Best Forex Brokers In The UK

For the 10th year running, I’ve compared FCA-regulated forex brokers that offer forex trading in the United Kingdom. Below is my shortlist of the best Forex brokers in The UK based on important trading features like spreads and Forex trading platforms.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

My findings determined the July 2025 top FCA-regulated brokers are:

- Pepperstone - Best Forex Brokers In UK Overall

- Eightcap - Great Range of Markets

- OANDA - Most Trusted Broker Overall

- eToro - Great Copy Trading Software

- Plus500 - Best Forex Broker For Beginners

- IG Group - Good Range Of Trading Platforms

- CMC Markets - Top Range Of Currency Pairs

- XTB - Best Forex Demo Account

- City Index - Top Forex Broker For No Commissions

- FxPro - Good UK Based Customer Services

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (GBP Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

FCA CySEC, BaFin |

0.10 | 0.30 | 0.20 | £2.25 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

91 |

FCA CIRO |

- | - | - | - | 0.6 | 0.9 | 0.7 |

|

|

|

- | $0 | 70+ | 4+ |

|

||

Read review ›

Read review ›

|

43 |

FCA CySEC |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 46+ | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

57 |

FCA CySEC |

- | - | - | - | 1.70 | 2.3 | 1.4 |

|

|

|

140ms | $100 | 71+ | 15+ | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

96 |

FCA CySEC, ASIC |

0.06 | 0.23 | 0.27 | £2.25 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

71 |

FCA BaFin, CySEC |

0.16 | 0.59 | 0.29 | £3.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $450 | 100+ | 12+ | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

69 |

FCA BaFin |

0.5 | 0.9 | 0.6 | £2.50 | 1.12 | 1.30 | 1.64 |

|

|

|

138ms | $0 | 338+ | 19+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

51 |

FCA CySEC, BaFin |

0.9 | 0.14 | 0.13 | - | 0.9 | 1.4 | 1.3 |

|

|

|

160ms | $250 | 49+ | 16+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

66 |

FCA ASIC, MAS |

- | - | - | - | 0.70 | 1.1 | 2.2 |

|

|

|

95ms | $150 | 84+ | 25+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

59 |

FCA CySEC |

0.32 | 0.37 | 0.51 | £2.63 | 1.32 | 1.7 | 1.95 |

|

|

|

151ms | $0 | 69+ | 30+ | 30:1 | 200:1 |

|

Who Are The Best Forex Brokers In The UK?

By comparing spreads, commissions, trading platforms and features we were able to rank the best FCA regulated trading accounts for UK traders.

1. Pepperstone - Best Forex Brokers In the UK Overall

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.69

AUD/USD = 1.22

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

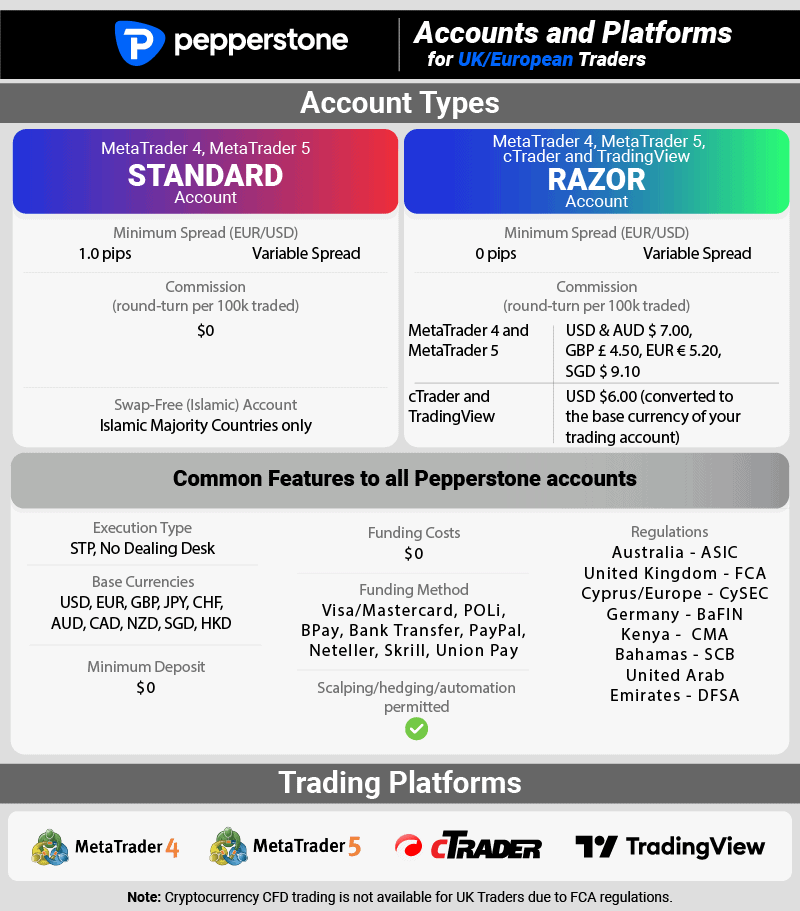

I rated Pepperstone as my best forex broker for the UK with a score 98/100. Features I liked with this broker include the Razor account which my tests found has 0 pip spreads, 93 currency pairs and some of the fastest execution speeds according to my tests.

Pepperstone also offers five trading platforms (from TradingView to MT4) and provides clients with excellent tools like Smart Trader Tools, trading signals from Autochartist and copy trading tools.

Pros & Cons

- Tight spreads with Razor account

- Fast execution speeds

- Great range of 5 trading platforms

- Lacks stockbroker services

- Educational resources are outdated

- Limited e-wallet payment methods

Broker Details

Razor Account Offers Zero Pip Spreads

I found the Razor account to be the best account Pepperstone offers as they low Raw spread from 0.0 pips and commissions at £2.25 per lot traded. I found these commissions to be £0.19p cheaper than the industry average (£2.44).

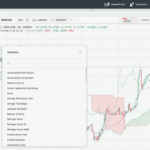

Not only did I find Pepperstone have spreads from 0 pips, but some Forex pairs like the EUR/USD remain at zero pip spread for long periods. My colleague, Ross Collins used the MT4 Expert Advisors tools called SpreadMonitorEA to capture the spreads with the Razor accounts over 24 hours to see how they performed against other brokers.

Ross found that Pepperstone provides 100% zero-pip spreads on EUR/USD (outside rollover), making them the tightest available in the industry. In addition to EUR/USD, he found the same for other currency pairs like AUDUSD GBP/USD, USD/CAD, USD/CHF and USD/JPY.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY |

|---|---|---|---|---|---|---|

| Pepperstone | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| CityIndex | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| EightCap | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| Admiral Markets | 100.00% | 99.57% | 79.13% | 95.22% | 100.00% | 100.00% |

| ThinkMarkets | 95.65% | 100.00% | 91.30% | 91.30% | 91.30% | 100.00% |

| Tickmill | 100.00% | 100.00% | 26.09% | 100.00% | 95.65% | 95.65% |

| Axi | 100.00% | 100.00% | 65.22% | 91.30% | 60.87% | 78.26% |

| CMC Markets | 100.00% | 95.65% | 65.22% | 86.96% | 65.22% | 78.26% |

Discover how Pepperstone compares against your current broker with our Pricing Tool to see how Pepperstone performs. Try it below:

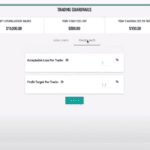

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Access Popular 3rd Party Trading Platforms

I was also impressed with the range of trading platforms available. You can choose from MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, the Pepperstone Trading App, and TradingView. This range of platforms means Pepperstone has the best platform options for to suit your trading style.

If you like chart trading for example, TradingView with its 400+ built-in indicators and 110+ smart drawing tools is a top choice.

If you want automation capability, MetaTrader 4, has a vast marketplace available with custom Expert Advisors you can use. MetaTrader 5 also has these Expert Advisors plus the ability to trade shares while cTrader is great for scalping.

These trading platforms are complemented with copy trading tools like cTrader Copy if you use cTrader and Copy Trading by Pepperstone with a MetaTrader 4 or 5 trading account.

Fast Execution Speeds On Pepperstone

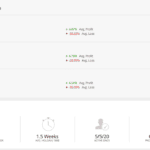

Tests by Ross Collins also found Pepperstone has fast execution speeds, which I think is a solid indicator of the broker’s trading conditions. Faster speeds reduce the chance of experiencing from slippage. Ross found that Pepperstone’s limit order speed averages 77ms, the second fastest of the brokers he tested and 100ms average for market orders.

We think this pairing of fast execution speeds and zero-pip spreads on EUR/USD makes Pepperstone an excellent candidate if you scalp the markets.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

2. Eightcap - Great Range of Markets

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 1

AUD/USD = 1.2

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

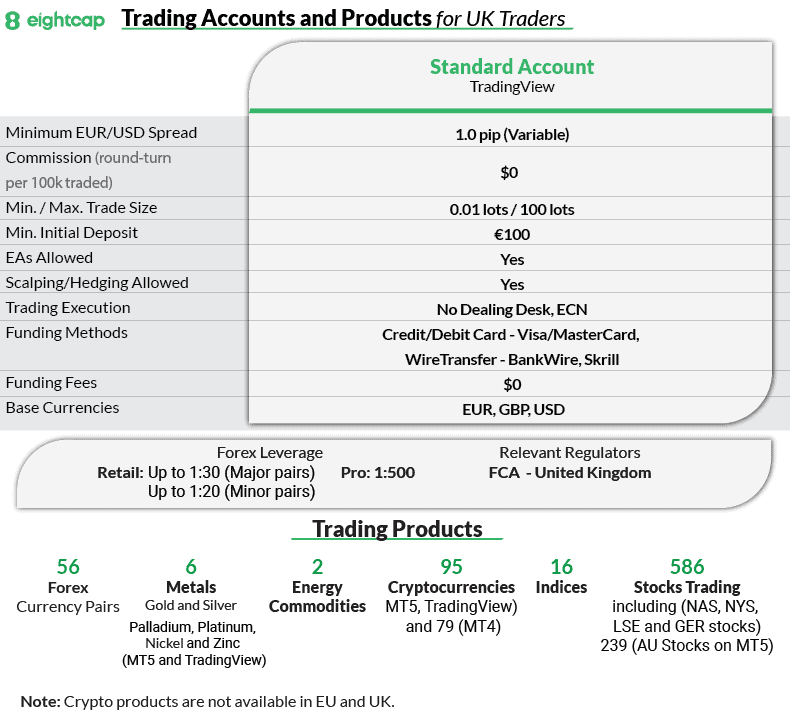

After receiving an FCA licence late last year, Eightcap is a new entry to my list for the UK, claiming second place. Eightcap is the only dedicated TradingView specialist in the UK and offers over 360+ markets. My tests found they have no Forex commissions with spreads avaging a 1.16 pips on EUR/USD.

With its low trading costs, great customer support, and wide range of markets, I scored Eightcap 96/100. If you want a broker with the best technical analysis platform, then Eightcap is a top choice.

View Eightcap ReviewVisit Eightcap

Fund an Eightcap account and unlock a TradingView Plus plan worth £33.95 per month

*Your capital is at risk ‘74% of retail CFD accounts lose money’

Pros & Cons

- Tight spreads on Standard account

- Offers TradingView platform

- Great range of 360+ products

- Limited range of trading platforms in the UK

- Cannot copy trade

- Education resources could be improved

Broker Details

Solid Range of Financial Markets

During my time testing Eightcap, I was impressed with their range of markets, which offers 360+ products, covering:

- 55 forex pairs (including major, minor, and exotic forex pairs),

- 150 share CFDs from UK to US markets like Tesco and Apple,

- 10 commodities covering gas and metals,

- 30 stock indices with FTSE 100, S&P 500, and NASDAQ available.

While you can certainly find other brokers with more products. Eightcp offer the most liquid asset like EUR/USD, Tesla, gold, and the FTSE 100 markets. As a result, this makes Eightcap a good choice if you are beginners as it forces you to focus on only the most important products and avoid being overwhelmed by choices.

Low Spreads With The Standard Account

Our analyst Ross Collins tested Eightcap’s spreads using the IceFX SpreadMonitor EA on MT4. His tests found that the brokers’ EUR/USD spread average was 1.16 pips, which is very competitive for commission-free trading. With superior spreads compared to notable brokers like City Index and FxPro, Eightcap is one of the best choices for low spreads in the market.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Trade with TradingView on Eightcap

While Eightcap only offers the TradingView, it is my favourite platform. I like the platform because of its large range of technical indicators, which stand at 400+ built indicators, 100,000 public indicators and 11+ smart drawing tools.

These drawing tools are always increasing with automated trend lines to help you spot near-term trends easily being a recent introduction.

TradingView also comes with excellent backtesting features so you can validate your trading strategies before putting them into practice. Backtesting tools I like include Bar Replay so you can test against historical performance and Strategy Tester which allows you to use Pine Script to create custom tests.

Other useful tools include screeners to identify potential trading opportunities based on strict criteria, new and analysis tools and economic calendars.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

3. OANDA - Most Trusted Broker

Forex Panel Score

Average Spread

EUR/USD = 0.6 GBP/USD = 0.9 AUD/USD = 0.7

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

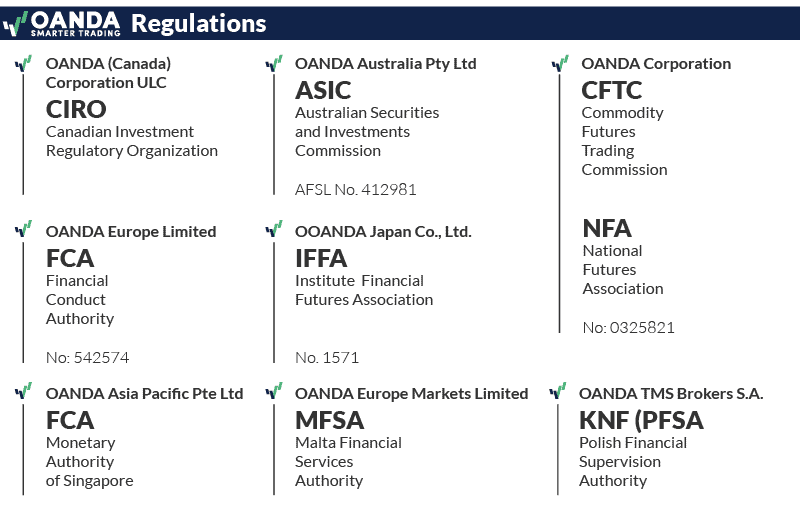

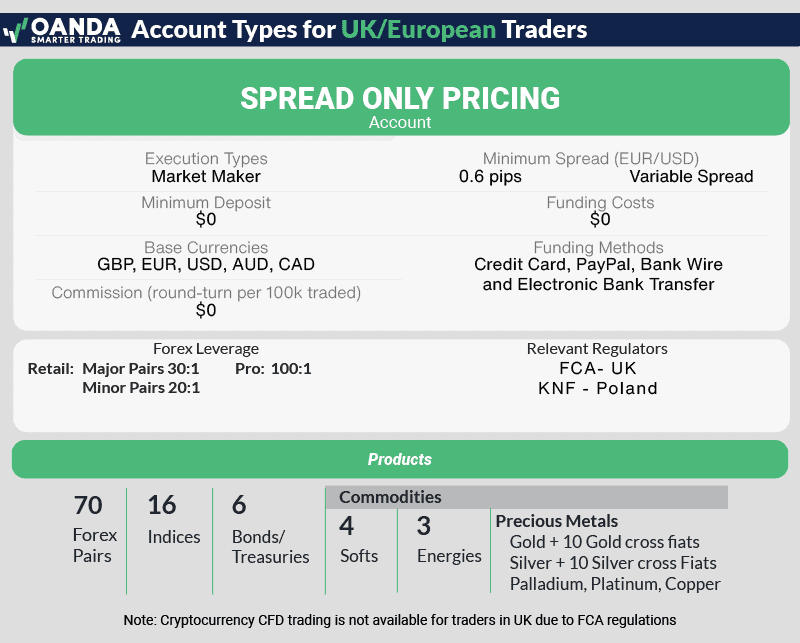

OANDA is my top pick for “most trusted” forex broker. With regulation from Tier-1 across the globe, over the 30 years, and a 4.1 score on Trustilot, I gave OANDA 100/100 for trust

OANDA provides excellent trading conditions including commission-free trading with spreads from 0.60 pips and top trading platforms. These platforms include MT4, MT5 TradingView and the OANDA Trade platform. If you use the latter, you will find it has a guaranteed-stop loss order, ability to order with small trade sizes and advanced charting from TradingView.

Pros & Cons

- Best regulated broker

- No minimum deposit

- Trade customised lots on OANDA Trade

- Doesn’t provide 24/7 support

- Not an ECN/STP broker

- No share CFDs

Broker Details

Most Trusted Forex Broker In UK

OANDA scored top marks (100/100) in my tests for safety as they are authorised by among the most regulators out in the markets with five Tier-1 authorities. Naturally OANDA is regulated by the FCA (the only one you need to be aware of as a trader in the UK) along with other top authorities like ASIC and the US’ CFTC/NFA.

I like to see brokers regulated by multiple authorities as it means they go through regular audits and have frameworks in place to provide secure and transparent trading services.

OANDA Trade Platform Is Great For New Traders

While testing the broker’s range of trading platforms, I found their OANDA Trade web platform is an excellent option if you’re a beginner. The platform has TradingView’s charting, so you get the best technical indicators like RSI or Bollinger Bands along with decent beginner-friendly tools like stop-loss and take-profit.

You can open positions with smaller trade sizes from 1 unit compared to 1,000 units from other brokers, allowing you to trade with smaller trading balances. I was able to open a 1 unit position on EUR/USD with a margin of £0.03 or 100 units for £2.77.

In addition to small trade sizes, you can use guaranteed stop-loss orders with OANDA Trade to protect your positions during unexpected volatile markets.

Spread-only Pricing Accounts with Tight Spreads

The spread-only pricing is your only option with OANDA’s trading account which means you do not pay commission. OANDA’s EUR/USD spread starts from 0.60 pips, but I found it hovers around 0.80 pips during most of the London trading session.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

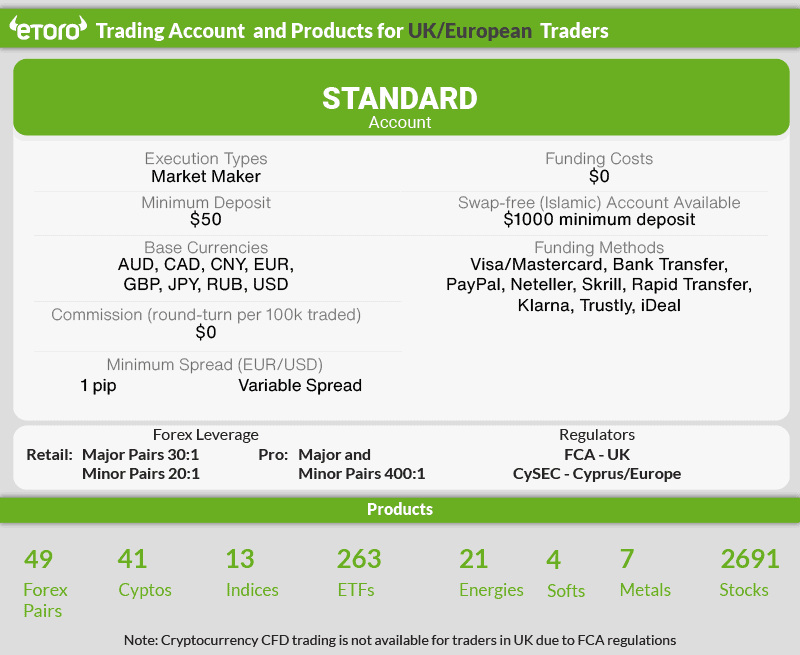

4. eToro - Great Copy Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

I found eToro to be the most user-friendly way to copy trade thanks to its CopyTrader platform. This platform has a wealth of tools to help you find and copy the right signal providers within its extensive network of 40 million+ traders.

eToro also impressed me with its 6,000 financial instruments and interesting financial baskets which allow develop diverse portfolios.

Lastly, I found eToro’s spreads to be competitive (starting from 1 pip for EUR/USD). You will also find that all markets’ spreads are commission-free (including Share CFDs), making it a great option for copy trading.

Pros & Cons

- Easy access to copy trading tools

- User-friendly platform

- No commissions on trading

- Slightly expensive spreads

- Doesn’t support MT4

- Has withdrawal fees ($5)

Broker Details

CopyTrader Is The Best Platform For Copy Trading

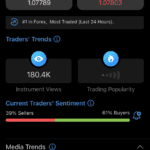

eToro’s CopyTrader is my top choice for copy trading as I found its platform easy to navigate, allowing you to mirror traders and invest your capital in a few clicks. This makes it easy for every level of trading experience to open an account and match their trading needs with any of the 20 million traders to copy trade.

The most noticeable feature for me was its filter system. This filter system gives you 14 settings to select to help find the right copy trader for your requirements. Some of these settings include profitability, risk score (eToro’s proprietary score), and the number of followers a trader has for social proof to help validate the trader’s performance.

Transparency Through eToro’s Copy Trader Profiles

Each trader’s detailed profile page serves as a comprehensive performance dashboard. You can view their complete trading history, performance metrics, and follower growth trends. This detailed insight helps you find signal providers whose trading style and risk approach match your investment goals.

Since eToro acts as both the broker and platform, all trades are independently verified and recorded. This ensures every performance statistic is authentic, giving you reliable data to make informed decisions about which traders to follow.

Interesting Trading Baskets With CopyPortfolios

eToro has pre-built investment portfolios or trading baskets known as Copy Portfolios. These trading baskets mix assets like stocks, ETFs, commodities and currencies which is a good way to diversify your portfolio and manage risks.

3 types of CopyPortfolios are available:

- Market Portfolios: are baskets that track specific markets or sectors

- Top Trader Portfolios: which is like an index combining the best traders in the eToro community

- Partner Portfolios: which are managed by professional partners of eToro like fund managers.

To trade these baskets are rebalanced automatically on a regulator basis to ensure the asset allocation is optimised at all times. You will need at least $500 to start trading, but there are no management fees since they are part of the spread.

*Your capital is at risk ‘51% of retail CFD accounts lose money’

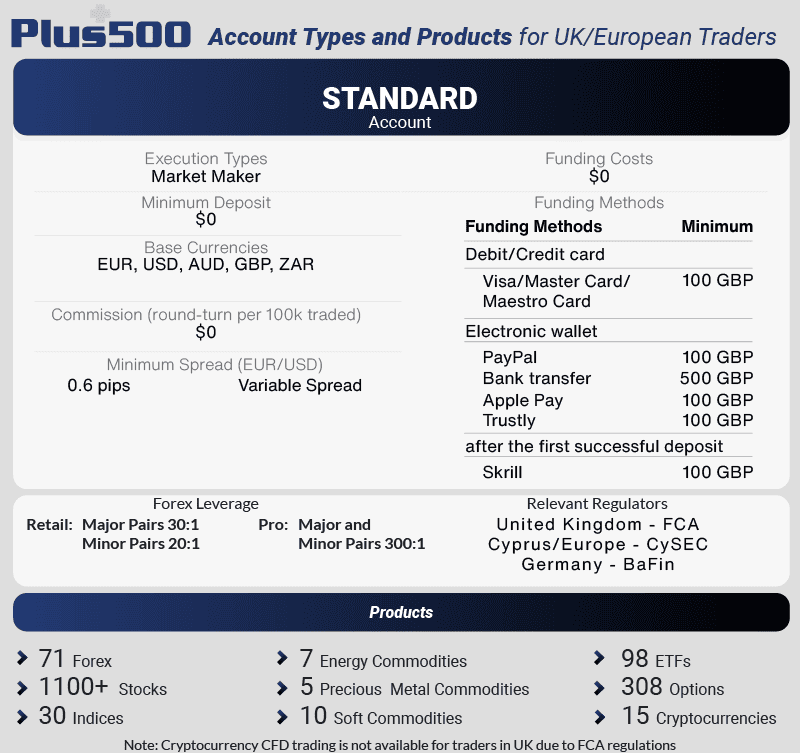

5. Plus500 - Top Forex Trading App

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why We Recommend Plus500

With commission-free trading, a guaranteed stop-loss and a wealth of trading instruments, CFD Provider Plus500 platform has excellent trading conditions for beginners. You will also find the platform has 54 educational materials covering all sorts of Forex topics from beginner to advanced level.

The broker’s spreads aren’t anything to shout about at 1.20 pips on EUR/USD but with risk management and market sentiment analysis (insight+), there is value to be found.

Pros & Cons

- Guaranteed stop-loss orders on Plus500 platform

- Additional trading tools with +Insights

- Excellent 50+ catalogue of trading lessons

- Inactivity fees

- No MetaTrader 4

- Lacks market research tools

Broker Details

When I opened my Plus500 account, I found the broker to offer a beginner-friendly service by offering a Standard account (spread-only, no commissions) and its proprietary trading platform. The Standard account’s spreads are inline with the rest of the industry, averaging 1.20 pips on EUR/USD, which is respectable for new traders.

Excellent Trading Tools For Beginners

I found that the Plus500 trading platform is ideal for beginners. The platform contains 119 indicators, 21 drawing tools, and 13 chart types for technical analysis, along with +insights to track market sentiment.

As a beginner, you can use this to help gauge market direction using Plus500’s client data, which is helpful in confirming your market analysis while learning to trade.

Top Risk Management Tools

You also have guaranteed stop-loss orders which protect you from market slippage. These are especially useful if you open a trade around high-impact market news like the non-farm payrolls, where the market can whipsaw, causing price slippage, which can be very costly.

Best Educational Resources for New Traders

In my opinion, Plus500 has the one of the most comprehensive collection of educational materials. The Beginner’s Guide and Trader’s Guide are 51 lessons that will get you going with Plus500 and learning trading strategies, with videos to make it easier to understand.

Webinars from Plus500 are also a great resource offering independent analysis covering trading strategies, market analysis, and risk management. These free webinars are provided by Corellian Academy, and I found them quite insightful, offering topics like how to trade the slow stochastic indicator in commodity markets.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

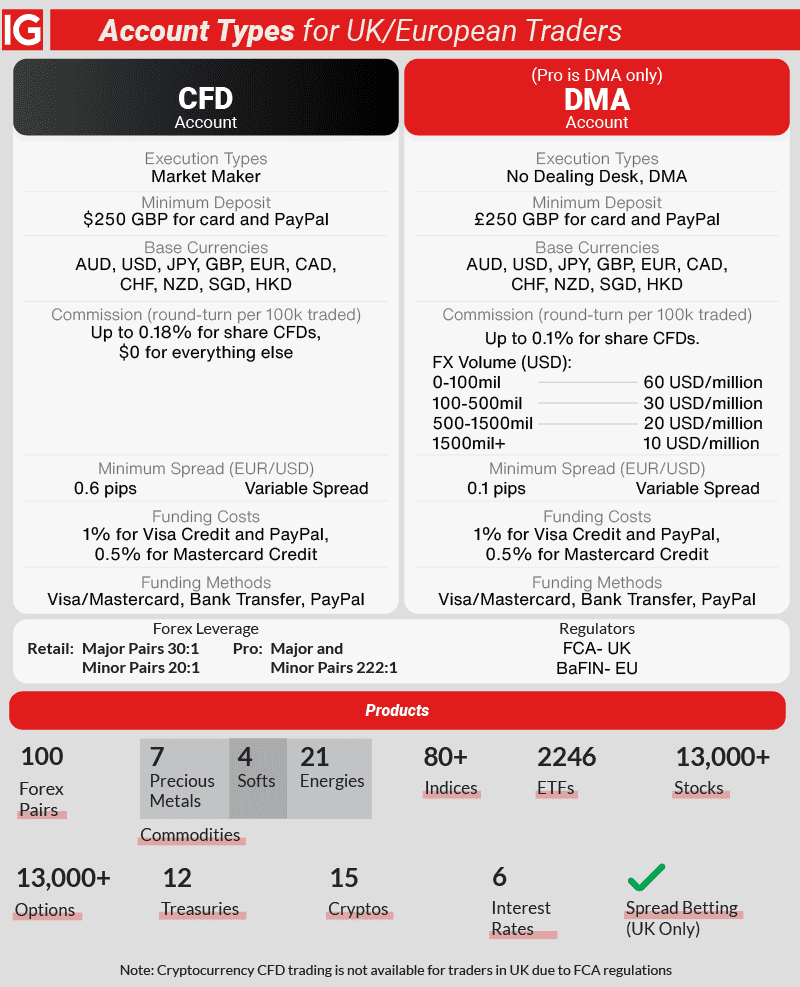

6. IG Group - Best Range Of Trading Platforms

Forex Panel Score

Average Spread

EUR/USD = 1.13

GBP/USD = 1.66

AUD/USD = 1.01

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

I awarded IG Group 78/100 in my review with the broker performing well in its trading platform category thanks to offering IG Trading platform, MT4, ProRealTime, and L2 Dealer. This range of platforms offers something for any trading style, from beginners (IG Trading platform) to professionals (L2 Dealer).

IG Group also has 17,000 financial products available, making it a top multi-asset broker with low spreads on its spread-only account. Among these product you will find less common choices like futures and options trading which can reduce your overnight charges. By removing swaps (or rolling fees) you can hold positions open for longer periods which is ideal for share CFDs.

Pros & Cons

- Great selection of advanced trading platforms

- Extensive range of 17,000 markets

- Provides market analysis with IGTV

- High minimum deposit

- MT4 can’t access all of IG Group’s markets

- Lacks social trading tools

Broker Details

Most Trading Platforms In the UK

IG Group offers plenty of platforms with third-party platforms like MT4 and ProRealTime, and proprietary L2 Dealer and IG Trading Platform, letting you customise how to trade on IG. A surprising favourite for me was the IG Trading Platform, as I found this platform offers a lot of features considering it’s a web platform.

The IG Trading platform has 30+ indicators covering popular indicators like moving averages and Pivot Points, making it a decent platform for technical analysis. Another feature I like is Signal Centre, which provides trading signals from PIA First and Autochartist, supplying you with professional level analysis which is ideal for day trading.

If you’re looking for more advanced charts, ProRealTime is my top pick, especially with its ProRealTrends tool that automates trend lines, support, and resistance levels for quicker market analysis. MetaTrader 4 is your best option if you want to automate your trades with its Expert Advisors – although ProRealTime also offers automation features.

I’ve created a quick tool that will help pair you with the best trading platform based on your trading style and experience, you can use this tool below:

IG Has The Largest Selection of Trading Products

IG Group stands out for having the largest range of financial instruments, giving you access to 17,000+ markets – almost 10 times more than what most UK brokers offer. You have access to every market from its 110 forex pairs to 130 indices and over 13,000+ share CFDs, giving you lots of day trading opportunities.

During my testing, I liked that IG Group has alternative derivatives like Futures/Forwards and Options trading on its platforms, expanding its range of products. I think these markets open up for you to trade with longer timeframes as you do not pay overnight funding fees, allowing you to hold positions for weeks if you wish.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

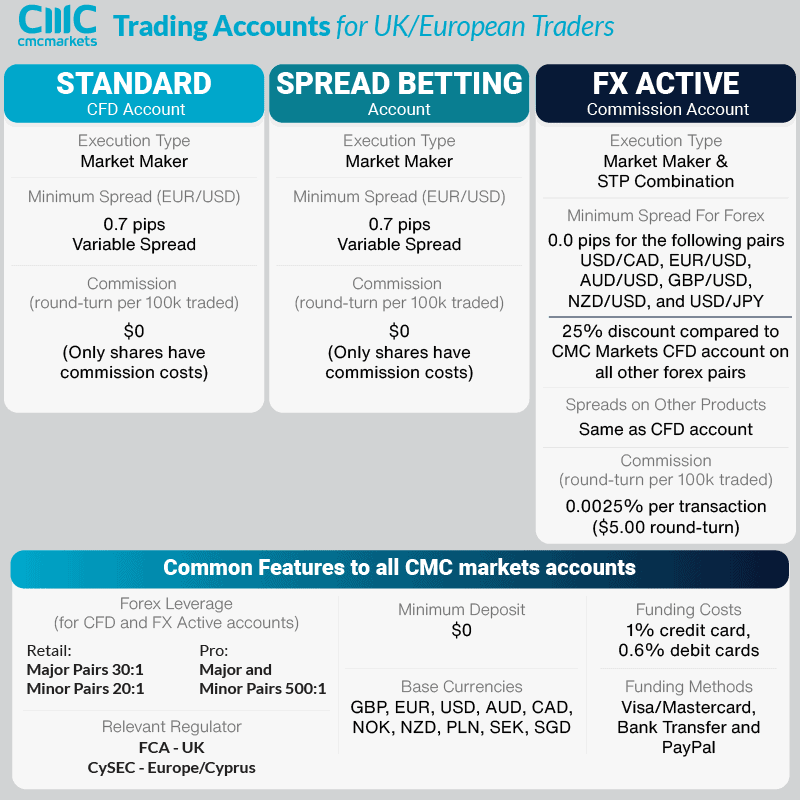

7. CMC Markets - CMC Markets - Top Range Of Currency Pairs

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.3

AUD/USD = 1.64

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

I found CMC Markets has the largest collection of currency pairs with 338 – almost 3 times more than the industry average. The broker’s Next Generation platform with its 80+ indicators and pattern recognition tool helps you trade multiple markets and therefore increase your trading opportunities.

To lower your trading costs with forex trading, I found the FX Active trading account to be a solid upgrade with low commissions at £2.50 per lot traded and spreads from 0.0 pips. With these excellent trading conditions and their large range of markets, I gave CMC Markets a score of 73/100 overall.

Pros & Cons

- Largest foreign exchange markets

- Low spreads with FX Active

- Excellent proprietary trading platform with NGEN

- Lacks customer support via live chat

- MT4 offers less forex pairs than NGEN

- No automated trading features on NGEN

Broker Details

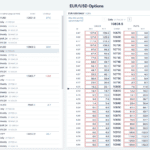

CMC Markets Has The Most Currency Pairs

CMC Markets is a top performer when it comes to its range of markets offering 12,000+ products, slightly behind IG Group. While checking the Forex watchlist on the platform, I found that CMC Markets offers 338 currency pairs, which is 3 times the amount IG Group offers.

| Broker | Number of Currency Pairs |

|---|---|

| CMC Markets | 338 |

| Pepperstone | 93 |

| Eightcap | 55 |

| OANDA | 68 |

| eToro | 55 |

| XTB | 48 |

| City Index | 84 |

| FXxPro | 69 |

The range of Forex markets CMC Markets offers gives experienced traders new ways to find trading opportunities on volatile markets, while finding potential arbitrage opportunities.

In addition to forex markets, the broker offers:

- 9,000+ stocks,

- 82+ indices,

- 124 commodities,

- 55 bonds and treasuries, and

- 10,000+ exchange-traded funds (ETFs).

FX Active Account Lowers Your Forex Trading Costs

To take full advantage of the available forex markets, the FX Active account provides the best value for forex trading. The account has spreads from 0.0 pips and £2.50 per lot traded commission on its forex pairs, making Forex trading cheaper.

Especially compared to its Standard account that has spreads averaging 1.13 pips on EUR/USD, saving you over 50% on trading fees with the FX Active account.

NGEN Platform Is Solid For Technical Analysis

As for trading platforms, they are limited on CMC Markets to MT4 – suitable for automated trading – or its CMC Markets Next Generation platform, which I think is the better choice for most traders.

The Next Generation (NGEN) platform has 80+ technical indicators and drawing tools with 12 different chart types, so you can customise your platform easily. I like that the platform offers an automated technical analysis tool that scans the markets for chart patterns like wedges or channels, delivering trading signals on your charts.

*Your capital is at risk ‘70% of retail CFD accounts lose money’

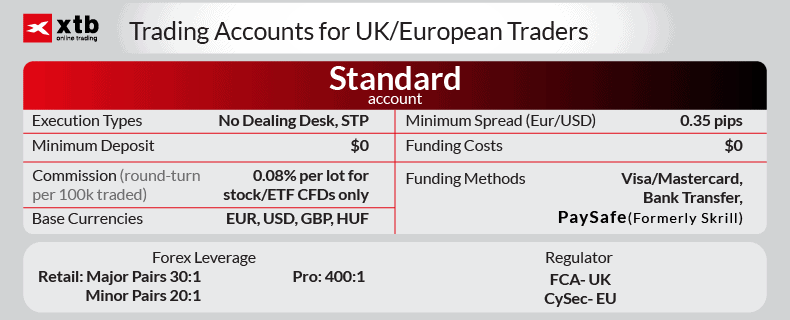

8. XTB - Best Forex Demo Account

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.4

AUD/USD = 1.3

Trading Platforms

MT4, xStation 5, xStation Mobile

Minimum Deposit

$0

Why We Recommend XTB

XTB is a top option if you’re looking to practice with a demo account. You can practice with the brokers own xStation5 platform which has top technical analysis tools like Elliot Wave and Harmonic Patterns and 6900+ markets. The demo account has a generous virtual balance of £100,000 and no expiry date

Pros & Cons

- Generous demo account

- Decent selection of financial markets

- xStation5 is a solid all-rounder platform

- Lacks third-party trading platforms like MT4

- Inactivity fees charged

- Requires a full account to access demo trading

Broker Details

XTB Has A Generous Demo Account

I found XTB has the best forex demo account, thanks to offering a large balance of £100,000, giving you plenty of trading funds to practice with. You have access to demo accounts on XTB’s xStation5, which is the broker’s proprietary trading platform, and I like that it does not expire, unless you don’t trade for 30 days.

Trade with xStation5

The xStation5 is a decent platform for technical analysis, providing 34 indicators, including Elliott Wave and Harmonic Pattern tools, for advanced analysis techniques. I did find it offers a Depth of Markets tool, helping you gauge buying and selling pressure through viewing XTB’s order flow, which is useful for scalpers.

What I found useful was the way the order tickets allow you to adjust your stop loss and take profit orders in monetary value instead of pips. I found this makes it easier to manage your risk as you’ll always know your potential loss and profit, preventing you from making mistakes with the wrong pips calculation.

XTB has over 6,900+ markets on the demo account for you to find your best asset to trade, ranging from 48 forex pairs to 30 indices like NASDAQ.

Competitive Spreads With Its Standard Account

I found the broker only offers a Standard account with spread-only pricing, which is from 0.90 pips on EUR/USD based on the broker’s published average spreads. Below is a table with the captured spreads. As you can see, XTB offers cheaper spreads than the industry average.

| EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | |

|---|---|---|---|---|---|---|---|---|

| XTB | 0.9 | 1.4 | 1.4 | 1.3 | 1.8 | 1.4 | 1.4 | 1.7 |

| Industry Average | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 |

*Your capital is at risk ‘73% of retail CFD accounts lose money’

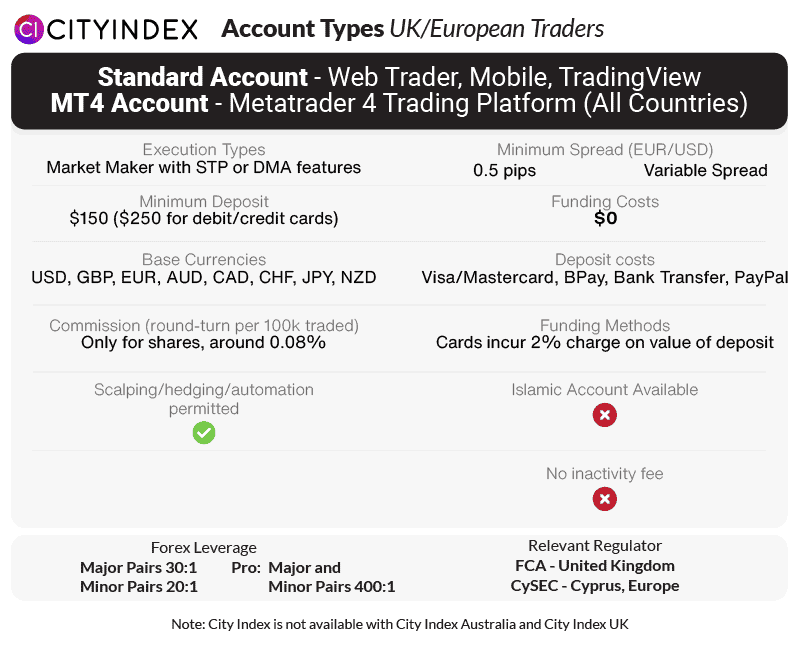

9. City Index - Top Forex Broker For No Commissions

Forex Panel Score

Average Spread

EUR/USD = 0.7

GBP/USD = 1.1

AUD/USD = 1.6

Trading Platforms

MT4, TradingView, City Index WebTrader

Minimum Deposit

$150

Why We Recommend City Index

City Index is my top choice for no-commission trading. Spreads averaged 0.7 pips on EUR/USD, 1.1 for EUR/GBP, and 1.1 for GBP/USD with their standard account, which are all very competitive. The City Index Platform includes unique tools like Trading Signals and Performance Analytics to improve your trading along with MT4 and TradingView.

The range of markets City Index is also amongst the best, offering 13,500+ products, which is why I scored them 9/10 for trading products. With 84 forex pairs and commission-free low spreads, City Index is a solid choice for day trading forex.

Pros & Cons

- Tight Standard account spreads with no commissions

- Large range of markets

- Negative balance protection

- Limited product range on MT4

- No RAW spread account

- No MT5

Broker Details

Low Spreads On The Standard Account

I like how City Index performed in my trading cost test for its Standard account, offering an average spread of 1.24 pips across the top majors in my testing. Using the data for EUR/USD, USD/JPY, GBP/USD, AUD/USD, and USD/CAD, City Index beat the industry average (1.52 pips) by 18%.

| Top 5 Major Pair Average Spread | |

|---|---|

| Broker | Major Pair Average Spread |

| OANDA | 1.12 |

| Eightcap | 1.16 |

| City Index | 1.24 |

| eToro | 1.30 |

| CMC Markets | 1.42 |

| XTB | 1.36 |

| IG | 1.38 |

| Pepperstone | 1.26 |

| FxPro | 1.62 |

| Plus500 | 1.60 |

| Industry Average | 1.53 |

I found these results to show that City Index offers solid, industry-beating spreads across all of its majors. Unlike other brokers I’ve tested who use low spreads on EUR/USD as an incentive, while offering expensive spreads on other majors like GBP/USD and USD/JPY.

After breaking down the costs, I found City Index has one of the lowest minimums for EUR/USD at 0.70 pips and USD/JPY at 0.60 pips. Both of these spreads compete with ECN brokers that offer tighter spreads with commissions, which is a solid achievement for City Index’s Standard account.

| EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | |

|---|---|---|---|---|---|---|---|---|

| City Index | 0.7 | 0.6 | 1.1 | 2.2 | 1.6 | 1.1 | 1.6 | 2.2 |

13,500+ Financial Markets With City Index

During my tests, City Index scored 9/10 for its selection of 13,500+ financial instruments, all available with low trading costs. Using the Standard account, you can trade a decent choice of 84 forex pairs or 27 commodities, as well as indices and commodity products like gold and silver.

Solid Range of Trading Platforms and Tools

On top of solid spreads and a large product catalogue, the broker offers top trading platforms, with access to the City Index Trading platform, MetaTrader 4, and TradingView.

I found that the City Index platform comes with Performance Analytics by Chasing Returns, which is like a trading mentor that I believe can help you become a better trader. While testing, I liked the features of guardrails that allow you to study your performance daily, helping you identify your strengths and weaknesses.

*Your capital is at risk ‘71% of retail CFD accounts lose money with City Index’

10. FxPro - Great UK Based Customers Services

Forex Panel Score

Average Spread

EUR/USD = 1.32

GBP/USD = 1.7

AUD/USD = 1.95

Trading Platforms

MT4, MT5, cTrader, FxPro Trading Platform

Minimum Deposit

$100

Why We Recommend FxPro

FxPro’s 24/5 live chat customer service team showed they have deep knowledge of their product when I tested. I also found their response time to be fast and efficiently answered my questions.

The broker has a decent range of platforms, which includes MT4, MetaTrader 5, FxPro Web Trader, and cTrader. I think cTrader is a great platform for algo traders with its cBots, and scalpers that can benefit from Direct Market Access for the broker’s 2,100+ markets.

Pros & Cons

- Low spreads on cTrader

- Offers excellent market analysis

- Great customer service available

- Wider spreads if you don’t use cTrader

- Has a minimum deposit

- Has inactivity fees

Broker Details

Excellent 24/5 Customer Service

I like that FxPro provides 24/5 customer support via Live Chat, and connecting with support took less than 30 seconds when I tested it. The best way I like to test a broker’s support is by asking technical questions, and I found the responses prompt and knowledgeable.

Usually, there is a delay from support while they go and look up the answer, but the conversation I had was direct and fluid. This gave me the impression that the support customer understood the product – a big plus in my books.

FxPro Has cTrader Platform

While reviewing FxPro, I used the cTrader platform, which is essentially the same as the MetaTrader 4 and 5 platforms combined but with a better interface, in my opinion. The cTrader is easy to use and has 65+ indicators pre-installed into the platform, which is more than MT4, and it allows you to program your own custom indicators.

I also like that cTrader takes advantage of FxPro’s Direct Market Access, allowing you to see the open and pending orders from the liquidity provider. I’m a fan of brokers providing this, as it can be used as an excellent tool to gauge market strength and supply/demand zones.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

Ask an Expert