Best Beginner Forex Trading Platform

Beginner Singaporean traders will want to choose a top forex trading platform offered by a forex broker from Singapore’s MAS regulator. Learn which are the best beginner Forex trading platforms from our experts.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Here are our top trading platforms for beginner traders from MAS regulated brokers

- OANDA - Best Trading Platforms For Beginners Overall

- City Index - Top Platform For Beginner Traders

- Saxo Markets - Offers Good Range of Financial Instruments

- eToro - Best Beginner Platform For Social Trading

- CMC Markets - Top Beginner Platform for Risk Management

- Interactive Brokers - Good WebTrader Platform

- IG Group - Top Choice For CFD Range for Beginner Traders

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

91 |

MAS, CIRO, ASIC FCA, NFA/CFTC |

- | 0.2 | 0.2 | - | 0.92 | 0.9 | 1.1 |

|

|

|

- | $0 | 68 | 4 |

|

||

Read review ›

Read review ›

|

66 | ASIC, MAS, FCA | 0.07 | 0.011 | 0.8 | $2.50 | 0.70 | 1.1 | 2.2 |

|

|

|

95ms | $0 | 84 | 5+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

55 |

ASIC, FINMA FCA, MAS |

0.9 | 0.7 | 0.9 | - | 1.1 | 1.8 | 1.1 |

|

|

|

135ms | $2000 | 327 | 9 | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

73 |

ASIC, MAS, FCA CIRO, FMA, BaFin |

0.5 | 0.9 | 0.6 | $2.50 | 1.3 | 1.5 | 1.5 |

|

|

|

138ms | $0 | 338 | 19 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

58 |

NFA, CFTC, CBI ASIC, FCA, MAS CIRO, JFSA |

- | - | - | 0.08%-0.2% | - |

|

|

|

110ms | $0 | 117 | 4 | 30:1 | 500:1 |

|

||

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

1. OANDA - Best Trading Platforms For Beginners Overall

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 0.9

AUD/USD = 0.7

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

We liked OANDA’s trading platform offerings of MetaTrader 4, TradingView and OANDA Trade as trading platform choices for newcomers. While MT4 is the most popular forex trading platform and a personal favourite of ours, the OANDA Trade mobile app is a particular highlight for us, combining ease of use with a great balance of features.

Lastly, from our testing, OANDA also has the lowest average spreads for a Standard account, averaging 0.70 pips for the 5 most traded forex pairs.

Pros & Cons

- Simple account creation process

- Guaranteed stop-loss order

- Best choice for TradingView

- Only 24/5 customer support

- Not enough educational videos

- No CFD shares

Broker Details

We’ve experienced trading with OANDA, a forex and CFD broker that various top-tier financial market regulators regulate. These include the MAS (Monetary Authority of Singapore), ASIC (Australian Securities and Investments Commission), and the FCA (Financial Conduct Authority, UK).

The top forex broker offers MetaTrader 4 as a trading platform option, with a range of charting and trading tools accessible to beginners wanting to develop automated trading strategies.

As a market maker, OANDA offers deep liquidity on the major currencies and the stock market, as well as a wide array of research tools and fast execution speeds.

Trading Accounts

Singaporean traders looking to trade Forex and CFDs with OANDA have a choice between a Standard Account and a Premium VIP Account. Interestingly, forex spreads remain consistent across both account types. However, VIP account holders do enjoy the benefit of personalised customer support. It’s also worth noting that setting up an OANDA trading account online is straightforward, and there’s no specific initial minimum deposit to worry about.

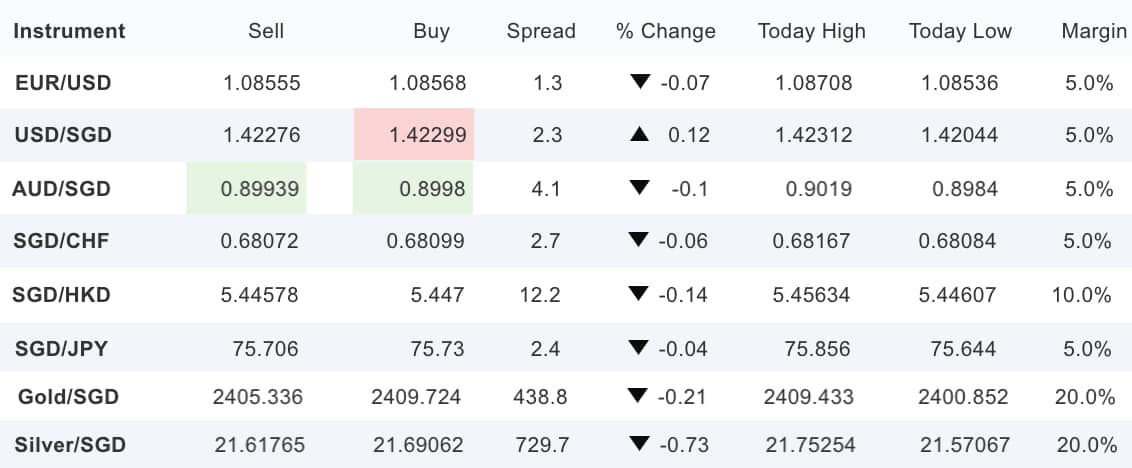

Once we had our OANDA account set up, we had access to financial markets that covered forex, indices, metals, commodities, and bonds. Below are financial instruments, including the Singapore Dollar and OANDA’s EUR/USD spreads as of 21 Nov 2020.

While currency trading is OANDA’s main focus, you also gain access to global markets with the broker offering:

- 71 Forex Pairs

- 31 Commodity CFDs

- 16 stock index CFDs

- 6 Bond CFDs

OANDA And MetaTrader 4 (MT4)

OANDA provides MetaTrader 4 as a trading platform option and has its proprietary OANDA Trade platforms available for web, desktop, and mobile. Their MetaTrader 4 suite is available both as a desktop platform and a mobile app. We found the MT4 mobile trading app to be comprehensive, boasting remarkable technical analysis tools, such as 9 chart types, 11 drawing tools, 32 overlay indicators, and 50 specialised tools on both iOS and Android apps.

You can automate trading via MetaTrader 4’s Expert Advisor (EA) algorithmic trading features. While developing EAs from scratch using the MQL4 programming language may be challenging for beginner traders, you can purchase or download free EAs from the MetaTrader marketplace. As one of the most popular forex trading platforms, the MT4 marketplace is enormous and offers a diverse range of technical indicators and EAs.

As well as a large marketplace to source trading tools, beginner traders can benefit from MT4’s established trading community. You can share ideas and learn about financial markets and forex trading from experienced MT4 users.

In addtion to the embedded tools and the online marketplace, as OANDA MT4 users, we could also use add-ons compatible with MT4. These add-ons include market scanning, pattern recognition, chart trading, and automated alert tools that are user-friendly. The Best MT5 brokers use their MT5 platform as it is also offered by the broker.

On the flip side, OANDA does not offer access to cTrader and charges inactivity fees. Nonetheless, it is still the best choice in Singapore for trading with forex, derivatives, equities and other financial instruments.

2. City Index - Top MetaTrader 4 Platform For Beginner Traders

Forex Panel Score

Average Spread

EUR/USD = 0.07

GBP/USD = 1.1

AUD/USD = 2.2

Trading Platforms

MT4, TradingView, City Index WebTrader

Minimum Deposit

$0

Why We Recommend City Index

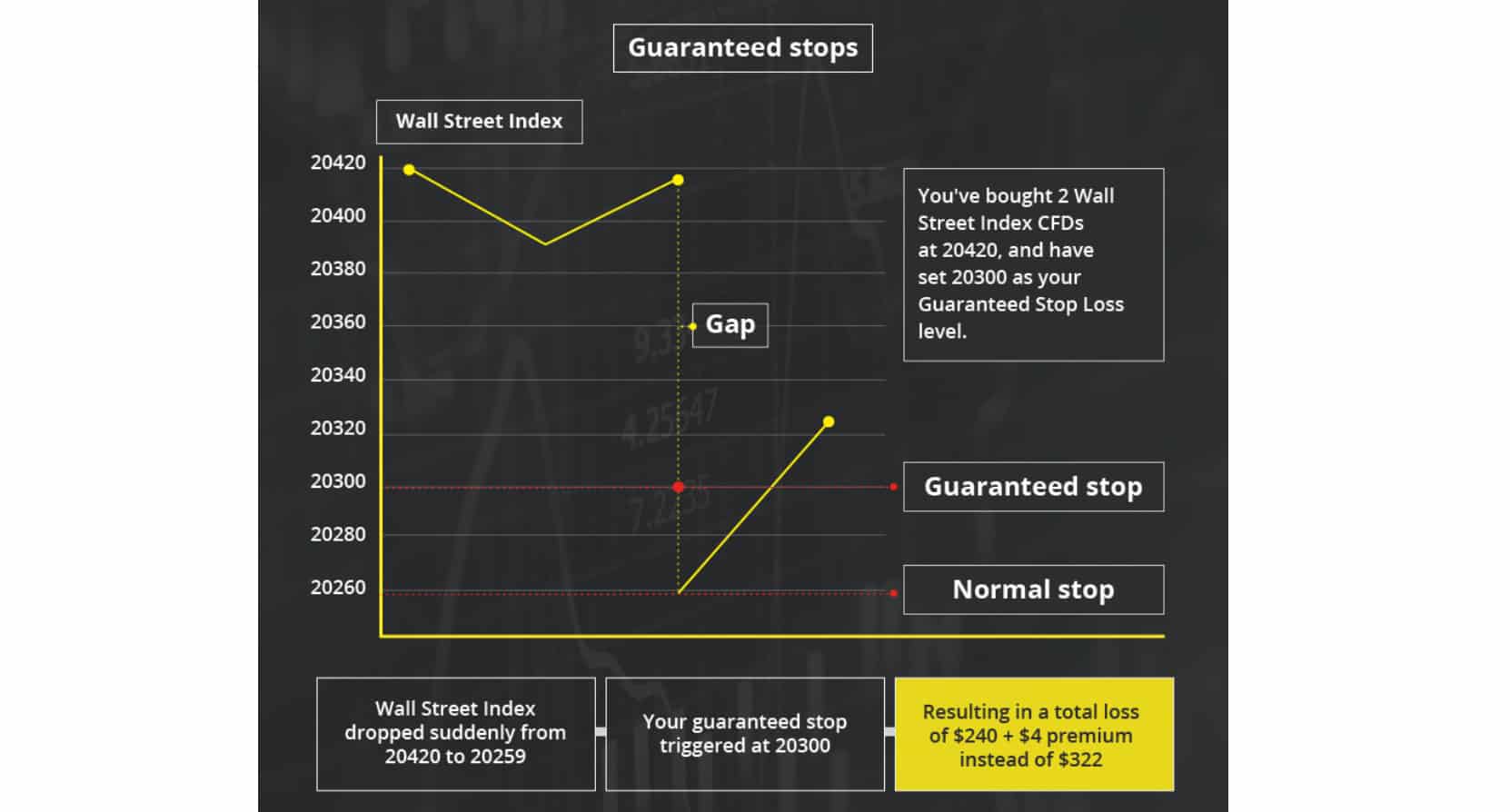

We think City Index stands out in its City Index trading platform, features like guaranteed stop loss orders and “Performance Analytics” which is like a trading coach in particular caters to beginner traders. You can also use MetaTrader 4 and TradingView.

For beginners, we recommend their commission-free account, which has an average spread of 0.7 pips for the EUR/USD pair.

Pros & Cons

- No commission forex spreads

- User-friendly platforms

- Good risk management tools

- Doesn’t offer MetaTrader 5

- Wider spreads for some markets

- MT4 has a smaller product range

Broker Details

We’ve had the opportunity to trade with City Index, an international broker that caters to foreign exchange and CFD trading for retail investor accounts. They’re not just supervised by the MAS (Monetary Authority of Singapore), but their various subsidiaries also adhere to guidelines provided by the ASIC (Australian Securities and Investments Commission) and the FCA (Financial Conduct Authority, UK). In our experience, when trading with City Index, we could access a variety of Forex products and CFD asset classes. These encompass Stock Index, Share, ETFs, Bond, Commodity, and Cryptocurrency markets.

Platforms To Trade Forex And CFDs

Trading CFDs and Forex with City Index allowed us multiple trading platform choices tailored to our trading experience level. They provide MetaTrader 4 (MT4) and AT Pro as desktop trading platforms, MT4, and their own proprietary software for web trader platforms and mobile trading apps.

- MetaTrader 4: Desktop, web trader and iOS and Android trading apps

- Proprietary City Index platform: Web trader, iOS and Android mobile apps

- AT Pro: Desktop trading platform only

Risk Management And Trading Tools For Beginner Traders

As AT Pro is an advanced platform, CompareForexBrokers recommends MetaTrader 4 or City Index’s proprietary trading platform for those new to CFD and forex trading.

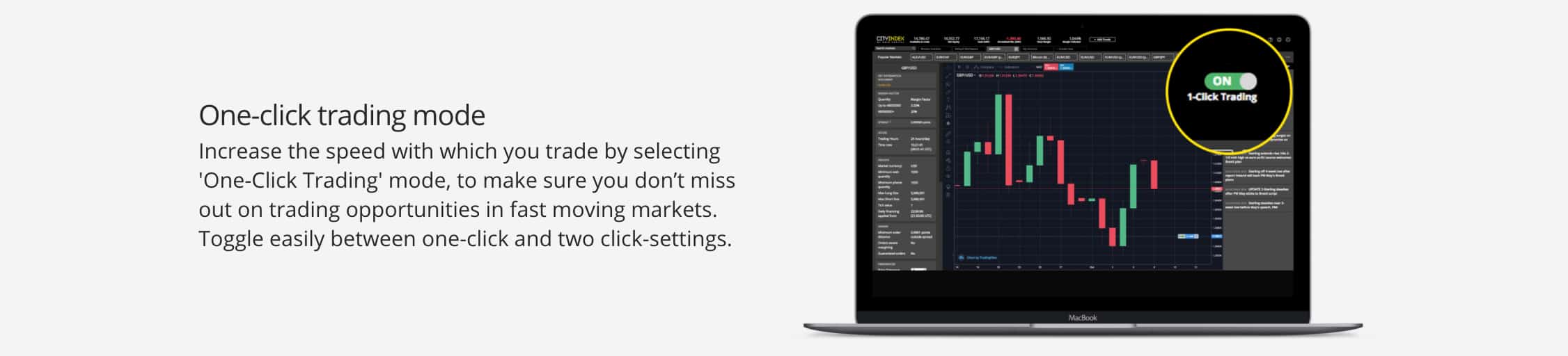

City Index Web Trader Platform

The broker’s online web trader platform is one of the best options for those new to trading CFDs, as it provides an easy-to-navigate trading environment with features such as one-click trading.

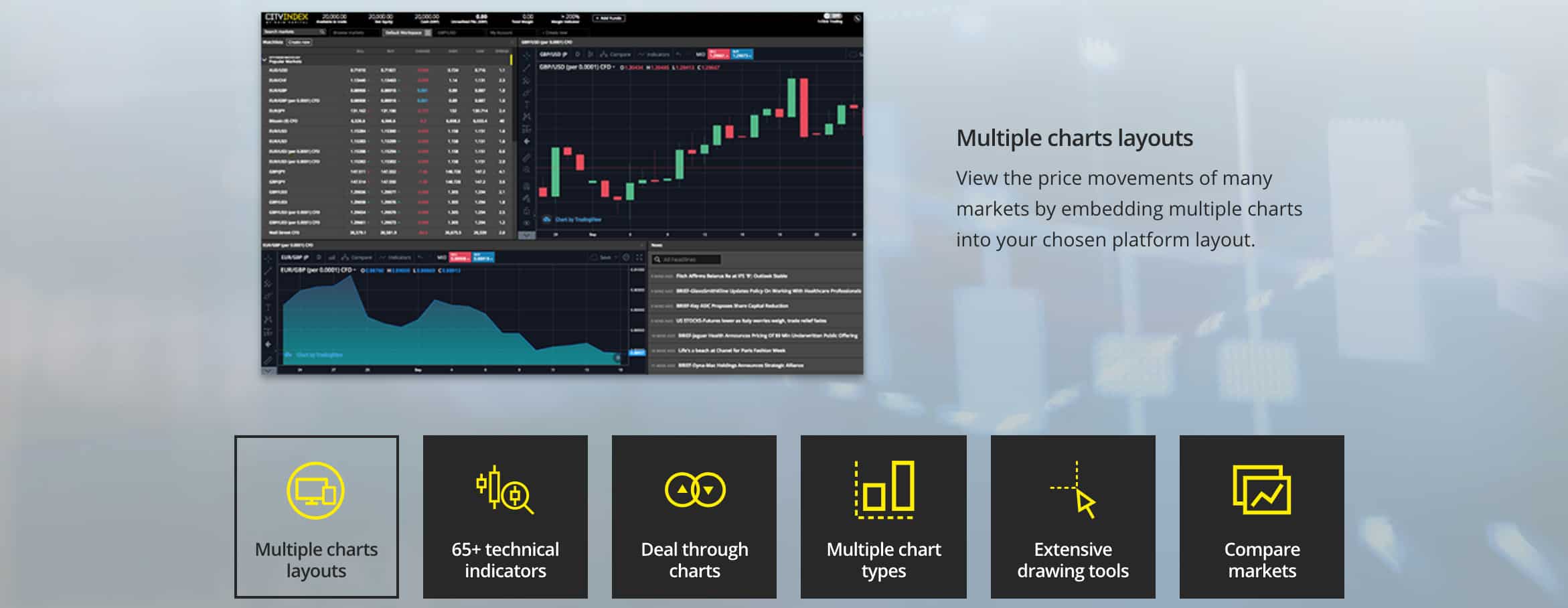

You can easily analyse CFD and forex markets with HTML 5 charts and over 65 technical indicators. You can also trade directly from charts, with the ability to edit positions, stops and limit orders from the same screen.

In addition to managing the high risk of trading with basic order types such as trailing stop loss and limit orders, you can pay a premium to place Guaranteed Stop Loss Orders (GSLOs). It ensures orders are closed at your desired price, regardless of volatile markets.

MetaTrader 4

Although many of MetaTrader 4’s features are designed for experienced high-volume investors, you can benefit from the wide range of trading and analysis tools as a beginner trader. MT4 trading platform features include:

- Sophisticated charting and analysis tools

- Economic calendar

- Advanced order types

- Automated trading with Expert Advisors

- Backtesting for Expert Advisors

To automate trading MT4, you can create your own Expert Advisors using the MQL4 programming language or download EAs and indicators online through MetaTrader’s Marketplace. The MetaTrader’s Marketplace is one of the largest trading communities, offering an extensive library of free and paid technical indicators and Expert Advisors.

Forex Trading: Commission Free Low Spreads

When we traded forex with City Index, we noticed the appeal of their tight no-commission spreads on major, minor, and exotic currency pairs. Compared to other top forex brokers, City Index’s spreads are generally lower than competitors. For the USD/JPY and EUR/USD currency pairs, City Index offers low spreads of 0.80 pips commission-free, while brokers such as CMC Markets offer spreads of 1.20 pips. Likewise, City Index offers spreads of 0.90 pips for the AUD/USD FX pair, with brokers including OANDA and Axi offering 1.20 pips.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

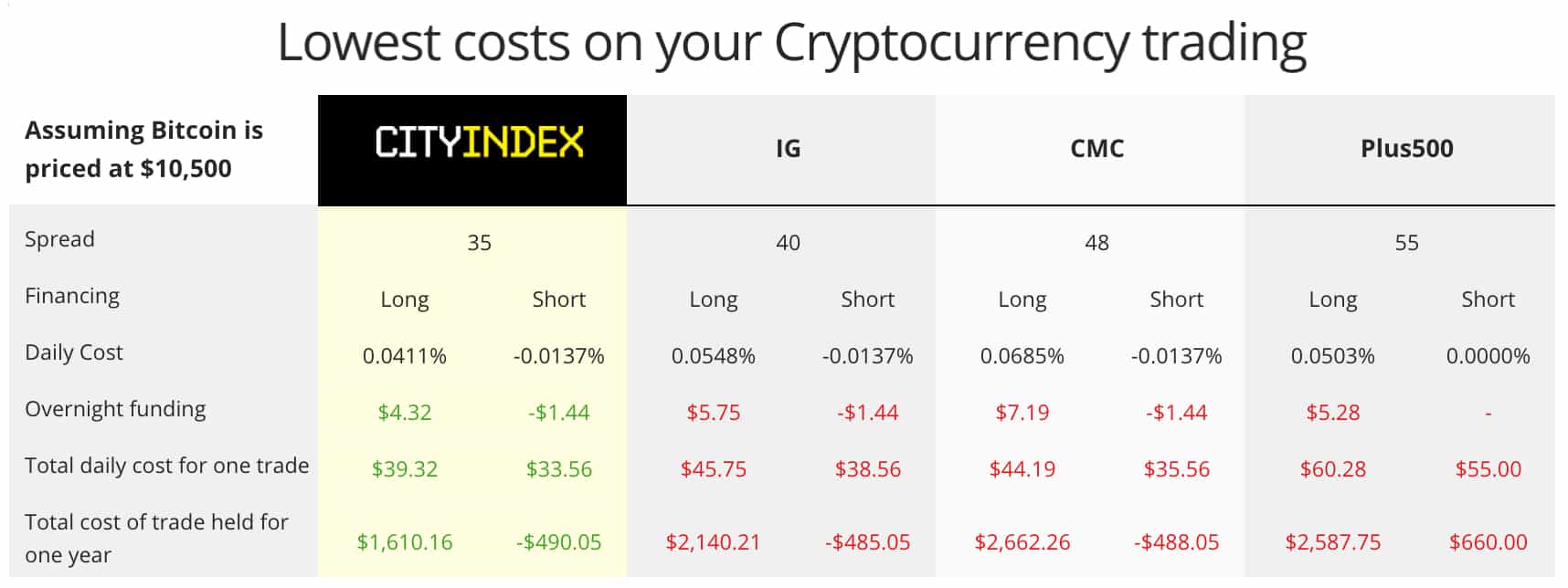

Cryptocurrency Trading

City Index presented us with the option of crypto trading, showcasing five different CFDs. Instead of trading the actual crypto asset, Contracts for Difference (CFDs) presented a host of benefits, as there’s no direct buying or selling of the physical underlying asset. This allows for both long and short positions, leveraged trades, no necessity for digital wallets, and a suite of other risk management tools. The crypto CFD spreads were tight, and the overnight financing costs stood competitive. The Crypto markets available when trading CFDs with City Index included:

- Bitcoin

- Bitcoin Cash

- Litecoin

- Ripple

- Ethereum

Although crypto CFD trading is becoming increasingly popular, beginner traders should know that cryptocurrency markets are incredibly volatile and have a high risk of losing money.

Your capital is at risk ‘70% of retail CFD accounts lose money with City Index’

3. Saxo Markets - Offers Good Range of Financial Instruments

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 0.7

AUD/USD = 0.9

Trading Platforms

MT4, TradingView, SaxoTraderGo, SaxoTrader Pro

Minimum Deposit

$0

Why We Recommend Saxo Markets

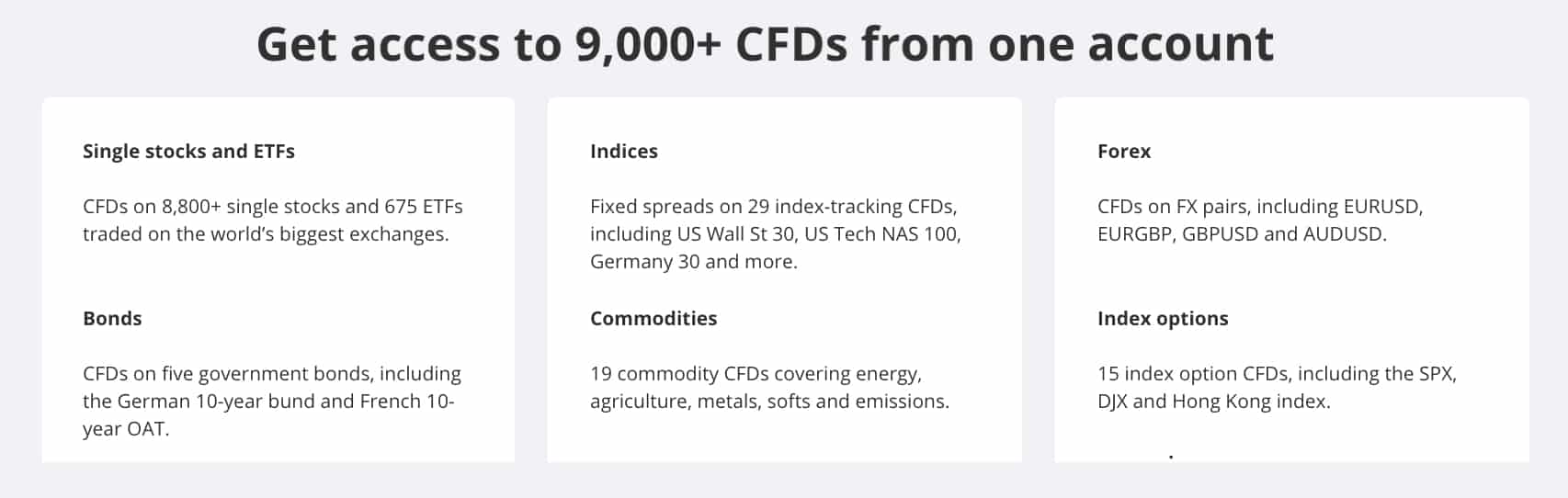

We like Saxo Markets’ broad range of financial instruments. Singaporean forex traders can trade over 9000 CFDs and up to 190 spot forex pairs, one of the best ranges for a MAS-regulated broker.

Pros & Cons

- Competitive low spreads

- Award-winning trading platform

- Wide range of services

- Leverage is limited

- Steep platform learning curve

- High minimum deposit

Broker Details

We’ve traded with Saxo Capital Markets, a fully regulated broker welcoming Singaporean forex traders. As well as oversight from the Monetary Authority of Singapore (MAS), Saxo subsidiaries follow the regulation of an additional 14 financial authorities, including the Danish Financial Supervisory Authority (FSA), the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC).

Our experience with Saxo Markets showed us they provide a user-friendly trading platform, diverse account types, and expansive market access.

Trading Platforms

Saxo offers two proprietary trading platforms tailored to Singaporean traders, each designed for different levels of trading experience. We found SaxoTraderGO to be quite intuitive, primarily crafted for those new to trading, whereas SaxoTraderPRO offers a comprehensive set of advanced trading tools tailored for seasoned forex traders. Some of the features in SaxoTraderGO that we found valuable for newcomers in CFD trading include:

- Account shield: A stop-loss on a trader’s entire account value

- Stop-limit and trailing stop-order types

- Margin breakdown and monitoring tools

- Margin alerts and push notifications

- Close all orders, or all orders of a specific asset class, within 2 clicks

The trading platform is available as an iOS or Android mobile trading app or online via a web trader platform.

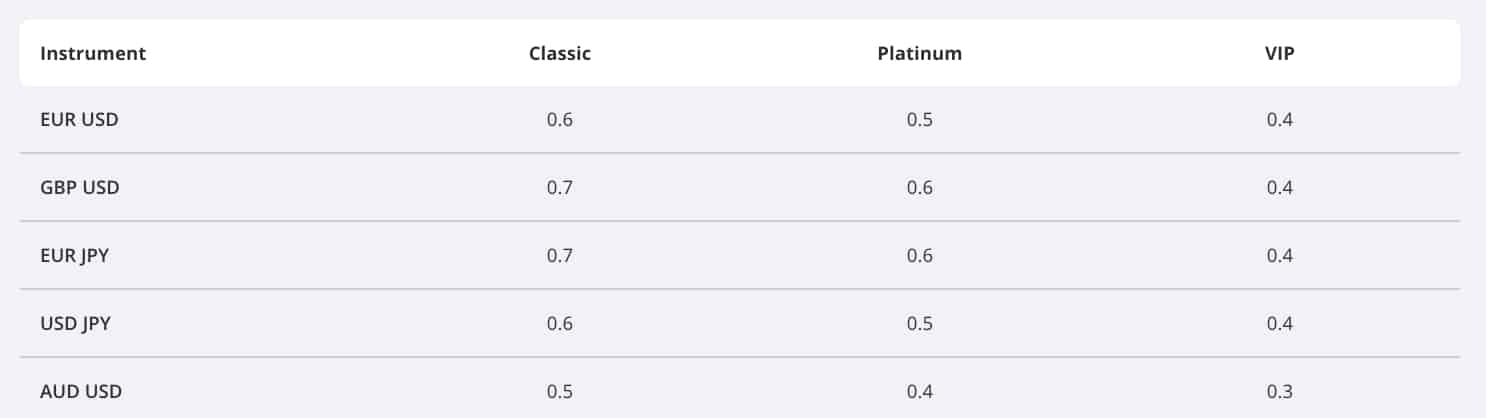

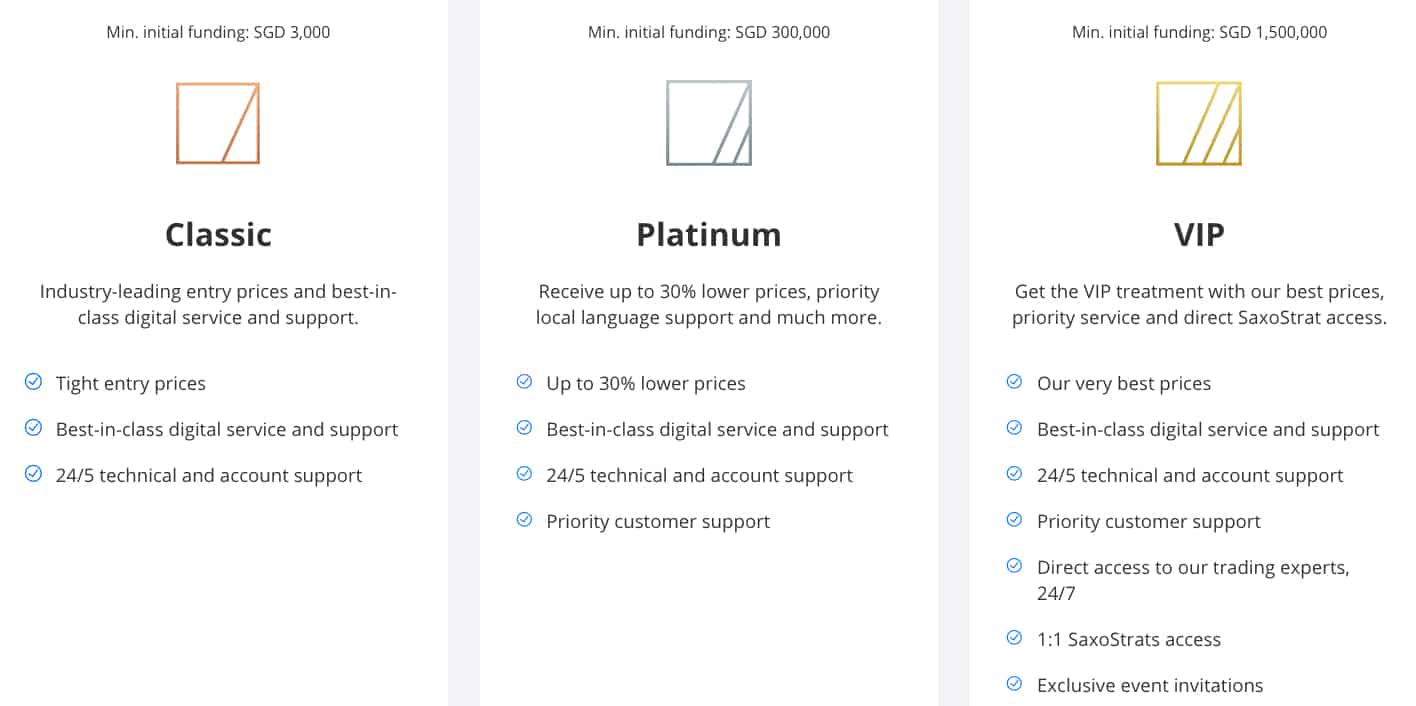

Trading Account Types

In our trading journey with Saxo Markets, we had the option to select from classic, platinum, and VIP account types. While the classic account offers standard spreads and customer support, the platinum and VIP accounts come with perks like discounted pricing featuring tighter spreads and premium customer service. For instance, we encountered spreads of 0.6 pips for the EUR/USD forex pair with the classic account, whereas with a VIP account, the same pair was available at 0.4 pips.

However, we observed that initiating CFD trades required a relatively higher initial deposit than other prominent forex brokers. For a classic account, one has to deposit at least SGD $3,000; for a platinum account, it’s SGD $300,000; for a VIP, it’s a substantial SGD $1.5 million. But, on the upside, irrespective of the account type, it’s possible to initiate an account in one among 19 base currencies, which include SGD, AUD, USD, JPY, and GBP.

Forex And CFD Trading Products

Saxo Markets avails traders with an impressive range of market access. With their extensive list of over 10,000 CFDs and thousands of standard instruments across 9 asset classes, their product list is indeed impressive. Some of the instruments we had access to include:

- Currency pairs: 182 spot pairs and 140 forwards

- CFDs: Over 9,000 contracts for difference

- Stock trading: Over 19,000 stocks from 37 different exchanges

- 200+ Futures

- 44+ Forex Options

- 1,200+ Listed Options

- 3,000+ ETFs (Exchange-Traded Funds)

- 250+ Mutual Funds

- 26+ Government Bonds

Contracts for Difference (CFDs)

- 29+ Index CFDs

- 15+ Index Options

- 19 Commodities derived from energy, softs, agriculture, emissions and metals

- Over 8,800 Share CFDs and 675+ ETFs (exchange-traded funds)

- 7 Forex CFDs

- 5 Bonds

4. eToro - Best Beginner Platform For Social Trading

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

As the number 1 social trading broker in the world, we found that eToro has the best beginner platform for social trading. We love the simplicity of eToro’s distinctive trading platform, which is specifically designed for copy trading.

While eToro doesn’t carry MAS regulation, Singaporean traders can still be onboarded through the broker’s CySEC regulator and utilise its account mirroring service.

For beginners eager to learn and grow, we think eToro is undeniably worth a look.

Pros & Cons

- Solid copy trading feature

- Exclusive trading platform

- Tradable markets include crypto

- Only 24/5 customer support

- High-risk trading

- High spreads and fees

Broker Details

We’ve had our trading experience with eToro, a prominent social-copy trading broker overseen by the FCA (Financial Conduct Authority, UK), ASIC (Australian Securities and Investments Commission), and CySEC (Cyprus Securities and Exchange Commission). While it’s worth noting that MAS doesn’t regulate them, we found their account mirroring service accessible and available for Singaporean traders.

Trading with eToro allowed us to easily purchase and offload an array of CFDs through their account mirroring services. We found their social-copy trading services particularly useful as beginners. It provided us with an insight into the forex markets, and simultaneously, we could emulate the trading approaches of seasoned investors.

Social-Copy Trading

Creating trading strategies complemented by effective risk management tools can be intricate. Thankfully, with eToro, we could replicate strategies framed by ‘Popular Investors’. When we were on the hunt for Popular Investors to follow and mirror, eToro made it convenient by allowing us to check out their risk profiles, trading histories, and even their locations.

Similarly to other social networks, eToro provides a newsfeed where you can keep up to date with forex markets and information from the Popular Investors you follow.

CopyPortfolios

If you want to simplify CFD trading further, you can use eToro’s CopyPortfolio products. While a higher minimum deposit of $5,000 is required to use the portfolio management service, it will allow you to easily invest in a well-diversified, balanced bundle of financial instruments. Although the minimum deposit is high, eToro does not charge management fees for using the CopyPortfolio features.

Here’s a peek into the investment portfolio types we encountered:

- Top Trader CopyPortfolio

- Market CopyPortfolio

While the Top Trader Portfolios encapsulate strategies of standout Popular Investors, the exact traders hinge on the portfolio’s overarching strategy. We perceived these as primarily medium to long-term investment avenues. In contrast, the Market Portfolios focus on various financial assets rather than spotlight top traders. The assets spanned from Forex and ETFs right through to Commodities and Indices.

5. CMC Markets - Top Beginner Platform for Risk Management

Forex Panel Score

Average Spread

EUR/USD = 0.5

GBP/USD = 0.9

AUD/USD = 0.6

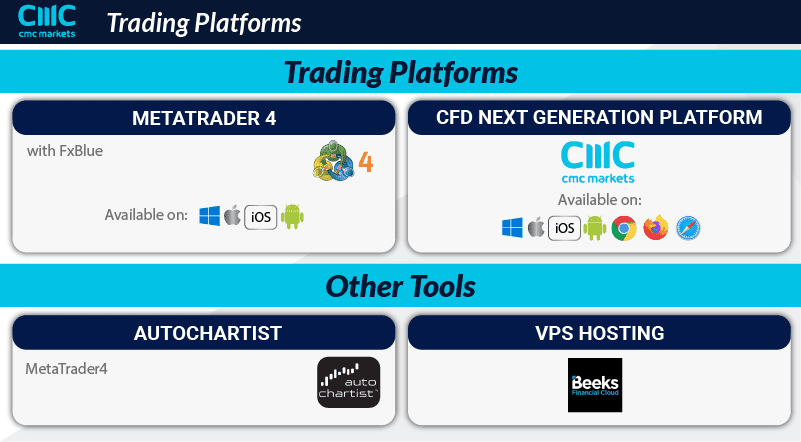

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

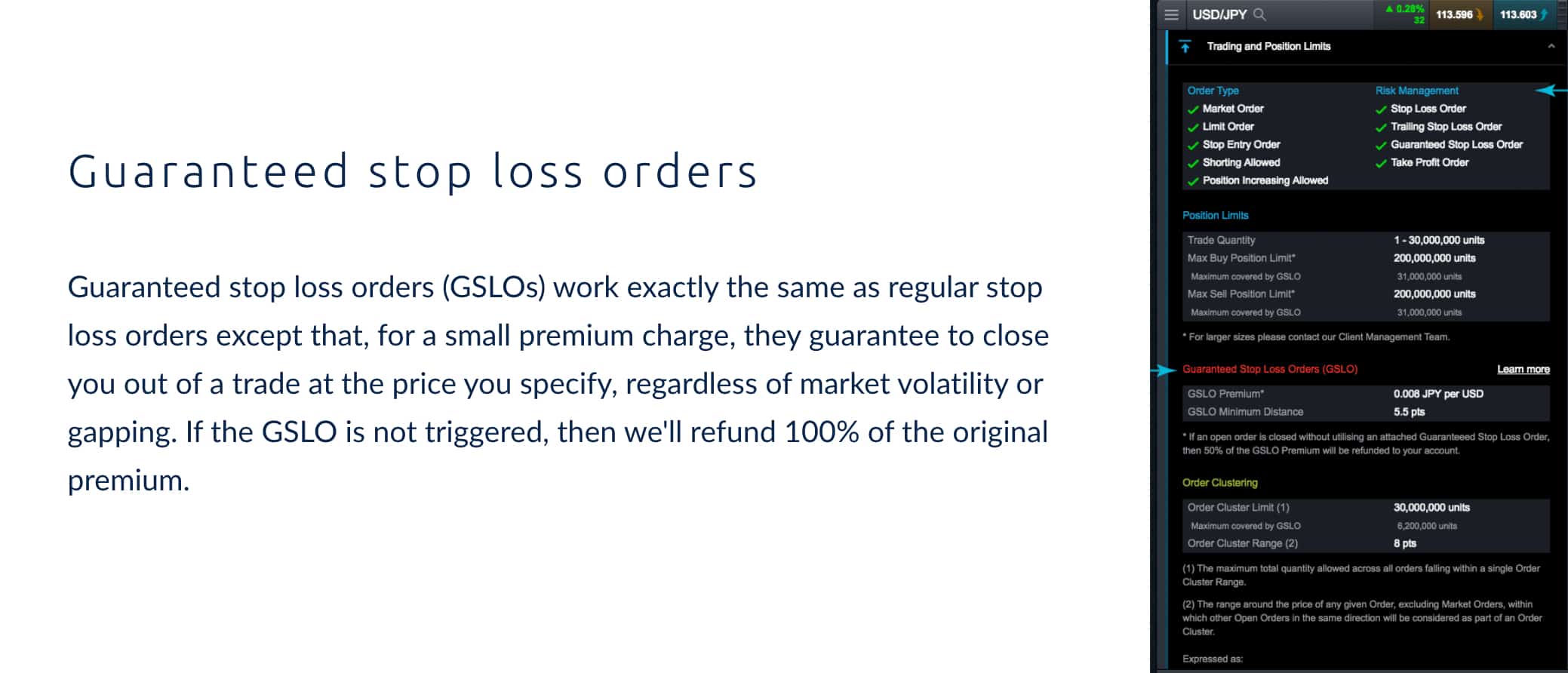

CMC Markets offers our favourite beginner platform for risk management. We think the broker’s excellent proprietary trading platform, Next Generation, is not only user-friendly with heaps of features, but it also offers guaranteed stop-loss orders, to help you minimise your risk of slippage, which not all platforms offer.

We also ranked CMC Markets highly for trust (9/10) and education (10/10) which are both features highly valued by beginners.

Pros & Cons

- Low funding barrier

- Extensive educational material

- No minimum deposit requirement

- Overwhelming product range

- No weekend support

- Average copy-trading features

Broker Details

In our trading journey, we’ve had the opportunity to experience CMC Markets, a broker regulated by MAS and other prominent financial authorities across the UK, NZ, Germany, Canada, and Australia. Our time with CMC Markets allowed us to trade CFDs and forex on MT4 and introduced us to their proprietary platform, Next Generation. We found that Next Generation catered exceptionally well to beginner traders, providing an extensive array of risk management tools.

Next Generation Trading Platform

Our interactions with the Next Generation platform highlighted its user-friendly nature. It boasts comprehensive charting and trading tools, including 12 chart types, 70 chart patterns, and 115+ technical indicators, which greatly aid when exploring investment avenues. Recognising the intricacies of technical analysis and risk management for new traders, Next Generation provides handy features like:

- Client sentiment data

- Pattern recognition market scanner

- Price projection tools

- Trading community and chart forum

- Trade directly from charts

The platform presents a standard, easily navigable format, but there’s also an advanced multiscreen layout for those wanting to push the boundaries a little. As we grew more familiar with the system, transitioning to this advanced interface opened up a world of enhanced trading tools.

The proprietary trading platform is available as an iOS and Android mobile trading app. Compared to other software, the Next Generations trading app offers superior mobile charting features, with 35 drawing tools and technical indicators available on the go.

Risk Management Tools

Given that CFD and forex trading come with inherent risks, it was vital for us to select a renowned forex broker recognised for its risk management tools. CMC Markets’ order types are tailored to minimise risks by setting parameters on potential profits and losses. On the Next Generation platform, we appreciated the assortment of complimentary order types and even had the choice to opt for a premium Guaranteed Stop Loss Order (GSLO).

These GSLOs ensured our trades were carried out at the exact prices we determined, nullifying risks associated with price fluctuations due to lag. What’s more, if the GSLO wasn’t activated, CMC Markets was fair enough to return the charge – a touch we genuinely valued.

Order Types Available On Next Generation

- Market Orders

- Limit and Stop Entry

- Stop-Loss Orders

- Take-Profit

- Trailing Stop Loss

- Guaranteed Stop Loss

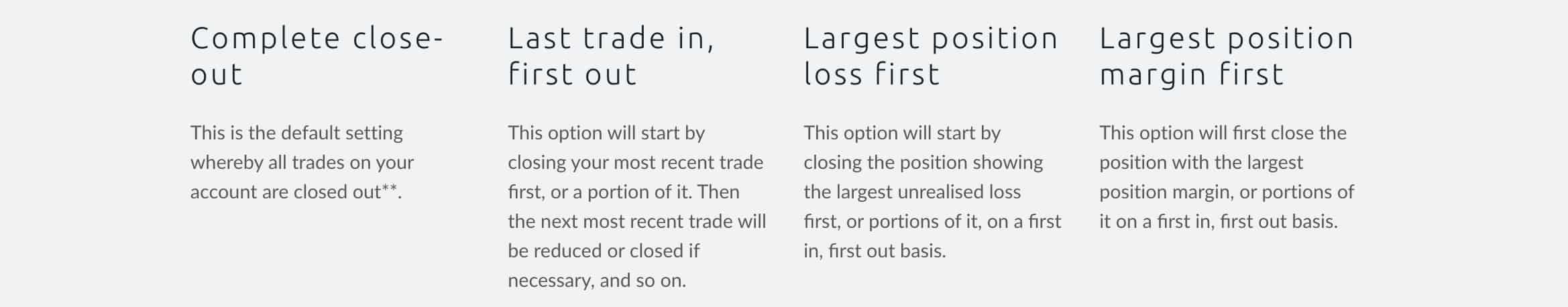

Lastly, CMC Markets has a thoughtful ‘account close-out’ feature. It comes into play by automatically shutting all active trades if the trading balance hits a specific threshold. Options for this include:

- Complete close-out

- Largest position loss first

- Largest position margin first

- Last trade in, first out

6. Interactive Brokers - Good WebTrader Platform

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

We liked Interactive Brokers for its comprehensive yet simple WebTrader platform, catering to forex and a broader spectrum of financial instruments.

What also stood out for us, especially for beginners, is the Interactive Brokers Traders’ Academy.

It offers invaluable resources like webinars and platform tutorials, ensuring newcomers are well-equipped to start their trading journey confidently. Interactive Brokers is an optimal choice for those taking their first steps in the trading world.

Pros & Cons

- $0 minimum deposit requirement

- A large range of markets

- Good WebTrader platform

- Relatively low leverage

- Steep learning curve IBKR platform

- Lacks choice of trading platforms

Broker Details

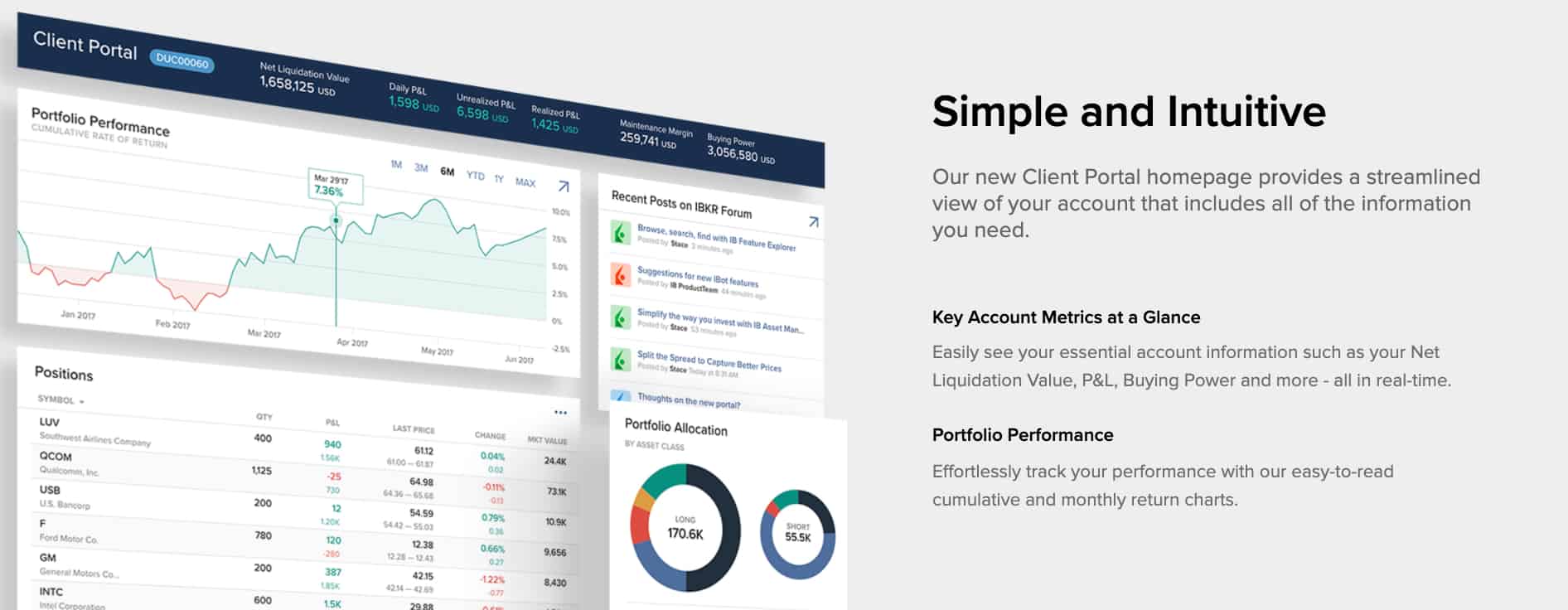

In our journey through the world of forex trading, we’ve had the privilege of exploring Interactive Brokers. While they don’t possess a MAS financial services license, they’re supervised by several top-tier financial regulators spanning Japan, India, Hong Kong, Australia, Luxembourg, the UK, Canada, and the US (CFTC). Their proprietary online trading platforms, Client Portal and IBKR WebTrader, have struck a chord with us, especially considering their suitability for beginner traders like us. Notably, both platforms also boast numerous advanced trading tools.

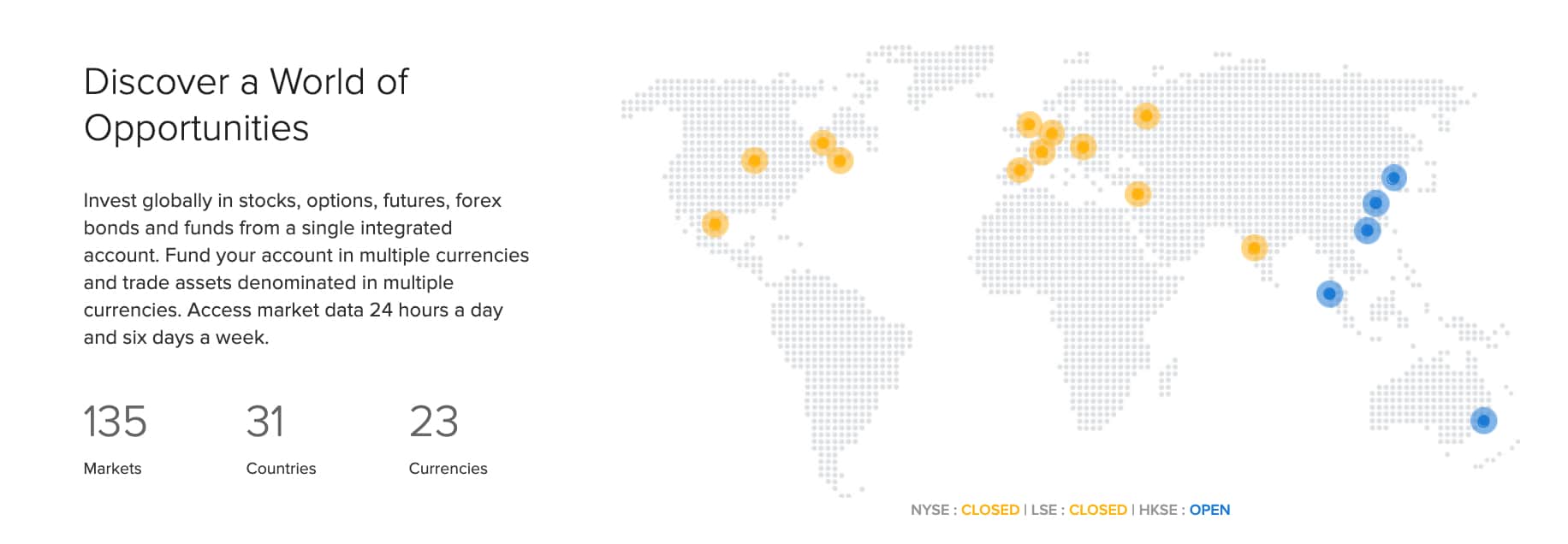

Client Portal Web Trader Platform

Our experience with Interactive Brokers’ Client Portal revealed it as a fantastic starting point for newcomers to trading. The platform is designed to be user-friendly, merging various trading necessities into a single platform. Whether managing orders, assessing the markets, or keeping up-to-date with the latest news, the web trader interface covers it. Our significant highlight was accessing 135 distinct financial markets on both web trader platforms. These spanned from Forex to bonds, options, funds, futures, and even warrants. Among the trading tools available on Client Portal, we found particularly useful were:

- Search function

- A range of order types

- Alerts and notifications

- Fee reports

- IBot technology, a digital assistant to help out and place orders

IBKR WebTrader

Upon upgrading to a Pro account type, we were welcomed as VIP clients to the IBKR Web Trader platform. This platform can be tailored to individual preferences, and despite being for ‘Pro’ members, it maintains a beginner-friendly approach. Some of the intuitive trading tools that aided our trading strategy development include:

- Market Scanners

- Market Depth

- Real-time News

7. IG Group - Top Choice For CFD Range for Beginner Traders

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

We like IG’s immense range of CFD products, offering access to an impressive array of over 17,000 financial instruments. This is an unprecedented range of products that we haven’t seen with other MAS-regulated brokers. These allow beginners to diversify their trading across different assets easily.

In our experience, IG’s proprietary platform and MT4 are ideal choices for those new to trading, offering credibility and variety.

Pros & Cons

- Extensive product range

- Highly trusted broker

- Good for high-volume traders

- Requires minimum deposit to fund account

- No share trading for SG traders

- Customer support is only on weekdays

Broker Details

In our exploration of forex trading platforms, we’ve had the opportunity to experience IG Markets first-hand. This platform is fully regulated and is overseen by a host of esteemed regulatory bodies such as MAS, the CFTC, FCA, BaFin, ASIC, and FSB, to name a few.

Alongside facilitating access to forex markets, IG Markets has provided us with many CFD trading products. Their expansive selection of over 17,000 financial instruments has empowered beginner traders to shape comprehensive trading strategies encompassing a variety of asset classes. Some of the assets we’ve engaged with include:

- Forex: Over 80 major, minor and exotic currency pairs

- Indices: 30+ indices, including the US 500 and the Singapore Index

- Shares: 12,000+ stocks

- Commodities: Metals, Oil & Gas, and Softs

- Cryptocurrency: 8 Crypto CFDs, including Bitcoin

- Plus, unique products such as knock-outs, ETPs, Options and Indices denominated in the Singapore Dollar

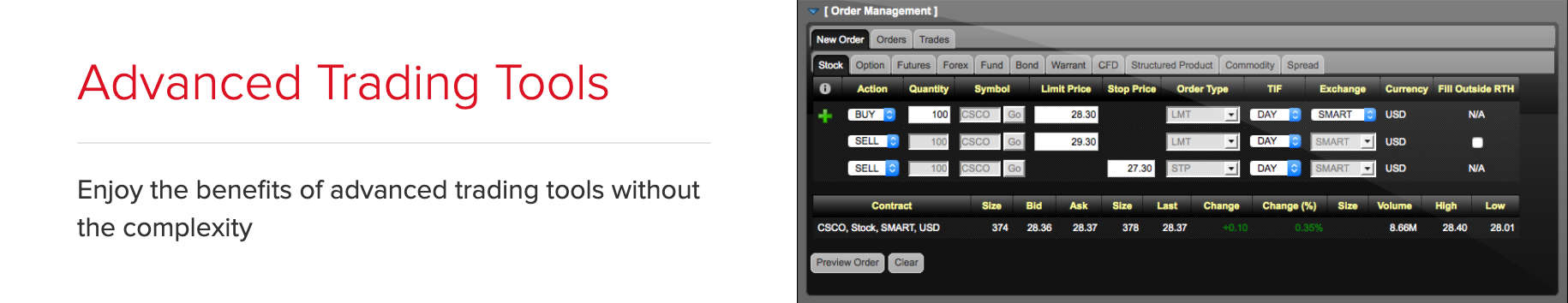

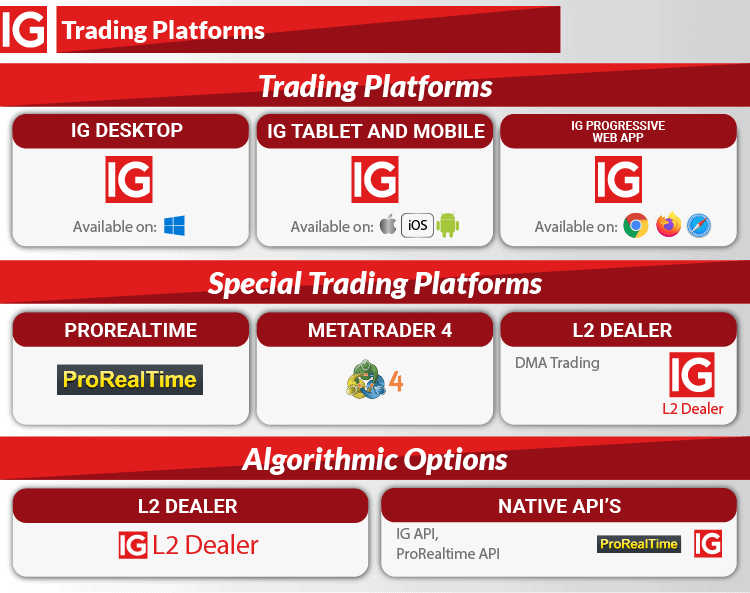

Trading Platform

As customers of IG Markets, we were presented with several platform choices: the broker’s own proprietary platform, the widely-used MetaTrader 4 (MT4), and the L2 Dealer. We found that while the L2 Dealer tends to cater more to the seasoned traders, beginners felt quite comfortable using either the MT4 or IG’s own software. Both are available as a web trader platform or as a mobile app.

IG’s online trading platform came across as particularly convenient, eliminating the need for downloading or installing any desktop software. We navigated the proprietary web trader platform smoothly with its beginner-friendly analysis and charting tools. Some additional features we appreciated include alerts and notifications, timely Reuters news updates, and automated trading tools.

When choosing to utilise MT4 with IG Markets, we were met with all the standard inbuilt trading utilities MT4 is renowned for, such as Expert Advisors, comprehensive charting features, and Autochartist. Beyond these, IG Markets also provides 18 extra add-ons and technical indicators on MT4, enhancing our trading experience further.

Ask an Expert