High Leverage Forex Brokers For UK Trading

Forex traders in the UK may find leverage useful to increase returns when trading in the currency market. We look at the best UK forex brokers with high leverage based on spread, forex trading platforms and features.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Our list of the best low spread forex brokers is:

- Pepperstone - Best Broker With High Leverage On MT4

- IG Group - Largest Range Of Trading Products

- AvaTrade - Leverage Forex Broker For Day Trading

- FOREX.com - Great FX Education Resources

- FXTM - Forex Broker With Great Educational Resources

- BlackBull Markets - Top Broker With High Leverage

- IC Markets - Great Forex Broker With MetaTrader 5

- FP Markets - Good Forex Broker For Scalping

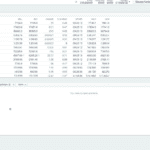

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

FCA CySEC, BaFin |

0.10 | 0.30 | 0.20 | £2.25 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

71 |

FCA BaFin, CySEC |

0.16 | 0.59 | 0.29 | £3.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $450 | 100+ | 12+ | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

64 |

CySEC CBI, KNF |

- | - | - | - | - | - | - |

|

|

|

160ms | $100 | 55+ | 15+ | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

84 |

FCA CySEC, CIRO |

- | - | - | $6.00 | 1.2 | 1.6 | 1.4 |

|

|

|

30 ms (May 2023) | $100 | 80+ | 8+ | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

61 |

FCA CySEC |

0.0 | 0.0 | 0.5 | $2.00 | 1.9 | 2 | 2 |

|

|

|

160ms | $500 | 63+ | - | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

93 | CySEC | 0.02 | 0.23 | 0.17 | $3.50 | 0.62 | 0.83 | 0.77 |

|

|

|

134ms | $0 | 61+ | 18+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

80 | CySEC | 0.10 | 0.20 | 0.20 | $3.00 | 1.1 | 1.3 | 1.3 |

|

|

|

225ms | $100 | 70+ | 10+ | 30:1 | 500:1 |

|

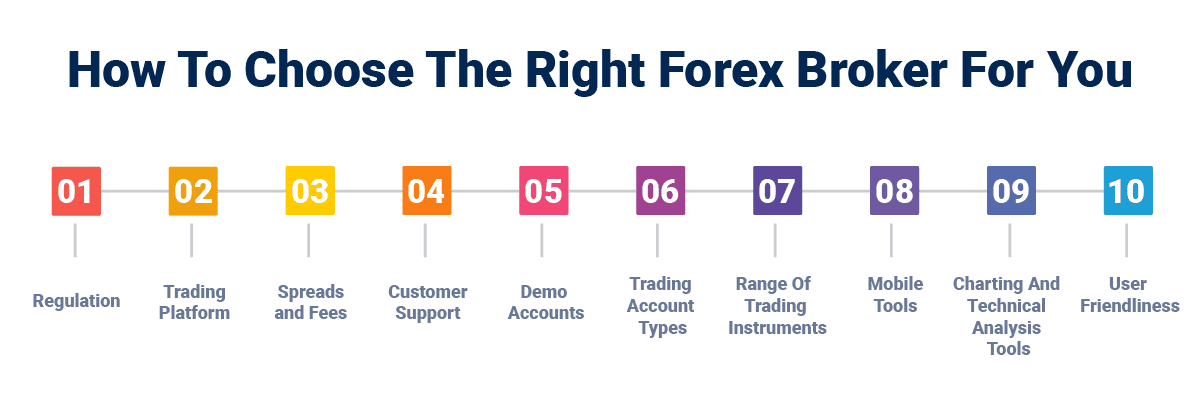

What Are The Highest Leverage Forex Brokers In The UK?

Our list of forex brokers in the UK is tailored for general traders, although some traders may require higher leverage to execute their trading strategies. We compared the top FCA regulations and international brokers to present the choices for UK traders seeking high-margin trading platforms.

1. Pepperstone - Best Broker With High Leverage On MT4

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

In our tests, Pepperstone excels for high leverage. Leverage for Forex pairs adheres to FCA limits: major pairs at 1:30, minor pairs at 1:20 while Eligible pros get 1:500 leverage.

We think Pepperstone shines in trading costs (avg. 0.36 pips for EUR/USD), platforms (MT4, M5, cTrader, TradingView), and customer service. We have also given them top marks for fast MT4 execution with an average of 77ms for limit orders making Pepperstone ideal for scalp trading. Overall we gave Pepperstone a score of 97/100.

Pros & Cons

- Offers 1:30 leverage on majors, 1:500 for professional traders

- Trade 1,200+ financial instruments

- Fast execution speeds

- Lacks digital wallets for funding

- Limited risk management tools

Broker Details

Pepperstone Offers High Leverage, A Wide Range Of Trading Products, And Competitive Pricing

Founded in Melbourne in 2010, Pepperstone claims over 300,000 active clients and a total trade value of USD 8.9 billion annually. This makes it among the largest online brokers in the world. Forex traders, in particular, prefer Pepperstone for its breadth of product offerings – over 92 currency pairs – including major currency pairs, minor currency pairs, and exotics. They also offer a range of other asset classes to deal in CFDs: commodities, stocks, exchange-traded funds (ETFs), and indices.

Key Strengths

- Extensive selection of trading products, particularly forex pairs

- Competitive trading fees across account types

- A variety of trading platforms suitable for beginner and advanced traders

Leverage Available

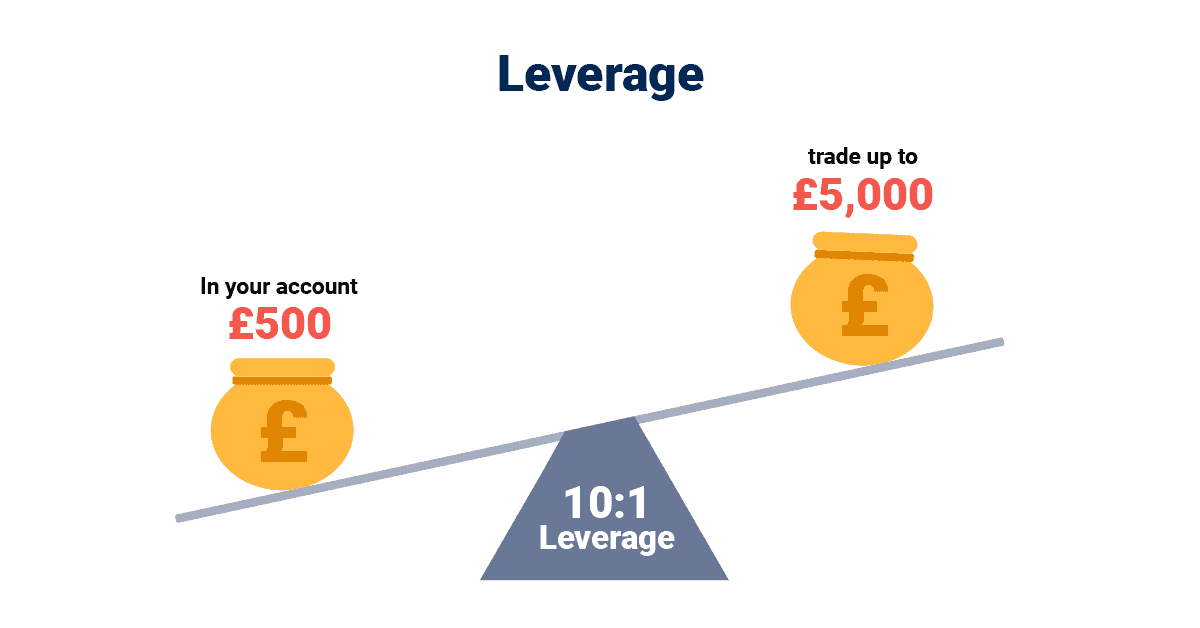

The FCA sets retail leverage for UK traders for retail traders, while professional leverage varies. Retail traders can access higher leverage only by using brokers regulated in another region.

| Forex Broker | Retail Leverage | Professional Leverage | Regulation |

|---|---|---|---|

| Pepperstone | 30:1 | 500:1 | United Kingdom (FCA) |

| IC Markets | 30:1 | 500:1 | United Kingdom (FCA) |

| Blackbull Markets | 500:1 | 500:1 | New Zealand (FMA) |

| Eightcap | 30:1 | 500:1 | United Kingdom (FCA) |

| Plus500 | 30:1 | 300:1 | United Kingdom (FCA) |

| FP Markets | 30:1 | 500:1 | United Kingdom (FCA) |

| CMC Markets | 30:1 | 500:1 | United Kingdom (FCA) |

| eToro | 30:1 | 400:1 | United Kingdom (FCA) |

| AvaTrade | 30:1 | 400:1 | United Kingdom (FCA) |

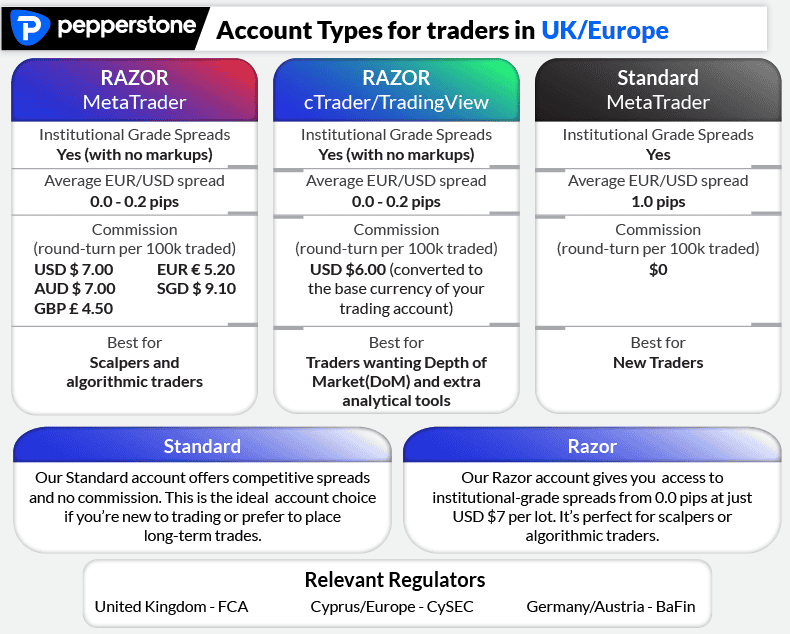

Pepperstone Trading Accounts

Pepperstone offers UK forex traders a choice of three accounts:

- Standard account (MetaTrader 4/5). Standard account holders pay no commission on round-turn trades of standard 100,000 lots, only spread fees. The spread for this account type is 1.0 pips.

- Razor account (cTrader and TradingView). Spreads with this account type are tighter than the Standard offering: 0.0 to 0.2 pips. Traders will pay a commission of USD 6.00 for each round-turn trade of a standard lot.

- Razor account (MetaTrader 4/5). Like its sibling, this Razor account offers low spreads from 0.0 to 0.2 pips but a higher commission of USD 7.00 per round-turn trade of a standard lot.

Given that all Pepperstone accounts offer competitive terms, your preferred trading platform or trading style may be the deciding factor when selecting your account type. For example, if you’re accustomed to MetaTrader and generally place long-term trades, then the Standard account likely fits your needs.

If your trading strategy requires Depth of Market (DoM) views and the sophisticated trading tools offered by cTrader or the advanced charting of TradingView, a Razor account may be your best bet. Likewise, scalpers and algorithmic traders may find a Razor MetaTrader account’s slightly higher commission costs worth it in exchange for access to the MetaTrader 4 or MetaTrader 5 trading platforms.

New traders can open a demo account, while those ready to go live have no requirement to make a minimum deposit. It is, however, recommended that you deposit at least USD 200 to meet the minimum margin requirements to open a position.

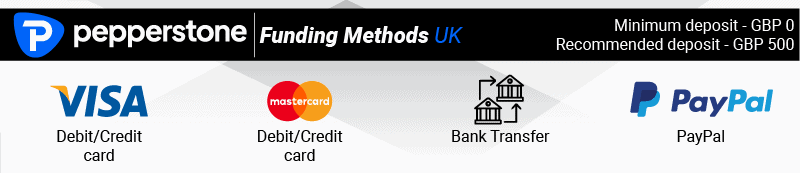

Funding methods include Visa and MasterCard Debit and Credit, PayPal, and bank transfers. An international transfer using a bank transfer will have a small fee and may have fees from the provider’s end. Other than that, Pepperstone doesn’t have any transfer costs.

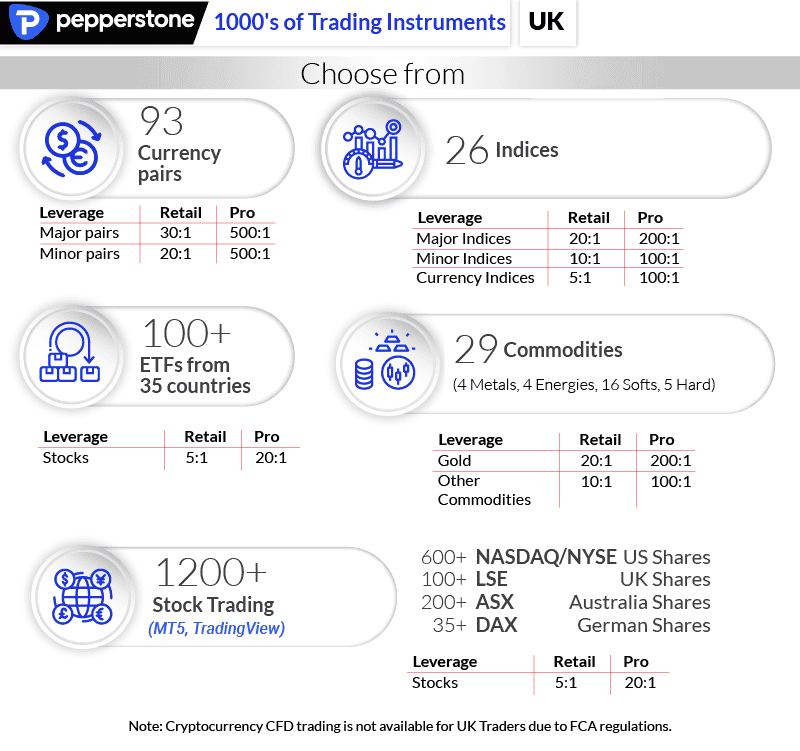

Pepperstone Trading Products

When it comes to available trading products, Pepperstone offers UK retail investors an impressive selection of forex pairs. They also offer a diverse range of asset classes to help investors diversify their portfolios effectively.

UK forex traders are spoiled for choice with Pepperstone: the broker offers 7 major pairs, 9 minor pairs, 17 exotics, and 30 cross pairs for a total of 92 currency pairs. For those interested in high-leverage trading (which we assume you are if you’re reading this), Pepperstone account holders can trade major pairs on margin at the maximum rate of 30:1 and minor pairs at 20:1.

When it comes to CFDs, Pepperstone’s available trading products include 25 commodities, 25 indices, 100+ ETFs sourced from 35 countries around the world, and more than 800 shares.

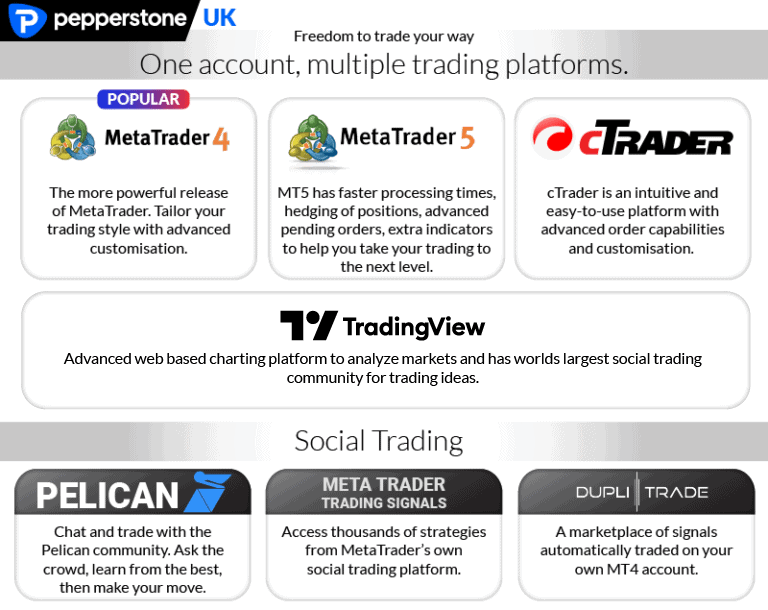

Pepperstone Trading Platforms

While the UK arm of Pepperstone may have a limited variety of trading platforms as its Australian parent, they remain a standout for a selection of trading platforms designed to provide all account holders with a quality trading experience, regardless of experience level.

All of Pepperstone’s trading platforms are available on Windows and Mac OS for desktop, iOS, and Android for mobile and tablets, as well as through the MT4 and MT5 web app, WebTrader.

As a starting point, Pepperstone account holders can select between cTrader and MetaTrader 4 or MetaTrader 5 (depending on account type).

If you opt for MetaTrader 4 or MetaTrader 5, you can access multiple integrations and add-ons designed to enhance almost any trading strategy. These include the Smart Trader suite of Tools, Expert Advisors (EAs), advanced charting, and technical indicators.

If Depth of Market and advanced charting matter most to you, Pepperstone offers the option of cTrader. If you have a Razer (cTrader) account, you can use the same login to access TradingView, where you can trade directly from charts. This platform is powered by cTrader though you don’t need to be using cTrader. You can use TradingView via your browser or their Windows desktop app.

Capitalise.ai is the latest addition to the portfolio of trading platforms Pepperstone offers. With this platform, you can automate your trading without knowing any code. Manual trading is also available should you prefer to use more traditional methods.

Pepperstone has also partnered with DupliTrade and Pelican to allow for social trading and copy trading.

Our Verdict On Pepperstone

Experienced forex traders searching for the best high-leverage forex broker in the United Kingdom can’t miss Pepperstone. As explained, they offer the highest leverage available based on FCA regulation and with tight spreads, the fastest execution speed and the best choice of trading software were named the Best Forex Brokers In UK in 2025.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

2. IG Group - Largest Range Of Trading Products

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

IG Group is a solid choice for trading multiple markets as the broker has low spreads (usually with no commissions) on over 17,000 markets. Leverage is the maximum (1:30) set by the FCA if you are a retail trader but is limited to 1:222 for professional Forex traders.

We gave IG Group a score of 81/100, for their product range, trust, and trading platforms. Spreads are decent with an average spread of 1.13 pips for EUR/USD, notably lower than the industry average of 1.24 pips.

Pros & Cons

- 17,000 markets to trade

- Competitive spreads

- Decent tools for technical analysis

- Has a minimum deposit

- Doesn’t offer the TradingView platform

- No social trading tools

- Capped leverage of 1:222 for professional traders

Broker Details

IG Is A High-Leverage Broker With A Wide Array Of Trading Products

For UK brokers searching for a home-grown success story with a global reputation, look no further than IG. Founded in the UK in 1974 as a spread betting business, IG has since expanded to become one of the largest online brokerages in the world, serving more than 290,000 active traders around the world with access to over 17,000 financial instruments.

Key Strengths:

- Sophisticated trading platforms backed by years of experience and fine-tuning

- Extensive selection of trading products ranging from forex pairs to CFDs to exotic commodities to bonds and treasuries

- Sophisticated market analysis and research

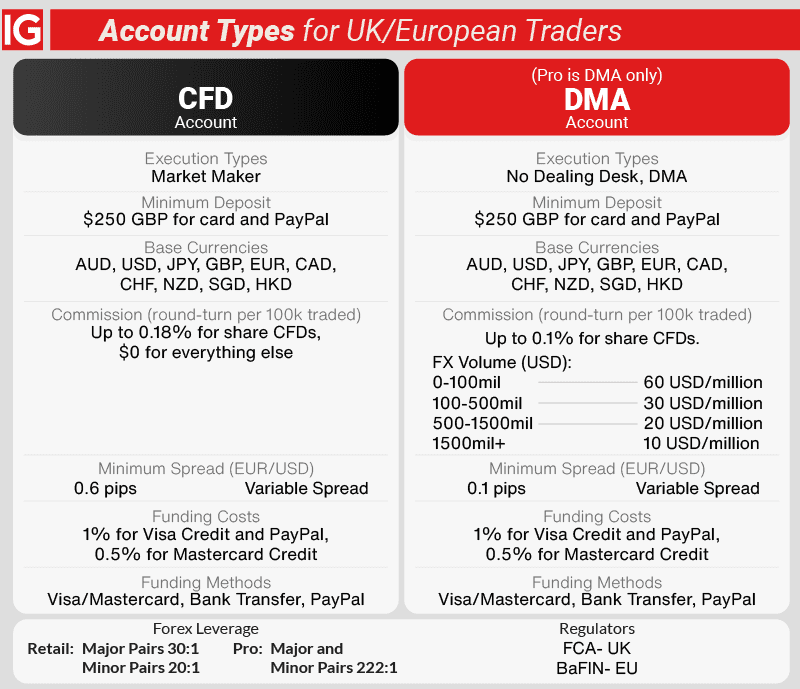

IG Trading Accounts

While the majority of IG’s UK customers will qualify for only a CFD account, the broker also offers a direct market access option for licensed professional traders:

- CFD account. Analogous to the Standard account offered by other international forex brokers, the CFD account uses a market-maker model to ensure that traders always have a partner opposite their trades. Spreads start at 0.6 pips, and traders pay no commissions, save for share CFDs, for which IG charges 0.18%.

- DMA account. Indeed for professional traders, this account type offers direct market access and operates on a no-dealing desk basis. Spreads begin at 0.1 pips for major currency pairs. Traders using this account type will need to master a complicated, tiered commission structure (see table below). With this system, the more you trade each month, the less you will pay in commissions.

Unlike other brokers we profiled, IG does charge a funding fee depending on your preferred method: 1% for Visa or PayPal and 0.5% for MasterCard credit card payments.

Both the CFD and DMA accounts require a minimum deposit of £ 250 to begin trading. Novices can practice with a demo account before trading live to test features and experience the trading process.

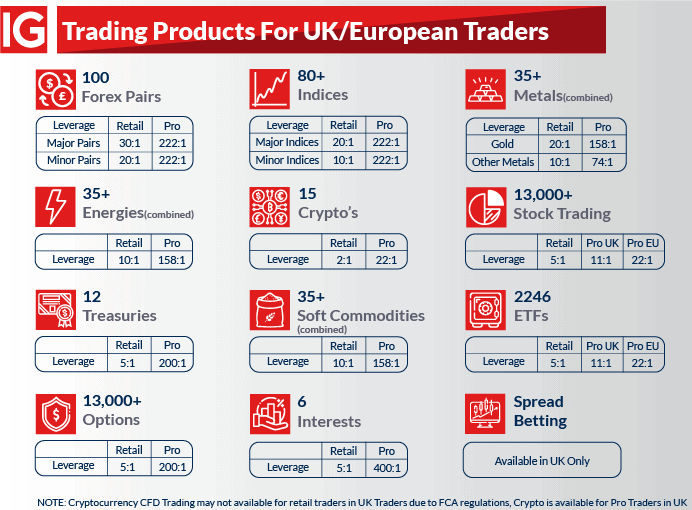

IG Trading Products

Simply put, IG tops the list of high-leverage UK forex brokers regarding available asset classes. Its forex offering alone exceeds 100 pairs and includes virtually every other trading instrument permitted by the FCA.

Account holders can choose from over 100 hard and soft commodities, as well as energies; more than 2,000 ETFs, 80 indices; 13,000 options and 13,000 stocks. IG allows for direct investing or trading in CFDs.

Pro traders also have access to 15 cryptocurrencies for direct investment.

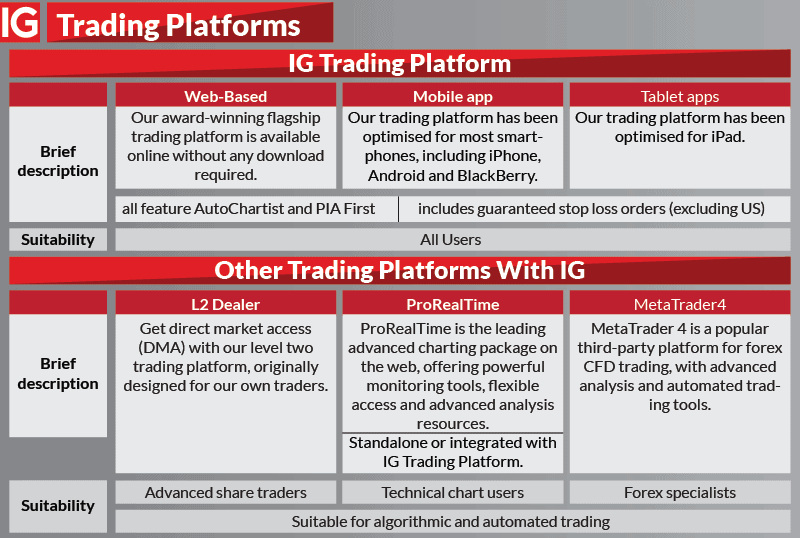

IG Trading Platforms

IG has dedicated significant resources to developing its own trading platforms, which have been optimised for web, mobile, and tablet use, similar to Forex.com.

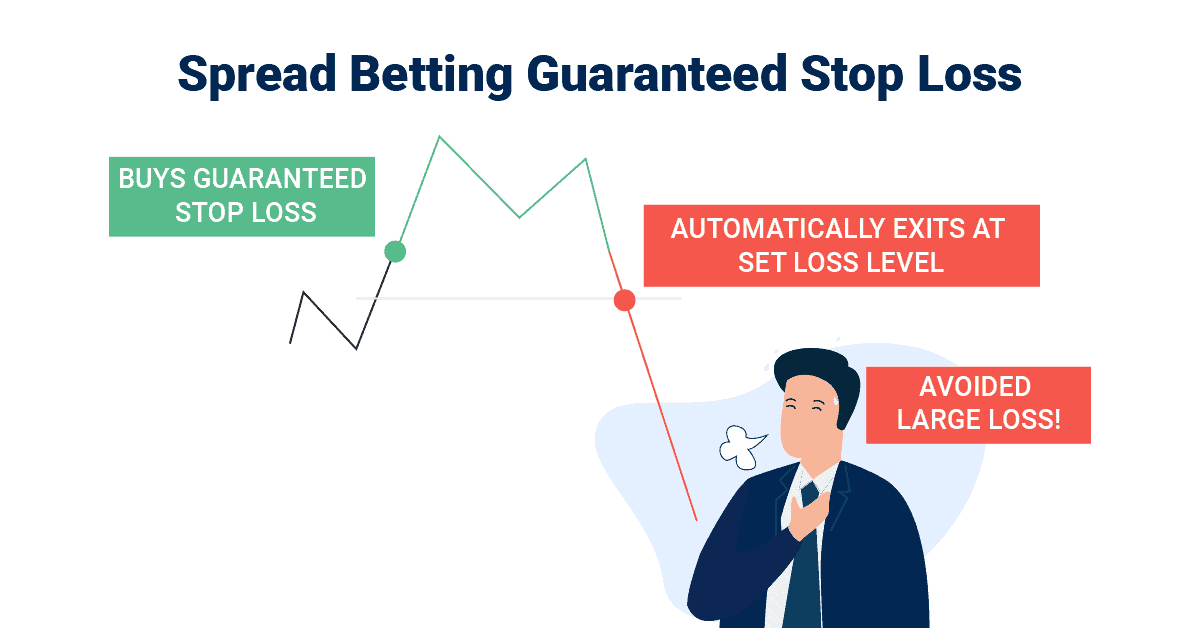

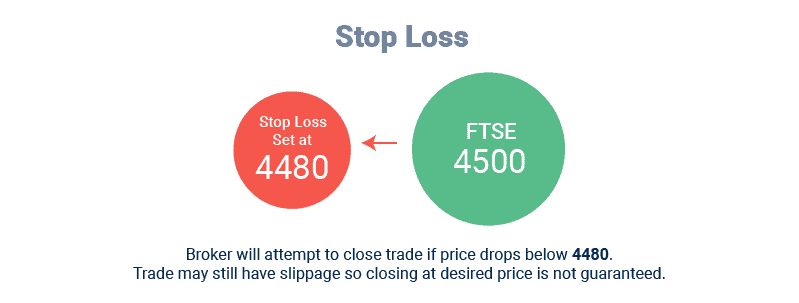

What are among the most popular features IG baked into its platform? Guaranteed stop-loss orders to mitigate risk, as well as partial fills and point-through execution for guaranteed pricing. The platform also boasts execution speeds of 0.014 ms, comparable to other major trading platforms.

For those who prefer third-party platforms, IG allows account holders to trade using MetaTrader 4, L2 Dealer, and ProRealtime. Advanced share traders will appreciate the direct market access option for shares afforded by L2 Dealer, while those who trade from charts may fare best with ProRealTime, which can operate as a standalone platform or as an integration.

Our Verdict On IG

With an impressive array of trading products and a truly global liquidity reach, it’s hard to find fault with this high-leverage broker. The allegiance to its trading platforms at the expense of more forex-friendly options, however, edged it out of the top spot.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

3. AvaTrade - Great High-Leverage Forex Broker For Day Trading

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

We appreciate AvaTrade’s fixed spreads, starting at 0.9 pips on EUR/USD, ensuring predictable day trading costs. This beats average spreads from variable spread brokers like FXCM, preventing unexpected price spikes.

AvaTrade’s unique risk management tool, AvaProtect, is especially helpful for a novice like me. For a fee, it shields my position from 100% of losses within a chosen timeframe, accessible through AvaTradeGo or AvaOptions mobile apps.

Pros & Cons

- Low fixed spreads

- Good selection of trading tools

- Unique risk management tool (AvaProtect)

- No RAW spread pricing options

- Has inactivity fees

- AvaProtect is not available on MT4

- Leverage is limited to 1:400 for professional traders

Broker Details

AvaTrade Offers Fixed Spread, No Commission Trades, And Powerful Risk Protection Tools

One of the most established and well-known online brokerages, AvaTrade, caters to retail investors interested in trading CFDs and forex, boasting almost two decades of experience. Based in Dublin, this subsidiary of the AVA Group has expanded from a single office in 2006 to a multinational operation with a physical presence in four key jurisdictions, multiple Tier-1 licenses, and a remarkable range of financial instruments for trading.

Key Strengths:

- Powerful risk management tools, including AvaProtect

- Excellent educational tools and support for beginner traders

- Wide variety of trading platforms and integrations

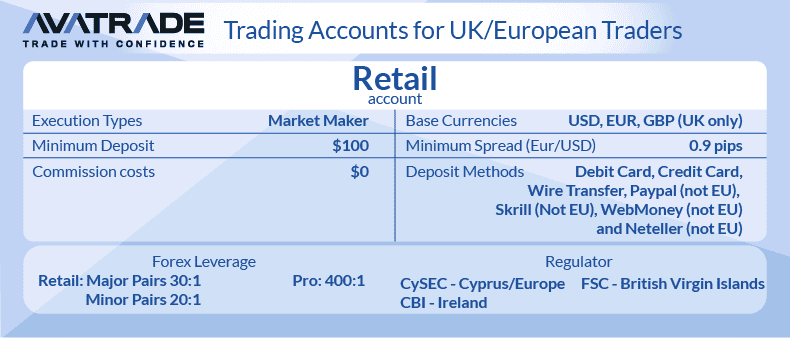

Among the UK forex brokers we reviewed, AvaTrade takes a novel approach: one account type to rule them all. You’ll use a Retail account unless you qualify as a Professional Trader per UK regulations.

Because AvaTrade acts as a market-maker, account holders pay no commission on trades regardless of size. That said, the broker will sit on the opposite side of some trades and the fixed minimum spread of 0.9 pips may not appeal to some active traders.

AvaTrade stands out from other high-leverage brokers in terms of investor protection, which is an essential feature for exploring high-risk trading strategies. AvaProtect is a unique risk management tool that allows traders to “insure” specific trades for up to USD 1 million for a set period. During this time, the broker promises to reimburse any losses into the trading account. However, this tool is only available to account holders trading via the AvaTradeGO mobile app. Like all FCA-regulated brokers, AvaTrade offers Negative Balance Protection.

You can open a demo account if you want to try out AvaTrade before committing. It can be activated after making a minimum deposit of USD 100.

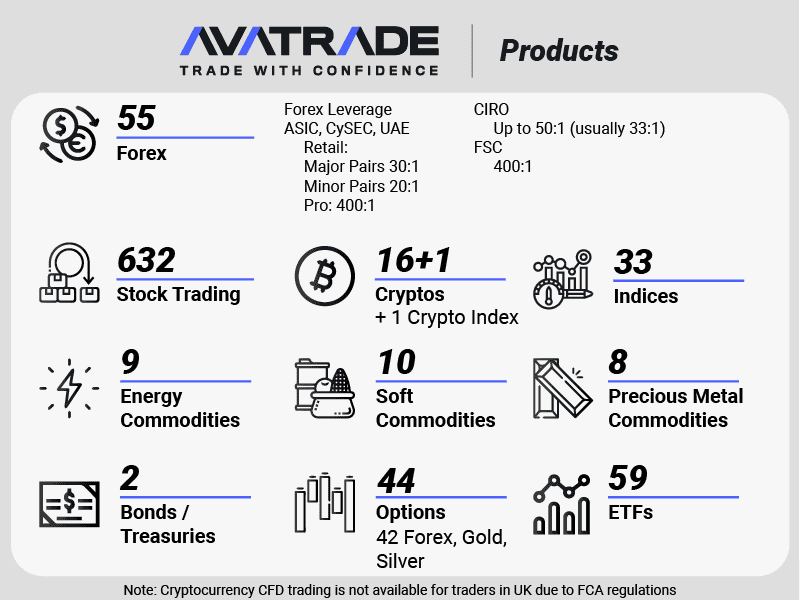

AvaTrade Trading Products

In keeping with its status as one of the best-regulated forex brokers, AvaTrade offers account holders access to a full range of financial instruments, from forex to CFDs to cryptocurrency.

AvaTrade’s available trading products range from 55 forex pairs, including major, minor, and exotic pairs; 59 ETFs, 44 options, and 33 indices. Following FCA regulations, leverage for major currency pairs is capped at 30:1 and 20:1 for minor pairs. AvaTrade also allows trading in 27 commodities.

AvaTrade account holders in the UK have the option to invest directly in over 16 cryptocurrencies and one cryptocurrency index. However, trading in crypto CFDs is prohibited under FCA regulations. You would need to compare forex brokers outside of the UK if this is what you want to trade.

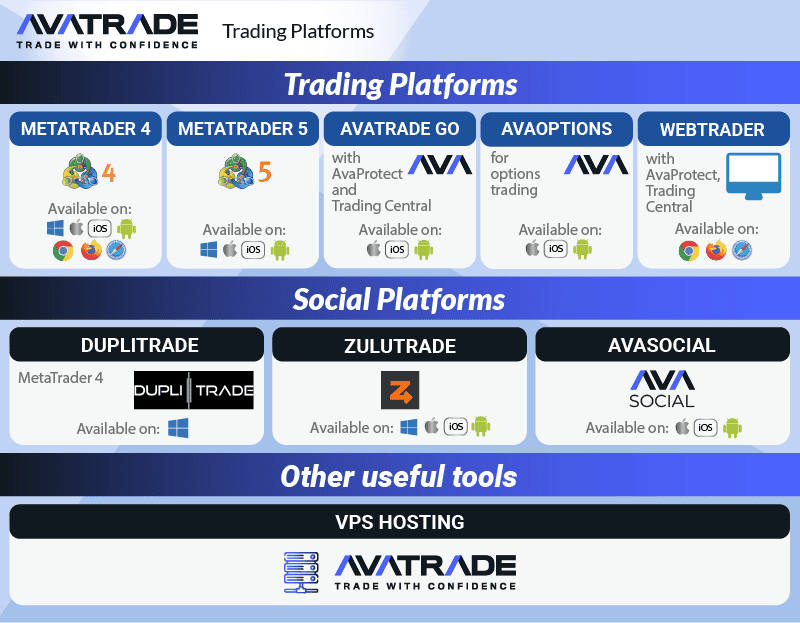

AvaTrade Trading Platforms

AvaTrade’s entire range of trading platforms can be accessed in multiple formats, including Windows/Mac OS for desktop, iOS/Android for mobile and tablets, and the MT4/MT5 WebTrader web app.

With the most trading platform options of any FCA-regulated UK forex broker we reviewed, AvaTrade has something for every trading style, experience level, or strategy. Account holders at AvaTrade can use MetaTrader 4 and MetaTrader 5 platforms. They also have access to various apps and integrations, including AvaOptions for options trading and VPS hosting.

For social traders, AvaTrade includes a Zulutrade add-on, as well as its own AvaSocial tool and a Duplitrade integration for copy trading with MetaTrader 4.

Our Verdict On AvaTrade

AvaTrade’s combination of powerful risk protection tools, comprehensive educational resources, and easy-to-understand account structure make it an ideal choice for novice traders who want the option to explore high-leverage trading as their skills increase.

*Your capital is at risk ‘63% of retail CFD accounts lose money’

4. FOREX.com - Top Broker With Solid All-Around Offering

Forex Panel Score

Average Spread

EUR/USD = 0.8

GBP/USD = 0.8

AUD/USD = 1.7

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

FOREX.com, as our evaluated broker, scored 84/100 in our assessment. We found its trading platforms and educational resources to be strong, contributing to a positive overall trading experience. However, the limited product range, offering fewer than 500 markets, influenced our rating.

In our tests, FOREX.com presented a competitive average spread of 1.2 pips on EUR/USD, slightly below the industry average. While it may not cater to those seeking an extensive market selection, we acknowledge its appeal for traders valuing robust platforms and educational support.

Pros & Cons

- Decent choice of platforms

- Large selection of forex pairs (80+)

- Good variety of gold and silver crosses

- No MT5 platform

- Has a minimum deposit requirement

- Customer service isn’t always available

- Max. leverage of 1:400 for pro traders

Broker Details

FOREX.com Has A DMA Account, Competitive Trading Fees, And Extensive Analysis Tools

While New Jersey-based FOREX.com has offered retail investment services to Americans since 2001, it’s a comparative newcomer to the international scene. This high-leverage forex broker received its FCA licence in 2009 and has been touting its “gold standard” trading experience to UK forex traders ever since.

Key Strengths:

- Competitive trading fees backed by deep liquidity

- Excellent range of forex pairs, as well as other financial instruments

- Extensive technical analysis tools suitable for experienced traders

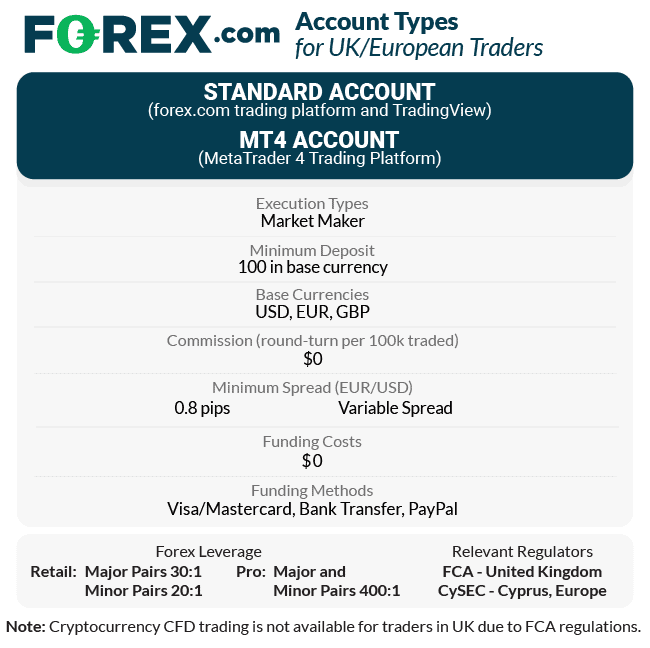

FOREX.com Trading Accounts

FOREX.com has two account options for UK traders, each geared towards a specific investor type.

- Standard account. This market maker style account has no commission costs on round turn trades of standard lots. Spreads are from 0.8 pips but require the use of one of the FOREX.com trading platforms. Benefits with this account mean access to extra features FOREX.com offers, such as Guaranteed-Stop Loss, trading signals, trading central, and ‘chasing returns’.

- MT4 Account. This account is the same as the Standard Account but works with the MetaTrader 4 trading platform. While you can access features on Trading Central, you won’t get the other features found with the Standard Account.

For anyone interested in forex trading but still needs to get ready to go pro – or even live – FOREX.com has a demo account option.

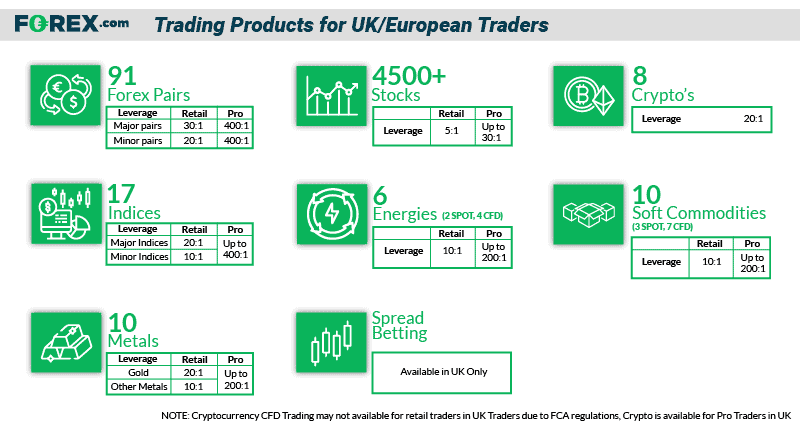

FOREX.com Trading Products

UK forex traders can’t do much better than FOREX.com regarding currency pairs – the broker claims over 91 major, minor, and exotic combinations, all of which are available for spread betting.

FOREX.com’s available financial instruments include more than 4,500 stocks, 17 indices, and a full range of hard and soft commodities – 26 total.

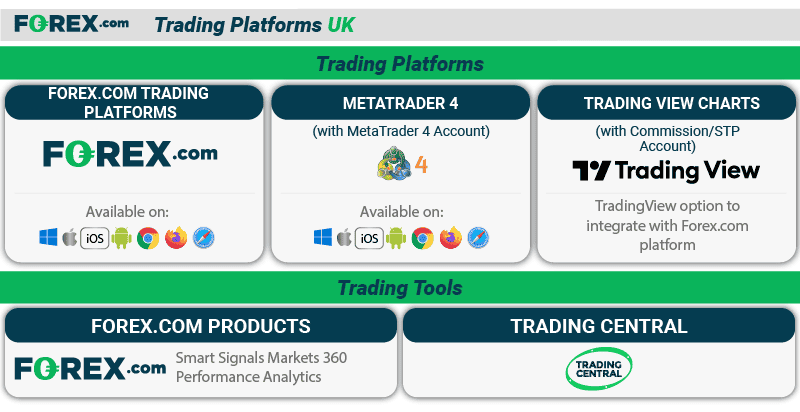

FOREX.com Trading Platforms

Be aware that committing to FOREX.com may require using the broker’s exclusive trading platforms. While the option to trade using MetaTrader 4 and TradingView exists, FOREX.com would much prefer you use its desktop, mobile, or web apps. This isn’t a bad thing; the Forex.com platform is a very good platform with good third-party tools made by Chasing Returns and also has a Guaranteed Stop Loss Order.

That said, FOREX.com does allow for integrations with multiple award-winning tools and integrations to ensure that account holders don’t want to analyse. Popular add-ons include TradingView for advanced charting, Trading Central, and Smart Signals.

Our Verdict On FOREX.com

While the broker may appear somewhat possessive due to its limited trading platform options, it makes up for it with an impressive variety of forex pairs. It is the only direct market access account of any high-leverage UK broker.

*Your capital is at risk up to ‘76% of retail CFD accounts lose money with FOREX.com’

5. FXTM - Forex Broker With Great Educational Resources

Forex Panel Score

Average Spread

EUR/USD = 0

GBP/USD = 0

AUD/USD = 0.5

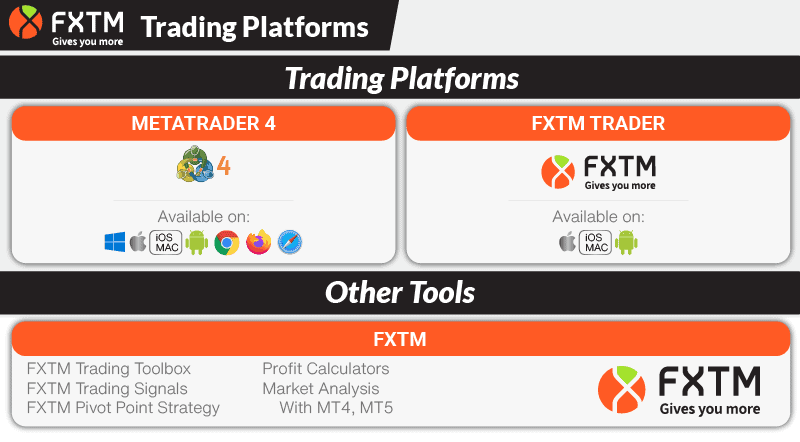

Trading Platforms

MT4, MT5

Minimum Deposit

$10

Why We Recommend FXTM

FXTM is a broker we scored highly, rating 60/100 with top marks in trading education resources and trading platform tools. Although brokers aren’t the best place to learn how to trade, we did like FXTM’s education area. These resources are filled with information covering the basics and how to develop your trading strategy.

In addition to the educational resources, we rated the broker highly for their MT4 trading tools, which include “Pivot SR Levels” – a handy tool if you trade price action.

Pros & Cons

- Great education resources

- Offers micro lot trading

- Tight average spreads from 0.0 pips

- Micro account limited to forex and metals

- Has a minimum deposit

- Withdrawal fees

Broker Details

FXTM Offers Great Educational And Market Research Tools

If you’re new to trading forex or trade mainly casually, FXTM may be the best broker for your needs. This forex and CFD broker is among the only ones we reviewed to offer micro accounts, a low minimum deposit, and a straightforward account setup process to make it easy to start trading.

Key Strengths:

- Excellent educational and market research tools

- Wide range of account types suitable for traders experimenting with different strategies and financial instruments

- Award-winning trading experience across web, mobile, and other platforms

In addition to the UK’s Financial Conduct Authority, this high-leverage forex broker also holds licenses from the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority of Mauritius.

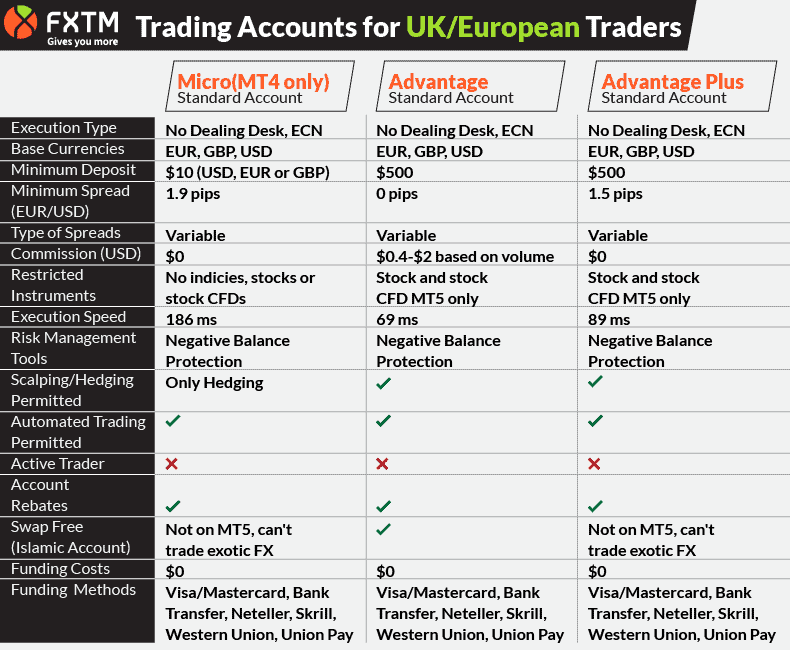

FXTM Trading Accounts

FXTM clients can choose from between three different account types, all of which offer an ECN-like trading experience with straight-through processing (STP):

- Micro account. This no-dealing desk account is ideal for forex traders trading micro lots of less than 100,000 units. Spreads start at 1.9 pips for this commission-free account.

- Advantage account. With tight spreads starting at 0.0 pips and a wider range of trading products, this account type may be more suitable for those willing to make more serious investments in forex markets. Commissions range from USD 0.4 to 2.00, depending on trading volume.

- Advantage Plus account. Best-suited to those looking for the features of a standard-type account, FXTM’s Advantage Plus uses a commission-free fee structure, meaning traders pay on the spread fees. Spreads for this account type start at 1.5 pips.

Similar to the Pepperstone reviewed above, FXTM matches specific trading platforms to account types. Micro account holders should be familiar with or prepared to learn MetaTrader 4. Those interested in trading stocks and stock CFDs will need access to MetaTrader 5 and an Advantage or Advantage Plus account at the same time.

All FXTM account types offer limited rebates depending on trading activity, negative balance protection (per FCA regulations), and automated trading. Advantage and Advantage Plus account holders can also scalp and hedge.

New traders have the opportunity to try out a free FXTM demo account to get a feel for trading. However, those interested in active trading will need to make a minimum deposit ranging from USD 10 to USD 500, depending on account type.

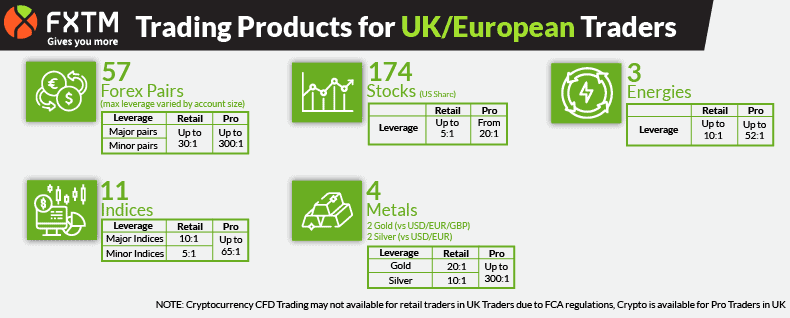

FXTM Trading Products

What FXTM may lack in variety when it comes to trading products, it makes up for in leverage. Unlike other UK forex brokers we reviewed, FXTM offers margin rates of 30:1 for major and minor forex pairs and 20:1 for gold.

In addition to forex and precious metals, FXTM Advantage and Advantage Plus account holders can invest in 11 indices, 175 stocks, and three energy commodities.

This broker does not offer cryptocurrencies or crypto CFDs to UK customers, and those with Micro accounts are limited to trading forex and commodities.

FXTM Trading Platforms

FXTM prides itself on being a ‘client-centered’ broker and has gone to considerable trouble to ensure that customers can access the forex markets anytime, anywhere. The broker also offers account holders access to MetaTrader 4 and MetaTrader 5 via desktop, WebTrader, and tablet formats across iOS, Windows, and Android operating systems.

This top forex broker has taken a ‘don’t fix what’s not broken approach’ regarding platforms. Rather than developing a proprietary trading platform, FXTM focuses on providing traders access to the technical analysis, charting, and risk management tools they need via custom integrations. FTXM trading signals, for example, support social trading, with the FXTM Trading Toolbox offering access to more advanced charting options.

Our Verdict On FXTM

While FXTM is more limited in scope than other FCA-regulated forex brokers, it deserves a second look for its high leverage and unique account types suited for casual or hobby traders.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

6. BlackBull Markets - Top Broker With High Leverage

Forex Panel Score

Average Spread

EUR/USD = 0.23

GBP/USD = 0.72

AUD/USD = 0.65

Trading Platforms

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlackBull Trade

Minimum Deposit

$0

Why We Recommend BlackBull Markets

BlackBull Markets is an excellent broker if you want access to 1:500 leverage, the highest available on major currency pairs. The broker can offer this as the FCA does not regulate it, but other top regulators do, so it’s still safe.

What impressed me the most was that the execution time on trades was the fastest I’ve tested; we recorded 72ms on MetaTrader 4. Considering the industry average we captured was 129ms, this far superior speed can reduce the chances of price slippage.

Pros & Cons

- Offers the highest leverage – 1:500

- Excellent execution speeds from 72ms

- Good choice of trading products

- Not regulated by FCA

- High minimum deposits

- Withdrawal fees

Broker Details

Non-FCA-Regulated High-Leverage Forex Brokers

Be aware that British citizens can only trade forex via an FCA-regulated broker – no matter where they reside. (The previous section of this article includes comprehensive reviews of FCA-licensed brokers with high leverage that may fit your needs and trading budget.) If, however, you’re an international trader living in the UK, you can open an account with one of the below high-leverage brokers licensed by a regulator in another jurisdiction.

When signing up with the broker, you will want to sign with a broker (or a broker’s subsidiary) that uses a regulator with more relaxed leverage rules. Brokers (or their subsidiaries) based in countries such as Bahamas, Belize, Mauritius, Seychelles, Vanuatu, and even New Zealand and South Africa are examples of countries for you to consider since they have a financial regulator that allows high leverage. You should avoid brokers (and their subsidiaries) based in countries such as Australia, Singapore, the UAE, Canada, and all members of the European Union because leverage is limited due to regulatory reasons, similar to the FCA.

Blackbull Markets Offers High Leverage Coupled With Fast Execution Speeds

Auckland-based BlackBull Markets has only been on the scene since 2014 and may not be as well known as other brokers we profiled. Still, its focus on innovative trading technology combined with high leverage makes it a compelling presence in the trading industry. Ultra-fast execution speeds mean BlackBull’s 20,000 active clients enjoy an authentic ECN-style experience and ultra-high leverage – margins touch 500:1.

Key Strengths

- Leverage of up to 500:1 for certain products – the highest of any Tier-1-regulated broker

- A proprietary trade-order aggregation software that reduces execution time

- STP-style execution for fast order placement

BlackBull Markets has two entities. One is based in New Zealand, which is regulated by the Financial Markets Authority (FMA) and the second is based in Seychelles. This entity holds a license from the Financial Services Authority (FSA) of Seychelles. When signing up with Blackbull Markets, you can choose either entity since both allow leverage up to 500:1.

BlackBull Markets Trading Accounts

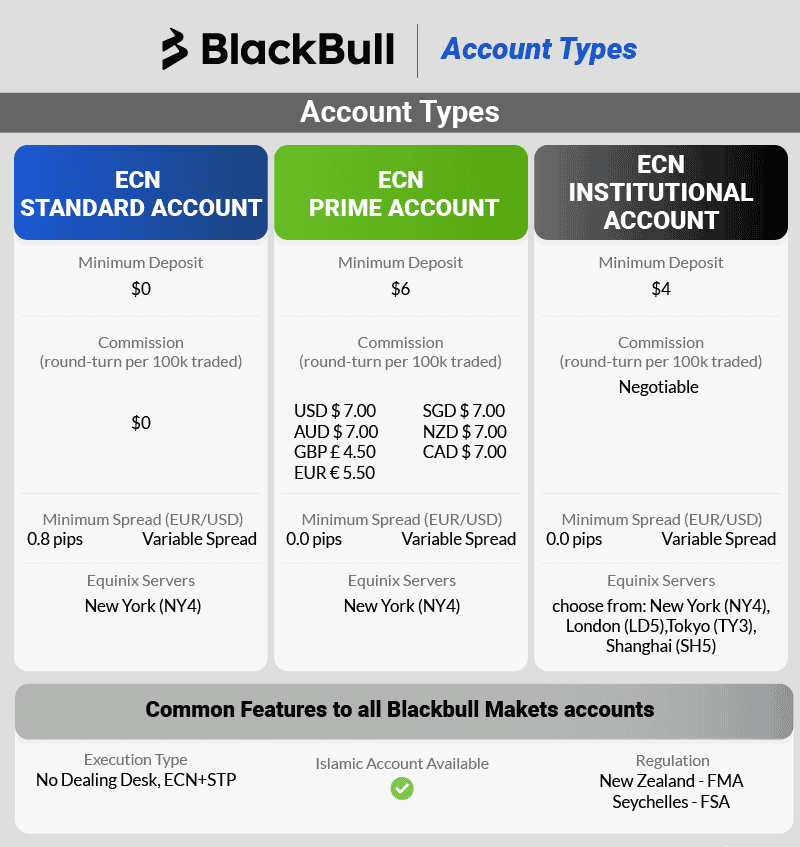

Similar to other high-leverage forex brokers, BlackBull Markets offers a range of account types designed to suit a variety of trading needs:

- ECN Standard account. As the name suggests, this commission-free account offers an ECN-like trading experience with straight-through processing and variable spreads starting at 0.8 pips.

- ECN Prime account. In exchange for a commission of £ 4.50 on round-turn trades of standard lots, ECN Prime account holders enjoy tight spreads starting at 0.0 pips and the same ECN-like trading experience.

- ECN Institutional. Designed for professional traders and institutional investors, this account type operates on a negotiable commission basis. Spreads start at 0.0 pips. BlackBull allows investors to execute trades through four Equinix servers located in key financial markets: New York, Shanghai, Tokyo, and London.

BlackBull offers an Islamic or ‘swap-free’ trading account for British forex traders living in majority-Muslim countries.

All BlackBull Markets account types support scalping, hedging, and automated trading. Traders can also use stop loss and take profit order types to protect their investments and limit losses.

BlackBull Markets requires a USD 50.00 deposit to open an account and offers all forex traders an ECN-like, no-dealing desk trading experience, regardless of account type. Demo accounts are available on a 30-day basis, at which point traders can convert to a live account.

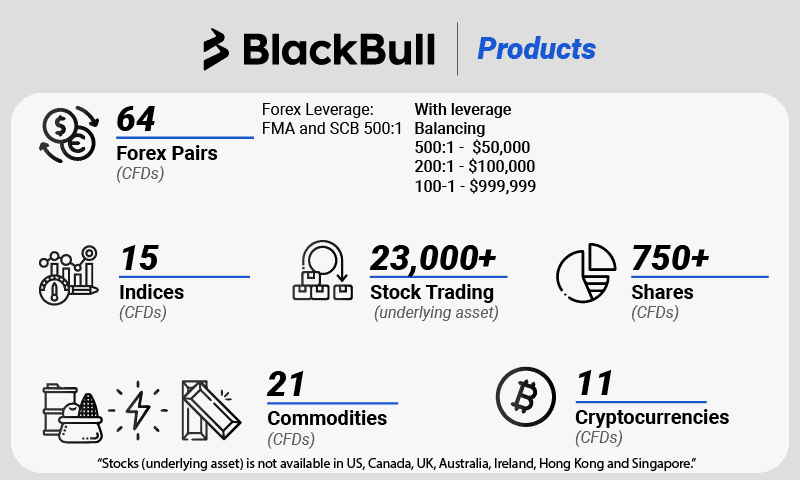

BlackBull Markets Trading Products

BlackBull Markets account holders have access to some of the highest leverage rates in the world: up to 500:1 for the 64 forex pairs on offer. Just note that the more equity you have in your trading account, the lower the maximum leverage available.

In addition to its major, minor, and exotic currency pairs, this high-leverage broker supports CFD trading in the commodities markets and stocks, shares, and indices. Cryptocurrencies, including Bitcoin, are available for direct investment and corresponding CFDs.

BlackBull Markets does not offer spread betting but supports scalping, hedging, and automated trading styles.

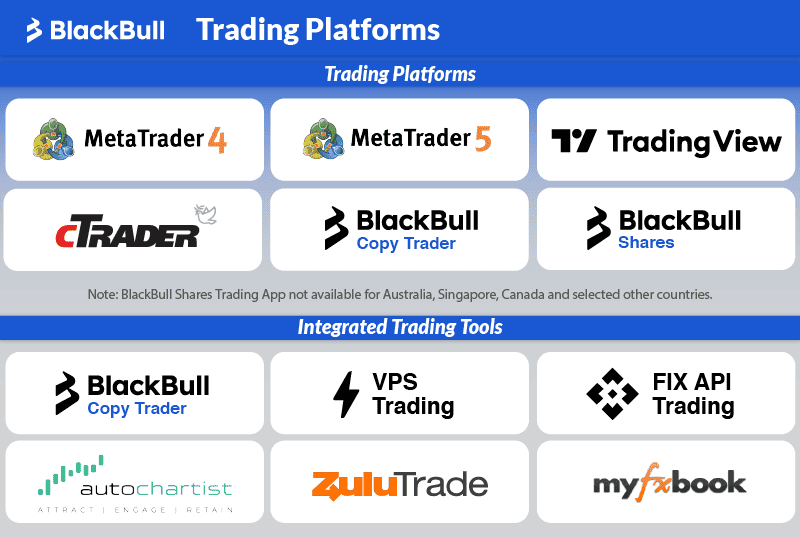

BlackBull Markets Trading Platforms

In line with its dedication to trading technology innovations, BlackBull Markets provides account holders with multiple trading options. Apart from the BlackBull Shares mobile app, account holders have the option to trade forex, CFDs, and shares using MetaTrader 4 and MetaTrader 5 through desktop, WebTrader web app, or mobile.

Social traders can choose between HokoCloud and ZuluTrade solutions and a MyFxBook integration for MetaTrader4 and MetaTrader 5. BlackBull Markets also offers VPS and API trading integrations for even faster execution speeds, regardless of platform.

Our Verdict On BlackBull Markets

For traders authorised to open an account with a non-FCA-regulated broker, BlackBull Markets offers an attractive combination of high leverage and fast execution speeds.

7. IC Markets - Great Forex Broker With MetaTrader 5

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

IC Markets is one of our top-rated brokers, scoring 84/100 with excellent execution speeds, tight spreads, and a decent choice of markets. In our tests, the broker offers a tight average spread of 0.32 pips on EUR/USD with their RAW account, better than the industry average of 0.49 pips.

We also liked the result of our tests showing the broker has zero-pip spreads were available 97.83% of the time. This is great if you’re a scalper, as the Depth of Market feature on MT5 allows for faster trades and seeing market orders.

Pros & Cons

- Leverage of 1:500

- Low trading costs

- Choice of MetaTrader or cTrader platforms

- No fees for depositing or withdrawing

- Different commissions for MetaTrader and cTrader

- Lacks market analysis resources

Broker Details

IC Markets Provides Higher Margin Limits And Affordable Pricing

Since its founding in 2007, Sydney-based IC Markets has grown to become one of the largest forex brokers in the world. IC Markets is a no-dealing desk broker offering commission-free, spread-only trading or commission-based pricing. This international high-leverage broker has access to deep liquidity, sourcing its prices from over 25 liquidity providers worldwide to provide traders with the best rates.

Key Strengths

- Access to deep liquidity means excellent rates and low trading costs

- Variety of trading platforms and tools

- Award-winning customer support

When signing up with IC Markets, to get leverage of up to 500:1, you will want to sign up with the broker’s subsidiary in Seychelles. The Financial Services Authority of Seychelles regulates this entity with License number: SD018.

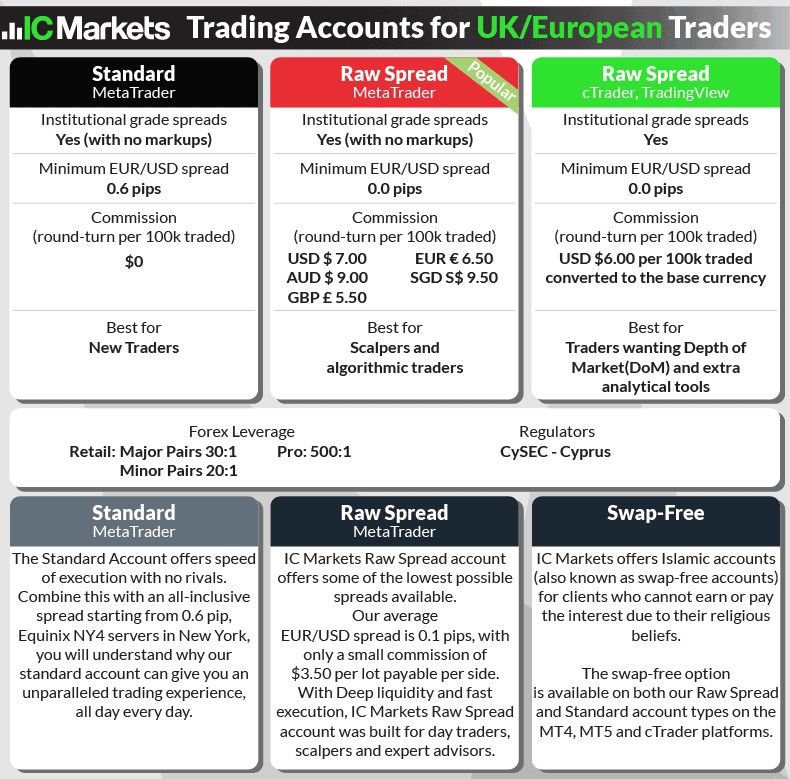

IC Markets Trading Accounts

IC Markets clients have the option to select from three account types and two pricing structures, depending on their preferred trading platform:

- Standard account. This commission-free account type offers institutional-grade spreads with no markups starting from 0.6 pips.

- Raw Spread account (MetaTrader). Tight spreads start from as low as 0.0 pips for major currency pairs like EUR/USD. Traders using a GBP-based account pay a commission of £ 5.00 on round-turn trades of 100,000 lots. It’s an excellent choice for algorithmic traders and scalpers who trade frequently.

- Raw Spread account (cTrader). With tight spreads and a flat commission of USD 3.00 for all round-turn trades of standard lots, the Raw Spread account with cTrader has competitive pricing. It may better meet the needs of traders seeking access to extra analytical tools.

IC Markets provides 24/7 live assistance for account holders, going beyond the typical Monday-to-Friday support offered by most brokers. Since forex markets operate around the clock, on-demand help can sometimes mean the difference between large profits and huge losses. Traders can reach support personnel, who are also traders, through live chat, email, and toll-free phone calls.

New traders and those unfamiliar with IC Markets can get to know this high-leverage forex broker with a demo account. For anyone wishing to convert to a live account, a minimum deposit equivalent to USD 200 in a currency supported by IC Markets is recommended.

IC Markets Trading Products

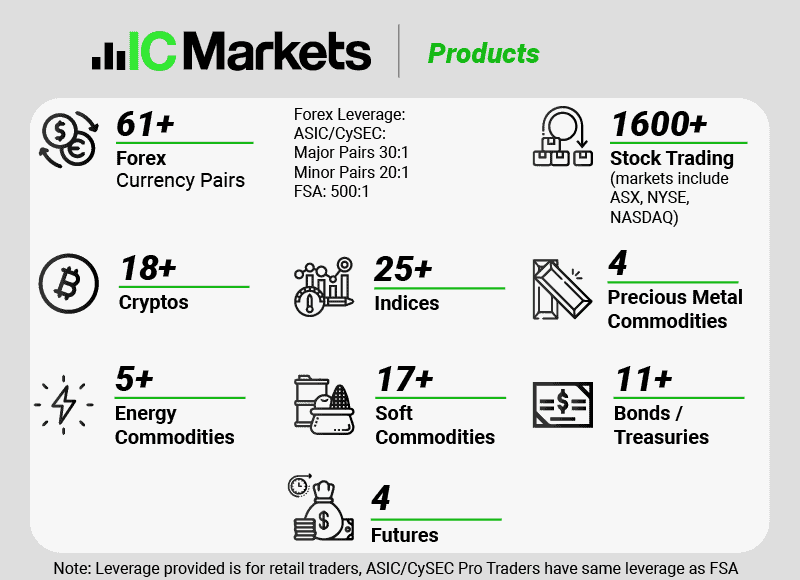

As an international online broker catering to retail investors of all stripes, IC Markets can provide traders with a comprehensive selection of assets, financial instruments to invest in, and related CFDs.

In addition to 61 currency pairs, IC Markets account holders can trade commodities, indices, stocks, cryptocurrencies, and bonds (sometimes called treasuries).

One unique asset class not offered by other top forex brokers? IC Markets provides access to four futures, including ICE Dollar Index Futures, CBOE VIX Index Futures, Brent Crude Oil Futures, and WTI Crude Oil Futures.

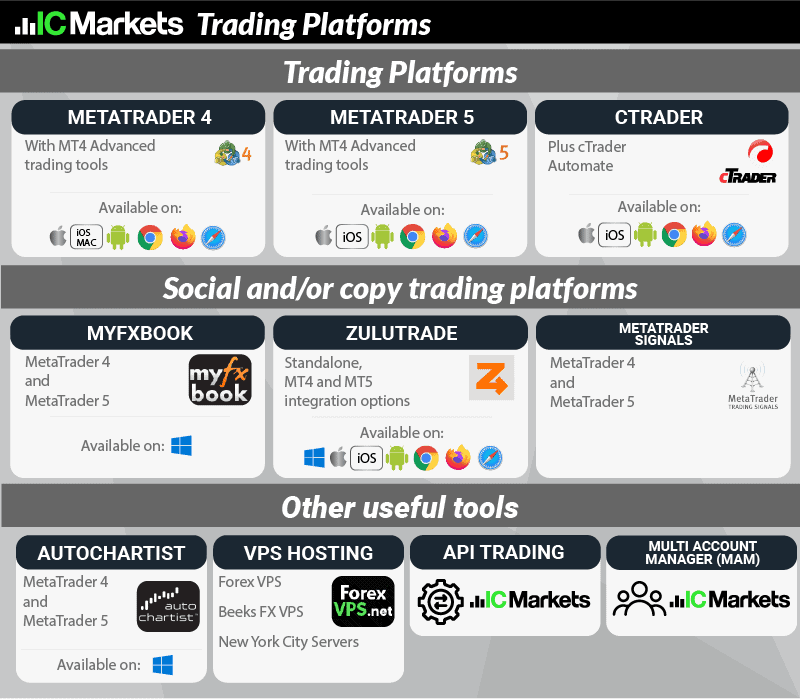

IC Markets Trading Platforms

While IC Markets doesn’t (yet) offer account holders the option to trade via a home-grown platform, it does provide access to its preferred platforms – MetaTrader 4, MetaTrader 5, cTrader, and TradingView – across all devices and operating systems.

Whether you trade on a desktop client terminal, the WebTrader web app, or your Android or iOS mobile, IC Markets has a solution.

In addition to MetaTrader 4 and MetaTrader 5, traders committed to a social trading or copy trading strategy can execute orders on ZuluTrade as a stand-alone platform. For those who prefer to trade on MetaTrader platforms, IC Markets offers MyFxBook and MetaTrader Signals integrations.

Other useful tools and integrations available to IC Markets account holders include Autochartist for advanced charting, VPS hosting, API trading, and multi-user account management.

Our Verdict On IC Markets

For beginners ready to transition to trading on margin or intermediate traders searching for higher margin limits, IC Markets provides a compelling blend of global reputation, solid customer support, and affordable pricing.

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

8. FP Markets - Good Forex Broker For Scalping

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

We consider FP Markets an excellent choice for scalping, earning a 79/100 score in our tests, primarily due to low trading costs and an extensive market range.

Notably, they offer zero spreads on major currency pairs, consistently observed at 97.83% in our tests. We also like their low spreads which average remains a mere 0.1 pips on EUR/USD making it ideal for cost-conscious scalpers.

With over 11,000 markets, it provides abundant options for making numerous small, quick trades without significant losses to spreads.

Pros & Cons

- Leverage of 1:500

- Low trading costs with the RAW account

- Easy account opening and funding

- Wide choice of markets

- Time-limited demo accounts

- Basic mobile trading app

- Limited market research resources

Broker Details

FP Markets Offers High Leverage And A Solid Collection Of Trading Products

While not the most sophisticated option, Best Forex Brokers In Australia FP Markets can claim competitive trading costs and a solid range of asset classes for trading, including major and minor currency pairs, and other financial instruments for CFD trading.

Key Strengths

- Competitive trading fees

- High-quality educational resources for beginners

- Easy account opening and funding options, including credit card and electronic payment services

To get leverage higher than 30:1 (permitted by FCA), you must sign with the FP Markets entity based in Saint Vincent and the Grenadines.

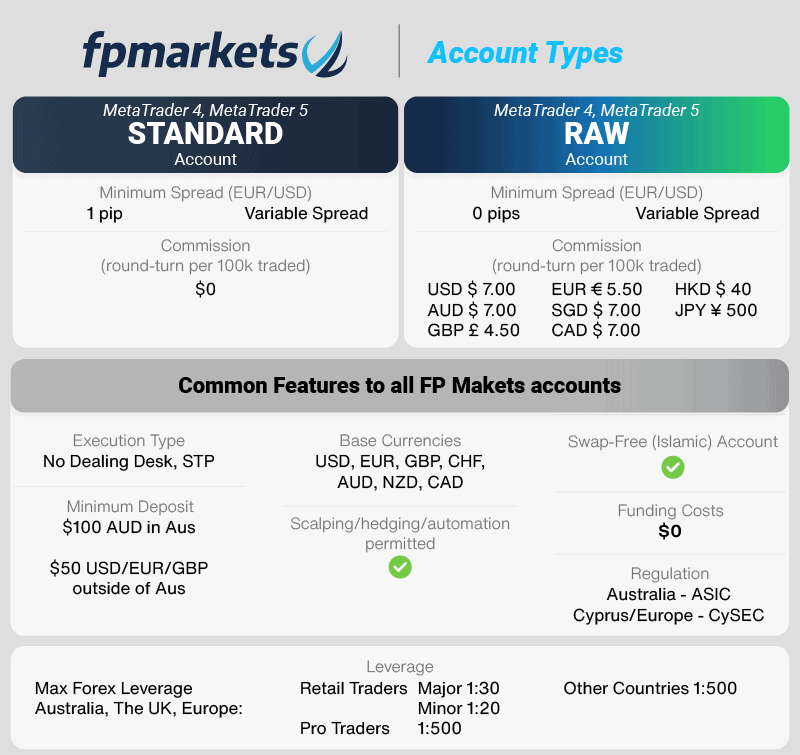

FP Markets Trading Accounts

Like many of the best forex brokers, FP Markets provides account holders with two options. The Standard and Raw account types include ECN-style pricing via an STP trading environment and operate on a no-dealing desk model.

Standard account. This commission-free account requires traders to pay only spread fees for round-turn trades of a standard lot. Note, however, that variable spreads start at 1.0 pips.

Raw account. Variable spreads are narrower with the raw account – some currency pairs have spreads as tight as 0.0 pips – but the broker charges a commission of £4.50 for round-turn trades of standard lots.

All FP Markets accounts operate on a no-dealing desk model with STP for fast execution speeds. Likewise, scalping, hedging, and automated trading styles are all permitted.

FP Markets allows traders still learning the ropes to practise executing orders or test a trading strategy via a demo account. To begin live trading with this high-leverage broker, demo account holders need only make a minimum deposit of £ 50.00.

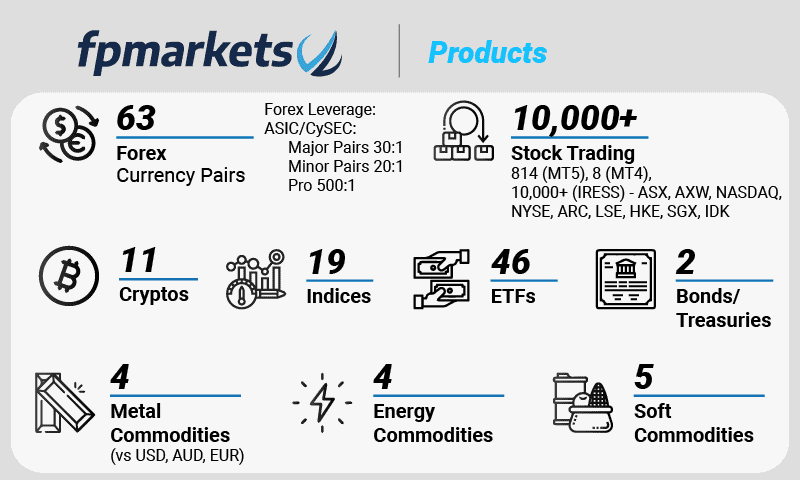

FP Markets Trading Products

Though not as varied as other high-leverage forex brokers, FP Markets claims a solid collection of trading products.

Forex traders can choose from more than 60 currency pairs, ranging from major pairs like EUR/USD, AUD/USD, USD/GBP, and USD/CHF to minors and exotics. In addition to forex, FP Markets account holders can trade in CFD derivatives.

However, FP Markets does stand out for a strong stock CFD selection, including 46 ETFs and two bonds. (Note, however, that bond CFDs and ETF CFDs aren’t available.)

FP Markets account holders can now trade 19 indices, four cryptocurrencies, four energy commodities, and two metals.

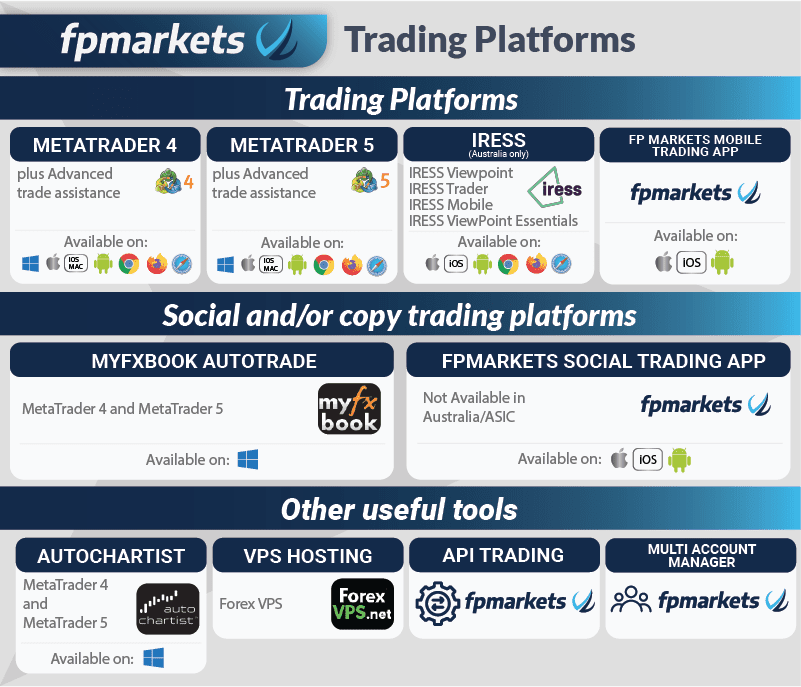

FP Markets Trading Platforms

If you’ve heard of it, you can probably trade on it with this broker. FP Markets goes more than the extra mile when it comes to available trading platforms, add-ons, and tools. Every one of the broker’s trading platform options comes in web, mobile app, and desktop formats, no matter what your operating system.

The broker’s home-grown mobile app, FP Markets Mobile, is a user favourite for its straightforward interface. Still, account holders can also trade on the popular MetaTrader 4, MetaTrader 5, cTrader, or TradingView platforms.

Traders using a social or copy trading strategy can use MyFxBook integrations for MetaTrader and FP Markets’ social trading app, compatible with the broker’s proprietary mobile app.

Finally, account holders enjoy access to advanced trading tools like Autochartist, API trading, VPS hosting, and a multi-account manager.