markets

- Need a minimum deposit

- Customer support isn’t 24/7

Broker Details

We’ve tested over 40 brokers, and none come close to offering the number of crypto markets Eightcap does. With 95 cryptocurrencies available, only XM, offering 58 crypto products, came close. The broker offers highly liquid cryptocurrencies like Bitcoin and Ethereum and less popular coins such as Decentreland or Chainlink, giving you a nice range of products to trade.

The main advantage we find with trading crypto through regulated forex brokers like Eightcap is that a regulator like the Canadian Investment Regulatory Organization (CIRO) or the Financial Conduct Authority (FCA) protects your capital and rights. This protection can add confidence when trading highly volatile markets such as crypto, especially if you are just starting.

In addition to the wide choice of crypto, Eightcap offers trading in more traditional markets, such as forex, indices, and commodities.

As for the trading costs on Eightcap, we found them to be low overall, with its Raw account spreads averaging 0.06 pips on EUR/USD and $12 on BTC/USD.

| BROKER | EUR/USD |

|---|---|

| Eightcap | 0.06 |

| Fusion Markets | 0.13 |

| FP Markets | 0.1 |

| TMGM | 0.1 |

Eightcap offers multiple platforms on which you can automate your crypto strategies. MetaTrader 4 and MT5 allow you to automate your trades through Expert Advisors fully. TradingView is also available, but you need third-party tools to fully automate your strategies on the platform, which is why MT4 and MT5 are popular choices.

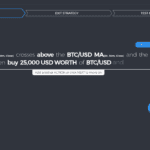

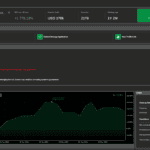

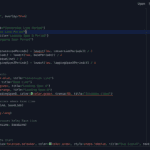

To develop an expert advisor, you must know how to code using the MQL language unique to MetaTrader platforms. Fortunately, Eightcap offers Capitalise.ai, a platform that lets you automate your strategy without writing a line of code.

We tried the platform and found its instruction-based interface easy to use. All we had to do was type in the trading conditions and the asset for our entry and exit rules, and then Capitalise AI would instantly develop the automated strategy.

A nice touch Capitalise AI offers is the ability to backtest the strategy over the last 90 days, allowing you to review its potential profitability. Using similar tools, you can also forward-test the strategy, where Capitalise AI will trade with a demo account so you can monitor it in real-time. Both of these tools can help you maximize your strategy before deploying it live on your Eightcap account.

2. FP Markets - Top Broker For Scalping Crypto Markets

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.2 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

We like FP Markets because they impressed in our tests, achieving zero-pip spreads 97.83% of the time, saving you money on the spread. This is why we recommend FP Markets for scalpers, as not paying a spread allows you to squeeze out more profit from your trades.

The broker has a wide range of trading platforms (such as MetaTrader 4, MetaTrader 5, cTrader and TradingView) that allow you to automate your trades. You also have a decent selection of cryptocurrencies from Bitcoin to Solana to scalp on too.

Pros & Cons

- Offers zero-spreads

- Has a good choice of trading platforms

- Good choice of crypto markets

- Requires a minimum deposit

- IRESS platform unavailable in Canada

- The mobile trading app lacks any features

Broker Details

Scalpers need fast market order speeds, which is why, based on our testing, we think FP Market is best.

Our chief of research, Ross Collins, tested the broker’s market order speed on the MT4 platform and compared the results against 14 other brokers to find the fastest broker.

Ross found that FP Market’s execution speed was the fourth fastest, at an average of 96ms. This speed is important if your automated trades rely on market orders instead of limit orders, as the faster the speed, the less likely you are to suffer from slippage or unfilled orders.

| Broker | Market Order Rank | Market Order Speed |

|---|---|---|

| Fusion Markets | 1 | 77 |

| OANDA | 2 | 84 |

| Exness | 3 | 88 |

| FOREX.com | 4 | 88 |

| BlackBull Markets | 5 | 90 |

| Octa | 6 | 91 |

| Blueberry Markets | 7 | 94 |

| FP Markets | 8 | 96 |

| Global Primes | 9 | 98 |

| Pepperstone | 10 | 100 |

| Tickmill | 11 | 112 |

| FBS | 12 | 118 |

| TMGM | 13 | 129 |

| City Index | 14 | 131 |

We think the Raw account is the optimal choice for getting the lowest trading costs on FP Markets and maximizing your profit margins when scalping crypto. This account offered much tighter spreads, at 0.10 pips on average for EUR/USD, while needing to pay only a small commission of $3.00 per lot traded.

However, if you are against paying a commission and are happy to pay wider spreads on the Standard account, you’ll find FP Market’s spreads competitive, averaging one pip on EUR/USD.

For those looking to scalp cryptocurrencies, we found that FP Markets offered 11 cryptocurrencies, the most popular and liquid currencies, so you’ll have no trouble scalping. In addition to crypto, the broker provides 63 currency pairs, 19 indices, 10,000+ stocks, and 13 commodities so you can scalp other liquid markets like gold and EUR/USD alongside Bitcoin.

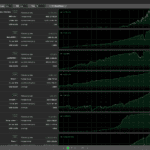

We found that FP Markets offers multiple platforms to automate crypto trading during our testing. These platforms include MetaTrader 5, MT4, TradingView, and cTrader.

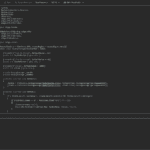

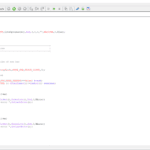

With FP Markets, you can automate your trades with cTrader through its cTrader Algo tab, which lets you program cBots to follow the entry and exit rules you code. cBots are similar to MetaTrader’s Expert Advisors, they are just written in a different language that will open, close, and manage risk based on your instructions.

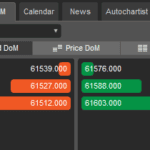

In particular, cBots can leverage the Level 2 pricing available on the platform through its Depths of Markets tool, giving your automation more accurate pricing. Based on the current market’s volume, more advanced trading conditions can be programmed to help time your trades better based on the liquidity provider’s order book.

One feature that stood out is cTrader Copy, a platform copy trading tool that we think is helpful if you like the idea of scalping but lack the time or skill to trade it. Using cTrader Copy will automatically trade the same markets as the signal provider, making it a hands-free experience. While using cTrader, we found over 411 traders to copy who leverage various automated trading strategies, including scalping.

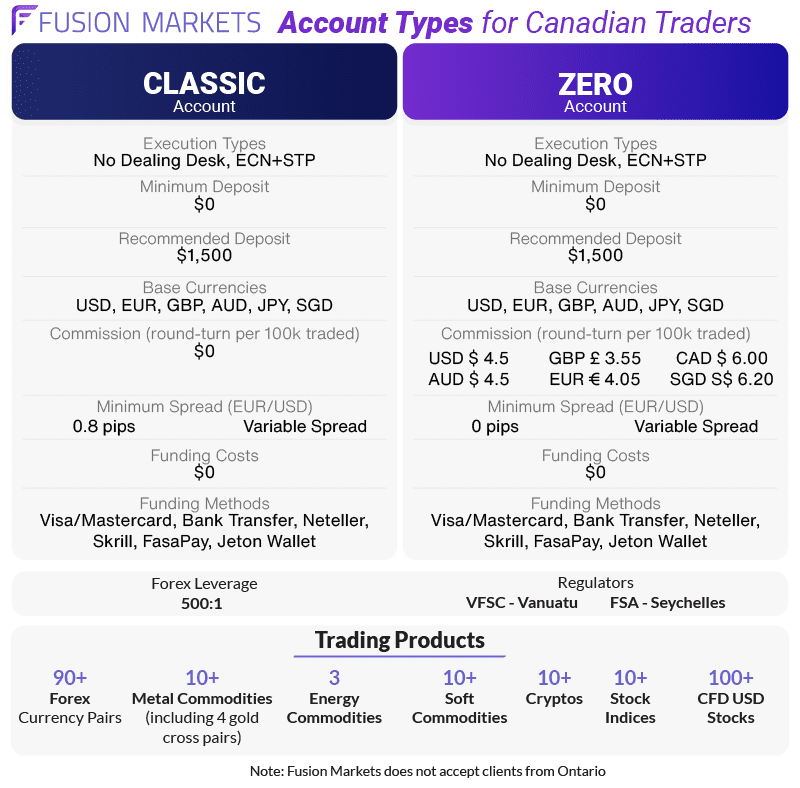

3. Fusion Markets - Great Broker With Cheapest Fees

Forex Panel Score

Average Spread

EUR/USD = 0.13

GBP/USD = 0.21

AUD/USD = 0.12

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why We Recommend Fusion Markets

Our tests show Fusion Markets is the most budget-friendly broker out there. In testing, the average RAW account spread was 0.22 pips on EUR/USD, only charging $2.25 per lot commission. That’s a fraction of the $7 per lot other brokers typically charge.

With fees this low, your automated crypto strategies can maximize your potential profit margins. Fusion Markets supports MT4 and MT5 platforms, allowing you to utilize Expert Advisors for automated strategies while reducing costs.

Pros & Cons

- The lowest commissions from $2.25 per lot

- Fast execution speeds at 77ms

- Great choice of trading tool

- Lacks TradingView

- Not the largest market choice

- Has inactivity fees

Broker Details

During our tests, we found Fusion Markets to offer the lowest overall trading fees, making it a great option to lower your automated crypto trading costs.

We tested Fusion Markets’ spreads for its Classic (spread-only) and Zero (commission-based) accounts and compared them with their peers.

The broker averaged an impressive 0.93 pips on EUR/USD for the Classic account, one of the lowest tested for an account with no commissions.

| BROKER | EUR/USD |

|---|---|

| OANDA | 0.6 |

| IC Markets | 0.62 |

| Fusion Markets | 0.93 |

| Admirals | 0.6 |

| Eightcap | 1 |

| Go Markets | 1 |

| OctaFX | 0.9 |

| TMGM | 1 |

| FIBO Group | 0.8 |

| Trading212 | 1.1 |

| ThinkMarkets | 1.1 |

| Axi | 1.2 |

| City Index | 0.7 |

| HYCM | 1.2 |

| eToro | 1 |

| FP Markets | 1.1 |

| Trading.com | 1 |

| CMC Markets | 1.12 |

| Exness | 1 |

| XTB | 0.9 |

| IG | 1.13 |

| Pepperstone | 1.12 |

| Blackbull Markets | 1.2 |

| HugosWay | 0.9 |

| Blueberry Markets | 1.2 |

| Saxo Markets | 1.2 |

| AccuIndex | 1.40 |

| MultiBank Group | 1.5 |

| Vantage FX | 1.4 |

| FXCM | 1.3 |

| Tickmill | 1.6 |

| Industry Average | 1.24 |

The Zero account followed suit with even tighter spreads, averaging 0.16 pips on EUR/USD, almost 50% lower than the industry average of 0.27 pips.

Commission on the Zero account is also one of the lowest in the industry, at just $2.25 per lot traded, cementing Fusion Markets as one of the cheapest brokers for Canadian traders. Lower trading fees improve your trades’ overall profit margins, costing you less to trade.

Fusion Markets also scored top marks in our execution speed analysis, offering limit order speeds of 79ms and market order speeds of 77ms. These speeds placed the broker second fastest out of 20 other brokers, perfect for ensuring you get the best prices when executing your trades and protecting you from price slippage that could cost you money.

| Broker | Overall Speed Ranking | Limit Order Speed (ms) | Limit Order Rank | Market Order Speed (ms) | Market Order Rank |

|---|---|---|---|---|---|

| BlackBull Markets | 1 | 72 | 1 | 90 | 5 |

| Fusion Markets | 2 | 79 | 3 | 77 | 1 |

| Pepperstone | 3 | 77 | 2 | 100 | 10 |

| OANDA | 4 | 86 | 5 | 84 | 2 |

| Octa | 5 | 81 | 4 | 91 | 6 |

| Exness | 6 | 92 | 10 | 88 | 3 |

| Blueberry Markets | 7 | 88 | 6 | 94 | 7 |

| FOREX.com | 8 | 98 | 13 | 88 | 4 |

| Global Prime | 9 | 88 | 7 | 98 | 9 |

| Tickmill | 10 | 91 | 9 | 112 | 11 |

| TMGM | 11 | 94 | 11 | 129 | 13 |

| City Index | 12 | 95 | 12 | 131 | 14 |

| Trading.com | 13 | 98 | 14 | 138 | 15 |

| FBS | 14 | 135 | 17 | 118 | 12 |

| Axi | 15 | 90 | 8 | 164 | 25 |

| Eightcap | 16 | 143 | 19 | 139 | 17 |

| IC Markets | 17 | 134 | 16 | 153 | 22 |

| FxPro | 18 | 151 | 23 | 138 | 16 |

| Go Markets | 19 | 144 | 20 | 145 | 20 |

| Markets.com | 20 | 150 | 22 | 141 | 18 |

| EasyMarkets | 21 | 155 | 24 | 155 | 24 |

| Admirals | 22 | 132 | 15 | 182 | 28 |

| IG | 23 | 174 | 26 | 141 | 19 |

| CMC Markets | 24 | 138 | 18 | 180 | 26 |

| FP Markets | 25 | 225 | 32 | 96 | 8 |

| VantageFX | 26 | 175 | 27 | 154 | 23 |

| XM | 27 | 148 | 21 | 184 | 29 |

| FXCM | 28 | 108 | 28 | 189 | 30 |

| Avatrade | 29 | 235 | 33 | 145 | 21 |

| ThinkMarkets | 30 | 161 | 25 | 248 | 36 |

| Tradersway | 31 | 198 | 29 | 214 | 33 |

| Swissquote | 32 | 258 | 37 | 198 | 31 |

| FXTM | 33 | 248 | 36 | 210 | 32 |

| Libertex | 34 | 215 | 31 | 244 | 35 |

| ATC Brokers | 35 | 238 | 34 | 241 | 34 |

| HYCM | 36 | 241 | 35 | 268 | 37 |

However, we found that TradingView is a decent pick if you want to semi-automate your trades while still having control over which signals get executed.

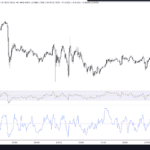

TradingView uses Pine script to develop its custom strategies. We liked that TradingView promotes an open-source environment, meaning many other coders provide free strategies and indicators that you can use to trade or adapt to your own strategy. The platform includes the 110+ indicators and 50+ drawing tools that come with TradingView by default, giving you a solid foundation to develop your scripts.

The downside of TradingView is that you cannot automatically execute your trades on the platform like you can with MT4, MT5, and cTrader. This limitation may prevent most algo traders from using TradingView. However, we think it’s a blessing in disguise that you can still generate alerts on the platform to verify each signal before executing a trade.

What also stood out is that TradingView syncs across all of your devices. We found that if you download the TradingView mobile app, your scripts can still run even if you have closed the desktop or web platform. This device syncing feature effectively allows your TradingView scripts to run 24/5 without needing a VPS, making it a top pick for (semi) automated trading tools.

Fusion Market’s cryptocurrency selection is average compared to other brokers, with just 10+ products, including Bitcoin, Dogecoin, and Solana. Although the range is limited, these highly liquid markets offer plenty of opportunities each day.

4. TMGM - Best Broker For Range of Markets

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.42

AUD/USD = 0.21

Trading Platforms

MT4, MT5, TMGM App

Minimum Deposit

$100

Why We Recommend TMGM

While it’s not CIRO-regulated, it accepts Canadian traders, providing higher leverage (1:500 vs. CIRO’s 1:30). This higher leverage is ideal for automated crypto trading as it lowers your margin requirements, enabling you to capitalize on market movements and potentially enhances your ROI.

On top of the leverage, TMGM offers a large range of 12,000 markets, allowing you to switch from crypto to forex, stocks, commodities, or indices. Letting you trade a range of markets, across multiple time zones, with one trading account.

Pros & Cons

- Decent choice of cryptocurrencies

- Offers 1:500 leverage

- Low trading fees

- Is not CIRO regulated

- Lacks educational resources

- Has a minimum deposit requirement

Broker Details

TMGM has a decent selection of 20 crypto markets you can trade, including popular cryptocurrencies like Bitcoin, Litecoin, and XRP.

However, if you like to trade multiple assets, we think TMGM is a top choice, with 1,400+ financial instruments available. This choice covers 61 forex, 12 indices, 1,200 stock CFDs, and 11 commodities.

You can access these financial instruments through TMGM’s two trading accounts. The Classic account is a variable spread account with no commissions, which is ideal if you want a simplified pricing structure. We found the spreads on this account very competitive, averaging one pip on EUR/USD, below the industry average of 1.11 pips.

The Edge account is for traders who want more transparency and potentially more reliable trading costs through tighter spreads and a small commission of $3.50 per lot traded. In our live spread tests for commission-based accounts, TMGM had the tighter average spread on EUR/USD at 0.15 pips, almost 50% lower than the industry average.

| EURUSD | Average Spread |

|---|---|

| TMGM | 0.15 |

| Tickmill | 0.15 |

| Fusion Markets | 0.16 |

| IC Markets | 0.19 |

| Pepperstone | 0.19 |

| FP Markets | 0.2 |

| EightCap | 0.2 |

| Admiral Markets | 0.21 |

| CityIndex | 0.22 |

| ThinkMarkets | 0.22 |

| Blueberry Markets | 0.27 |

| Go Markets | 0.38 |

| Axi | 0.43 |

| CMC Markets | 0.44 |

| Blackbull Markets | 0.46 |

| Industry Average | 0.27 |

A special note to consider is that TMGM is not regulated by the Canadian Investment Regulatory Organization (CIRO). Instead, the entity you will be using is regulated by the Vanuatu Financial Services Commission (VFSC), allowing you to leverage up to 1:1000.

As a Canadian trader, you will be restricted to 1:30 under a CIRO-regulated broker, so TMGM might be an option if you have a smaller trading balance. Just be warned that the increased leverage will significantly increase your risk exposure.

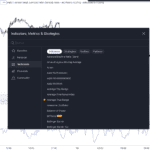

The broker also offers multiple platforms with automation features, such as MetaTrader 4 and MetaTrader 5.

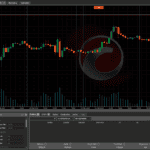

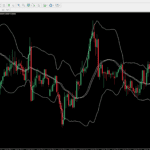

On MT4, you can access a range of cryptos and benefit from the execution speed with 38+ indicators, including MACD and Bollinger Bands. You can also use Expert Advisors to automate your trading strategies. You can program them using the MQL code or tap into the largest trading communities to find a pre-built Expert Advisor.

The only downside of using MT4 as an automation platform is that the Expert Advisors will only run if your platform is open. So, if you seek to trade 24/5, you’ll need a VPS. Fortunately, Fusion Markets offers a selection of discounted VPS services you can access with a live account.