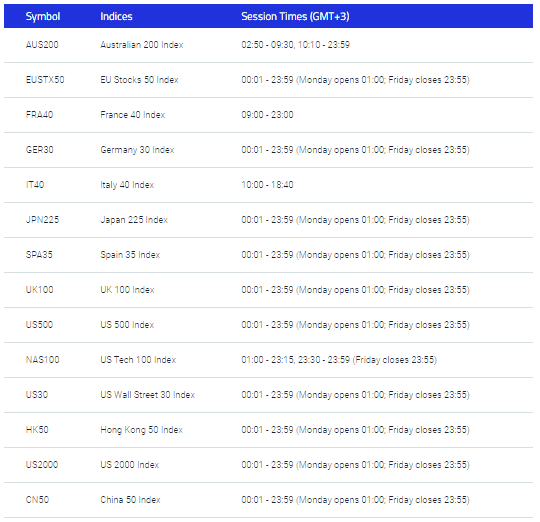

Pepperstone Leverage For UK Traders 2024

Pepperstone Limited is the FCA-regulated subsidiary for UK residents with a maximum leverage requirement of 30:1 for retail traders. Only those who qualify as professional traders can get the higher 500:1 leverage that Pepperstone can offer.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert