Best FCA Regulated Forex Brokers

The first step to forex trading is choosing the right forex broker. To help find the best forex broker for your needs we compared FCA-regulated brokers based on their trading fees, execution speeds, features and trading platforms.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Our list of the top UK FCA regulated forex brokers is:

- Pepperstone - Best MT4 Forex Broker

- City Index - Best Standard Account Broker

- Plus500 - Best Forex Trading App In UK

- eToro - Top Broker For Copy Trading

- IG Group - Largest Range of Trading Products

- Eightcap - Best Broker With TradingView Platform

- OANDA - Most Trusted Forex Broker

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

FCA CySEC, BaFin |

0.10 | 0.30 | 0.20 | £2.25 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 | CySEC | 0.02 | 0.23 | 0.17 | $3.50 | 0.62 | 0.83 | 0.77 |

|

|

|

134ms | $0 | 61+ | 18+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

66 |

FCA ASIC, MAS |

- | - | - | - | 0.70 | 1.1 | 2.2 |

|

|

|

95ms | $150 | 84+ | 25+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

57 |

FCA CySEC |

- | - | - | - | 1.70 | 2.3 | 1.4 |

|

|

|

140ms | $100 | 71+ | 15+ | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

43 |

FCA CySEC |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 46+ | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

71 |

FCA BaFin, CySEC |

0.16 | 0.59 | 0.29 | £3.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $450 | 100+ | 12+ | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

96 |

FCA CySEC, ASIC |

0.06 | 0.23 | 0.27 | £2.25 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

92 | ASIC, VFSA, FSA-S | 0.11 | 0.24 | 0.12 | $2.25 | 0.83 | 1.42 | 1.12 |

|

|

|

79ms | $0 | 84 | 14 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

91 |

FCA CIRO |

- | - | - | - | 0.6 | 0.9 | 0.7 |

|

|

|

- | $0 | 70+ | 4+ |

|

Who Are The Best FCA-Regulated Forex Brokers?

We compared the established providers with the strongest reputation based on spreads, fees and platform features to determine the best-of-the-best.

1. Pepperstone - The Best Forex Broker for MT4

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We favour Pepperstone for its harmonious blend of low trading costs, swift execution, and additional MetaTrader 4 service like Myfxbook for automated trading. Offering compatibility with MT5, cTrader, and TradingView enhances its versatility.

Our robust tests resulted in a commendable 98/100 score, with execution speed (77 ms for limit orders and low spreads averaging 1.12 pips for EUR/USD and 0.1 pips for Razor account being strong points.

Pros & Cons

- Best RAW account spreads

- Fast limit order execution speeds

- Easy account opening

- 4 Trading platforms

- Top 3rd party tools for automation and copy trading

- Average Standard account spreads

- Few e-wallet funding options

- Lacks guaranteed stop-loss orders

Broker Details

We Rated Pepperstone The Best With A Score Of 98/100

- Competitive spreads and commissions provide good value-for-money

- Fast execution speeds – less than 100ms for limit and market orders

- Wide variety of trading platforms – five in total

- Investment Trends Award winner for customer service

- Excellent range of markets, including crypto

- Excellent trust scores – 91/100 – and multiple Tier-1 licenses

The CompareForexBrokers team developed a scoring methodology so we can score the Forex brokers we review, free from any personal bias we have. To do this, we compared 10 categories that we think are critical for choosing a Forex broker. Obviously, some categories will be more important than others, so we gave a weighting to these categories. The table below shows the categories that make up our scoring system and the weighting we gave them.

| Trading Costs | Trading Experience | Trust | Trading Platforms | Customer Service | Range of Markets | Education | Funding | |

|---|---|---|---|---|---|---|---|---|

| Weighting | 25% | 15% | 20% | 15% | 10% | 5% | 5% | 5% |

The biggest weight is given to costs, sure you go into trading CFD products like forex, stocks, indices, and commodities with the hopes of making a profit, but you don’t want to see this eaten away with unnecessary costs. Costs include trading spreads, swaps, inactivity, and deposit fees. We also gave a large weight to Trading Experience since, naturally, you want to avoid issues when trading, such as slow trading execution, troublesome account opening, customer support without knowledge, and a difficult website to navigate. Lastly, we gave a higher weight to broker trust as using an appropriately regulated broker is important.

Overall Pepperstone scored a pretty remarkable 97 out of 100 and was the top scorer of all brokers we measured. Why did Pepperstone do so well?

| Broker | Trading Costs 2.5x | Trading Experience 2x | Trust 1.5x | Trading Platform 1.5x | Customer Service 1x | Range Of Markets 0.5x | Education 0.5x | Funding 0.5x | Total (Max 100) |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | 6.8 | 9.0 | 7.6 | 9.0 | 10.0 | 8.5 | 7.0 | 9.0 | 97 |

1. Trading Costs

The Top FCA Regulated Broker For Low Spreads (via its Razor Account)

As a no-dealing desk broker using STP trading execution, the Pepperstone Razor account is your best choice. We captured the spread data for 6 major currency pairs and then averaged the results. While Pepperstone finished 5th overall for commission-based trading with an average pip of 0.36, it is just 0.22 pips less than the overall winner Fusion Markets. More importantly, they finished number one of the FCA-regulated Forex brokers. So if you are a UK resident, Pepperstone should be your first choice.

| Tightest Spreads For FCA Regulated Brokers | |

|---|---|

| Broker | Average Spread |

| Pepperstone | 0.36 |

| ThinkMarkets | 0.46 |

| Tickmill | 0.47 |

| Axi | 0.73 |

| CMC Markets | 0.73 |

| Admiral Markets | 0.79 |

In fact, when we looked at how Pepperstone performed in our tests for individual currency pairs, Pepperstone finished number 1 for USDCHF with an average pip of 0.39, number 5 for EUR/USD (second to Tickmill of FCA regulated brokers) with an average pip of 0.19 and 3rd for AUD/USD (number 1 for FCA regulated brokers with 0.19 pips.

| AUDUSD | EURUSD | USDJPY | USDCHF | GBPUSD | USDCAD | |

|---|---|---|---|---|---|---|

| Pepperstone | 0.19 | 0.19 | 0.36 | 0.39 | 0.41 | 0.61 |

| CityIndex | 0.23 | 0.19 | 0.27 | 0.44 | 0.17 | 0.16 |

| TMGM | 0.15 | 0.15 | 0.33 | 0.51 | 0.35 | 0.43 |

| Fusion Markets | 0.09 | 0.15 | 0.22 | 0.41 | 0.21 | 0.23 |

| IC Markets | 0.23 | 1.19 | 0.24 | 0.57 | 0.27 | 0.45 |

| FP Markets | 0.31 | 0.20 | 0.39 | 0.63 | 0.31 | 0.51 |

In addition to low trading spreads, Pepperstone has no inactivity fees or deposit and withdrawal charges, so we think the broker is worthy of their score of 6.8 out of 10 for trading costs.

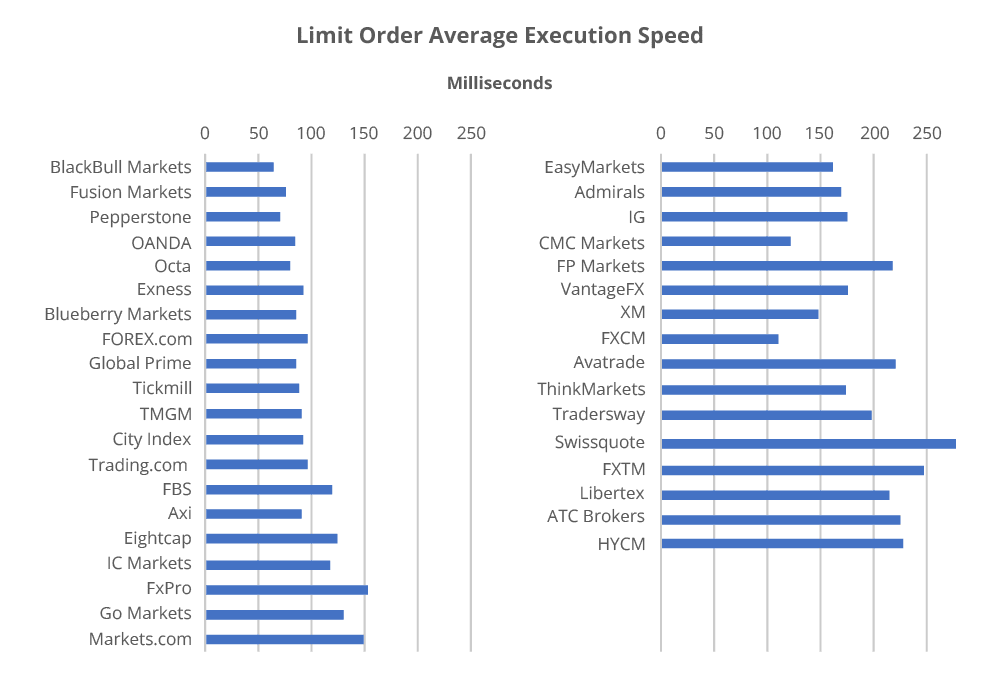

Trading Experience – Fast execution and easy account opening

When trading using variable spreads, especially with market execution, we completely understand the desire to get the spreads at the desired price so as to avoid negative slippage, which can be costly. Faster speed means less slippage risk to we tested the execution speed of 20 brokers and found that Pepperstone was number 2 for limit orders with a speed of 77 ms and number 5 for Market Orders with an avg speed of 100 ms.

2. Account Opening

We opened the account of 20 brokers to see how easy they are to join. Pepperstone seemed to be among the easiest. We especially liked that you do not need to provide your funding details or ID to get started with a demo account which allows you to commence trading immediately. When opening a live account, you will need to upload some ID documentation like a photo of your passport and answer a few questions to confirm you understand what Forex is, but once done, you can get started trading within a day. We liked that you only need to fund the account once you make an actual trade and that Pepperstone gives you a dedicated account manager.

With fast execution, easy account opening, and a good choice of trading account types, we are comfortable with our score of 9 out of 10 for trading experience.

3. Range of Markets

With 92 Forex pairs for trading, 25 Indices, love 20 commodities, and 1000 stocks on global markets such as NYSE, LSE and ASX, Pepperstone provides you with a wealth of choices for trading. This collection is not just limited to CFD trading; all the same products are also available for spread betting. Spread betting is a popular alternative to CFD trading since there are tax savings. And like with Forex trading on a standard account, spread betting has no commissions. Overall, we gave Pepperstone a score of 8.5 out of 10 for their range of products. This score held back only because they don’t have bonds/treasuries.

Our Verdict On Pepperstone

Given that Pepperstone topped our scoring methodology, it is no surprise we think they are the best broker overall. Other features we like about Pepperstone are their choice of trading Platforms, these being MetaTrader 4, MetaTrader 5, TradingView and cTrader and social trading tools such as Pelican and MetaTrader Signals.

Pepperstone ReviewVisit Pepperstone

Your capital is at risk ‘81% of retail CFD accounts lose money with Pepperstone’

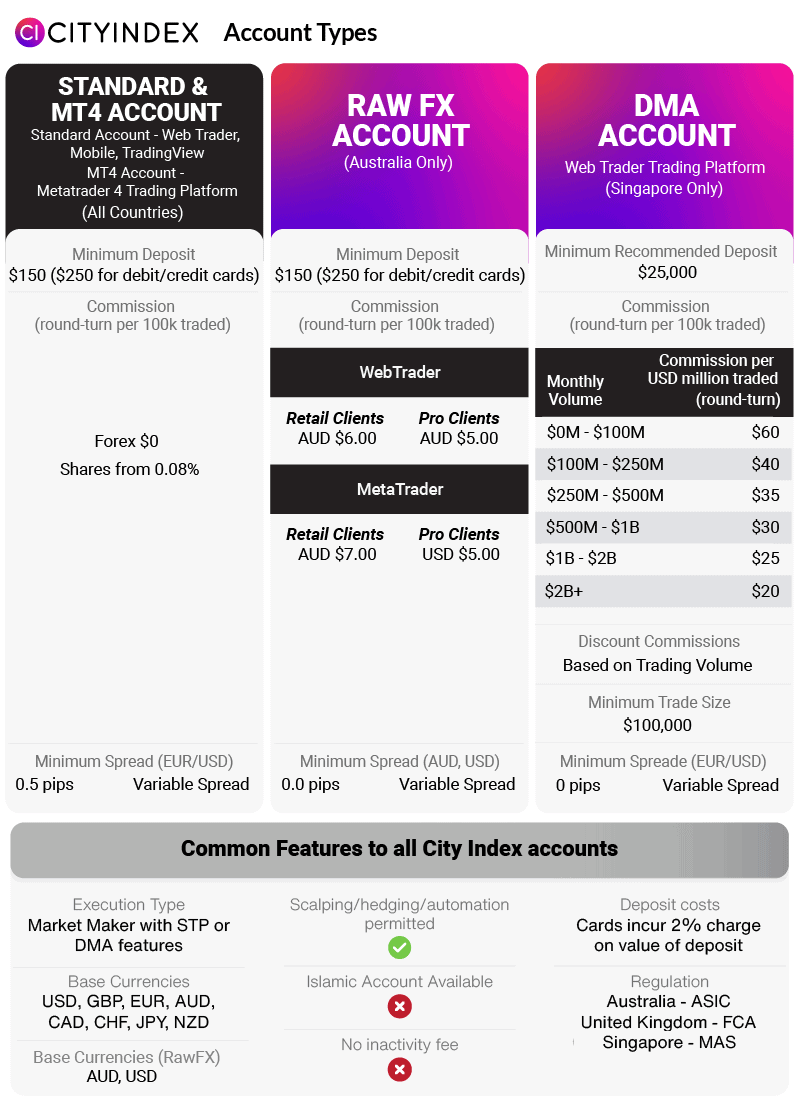

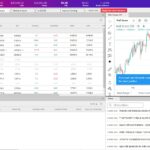

2. City Index - Best No Commission Trading Broker

Forex Panel Score

Average Spread

EUR/USD = 0.07

GBP/USD = 0.011

AUD/USD = 0.8

Trading Platforms

MT4, TradingView, City Index WebTrader

Minimum Deposit

$150

Why We Recommend City Index

Opt for simplicity in trading fees with City Index’s outstanding Standard account, featuring low average spreads and commission-free trading. The broker boasts 0.7 pips on EUR/USD and 0.6 pips on GBP/USD—significantly below the industry average of 1.24 pips. With no commissions, trading fees remain minimal, maximising your profits.

During our review, City Index’s customer service stood out. With 24/5 availability, their prompt responses and impressive expertise in both fundamental and technical aspects left a lasting positive impression on us.

Pros & Cons

- Low average spreads

- It has multiple trading platform options

- Excellent risk management tools

- Guaranteed stop loss with City Index WebTrader

- Lacks MetaTrader 5 platform

- Spread betting only available on Web Trader

- MT4 market range is limited

Broker Details

We Found City Index Has Good Risk Management For New Traders

If you’re not sure why it matters that a broker offers a guaranteed stop-loss order, that’s a good sign that you probably need one that does. Learning to trade involves a lot of trial and error, and most newcomers need some guardrails to protect their capital while honing a strategy. A guaranteed stop-loss, also known as a G-stop, ensures that you automatically exit a position when the market reaches a certain level. Regular stop orders are subject to slippage, but a G-stop requires your broker to fulfil your order at exactly the price you set. As you might imagine, this can easily end up a losing proposition for brokers, who make money off market volatility the same way traders do, and most don’t offer guaranteed stop-loss orders or charge a fee.

Other features new traders should look for are a good education library – as you will want to make sure your trading knowledge is up to scratch – and an easy-to-use trading platform.

Verdict On City Index

City Index is our choice for beginners. If you use the City Index Trading Platform, you can use a guaranteed stop loss to protect yourself should trades not go in your favour. You will need to pay a small premium, but we think this is a small price to pay in the whole scheme of things.

When it comes to educational materials, we scored City Index a solid 25 out of 30 for its resources, with top marks in both the intermediate and beginner categories. Ross and I also reviewed the available webinars and tutorials and found them both accurate and accessible.

Your capital is at risk ‘71% of retail CFD accounts lose money with City Index’

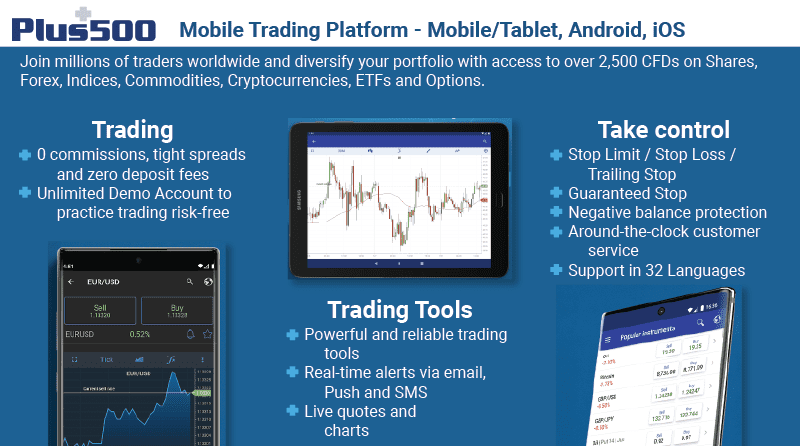

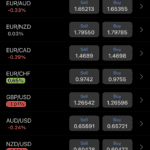

3. Plus500 - Best Trading App

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why We Recommend Plus500

The Plus500 trading app impressed us with its responsive charting, boasting 50+ trading indicators, a guaranteed stop loss and price alerts to stay informed on market shifts. These features proved invaluable for swift market analysis and receiving push notifications when our set price alerts were triggered, even on the go.

With a modest minimum deposit of $100, Plus500 offers accessibility for those cautious about risk. Furthermore, the CFD provider boasts an extensive market range, encompassing over 11,000 products, adding to its appeal.

Pros & Cons

- Excellent proprietary platform

- Low deposit requirement

- Offers over 11,000+ markets to trade

- Guaranteed stop-loss orders

- Lacks other trading platforms

- Has inactivity fees

- No social trading

- No automated trading tools

Broker Details

We Found Plus500 Offers The Best Mobile Trading Experience

While many traders like to tinker with strategies and observe the markets from the comfort of a desktop, others prefer the instant access and real-time engagement opportunities of trading on a mobile or tablet. If you fall into this category, working with a broker offering a premium trading experience in those formats is important. Plenty of excellent brokers offer apps – it’s practically a requirement at this point – but not all are created equal. Some are just watered-down versions of the web or desktop app only with fewer features.

Key features we think are important when choosing a mobile app include the user experience (UX) – most mobile apps are less visually appealing than desktop versions. This leads to the next point, can you test the app with a demo account? When testing, things to look for include advanced charting ability to switch between charts, types of orders such as stop orders, trailing stops, one-click trading, and the ability to expand and reduce the screen size. Lastly, does the app have seamless integration with the web and desktop versions?

To start using a mobile app, decide on your broker and visit the broker App Store if you have an iPhone or Google Playstore if you have an Android.

Our Verdict On Plus500

Not so with Plus500. As a ‘mobile-first’ brokerage, this British firm has poured significant time (and money) into developing a powerful, intuitive app that offers a pared-down interface without skimping on trading tools. We were most impressed that the Plus500 mobile app includes all the same charting and analysis tools as the web trader. We tested the advanced charting and drawing tools and found they provided a comprehensive on-the-go experience.

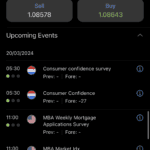

The images captured inside the app below demonstrate how easy it is to access critical features, like the economic calendar, and to open a position.

Your capital is at risk ‘80% of retail CFD accounts lose money with Plus500’

4. eToro - Great Copy Trading Software

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$500

Why We Recommend eToro

We appreciate eToro’s unique copy and social trading features, simplifying access to experienced traders’ insights. This unique offering allows you to benefit from currency market volatility without extensive learning, a rare and often costly feature in other platforms.

Furthermore, eToro’s commendable low average spread of 1.0 pip on EUR/USD, below the industry average of 1.24 pips, stands out. Unusual for copy trading platforms, this competitive spread indicates cost-effective trading without sacrificing service quality.

Pros & Cons

- CopyTrader platform is user-friendly

- Low spreads for Copy Trading

- No commissions for copy-trading

- No MT4 or MT5 support

- No ECN-style accounts

- Has withdrawal fees

Broker Details

eToro Has The Largest Social Trading Community

For those just starting out and casual retail traders, social and copy-trading strategies offer an opportunity to harness the wisdom of crowds and learn from seasoned experts. Social trading, as the name implies, involves mimicking the trading behaviour of a group of like-minded individuals. Copy trading, where smaller traders literally duplicate the positions of professionals and experts, goes even further. Both can help you test out or explore new trading strategies, however, not all platforms offer the necessary trading tools and integrations. If you don’t see MetaTrader Signals, Duplitrade, or ZuluTrade included in a broker’s offering, you may need to move on.

Our Verdict On eToro

Popular broker eToro, on the other hand, is all-in on social and copy trading. Indeed, eToro is famous for its ‘gamified’ approach to trading, with an interface that mimics a social media wall and direct access to advice from its most popular investors. eToro also offers ‘thematic investing’ via Smart Portfolios of assets centred around a specific industry or asset class. A look at some screenshots taken by Sean from inside his account gives you an idea of how closely the platform’s user experience mirrors that of a social media network.

Your capital is at risk ‘74% of retail CFD accounts lose money with eToro’

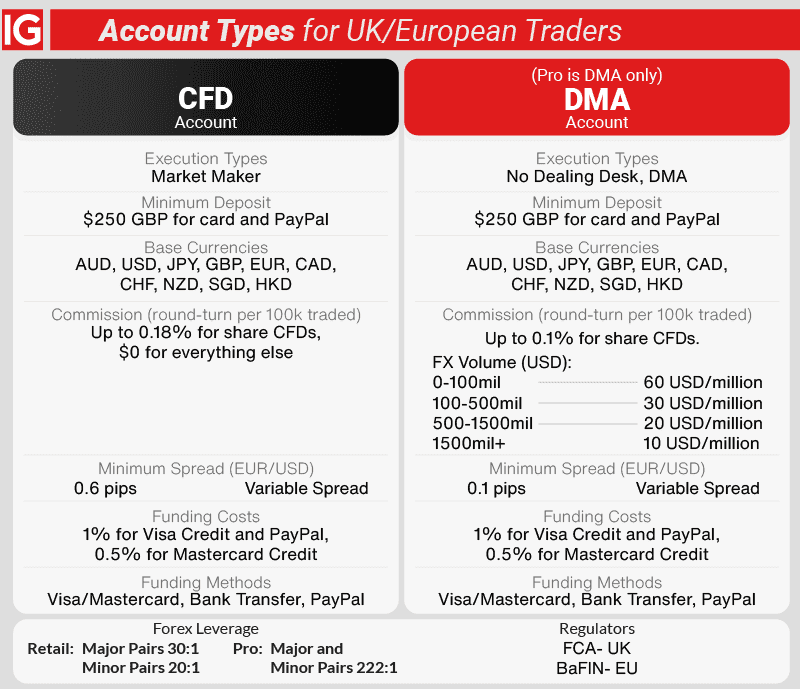

5. IG Group - Largest Range of Trading Products

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

IG Group’s extensive market selection, including 17,000+ options spanning forex, indices, commodities, and stocks, provides unparalleled trading product diversity. This eliminates the necessity for multiple broker accounts. Impressively, amidst this variety, IG Group sustains low average spreads.

Their spread-only account boasts a 1.13 pips average on EUR/USD and a minimal 1.01 on AUD/USD—both figures falling below industry averages. This combination of market breadth and competitive spreads positions IG Group attractively for traders seeking versatility and cost-effective trading solutions.

Pros & Cons

- Largest range of markets available

- Decent choice of trading platforms

- IG Academy is an excellent educational resource

- High minimum deposit compared to others

- Lacks social trading tools

- Tightest spreads for high-volume professional traders

Broker Details

Based On Marketcap IG Is One Of The Biggest Broker For Forex

IG was founded in London, UK, under the name Investor Gold Index but now is more commonly known as IG. This Forex broker is actually one of the world’s oldest and largest, being founded in 1974 and currently boasting 313,000 active traders. With so many active traders, it is no surprise that the broker is in the top ten Forex brokers worldwide by trading volume with 8.6 billion Average Daily Volume Transaction Volume (ADVT).

| Broker | Average Daily Transaction Volume (Billion USD) |

|---|---|

| IC Markets | 18.9 |

| Forex.com | 15.5 |

| XM | 13.4 |

| Saxo Bank | 12.3 |

| HF Markets | 11.5 |

| OANDA | 10.7 |

| AvaTrade | 7.8 |

| IG | 6.8 |

| Pepperstone | 6.7 |

| FxPro | 6.5 |

Our Verdict On IG

Remember what I was saying about the importance of a well-balanced portfolio? If you understand the importance of branching out into other asset classes but prefer to stick to forex or non-crypto CFDs, you’ll need a broker with access to a wide range of markets. Specifically, you’ll need to look for a minimum of 50 currency pairs, and some combination of indices, options, shares, exchange-traded funds (ETFs) and options. Oh, and a trading platform that supports multiple trading strategies. IG is not only one of the oldest and largest Forex brokers, but also has one of the largest ranges of Trading and spread betting products. They even claim to have invented spread betting and let you choose from 4 trading platforms.

Your capital is at risk ‘71% of retail CFD accounts lose money with IG Group’

6. Eightcap - Great Broker with TradingView

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.73

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$250

Why We Recommend Eightcap

We like Eightcap as they offer an overall decent service with low average spreads from 0.06 pips on EUR/USD with their RAW account. This is 72% lower than the industry average of 0.22 pips, though you have to pay $3.50 per lot traded, which is about average.

You can benefit from these spreads with TradingView, a platform with advanced charts and tools that can help analyse the markets, with quality-of-life improvements to trading like one-click trading.

View Eightcap ReviewVisit Eightcap

Fund an Eightcap account and unlock a TradingView Plus plan worth £33.95 per month

*Your capital is at risk ‘74% of retail CFD accounts lose money’

Pros & Cons

- Tight average spreads

- Good choice of trading platforms

- Allows automated trading

- The range of markets is low

- No copy trading tools

- Has a minimum deposit

Broker Details

Eightcap Offers Low Spreads And The Best CFD Range

One of the best risk management tools available to any trader, regardless of the broker: diversification. Even professional forex traders seldom limit themselves to a single tradeable asset, distributing their capital across multiple asset classes. “It’s common sense that you wouldn’t want to put all your eggs in one basket,” explains David Levy, one of our Forex Advisors and professional traders.

Our Verdict On Eightcap

Contracts for difference (CFDs) remain one of the most popular asset categories for day traders, along with crypto. Eightcap, which offers over 400 stocks, ten indices and four commodities, might not seem like the best choice, but for the whopping 86+ crypto CFDs available to trade. That’s more than any other Tier-1 regulated broker. These CFD crypto products are with MetaTrader 4, MetaTrader 5 and Capitalise.ai.

Ross reviewed the average spreads for coins across multiple brokers and found that Eightcap offered the tightest:

| Cryptocurrency CFDs | Eightcap Average Spread |

|---|---|

| Bitcoin | 12 |

| Cardano | 0.0028 |

| Dogecoin | 0.00005 |

| Etherreum | 2.2 |

| Uniswap | 0.2 |

Your capital is at risk ‘73% of retail CFD accounts lose money with Eightcap

‘

7. OANDA - Most Trusted Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 1.4

GBP/USD = 2

AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

In the realm of forex brokers, trust is paramount, making OANDA my preferred choice. Over 25 years, they’ve forged a robust reputation, boasting transparent pricing and approvals from nine regulators, including the FCA and ASIC.

With an overall solid service, we gave OANDA a 81/100 rating, excelling in various categories, notably trust. The offered spreads, averaging 0.7 pips on the top five major pairs, stand out as one of the lowest in our tests this year, reinforcing OANDA’s reliability.

Pros & Cons

- No minimum deposit

- Low average spreads

- Trade partial lots with OANDA Trade

- Not an ECN/STP broker

- Doesn’t offer share CFDs

- Educational resources are limited

Broker Details

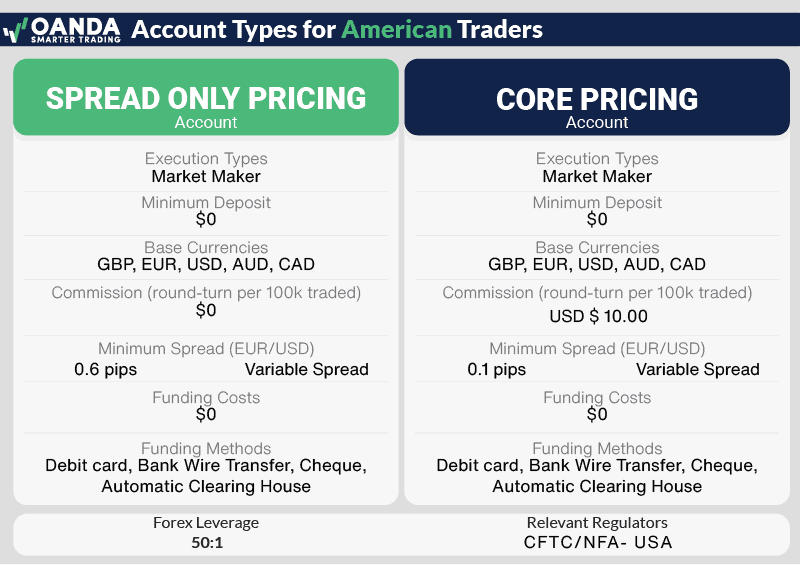

OANDA Has The Best Standard Account

Trading forex and CFDs carries enough inherent risk without the stress of worrying whether your brokerage applies safeguards to keep your funds safe. A license from a Tier-1 regulator like the UK’s Financial Conduct Authority (FCA) or the USA’s Commodities Futures Trading Commission (CFTC) is more than a rubber stamp. It’s a guarantee that the broker follows specific procedures to keep your money safe, such as storing client funds in a segregated account. (We all remember FTX…)

This goes double for Americans and Canadians, who are subject to tighter restrictions than other nationalities. US citizens can’t trade CFDs, for example, no matter where they live in the world, but you can trade spots, futures and options. We always recommend that Americans trade with an NFA or CFTC-licensed broker to avoid legal issues, and OANDA tops the list of North American brokers suitable for US citizens with an overall trust score of 83/100. We gave the New York-based brokerage top marks based on the number of licenses it holds; the length of time in operation – over thirty years; and a solid 3.7 rating on TrustPilot. Other brokers with relevant regulations include IG, Forex.com, TD Ameritrade and Trading.com

Our Verdict On OANDA

OANDA is one of the largest brokers in the US, with 70 Forex pairs for trading using spot prices. You can choose between a spread-only account or a commission-based account called a DMA account. One appealing aspect when trading with OANDA US is the discounts available for high-volume trading.

Your capital is at risk ‘76.6% of retail CFD accounts lose money with OANDA’

Ask an Expert