Pepperstone Leverage

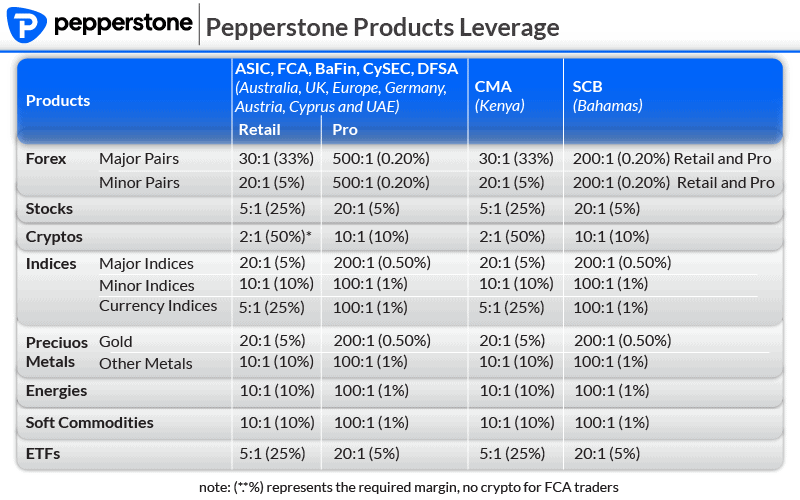

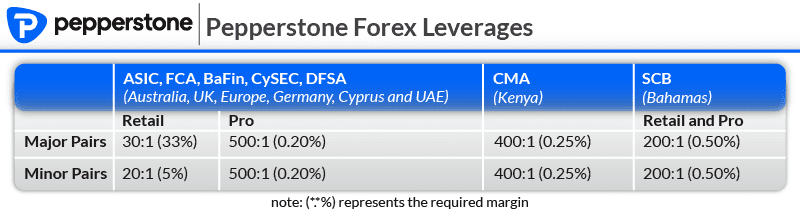

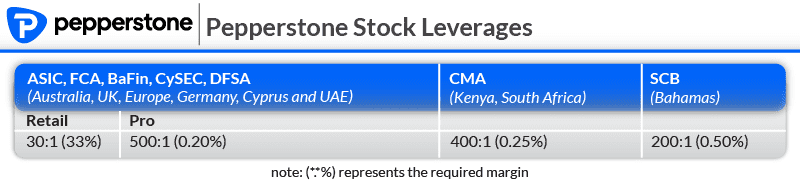

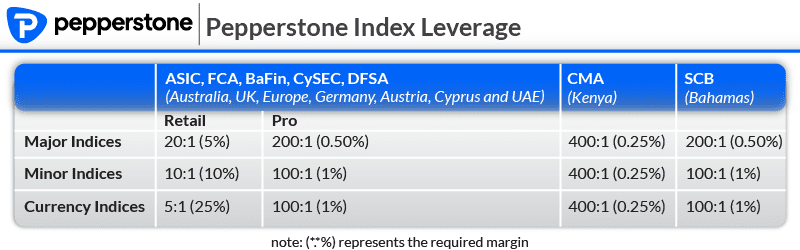

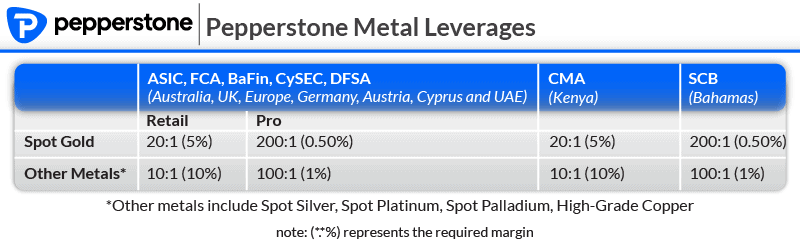

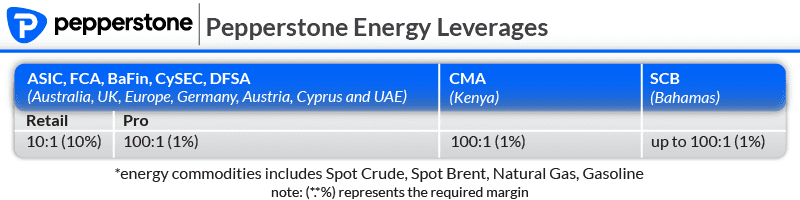

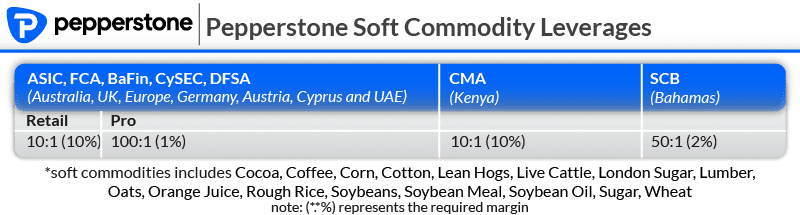

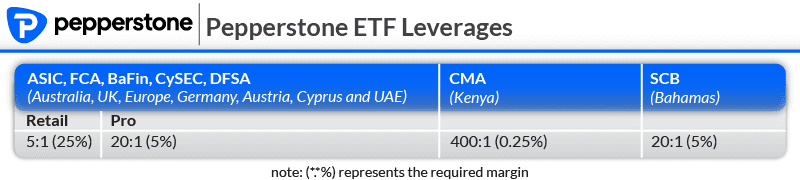

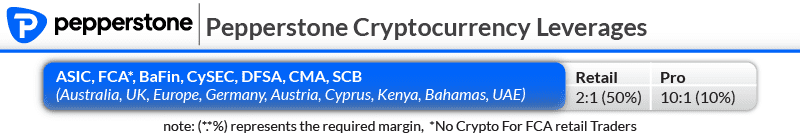

Pepperstone offers a leverage ratio of 30:1 for major forex currency pairs. Find out the leverage options Pepperstone offer for 150+ other financial products. These CFD products include cryptocurrencies like Bitcoin, indices, and metals like gold.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert

I live in the USA can I trade on your platform?

Hi Chris, sorry we are not a platform. We are a comparison website but if you are in the US, OANDA and Forex.com are two good brokers to consider. Just note that you are trading spot not CFDs since CFDs are not permitted in the US.