Best Copy Trading Platform

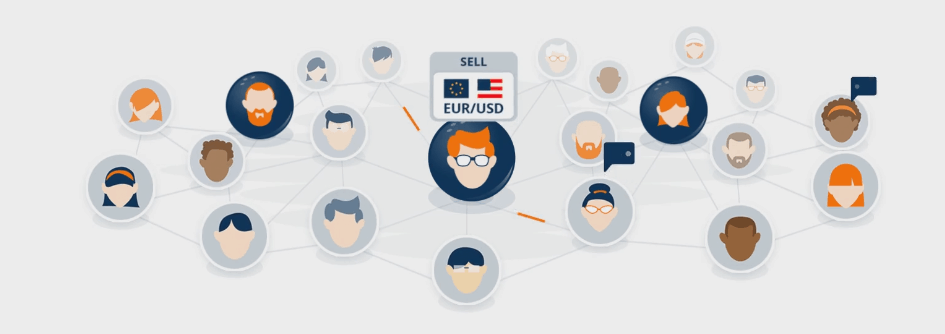

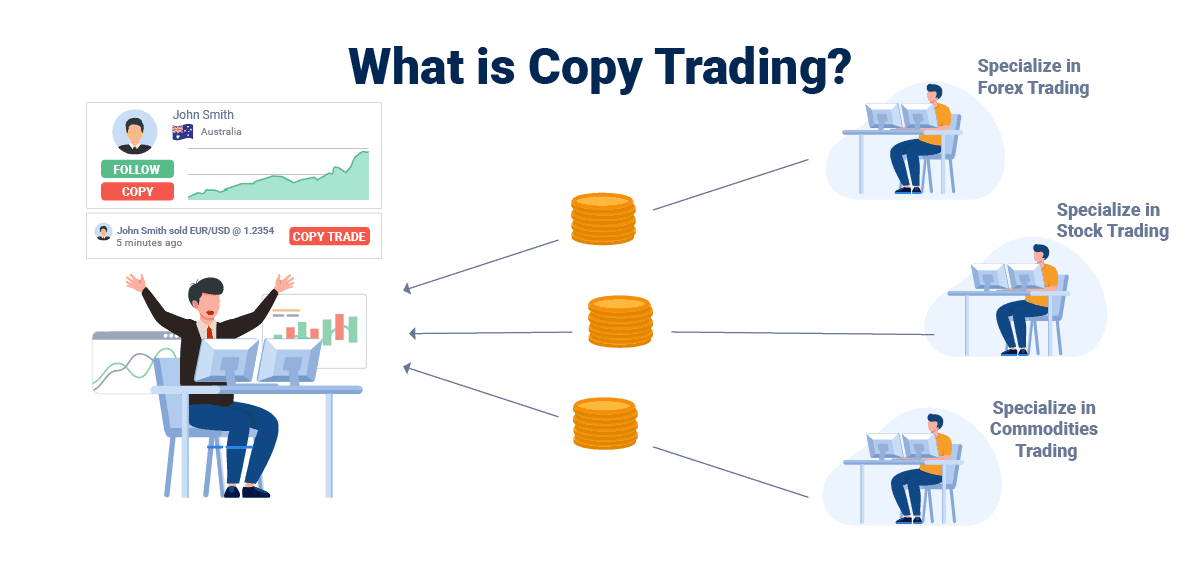

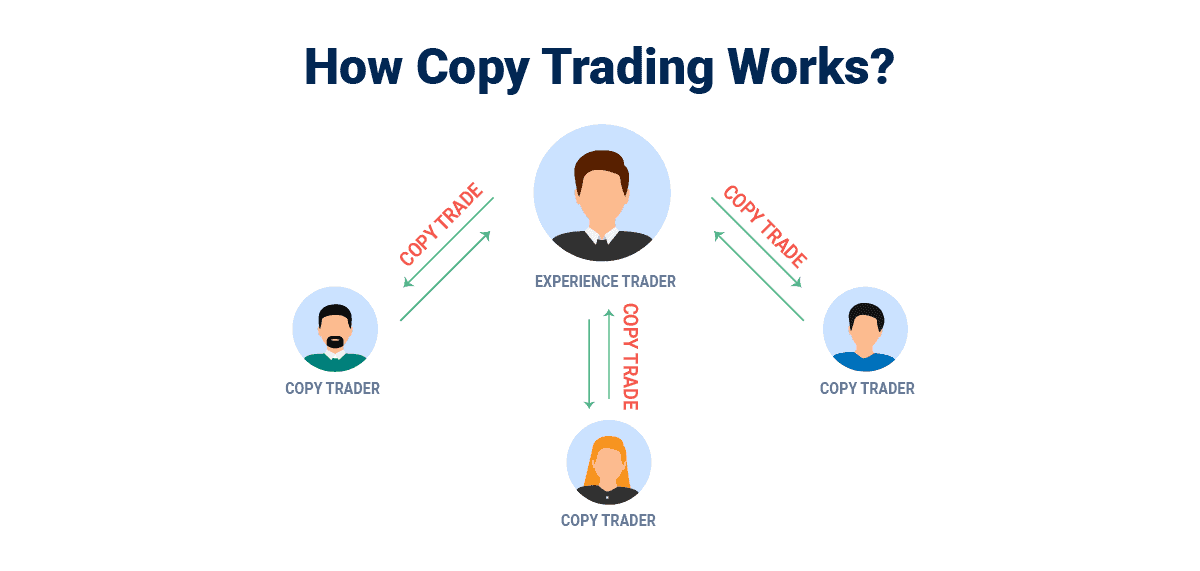

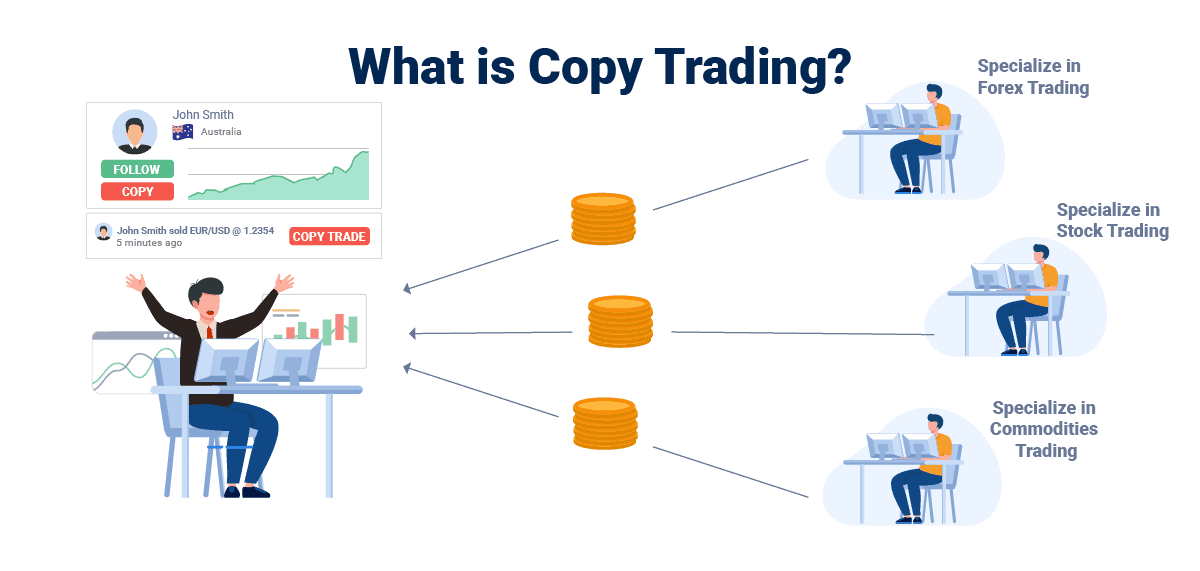

Copy trading allows you to copy positions taken by other traders. Choosing the right trader is critical as your success relies on choosing successful signal providers. Doing it effectively entails using copy trading software to help you find these traders.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

We list the brokers that offer the best copy trading options

- Pepperstone - Best Copy Trading Platforms Overall

- eToro - Top Copy Trading Platform Specialist

- IC Markets - Good Option Choice For cTrader Copy Platform

- AvaTrade - Broker Has 3 Copy Platforms Including DupliTrade

- FXTM - Find Top Copy Traders With FXTM Invest

- ZuluTrade - Best Copy Trading Platform For CFDs

- Darwinex - Best Copy And Social Trading Platform

- MyFxBook - Copy The Best Trader With MyFxBook Automate

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

FCA CySEC, BaFin |

0.10 | 0.30 | 0.20 | £2.25 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

43 |

FCA CySEC |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 46+ | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

93 | CySEC | 0.02 | 0.23 | 0.17 | $3.50 | 0.62 | 0.83 | 0.77 |

|

|

|

134ms | $0 | 61+ | 18+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

64 |

CySEC CBI, KNF |

- | - | - | - | - | - | - |

|

|

|

160ms | $100 | 55+ | 15+ | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

61 |

FCA CySEC |

0.0 | 0.0 | 0.5 | $2.00 | 1.9 | 2 | 2 |

|

|

|

160ms | $500 | 63+ | - | 30:1 | 300:1 |

|

What Is The Best Copy Trading Platform In The UK?

To determine the best copy trading broker we compared the fees, software and features of brokers offering this type of trading. We also considered regulation with extra points give if the broker was FCA regulated within the UK.

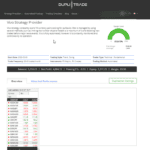

1. Pepperstone - Best Copy Trading Platforms Overall

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We recommend Pepperstone for its distinction as a leading MetaTrader 4 broker, mainly catering to UK traders. Notably, they provide two copy trading options: as a CFD broker or a UK Spread Betting broker, with the latter offering tax benefits for those in the UK. Their social trading tools, including Myfxbook, MetaTrader Signals, and DupliTrade, allow users to track and emulate experienced traders effortlessly, ensuring seamless integration with your Pepperstone account. This makes it our top pick for best copy trading platforms overall for those trading from the UK.

Pros & Cons

- Range of solid copy trading tools

- Low trading fees

- Fast execution speed

- Limited number of providers to copy from

- Lacks no guaranteed stop-loss order

- Demo account expires after 30 days

Broker Details

Pepperstone Presents Copy Trading Solutions Through MetaTrader 4, Signals, and DupliTrade

At Pepperstone, we’ve found that they offer one of the best copy trading software solutions for UK traders and stand as a global leader for the MetaTrader 4 platform. At Pepperstone, we’ve accessed copy trading through MetaTrader 4, Signals, and DupliTrade. Their social trading features enabled us to locate and replicate more seasoned traders’ trades easily.

Pepperstone can provide two copy trading options as a CFD broker or a UK Spread Betting broker, with the latter having tax benefits for UK residences.

With over a decade of business history, Australia-based Pepperstone is a leading multi-regulated CFD and Forex provider with multiple awards. We confirmed that they are duly authorised to offer online trading services by esteemed Forex regulators, such as:

- the Financial Conduct Authority (FCA) in the United Kingdom

- the Australian Securities and Investments Commission (ASIC) in Australia

- the Cyprus Securities and Exchange Commission (CySEC) in the European Union

- the Dubai Financial Services Authority (DFSA) in the UAE

Based on our review, Pepperstone turns out to be the best for UK-based clients when it comes to using a Forex copy trading platform.

UK Clients Can Access A Range Of Trading Strategies On Pepperstone’s Two Third-Party Copy Trading Platforms

UK-based Forex traders with little experience have the opportunity to access a variety of trading strategies from some of the most successful traders worldwide by using Pepperstone’s copy trading solutions, including:

- DupliTrade

- MetaTrader 4 Signals

| MetaTrader Signals | DupliTrade | |

|---|---|---|

| Free Signals | ✔ | ✘ |

| Paid Signals | Weekly or Monthly Subscription fee | ✘ |

| Verified Track Record | ✔ | ✔ |

| Trading History | ✔ | ✔ |

| Social Network | ✘ | ✘ |

| Minimum Deposit | ✘ | AUD $5,000 |

DupliTrade – A Copy Trading Platform And A Popular Trading Strategy Marketplace

This platform granted us access to trading signals delivered by seasoned traders. Simply put, it opens the door for novices to tap into the pros’ Forex trading acumen and tried-and-true trading tactics. We could begin trading automatically based on signals from premier strategy providers straight to our MetaTrader 4 trading account.

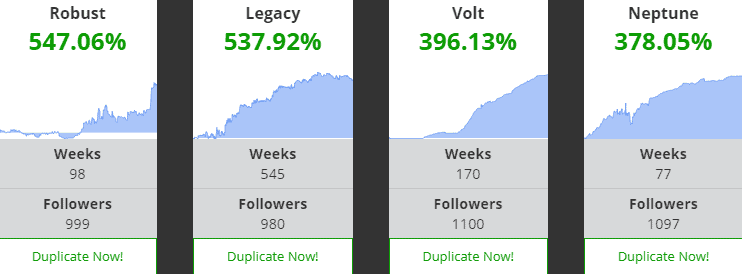

We observed that the top-performing strategies yielded returns of over 500%. Also, DupliTrade strategy providers use varied trading styles and techniques, such as swing trading, trend following, breakout, price action, and more.

MetaTrader 4 Signals

Our dive into MetaTrader 4 Signals showed it as an invaluable tool, providing live access to thousands of trading strategies and signals. Beginners can make trading decisions without being influenced by greed or fear. Pepperstone’s MT4 Signals topped our list for the Best Forex Signal Providers for 2025.

Remember, however, that there is a certain degree of risk that accompanies trading signals because signal providers’ past performance is not indicative of future results. Pepperstone also has no control over signals that come through its third-party social trading platforms. Therefore, signals should not be considered as any form of investment advice.

Why Do We Consider Pepperstone’s MetaTrader 4 As One Of The Best Solutions Offered By FCA-Regulated Online Brokers?

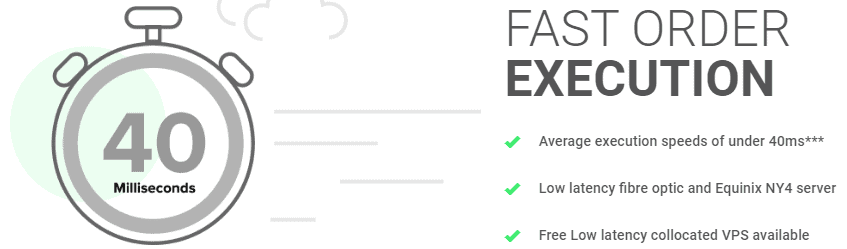

First, the brokerage ensured we received excellent order execution (our trade orders were processed in under 30 ms) with no dealing desk intervention or re-quotes – and this applied across all their platforms, including MetaTrader 5 and cTrader.

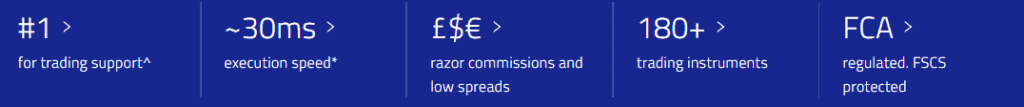

Second, we found that Pepperstone guarantees raw pricing courtesy of its broad and varied liquidity pool. Furthermore, UK clients could access incredibly tight spreads from 0.0 pips across their entire Forex and CFD product range (currently spanning over 180 financial instruments) and benefit from competitive commissions on the Razor trading account.

Pepperstone’s MT4 provided us with diverse chart configurations, adaptable order types, and impeccable support from expert advisors. We weren’t charged any deposit or withdrawal fees across all funding methods. The platform supports ten base currencies: AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, and HKD.

Additionally, we’ve seen Pepperstone earn multiple industry awards, especially for its professional 24/5 trading support. We benefited from a rich array of trading guides, tools, and tutorials, and they consistently host Forex trading webinars.

Summary Of Why Pepperstone Offers The Best Copy Trading Platforms

In summary, our experience showed that when it comes to copy trading solutions, Pepperstone is ahead of the curve. Traders can access low spreads from 0.0 pips on more than 180 instruments and experience rapid order execution speeds of 30 ms. Lastly, they offer a 30-day complimentary demo account with $50,000 virtual funds. This provides a risk-free environment to test trading strategies and copy trading in real-time conditions.

Pepperstone ReviewVisit Pepperstone

Your capital is at risk ‘74.8% of retail CFD accounts lose money with Pepperstone’

2. eToro - Top Copy Trading Platform Specialist

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

We highly recommend eToro, a globally recognised multi-regulated online broker. For UK customers, choosing eToro means joining one of the world’s largest trading communities and accessing its top-tier social trading platform. Here, seasoned investors generously share their expertise and strategies. Newcomers, on the other hand, have a golden opportunity to broaden their market knowledge. Rest assured, eToro has the tick of approval from the Financial Conduct Authority (FCA).

Pros & Cons

- User-friendly platform platform for copy trading

- Solid selection of markets to trade

- No commission on trades

- Lacks support for other trading platforms

- Has withdrawal fees

- No RAW spread pricing option

Broker Details

eToro Allows Traders To Enrich Their Knowledge With Social And Copy Trading

We’ve found eToro to be one of the well-respected, multi-regulated online brokers on the global stage, and it’s evident why they were among the pioneers in introducing the social trade platform. When we opted for eToro, being UK-based, we didn’t just access a trading platform; we joined one of the largest trading communities worldwide. Seasoned traders and investors like us could share expertise and trading strategies, but even those new to the financial markets found it an enriching learning journey.

As an online trading broker, eToro is authorised and regulated by the Financial Conduct Authority (FCA).

eToro’s CopyTrader Can Be Of Benefit To People Without Trading Experience

We recognise that trading success demands relentless dedication and time for research and refining techniques. This can be a daunting or near-impossible task for those of us with bustling daily lives. With limited experience, navigating the markets during the first month can take time and effort.

That’s where eToro’s innovative solution, the CopyTrader feature, came in handy for us. Through it, we could seamlessly view the real-time actions of other users and replicate their trading activities into our accounts, all without incurring additional fees from eToro outside the regular bid-ask spread.

eToro fees only include the standard bid-ask spread (see table below).

| Forex | Crypto | Commodities | Indices | Stocks &ETFs | |

|---|---|---|---|---|---|

| eToro Spreads Starting From | 1.0 pips | 0.75% | 2.0 pips | 100 pips | 0.09% |

How does eToro CopyTrader Work?

Identifying and copying the high-achievers within eToro’s trading community could generate a passive income, especially for beginners. Whether we selected one or multiple traders, it allowed us to diversify across several financial instruments like currency pairs, stock CFDs, commodity CFDs, ETFs, cryptocurrencies, and varying trading styles from scalping to swing trading.

CopyTrader enabled us to browse eToro’s vast user base and detect the top traders by using specific criteria – 12-month return, number of copiers, risk score, assets under management and so on.

Once we identified a trader who matched our criteria, we allocated some of our funds to start copying their positions. Typically, eToro mandates a minimum deposit of $200 for a live account, but they’ve made a temporary adjustment: now you need to allocate at least $500 to a trader. With that commitment, we could instantly mirror the trader’s actions in real time.

UK-based clients will have to satisfy another eToro requirement – there is a minimum amount for every copied position. Generally, the value of every copied trade has to be at least $1, but the brokerage has temporarily changed that amount to $2.

eToro’s Popular Investor Program Offers Benefits For Experienced Traders

Meanwhile, traders who have a solid, proven approach to markets and who are willing to earn a second income can join the broker’s Popular Investor program. To do so, you need to satisfy several specific requirements:

- minimum equity of $1,000

- two full months of statistics on eToro’s platform

- a maximum risk score below 7 for a minimum of two months

- minimum allocated funds (assets under management) of $500

- 150 characters of personal information (including full name and biography) added to their profile

- maintaining an active feed

The Popular Investor program is structured in 4 different tiers – Cadet, Champion, Elite, and Elite Pro, each having requirements and offering certain benefits.

It’s worth noting that we had to achieve the Champion rank to earn a monthly income. The minimum equity and minimum assets under management requirements for each tier are presented below.

| Cadet | Champion | Elite | Elite Pro | |

|---|---|---|---|---|

| Monthly Payment | ✘ | $400 or $800 | 1.5% or 2.0% | 2.0% or 2.5% |

| Minimum AUM | $500 | $50k | $500k | $10M |

| Minimum Equity | $1,000 | $5,000 | $25,000 | $50,000 |

Summary Of Why eToro Is The Top Copy Trading Specialist

In our experience, eToro’s platform is adeptly designed for newcomers. The CopyTrader system is intuitive, the educational resources are superior, and the social platform hosts millions of traders. Notably, in 2020, the average annual profit stood at 83.7% among the top 50 most copied traders. Click the button below to discover more about this copy trading platform.

*Your capital is at risk ‘51% of retail CFD accounts lose money’

3. IC Markets - Good Option Choice For cTrader Copy Platform

Forex Panel Score

Average Spread

EUR/USD = 0.62

GBP/USD = 0.83

AUD/USD = 0.77

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

We highly recommend IC Markets for those seeking an exceptional cTrader Copy trading platform. Boasting nearly 15 years in the industry, this Australian-based broker is one of the world’s leading Forex providers by volume. UK clients can be confident that the regulated CySEC backs them despite the company not holding an FCA licence.

Pros & Cons

- Fast execution speeds

- Low commission trading

- Easy to use copy trading interface

- Limited copy trading strategies to copy

- Range of markets is limited

Broker Details

IC Markets’ cTrader Platform Enables Copy Trading With Advanced Analytical Tools

IC Markets earned our top spot for the best forex broker featuring the cTrader Copy trading platform. Australia-based IC Markets is among the largest Forex providers by volume worldwide, with nearly 15 years of business history. While the broker doesn’t hold an FCA licence, UK clients are served through the CySEC – a regulated entity.

Additionally, the broker’s international operations are managed by an entity under the regulation of the Australian Securities and Investments Commission (ASIC).

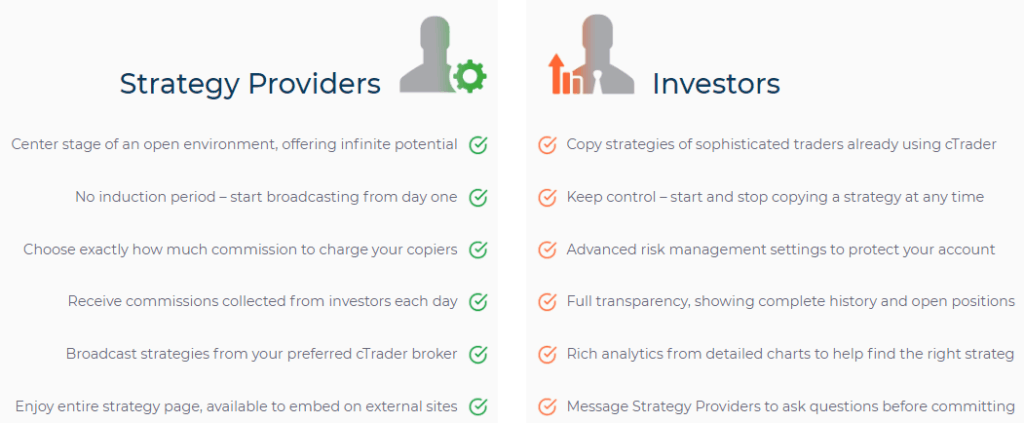

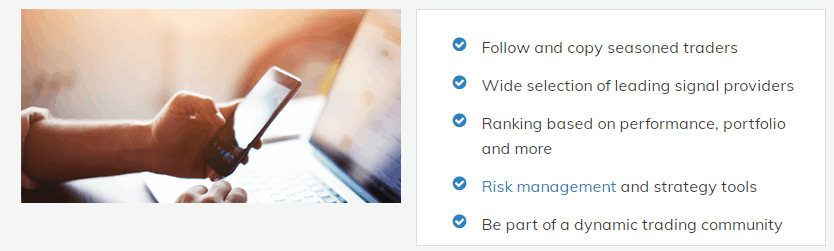

By selecting IC Markets’ cTrader trading software, UK-based clients can take advantage of the cTrader Copy functionality. It is a mirror trading feature previously known as cMirror, which allows users to copy trades and utilie an array of risk management tools.

Mirror Trading With cTrader Offered By A Leading Forex Broker

The cTrader Copy feature enables people with a proven trading system to become strategy providers and to broadcast signals to their followers in exchange for a set of fees (performance, management and volume fees). For followers or investors like us, pinpointing and adopting a trading strategy comes with no long-term commitment. We can cherry-pick a strategy provider by diving deep into comprehensive strategy profiles, taking into consideration parameters such as:

- Time Weighted ROI

- Breakdown of Traded Symbols

- Balance vs Equity

- and History of Followers

The cTrader Copy functionality offers benefits for every client with a cTrader account.

IC Markets cTrader Advantages

First, the cTrader software delivers speed and advanced analytics coupled with the deep interbank liquidity of IC Markets. UK-based clients can access real-time quotes and the lowest possible spreads (starting from 0.0 pips) offered on 64 currency pairs and 16 Stock Index CFDs. The average spread on EUR/USD remains 0.1 pips 24/5, while the brokerage will charge a competitive commission of $6.0 per round turn per Standard Lot.

Second, the cTrader platform opens the doors to Level II Pricing, allowing us a front-row seat to prices directly sourced from IC Markets’ elite liquidity suppliers.

Third, the trading platform ensures low latency and ultra-fast order execution since the broker’s cTrader server is located in the LD5 IBX Equinix Data Centre in London. The server has less than 1 ms latency to VPS providers. This can benefit high-frequency traders and scalpers particularly.

Other advantages of the IC Markets cTrader platform include:

- Multiple order types

- Micro lots availability

- No restrictions on limit orders and stop-loss orders

- Smart Stop Out tool, which ensures maximum protection for retail investor accounts

- No deposit and withdrawal fees

- Range of account funding options, including wire transfer, E-wallets, Credit and Debit Cards

- IC Markets’ Web Trader (cTrader Web) and a cTrader mobile app for both iOS and Android devices

Summary Of Why IC Markets Is The Best cTrader Copy Trading Platform

Overall, IC Markets is branded as a top cTrader broker. The cTrader Copy trading features advanced analytical tools that can enhance your trading experience. You can copy your favourite strategy or trader with a couple of clicks. If you’re new to cTrader, you can open a free demo account by clicking the button below.

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. AvaTrade - Broker Has 3 Copy Platforms Including DupliTrade

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

We recommend AvaTrade for its diverse products, particularly its three copy platforms: DupliTrade, ZuluTrade, and AvaSocial. While it doesn’t operate under FCA regulation, traders can be assured by its licencing from the Central Bank of Ireland (CBI) and seven additional international licenses. This makes AvaTrade a reliable choice for those keen on varied copy trading options.

Pros & Cons

- Fixed spread trading account

- Multiple social trading tools

- Copy trading on multiple platforms

- No RAW spreads option

- High inactivity fee

- Fixed spreads are slightly higher than average

Broker Details

AvaTrade Offers Multiple Options For Copy Trading Platforms

AvaTrade aims to help investors carry out copy trading via 3 powerful copy platforms, including DupliTrade, ZuluTrade, and AvaSocial. Founded in 2007, AvaTrade is an online trading broker not regulated by the FCA; instead, it holds a licence from the Central Bank of Ireland (CBI) and other 7 licences across the globe.

| DupliTrade | AvaSocial | ZuluTrade | |

|---|---|---|---|

| Minimum deposit | $2,000 | $100 | $500 |

| Free or Paid Signals | Free Signals | Free Signals | Paid Signals |

| Social Network | ✘ | ✔ | ✘ |

| Platforms | MT4 & MT5 | AvaSocial mobile app | MT4 & MT5 |

DupliTrade Automated Trading

With DupliTrade, even those of us relatively new to the scene or those who can’t be glued to our screens find the copy trading journey quite seamless. By depositing as little as $100, UK-based clients will be granted access to a portfolio of the best strategy providers. You can automatically duplicate your trading activity directly into your own MT4 and MetaTrader 5 trading accounts with the broker.

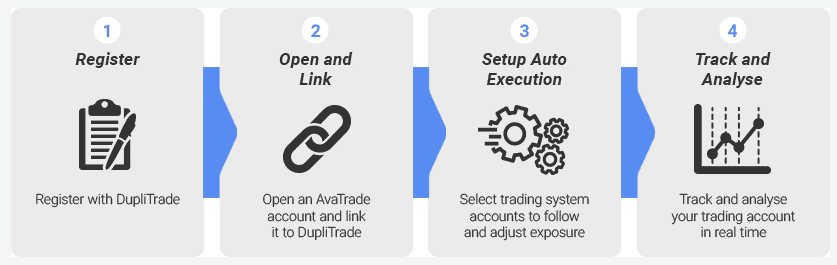

To sign up for DupliTrade’s automated trading service, UK clients need to:

- open a DupliTrade account

- open an account with AvaTrade and connect it to DupliTrade

- choose trading systems to follow and set risk preferences

After that, you will be able to freely track and analyse your trading accounts in real time.

Note that DupliTrade’s strategy providers aren’t just randomly picked; they undergo thorough auditing and possess commendable trading expertise. Thus, we’re confident that our funds are in professional hands when we take cues from them.

AvaSocial – AvaTrade’s Proprietary Platform For Social Trading

AvaTrade’s app, AvaSocial, can be a good choice for traders of different skill levels and knowledge. Those of us just dipping our toes into trading can expedite our learning curve by garnering insights from the pros. The AvaSocial app is the product of a tie-up between AvaTrade and FCA-regulated Pelican Exchange Limited.

The app allows UK clients to get in touch with top traders and qualified mentors to conduct one-on-one or group discussions about particular markets or trading-related topics. They can simply replicate their trading activity in a matter of seconds. Plus, we’re always in the loop with our contacts’ and prominent traders’ real-time activity updates. Engaging with the trading community is lively – we comment, share, or even like particular trades and equally celebrate our own triumphs across various social media.

A unique aspect of AvaSocial is the digital trophies – a recognition of our trading milestones, which we can flaunt to our trading peers.

AvaTrade has ensured an effortless registration process for the AvaSocial mobile app, which takes several minutes to complete.

ZuluTrade Social Forex Trading

Launched in 2007, ZuluTrade is a cutting-edge copy trading platform connecting directly to MetaTrader 4 and MetaTrader 5 through an API. By making a minimum deposit of $500, clients of AvaTrade can access ZuluTrade’s enormous trading community. Get fresh ideas, potentially follow over 10,000 signal providers, build scripts for trading bots, or protect your trading account against inconsistent trades.

Let’s take a look at some of the benefits that the ZuluTrade Automated Trading Platforms offer.

Summary Of Why AvaTrade Is The Best Broker Integrated With DupliTrade

Overall, AvaTrade made it into our best copy trading software for the UK trader list due to its multiple options for copy trading. You can confidently trade on over 1250 financial instruments across 7 different asset classes with competitive spreads. For more information, click the button below and see our full AvaTrade review.

*Your capital is at risk ‘63% of retail CFD accounts lose money’

5. FXTM - Find Top Copy Traders With FXTM Invest

Forex Panel Score

Average Spread

EUR/USD = 1.9

GBP/USD = 2.0

AUD/USD = 2.0

Trading Platforms

MT4, MT5

Minimum Deposit

$10

Why We Recommend FXTM

We highly recommend FXTM for those keen to delve into advanced social trading. Their FXTM Invest is a boon for UK traders, whether newcomers or those pressed for time to track market nuances. This user-friendly tool crafted by ForexTime allows traders to seamlessly mirror seasoned experts’ strategies.

Pros & Cons

- Micro account for micro lot trading

- No commission trading

- Solid educational resources

- Micro account limited to FX and metals

- Withdrawal fees

- Has a minimum deposit

Broker Details

FXTM Offers The Chance To Copy the Trading Patterns Of Professionals With FXTM Invest

Founded in 2011, FXTM is an award-winning CFD and Forex trading service provider authorised and regulated by the FCA and ESMA compliant. On the social trading front, FXTM offers its clientele an innovative solution. Novice traders from the UK and those who lack time to follow market developments strictly have the opportunity to join FXTM Invest. It is a user-friendly program by ForexTime that allows them to follow and automatically copy the trading patterns of professionals.

| Minimum Deposit | Copy Fee | Social Network | Real-Time Notifications | |

|---|---|---|---|---|

| FXTM Invest | $100 | 20% - 40% | ✘ | ✔ |

About FXTM Invest

There are two types of users involved in the program:

- Investors

- Strategy managers

After we set up our accounts with FXTM, we, as investors, can sift through a roster of accomplished traders, assess their profiles, and pinpoint a professional to shadow and replicate. We can allocate funds to a strategy manager upon zeroing in on them.

The minimum deposit required for the program is USD 100, EUR 100 or GBP 100. Every strategy manager will ask for a particular “copy fee”, usually a percentage of profits earned, while investors can withdraw profits from the copy trades at any time.

What Benefits Does FXTM Invest Offer To Users?

First, FXTM Invest empowers us investors to tap into trading avenues without the prerequisite of deep technical understanding. Furthermore, we can modulate our risk quotient using FXTM’s avant-garde tools.

We were free to handpick a strategy manager, ensuring their risk-reward matrix aligns with our personal aspirations and risk appetite. Our funds were always accessible, and the platform’s real-time hourly notifications kept us up-to-date on our investments.

As for strategy managers, first, they can set their own risk-reward parameters and their own preferred fee for the strategy they provide. FXTM will not charge them a commission. Moreover, strategy managers will not have to re-adjust a trading position for every new investor.

Additionally, they can own and maintain a dedicated page for their account, via which investors can connect to them. Last but not least, strategy managers will be able to monitor their performance in real time by using FXTM’s reporting tools.

Summary Of Why FXTM Is A Top Copy Trading Platform

Overall, FXTM allows traders to copy more experienced traders or to become strategy managers. At the end of the day, FXTM is a strong choice for traders who want to try something new in the social network space.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

6. ZuluTrade - Best Copy Trading Platform For CFDs

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

N/A

Minimum Deposit

N/A

Why We Recommend ZuluTrade

We highly recommend ZuluTrade as the go-to platform for those seeking excellence in CFD copy trading. Its unique structure requires it to collaborate with other systems. To utilise its copy trading service, traders must connect with a CFD and Forex brokerage.

Pros & Cons

- Tight standard account spreads

- Good trading platforms for beginners

- Solid range of CFD products

- Tight standard account spreads

- Good trading platforms for beginners

- Solid range of CFD products

Broker Details

ZuluTrade Users Can Copy Trade Professionals On CFD Products

ZuluTrade is a leading social trading platform operated by Triple A Experts SA, a company regulated in the EEA by Greece’s Hellenic Capital Market Commission (HCMC). The trading service is also licenced in the United States and Japan.

Unlike other copy trading platforms, ZuluTrade cannot function independently. It has to be linked with a CFD and Forex brokerage so that clients of that brokerage can access the copy trading service. That is why the minimum deposit required and the available CFD products will be in accordance with the broker’s provisions.

| Minimum Deposit | Subscription Fee | Performance Fee | Trading History | Supported Brokers | |

|---|---|---|---|---|---|

| FXTM Invest | $0 - $2,000 | - $30 for Profit Sharing Account - $0 for Classic Account | 25% | ✔ | 40 FX Brokers |

Among the best brokers supported by ZuluTrade, these names offer the most diverse list of CFDs:

- ThinkMarkets with over 1,500 CFD instruments

- IC Markets with over 850 CFD instruments

- Pepperstone with over 180 CFD instruments

- Oanda with over 100 CFD instruments

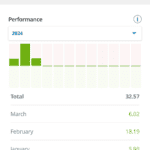

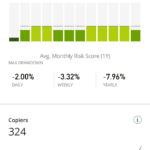

ZuluTrade Copy Top Performing Traders

Similar to most copy trading platforms, there are two types of ZuluTrade users – signal providers and followers. Investors (followers) can select a signal provider based on his/her ZuluRank, which factors in ROI, trading volume, AUM, drawdown, and duration of active trades, among other parameters.

There are specific requirements that a user has to meet to qualify for a signal provider status:

- minimum 12 weeks of trading history with ZuluTrade

- average pip win per trade higher than 3 pips

- maximum historic drawdown below 30%

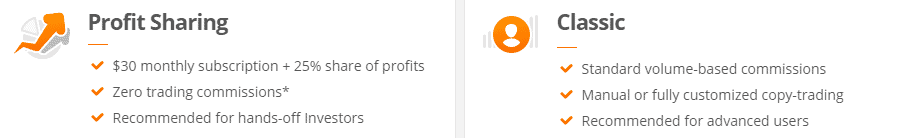

ZuluTrade Account Types

To start copy trading, we needed to initiate and align a ZuluTrade account with a CFD and Forex broker.

Beginners may open a Profit Sharing account, which does not include additional trading commissions for copy trading. You will only pay a monthly subscription fee of $30 and share 25% of your earnings.

Meanwhile, experienced traders may choose to open a Classic account, which charges volume-based commissions.

With ZuluTrade, users can copy trades across a variety of asset classes – currency pairs, shares CFDs, commodity CFDs, stock index CFDs, or cryptocurrencies such as Bitcoin. The platform also grants access to thousands of signal providers with unique profiles.

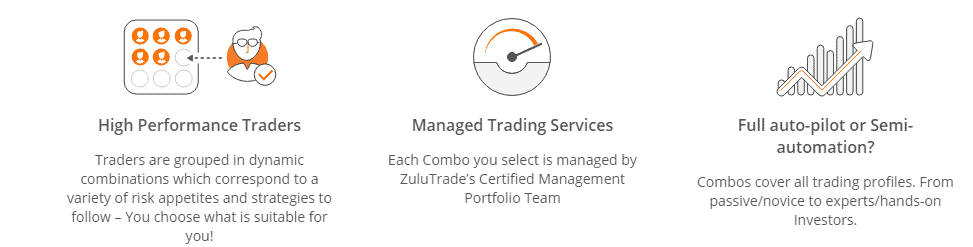

ZuluTrade Traders Combos

ZuluTrade’s Traders’ Combos is a unique feature that combines some of the best trading strategies on ZuluTrade. These investable portfolios allow traders to gain diversified exposure to the market. The Traders Combos are similar to eToro’s CopyPortfolios.

Summary Of Why ZuluTrade Is The Best Copy Trading Platform For CFDs

Overall, ZuluTrade offers a professional marketplace in the area of copy trading. The most unique feature is the new Profit Sharing plan that allows traders to only pay for the trading signals when they are profitable. There is also a risk-free demo account with the same features as real accounts.

7. Darwinex - Best Copy And Social Trading Platform

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

N/A

Minimum Deposit

N/A

Why We Recommend Darwinex

We recommend Darwinex as the top choice for both copy and social trading. This innovative brokerage uniquely bridges professional traders with global market access and backers eager to support them.

Pros & Cons

- Easy to user platform for copy trading

- No minimum deposits

- Low spreads

- Lackluster number of strategies

- Limited markets available

- Performance fees

Broker Details

Darwinex Allows Investing In DARWINs As Tradable Assets

At Darwinex, we found an all-in-one solution for copy trading and social trading. Established in 2012, Darwinex operates under the trading name of Tradeslide Trading Tech Limited, regulated by the UK’s FCA. What we found particularly interesting is its approach to connecting experienced traders with exposure to global markets and users (investors) who support them.

What sets Darwinex apart from traditional copy trading platforms is its unique proposition: instead of directly mirroring the trading activity of other users, we, as clients, had the option to invest in DARWINs (Dynamic Asset and Risk Weighted Investments).

| Management Fee | Performance Fee | Investment Opportunities | Invested in DARWINs | DARWIN Providers Earning Potential | |

|---|---|---|---|---|---|

| Darwinex | 1.2% annual fee on invested equity | 20% | + 2,000 DARWINs | +$55M | 15% performance fee on investor profits |

What Are DARWINs?

Every DARWIN is a tradable asset, and its value is in tight connection either with the performance of a trader who trades at Darwinex or a particular automated strategy.

It is important to note that investors can only invest in trades as DARWINs, or they will never be granted access to traders’ track records and active trades. So, this is different from the traditional copy trading model.

How DARWINs Work?

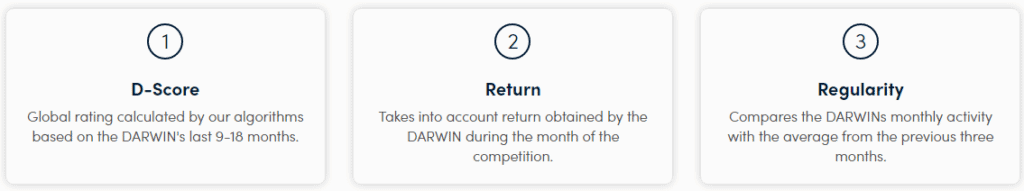

DARWINs (traders) are required to meet certain criteria to be considered investable. Their performance is rated on a scale of 0 to 10, with several parameters like trading experience, risk management strategy, timing, consistency and scalability.

These parameters, taken together, comprise the DARWIN investor appeal (DARWINia) score (D-Score).

The final ranking criteria for DARWINs consist of:

- D-Score over the past 9-18 months

- The return during the month of the competition

- The monthly activity compared to the average from the prior three months

Darwinex will charge investors an annual fee of 1.2% on their invested equity and an additional performance fee of 20% (only if they generate profits with their DARWINs). DARWIN providers (traders) will earn 15% of that 20% performance fee, while Darwinex – the remaining 5%. Consequently, DARWIN providers’ main objective should be to achieve consistent profits.

Summary Of Why Darwinex Is The Best Copy And Social Trading Platform

In conclusion, our experience with Darwinex confirmed its position as an inventive social trading platform under the FCA’s oversight. Darwinex extends two distinct account options – one tailored for traders and another for those inclined towards copy trading. When choosing, ensure the trading account aligns with your trading objectives. The only shortcoming we identified was the restricted selection of available CFD products.

*Your capital is at risk ‘63% of retail CFD accounts lose money’

8. MyFxBook - Copy The Best Trader With MyFxBook Automate

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

N/A

Minimum Deposit

N/A

Why We Recommend MyFxBook

We recommend MyFxBook Autotrade for traders aiming to mirror top performers effortlessly. This service showcases genuine accounts and allows UK clients to replicate diverse trading strategies into their MT4 or MT5 accounts. Owned by Myfxbook, the platform ensures users maintain total command, granting them the flexibility to add or remove trading systems as they see fit. Plus, trade replication is seamless and automated.

Pros & Cons

- Wide range of traders to follow

- Verified MyFXBook performances

- Flexible copy trading options

- Limited choice of brokers offer it

- Email-only customer service

- Can’t connect with a demo account

Broker Details

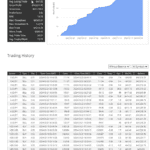

MyFxBook’s Copy Trading Platform Has A User-Friendly Interface Perfect For Beginners

Our experience with MyFxBook Autotrade revealed it as a noteworthy account-mirroring service, focusing exclusively on real accounts without needing our own VPS. AutoTrade, a Myfxbook venture, enables UK-based clients like us to replicate various trading systems straight into our MT4 or MT5 trading accounts.

The platform afforded us total autonomy, allowing us to introduce or eliminate trading systems from our accounts at our discretion. Copying trades are carried out automatically through the use of AI algorithms.

| Fees | Minimum Account Balance | Track Record | Trading Strategies | |

|---|---|---|---|---|

| MyFxBook AutoTrade | -Free -Or, markup spreads | $1,000 per system (recommended) | Fully Verified | +40 Systems |

How To Use AutoTrade?

Upon exploring, AutoTrade only showcased dependable (vetted) trading systems and real-time systems active on live accounts. This ensures that traders like us don’t stumble upon systems operating on demo accounts.

To start trading forex with AutoTrade copy trading platform, UK-based traders need to:

- create a live MT4 trading account with a Forex broker of their choice

- sign up for AutoTrade on the MyFxBook website

- connect their MT4 account to MyFxBook AutoTrade

It’s worth noting that all trading systems we observed on Myfxbook operated with real funds, maintained a minimum account balance of $1,000, exhibited a trading chronicle of at least 100 trades, had a track record spanning a minimum of 3 months, and the average pip win per transaction surpassed 10 pips.

AutoTrade will present only real data with accurate statistics. This may help traders reduce the high risk that stems from trading CFDs and improve their profitability. We appreciated that the platform refrained from displaying endless drawdowns.

Summary Of Why MyFxBook AutoTrade Is A Good Choice For Beginner Traders

In wrapping up, our exploration affirmed MyFxBook’s reputation as one of the leading names in the FX copy trading realm. The FXAutoTrade copy trading platform stands out primarily due to its beginner-friendly interface. Notably, the platform supports esteemed brokers such as Pepperstone, Fusion Markets, IC Markets, and FP Markets.

Ask an Expert

what would happen if i copied the portfolio of a non-UK trader on eToro and they traded crypto CFDs- something I am not allowed to do due to FCA regulation?

Traders in the UK are no permitted by the FCA to trade crypto products For this reason you will not be able to copy Crypto products from other traders.