Canadian Demo Trading Platforms

The best forex demo accounts in Canada allow you to test trading platforms and gain confidence using virtual currencies. These forex brokers allow you to test MetaTrader 4 and other forex platforms before using real money.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The July 2025 Best Canadian Forex Broker List Is

- OANDA - Best Demo Trading Account For Beginners

- FOREX.com - Good Demo Trading With Solid All around Offering

- Friedberg Direct Powered By Avatrade - Great Demo Account For Day Trading

- Friedberg Direct Powered By FXCM - Good Range Of Trading Platforms

- FP Markets - Top Demo Account For Scalping

- Eightcap - Best Demo Account For Cryptocurrency Trading

- TMGM - Top Broker For Range of Markets

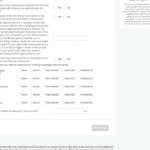

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

91 |

FCA, CIRO, ASIC FSC-BVI, NFA, CFTC MAS, JFSA, KNF |

- | - | - | - | 1.4 | 2 | 1.4 |

|

|

|

120ms | $0 | 69+ | - | 50:1 | - |

|

Read review ›

Read review ›

|

84 | CIRO, FCA, NFA, CFTC, MAS, JFSA, CIMA | - | - | - | $7.00 | 1.2 | 1.5 | 1.4 |

|

|

|

30 ms (May 2023) | $100 | 80+ | - | 33:1 | 33:1 |

|

Read review ›

Read review ›

|

64 |

CIRO, FSCA ADGM, CBI |

- | - | - | - | 0.90 | 1.5 | 1.1 |

|

|

|

160ms | $100 | 37+ | - | 33:1 | 33:1 |

|

Read review ›

Read review ›

|

70 |

ASIC, FCA FSCA, CIRO |

0.22 | 0.80 | 0.40 | $3.00 | 1.3 | 1.4 | 1.7 |

|

|

|

150ms | $300 | 39+ | - | 30:1 |

|

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

71 |

FMA, VFSC ASIC |

0.20 | 0.30 | 0.10 | $3.50 | 1.20 | 1.20 | 1.0 |

|

|

|

94ms | $100 | 61 | 12 | 30:1 | 200:1 |

|

Best Demo Trading Accounts

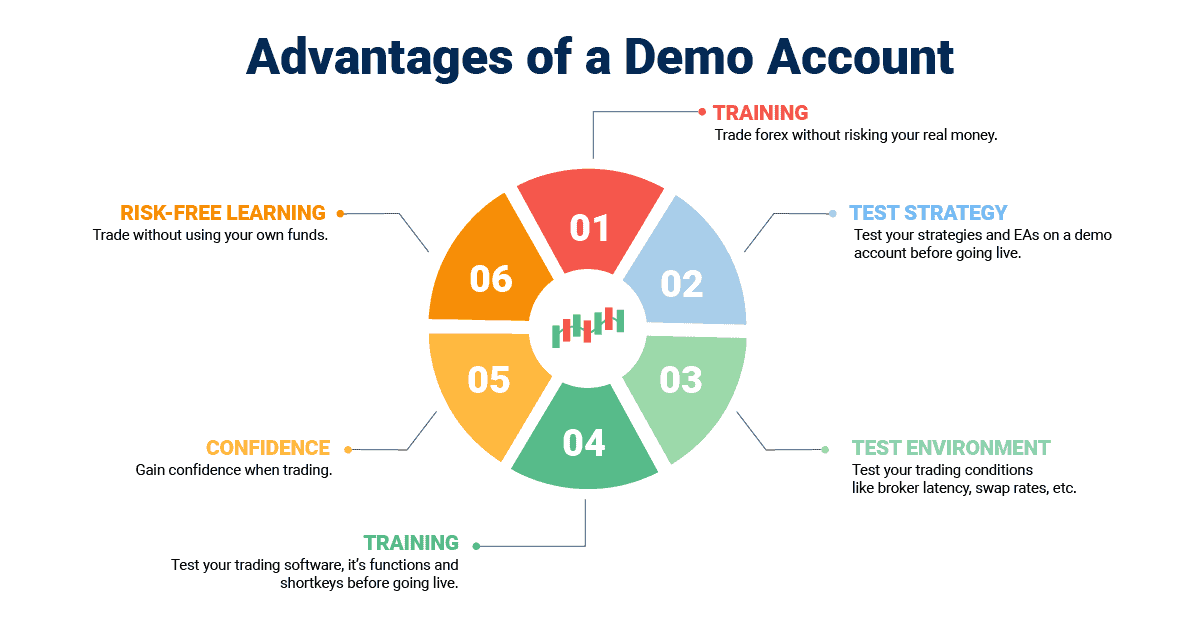

At the start of the year, the CompareForexBrokers team named their 2025 best forex brokers for Canadian traders but you might be looking for a free environment to practice and hone your trading skills

On this page, we look at some of the best demo accounts available. Demo accounts not only allow you to test the trading platform before you commit but also test the broker itself. The other benefit is that you can use the demo account as a practice account to test your strategies and improve your trading ability.

Brokers that make up our list of best demo accounts are all regulated by CIRO (formerly IIROC) unless noted.

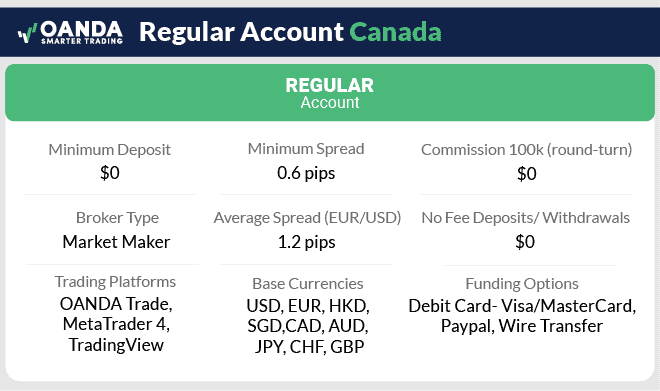

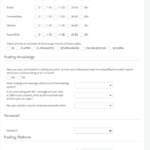

1. OANDA - Best Demo Trading Account For Beginners

Forex Panel Score

Average Spread

EUR/USD = 1.4 GBP/USD = 2 AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

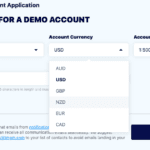

In our tests, OANDA stands out with its score of 71/100 (the highest in Canada). The broker’s demo account lets you access multiple platforms like TradingView and MetaTrader 4, giving you a choice of platforms to try.

We highly rate OANDA for beginners, as the OANDA Trade platform allows trading in small lot sizes, less than a micro lot, down to a single unit of currency. This feature is valuable for practicing low-risk trading before transitioning to risking more funds.

Pros & Cons

- Good choice of trading platforms

- No minimum deposit needed

- Can trade smaller lot sizes than a micro lot

- Customer service is only available during the week

- Lacks share CFDs

- Not an ECN/STP broker

Broker Details

From our testing, OANDA offers the best demo account experience for beginners because of several factors: unlimited demo accounts, a range of platforms to test and an easy account opening process.

NO EXPIRY ON DEMO ACCOUNT

OANDA allows you to test all of its trading platforms, OANDA Trade, MetaTrader 4 and TradingView, with no expiry on its demo account, giving an advantage over other brokers whose demo accounts expire after 30 days.

Having an unlimited demo account gives you the ability to top up your virtual trading funds as you need. In addition, having long-term access to your Forex demo account will make you a better trader as you have longer to practice trading and test your trading strategies.

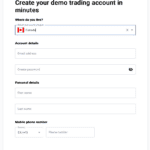

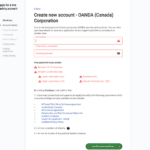

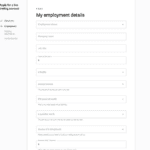

EASY ACCOUNT OPENING PROCESS

When opening a Forex demo account, we found OANDA had a really simple, straightforward sign-up process.

To open a demo account, you can sign up using your social media login like Gmail or Facebook. That’s it, no need to provide details like your name, address or even funding details like a credit card. This allows you to test the demo account in minutes.

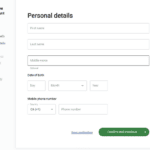

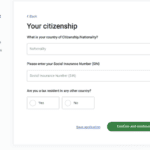

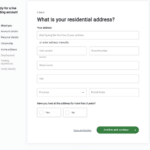

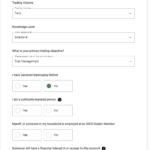

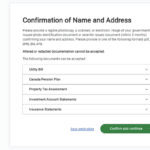

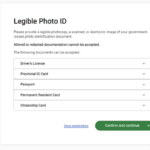

Signing up for a live account does have a few extra steps. This time you will need to provide details such as your name, email, and address and upload evidence such as a digital photo of yourself and your ID. But, you still don’t need to provide your funding details or transfer cash into your trading account until you make your first trade.

Our lead tester, Ross Collins rated the account opening experience with OANDA as 14 out of 15. In particular, he noted that there were no defects or roadblocks during this process, a feature all too common with many brokers.

DEMO ACCOUNTS FOR ALL OF OANDA’S PLATFORMS

You can test each of OANDA’s 3 platforms on the broker’s demo account, something not all brokers offer. For what it’s worth, we could equally recommend each platform, but each has unique benefits.

We think OANDA Trade should be your choice if you like technical analysis and trade performance tools, while MT4 is the only automation option with OANDA. If you like charts and indicators then TradingView is the way to go.

However, OANDA Trade is our pick for beginners. When we tested OANDA Trade, we liked how the platform comes with built-in market sentiment tools. This feature allows you to gauge market bias by using OANDA’s open orders book, which can be used to validate your trading ideas.

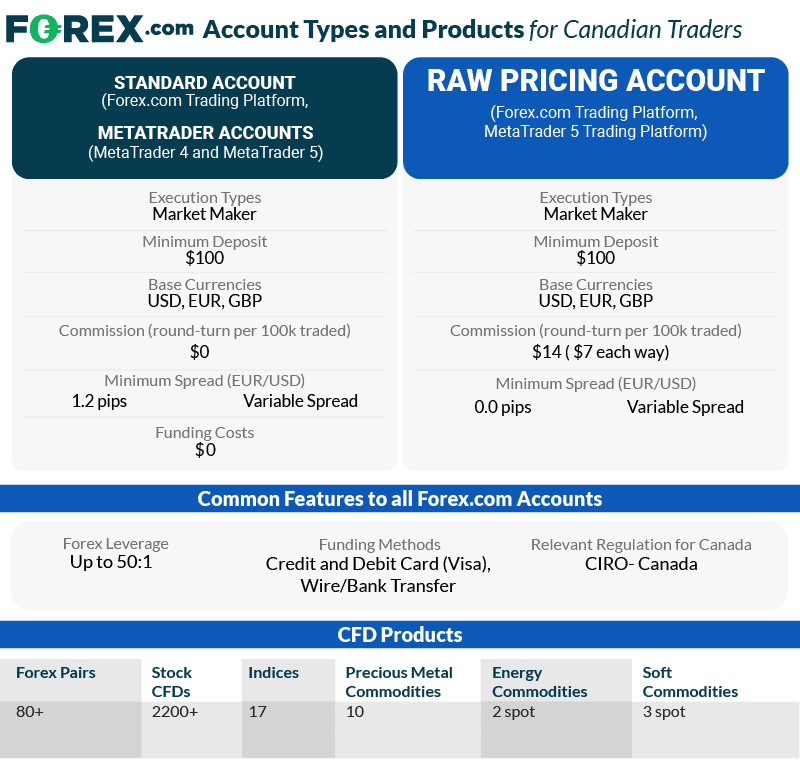

2. FOREX.com - Good Demo Trading With Solid All-around Offering

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 0.8 AUD/USD = 1.7

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

FOREX.com impressed us with the range of platforms available, like MT5 and TradingView. This lets you choose your favourite platform to access Forex.com’s excellent trading range and spreads.

You can use these platforms to trade over 3,000 markets with 80+ forex pairs (one of the most extensive ranges in Canada).

Pros & Cons

- Large choice of FX markets (80+)

- Great trading platforms are available

- Has low average spreads

- A minimum deposit is required

- Lacks weekend customer support

- Not all trading tools available in Canada

Broker Details

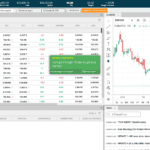

We think FOREX.com’s demo account is a solid all-round offering because of the trading platforms available, MT4, MT5 and Forex.com Trading platform, and the +2500 markets you can trade with, including 80 currency pairs.

ONE DEMO ACCOUNT FOR ALL PLATFORMS

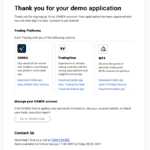

With FOREX.com you get a demo account with $50,000 in virtual funds, which expires after 90 days. Like with all demo accounts, prices and spreads are taken from live price feeds so that you can test the account and platform in a real-trading environment without risking your own funds.

To access a demo account, you fill in a few details, including your email address, phone number, and your first & last name. Once you complete that, you get your account username and password.

One thing we particularly like about FOREX.com is that they have one trading account that can be used to access all of their trading platforms. Most brokers need you to have separate logins for your web account and trading platform accounts like MT4/5.

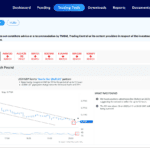

EXCELLENT PLATFORM EXPERIENCE

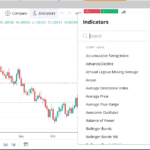

When testing FOREX.com’s demo account, we loved the broker’s in-house developed FOREX.com Web Trading platform, which leverages TradingView’s charts. Having access to over 100 technical indicators was a particular highlight for our technical analysis needs.

Additionally, FOREX.com offer GSLO (guaranteed stop loss orders) for risk management, which we used to limit our slippage in a demo account before trading in a live account. Lastly, we particularly liked Performance Analytics, a free risk management tool, in which you can learn about your trading psychology to become a better trader in 4 simple steps.

To access it, simply log into your account and head to the Performance Analytics tab on Web Trader or tap ‘More’ and then ‘Performance Analytics’ on the FOREX.com mobile trading app.

In addition to FOREX.com platform, we were able to test MetaTrader 4, MetaTrader 5 and TradingView in the same demo account. All platforms are available as a download for desktops, web browsers and apps for mobile trading.

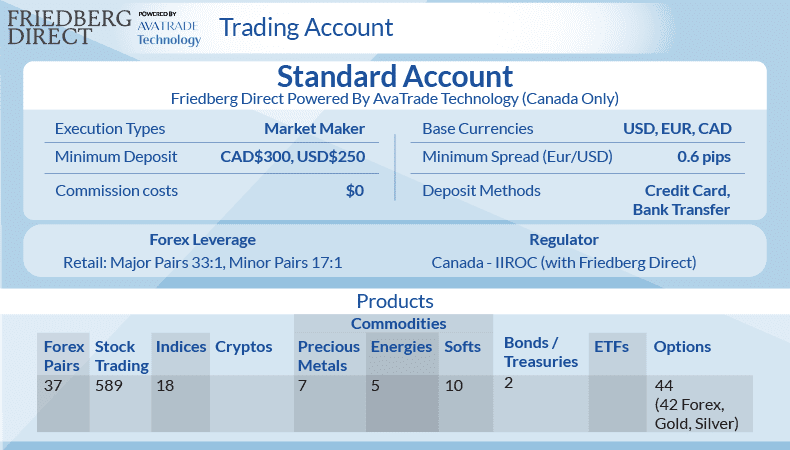

3. Friedberg Direct Powered By AvaTrade - Great Demo Account For Day Trading

Forex Panel Score

Average Spread

EUR/USD = 0.9 GBP/USD = 1.5 AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

We like AvaTrade for day trading because it offers an excellent demo account with tight fixed spreads. You can practice on versatile and popular trading platforms with access to MetaTrader 4, MetaTrader 5, and AvaTrade WebTrader platforms.

AvaTrade’s tight fixed spreads, starting at just 0.6 pips on EUR/USD with no commission, are excellent if you day trade. It allows you to trade during the day without worrying about excessive trading costs caused by market volatility around major announcements or price spikes.

Pros & Cons

- Tight spreads that are fixed

- Solid choice of trading platforms

- Excellent risk management tools

- Limited market analysis research tools

- Charges inactivity fees

- Customer support is limited

Broker Details

With Friedberg Direct powered by AvaTrade technology, you have access to fixed spreads and the popular, MetaTrader 4 platform on the broker’s demo trading account, which is great for day traders.

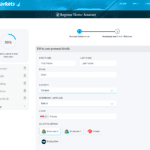

EASY DEMO ACCOUNT SIGNUP PROCESS

From our testing, AvaTrade’s demo account is easy to set up. You apply for a demo account on the broker’s, then fill out some details, which includes your name and contact details. Once you have entered them, you will be given the demo account.

The whole process took 30 seconds, more or less. This is nice because some brokers take much longer to open a demo account and some make you open a live account before accessing the demo account.

With AvaTrade’s demo account, you will get $100,000 in virtual funds, along with access to the MT4 WebTrader and Desktop version for 21 days. The MT4 demo provides ample virtual funds to practice risk-free, which helps avoid costly mistakes while learning a new platform.

One slight downside is AvaTrade don’t let you use the MT5 platform for the demo account.

FIXED SPREADS FOR STABLE DAY TRADING

While fixed-spread brokers are uncommon, and usually have wide spreads to compensate for the stability of the price, Friedberg Direct powered by AvaTrade offers stable fixed spreads from 0.9 pips for EUR/USD.

What I liked about the fixed spreads is that they were stable and lower than some of the most popular brokers, like forex.com. Fixed spreads are ideal for you if you like to trade around news events to take advantage of the extra volatility injected into the markets.

When you are ready to move on to a live trading account with Friedberg Direct With AvaTrade, you’ll find the broker offers just one standard account. This is a commission-free fixed-spread trading account.

EXCELLENT RANGE OF PLATFORMS

AvaTrade has an excellent range of platforms, including MT4, MT5 and the broker’s own AvaTradeGO, which you can all use on the broker’s demo account.

Each of AvaTrade’s platforms offers unique advantages, which we tested. AvaTradeGO mobile app is a user-friendly platform with over 90 indicators for charting, MT4 and MT5 offer the standard, out-of-the-box MetaTrader experience and the broker’s WebTrader gives you access to popular copy trading platforms, DupliTrade and ZuluTrade.

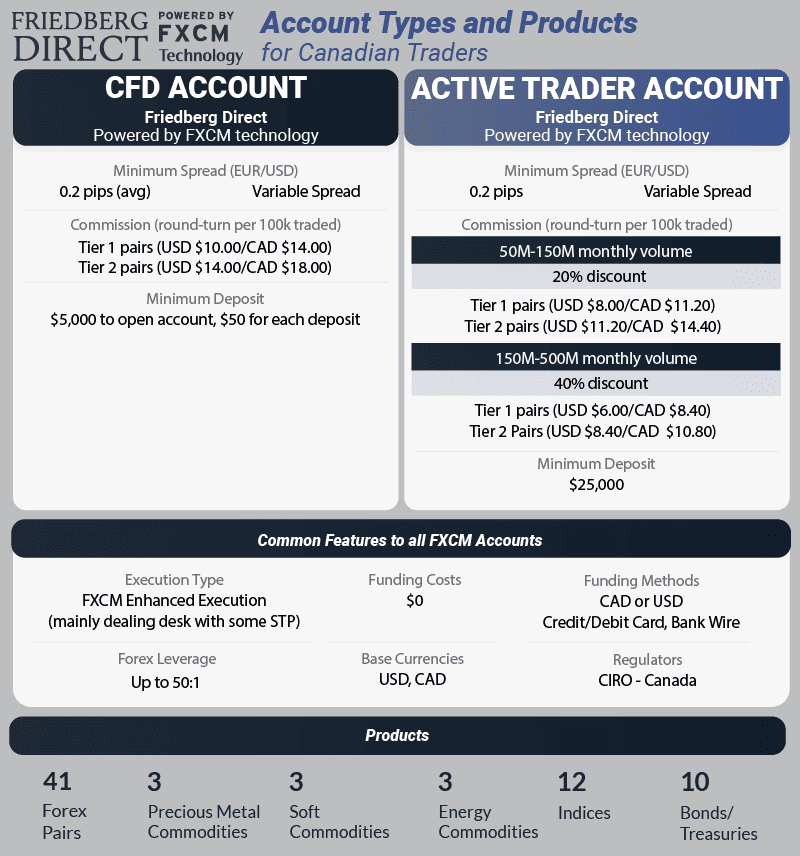

4. Friedberg Direct Powered By FXCM - Good Range Of Trading Platforms

Forex Panel Score

Average Spread

EUR/USD = 0.3 GBP/USD = 0.9 AUD/USD = 0.4

Trading Platforms

MT4, TradingView, Trading Station

Minimum Deposit

$50

Why We Recommend FXCM

FXCM has a decent choice of trading platforms to demo trade with. TradeStation 3.0 and MetaTrader 4, you have options that cater to both research and technical charting needs.

But what truly sets FXCM apart is the eFXPlus tool, offering insights and tactical FX trade ideas from top banks’ research desks. Plus, FXCM gives you a generous $50,000 risk-free demo trading account to practice and learn.

Pros & Cons

- A variety of trading platforms

- Excellent automation tools

- A decent demo account is available

- A high minimum deposit is required

- Customer support is limited over the weekend

- No MetaTrader 5 platform

Broker Details

While FXCM has a good range of platforms, through Friedberg Direct you can only demo with two of them: MetaTrader 4 and Trading Station. However, both of these are good platforms with great trading tools and market research, such as the Economic Insights tool, which is built into the Trading Station platform.

FXCM DEMO ACCOUNTS

Friedberg Direct provides a $50,000 demo account. Accessing the demo account is easy; you only have to input your e-mail address and location to open it. It took less than 30 seconds to receive my account details and log in to the web version of the Trading Station settings.

Your account details are shared across each platform, which allows you to test the Trading Station and MetaTrader 4 platforms with virtual funds. Experiencing each platform with real market conditions can help you determine which platform is the right fit for you.

INTUITIVE TOOLS THAT IMPROVE THE TRADING PLATFORMS

The Friedberg Direct partnership with FXCM leverages FXCM’s technology to provide two trading platforms: MT4 and FXCM’s own, Trading Station.

I liked that FXCM’s Trading Station platform includes automated economic insights and technical analysis by Trading Central. The Economic Insights isn’t on many platforms and can clearly show how much volatility each event made post-announcement.

This is useful because you can see how much the news event has driven recent price action and whether or not the impact will affect the current trend. So it’s ideal for identifying potential trade setups (or avoiding weak trade entries). You should try this platform if you use fundamental analysis to help find trading ideas.

You can also access the MetaTrader 4 platform, which has a user-friendly interface and allows you to customize your interface better than the Trading Station platform. If you are a scalper, choose this platform instead of the Trading Station platform. Unlike the Trading Station, the MT4 platform has one-click trading enabled, which means you can preset your trading ticket with your defined position size, stop loss, and take profit orders.

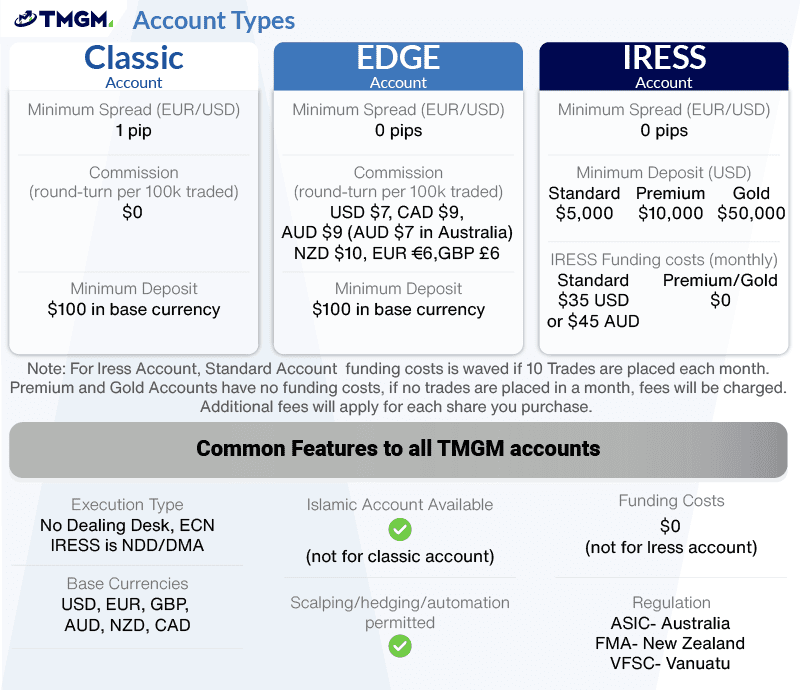

5. TMGM - Top Broker For Range of Markets

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.42 AUD/USD = 0.21

Trading Platforms

MT4, MT5, TMGM App

Minimum Deposit

$100

Why We Recommend TMGM

TMGM earns our recommendation as the top broker for its extensive range of markets, even though it’s not CIRO-regulated. The broker accepts Canadian traders, offering higher leverage (1:500) than CIRO-regulated brokers (1:30), so you can demo an account with high leverage.

The broker also has an impressive range of 12,000+ markets, providing many options to trade with high leverage. The wide choice of markets keeps your trading options open, letting you trade multiple markets with one account with low spreads and high leverage.

Pros & Cons

- An extensive range of markets

- High leverage available

- Low RAW spreads

- Not CIRO regulated

- Requires a minimum deposit

- Forex pairs are limited compared to competitor

Broker Details

TMGM has a great range of markets to trade on its MetaTrader 4 (MT4), which is the main trading platform the broker offers on its demo account.

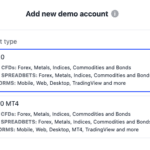

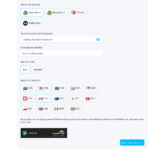

TMGM DEMO TRADING ACCOUNT

The demo account offered by TMGM is for the MetaTrader 4 platform, which gives you $50,000 in virtual trading funds, enough for you to test.

Signing up for the Demo Account was easy. You just fill in your name, email, and mobile number to get started. What I liked is that TMGM assisted in setting up the demo account to suit our needs.

You can choose your account to be in CAD, select your leverage, and your deposit amount. Then, once configured, you can use the details to access your new MT4 demo trading account.

You can access the free technical analysis tools provided by TMGM with your demo account too. The most popular tool is Trading Central, which generates trading ideas based on chart patterns across several markets. What I like about this tool is it provides a breakdown analysis for you along with an explanation of what was found.

This is useful for you to test out the trade ideas whilst testing our TMGMs spreads and execution speed on the demo account.

GREAT RANGE OF MARKETS

TMGM offers a great range of markets, including 61 Forex Pairs, 1200 shares and a smaller range of indices, metals and energies.

Also, TMGM is not a CIRO-regulated broker, which has two main benefits.

One, you can also trade 20 cryptocurrencies, which Canadian-based brokers are not able to offer.

And two, TMGM gives you access to 1:500 leverage for forex trading, which CIRO normally caps at 1:50 for Canadian brokers.

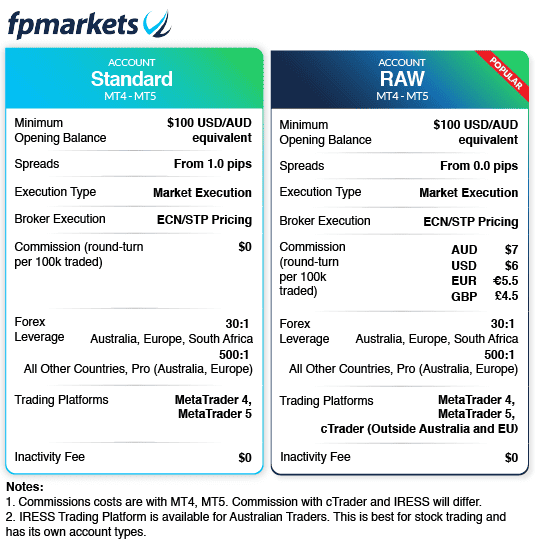

6. FP Markets - Top Demo Account For Scalping

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.2 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

We recommend FP Markets for its decent average RAW spreads, providing an excellent environment for scalping the markets. In fact, in our test, the broker achieved a 0.0 pip spread on EUR/USD 97.83% of the time, only slightly rising to 0.1 pip.

The broker allows scalping on their demo accounts, which is available on several platforms, including MetaTrader 4, MT5, cTrader and TradingView.

Pros & Cons

- Offers zero-spreads

- Has a good choice of trading platforms

- Good choice of crypto markets

- Requires a minimum deposit

- IRESS platform unavailable in Canada

- The mobile trading app lacks any features

Broker Details

FP MARKETS DEMO ACCOUNTS

For Canadian residents, FP Markets offers a demo account for MT4, MT5, cTrader and TradingView, which is a great range not all countries receive.

When signing up for a demo account, we found the process relatively simple, scoring FP Markets a 12/15. The two aspects we particularly liked were the useful account manager assigned to us and the fact it only took a couple of hours to open our account.

FP Markets does, however, lose points for not giving us access to the client portal, limiting the features we could use while trading in a demo account.

Once open, you’ll start with $100,000 in virtual funds and prices and charts will be displayed in real-time, closely mirroring live market conditions. While trading, we found it a smooth process to access trading tools such as trend lines and indicators by clicking on the ‘insert’ tab.

GREAT FOR SCALPING

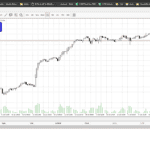

We found FP Markets are great for scalping because of the broker’s competitive spreads and fast execution speeds.

Firstly, we found FP Markets had market order execution speeds of 96ms when testing on the broker’s MT4 demo account. This put the broker at 4th fastest overall for market orders, but the fastest overall on this list.

Secondly, from our analysis, FP Markets has competitive average RAW account spreads of 0.22 pips for the 5 major currency pairs. This put the broker 5th overall, but, again, first overall on this list for low spreads in Canada.

Having fast execution speeds and competitive spreads meant our slippage was reduced and trading costs lowered overall, suiting us when scalping on a demo account.

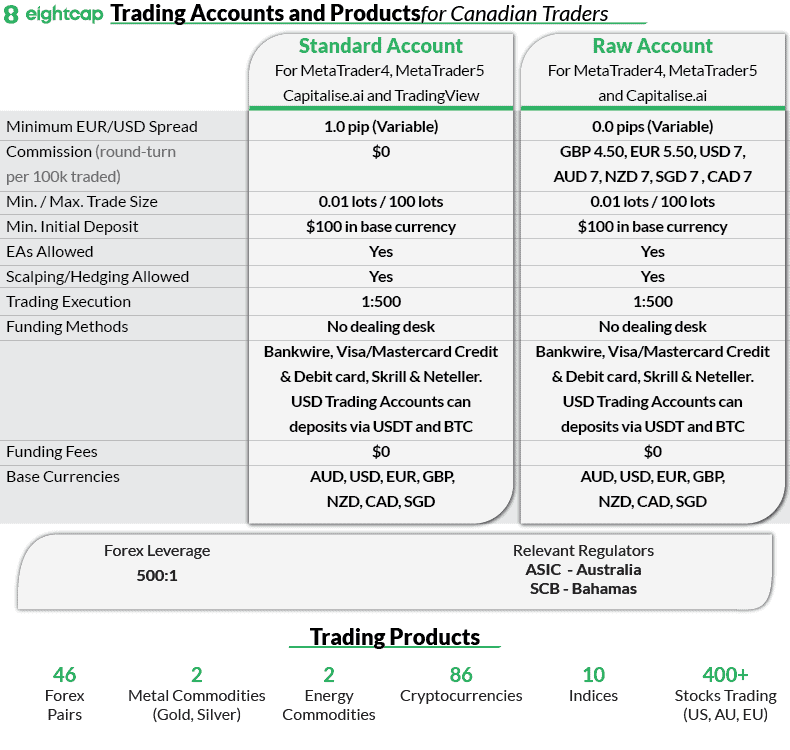

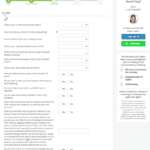

7. Eightcap - Best Demo Account For Cryptocurrency Trading

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.73 AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

We like Eightcap as it’s one of the few brokers offering crypto markets in Canada and has one of the lowest average spreads available. The average spreads start from 0.06 pips on EUR/USD for its RAW accounts, which is lower than the industry average of 0.22 pips.

Eightcap has an impressive choice of markets, especially the cryptocurrency markets offering popular coins from Bitcoin to XRP.

Pros & Cons

- Solid range of crypto markets

- Low average RAW spreads

- Good choice of trading platforms

- Limited range of traditional markets

- Customer support is lacking on weekends

- A minimum deposit is required

Broker Details

EIGHTCAP’S DEMO ACCOUNT EXPERIENCE

Eightcap offers demo accounts for MetaTrader 4 and MetaTrader 5 platforms, while TradingView is not available for demo trading.

These demo accounts are initially valid for a 30-day trial period, but there is an option to request an extension or to make the account permanent if needed, which we liked. Each demo account is equipped with $50,000 in virtual currency, which can be adjusted based on your preferences to better suit your trading strategy needs.

From our experience, registering for an Eightcap demo account is more thorough than with other online brokers, even asking for spurious information like financial hardships, job loss and mental health issues.

However, we were assigned an account manager and our account was opened in a matter of minutes, which not many brokers can boast. This is why we scored Eightcap a 12/15 for ease of account opening.

TOP CRYPTO BROKER

When we tested Eightcap’s demo account, we found the broker had a huge range of 95 crypto products to trade (79 using MT4, 95 for MT5). This includes crypto crosses and crypto indices. Also, you don’t need to create a wallet to get started.

Best of all, we found Eightcap’s spreads were the tightest we’ve seen for a crypto broker. As an example, bitcoin spreads were 12 points per coin (Vs IC Markets 18.2 points), Dogecoin was 0.0002 p/coin (Vs eToro 0.0044 pts) and Ethereum was 0.45 p/coin (Vs IG Group at 1.2 pts).

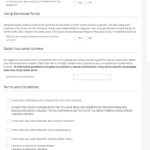

Ask an Expert