Best Trading Platforms for Beginners

In Canada, CFDs serve as a compelling alternative to forex trading. When venturing into CFD trading, opt for platforms that offer top-tier commodities and ETFs. Our expert team has handpicked the best CFD trading platforms in Canada for beginners.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The top forex trading platforms for beginners in Canada are:

- OANDA - Top CFD Trading Platforms for Beginners

- FP Markets - Best Forex Broker for Beginners

- FOREX.com - Great Forex Trading Platform

- CMC Markets - Best CFD Broker For Beginners

- Admiral Markets - Best Forex Education Facilities

- Friedberg Direct powered by FXCM - Good choice for Micro Lot Trading

- Friedberg Direct powered by AvaTrade - Great Risk Management For Options Trading

- Fusion Markets - Top Low Spread And Low Commission MT4 Broker

- TMGM - Has Negative Balance Protection

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

91 |

FCA, CIRO, ASIC FSC-BVI, NFA, CFTC MAS, JFSA, KNF |

- | - | - | - | 1.4 | 2 | 1.4 |

|

|

|

120ms | $0 | 69+ | - | 50:1 | - |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

84 | CIRO, FCA, NFA, CFTC, MAS, JFSA, CIMA | - | - | - | $7.00 | 1.2 | 1.5 | 1.4 |

|

|

|

30 ms (May 2023) | $100 | 80+ | - | 33:1 | 33:1 |

|

Read review ›

Read review ›

|

73 |

ASIC, MAS, FCA CIRO, FMA, BaFin |

0.5 | 0.9 | 0.6 | $2.50 | 1.3 | 1.5 | 1.5 |

|

|

|

138ms | $0 | 338 | 19 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

73 |

ASIC, FCA, CySEC CIRO, FSA, EFSA |

0.1 | 0.7 | 0.6 | $3.00 | 0.8 | 1.0 | 1.0 |

|

|

|

132ms | $100 | 50 | 37 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

70 |

ASIC, FCA FSCA, CIRO |

0.22 | 0.80 | 0.40 | $3.00 | 1.3 | 1.4 | 1.7 |

|

|

|

150ms | $300 | 39+ | - | 30:1 |

|

|

Read review ›

Read review ›

|

64 |

CIRO, FSCA ADGM, CBI |

- | - | - | - | 0.90 | 1.5 | 1.1 |

|

|

|

160ms | $100 | 37+ | - | 33:1 | 33:1 |

|

Read review ›

Read review ›

|

92 | ASIC, VFSA, FSA-S | 0.11 | 0.24 | 0.12 | $2.25 | 0.83 | 1.42 | 1.12 |

|

|

|

79ms | $0 | 84 | 14 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

71 |

FMA, VFSC ASIC |

0.20 | 0.30 | 0.10 | $3.50 | 1.20 | 1.20 | 1.0 |

|

|

|

94ms | $100 | 61 | 12 | 30:1 | 200:1 |

|

Who Are The Best Forex Brokers For Beginner Canadian Traders?

By shortlisting all the CIRO brokers and then comparing them based on their spreads, trading platforms and features we were able to determine the best broker for each trading style. This included the best overall category.

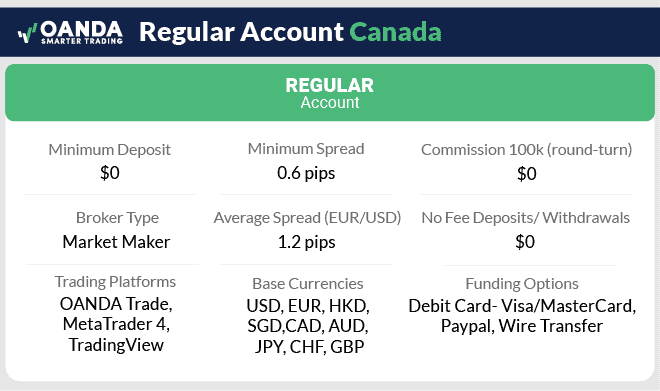

1. OANDA - Top CFD Trading Platforms for Beginners

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 0.9

AUD/USD = 0.7

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

We liked how OANDA Trade platform strikes a balance between being easy for newcomers yet equipped with high-quality trading tools. On another note, OANDA also offers excellent educational resources for beginners including Market Pulse, which provides top-quality research articles and daily analysis updates.

Pros & Cons

- Three top trading platforms

- Large select of Forex Pairs

- Extra trading tools for analysis

- No crypto or share markets

- No ECN/STP service

- Lacks a guaranteed stop-loss order

Broker Details

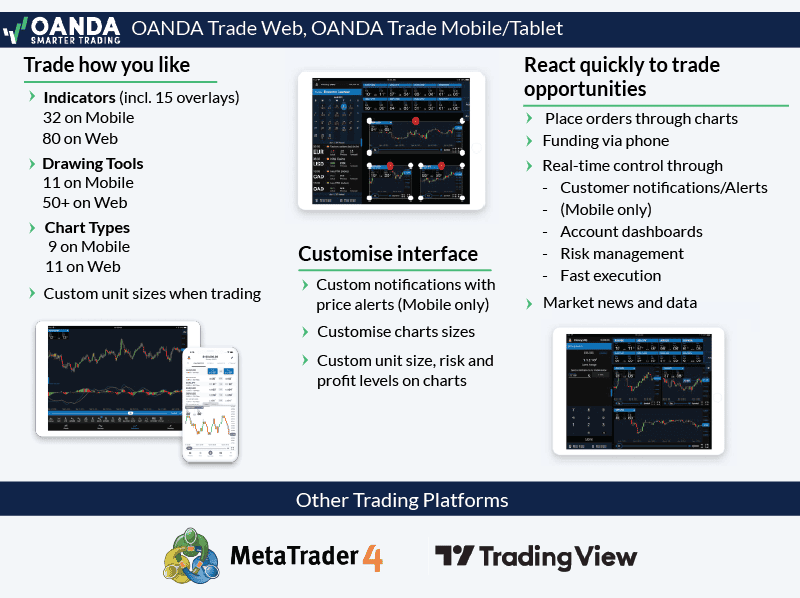

OANDA Has Top Choice of CFD Trading Platforms for Beginners

At OANDA, we found a great range of trading platforms that can ease the trading journey for beginners. These include OANDA Trade, which is both intuitive and equipped with high-quality tools, the ever-reliable (and popular) MetaTrader 4 (MT4) and powerful charting platform, TradingView.

In our broker tests, OANDA stood out as a broker that offered beginners a great balance of user-friendly features and low trading costs. We scored OANDA 71/100 with our methodology, which is high because we are strict with our scoring. This score places OANDA as the best overall broker in Canada (with CIRO regulation) and in our top ten brokers worldwide.

Key Strengths

- Three leading trading platforms

- Low trading costs

- Free access to trading tools

- Large selection of tradeable forex pairs

OANDA Trade is ideal for beginners

The OANDA Trade web platform and mobile apps are top choices if you are just starting out trading. The Web platform has over 80+ indicators, 50+ drawing tools and 11 chart types to help you assess the markets and make trading decisions. And, to make sure you can easily familiarise yourself with the OANDA Trade, an extensive user guide is provided.

The user guide includes step-by-step instructions for setting your user preferences (such as background colours, timezones and scales on charts). It also has YouTube videos for setting up charts, adding or removing indicators and drawing tools, and screenshots for how to place a trade.

OANDA also includes learning resources to help you learn to be a better trader. These resources cover topics such as leveraged trading, technical analysis, and a fundamental analysis primer. A webinar series is also available covering all aspects of CFD trading.

Top secondary platforms: MetaTrader 4 and TradingView

As one of most reliable platforms on the market, MT4 combines an easy-to-use interface with advanced trading tools. MT4 also has a vast online trading community, many learning resources and numerous blogs and forums for additional guidance as a beginner.

What OANDA offers that differs from other MT4 brokers is a free plugin to enhance your trading experience, such as the Proprietary MT4 plug-in, MT4 premium upgrade and MT4 open order indicator.

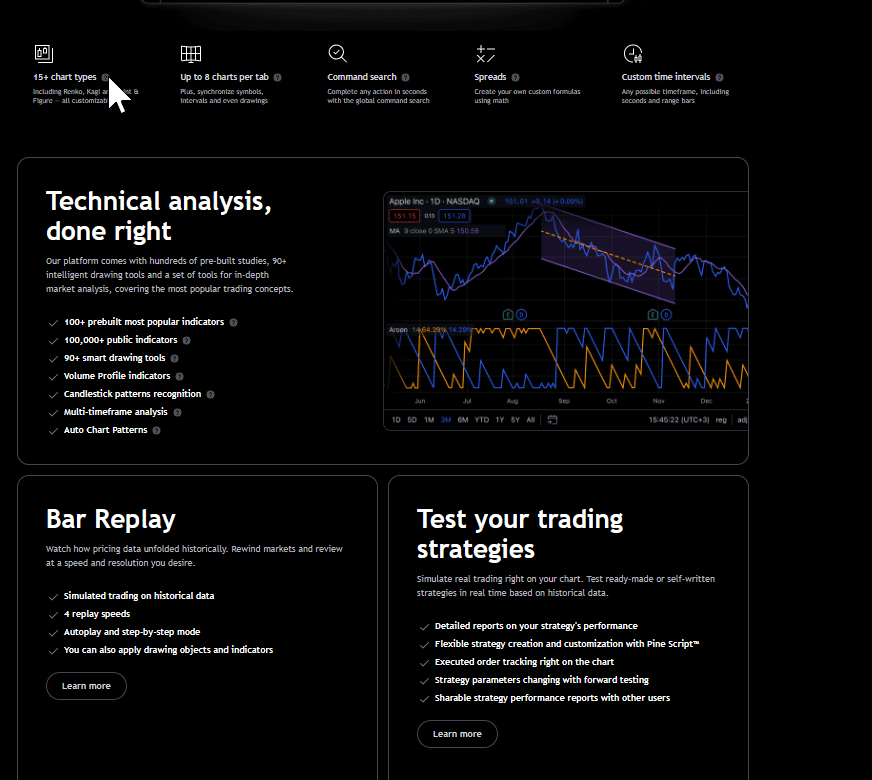

The last platform OANDA offers is TradingView, uniquely available Canadian traders, which is a powerful chart trading platform with social trading features. This feature allows you to share trading ideas and learn from the best traders from the platform’s 50 million users.

While the TradingView platform is ideal for chart trading, we wish to highlight the platform’s social trading features. The platform is designed to encourage users to post their own trading and education ideas so that you can learn from the best traders in their community. This will not only help you be a better trader but allow you to learn how to take full advantage of 8 chart types, 100+ indicators and 90+ drawing tools the platform offers.

OANDA has commission-free spreads

OANDA only offers a spread-based Regular account, which is commission-free. We appreciate spread-based accounts, especially for newcomers, as all commission costs are encompassed within the spread. This removes the hassle of extra commission charges when entering or exiting trades.

When looking at published spreads, OANDA is the top rated Canadian broker, with average spreads of 0.70 pips for the 5 major currency pairs. This is extremely tight when you consider the industry average spread across the 5 majors is 1.52 pips.

You can open a standard account with OANDA with no minimum deposit to get started. Our Chief Technology Research, Ross Collins, gave OANDA a 12 out of 15 rating for the Account Opening experience, making it a stress-free and low-cost funding option for beginner traders.

A Solid Choice of Forex and Commodities Products

OANDA gives you exposure to trade almost 70 forex pairs (including the majors, minors, and exotic pairs), one of Canada’s most extensive offerings. You can also trade over 20+ metal crosses, including XAU/EUR and XAU/JPY. OANDA is ideal for FX traders who want to diversify their commodity trading, particularly metals, but light on other asset classes.

Our Verdict on OANDA

Our experience with OANDA cemented its position as the go-to CFD broker for beginners due to its straightforward approach to an easily accessible standard account, a concentrated range of forex-centric products, and an exceptional line-up of user-friendly trading platforms with advanced tools. Hence, we confidently endorse OANDA as the broker with the best CFD forex platforms for beginners.

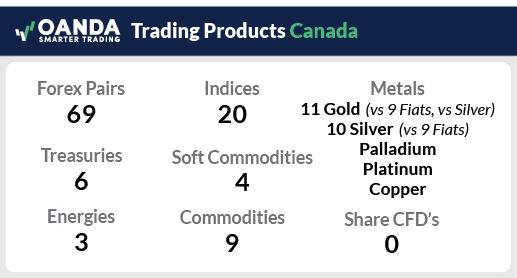

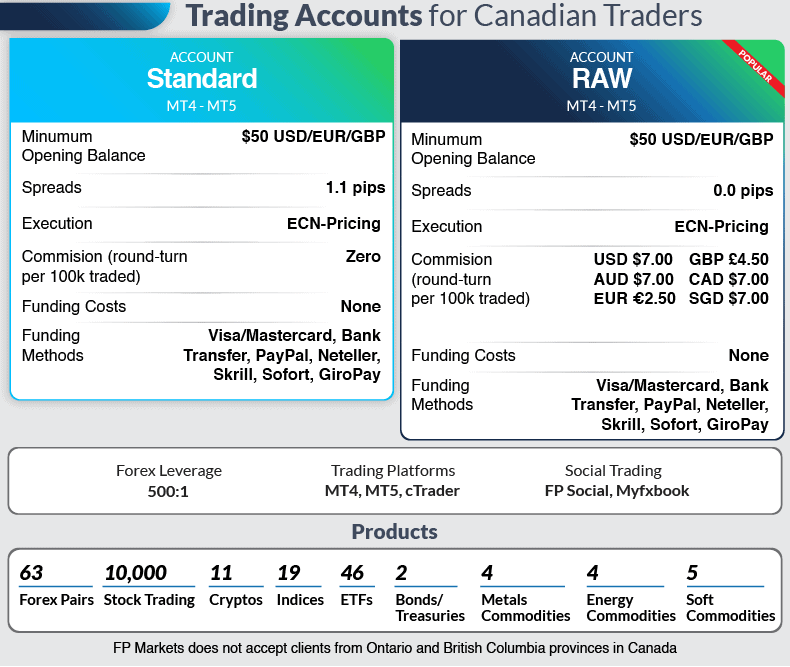

2. FP Markets - Best Forex Broker for Beginners

Forex Panel Score

Average Spread

EUR/USD = 1.1

GBP/USD = 1.3

AUD/USD = 1.3

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$50

Why We Recommend FP Markets

FP Markets is a low-cost broker with fast execution speeds and a good overall platform experience, making it our top choice for beginners in Canada. Social trading is also available via MetaTrader signals, Myfxbook and the broker’s own copy trading platform, which is suited to traders just starting out.

Pros & Cons

- Low spreads

- Fast execution speeds

- MT4, MT5, cTrader and TradingView available

- FP Markets Mobile app limited

- Not all products available on MT4

- Limited risk management tools

Broker Details

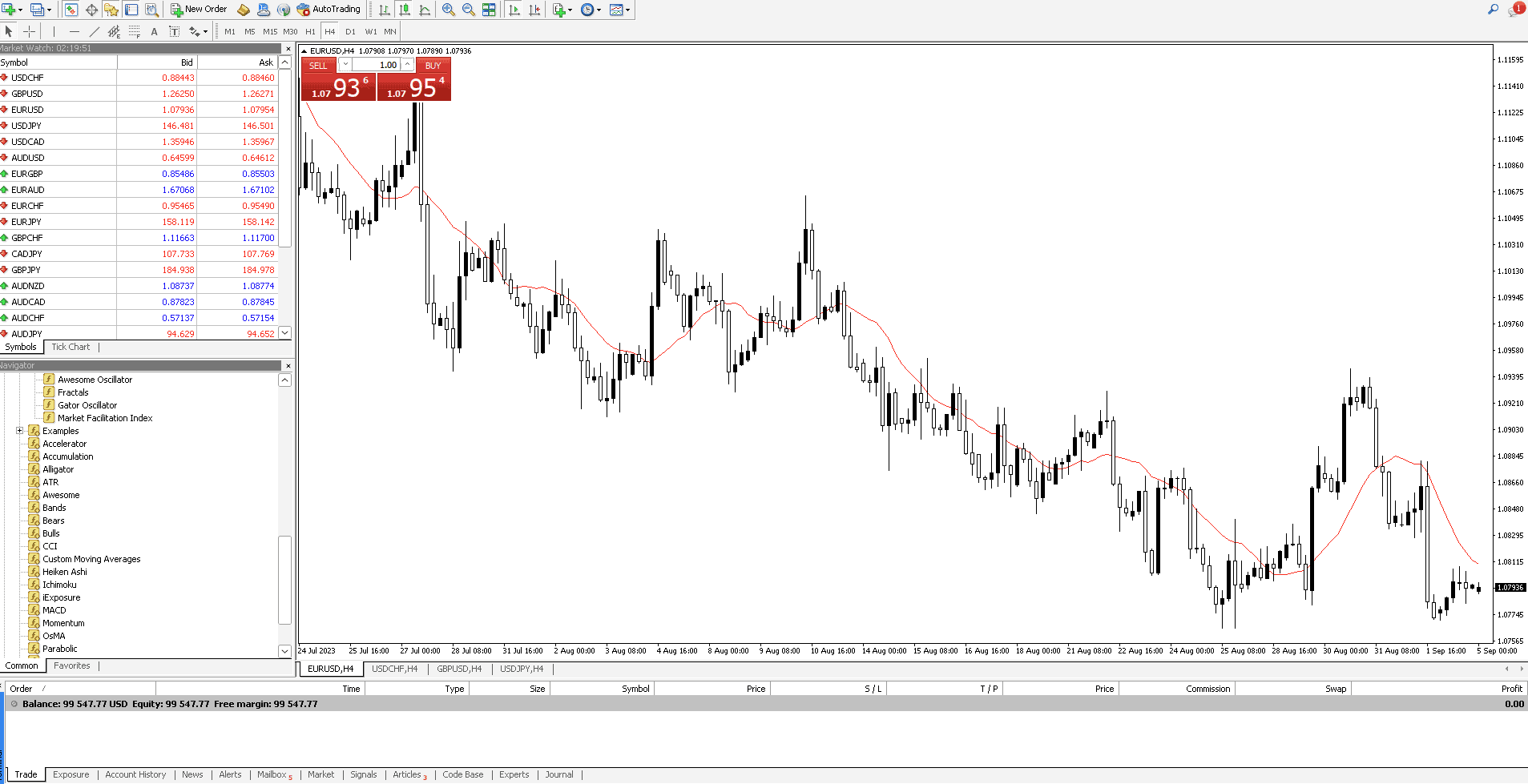

Low spreads and fast execution speeds

FP Markets offers two low-cost account types which both feature competitive spreads, the Standard and RAW account.

While the RAW account (or commission-based) has the more competitive spreads, FP Markets’ Standard account also compares favourably with the industry average. When looking at the top 5 most traded currency pairs, FP Markets has an average spread of 1.30 pips against the industry average of 1.52 pips for Standard Accounts.

This makes FP Markets a low-cost broker, which is ideal for beginners looking to keep trading costs low. In addition to this, FP Markets has fast execution speeds, particularly for market orders. Having tested the execution speeds of 20 top brokers, FP Markets came up as the 4th fastest broker for market orders with an average execution speed of 96ms.

Great Trading Platform Experience

In terms of platforms, FP Markets offers the popular MetaTrader 4 as well as its upgrade MetaTrader 5, which are both reliable and user-friendly platforms. As a Canadian trader, you can also use cTrader as an alternative platform, which is a top algorithmic platform.

With the MetaTrader platforms, FP Markets gives you access to the MetaTrader signals market as well as support for Myfxbook for social copy trading and its AI features. FP Markets also offers its own social copy trading platform which makes the broker a great choice for social copy trading.

Lastly, with cTrader, you can use cAlgo is a useful algorithmic tool, letting you build trading cBots and custom technical indicators using C# programming language. With a direct access environment, cAlgo gives you fast execution ideal for algorithmic trading. While this platform may be for more advanced traders, it’s useful to have the option of cTrader if you are drawn to algorithmic trading.

High Leverage with FP Markets

Given FP Markets is not CIRO regulated, the broker offers up to 500:1 leverage, which is higher than the 50:1 leverage that most Canadian-regulated brokers offer. While FP Markets is non-CIRO regulated, you can still use the financial services of the broker as a Canadian due to offshore regulations from CySEC in Cyprus. It must be stated, however, that using high leverage as a beginner is not advised until you gain more experience as a trader.

The Ability to Trade Cryptocurrencies in Canada

Another benefit of being non-CIRO regulated is that FP Markets gives you access to its full cryptocurrency range as a Canadian trader. Most Canadian brokers don’t allow the use of crypto trading due to strict CIRO regulations. This is a great alternative for Canadian traders wishing to access a bigger and more diverse range of products to trade. The main downside in terms of trading products is you’ll have to use MT5 to access the full range of FP Markets’ CFD products.

Final Verdict on FP Markets

Overall, we recommend FP Markets for beginners due to its competitive spreads, fast execution speeds and reliable trading platform experience. Additional benefits of using FP Markets includes high leverage of up to 500:1 and the ability to trade cryptocurrencies due to being a non-CIRO regulated broker. All of these factors make it an easy choice for beginners in Canada who seek a low-cost environment, user-friendly platforms and a good range of products to trade.

Broker Screenshots

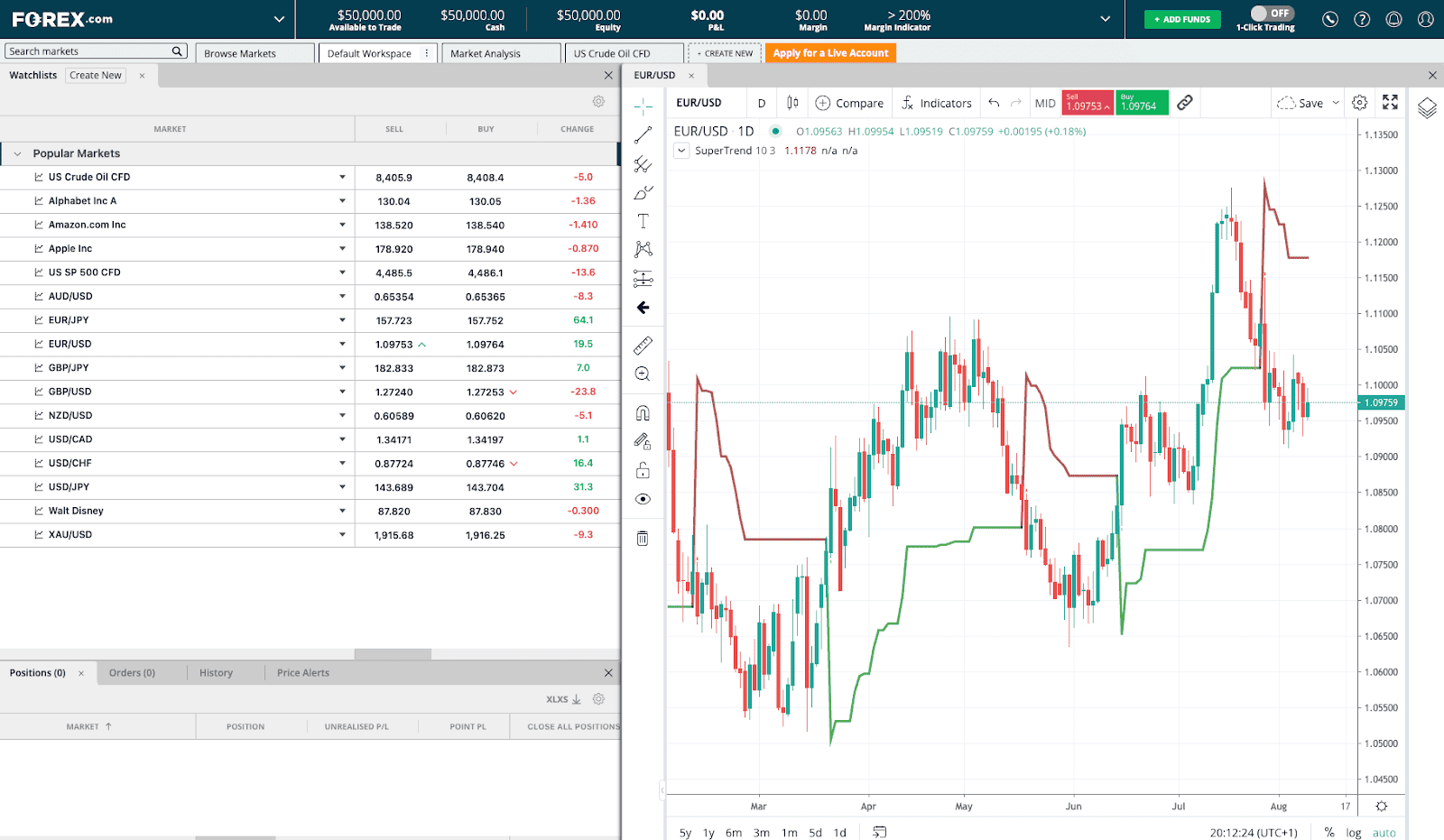

3. FOREX.com - BEST FOREX TRADING PLATFORM FOR BEGINNER TRADERS

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.6

AUD/USD = 1.4

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

We discovered that FOREX.com delivers a straightforward forex trading platform that’s user-friendly. The broker’s access to a wide variety of trading indicators and an extensive range of markets to trade sets them apart. Given these attributes, it’s no wonder we consider FOREX.com the top choice for the best forex trading platform for Canadian traders.

Pros & Cons

- Has a solid selection of forex pairs

- A good variety of trading platforms

- Offers top market analysis resources

- $100 minimum deposit

- Lacks trading tools

- Has 24/5 customer service

Broker Details

FOREX.com’s Trading Platform has great charting features

FOREX.com offers its proprietary trading platform, which is designed with beginners in mind. If you want a trading platform that is clean, easy to use and has a solid selection of trading indicators, then Forex.com is our top pick.

Key Strengths:

- Multiple trading platforms

- Competitive spreads

- Top range of markets

Top Trading Platform for Beginners from Forex.com

Let’s face it. If you are a beginner, you don’t want to be intimidated by a trading platform that makes it hard to trade or find the assets you wish to trade. This is where we think FOREX.com’s Web Trader platform excels.

We like that FOREX.com has kept its platform simple by providing a clean interface with just the essentials needed to trade.

The charts are excellent as TradingView powers them, so you will benefit from all of the features that the TradingView SuperCharts offer. These features include 100+ trading indicators, 30+ drawing tools like the Fibonacci Retracement tools, and the ability to customise the chart’s appearance.

As you can see in the image above, the screen and charts are very clean, making it easy to view the information you need with minimal fuss. To ensure you can execute trades quickly, you can trade directly via the charts.

Another feature we like about this platform is the fast execution speed. FOREX.com boasts that its execution speeds are 0.03 seconds on average, which we think is very impressive.

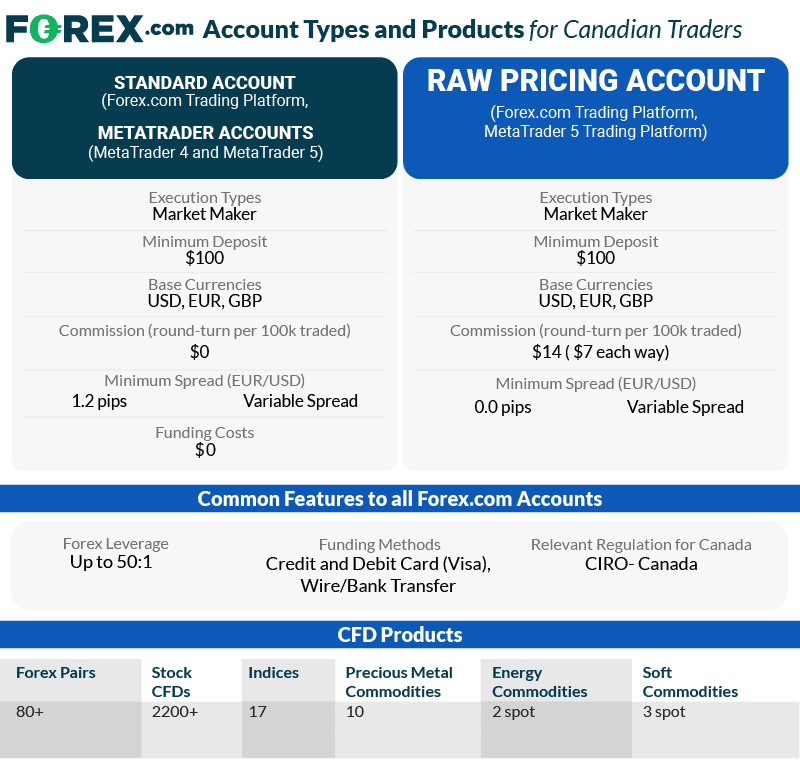

FOREX.com offers commission-free and RAW/ECN-style accounts

FOREX.com offers both a Standard (commission-free) and RAW Pricing (ECN-style) trading account.

While the RAW pricing account offers spreads from 0.0 pips, FOREX.com charges expensive commissions of $7 per side ($14 round-turn), which is double the industry average of $3.50 per side. As such, we recommend the Standard account for beginners with less cost variables to worry about (despite slightly wider spreads).

With both trading accounts, Forex.com allows micro-lot trade sizes, which are ideal for beginners to start with, as they require less margin to trade. Micro-lot sizes are a good starting block if you want to trade in a live environment without risking too much capital.

Our Verdict on FOREX.com

We like FOREX.com’s approach to providing a straightforward forex trading platform that is easy to use with access to a solid range of trading indicators and a comprehensive range of markets to trade. Pairing these factors together makes it our top pick as the best forex trading platform.

Broker Screenshots

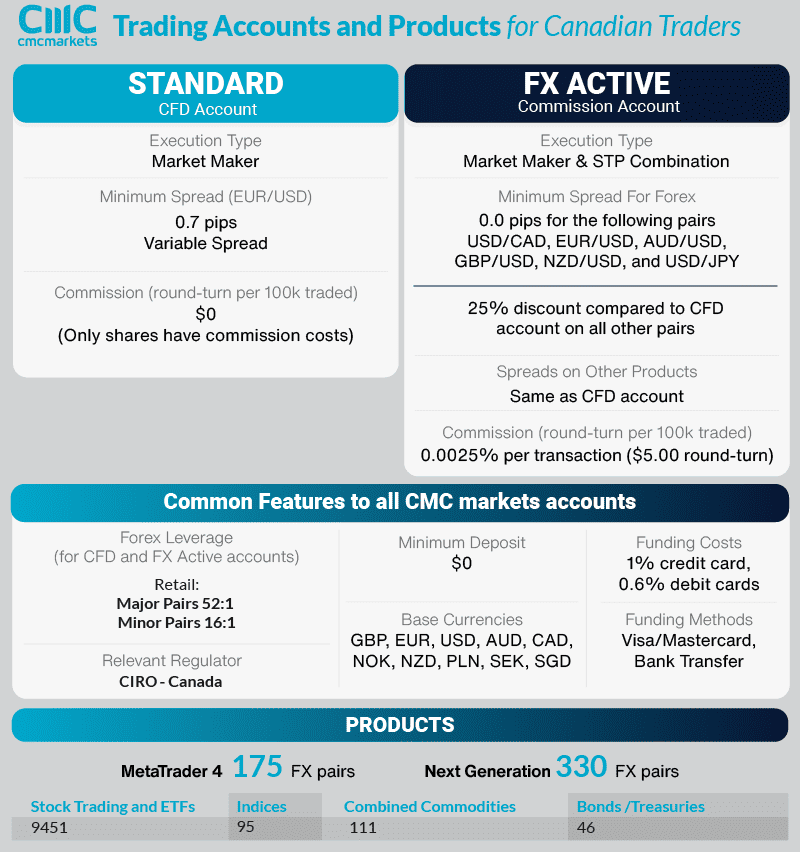

4. CMC Markets - BEST CFD BROKER FOR BEGINNERS

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.3

AUD/USD = 1.64

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

From our experience, CMC offers a standout trading platform, particularly for CFDs on shares, paired with competitive pricing. What sets CMC Markets apart is the broker’s notably low costs, tight spreads and low commissions, and an impressive array of over 10,000 trading markets. CMC Markets’ proprietary trading platform truly delivers, and risk management features like stop-loss orders add an extra layer of security. For those venturing into forex and CFD trading, CMC Markets ticks all the boxes.

Pros & Cons

- Excellent trading platform for beginners

- Low-cost broker

- Has a top selection of trading tools

- Limited customer support via the mobile app

- 330 Forex pairs is overkill for beginners

- Lacks social trading tools

Broker Details

CMC Markets has useful risk management tools

A good trading plan should have a sound risk management plan, and CMC Markets provides a guaranteed stop loss (GSLO) to limit your trading risks. We haven’t come across many CIRO-regulated brokers that offer a GSLO, which ensures you will not experience slippage. CMC Markets does offer this order type, however, as long as you use the CMC Next Generation trading platform.

Key Strengths:

- CMC NGEN – excellent proprietary trading platform

- Helpful trading tools like pattern recognition software

- Guaranteed Stop Loss Order with NGEN Platform

- Over 12,000 trading instruments to trade

Guaranteed Stop Loss Orders on the Next Generation (NGEN) Platform

Having the option to use a guaranteed stop loss order (GSLO) can bring peace of mind if you are a beginner CFD trader. Unlike a regular stop-loss order that can result in slippage during volatile trading periods (and therefore possibly cost you more money), guaranteed stop losses cut your trades at the price you requested.

For example, if you had a regular stop loss on EUR/USD currency pair at 1.0970 but the market gapped past that price to 1.0960 due to high volatility, then the stop loss would be executed at 1.0960, resulting in a 10 pip greater loss. In the same scenario, the GSLO would have executed at 1.0970, protecting the position from slipping further and saving you from losing an extra 10 pips.

The NGEN platform itself is also user-friendly, equipped with advanced trading tools and comprehensive market research, which is perfect for beginners. We particularly like the NGEN mobile app, which manages to be smooth while organising a lot of information with limited screen space.

CMC Markets has competitive Standard account spreads

While CMC Markets offers 2 account types, it is the broker’s Standard account that is best suited for beginners. The broker’s Standard account averaged spreads of 1.11 pips from our testing, which was our top rated Canadian low-spread broker.

Our Verdict on CMC Markets

CMC Markets is an excellent broker overall with a top trading platform that offers good trading tools if you are just starting, like a guaranteed stop-loss order. CMC Markets is our recommendation if you want a platform that allows you to control your maximum losses.

5. Admiral Markets - BEST FOREX EDUCATION FACILITIES

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 1.0

AUD/USD = 1.0

Trading Platforms

MT4, MT5, Admirals Platform

Minimum Deposit

$100

Why We Recommend Admiral Markets

We liked how Admirals prioritises education, especially for those new to the trading scene. A reliable trading service featuring low spreads matches their comprehensive education section. For Canadian traders keen on bolstering their knowledge while enjoying favourable trading conditions, Admirals stands out as the best broker for education.

Pros & Cons

- Has full trading courses available

- Competitive spreads

- Good selection of trading platforms

- No social trading tools

- Has withdrawal fees

- No proprietary trading platform on desktop

Broker Details

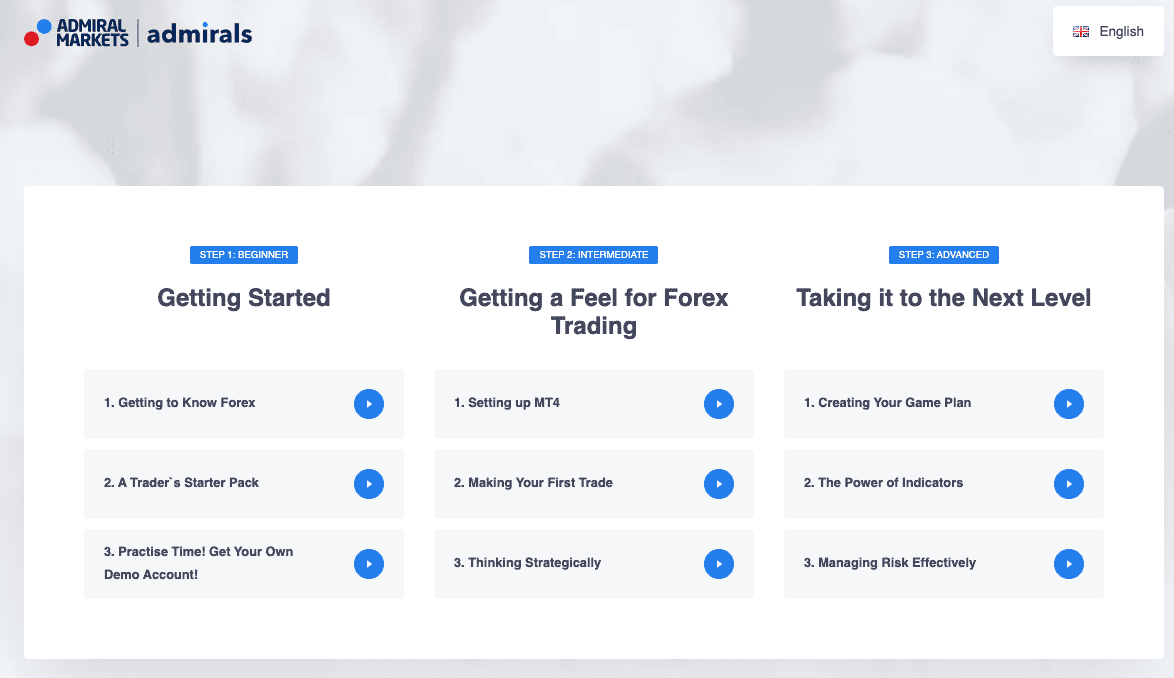

Admirals provides multiple trading courses

Most brokers invest in providing the absolute basic information when it comes to trading education. Fortunately, Admirals understands the value of education and has provided two excellent courses that would appeal if you are a beginner CFD trader. If you want a solid foundation to learn how to trade, then our top choice would be with Admirals.

Key Strengths:

- Excellent trading courses

- Low minimum deposit

- Competitive spreads

Two Free Trading Courses with Admirals

We liked how Admirals offers a great selection of trading resources for its traders. There are a few standout materials you can use to learn more about trading that are ideal if you are a beginner.

The first is the Forex101 course, which has nine online video lessons and quizzes to help you learn. This course is aimed at if you’ve just started learning about the forex markets as it covers many basics. It’ll walk you through understanding what forex is to learn about risk management.

Then there is the Zero to Hero course that aims to help you learn to trade forex over 20 days. We like that this course is taught by professional traders that guides you from the basics of technical and fundamental analysis to developing the trading techniques so you can use them in real market conditions. If you know the basics of trading, then you should start this course as it covers more advanced topics and is taught by professional traders.

Admirals also has a large YouTube channel with over 3,500 videos on trading education, analysis, and tips for you to watch in your own time. With a channel like this, it shows they are committed to providing a continual education experience for its traders.

Admirals offers commission-free, STP trading

Admirals uses Straight Through Processing (STP) trading execution to bring you low spreads, which start from 0.6 pips. The broker does this through its Trade.MT4 account, which features no commissions, and you can trade 37 Forex pairs using the MT4 trading platform.

Our Verdict on Admirals

If education is a priority for you and you have just started learning to trade the markets, then setting up with Admirals is a solid choice. Not only do they provide a comprehensive education section, but they have a solid trading service with low spreads.

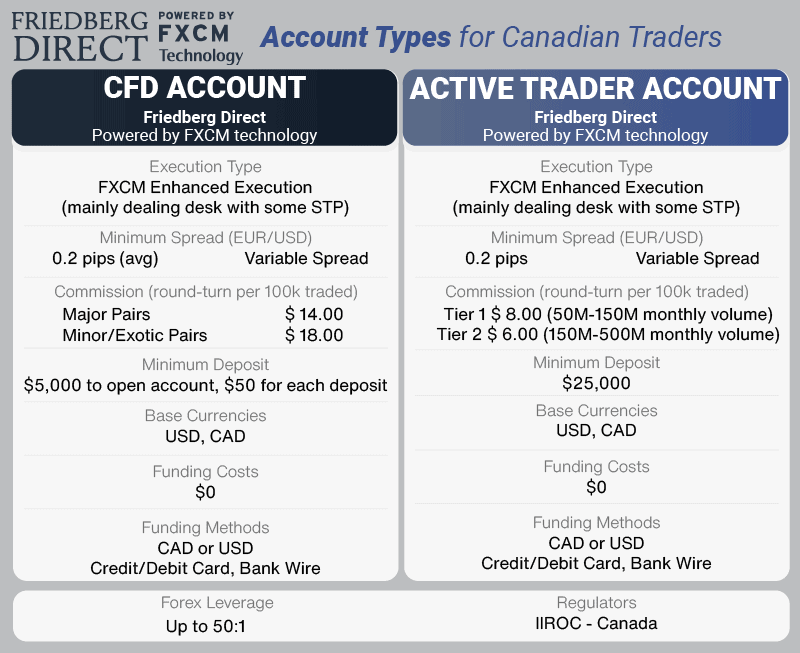

6. Friedberg Direct powered by FXCM - BEST BROKER FOR NOVICE MICRO LOT TRADING

Forex Panel Score

Average Spread

EUR/USD = 0.3

GBP/USD = 0.9

AUD/USD = 0.4

Trading Platforms

MT4, TradingView, Trading Station

Minimum Deposit

$300

Why We Recommend FXCM

We learned that Friedberg Direct, backed by FXCM, brings beginner-friendly features suitable for those new to trading. That said, the broker’s CFD trading tends to be on the pricier side. OANDA emerged as a more fitting choice for those who prioritise low trade sizes.

Pros & Cons

- A solid range of low trade sizes is available

- NDD execution through FXCM

- Variety of trading platforms to choose from

- $5,000 minimum deposit

- Limited customer support hours

- No share CFDs

Broker Details

Friedberg Direct powered by FXCM has trading with units of 100

Friedberg Direct powered by FXCM, offers one of the lowest trade sizes available, allowing you to trade with a smaller margin while you are finding your feet. This makes FXCM an ideal choice if you are a beginner wanting to start trading with smaller lots.

Key Strengths:

- Solid ECN-style execution

- Multiple trading platforms

- Small trading sizes available

Trade with smaller trade sizes with FXCM

FXCM allows you to trade using units as low as 100. Smaller lot sizes mean you can trade while risking less of your own capital. While most brokers in Canada limit lot trading to Micro-lots (10,000 or higher), FXCM allows you to trade using micro-lots ( 1,000 units).

We liked that FXCM offers lower trade sizes because it allows you to trade using your own currency with leverage without risking too much before you are ready. In other words, Micro-lot trading means you start small and build your way up to a trading size that suits your risk tolerance. OANDA is the only other broker we have reviewed in Canada with this kind of trading.

To trade with these smaller sizes, you must use the broker’s proprietary platform, Trading Station 3.0, which is FXCM’s proprietary trading CFD platform. We think Trading Station is a good option if you are a beginner, especially since it comes with charts that are pre-loaded with indicators such as the Bollinger bands. You can even trade CFDs directly off the charts, which is helpful if you need to place a trade quickly.

Friedberg Direct (powered by FXCM) has discounts for active traders

While Friedberg Direct (powered by FXCM) offers competitive spreads from 0.2 pips on both its accounts, FXCM is not a discount broker with a high minimum deposit requirement and high commission fees. The only benefit you’ll get is receiving discounts on your commissions if you are a high-volume trader with with the Active Trader account. This may not be ideal for beginners though with the cost barrier too high for some.

Our Verdict on FXCM

Overall, Friedberg Direct (powered by FXCM) has some beginner-friendly features that appeal if you are just starting out. However, we find them an expensive CFD broker, and if low trade sizes are important to you, then we recommend you use OANDA.

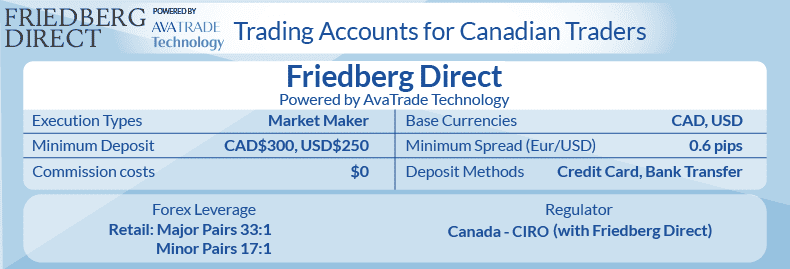

7. Friedberg Direct powered by AvaTrade has AvaProtect - TOP OPTIONS TRADING FOR NEW TRADERS

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

We liked how AvaTrade utilises its AvaOptions technology to provide a straightforward and unique risk management tool, perfect for beginners seeking a simple solution for short-term risk control. For Canadian traders after a CFD broker that stands tall in risk management capabilities, pairing Friedberg Direct with Avatrade is a stellar choice.

Pros & Cons

- Stable low-spreads throughout the day

- Intuitive proprietary web trading platform

- Unique risk management tools

- A high minimum deposit is required to open an account

- Limited customer support hours

- AvaOptions is unavailable on MetaTrader platforms

Broker Details

Friedberg Direct powered by AvaTrade has AvaProtect

Provided you are trading Options that are unique to the AvaProtect app, Friedberg Direct powered by AvaTrade has a unique risk management product called AvaProtect. This is essentially insurance you take out on your trade, and you can receive your losses back if price movements are unfavourable. AvaProtect can be a good tool if you are just starting and aren’t too confident in your trades, as it provides an element of protection should you regret your trade within the allowable window.

Key Strengths:

- Low fixed spreads

- Solid range of CFD products

- AvaOptions and AvaTradeGo unique platforms

AvaProtect returns your losses for a fixed price

Unlike the other brokers on this list, which allow you to trade with CFD products, AvaTrade also has options for trading. You have vanilla options for 40 FX pairs as well as gold and silver, and to help with your trading, AvaTrade has an app designed specifically for options trading – AvaOptions.

In addition to being specifically designed for options trading, AvaTrade comes with AvaProtect. This is helpful because you can protect against future losses within a set time frame.

For example, if you took out AvaProtect on your EUR/USD for six hours and the financial markets crashed then, at any time within those six hours, you can activate AvaProtect, and it will close out your CFD positions and return your losses to you in cash – it doesn’t matter if it dropped 10 pips or 100 pips. However, if it crashed after AvaProtect expired, you are no longer eligible for reimbursement.

To use AvaProtect, you must pay a small premium and select how long you want the protection. The premium increases the longer you want the protection from AvaProtect. However, you will never lose more than the premium you pay should the financial markets go against you.

Our Verdict on Friedberg Direct powered by AvaTrade

We like that AvaTrade has used its AvaOptions technology to offer a simple and unique risk management tool that is ideal for beginners who want an easy solution to short-term risk management. You should choose Friedberg Direct with Avatrade if you want a CFD broker with excellent risk management tools.

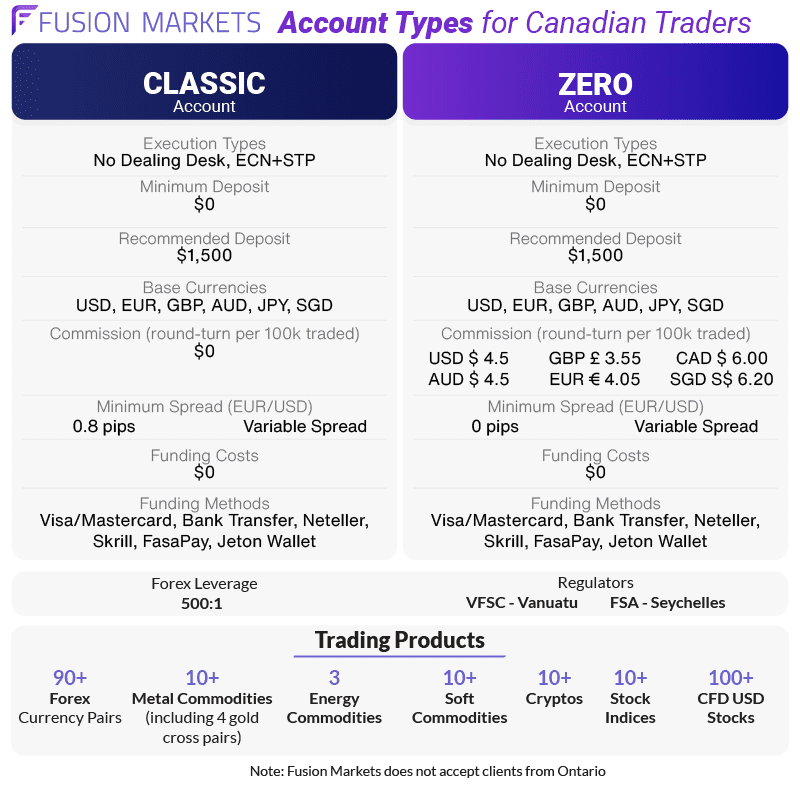

8. Fusion Markets - BEST LOW COMMISSION MT4 FOREX BROKER

Forex Panel Score

Average Spread

EUR/USD = 0.93

GBP/USD = 1.08

AUD/USD = 0.92

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why We Recommend Fusion Markets

We found that Fusion Markets stands out as a top-tier, low-commission forex broker, boasting some of the finest copy trading tools in the industry. Fusion Markets is a brilliant choice for Canadian traders keen on tapping into the forex markets without diving deep into the learning curve, especially for the broker’s notable copy trading tools.

Pros & Cons

- Fast execution speeds on MetaTrader 4

- Wide range of trading tools

- Lowest trading commissions

- High deposit fee if depositing via wire transfer

- No TradingView platform

- Limited range of trading products

Broker Details

Fusion Markets Has The Lowest Costs With MT4, MT5 and cTrader

Commission costs along with the spreads, are two of the main trading costs you will pay when trading. Since you pay commission and spread cost for each lot open and close it helps to find a broker that will save you on these expenses.

We tested how 20 Forex brokers performed when it comes to spreads and commissions and found Fusion Markets has among the lowest trading costs. For this reason, if you wish to save on your expenses, we recommend Fusion Markets.

Key Strengths:

- Low commission ECN broker

- Copy trading is available on multiple platforms

- Choice of MT4, MT5 and cTrader platforms

- Excellent selection of trading products

Our test prove Fusion Markets have the lowest costs.

Our tests conducted by Ross found Fusion Markers have the lowest spreads and commissions fees.

To capture the spreads for our test, we used an Expert Advisor (EA) on MetaTrader 4 for a 24 hour period, 1 week apart. This experiment captured the movement of 6 currency pairs, EUR/USD, AUD/USD, USD/JPY, GBP/USD, USD/CAD and USD/CHF from which we average the results.

Our results found Fusion Markets was the winner overall with an average of 0.22 pips when we combined the average of all 6 currency pairs. The broker was also the winner for AUD/USD (0.09 pips) and USD/JPY (0.22 pips), they also finished top three for the other 4 pairs.

| Broker | Average Spread | AUD/USD | EUR/USD | GBP/USD | USD/CAD | USD/CHF | USD/JPY |

|---|---|---|---|---|---|---|---|

| Fusion Markets | 0.22 | 0/09 | 0.16 | 0.21 | 0.23 | 0.41 | 0.22 |

| IC Markets | 0.32 | 0.23 | 0.19 | 0.27 | 0.45 | 0.57 | 0.24 |

| TMGM | 0.32 | 0.15 | 0.15 | 0.35 | 0.43 | 0.51 | 0.33 |

| Pepperstone | 0.36 | 0.19 | 0.19 | 0.41 | 0.61 | 0.39 | 0.33 |

| FP Markets | 0.41 | 0.31 | 0.20 | 0.31 | 0.51 | 0.71 | 0.39 |

| EightCap | 0.50 | 0.48 | 0.20 | 0.44 | 0.64 | 0.76 | 0.58 |

| CMC Markets | 0.73 | 0.68 | 0.44 | 0.90 | 0.75 | 0.94 | 0.64 |

We also compared the commission brokers offer. What we noticed is that commission costs with brokers outside Canada are lower than CIRO regulated brokers. Why this is, we can’t be sure but the bottom line is, it’s cheaper to trade with an offshore broker.

| Broker | USD | Broker | |

|---|---|---|---|

| Tickmill | $2.00 | City Index | $2.50 |

| RoboForex | $2.00 | VT Markets | $3.00 |

| FXTM | $2.00 | FIBO Group | $3.00 |

| Fusion Markets | $2.25 | ThinkMarkets | $3.50 |

| London Capital Group | $2.25 | Dukascopy | $3.50 |

| CMC Markets | $2.50 | Global Prime | $3.50 |

| BD Swiss | $2.50 | TMGM | $3.50 |

| AMarkets | $2.50 | OctaFx | $3.50 |

| Fair Markets | $2.50 | XM | $3.50 |

| Go Markets | $2.50 | HYCM | $4.00 |

Our Verdict on Fusion Markets

Fusion Markets is an excellent low-commission forex broker and provides access to some of the best copy trading tools. So, if you want to have exposure to the forex markets without learning how to do it, then we recommend Fusion Markets for their copy trading tools.

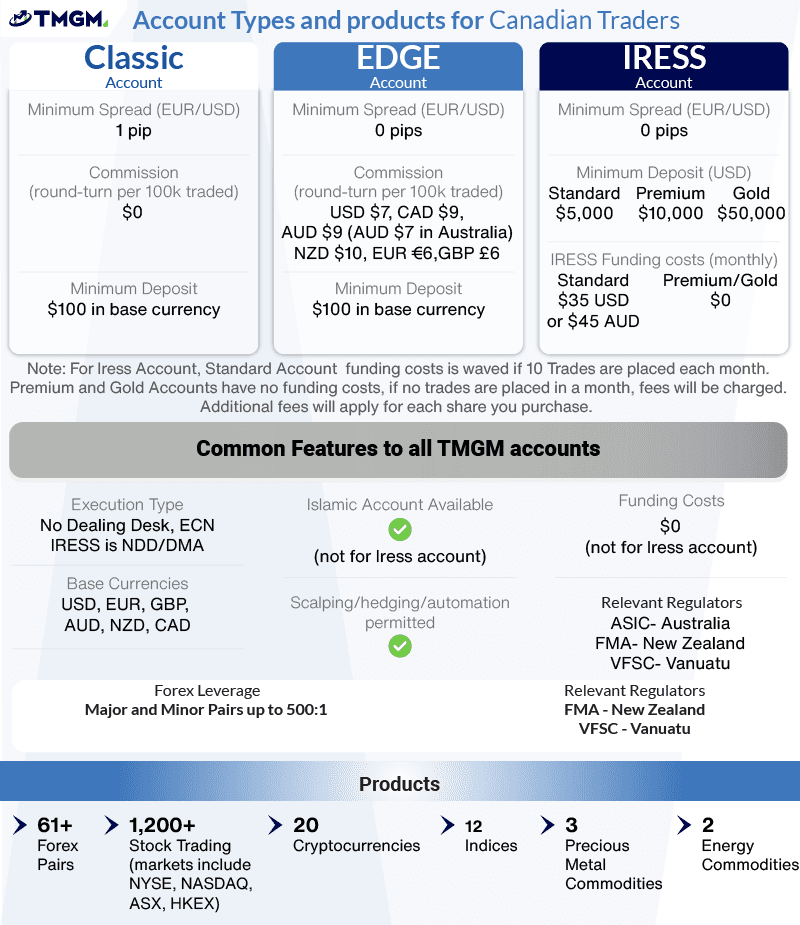

9. TMGM - BEST RISK MANAGMENT TRADING FEATURES

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 1.32

AUD/USD = 1.11

Trading Platforms

MT4, MT5, TMGM App

Minimum Deposit

$100

Why We Recommend TMGM

We liked how TMGM caters primarily to beginners. It stands out with low trading fees and a top-notch platform that integrates MetaTrader 4. But what truly caught our attention was their negative balance protection. This means that new traders can rest easy knowing that they won’t owe the broker any extra cash in the face of adverse market conditions.

Pros & Cons

- Low spreads from one pip

- Has negative balance protection

- 24/7 customer support

- Limited forex pairs to trade compared to other brokers

- Minimum deposit is $100

- Limited educational content

Broker Details

TMGM protects your funds from going below $0

Risk management is key when it comes to trading successfully. However, not everyone can manage their emotions and risks so easily. What we like about TMGM’s platform is that they offer negative balance protection, which stops your account from going below $0. That is why we recommend TMGM as an ideal broker for beginners.

Key Strengths:

- Excellent beginner-friendly trading platforms

- Fast execution speeds

- Improved risk management tools

- Low trading fees

Negative Account Protection

What we like about TMGM is that they understand that mistakes and bad trades can happen, so they provide an automatic service that can protect you from going into a negative balance (which would mean you would owe TMGM more money). Although it’s not nice to think about losing all of your money, it’s better to have negative account protection in place (especially as a beginner) – just in case an unexpected market event impacts your trades, wiping you out.

You get access to this feature automatically, but should you ever need to use it, you simply email their trading support.

Account Types and Products

TMGM provides two different trading accounts you can choose from. The Classic is their standard account, which is a spread-only account. This means you are charged TMGM’s spread when you enter the market, and it is commission-free. The spreads on the Classic account are from one pip on the EUR/USD. This account is ideal if you are a beginner because it simplifies your trading costs to one low-spread payment.

The other account is the Edge account, which is a commission-based trading account. So you pay a commission for each buy and sell of your position, but you get access to TMGM’s best spreads, which are from 0.0 pips on the EUR/USD.

Commission for this account is CAD$ 9 per 100k round-turn trade (which means you pay CAD$ 9 per 100k to open & close the trade). So, if you are just starting, then you will most likely be trading micro-lots, for which the commission works out to be just CAD$0.09 per 1k, or if you want to trade mini-lots, then it’s just CAD$ 0.90 per 10k.

Execution Speeds

Ross Collins, our Chief of Research, tested the execution speeds of 20 of the most popular forex brokers for both market and limit orders. In both cases, TMGM posted impressive results.

Using a demo account, Ross found that TMGM executed limit orders in less than 100 ms. turnaround times for market orders were slightly slower – less than 150 ms – but still firmly in the top ten.

While execution speed might not be a top-of-mind concern as a beginner, it’s important to sign on with a broker that will continue to meet your needs as your skills improve. Suppose you find you prefer scalping or automated trading. In that case, you’ll need a broker with the infrastructure to complete your trades as quickly as possible to benefit from micro-movements in the market.

Our Verdict on TMGM

Overall, we rate TMGM as a beginner-friendly broker. They provide low trading fees, an excellent trading platform with MetaTrader 4, and they have negative account protection in place, which is helpful if you are just starting out as you know that if anything terrible happens, then you will not owe the broker more money.

Ask an Expert