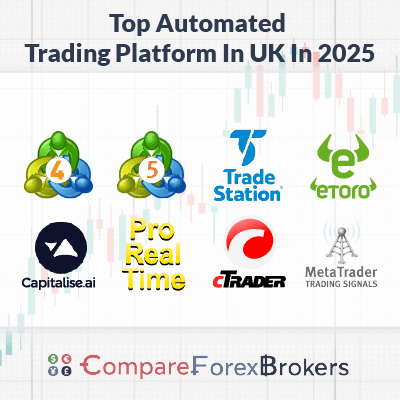

Best UK Automated Trading Platforms

Automated trading platforms offering social-copy and/or algorithmic trading features allow you to save time and effort for CFD and forex trading. Read on to discover the various ways you can automate trading strategies in 2025.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Our July 2025 best algorithmic trading software UK list is

- MetaTrader 4 EAs - Best Platform For Automation

- MetaTrader 5 EAs - Good Algo Platform CFD Trading

- Tradestation - Top Automated Trading Software

- eToro - Best Social Trading Platform

- Capitalise.ai - Top Free Algorithmic Trading Platform

- ProRealTime - Top Analysis + Auto Trading Platform

- cTrader - Good Platform For Algorithmic Trading

- MetaTrader Signals - Copy Trading Software

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

FCA CySEC, BaFin |

0.10 | 0.30 | 0.20 | £2.25 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

96 |

FCA CySEC, ASIC |

0.06 | 0.23 | 0.27 | £2.25 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

52 |

FCA CBI |

- | - | - | 0.08%-0.2% | - |

|

|

|

110ms | $0 | 100+ | - | 30:1 | 500:1 |

|

||

Read review ›

Read review ›

|

43 |

FCA CySEC |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 46+ | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

70 |

FCA BaFin, CySEC |

0.30 | 0.90 | 0.40 | $3.00 | 1.3 | 1.4 | 1.7 |

|

|

|

150ms | $300 | 42+ | 7+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

71 |

FCA BaFin, CySEC |

0.16 | 0.59 | 0.29 | £3.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $450 | 100+ | 12+ | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

59 |

FCA CySEC |

0.32 | 0.37 | 0.51 | £2.63 | 1.32 | 1.7 | 1.95 |

|

|

|

151ms | $0 | 69+ | 30+ | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

66 |

FCA ASIC, MAS |

- | - | - | - | 0.70 | 1.1 | 2.2 |

|

|

|

95ms | $150 | 84+ | 25+ | 30:1 | 500:1 |

|

What Are The Best AI Trading Platform In The UK?

Our team created a list of the best forex brokers in UK to help UK traders choose the best provider. That said, UK traders who primarily implement automated strategies rely more on some factors, including execution speed, spreads, and trading platform features. We revised the list for this subset of traders based on the new weightings.

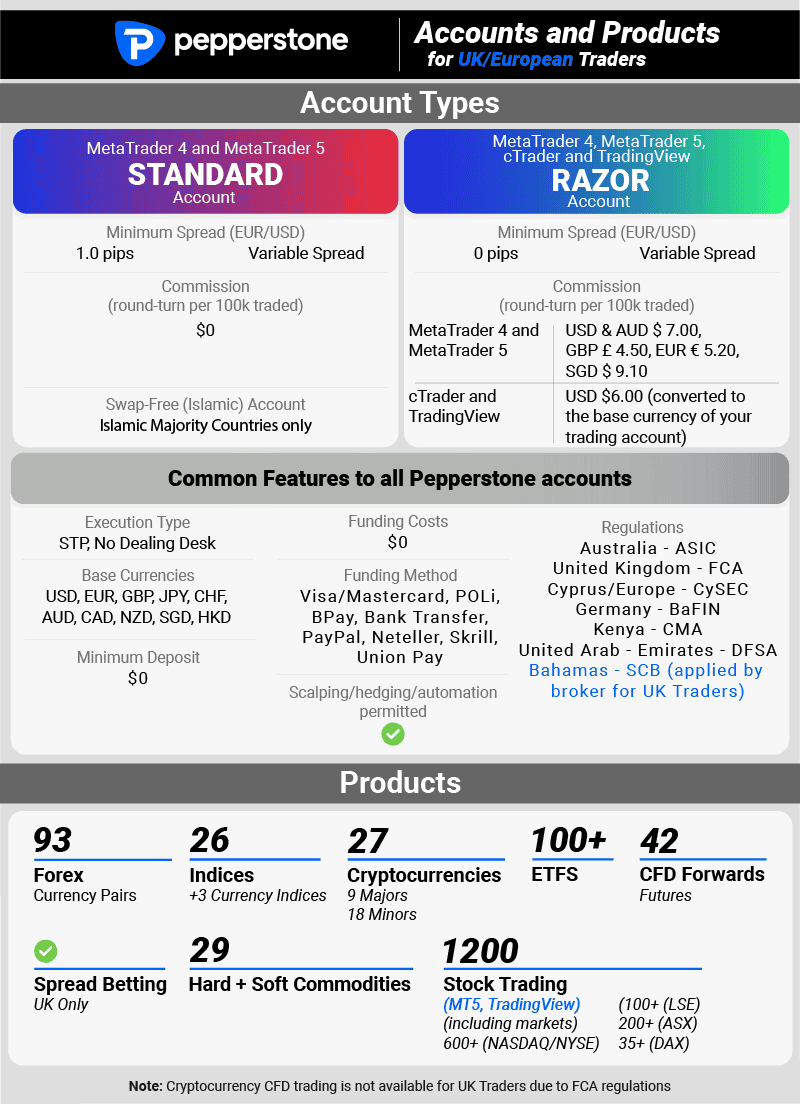

1. MetaTrader 4 EAs with Pepperstone - Best Platform For Automation

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend MetaTrader 4 EAs

For MetaTrader 4, we like Pepperstone as the top broker, offering improved MT4 tools and fast execution speeds. We recommend MetaTrader 4 EAs for automated trading because it simplifies your trading experience with excellent automation features.

With MetaTrader 4, you can program Expert Advisors (EAs) to handle your trades autonomously, allowing the EA to trade in multiple markets at once or scan the markets all day.

Pros & Cons

- Available on most brokers

- Fast performance

- Access to thousands of indicators

- Interface is basic

- Can’t trade share CFDs

- No native platform for Mac computers

Broker Details

MetaTrader 4 is the oldest platform on our list, but it is also the most popular thanks to its huge community of dedicated traders. The core reason for its popularity is that MT4 introduced Expert Advisors, which are programmable robots that allow you to automate your trades or develop customised technical indicators with MQL4.

As part of our testing, we tried MetaTrader 4 and found the platform offered 30+ technical indicators and drawing tools, such as moving averages and MACDs, out of the box. This selection of indicators gives you a good foundation for developing your EAs.

We liked the automation MT4 offers. You can append an EA to any market by clicking “Autotrading,” the robot will start scanning for market conditions that match its rules. EAs can follow everything from entry and exit conditions to risk management and scaling rules and, if programmed well, can sufficiently run an entire trading account with little human interaction.

Our issue was developing an EA. Although it has no limits because it can be programmed in MQL4 to develop a fully automated strategy, you still have to know how to code. Fortunately, MT4’s community is large, so you can find EAs pre-built by other knowledgeable traders or hire a programmer to develop one for you.

During our testing, we used Pepperstone to trade on MetaTrader 4. It’s our best-rated broker, scoring 98/100 in our recent review, offering low trading costs and excellent trading conditions.

In particular, while testing Pepperstone’s trading costs, our analyst Ross Collins discovered that the broker offered its Razor account spreads at 0.0 pips 100% of the time across its major pairs. This trading account is ideal for testing MT4 automation, with zero spreads and improved overall trading costs—especially if your EA trades frequently.

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| TMGM | 97.83% |

| FP Markets | 97.83% |

| Eightcap | 97.83% |

| Admirals | 95.60% |

| Blueberry Markets | 94.20% |

Not only did they score high in our trading costs category, but they were also impressed with our execution speed testing. Our analyst ranked them as third-fastest overall, with limit order speeds of 77ms and market order speeds of 100ms.

Execution speed is vital for automating trades. It allows the EA to send instructions to the broker without lag, protecting you from potential price slippage.

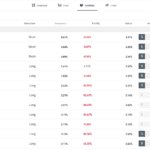

| Broker | Overall Speed Ranking | Limit Order Rank | Limit Order Speed (ms) | Market Order Rank | Market Order Speed (ms) |

|---|---|---|---|---|---|

| Blackbull Markets | 1 | 1 | 72 | 5 | 90 |

| Fusion Markets | 2 | 3 | 79 | 1 | 77 |

| Pepperstone | 3 | 2 | 77 | 10 | 100 |

| OANDA | 4 | 5 | 86 | 2 | 84 |

| Octa | 5 | 4 | 81 | 6 | 91 |

| Exness | 6 | 10 | 92 | 3 | 88 |

| Blueberry Markets | 7 | 6 | 88 | 7 | 94 |

| FOREX.com | 8 | 13 | 98 | 4 | 88 |

| Global Prime | 9 | 7 | 88 | 9 | 98 |

| Tickmill | 10 | 9 | 91 | 11 | 112 |

| TMGM | 11 | 11 | 94 | 13 | 129 |

| City Index | 12 | 12 | 95 | 14 | 131 |

| Trading.com | 13 | 14 | 98 | 15 | 138 |

| FBS | 14 | 17 | 135 | 12 | 118 |

| Axi | 15 | 8 | 90 | 25 | 164 |

| Eightcap | 16 | 19 | 143 | 17 | 139 |

| IC Markets | 17 | 16 | 134 | 22 | 153 |

| FxPro | 18 | 23 | 151 | 16 | 138 |

| Go Markets | 19 | 20 | 144 | 20 | 145 |

| Markets.com | 20 | 22 | 150 | 18 | 141 |

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

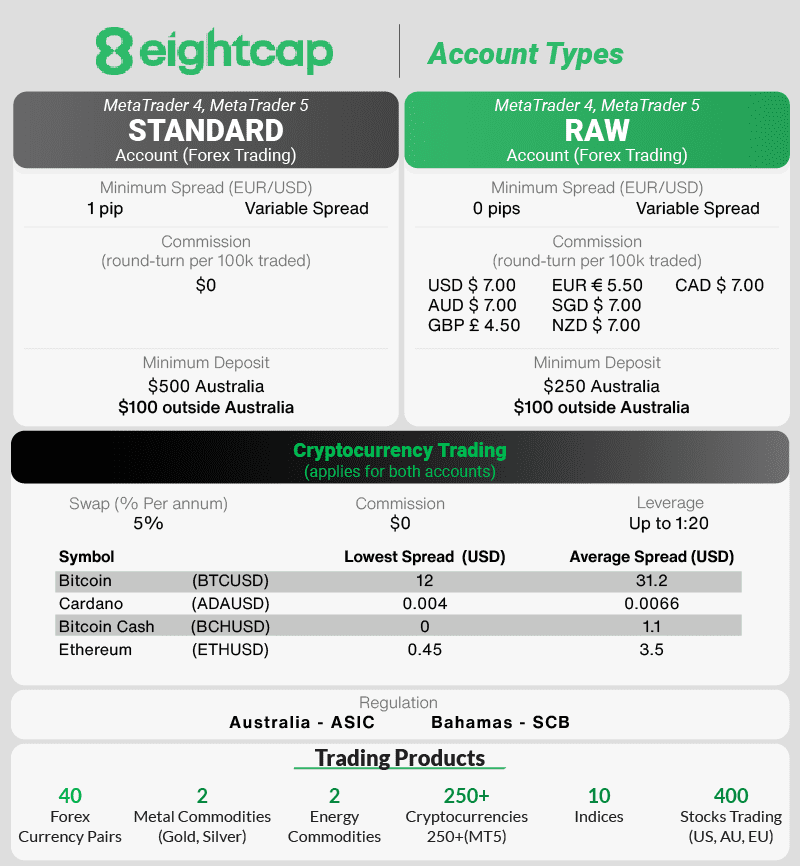

2. MetaTrader 5 EAs with Eightcap - Good Algo Platform CFD Trading

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.73

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend MetaTrader 5 EAs

Our top pick for the MT5 platform is Eightcap, which offers tight average spreads from 0.06 pips on EUR/USD and a decent range of markets to automate. The MetaTrader 5 platform takes all of the popular features of MT4 and enhances it for even better performance, giving your EAs a speed boost, which is vital for executing trades fast.

In particular, if you want also to automate trading stocks, MetaTrader 5 lets you do this while keeping the same interface and functionality of the MT4 platform.

Pros & Cons

- Improved software performance

- Has access to stock CFDs

- Better range of indicators than MT4

- Have to upgrade MT4 EAs to work on MT5

- The marketplace for indicators is less popular than MT4

- Charting isn’t as advanced as some of its competitors

Broker Details

MetaTrader 5 is an upgraded version of MT4 that shares many of the same features, including the use of Expert Advisors to automate trades. The platform introduces features such as Depth of Markets and a native economic calendar, plus 38+ new indicators and drawing tools.

While testing the platform, one of the improvements MT5 offers is that the platform’s software has been rebuilt to improve performance and allow you to trade shares on the platform. MT4’s main limitation was that it couldn’t host share CFD markets on its platform. The boost in software performance helps speed up the EA’s instructions, so your automated strategies will be executed faster than on MT4.

Because of this improvement, our MT4 EAs and indicators cannot be used on MT5, so we had to transition the EAs from MQL4 to MQL5. After a quick research, we found that MetaTrader 5 had articles on how to do this, but converting requires programming knowledge. Fortunately, most third-party EA developers provide an MT5 version of their EAs so that you can download and install it instead.

We liked that MetaTrader 5 kept the same interface so we could operate the platform and set up our EAs without a hitch. Like MT4, you activate the “Autotrading” feature, and your EAs will run and execute trades automatically until you turn them off.

For MetaTrader 5, we tested Eightcap’s standard account, which allowed us to run our EAs across multiple markets, including the 586 share CFDs available. The broker also offers 68 currency pairs, 16 indices, and eight commodities, giving you a full spectrum of markets to automate your trades.

Spreads on Eightcap’s standard account were competitive. They averaged 1.0 pip on EUR/USD, which is better than the industry average of 1.24 pips.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

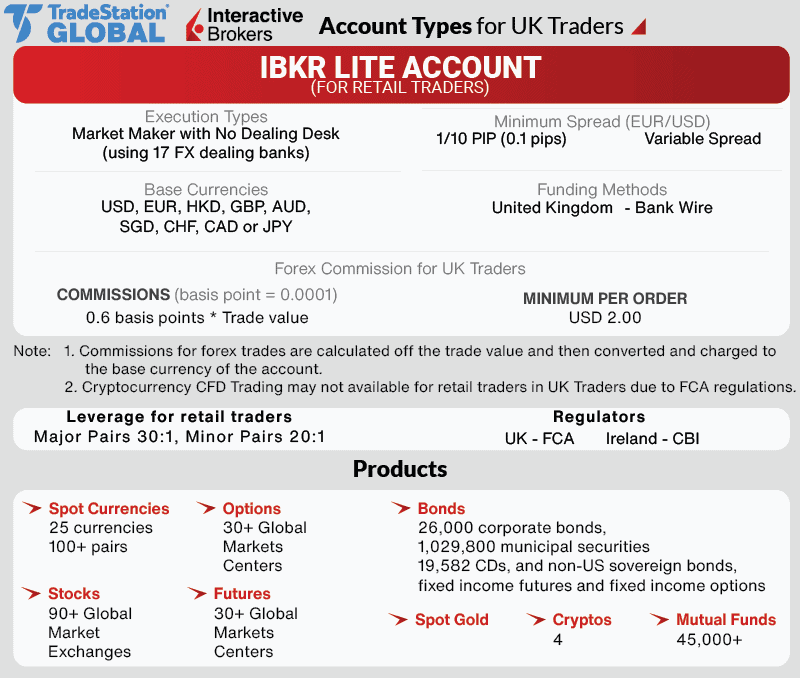

3. Tradestation with Interactive Brokers - Top Automated Trading Software

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Tradestation

Interactive Brokers is our top choice as it offers an impressive range of advanced trading tools to help monitor, manage, and execute your trades easily. TradeStation is an excellent tool that makes developing automated trading strategies a breeze.

We like how the platform allows you to create your trading strategy manually by setting your rules, and then TradeStation’s tools take over, automating your strategy following your rules.

Pros & Cons

- Develop automated strategies with EasyLanguage

- Advanced trading platform

- Available on the web, desktop, and mobile app

- It doesn’t provide access to forex markets

- The platform can have a long learning curve

- The monthly fee to use the platform (waived if requirements are met)

Broker Details

TradeStation offers multiple ways to automate your trading with their desktop platform.

In our testing, we found that you can develop automated strategies through Tradestation’s EasyLanguage tool. This tool aims to help you build and run your automation with little programming knowledge.

For us, this is a step up on the Expert Advisors that MT4/5 offers, as they have simplified a difficult skill to make automated trading more accessible. It still had a learning curve, but we could set up and run our first basic strategy after creating our trading rules.

Being able to program your automated trades in plain English compared to programming is a huge benefit, making trade automation possible for a wider range of traders.

During our tests, we found that TradeStation leverages Interactive Broker’s trading accounts, offering tight spreads and low commissions across multiple assets, including 26 forex pairs and 125 international stock exchanges.

The trading costs on TradeStation differ from those of the other forex brokers on the list. Forex commission fees are charged at a rate of 0.6 basis points x trade value, with a minimum fee of $2.00. Due to its $2.00 minimum fee, TradeStation would be an expensive broker if you trade small trade sizes (less than one lot).

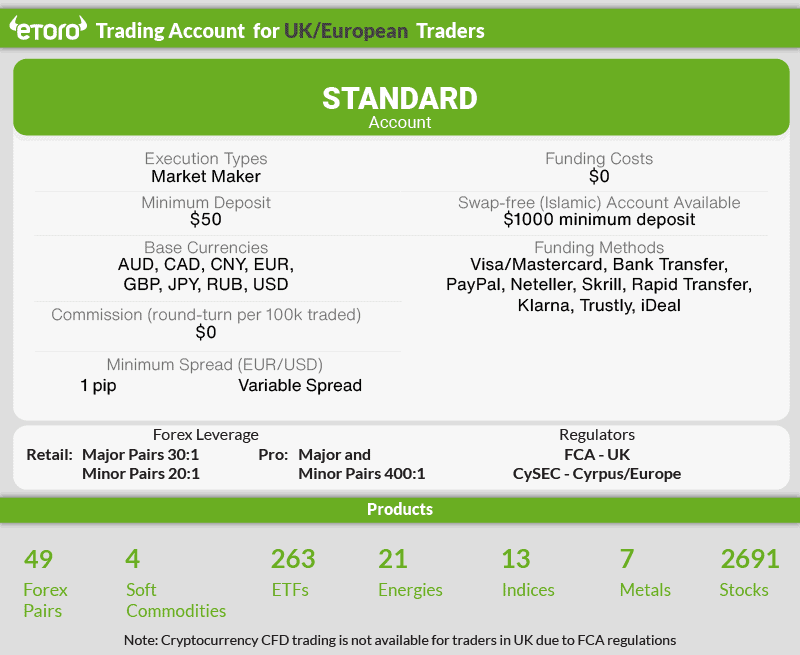

4. eToro - Best Social Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro Trading Platforms

Minimum Deposit

$50

Why We Recommend eToro

We recommend eToro for its social trading features, which are ideal if you want to let other people trade your funds. eToro is unique to this list because of its excellent copy trading platform, where you can choose experienced traders to follow and automatically copy their trades.

This fully automated process eliminates guesswork in trading, making it great for those who want to gain exposure to the markets without the knowledge or experience.

Pros & Cons

- Excellent platform for copy trading

- 30,000,000+ traders to copy from

- No commissions on trades

- You can only use the CopyTrader platform

- Is not an ECN/STP broker

- Has a withdrawal fee

Broker Details

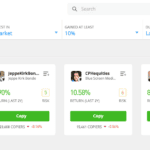

eToro offers a different take on automated trading. In this approach, you mirror the trades of an experienced trader without having to do the analysis and trading yourself.

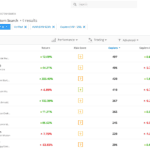

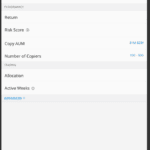

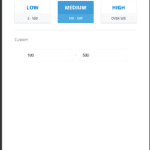

While exploring the eToro CopyTrading platform, we found you can copy over 2,000,000 traders, each with their own strategy and specialist markets. We used the platform’s search feature to narrow down the selection, which allowed us to specify our trading criteria based on 14 categories.

While exploring the eToro CopyTrading platform, we found you can copy over 2,000,000 traders, each with their own strategy and specialist markets. We used the platform’s search feature to narrow down the selection, which allowed us to specify our trading criteria based on 14 categories.

The Assets Under Management (AUM) and Number of Copiers are two good categories to choose from as they show faith in the trader’s ability by others voting with their dollars. After setting our criteria, the platform quickly narrowed the selection to 9, making it easier to manually verify the trader’s performance.

We liked the amount of statistical data available on the platform to analyse. Each trader’s profile displays their current open positions, trading history, monthly performance, and average profitability. The profile also displays an area showing the flow of people copy-trading the individual, which can be a solid indicator of trust when a rise in copiers is seen.

Instead of managing positions, you manage your funds invested in other traders—essentially building a portfolio of traders specialising in different markets. eToro offers a wide range of trading markets, including 49 currency pairs, 2961 stocks, 13 indices, and 41 commodities, so that you can find and fund traders who specialise in each market to diversify your market risk.

While testing the platform, we used eToro’s spread-only account with no commissions (even on stocks) and found its spreads competitive, considering it offers social trading tools. Based on our findings, eToro averaged a one-pip spread on EUR/USD, below the industry average.

*Your capital is at risk ‘51% of retail CFD accounts lose money’

5. Capitalise.ai with FXCM - Top Free Algorithmic Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 0.3

GBP/USD = 0.9

AUD/USD = 0.4

Trading Platforms

MT4, TradingView, Trading Station

Minimum Deposit

$50

Why We Recommend Capitalise.ai

We think FXCM and Capitalise.ai are excellent choices for automating your trades with FXCM’s competitive spreads and Capitalise.ai’s innovative approach to automated trading, particularly its AI strategy generator. You just tell the AI your rules, and it crafts your strategy, ready to use on MT4.

Plus, we like the ability to backtest your strategy right away. You get immediate insights into how your strategy would have performed in the past, quickly helping you decide if a strategy is worth it.

Pros & Cons

- Compatible with MetaTrader 4

- Excellent back-testing software

- Develop strategies quickly with AI

- Limited choice of indicators to work with

- Not all trading products are available

- Has a learning curve to work the AI

Broker Details

We highly rate Capitalise AI as it is one of the only automated trading platforms that allows you to program your strategies without any coding knowledge. This AI saves you hours from learning how to develop an Expert Advisor or paying someone else.

While using the Capitalise AI platform, we liked that you were given an interactive tutorial to help you learn the ropes of developing your first automation. After completing this, we generated our strategy by typing the entry and exit conditions. We were impressed with the range of conditions you can use, which included technical indicators and price action conditions such as ‘moving averages’ and ‘price reversals’ to customise your strategies.

You can test your strategy with the built-in backtesting tool, which is limited to 90 days, to see its recent performance. Alternatively, you can forward test the strategy, where Capitalise AI will deploy the automation on a demo account and record the trading performance in a live environment.

We think this is a top feature, as you can run your tests in a live environment to see how the strategy performs without opening new demo accounts.

To access Capitalise AI, we recommend using FXCM, as we found they offer the platform for free. Capitalise AI integrates with Trading Station and MetaTrader 4, which will execute the trades generated by the automated strategy on Capitalise AI.

FXCM also stood out for us with its low Standard account spreads. Based on our analyst’s testing, Ross found FXCM to offer the third-best Standard account spreads at 0.93 pips on EUR/USD. This spread is the lowest out of the brokers who support Capitalise AI.

| EURUSD | SPREAD |

|---|---|

| IC Markets | 0.73 |

| Admiral Markets | 0.74 |

| CMC Markets | 0.8 |

| FXCM | 0.93 |

| TMGM | 1 |

| FusionMarkets | 1.01 |

| OandA | 1.06 |

| City Index | 1.16 |

| EightCap | 1.16 |

| FP Markets | 1.19 |

| Pepperstone | 1.21 |

| Blackbull Markets | 1.34 |

| Go Markets | 1.34 |

| Axi | 1.45 |

| FXPro | 1.59 |

*Your capital is at risk ‘62% of retail CFD accounts lose money’

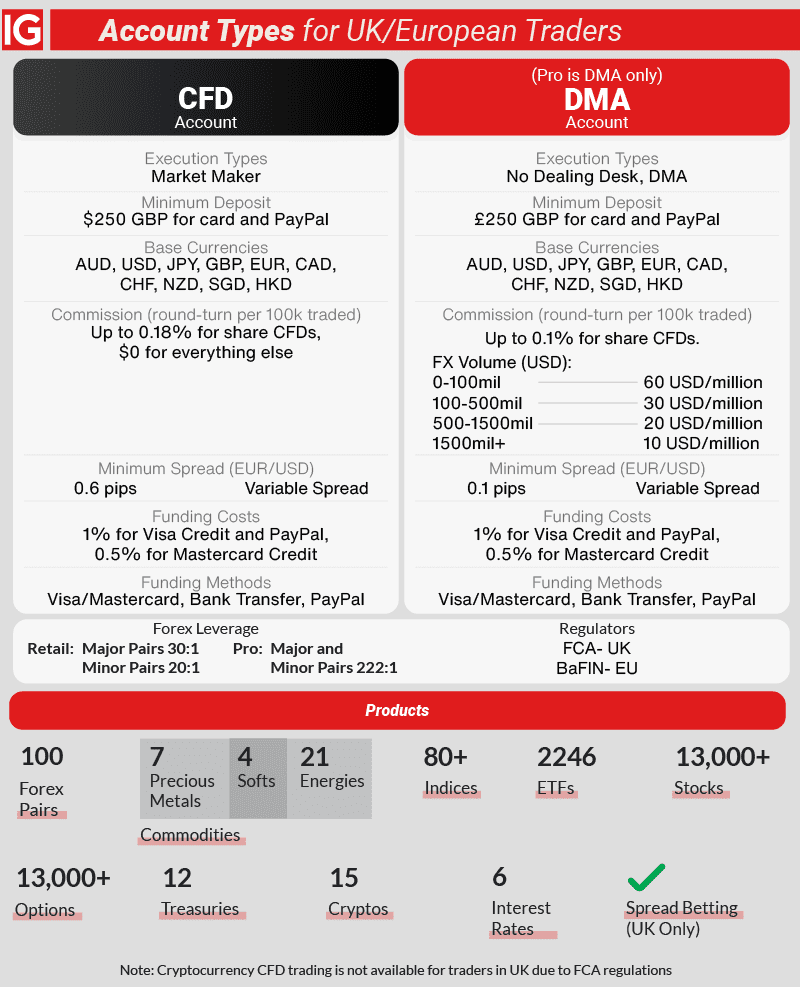

6. ProRealTime with IG Group - Top Analysis + Auto Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend ProRealTime

Our top pick is IG Group with ProRealTime, as the broker offers a wide range of markets with competitive spreads you can use to utilise ProRealTime’s features.

We like ProRealTime for its combination of detailed charting and automated trading capabilities, but what really impressed us is how ProRealTime simplifies creating a trading strategy through a wizard tool.

The ProBuilder wizard tool guides you step-by-step through developing your strategy using a rule-based approach, making it accessible even if you’re new to trading.

Pros & Cons

- Great charts with automated tools

- ProBuilder tool helps you automate strategies

- Decent backtesting tools

- Limited broker support

- Charges fees for market data

- Charts and tools can be challenging to set up

Broker Details

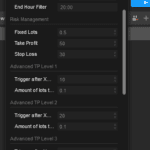

From our testing, we found that ProRealTime offered the best range of ways to automate your trading and analysis. You can develop your automation with coding using ProBuilder or the Automation Wizard to define your trading conditions (including risk management) through a user interface. This wizard makes it easy to transform your strategy into automation if you do not know how to code.

The platform also has automated technical analysis tools called ProRealTrend. This tool automatically plots major and minor support and resistance levels and trend lines that you can apply to your charts. We like this feature because it makes it easier to identify key areas of the market. Plus, you can attach pending orders to the ProRealTrend lines, making it an ideal tool for trade breakouts.

We found IG Group to be the best broker for ProRealTime as the platform allows you to take advantage of the broker’s 17,000+ markets. The brokers offer 80+ forex pairs, 12,000+ share CFDs, 130 indices, 41 commodities, and 7,000+ option markets.

Through an IG Trading Account, you get free access to ProRealTime and its features as long as you make four monthly trades. Otherwise, you may have to pay a subscription fee to run ProRealTime.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

7. cTrader with FxPro - Good Platform For Algorithmic Trading

Forex Panel Score

Average Spread

EUR/USD = 0.2

GBP/USD = 0.2

AUD/USD = 0.5

Trading Platforms

MT4, MT5, cTrader, FxPro Trading Platform

Minimum Deposit

$100

Why We Recommend cTrader

FXPro is our top choice because of its low average spreads and fast execution speed, which pair nicely with cTrader’s excellent trading platform. We like its sleek interface and algorithmic trading features, which blend the best features of MetaTrader 4 and MetaTrader 5.

With cTrader, you can develop your own automated strategy (cBot) or download pre-built cBots from its marketplace.

cTrader impressed us as they are one of the few platforms to offer a native trading platform for Mac users, improving performance for the cBots on a Mac.

Pros & Cons

- Excellent user interface

- Has fast execution times

- Offers a marketplace to find cBots

- Not supported by all brokers

- Programming cBots can be complicated

- Smaller marketplace for indicators compared to MT4

Broker Details

In our testing, we found many similarities between MetaTrader 4/MT5 and cTrader. In particular, the automation tools available allow you to program a bespoke trading robot.

Like MetaTrader’s Expert Advisors, you can develop your own “cBot” that will follow your trading rules and automatically trade. We liked that the platform open-sourced all 70+ built-in indicators, allowing you to use them to write your cBot, giving you a head start.

Another highlight we liked was that cTrader segments algorithmic trading away from the platform’s manual and copy trading workspaces. We think this declutters the platform from distractions when building and testing your cBot, helping you forward and backtest using the Automate tools within the workspace.

With cTrader offering a range of advanced features for algo trading and a depth of markets, we found that FxPro had the best overall experience as an STP broker. We think this helps with algo trading as the broker offers Raw spreads, faster execution times, and direct market access, giving your cBots better pricing and lower trading costs.

In our testing, we found that you can only access cTrader through its FxPro cTrader account, which is a commission-based account with tight spreads. The account offered decent spreads across the major pairs from our testing, averaging 0.32 pips on EUR/USD, with commissions of $3.00 per lot traded, one of the lowest commissions available.

| Pair | Avg. RAW Spread |

|---|---|

| EUR/USD | 0.32 |

| USD/JPY | 0.42 |

| GBP/USD | 0.37 |

| AUD/USD | 0.51 |

| USD/CAD | 0.74 |

| Overall Average | 0.47 |

If you wish to algo trade with a spread-only account, you can access the FxPro MT4 and FxPro MT4 Fixed accounts, which offer variable and fixed spreads on currency pairs.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

8. MetaTrader Signals with City Index - Copy Trading Software

Forex Panel Score

Average Spread

EUR/USD = 0.07

GBP/USD = 0.011

AUD/USD = 0.8

Trading Platforms

MT4, TradingView,

City Index WebTrader

Minimum Deposit

$0

Why We Recommend MetaTrader Signals

We recommend MetaTrader Signals as there’s a wide selection of signal providers to copy, allowing you to choose based on your trading preferences.

We like that you can view and assess the performance of these providers within the platform and that the signals are available on MetaTrader 4 and MT5.

The service allows you to subscribe to signal services and automate the trades based on these signals or receive alerts for manual execution (giving you the final say).

Pros & Cons

- View signals performance over time

- Over 3,000+ providers

- Free or paid signals are available

- The accuracy of signals depends on the broker’s execution

- No control over the strategy

- Paid signals can be expensive

Broker Details

Like eToro, you can use MetaTrader Signals to copy experienced traders who offer services through MetaTrader’s online marketplace or within the ‘Signals’ tab on the desktop platform.

We tried the MetaTrader Signals on the desktop platform and found that searching based on our criteria was non-existent. However, the web platform allowed us to search based on a range of conditions, such as:

- No. of Copy Traders

- Max drawdown

- Profit/Month

- Initial Deposit

Using this tool, we narrowed down our options from the 7,000+ signal providers on the MetaQuotes Marketplace. MetaTrader Signals offers real-time analytics and trading history with each signal provider, helping you verify and choose the right traders to copy.

When you copy a signal provider, the MetaTrader platform will automatically mirror their trades, allowing you to profit when they profit (or take losses when they do).

We used our City Index CFD account (but you can use spread betting) to mirror the trades as the broker provides a solid selection of tradeable markets, allowing us to copy any currency pair our copy trader trades.

Based on our testing, the City Index CFD account also stood out for its low spreads. The broker averaged 0.70 pips on EUR/USD, one of the lowest in our industry tests—comfortably beating the industry average of 1.24 pips.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

Ask an Expert

What are good brokers that allow me to use capitalise.ai?

Eightcap is your best choice but other brokes include FXCM and Intereactive Brokers