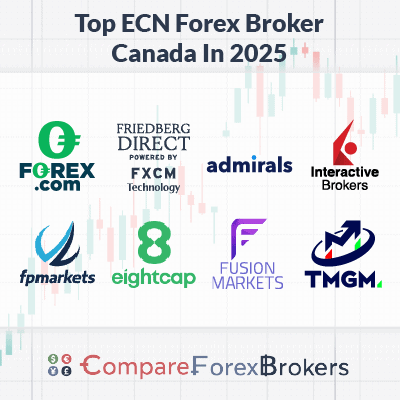

ECN Brokers In Canada

The best ECN Forex Brokers Canada have offer low spreads as there is no dealing desk and use STP execution. We look at the best Fx brokers for Canadian traders along with trading platforms, account types and products.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The best ECN accounts with no dealing desk are:

- FOREX.com - Solid All Around Offering

- Friedberg Direct Powered by FXCM - Top ECN Broker With Free Trading Tools

- Admirals - Good ECN Broker With MetaTrader 5

- Interactive Brokers - Great ECN Broker For Professional Traders

- FP Markets - Great ECN Broker For Scalping

- Eightcap - Top Choice For Crypto Trading

- Fusion Markets - Cheapest Broker

- TMGM - Top Broker For Range Of Markets

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

84 | CIRO, FCA, NFA, CFTC, MAS, JFSA, CIMA | - | - | - | $7.00 | 1.2 | 1.5 | 1.4 |

|

|

|

30 ms (May 2023) | $100 | 80+ | - | 33:1 | 33:1 |

|

Read review ›

Read review ›

|

70 |

ASIC, FCA FSCA, CIRO |

0.22 | 0.80 | 0.40 | $3.00 | 1.3 | 1.4 | 1.7 |

|

|

|

150ms | $300 | 39+ | - | 30:1 |

|

|

Read review ›

Read review ›

|

52 |

CIRO NFA/CFTC,ASIC,FCA,MAS |

- | - | - | 0.08%-0.2% | - |

|

|

|

120ms | $0 | 100+ | - | 30:1 |

|

|||

Read review ›

Read review ›

|

73 |

ASIC, FCA, CySEC CIRO, FSA, EFSA |

0.1 | 0.7 | 0.6 | $3.00 | 0.8 | 1.0 | 1.0 |

|

|

|

132ms | $100 | 50 | 37 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

96 |

FCA, ASIC CySEC, SCB |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

92 | ASIC, VFSA, FSA-S | 0.11 | 0.24 | 0.12 | $2.25 | 0.83 | 1.42 | 1.12 |

|

|

|

79ms | $0 | 84 | 14 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

71 |

FMA, VFSC ASIC |

0.20 | 0.30 | 0.10 | $3.50 | 1.20 | 1.20 | 1.0 |

|

|

|

94ms | $100 | 61 | 12 | 30:1 | 200:1 |

|

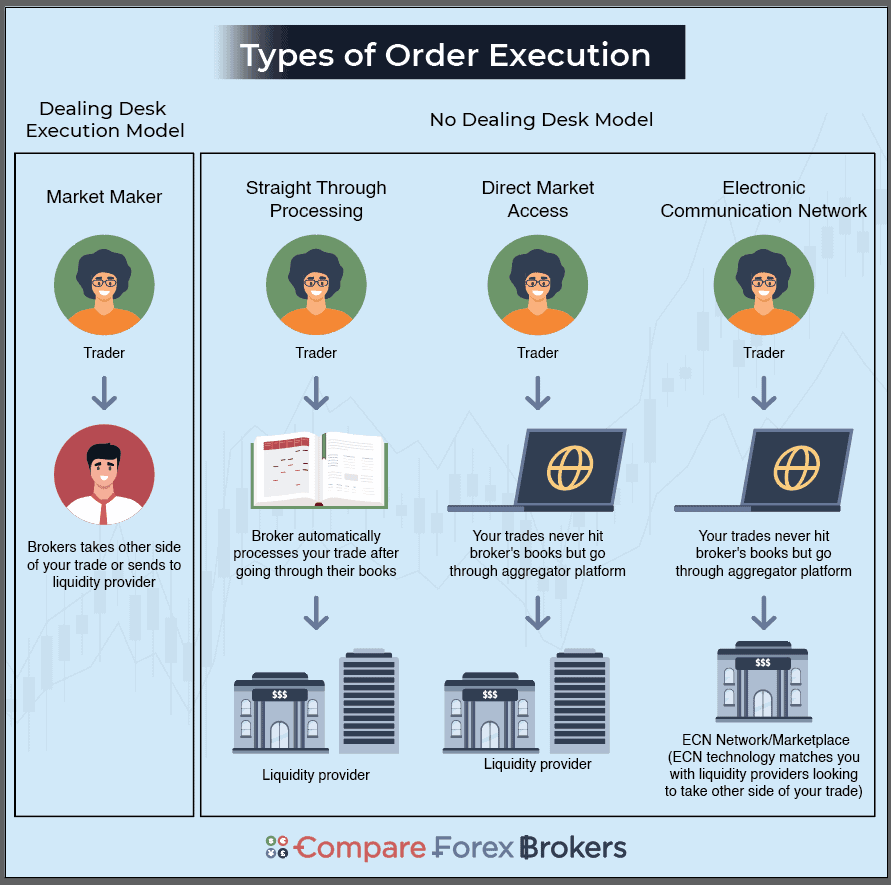

What Are The Best Canadian Forex Brokers That Offer True ECN?

We have compiled the best Canadian ECN Forex brokers in the list below. Our team at Compare Forex Brokers considered what benefits electronic communication network (ECN) brokers provide and what is important for you as a trader. This means we considered the trading accounts, platforms, and execution speeds for each broker before placing them on the list. Below, we rank the best ECN forex brokers for Canadian traders and their best features.

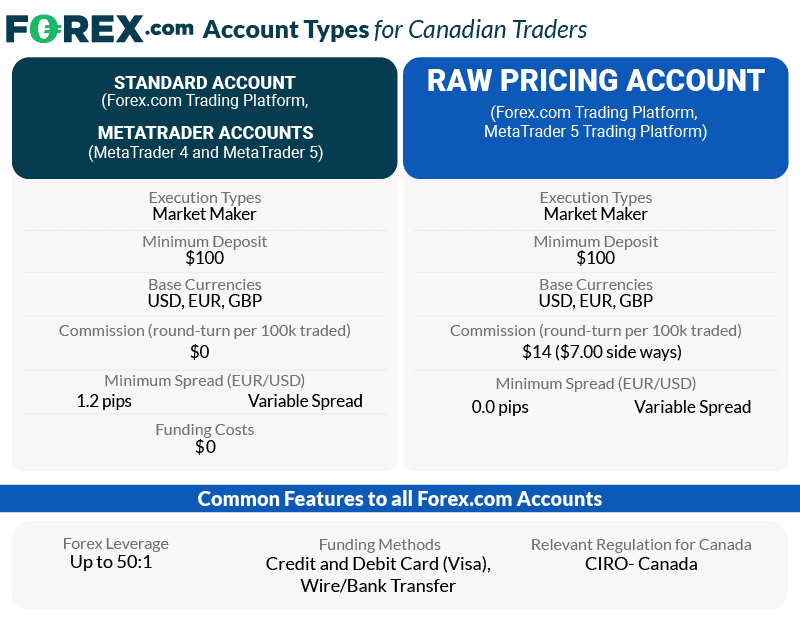

1. FOREX.com - Solid All-Around Offering

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 0.8 AUD/USD = 1.7

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

We recommend FOREX.com for its solid all-around offering, which includes competitive spreads and a decent range of markets to trade. With spreads for EUR/USD at just 1.2 pips, it’s more affordable compared to the industry average of 1.24 pips. When trading you can choose between FOREX.com platform, MetaTrader 5 and TradingView all top trading platforms.

In our review, the broker scored 60/100, scoring highly for its excellent educational resources and trading platforms available.

Pros & Cons

- Decent average spreads

- A variety of trading platforms

- Offers exotic gold and silver crosses

- Requires a minimum deposit

- Weekday customer support only

- MetaTrader 5 unavailable

Broker Details

From our extensive analysis, FOREX.com is one of the few CIRO-regulated brokers that provides RAW trading accounts with ECN pricing from 0.0 pips. We also rated FOREX.com highly for its excellent platform experience (8/10), huge range of currency pairs and trust (8/10).

Low costs Through Volume-based Rebates

FOREX.com provides a RAW Pricing account with low spreads from 0.0 pips on EUR/USD. While spreads start low, FOREX.com charges commissions of CAD$14 per lot round turn, which is double the industry standard for a RAW account.

However, where we found the best way to lower your trading costs is through volume-based rebates for active traders. This requires you to trade a minimum volume of $50M over a month (or open an account with a $10,000 initial deposit). If you meet the requirements, then you’ll receive cash rebates that can reduce your costs by up to 15%.

We particularly like that Forex.com uses its price improvement technology to ensure you get better entries when using limit orders. This is where you can benefit from positive slippage, a bonus because sometimes it can put you into profit immediately.

Trade +80 Currency Pairs with RAW Pricing

FOREX.com has over 3,000 CFD trading products across stocks, indices, forex market and commodities.

We particularly like Forex.com for its solid selection of currency pairs to trade from. You can trade over 80+ currency pairs, including 20+ exotic pairs, which allows you to take advantage of the volatility that exotic pairs can provide, especially when the majors are calm.

Excellent Platform Experience

A broker’s competitive ECN pricing is only as good as its trading platforms, and luckily FOREX.com has a great range of platforms, including MetaTrader 4, MetaTrader 5 and its own, excellent proprietary platform.

Whether you use the desktop, web trader or mobile app, there is something for everyone. From our testing, we recommend the Advanced Trading platform (Desktop) for more experienced traders with advanced order types and deep customization.

The web trader is suited for more casual traders with great charting features (including 100 indicators) through TradingView, while the mobile app offers a fluid user interface and minimalist design.

FOREX.com ReviewVisit FOREX.com

Your capital is at risk ‘69% to 77.7% of retail CFD accounts lose money with FOREX.com’

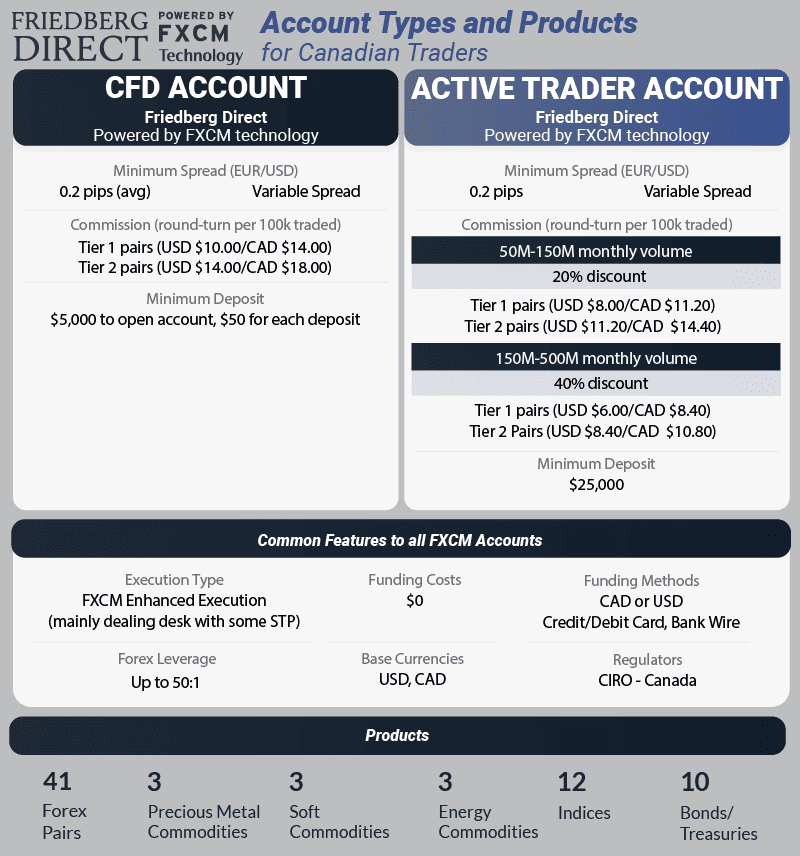

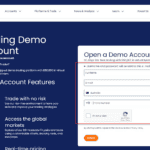

2. Friedberg Direct Powered by FXCM - Top ECN Broker With Free Trading Tools

Forex Panel Score

Average Spread

EUR/USD = 0.3 GBP/USD = 0.9 AUD/USD = 0.4

Trading Platforms

MT4, TradingView, Trading Station

Minimum Deposit

$50

Why We Recommend FXCM

We recommend FXCM as a top ECN broker for its 30+ free trading tools that can make a big difference in your trading. The broker has low average RAW spreads at 0.3 pips on EUR/USD, allowing you to trade more cost-effectively.

FXCM also offers a range of platforms, including Trading Station and MetaTrader 4. These low spreads are great if you automate trading with tools like Expert Advisors (EAs) on the MetaTrader 4.

Pros & Cons

- Wide range of free trading tools

- No Dealing Desk Broker

- Small trade sizes offered

- High minimum deposit

- Restricted support hours

- No TradingView paltform

Broker Details

To us, Friedberg Direct powered by FXCM is the best ECN-style provider with free trading tools and a great overall platform user experience. Using FXCM’s technology, you also benefit from low spreads through volume-based discounts and enhanced execution services with a CIRO-regulated forex broker.

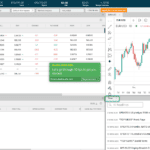

Excellent Range of Trading Tools

From our testing, you’ll obtain the most benefit from FXCM’s flagship platform, Trading Station, particularly the trading tools it offers.

One highlight that we observed include the Marketscope 2.0 charting tool, which is a powerful charting package featuring real volume indicators and an extensive range of charting tools. We particularly liked the ease with which you can edit orders, with a simple drag and drop.

We also appreciated having access to Trading Central, which provides useful news headlines, videos, research, signals, and analysis.

Transparent Pricing and Execution Methods

From our testing, one of the main attractions of FXCM is the broker’s detailed monthly execution reports highlighting slippage statistics and trade execution quality across all order types. This appealed to us because the broker wasn’t trying to favourably manipulate the data.

We also like that FXCM allowed us to select execution type by order, rather than having the execution method separated by account type like some brokers do.

Discounts for Active Traders

From our analysis, the broker’s published spreads of 0.56 pips for its CFD (commission-based) account are just above the industry average of 0.44 pips for the 6 major currency pairs.

Adding on the expensive commissions of CAD 14 for major pairs, FXCM’s trading costs start to add up, so where the value lies is through volume-based rebates if you’re an active trader.

You can significantly reduce your trading commission by up to 40% with an Active Trader account. To take advantage of the discount, however, requires substantial initial capital of $25,000 and a minimum monthly trading volume of $50m.

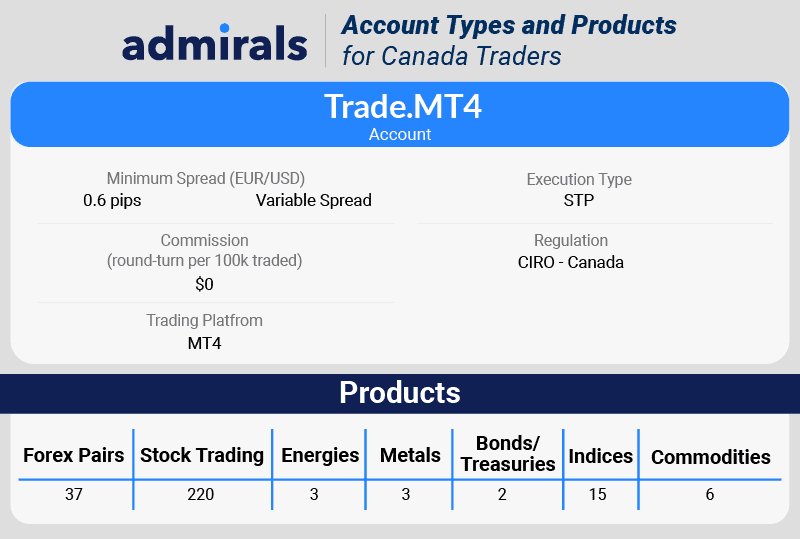

3. Admirals - Good ECN Broker With MetaTrader 5

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.6 AUD/USD = 0.5

Trading Platforms

MT4, MT5, Admirals Platform

Minimum Deposit

$100

Why We Recommend Admirals

What stands out is that Admiral offers extra premium tools for the MetaTrader 5, packed with features that make trading more efficient for you with new technical analysis plugins. The broker has low average RAW spreads from 0.1 pips on EUR/USD, which is over 50% better than the industry average, which is a positive.

We gave Admirals a score of 68/100, scoring highly for its various platforms, educational resources, and a wide range of markets.

Pros & Cons

- Offers MetaTrader Supreme Edition

- Good range of trading products

- Tight average RAW spreads

- Lacks social trading tools

- Charges withdrawal fees

- Requires minimum deposit

Broker Details

Admirals is our choice for the lowest spread Canadian forex broker offering no-commission, ECN-like spreads. In addition, we like Admirals platform offering, particularly its MetaTrader upgrade, Supreme Edition, which enhances your MT4/MT5 trading experience.

Lowest ECN-Like Spreads for a Canadian Broker

While Admirals only offers one no-commission account, it uses STP execution, which gives it ECN-like low spreads.

In fact, when we tested 15 top brokers, Admirals came out as the top Canadian broker with the lowest spreads for a Standard account. The CIRO-regulated broker had average spreads of 1.31 pips for the 5 major currency pairs, placing it in the top 5 overall and number 1 for Canadian brokers.

Enhanced MetaTrader Platform Experience

With Admirals you can also get an enhanced version of MetaTrader 4 and MetaTrader 5, exclusively available under the name MT4/MT5 Supreme Edition. No other Canadian broker offers this. With this update, you will get such benefits as an enhanced version of 1-Click-Trading, integrated correlation matrix and new types of orders.

We particularly like the charting package, Technical Insight, which you can integrate with Trading Central for those charting nerds who like advanced technical analysis to optimize your trading.

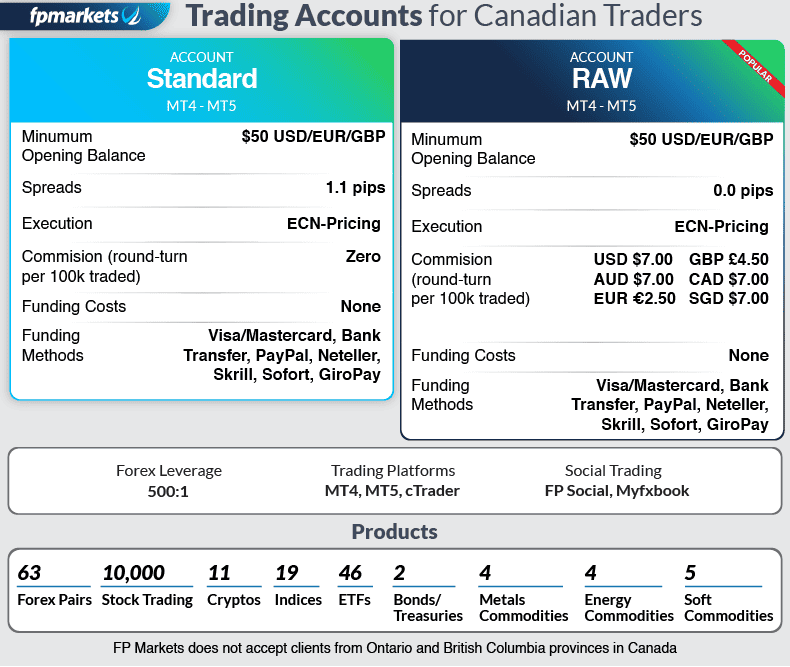

4. FP Markets - Great ECN Broker For Scalping

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.2 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

FP Markets is our top pick for scalping forex, as they impressed us with its tight average RAW spreads. In our testing, the broker kept its EUR/USD spreads at 0.0 pips for 97.83% of the time. When it wasn’t at 0.0, it averaged 0.1 pips – these are ideal spreads for scalping.

Plus, you can choose between trading platforms like MetaTrader 4, MT5, cTrader and TradingView, perfect for scalping as you can use the one-click trading feature to execute your trades instantly.

Pros & Cons

- Has zero-spreads

- Decent choice of trading products

- Has copy trading tools

- The IRESS platform isn’t available

- Limited access to shares vs. IRESS.

- The trading app is basic

Broker Details

With fast execution speeds and low spreads, FP Markets is our top ECN forex broker for scalping. We also like FP Markets’ platform offering, which includes both MetaTrader platforms, its proprietary app and the IRESS platform for shares trading.

Tight Spreads Across the Board

FP Markets offers very competitive spreads for both its Standard and RAW accounts.

When we measured against the industry average, the broker’s RAW account had spreads averaging 0.22 pips for the top 5 most traded currency pairs. This stacked up well against the industry average of 0.45 pips.

For FP Markets’ Standard account, the broker had an average spread of 1.30 pips Vs. the industry average of 1.52 pips for the top 5 majors.

While FP Markets’ commissions are just in line with the industry average at CAD $7, having such tight spreads keeps your trading costs low.

One thing to note with FP Markets is you’ll have to use MT5 to trade the majority of the broker’s products. This may be a downside to some who are used to MT4 but to our eyes, MT5 is a far superior trading platform in every way.

Fast Market Order Speeds

We tested 20 top brokers to determine which had the fastest execution speeds and found FP Markets had fast market order speeds.

Conducted using the MT4 platform to test the average execution speed of limit and market orders, FP Markets had an average market order speed of 96ms. This put FP Markets as the 4th fastest broker for market orders.

The combination of competitive spreads and fast execution speeds is the reason we recommend FP Markets for scalpers who seek to enter and exit positions very quickly while keeping their trading costs low with minimal execution latency.

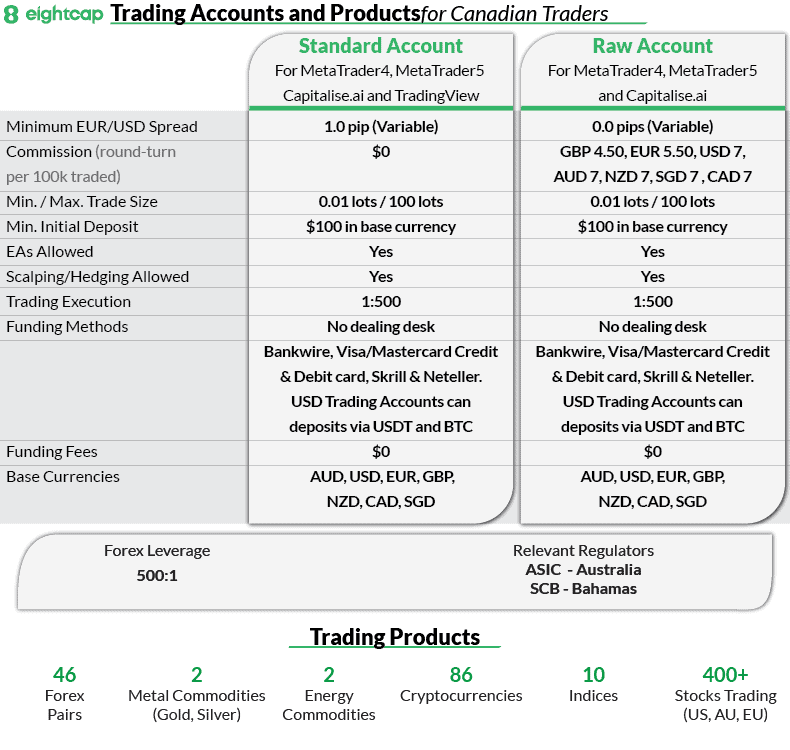

5. Eightcap - Top Choice For Crypto Trading

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.73 AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

We highly recommend Eightcap, especially for its 95 cryptocurrencies which you can trade using the TradingView platform. With advanced charting tools, TradingView enhances your technical analysis, speeding up your trading decisions. Other platforms available include MT5 and MT4.

What’s more, Eightcap offers incredibly low average RAW spreads, just 0.06 pips on EUR/USD, making it a cost-effective choice. Eightcap has 56 Forex pairs to trade from.

The focus on providing quality platforms like TradingView and low spreads makes Eightcap an excellent choice if you seek advanced and affordable tools.

Pros & Cons

- Offers TradingView platform, MT4 and MT5

- Provides automated trading tools

- Low average RAW spreads

- The range of markets is ok

- No customer support on the weekend

- Requires a minimum deposit

Broker Details

We recommend Eightcap’s ECN-like services for its wide range of crypto markets. To help you trade crypto, Eightcap also offers many third-party services like FlashTrader, which allows you to calculate position size and place stops and limits instantly and Capitalise.ai, which helps you create automated trading strategies without any coding knowledge.

Competitive, ECN-like Spreads

From our analysis, Eightcap offers competitive ECN-like spreads across both its accounts compared to the industry average.

When looking at published spreads, Eightcap’s Standard account has average spreads of 1.06 pips for the 5 major currency pairs against the industry average of 1.52 pips. Its RAW account spreads were even lower, at 0.30 pips against the industry average of 0.45 pips.

80+ Cryptocurrencies

As a Canadian trader, you can trade an extensive range of crypto markets on Eightcap, including some of the most popular assets like BTC, ETH, XRP, and SOL. You can trade them with competitive spreads when compared to other crypto brokers like eToro and IC Markets.

As an example, with Eightcap, you can obtain spreads of 12 pts for bitcoin, which is tighter than its nearest competitive IC Markets can offer at 18.2 pts.

We also like that Eightcap provides trading tools that specifically help crypto traders. For example, FlashTrader, which allowed us to manage our crypto risk by adding stops and targets to every trade automatically, with one click.

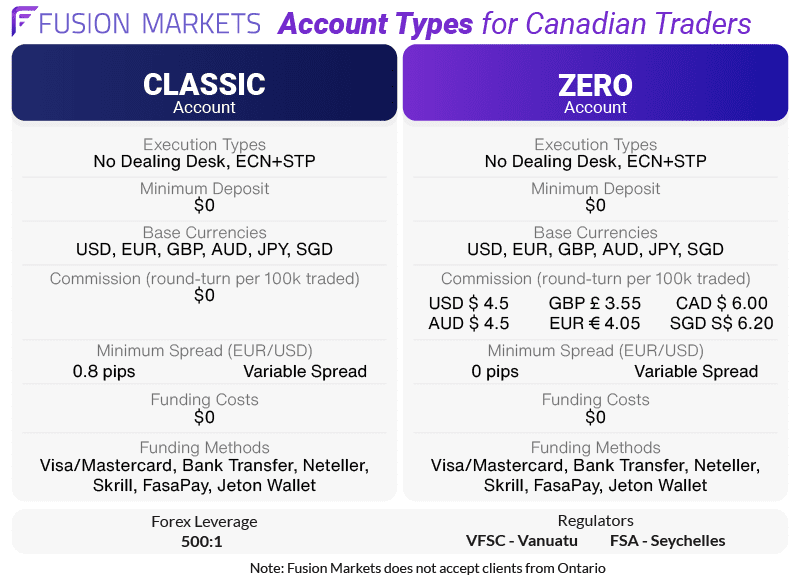

6. Fusion Markets - Cheapest Broker

Forex Panel Score

Average Spread

EUR/USD = 0.13 GBP/USD = 0.21 AUD/USD = 0.12

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why We Recommend Fusion Markets

We recommend Fusion Markets as the cheapest broker we’ve tested, with an unbeatable commission rate of only $2.25 per lot, about 35% lower than the industry average. The broker’s Zero account RAW spreads average 0.22 pips for EUR/USD, the best we’ve seen.

This combination of low commission and tight spreads is why we’ve rated Fusion Markets a remarkable 79/100. If you seek value and efficiency, Fusion Markets is a top-tier choice that maximises your trading potential while minimising costs.

Pros & Cons

- Lowest commissions broker

- Fast execution speeds

- Provides decent trading tools

- Lacks TradingView

- The product range is limited

- Inactivity fees

Broker Details

One of the key reasons to look for an ECN broker is for the reduced forex trading costs due to their ECN pricing accounts. From our analysis, Fusion Markets is a top choice for this because its Zero account has the lowest commissions available in Canada. Further highlights that add to the broker’s low ECN prices include achieving the fastest execution speeds we’ve tested and ultra competitive spreads.

Cheapest Broker (Low Spreads/Cheap Commissions)

We tested 15 of the best ECN-style forex brokers to see which broker offered the lowest commissions. Fusion Markets was the lowest from our results, making it our number one forex broker for low commissions.

This is thanks to the broker’s Zero trading account, which has the lowest spreads based on our testing. Compared to a list of 15 top brokers, Fusion Markets had average spreads of 0.22 pips, which topped our list of lowest ECN/RAW account spreads.

Combining these low spreads with commissions of USD $4.50 per round turn trade against the industry average of USD $7, these are the lowest trading costs in Canada.

Similarly, Fusion Markets’ Classic account had competitive spreads of 1.19 pips for the major USD-backed currency pairs. From our testing, this put Fusion Markets in third position overall, just behind IC Markets (1.01 pips) and CMC Markets (1.11 pips).

Fastest Execution Speeds We’ve Tested

Not only does Fusion Markets offer the lowest trading costs, it also offers some of the fastest execution speeds for an ECN broker.

We tested the execution speeds of 20 top brokers using limit and market orders on MT4 and Fusion Markets came out 2nd overall. The broker had execution speeds of 79ms for limit orders and 77ms for market orders, which is lightning fast.

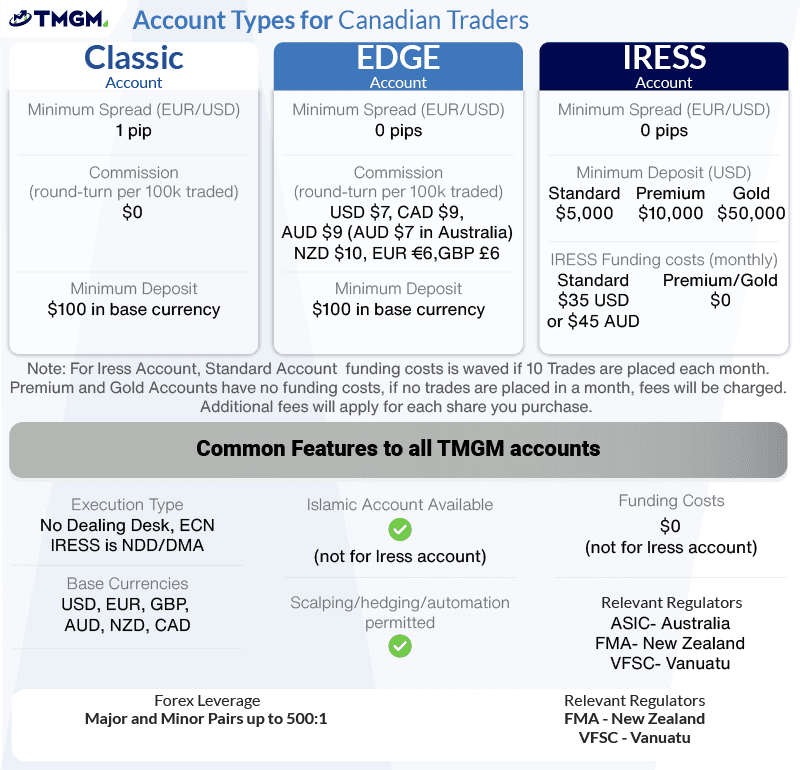

7. TMGM - Top Broker For Range Of Markets

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.42 AUD/USD = 0.21

Trading Platforms

MT4, MT5, TMGM App

Minimum Deposit

$100

Why We Recommend TMGM

TMGM is the top MetaTrader 4 ECN broker, particularly for its impressive range of over 12,000 markets, including shares, forex, indices, and commodities. This diverse offering is ideal if you seek out different markets to exploit volatility.

In our review, TMGM earned a score of 71/100, reflecting its low trading costs, excellent market choices, and comprehensive range of trading platforms.

Pros & Cons

- Fast execution speeds

- Wide choice of markets

- Low trading fee

- Educational resources are lacking

- Minimum deposit required

- Limited forex pairs range

Broker Details

We rated TMGM a solid score of 71/100 in our broker tests, which put TMGM in the top 10 brokers we’ve tested. In particular, we scored TMGM highly for its fast execution speeds and low spreads through the broker’s ECN pricing and deep liquidity pool. As a bonus, TMGM also provides a high leverage of 1:500 for Canadian traders, thanks to its VFSC regulations.

Top 4 Most Competitive ECN-Like Spreads

Both of TMGM’s trading accounts offer competitive spreads from our testing.

The broker’s Classic account has average forex spreads of 1.11 pips while its Edge account has average spreads of 0.32 pips across the 5 major pairs. This puts TMGM in the top 4 brokers for both Standard accounts and RAW/ECN accounts.

From our testing, both trading accounts gave us access to the high leverage and fast ECN-style execution speeds that TMGM offers.

Fast Execution Speeds

One of the strengths of trading with an ECN broker is the execution speed is faster than the market maker model.

When we tested 20 leading brokers to find the fastest execution speeds, TMGM recorded an impressive average execution speed of just 94ms for limit orders and 129ms for market orders. These execution speeds put TMGM in the top five fastest execution brokers worldwide.

High Leverage of 1:500

TMGM is unique to this list as an ECN forex broker overall, given the broker provides high leverage up to 1:500.

The reason for this high leverage is that TMGM isn’t directly regulated by CIRO in Canada, which restricts leverage to 50:1. As a Canadian trader, you will be opening an account with their VFCS entity, with more relaxed leverage restrictions, which is how TMGM can offer you 1:500 leverage.

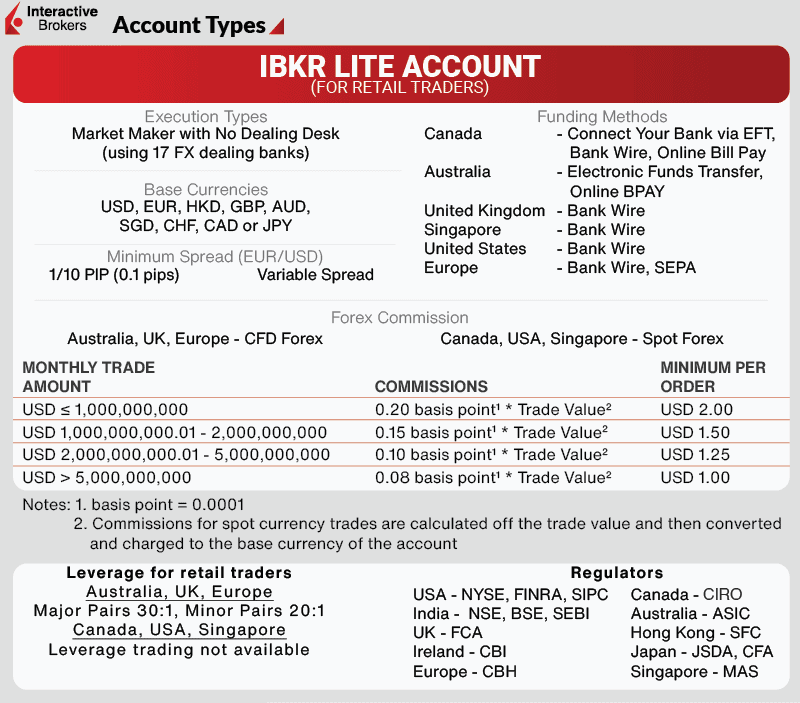

8. Interactive Brokers - Great ECN Broker For Professional Traders

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

We recommend Interactive Brokers for professional traders because of the range of professional trading tools and low commissions. The broker’s low average RAW spreads for EUR/USD are just 0.1 pips, significantly below the industry average. This means you get to trade with minimal costs, maximising your potential profits.

Moreover, its minimum commission is only $2.25 per lot, one of the lowest for a CIRO-regulated broker.

Pros & Cons

- Excellent all-in-one platform

- No minimum deposit

- Largest choice of markets available

- High commissions for low trade sizes

- No MetaTrader platforms

- IBKR platform has a steep learning curv

Broker Details

Take it from us, Interactive Brokers is an all-in-one broker catering to experienced traders seeking advanced trading tools and global market access. If you are an experienced trader, you will appreciate the huge range of products, which includes over 100 currency pairs and more complex derivatives like options and mutual funds.

Over 1 Million Trading Instruments

The sheer immensity of over 1 million markets that Interactive Brokers offers will benefit traders seeking to diversify their trading portfolio under one trading account.

In addition to common markets such as forex and stocks, you can also trade complex derivatives such as options, ETFs and mutual funds. We think this is ideal for experienced traders who seek a wide range of markets from one broker. From our analysis, no other broker comes close to offering such an extensive selection of products.

Low Fee Trading Accounts

Interactive Brokers achieve low trading fees with its BestX technology, which optimizes order routing. This is achieved by getting the market prices from 17 of the world’s largest FX dealers to get the best possible pricing and execution.

If you want to trade spot forex, then the spreads start at 0.1 pips, but you have to pay a small commission. The commission is charged in basis points instead of a fixed amount, which ranges from 0.08 bps to 0.20 bps, with a minimum of a $4 commission per lot, round turn.

While these commissions are low against the industry average of $7, it should be noted that commissions vary based on your trade value, making trading costs harder to track. As such, we can only recommend IB for experienced traders who can manage their trading costs well.

Ask an Expert