Best Forex Brokers For Beginners In USA

To find the best forex broker for traders in the USA, we compared the full list of CFTC-regulated brokers based on forex trading platform, spreads and features. View the full forex broker comparison below.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

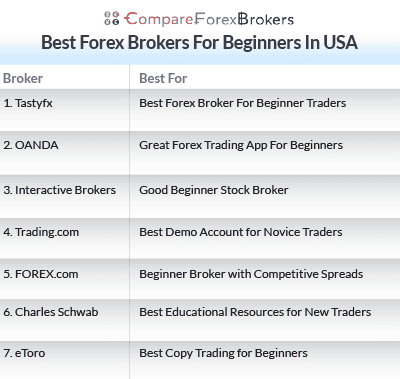

The top 7 beginner forex brokers for USA traders are:

- Tastyfx - Best Forex Broker For Beginner Traders

- OANDA - Great Forex Trading App For Beginners

- Interactive Brokers - Good Beginner Stock Broker

- Trading.com - Best Demo Account for Novice Traders

- FOREX.com - Beginner Broker with Competitive Spreads

- Charles Schwab - Best Educational Resources for New Traders

- eToro - Best Copy Trading for Beginners

Who Is The Top Beginner Forex Broker?

Tastyfx is the best forex broker for beginner US traders offering a free demo account, $0 minimum deposit and an easy to use trading platform. Other brokers regulated by the CFTC and NFA were shortlisted based on platform usability, educational tools, and customer service levels.

1. Tastyfx - Best Forex Broker For Beginner Traders

Forex Panel Score

Average Spread

EUR/USD = 1.13

GBP/USD = 1.66

AUD/USD = 1.01

Trading Platforms

MT4, tastyfx Web Platform, tastyfx Mobile App, ProRealTime

Minimum Deposit

$250

Why We Recommend Tastyfx

We were impressed with Tastyfx’s wide range of trading pairs and competitive spreads, making it a standout among US forex brokers we reviewed. The platform offers a strong selection of calculators and charting tools, which enhance the trading experience. Beginners benefit from extensive educational resources and research materials. Tastyfx, formerly known as IG Markets, continues its strong legacy in its new format.

Pros & Cons

- Comprehensive educational tools and trading support

- Impressive proprietary trading platforms

- Robust research tools and trading strategy insights

- Limited Product Ranges

- Limited trading products on MT4

- Limited account type for US-based traders

Broker Details

Among all the online forex brokers we’ve reviewed in the US, Tastyfx stands out for its wide variety of trading pairs, competitive low spreads, and extensive range of calculators and charting tools.

With our experience navigating the global trading scene, we can vouch for Tastyfx’s strong reputation. It’s particularly advantageous for beginners, thanks to its impressive array of educational resources and research materials. Tastyfx offers valuable guides, demonstrations, and the chance to practice with a demo account before moving on to live trading.

Key Strengths:

- Excellent educational tools and trading supports

- Great proprietary trading platforms

- Extensive research tools and trading strategy ideas

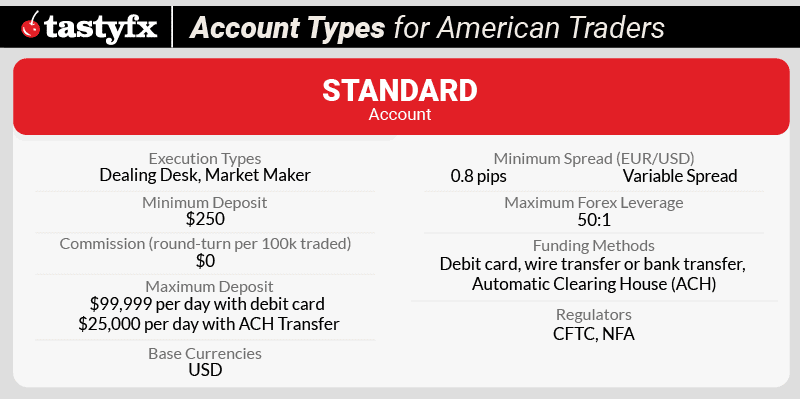

Tastyfx Trading Accounts

While tastyfx offers only a single account type for US-based forex traders, the broker’s Standard account caters aptly to newcomers and seasoned traders.

Variable spreads starting at just 0.08 pips are highly competitive, beating Tastyfx’s closest rivals by up to 20% for EUR/USD pairs. Although Tastyfx operates as a market maker, the lack of commissions on trades keeps it cost-effective, even for high-volume traders.

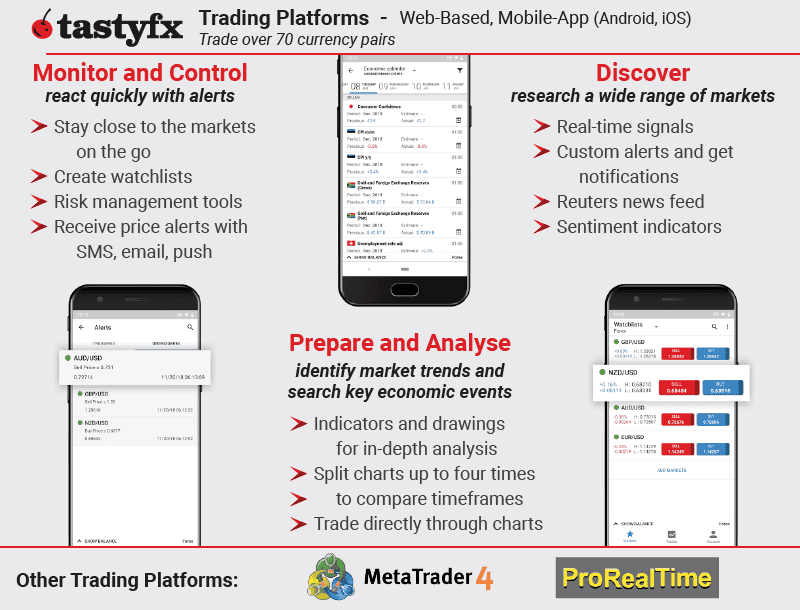

Tastyfx Trading Platforms

From our experience, Tastyfx’s proprietary platforms—whether web, mobile, or tablet—adapt seamlessly to your trading needs and skill level. US users benefit from access to 25 indicators, 17 drawing tools, and a range of market research tools on Tastyfx’s platforms.

For forex trading specialists and those interested in implementing automated trading strategies, Tastyfx offers two additional platforms: MetaTrader4 and ProRealTime.

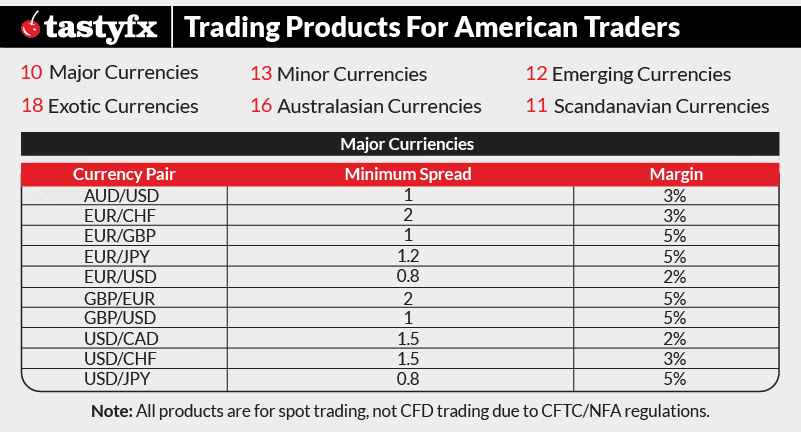

Tastyfx Trading Products

In addition to major currency pairs such as AUD/USD, NZD/USD, and USD/SGD, the broker offers a range of exotic options, with a special emphasis on Asian and Scandinavian currencies.

Tastyfx caps leverage for major currency pairs at 50:1 – the maximum allowed by US law – and minor pairs at 20:1.

Our Verdict on Tastyfx

As pioneers in offering trading accounts for individuals, Tastyfx has had ample time to refine its platforms and gather valuable data. This dedication is evident. Although experienced traders might look for more advanced options, Tastyfx is a great choice for those just starting in forex trading.

2. OANDA - Great Forex Trading App For Beginners

Forex Panel Score

Average Spread

EUR/USD = 0.89 GBP/USD = 1.54 AUD/USD = 1.37

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

We’ve put OANDA to the test, and it didn’t disappoint. They’ve mastered the global forex game with over 25 years of experience and branches stretching from the US to Australia. We found their account structure straightforward, perfect for those just dipping their toes into forex. Plus, trading costs are easy to work out, eliminating any guesswork.

Pros & Cons

- Low spreads and competitive trading costs

- Offers an extensive range of forex pairs

- Provides trading tools for free

- No share products to trade

- Customer support is not 24/7

- Limited educational resources

Broker Details

Having personally trialled the global forex broker OANDA, which boasts offices across Europe, the US, Asia, and Australia, we can attest to the value you’ll derive from their over 25 years in the industry. Their straightforward account structure and quickly calculable trading costs make them a solid choice for beginners. Meanwhile, we observed that the array of potent integrations and their well-crafted in-house platform offer a wealth of advantages to the more advanced traders.

Key Strengths:

- Low spreads and competitive trading costs

- Wide variety of assets to trade

- 24/7 customer support by traders, for traders

OANDA Trading Accounts

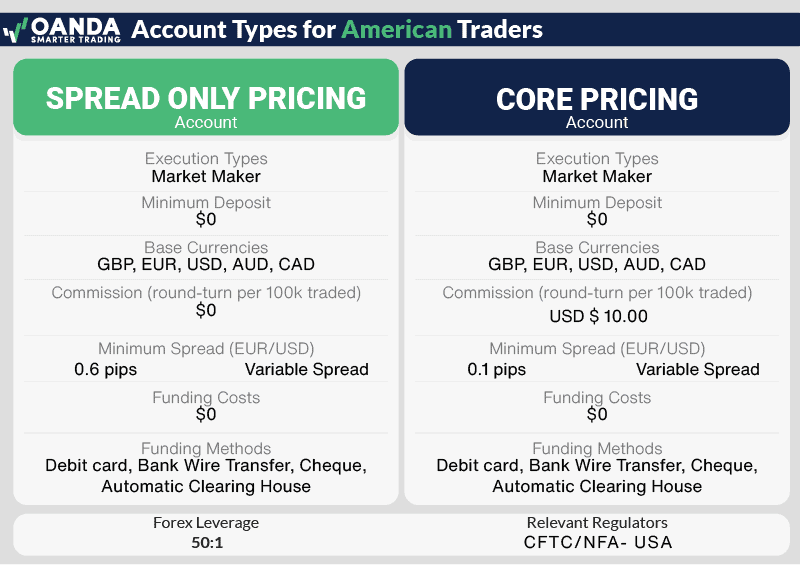

For high-volume traders or beginners aiming to boost their ROI, OANDA’s fee structure might be precisely what you’re after. Their Spread Only Pricing account wraps the commission within the spread from just 0.6 pips. You’ll also appreciate the low forex fees on extended positions.

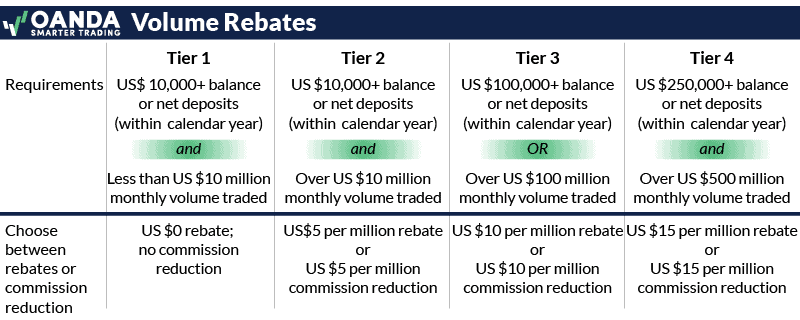

OANDA also offers American account holders an attractive rebate program to reward high-volume traders with cash rebates and commission reductions ranging from USD 5.00 and USD 15.00 per million dollars traded.

Minimum Deposit And Funding Methods

There’s no pressure to front a minimum deposit or sustain a minimum balance to activate and maintain your OANDA account. However, you’d incur a monthly fee of up to ten units of your account currency if you remain inactive for over a year.

OANDA also assists in reducing some indirect trading expenses, like withdrawals. You can confidently pull funds out of your OANDA account free of charge, irrespective of your chosen method: debit card, credit card or ACH transfer. But remember that opting for wire or ACH money transfers might stretch processing times beyond six days.

OANDA Trading Platforms

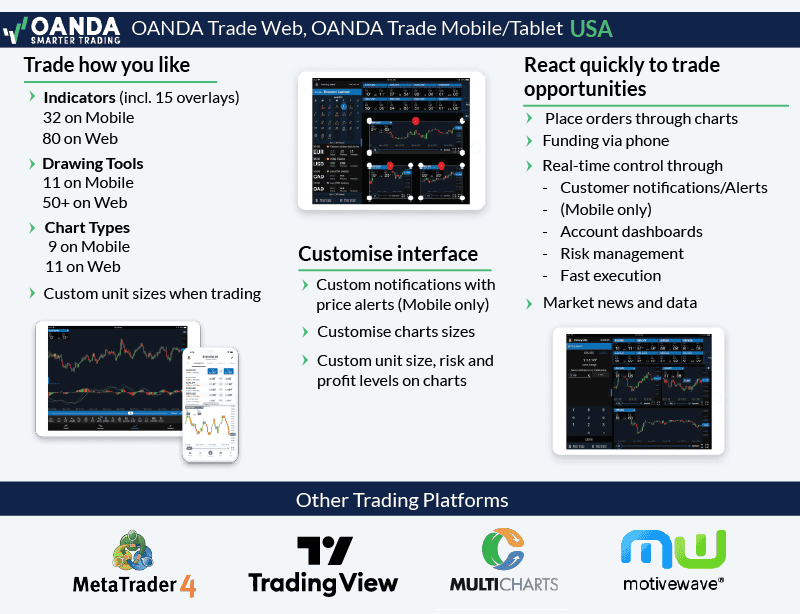

OANDA presents a diverse suite of trading platforms featuring their proprietary web, mobile, and tablet options powered by TradingView. Our experience indicated that newcomers and seasoned traders would find these platforms apt. The OANDA Trade platform, particularly, caught our eye with its robust performance analytics and advanced charting options.

If you’re a MetaTrader 4 user, OANDA also allows access to additional tools, including advanced indicators, mini charts, alert trading, EAs, alert trading and one-cancels-the-other orders, keyboard trading and tick trading via MetaTrader Premium. For automated trading, OANDA offers US traders a private API, OANDA v20 REST, which allows for automated trades via the OANDA Trade platforms.

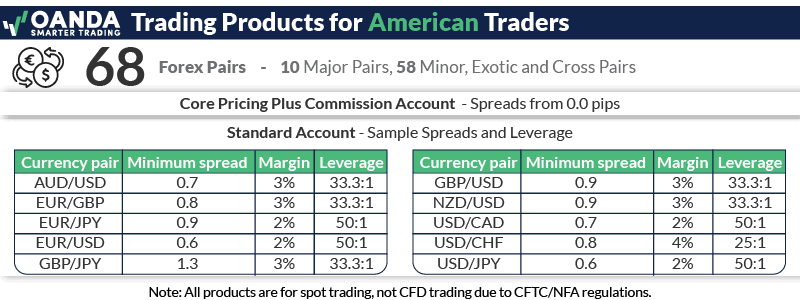

OANDA Trading Products

One area of improvement? Available markets. While OANDA grants American traders access to a commendable 68 currency pairs, we felt there’s room for a bit more diversity. You’ll undoubtedly find all the major pairs – EUR, GBP, USD, JPY, NZD, AUD, and CHF – but perhaps fewer exotic options than provided by some competitors.

Our Verdict on OANDA

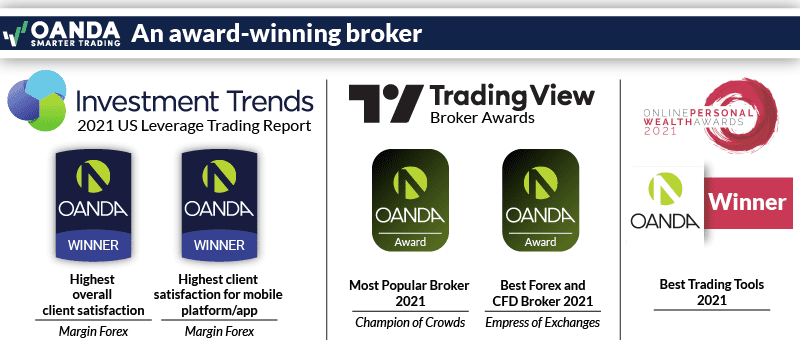

Given OANDA’s remarkable range of instruments, tight spreads, and dynamic trading tools apt for any strategy, they easily clinch the top rank among forex brokers catering to US traders. They were also named the overall Best Forex Brokers In USA for more advanced traders based on their low trading costs and advanced trading environment.

Exclusive 10% Cashback Offer Available (Terms and Conditions Apply)

3. Interactive Brokers - Good Beginner Stock Broker

Forex Panel Score

Average Spread

EUR/USD = N/A GBP/USD = N/A AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

Despite IBKR’s label as a “discount” broker, the broker impressed us with its institutional-grade trading environment and they certainly don’t skimp on the quality of their trading tools. Contrary to what one might expect, their competitive trading costs aren’t at the expense of a top-notch trading experience.

While the platform has a steep learning curve, we found the cost savings and access to 105+ currency pairs worth the initial effort for serious beginners. Their mobile platform shines, incorporating a range of analytical, charting, and market research tools.

Pros & Cons

- Ultra-competitive spreads and commissions

- Access to 105+ forex pairs

- $0 minimum deposit

- Institutional-grade execution

- Complex platform for beginners

- Steep learning curve

- No MetaTrader support

Broker Details

IBKR Has The Best Apps And Mobile Interface

While some might label IBKR as merely a ‘discount’ broker, our experience with them paints a different picture. Indeed, IBKR has rolled out an impressive suite of trading tools for US account holders. Their low trading costs didn’t compromise the quality of our trading environment. They presented us with a great collection of tradable assets and the tools we expect for analysis, charting, and market research.

Key Strengths:

- Large selection of assets to trade (105+ currency pairs)

- Strong market research and educational tools

- Low trading costs

Interactive Brokers Trading Platforms

Being familiar with Interactive Brokers, or IBKR as many know it, we were particularly drawn to its stellar mobile app. Tailored for traders always on the move, this app ensures trading from a smartphone or tablet feels just as seamless as from a web app or desktop. While some might associate IBKR primarily with its stock and ETF platforms, you can trade forex across 105 currency pairs.

One of the great things about IBKR Mobile was its genuine mobile-first approach. Its streamlined, mobile-centric interface didn’t compromise on data richness, technical analysis or charting tools.

Features like SmartRouting™ impressed us by efficiently scanning markets to pinpoint the optimal ECN or market centre for order routing. Security, of course, was paramount. With trading primarily via mobile devices, the multiple security layers, including two-factor identification and Face ID, gave us peace of mind regarding personal data and transaction records.

Other IBKR Trading Platforms

Apart from the mobile platform, we explored several other trading arenas IBKR presented:

Trader Workstation is Interactive Brokers’ most powerful trading platform, which makes sense since this is the only platform you can download onto your desktop. During our review, we found TWS overwhelming at first as it offers over 100 order types, advanced algorithms, and extensive customization options. The interface feels dated compared to modern platforms, but the depth of control it provides is unmatched.

IBKR Client Portal is a lite version of Trader Workstation but for web browsers. We found this platform more suitable for beginners, offering essential charting tools, market data, and straightforward order entry.

GlobalTrader facilitates stock and forex trading across global markets. The platform also caters to crypto and funds trading. IBKR Mobile brings the trading experience to iOS and Android devices with real-time quotes, advanced charts, and the ability to manage positions on the go.

One notable limitation is that IBKR doesn’t support MetaTrader 4 or MT5. If you’re specifically looking for MT4, check out our comparison of the best MT4 brokers.

IBKR Accounts and Products

IBKR offers two account types for US traders: IBKR Lite and IBKR Pro.

The IBKR Lite account operates commission-free for US stocks and ETFs, making it ideal if you’re exploring multiple asset classes. However, forex trades on this account use wider spreads as IBKR builds their profit into the quote.

For forex-focused beginners, we’d recommend the IBKR Pro account. You’ll pay $2 commission per 100,000 traded, but you’ll get raw spreads starting at just 0.2 pips on major pairs. For high-volume traders, their tiered pricing reduces costs further – we’ve seen commissions drop as low as $0.10 per contract at higher volumes.

There’s no minimum deposit requirement, though you’ll need sufficient margin to open positions based on IBKR’s risk management rules.

With access to over 105 currency pairs across majors, minors, and exotics – one of the widest selections among US brokers – you’ll find all the major pairs like EUR/USD, GBP/USD, and USD/JPY with spreads consistently between 0.2 and 0.4 pips on the Pro account.

Beyond forex, IBKR provides access to stocks, ETFs, options, futures, and bonds. This makes it valuable if you’re planning to diversify beyond currency trading as your skills develop.

Leverage caps at 30:1, following NFA regulations.

IBKR: Our Verdict

For seasoned traders or beginners willing to tackle a learning curve, IBKR’s competitive pricing was a definite advantage. The cost-effectiveness and their mobile trading app made our trading journey with IBKR quite fulfilling.

The $0 minimum deposit removes barriers to entry, while the tiered commission structure rewards you as trading volume grows. However, if you’re after MetaTrader support or prefer a simpler interface, consider other trading platforms in the USA.

4. Trading.com - Best Demo Account for Novice Traders

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 1.3

AUD/USD = 1.0

Trading Platforms

MT5

Minimum Deposit

$50

Why We Recommend Trading.com

Trading.com stands out for those in the US who want the best of MetaTrader 5. Specialising exclusively in the latest offering from MetaQuotes, Trading.com has a lot to offer automated trading enthusiasts. While some competitors might offer tighter spreads or additional trading tools, when it comes to leveraging Expert Advisors for technical investment, Trading.com clearly emerges as our top choice.

Pros & Cons

- Commission free trading

- The research portal is impressive

- Competitive spreads

- Only offers forex markets

- Operates as a market-maker

- Has inactivity fees

Broker Details

For those with a penchant for automated trading or keen to dive into a broader spectrum of markets and instruments than MetaTrader 4 can cater to, settling for a broker proficiently in the platform’s upgraded and swifter version is the way to go.

While many brokers have integrated MetaTrader 5, we’ve noticed that Trading.com has carved a niche by zeroing in exclusively on this evolved successor to the renowned MT4.

Key Strengths:

- Wide range of available instruments to trade

- Straightforward trading environment

- Round-the-clock, live customer support

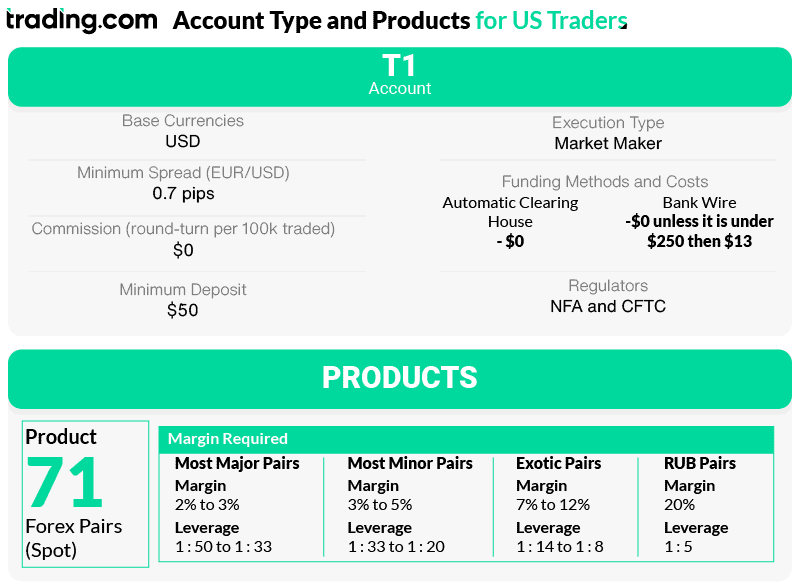

Trading.com Account Types

With Trading.com, we’ve had access to a singular, fuss-free account tailored for US traders. A modest initial deposit of USD$50, conveniently payable through wire or ACH transfer, as well as credit or debit card, and we were set to commence our trading journey.

It’s worth noting that this broker operates as a market-maker, ensuring a trade’s execution. Moreover, with spreads commencing at a commendable 0.7 pips and the absence of commission on round-turn trades of standard lots, it’s a worthwhile consideration.

For forex enthusiasts among us, Trading.com hits the mark. They provide 71 pairs in total, covering all major, minor, and exotic categories, including RUB pairs. Their leverage scales to the utmost permitted by US regulations.

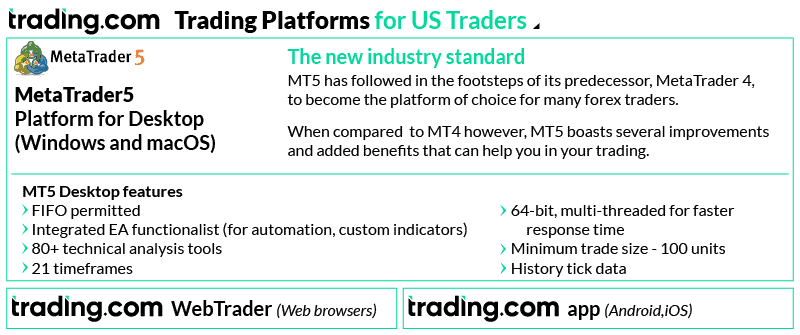

Trading.com Trading Platforms

Whether you’re venturing into trading or eager to acquaint yourself with MT5’s enhanced functionalities, we reckon Trading.com is the optimal broker for those predominantly inclined towards MT5.

So, why this unwavering commitment to MetaTrader 5? Essentially, the latest iteration encapsulates the core strengths of MetaTrader 4 and introduces a set of novel features, positioning it as the dream platform for automated trading. The MT5 setup empowers traders like us to craft, evaluate, and deploy our customised trading bots or procure them from an active marketplace.

Furthermore, the platform impresses with its rapid execution and advanced charting capabilities, allowing us to monitor up to 100 charts concurrently across 21 timeframes with 80 technical analysis instruments.

Our Verdict on Trading.com

While Trading.com might not serve up the most thrilling spreads or a toolkit as exhaustive as some leading US forex brokers, it’s the go-to for those who leverage Expert Advisors. The broker offers only MetaTrader 5, which means access to thousands of bots.

5. FOREX.com - Beginner Broker with Competitive Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.21

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, TradingView, FOREX.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

We were impressed with FOREX.com’s low spreads and its solid selection of trading platforms and products. If you are using MetaTrader 4, MetaTrader 5 or TradingView, you’ll find an ideal blend of tight spreads and swift execution. With over 80 forex spot pairs for trade, we think FOREX.com is one of the best choices for Forex trading.

Pros & Cons

- Competitive spreads

- Great range of currency pairs

- Good education resources

- No 3rd party social trading tools

- No swap-free account

- Limited crypto range (where offered)

Broker Details

Having put FOREX.com through its paces, we can confirm their no-dealing desk model does indeed grant US traders access to the most competitive spreads compared to other international brokers active in the USA.

Key Strengths:

- Sophisticated technical trading tools

- Great variety of currency pairs

- Fast trade execution

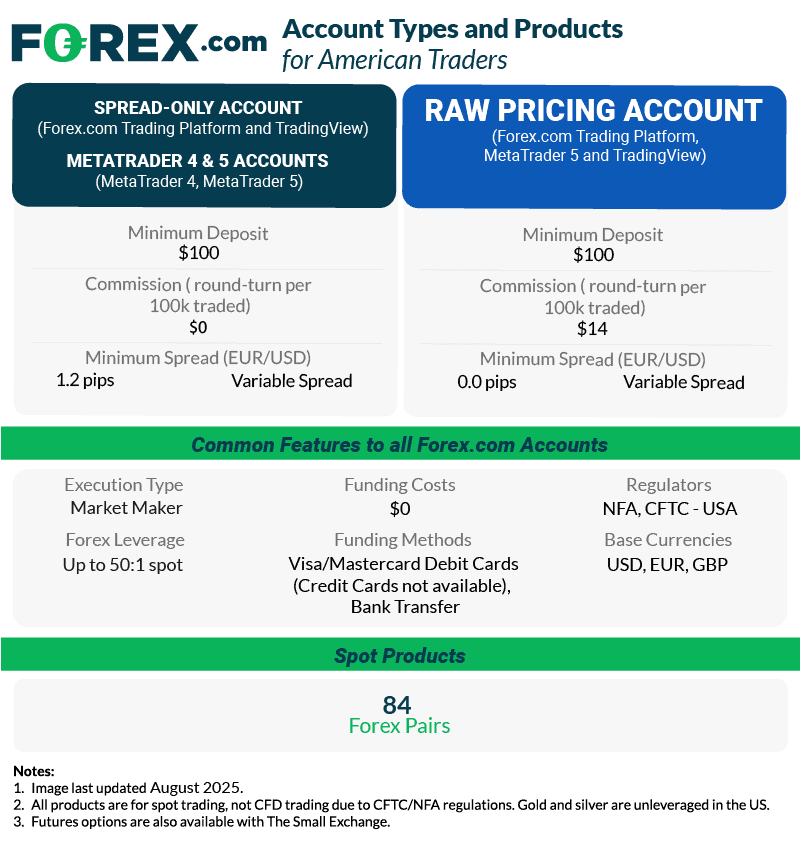

FOREX.com Account Types

FOREX.com is a market maker for its Standard and MetaTrader 4/5 accounts, offering variable spreads commencing from 1.2 pip without any commissions. You’ll appreciate the inclusion of NinjaTrader for automating your trades.

If you are after spreads from 0 pips, FOREX.com RAW Pricing account is available. You will pay a commission of $14 per lot round-turn ($7 for entry and another $7 for exit) for every 100k lot but this is outside the spread meaning better price transparency. Platforms with the RAW account include MetaTrader 5, TradingView and the FOREX.com platform.

FOREX.com Trading Products

With an impressive lineup of 84 currency pairs spanning majors, minors, and exotics, FOREX.com is a front-runner for those traders focused solely on currencies. Notably, minimum spreads for popular pairs such as EUR/USD, USD/CAD, and EUR/GBP can reach lows of 1.2 pip when using a standard account.

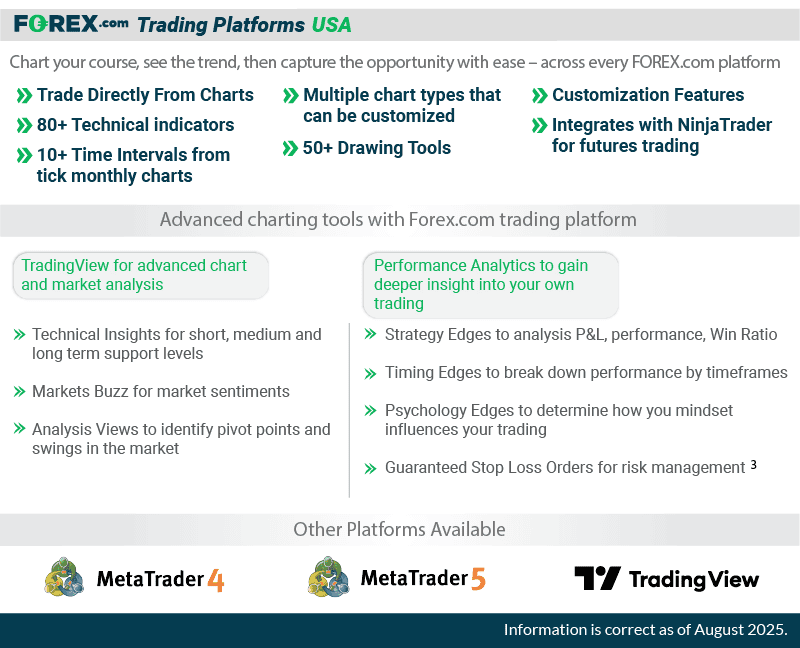

FOREX.com Trading Platforms

FOREX.com likewise offers US-based forex traders a variety when it comes to Trading Platforms. In addition to the broker’s own mobile, web and desktop trading interfaces, you have the option to trade via MetaTrader 4 and MetaTrader 5.

For those with more ‘advanced’ account preferences, FOREX.com supports integrations with superior charting tools like TradingView and sophisticated analytics through Trading Central. And if automation or algorithmic trading is your cup of tea, TradingView can seamlessly integrate with the FOREX.com platform.

Our Verdict on FOREX.com

For those dedicated to good trading platforms like FOREX.com or MT4, desiring the tightest spreads and unmatched execution speed, FOREX.com is your golden ticket, their offering of 84 forex pairs is bound to satiate the majority of forex traders.

*Your capital is at risk up to ‘76% of retail CFD accounts lose money with FOREX.com’

6. Charles Schwab - Best Educational Resources for New Traders

Forex Panel Score

Average Spread

EUR/USD = 1.4

GBP/USD = 1.3

AUD/USD = 1.2

Trading Platforms

thinkorswim desktop, thinkorswim web, thinkorswim mobile, Schwab.com, Schwab Mobile

Minimum Deposit

$0

Why We Recommend Charles Schwab

Charles Schwab stands out as a top choice for US traders, offering an exceptional range of market research and educational resources. Known for its strong presence in forex trading, Schwab also excels in more traditional investment options, including Money Market Funds, and Mutual Funds. This combination makes it a well-rounded choice for both forex traders and those looking to diversify their portfolios with a variety of investment products.

Pros & Cons

- Superior market research and analysis tools

- Outstanding customer service

- Competitive trading fees

- Limited Forex Pairs

- Lacks third-party integrations

- No support for social or copy trading

Broker Details

Perhaps better known for more traditional investments, Charles Schwab also is one of the premium Forex Brokers Accepting US Clients. Charles Schwab boasts access to market research and educational tools that many others struggle to rival.

Key Strengths:

- Top-tier market research and analysis tools

- Excellent customer service

- $0 Commission on Listed Equity Trades Online

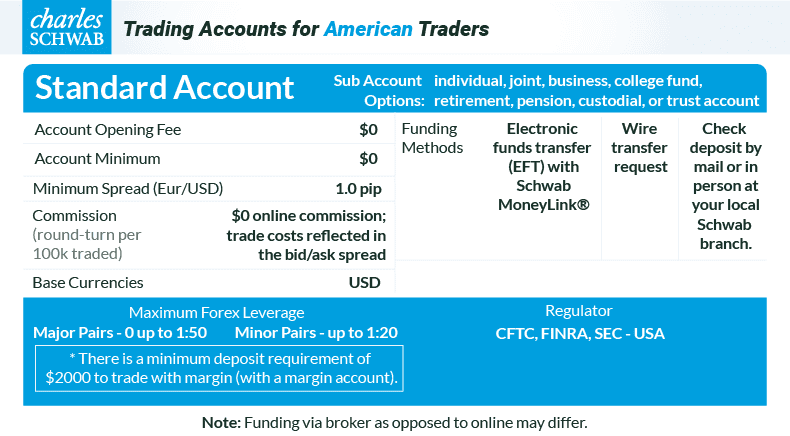

Charles Schwab Account Types

Charles Schwab excels in offering a comprehensive range of investment products and services for US traders. Their offerings include brokerage and trading services, Retirement Accounts (IRAs), personal choice retirement plans, small business solutions, and accounts tailored to various financial goals.

Based on our experience, the Charles Schwab Standard account operates on a dealing desk model, offering spreads starting at 1.0 pips. This is competitive with other US forex brokers. Importantly, there are no commissions on trades, regardless of size, making it a cost-effective choice for traders.

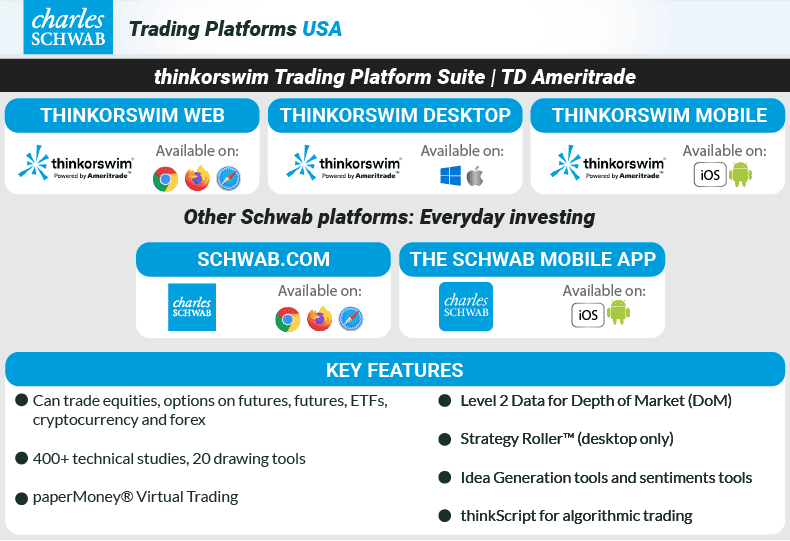

Charles Schwab Trading Platforms

Unlike other brokers, which typically emphasise providing access to the MetaTrader 4 platform, Charles Schwab is fully committed to Thinkorswim. For those accustomed to MetaTrader 4, the features are comparable and complemented with added benefits like depth of market. We’ve found scalping to be a viable strategy here.

Charles Schwab’s thinkorswim platform offers robust charting tools with hundreds of indicators and drawing tools, plus built-in insights from expert commentary and live news. It also provides on-demand education via the Learning Center. While Schwab focuses on innovation through user feedback and offers a broad range of products including stocks, ETFs, options, futures, and forex, the platform lacks third-party integrations and does not support social or copy trading.

Charles Schwab Trading Products

Although Charles Schwab offers a limited selection of account types and trading platforms, it compensates with a diverse array of products. For example, US traders can access 65 forex pairs and explore a broad spectrum of other options, including ETFs, stocks, cryptocurrencies, and mutual funds. Additionally, Schwab provides opportunities to trade bonds, futures, and options, catering to various investment strategies.

Our Verdict on Charles Schwab

For traders who prefer the security of working with a trusted financial institution, Charles Schwab is a strong choice. It meets the needs of forex traders well, but if you’re looking to diversify your portfolio, you’ll benefit from the broker’s wide range of investment options.

7. eToro - Best Copy Trading for Beginners

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

We spent considerable time with eToro and found it to be an outstanding platform for those newer to trading. It allows you to tap into the expertise of seasoned market players. While its focus leans more towards stocks, ETFs, and cryptocurrencies, it serves as an excellent springboard for those contemplating more intricate asset trading. We recommend eToro as the best broker for those venturing into social and copy trading.

Pros & Cons

- Intuitive platform focused on copy trading

- Zero commissions on trading

- Can choose traders based on their track record

- Lacks third-party trading platforms

- Has withdrawal fees

- Does not offer ECN/STP executions

Broker Details

While exploring various trading platforms, eToro caught our attention with its distinct branding and resemblance to a social media interface. Although it’s a big name globally, eToro has yet to make its mark in the US fully. However, for those passionate about crypto, it’s worth a look.

While eToro’s US offerings don’t encompass forex trading, it allows trading in cryptocurrencies, ETFs, and stocks. Its unique selling point drew us to its dedicated focus on social and copy trading platforms.

Key Strengths:

- Innovative, game-ified approach to investing

- Excellent selection of cryptocurrencies

- Supports social and copy trading

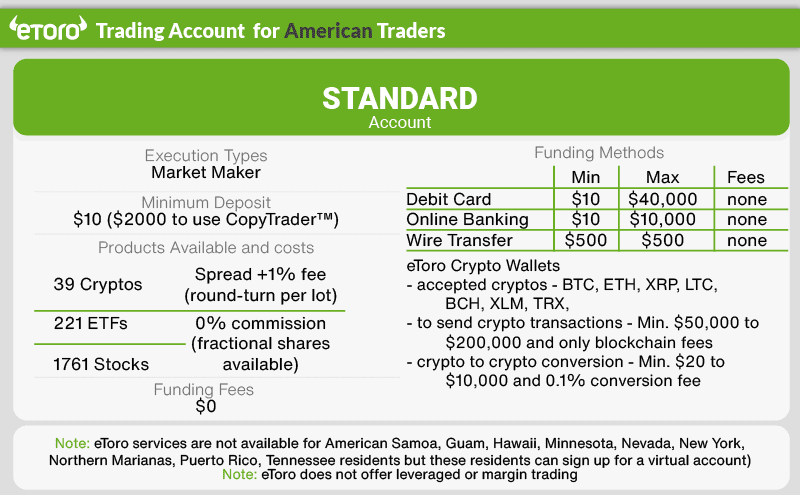

eToro Account Types

For those in the US lucky enough to be in one of the few states where eToro operates, setting up a Standard account is a breeze, and you can fund it with various currencies, crypto included.

eToro operates as a market-maker, charging a ‘spread plus 1%’ fee for every 100K standard lot on round-turn trades, starting with a minimum spread of 1.0 pips. But, it’s worth noting the competitive edge: we can trade stocks and ETFs with a 0% commission, even when dealing with fractional shares.

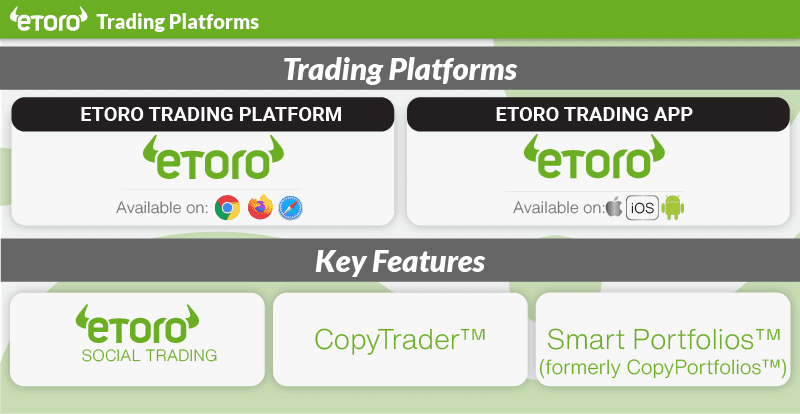

eToro Trading Platforms

As one might expect from a broker touting itself as ‘the world’s largest social investment community, eToro’s trading platforms are optimised for just that: social trading forex

The platform showcases top traders’ sentiment data, and a feed strikingly similar to Twitter gives us real-time market insights directly from the eToro community. Just a heads-up: eToro has kept it simple with web and mobile interfaces and doesn’t entertain third-party integrations.

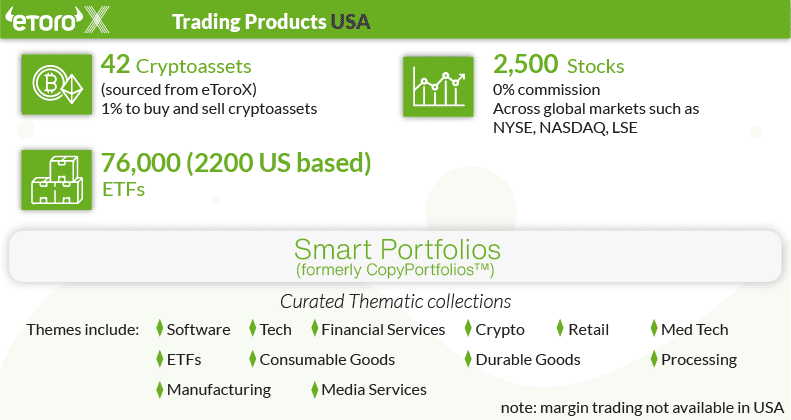

eToro Trading Products

While US-based eToro account holders don’t have the option to trade in crypto, they do have access to over 42 cryptocurrencies, as well as 2,500 stocks and 76,000 EFTs. eToro also offers investors the option to trade using Smart Portfolios, curated indices of similar stocks.

Our Verdict on eToro

For budding traders or those just dipping their toes into the market, eToro offers a valuable learning experience, especially by observing seasoned market players. While the platform leans more towards cryptocurrency, stocks, and ETFs rather than forex, it can serve as a gateway to more intricate trading instruments.