Key Learnings

- Margin trading involves borrowing funds from your CFD broker to increase the size of your position

- Trading with margin, also called ‘leveraged trading’, can dramatically enlarge your profits and losses

- Understanding the difference between initial and maintenance margin is critical to planning a leveraged trading strategy

What is CFD Margin?

Margin is a fundamental concept to understand before you start trading so that your CFD trading doesn’t get out of hand should the market move against you.

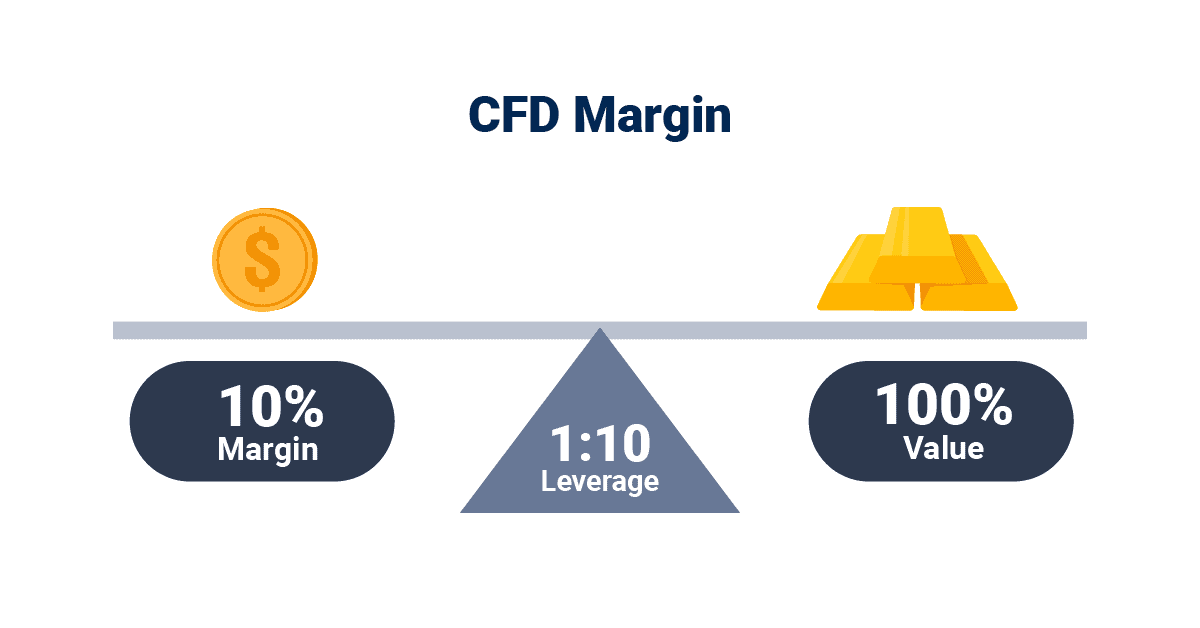

In CFD (contracts for difference) trading, margin refers to the initial amount of funds required to open a position. It acts as a form of collateral that ensures you can cover potential losses as a trader. The concept of CFD margin is fundamental to understanding how much exposure you will have to the market.

In essence, there are two types of margin:

- Initial margin – (or deposit margin) is the minimum amount required to open a position

- Maintenance margin – (sometimes called mark-to-market margin or variation margin) is the minimum amount needed to keep the position open

In this What is CFD Margin page, we explain the fundamentals of CFD margin, the pros and cons of using margin, and how you can use it to boost your trading profits

How is CFD Margin Calculated?

Accurate calculation of your CFD margin is essential for maintaining your trading positions and managing your risks effectively. It determines the amount of capital required to enter and maintain a CFD position, enabling you to assess your financial commitment and potential returns.

Margin: Forex

Calculating the initial margin for forex trading involves understanding your leverage and position size. To calculate the maintenance margin for forex trading, traders need to monitor their account’s equity.

Margin: Other Markets

Unlike forex trading, margin calculations for shares, indices and other financial instruments involve additional factors such as dividend payments, market volatility, and specific contract specifications. As a trader, you must consider these variables to accurately assess the margin requirements for different markets.

CFD Margin: An Example

CFDs are different from buying shares in the stock market. If you buy 1,000 shares of Vodafone at £1 a share and hold the position for 3 months before selling at £2, the profit will be 1,000 x (£2 – £1) = £1,000.

But when buying physical shares, you only realise a profit or loss in your account when they’re sold, which is different from CFDs. So in the above example, you only earned the £1,000 profit when you sold the shares.

Margined products like CFDs work differently because all profits and losses are credited and debited from an account in real-time, and this is called maintenance margin. For example:

- You buy 1,000 shares of Barclays as CFDs at £1.00 each

- The market moves sharply higher, and you sell them 4 weeks later at £2

- Within this 4-week time period, you’ll be credited the daily profits and debited the daily losses as the share price moves higher and lower in real-time

- So although the total trade makes a profit of £1,000, this is credited over the 4 weeks

Note that although the trade is open for a total of 4 weeks, we have only indicated the first 5 days of trading to show the daily change and running total in your maintenance margin.

|

Activity

|

Day 1

|

Day 2

|

Day 3

|

Day 4

|

Day 5

|

| Barclays end of day closing price |

£1.05

|

£1.00

|

£0.95

|

£1.06

|

£1.12

|

| Maintenance margin (daily) |

£50

|

(£50)

|

(£50)

|

£110

|

£60

|

| Maintenance margin (running total) |

£50

|

£0

|

(£50)

|

£60

|

£120

|

What is interesting to note in the above table is that the maintenance margin can be both a positive and negative figure. On day 1, it’s a positive £50, but on day 3, it’s a negative £50 before going positive again on days 4 and 5.

Another example – Maintenance margin over 2 days

- Today, you buy 1,000 shares of XYZ Industries at £3.00 using CFDs

- Tonight, they close at £3.25 so your account will be credited with a positive maintenance margin of £250 (1,000 x £0.25)

- However, the share price reverses the following day, and you sell out at £3.00, the price where you initially bought the CFD position

- £250 in negative maintenance margin will, therefore be debited from your account

- So, although it was a scratch trade (zero profit/loss), it looked like you made a profit of £250 one day and then a loss of £250 the next – that’s maintenance margin at work

- Note – in this example, I haven’t considered commissions or financing charges to keep things simple

Why Maintenance Margin is So Important

Because CFDs are a leveraged product, maintenance margin plays a vital role in CFD trading.

Without this leverage, a trade could go horribly wrong, and the trader might not be able to pay the loss when the position is liquidated. But as maintenance margin accounts for any losses on a real-time basis, it’s hard for a trade to get completely out of hand.

One final point – If you can’t pay any margin owed by the end of the day, your UK CFD broker has the right to take over your position and close it, usually, of course, for a loss. This is called a margin call. And sadly, there’s little a client can do in such a situation, as the broker’s official terms & conditions will have been broken. Choose from the best CFD trading platforms for clear margin rules and effective risk management tools.

How to Start Trading CFDs

If you’re ready to start trading CFDs, you can follow this step-by-step guide to get started:

- Choose a reputable CFD broker

- Open and fund a trading account

- Choose a CFD market

- Develop a trading plan

- Place a trade

What is Spread Betting Margin?

As a UK trader, you have access to a unique form of derivative strategy called spread betting. Spread betting involves making predictions on whether an asset’s price will rise or fall. The ‘spread’ represents the difference between the buying and selling prices, and traders bet on this price movement. Key features include leverage, tax advantages, and the ability to go long or short on various markets, similar to CFDs, offering a versatile approach for trading.

Similar to CFD margin, Spread betting margin is essentially a deposit required to open a position in spread betting. It allows you to control a more substantial position size with a smaller amount of capital. Margin acts as a security, ensuring that you have sufficient funds to cover potential losses, given the leveraged nature of spread betting.

Calculating Spread Betting Margin

In spread betting, the margin is calculated by multiplying the total value of the position by the margin rate set by the broker. The total value of your position is the price of the spread betting market multiplied by the trade value. Margin is usually expressed as a percentage, between 1% and 100% (but mostly on the lower end).

Spread Betting Calculator

To use our spread betting calculator below, simply enter your trade size, opening price level and choose a market (either forex or other market) to calculate your margin and the resulting P&L.

Our spread betting calculator

You can take some of the guesswork out of spread betting. Use our example below to explore how margin requirements, as well as profit and loss, are calculated on spread bets.

Market moved by: points (%)

= Size x (Opening Price Level - Closing Price Level)

= x ( - )

= x ()

=

*All values are estimated and for referencing only. The resulting P&L does not include cost and charges such as overnight funding.

SELL

BUY

GBP(£)

min: 0.25

For more information about how to use our Spread Betting Calculator Tool, click here.

Spread Betting Margin Example

To see how margin works in practice, let’s take a look at an example.

Say you want to bet £10 per point on Barclays PLC. Its share price is 130 GBX (British pence sterling), and its margin requirement is 20%.

The total value of your trade is (£10 x 130) £1300, so you need 20% of 1300 as margin: £260. The equivalent when investing would be buying 1000 Barclays shares, which would cost you (1000 x 130p) the full £1300.

So in the above Barclays PLC spread betting example, if you spread bet using leverage, your required margin is £260. For a non-leveraged trade, the deposit required to open the trade is £1300. Therefore, the benefit of spread betting, being a leveraged trade, is that you can open a position with less capital due to the margin requirement.

How to Start Spread Betting

The step-by-step process to start spread betting follows a similar process to when you’re starting out trading CFDs. One major difference is that only brokers from certain countries or regions offer spread betting as a trading option. As a UK trader, provided you choose a

- Learn about the fundamentals of spread betting

- Choose a reputable CFD provider that offers spread betting

- Open and fund a spread betting account

- Choose a spread betting market

- Develop a trading strategy

- Place a spread bet

Key Takeaways

- Margin trading entails borrowing capital from your CFD broker to augment your position’s size.

- Engaging in margin trading, often referred to as ‘leveraged trading,’ has the potential to significantly amplify both gains and losses.

- A key element in devising a leveraged trading strategy is comprehending the distinction between initial and maintenance margin.

FAQ

What does CFD mean?

CFD stands for Contracts For Difference. They are an agreement between a CFD trader and a broker to exchange the difference in the value of a financial instrument between the opening and closing of a trade. Basically, CFDs are financial derivatives that allow you to speculate on the price movements of assets without owning them physically. This allows for a more flexible and leveraged approach to trading, potentially amplifying profits but also risks. You can trade most major financial markets as CFDs such as shares, indices, bonds and commodities.

Is CFD trading profitable?

CFD trading can be very profitable provided you are consistently making successful trades. Given the volatility of financial markets and the risky nature of CFD trading, it’s important to educate yourself on the basics, develop an informed trading strategy and practice CFD trading using a demo account before opening a live account with real money.

What is the difference between CFDs and forex?

CFDs are a way of trading whereas forex is a financial market itself. You can trade most major financial markets as CFDs, whether it’s a share CFD, an index CFD or a Forex CFD. Specifically, forex CFDs are contracts used to trade currency pairs via leverage (as mentioned above). Given the forex market can be highly volatile, you can choose to trade this asset class using CFDs as it enables you to speculate on both rising and falling prices.

Is CFD margin taxable?

Technically not, but it’s a little complicated. The easy way to look at it is that CFD trading in general is taxable. When you realise a profit for a CFD trade, you are subject to capital gains tax. Similarly, CFD losses are tax deductible, and trades can be done through direct market access.

What is a CFD margin requirement?

CFD margin requirement is the minimum amount that you’ll need to have in your account to trade a CFD. A CFD margin is usually expressed as a percentage of the total value of the trade. I.E. If the total value of the trade is £1000 and the margin is 20%, you’ll need to have a minimum of £200 in your account to make the CFD trade.