Best Beginner Forex Brokers

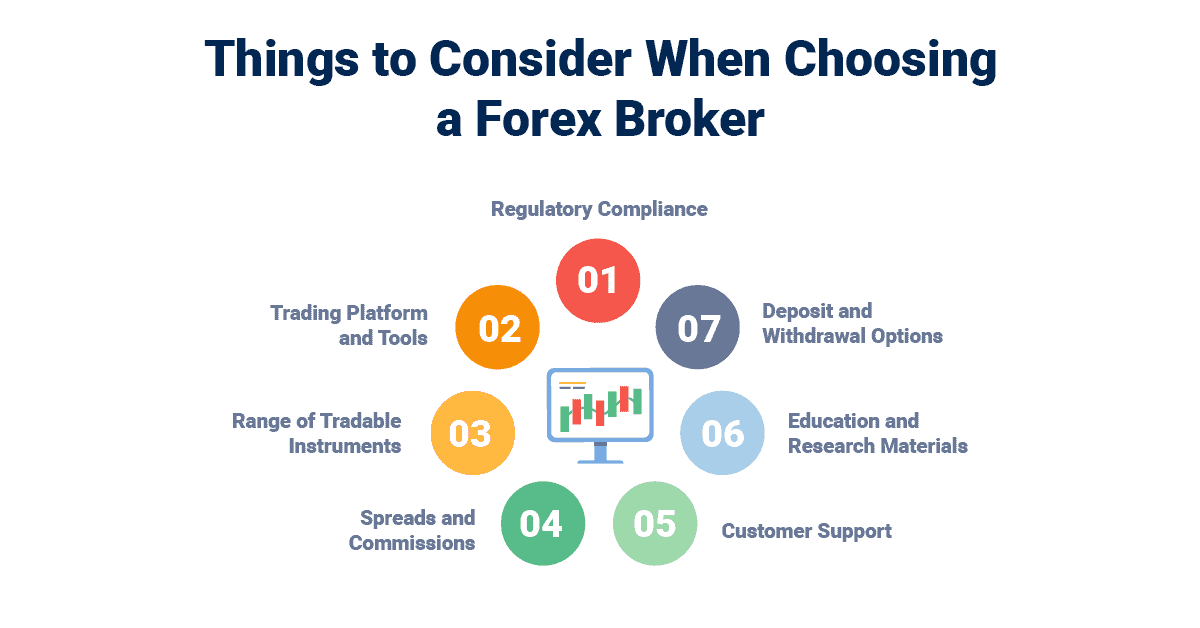

A beginner forex trader needs to select an appropriate forex broker that has an easy-to-use forex trading platform, training guides, and strong customer service. We analysed the best beginner forex brokers based on the factors below.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

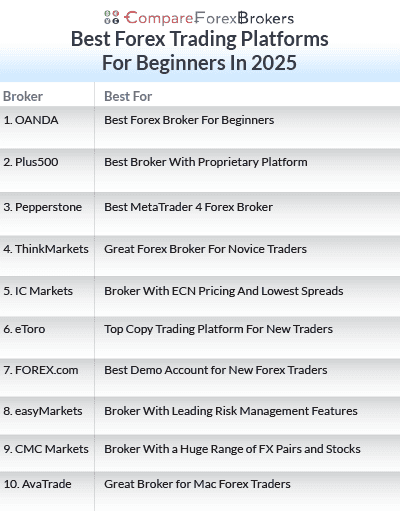

Our list of the best beginner Malaysian forex brokers is:

- OANDA - Best Forex Broker For Beginners

- Plus500 - Best Broker With Proprietary Platform

- Pepperstone - Best MetaTrader 4 Forex Broker

- ThinkMarkets - Great Forex Broker For Novice Traders

- IC Markets - Broker With ECN Pricing And Lowest Spreads

- eToro - Top Copy Trading Platform For New Traders

- FOREX.com - Best Demo Account for New Forex Traders

- easyMarkets - Broker With Leading Risk Management Features

- CMC Markets - Broker With a Huge Range of FX Pairs and Stocks

- AvaTrade - Great Broker for Mac Forex Traders

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

91 |

MAS, CIRO, ASIC FCA, NFA/CFTC |

- | 0.2 | 0.2 | - | 0.90 | 1.78 | 1.54 |

|

|

|

- | $0 | 68 | 4 |

|

||

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

73 |

FCA, FSCA ASIC, FSA-S, CySEC |

0.11 | 0.23 | 0.24 | $3.50 | 1.1 | 1.3 | 1.1 |

|

|

|

161ms | $0 | 46 | 27 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

84 |

FCA, CIRO, NFA/CFTC CySEC, JFSA, CIMA |

0.17 | 0.29 | 0.3 | $6.00 | 1.5 | 1.8 | 1.5 |

|

|

|

30 ms (May 2023) | $100 | 91 | 8 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

52 |

ASIC, CySEC FSA-S, FSC-BVI |

- | - | - | - | 0.70 | 0.90 | 0.90 |

|

|

|

155ms |

$200 (Standard) $3,000 (Premium) $10,000 (VIP) |

62+ | 17+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

73 |

ASIC, MAS, FCA CIRO, FMA, BaFin |

0.5 | 0.9 | 0.6 | $2.50 | 1.3 | 1.5 | 1.5 |

|

|

|

138ms | $0 | 338 | 19 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

What Are The Best Malaysian Forex Trading Platforms For Beginners?

New to forex trading and wondering how to choose the best SCM-regulated forex broker? CompareForexBrokers.com has profiled the top brokerages ideally suited for Malaysian readers new to trading forex and CFD products.

1. OANDA - Best Forex Broker For Beginners

Forex Panel Score

Average Spread

EUR/USD = 1.4

GBP/USD = 2

AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

We were impressed with OANDA as it ensures a secure trading environment. The absence of minimum deposits and the availability of low trade sizes, complemented by a free demo account and comprehensive charting tools, make it an appealing choice for those starting out. Seasoned traders can also appreciate the tight spreads and swift execution times.

Pros & Cons

- Fast execution speeds

- No minimum deposit

- Good trading platforms for beginners

- No negative balance protection

- No guaranteed stop loss

- Limited educational resources

Broker Details

OANDA is a forex and CFD broker regulated by various top-tier financial market regulators including MAS (Monetary Authority of Singapore), ASIC (Australian Securities and Investments Commission) and the FCA (Financial Conduct Authority, UK).

The top forex broker offers MetaTrader 4 as a trading platform option, with a range of charting and trading tools accessible, especially if you want to develop automated trading strategies.

Trading Accounts

When we traded Forex and CFDs with OANDA, we had the option to choose between a Standard Account and a Premium VIP Account. Interestingly, the Forex spreads remained consistent across both account types, but those with a VIP account benefit from personalised customer support. Opening an OANDA trading account was simple without any initial minimum deposit.

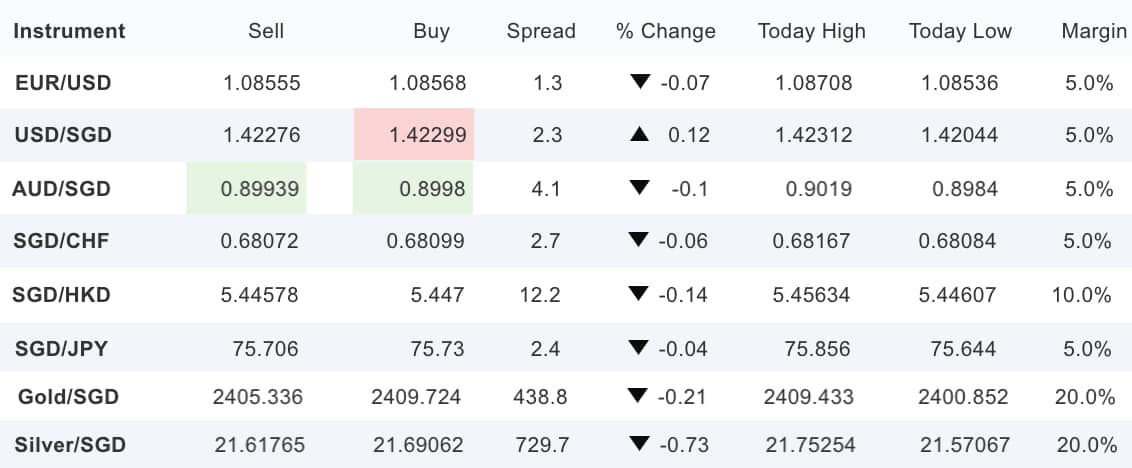

After signing up with OANDA, we gained access to financial markets covering forex, indices, metals, commodities and bonds. Below, we show the financial instruments that include the Singapore Dollar along with OANDA’s EUR/USD spreads.

While currency trading is OANDA’s main focus, you also gain access to global markets with the broker offering:

- 71 Forex Pairs

- 31 Commodity CFDs

- 16 stock index CFDs

- 6 Bond CFDs

OANDA And MetaTrader 4 (MT4)

The online broker offers MetaTrader 4 as a trading platform option, available on desktop and mobile. The same goes for their proprietary OANDA Trade (web trader). The MT4 mobile trading app impressed us with its comprehensive technical analysis tools, including 9 chart types, 11 drawing tools, 32 overlay indicators and 50 technical tools on both the iOS and Android apps.

As OANDA customers, we had the flexibility to automate our trades through MetaTrader 4’s Expert Advisor (EA) algorithmic trading features. While developing EAs from scratch using the MQL4 programming language may be challenging for beginner traders, we found that EAs can be readily purchased or even obtained for free from the MetaTrader marketplace. As one of the most popular forex trading platforms, the MT4 marketplace is huge and offers a diverse range of technical indicators and EAs.

We appreciated the established trading community within MT4 and its large marketplace for sourcing trading tools. It was an excellent space for us to exchange ideas and gain insights about financial markets and forex trading from seasoned MT4 users.

Apart from the inbuilt tools and an online marketplace, we could access technical analysis tools compatible with MT4. The package includes easy-to-use market scanning, pattern recognition, chart trading, and automated alert tools. You can also choose the MT5 platform. You’ll find that many of the Best MT5 Brokers are known for their expertise with this platform.

2. Plus500 - Best Broker With Proprietary Platform

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why We Recommend Plus500

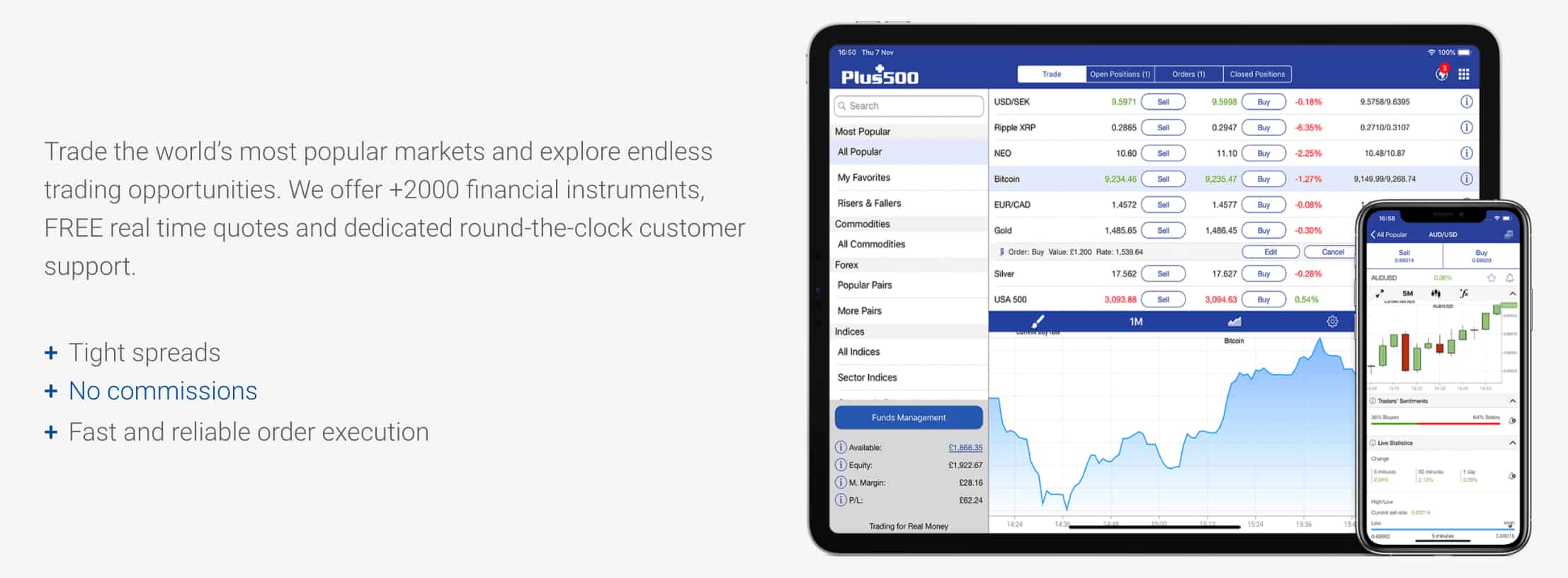

We found Plus500 to be a solid choice for budding traders in Malaysia. Offering its bespoke web trader platform and mobile app, you can access over 2,000 financial instruments, from shares to cryptocurrencies. They keep trading fees minimal and charges no costs for deposits and when initiating or closing a transaction. In essence, Plus500 delivers a straightforward and cost-effective trading experience.

Pros & Cons

- Easy-to-use trading platform

- Protect against negative balance

- Risk management order types

- Doesn’t offer MetaTrader suite

- No trading automation

- No social/copy trading tools

Broker Details

Plus500 is a CFD provider that offers its proprietary trading software as a web trader platform or mobile app. You can trade a wide range of financial instruments as a Plus500 client, gaining access to over 2,000 shares, cryptocurrency, options, indices, commodity, and forex markets.

As a Market Maker Brokers broker, we traded spreads with the broker setting its own bid-ask prices and filling orders using its own internal liquidity. Plus500 spreads are wider than ECN brokers; however, have no commission costs on top of the spread. Overall, there are minimal trading fees and account management costs, as we paid no fees when depositing funds and no commission fees when we opened or closed a trade.

Mobile Trading Apps

Whether we were using a mobile or tablet device, Plus500’s easy-to-use proprietary trading app well suited the beginner traders in our team. Their mobile trading app is compatible with the following devices:

- iOS trading app for iPhones and iPads (App Store 3.9 stars)

- Android devices (Google Play 4 stars)

- Windows mobile app

- Smartwatches

Mobile App Risk Management Features for Beginners

Plus500 offers excellent risk management features with top-tier regulation and guaranteed stop-loss orders (GSLOs). As forex and CFDs are complex instruments that come with a high risk of losing money, we believe strong risk management tools are vital for beginner traders. To add further transparency regarding financial reporting and regulation, the CFD provider is listed on the London Stock Exchange and overseen by seven different tier-one financial authorities:

- FCA (Financial Conduct Authority UK)

- CySEC (Cyprus Securities and Exchange Commission)

- ASIC (Australian Securities and Investments Commission)

- FSCA (Financial Sector Conduct Authority, South Africa)

- MAS (Monetary Authority of Singapore)

- ISA (Israel Securities Authority)

- FMA (Financial Markets Authority, NZ)

When we signed up with a highly regulated CFD provider, we felt reassured that our funds were protected and appreciated the negative balance protection available in certain locations. To manage risks, we utilised both basic and premium pending order types. The GSLOs allowed us to pay a premium to secure a guarantee from Plus500 that our order would be executed at our specified price, regardless of gapping. As well as order types, risk management features on the Plus500 mobile trading app include traders’ sentiment, market and price alerts, plus an economic calendar.

3. Pepperstone - Best MetaTrader 4 Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.40

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We were impressed with Pepperstone catering to all trading levels. Beyond forex, they offer an extensive array of CFDs, notably in equities. If you are keen to bolster your market knowledge, their online resources prove invaluable. Pepperstone stands as a comprehensive and user-friendly broker option.

Pros & Cons

- Great customer service

- Good trading platforms for beginners

- Fast execution speeds

- Demo account is limited

- Educational resources could be updated

- Lacks guaranteed stop loss orders

Broker Details

We’ve used Pepperstone in several of our tests, and it often comes out on top. The top broker offers the MetaTrader 4, MetaTrader 5, and cTrader trading platforms. Each platform provides ultra-tight spreads, fast execution, and great market access, yet we recommend using MT4 for the great range of trading tools Pepperstone offers on the platform.

Pepperstone is a regulated broker with ASIC, FCA, CySEC, BaFin, CMA, and DFSA that facilitates forex and CFD trading for traders around the world.

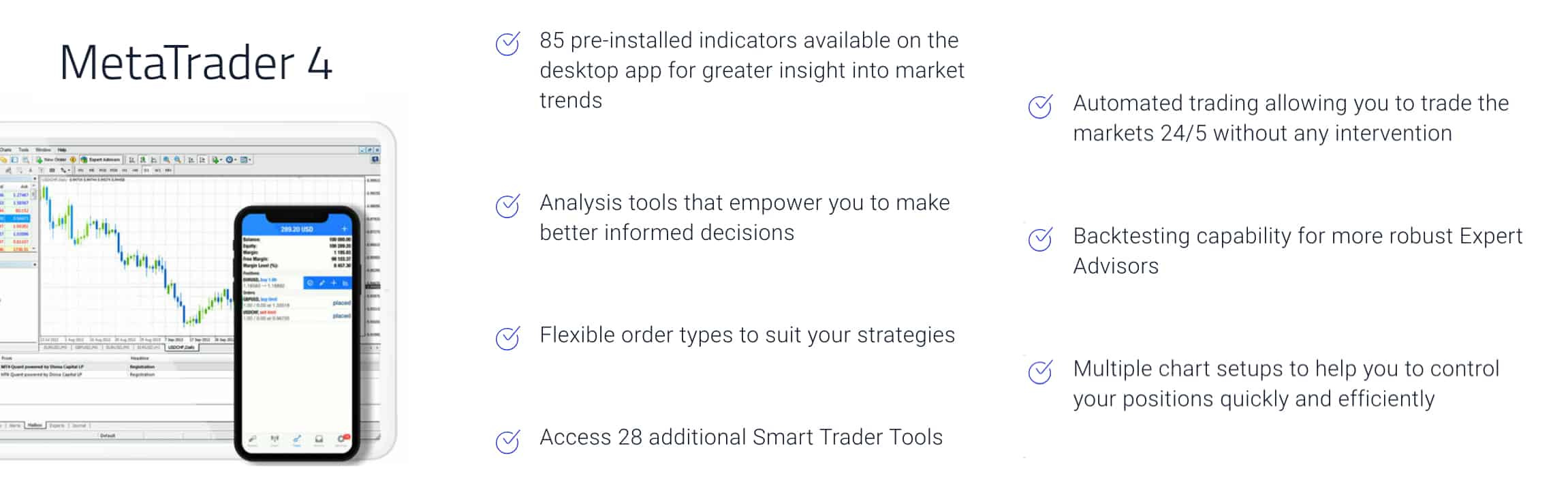

When we explored MetaTrader 4 (MT4), we quickly realised why it’s the top choice for forex trading globally. A significant perk for those starting in forex trading is the flexibility to switch between MT4 forex brokers when required, given that most online brokers provide this platform. Our experience highlighted MT4’s popularity stemming from multiple features, notably the power to copy-trade and acquire automated bots from the most comprehensive trading community currently available for retail investor accounts.

Why Pepperstone Is The Best MT4 Broker For Beginner Traders

We found MT4 a suitable platform for both beginners and experienced traders, with extensive financial instruments and automated trading tools available. Through MT4, we managed the inherent risks of trading using various order types, created automated trading strategies with Expert Advisors, and conducted thorough backtesting and optimisation of strategies using the platform’s backtesting functionalities.

MT4 trading tools and features include:

- A customisable, user-friendly interface.

- Charting tools with 85 inbuilt indicators.

- Algorithmic trading via Expert Advisors (EAS, trading robots).

- Develop your own EAs using the MQL4 programming language.

- Download EAs from the huge MT4 community and marketplace.

- Robust backtesting tools for EAs.

- AutoChartist automatic market scanner to detect trading opportunities.

- Third-party account mirroring services (Myfxbook, ZuluTrade, and DupliTrade).

- Limit and stop-loss order types.

- Real-time news.

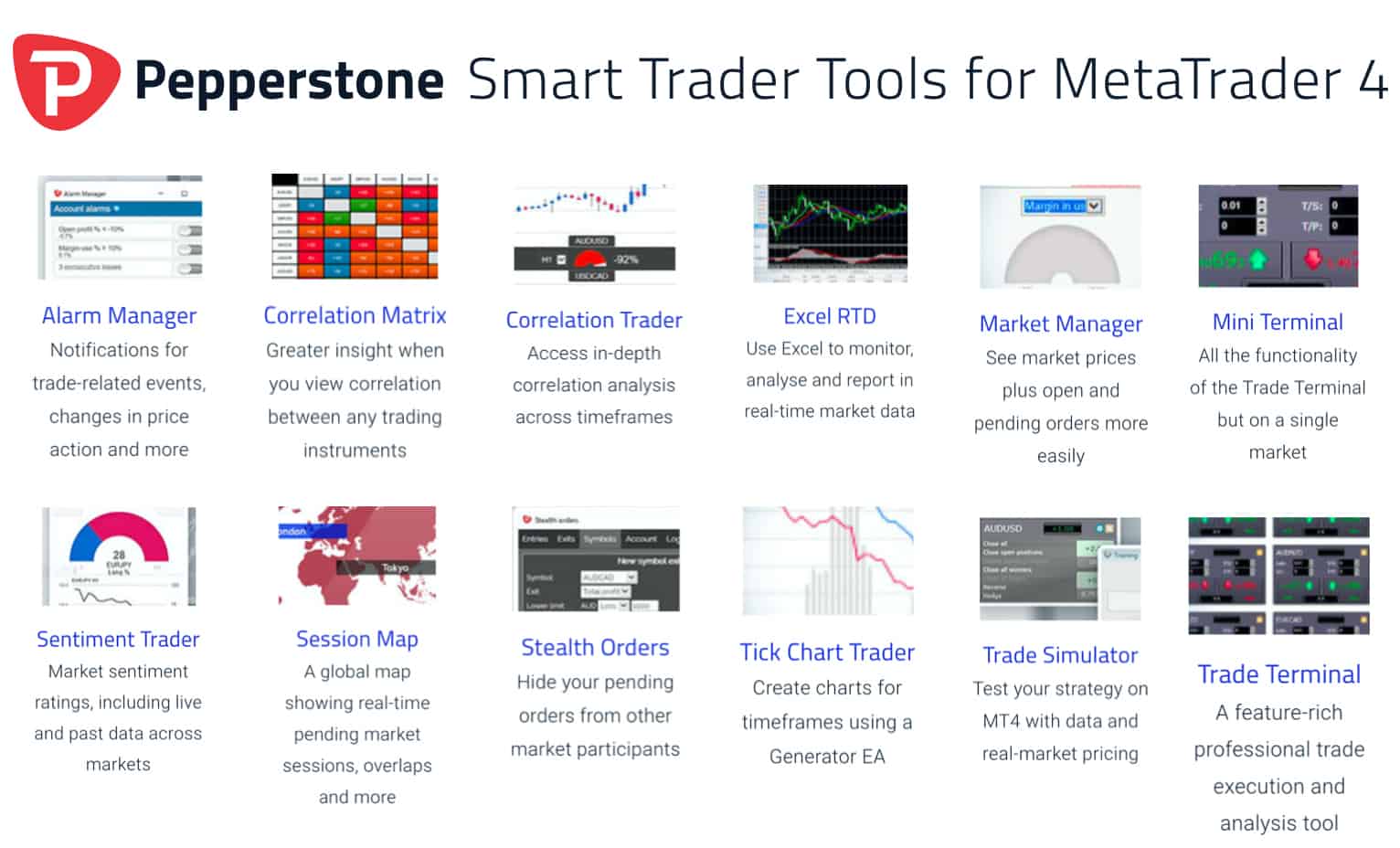

Besides the comprehensive range of inbuilt trading tools, MetaTrader users can download an add-on suite of Smart Trader Tools to enhance the MT4 platform. The package includes 28 additional technical indicators and Expert Advisors designed to automate market research, analysis, and trading.

No Dealing Desk Execution

We learned that Pepperstone fills orders using 22 top-tier liquidity providers, giving us access to some of the best spreads available to retail investor accounts. The broker executes orders with no dealing desk (NDD) and straight-through-processing (STP), with Equinix servers allowing for fast execution speeds. As shown below, Pepperstone executes orders faster than other online brokers we’ve looked into, guaranteeing that we face minimal slippage.

MT4 Education and Demo Accounts

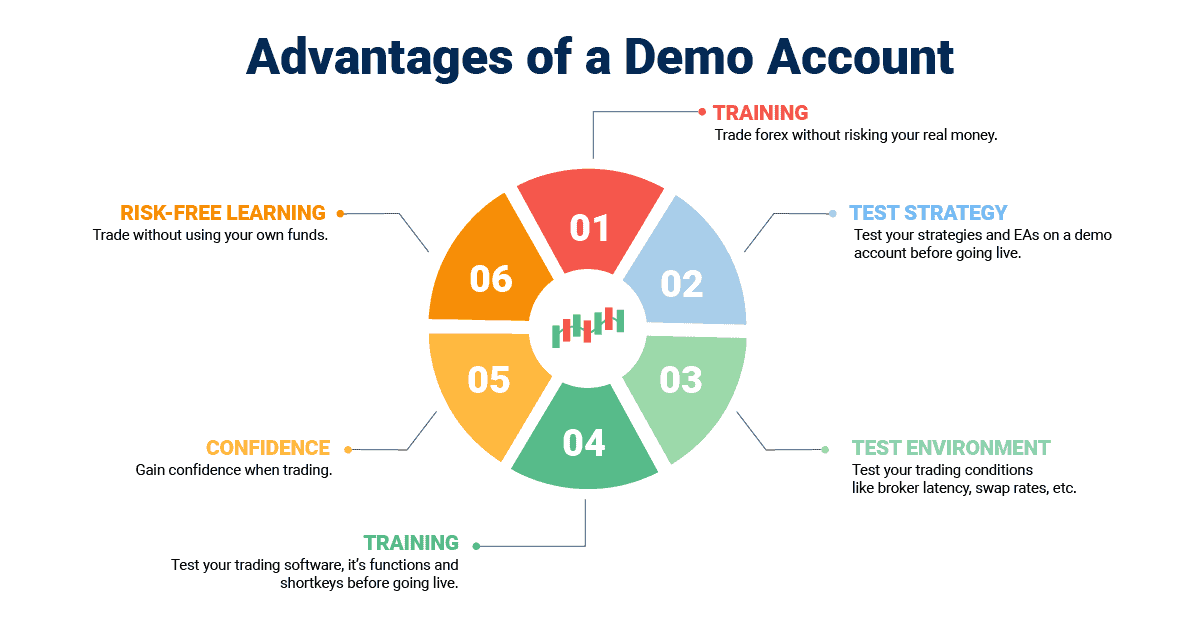

As CFD and forex trading are complex and come with a high risk of losing money, we liked how Pepperstone provides an excellent demo account and quality educational resources.

Pepperstone’s website has a thorough MetaTrader 4 course that we found beneficial. The beginner traders stated it helped them familiarise themselves with the trading platform. Plus, we gained insights into the platform’s extensive features, mobile trading, Expert Advisors, VPS, and Smart Trader Tools through the 11-part course.

Lastly, Pepperstone provides a demo account enabling traders like us to familiarise ourselves with the MT4 platform and test trading strategies. We were pleased to see an addition of $50,000 in virtual funds to our demo account, with the trial available for 30 days.

4. ThinkMarkets - Great Forex Broker For Novice Traders

Forex Panel Score

Average Spread

EUR/USD = 1.1

GBP/USD = 1.3

AUD/USD = 1.1

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

We liked ThinkMarkets’s competitive fees, stringent regulation, and strong trader protection measures. They’re a standout CFD broker tailored for new traders offering intuitive trading platforms. Navigating trades will be a breeze. If you are keen on a risk-free practice, ThinkMarkets’s demo account is great to use before you dive into live trading.

Pros & Cons

- Tight average spreads

- Three account types

- 24/7 customer support

- Standard account needed to access ThinkTrader

- $500 minimum deposit for ThinkZero account

- High minimum deposit

Broker Details

We have six key reasons why we deem ThinkMarkets a top forex broker for beginner traders:

- $0 minimum deposit and no deposit fees

- Negative Balance Protection

- Low trading fees with spreads from 0.4 pips

- Forex training and 24/5 customer support

- Three leading trading platforms, including MT4

- Tier-1 regulation in the UK, Australia and SA

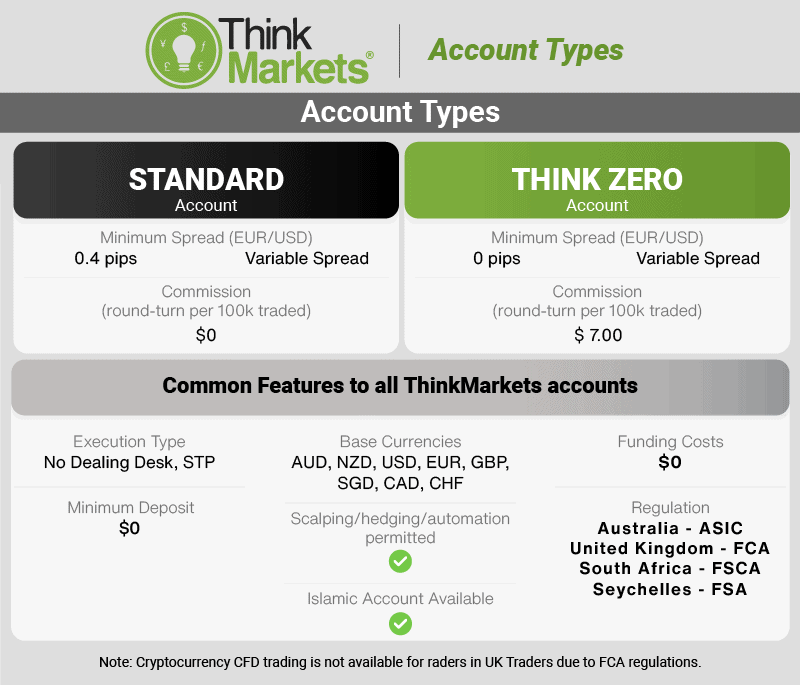

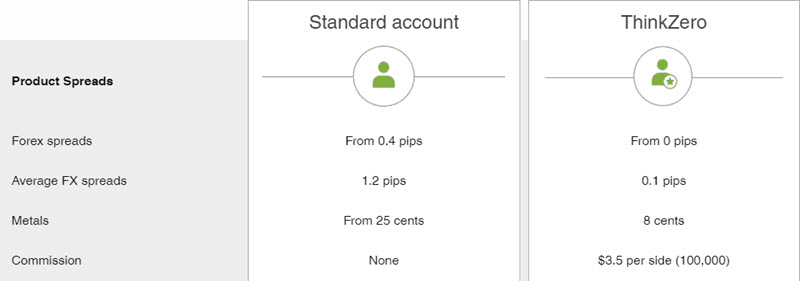

$0 Minimum Deposit Requirement for Standard Account Type

ThinkMarkets offers two forex trading accounts. The broker designed its Standard Account type for beginner traders, with no commission fees and a $0 minimum deposit required to open an account. We paid no funding costs when using deposit methods such as wire transfer, debit card, Neteller, Skrill, and credit card. On top of fee-free deposits, there were no withdrawal fees.

Negative Balance Trader Protection

When we began using ThinkMarkets, one standout feature we appreciated was that all their customers were granted negative balance protection. This helps reduce the high risk that comes with forex and CFD trading since you can’t lose more than what’s been deposited in your trading account.

If our trading account balance hit $0, ThinkMarkets’ Negative Balance Protection policy promptly closed all our active trades. This ensured we never faced a Negative Balance Protection. If negative balances occur because of high volatility in CFD and foreign exchange markets, the broker will pay you out any negative balance. It’s worth noting that only a few forex brokers provide this safety net, making our experience with ThinkMarkets much more secure.

Low Trading Fees With No Commissions

Our experience with the ThinkMarkets standard account highlighted its spread-only nature without flat-rate commission fees. This meant that ThinkMarkets primarily profits from the difference between the ‘ask’ and ‘sell’ price of any forex pair. The minimum spread is 0.4 pips, and the average spread is 1.2 pips for commonly traded major forex pairs. We’d recommend the standard account, especially for newcomers in trading, to avoid commission fee calculations.

Forex Training and Customer Support

ThinkMarkets offers an online training course for beginner, intermediate, and experienced traders. We also benefitted from weekly webinars and trading platform tutorials. Trading guides were available, covering topics like:

- Understanding Market Trends

- Support and Resistance

- Chart Patterns

- Introduction to Candlesticks

- Building a WatchList

- MT4 Tips and Tricks

- Introduction to Price Action

Customer service is available 24 hours a day, 5 days a week (weekdays), and operates from the following locations:

- London, UK

- Melbourne, Australia

- Johannesburg, South Africa

There are also local numbers for Italy and Spain.

A Selection of the Best Forex Trading Platforms

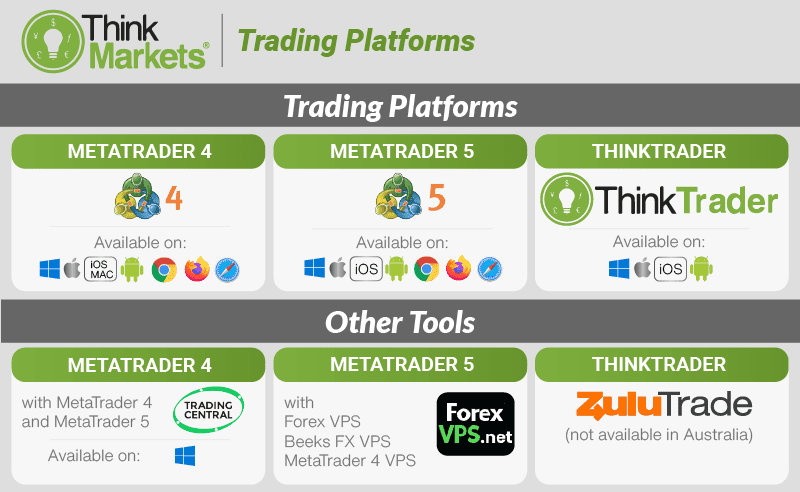

Our options spanned MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the online broker’s proprietary trading platform, ThinkTrader.

ThinkTrader

We experimented with their proprietary trading software, renowned for its intuitive yet advanced charting capabilities. The options for forex trading via ThinkTrader were a desktop platform and mobile apps for both iOS and Android. ThinkTrader platform features are comprehensive and user-friendly. ThinkTrader platform features include:

- Real-time market news and alerts.

- Sophisticated technical analysis tools: 100 technical indicators, 40 objects, 12 timeframes and 10 charts.

- Close all or multiple orders with one click.

- Multi-device login between desktop, tablet, and mobile apps.

- Trend-risk scanner: Trading signals feature that automatically scans markets for trading opportunities.

- Pending order types include limit and stop-loss orders.

- A range of asset classes, including forex, commodities, indices, shares and cryptocurrencies.

Tier-1 Regulation

As a beginner trader, you should choose a broker that has tier-1 regulation. ThinkMarkets is overseen by three core financial authorities, with trading regulations varying between jurisdictions:

- Australian Securities and Investments Commission (ASIC) in Australia – AFSL 424700

- Financial Conduct Authority (FCA) in the United Kingdom – License Number 10537331

- Financial Sector Conduct Authority (FSCA) in South Africa – FSP No 49835

In summary, our journey with ThinkMarkets highlighted it as an exemplary CFD broker, particularly suited for beginners. With its reasonable fees, premier regulation, and stringent trader protection measures, our trading experience was enhanced. We had a choice of three user-friendly platforms: MT4, MT5, and ThinkTrader. If you want to learn how to trade forex before using a live account with real money, ThinkMarkets offers a demo account.

5. IC Markets - Broker With ECN Pricing And Lowest Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

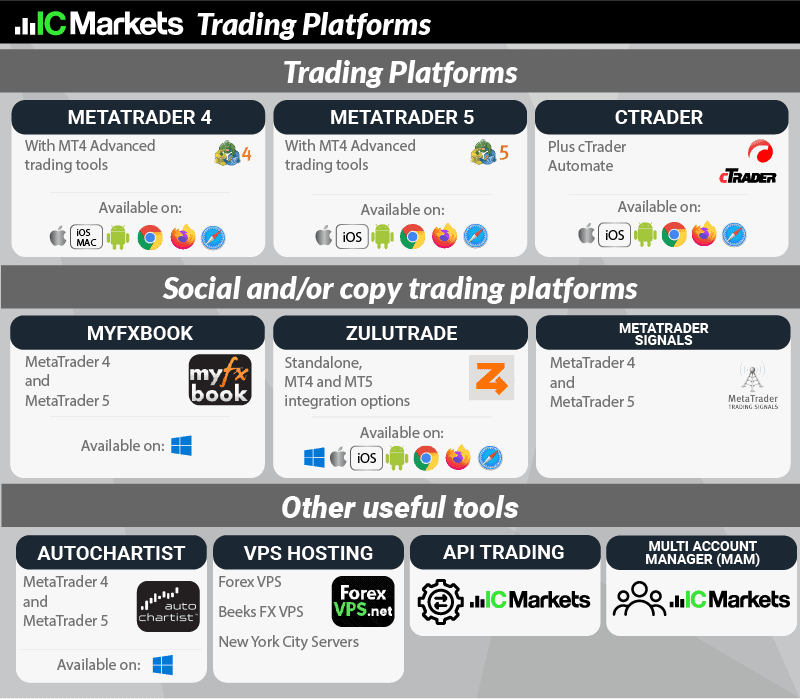

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

We found IC Markets to be a standout choice for beginner traders in Malaysia keen on ECN pricing. If you’re aiming to minimise trading costs for currencies and CFDs, this broker is an excellent pick. Their commitment to low expenses benefits those just starting their trading journey.

Pros & Cons

- Currency spreads from 0 pips

- MT4, MT5, cTrader and TradingView platforms

- Available social trading options

- Limited market research

- Needs more educational content

- No proprietary platform

Broker Details

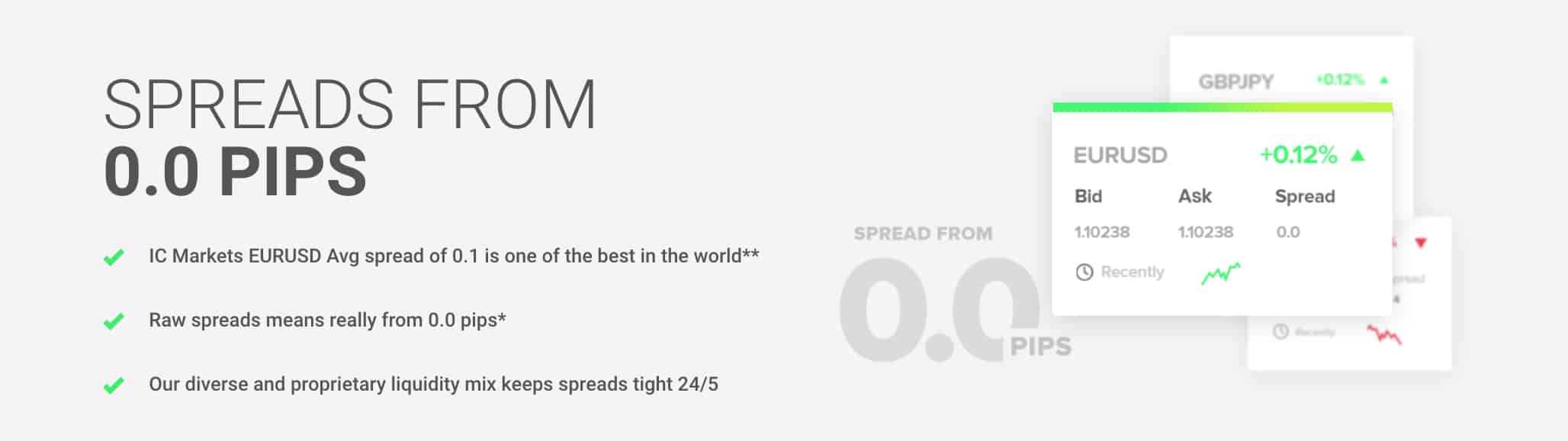

IC Markets Provides ECN Pricing And Low Spreads

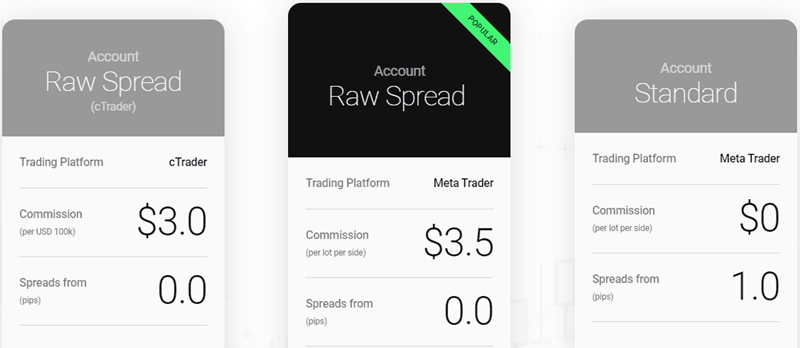

If you are a beginner trading wanting ECN pricing, then IC Markets is a good choice because of the following:

- Competitive spreads

- Commissions of $3.50 per side

- No funding or withdrawal fees

- A free demo account for trading

- Regulation in Australia (ASIC), Seychelles (FSA) and Europe (CySEC)

Why IC Markets Is The Cheapest FX Broker

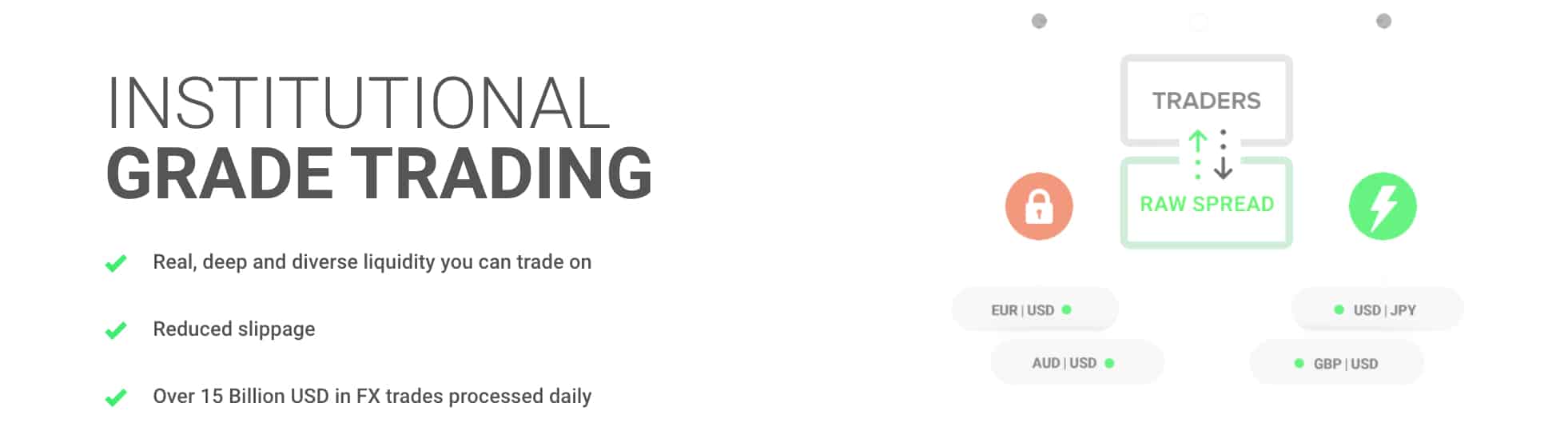

One of the brokers that caught our attention was IC Markets, primarily because they’re cost-effective. Besides the standard account type, the CFD broker offers an award-winning Raw Spread Account. Like ECN brokers, IC Markets links clients directly to esteemed liquidity sources like banks and other financial establishments. This direct connection enables retail investor accounts to tap into institutional-level spreads using a No Dealing Desk Brokers (NDD) execution. Instead of the conventional wider no-commission spreads, we were delighted to discover that with the Raw Spread account, we could tap into ECN-style spreads plunging to as low as 0.0 pips. IC Markets charges flat-rate commission fees for their brokerage services, calibrated on trade volume.

In our experience, the commission for Raw Spread account users was $3.50 for every 100k traded or £2.50 for the same amount when we set the base currency to pound. Another benefit? IC Markets doesn’t impose deposit or withdrawal fees. We began our trading journey with a minimum deposit of just $200.

We noticed the absence of markup spreads in the raw spread account. This means the remaining price difference between the ‘buy’ and ‘sell’ of forex pairs, such as EUR/USD, is market-determined. With IC Markets, their market size and access to top-tier diverse liquidity pools help them achieve the lowest average spreads of any broker.

As shown below, IC Markets Raw Account spreads are competitive. The online broker offers the tightest spreads for major forex pairs, such as:

- GBP/USD (Great British pound vs US dollar), with spreads averaging 0.40 pips

- EUR/GBP (Euro vs Great British pound), average spread 0.40 pips

- USD/SGD (US dollar vs Singapore dollar) average spreads 0.30 pips

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Platforms Offered By IC Markets

Our trading platform options with IC Markets were MetaTrader 4, MetaTrader 5, cTrader and TradingView. As we ventured further, IC Markets presented immensely useful trading tools:

- Free demo accounts for virtual trading, allowing beginners to build confidence trading CFDs before using a live account

- Virtual private server (VPS) access for VIP traders

- Fast NDD order execution

- Advanced trading tools with a suite of plug-ins to enhance MetaTrader 4 (I.e. sentiment trader and correlation trader)

- Automated trading with Expert Advisors (MT4 and MT5) and cBots (cTrader)

- Third-party Best Copy Trading Brokers such as Myfxbook and ZuluTrade

With IC Markets, we weren’t just getting low spreads and diverse platform options. Their global reputation and trustworthiness were evident. IC Markets Australian subsidy is regulated by ASIC (Australian Securities and Investments Commission, AFSL 335692), while CySEC (Cyprus Securities and Exchange Commission, License No 362/18) regulates European operations.

In conclusion, for those like us who prioritise minimised trading costs in their forex and CFD trading ventures, we recommend IC Markets as your broker.

6. eToro - Top Copy Trading Platform For New Traders

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

We liked how user-friendly this broker’s platform is, especially for those just starting forex trading. Having tested it ourselves, we can vouch for eToro’s reliability and swift execution times. The educational resources provided are top-notch, explicitly tailored for novice traders. Its customer support is responsive, and more importantly, they offer competitive spreads for the Malaysian market.

Pros & Cons

- Specially built for social trading

- Unique social trading features

- Wide range of CFD stocks, ETFs and Cryptos

- Customer support is sometimes inaccessible

- Allows only one account base currency

- Has withdrawal fees

Broker Details

We’ve found eToro to be a standout social trading broker and platform that suits beginner traders who want to spend as little time researching financial markets and developing trading strategies. Through eToro’s platform, we had the opportunity to copy the strategies of experienced investors while sharing ideas via newsfeeds and connecting with traders around the globe.

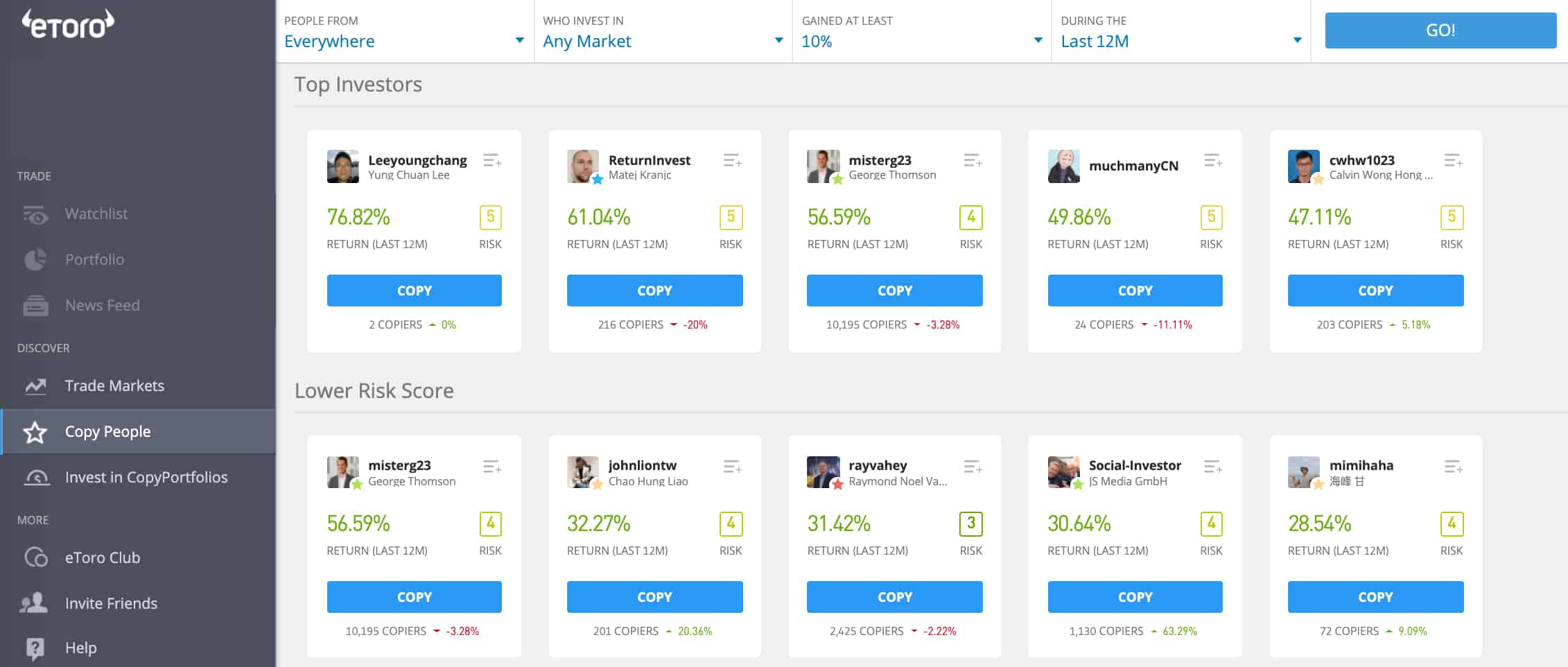

Social-Copy Trading with eToro’s CopyTrader

At eToro, we could easily copy the trading strategies of experienced traders, known as Popular Investors. It allowed us to view a Popular Investor’s trading history, portfolio performance, and location to find trading strategies to replicate that suit our risk tolerance and investment objectives.

For the beginners in our team, social trading provided a smoother entry into currency trading. Why? Because seasoned traders handle the fundamental and technical analysis on our behalf. It’s also a great chance to absorb knowledge from active traders with vast experience trading financial instruments.

Apart from forex pairs, we observed that eToro’s Popular Investors develop trading strategies that include Stocks, Commodities, ETFs, and Indices.

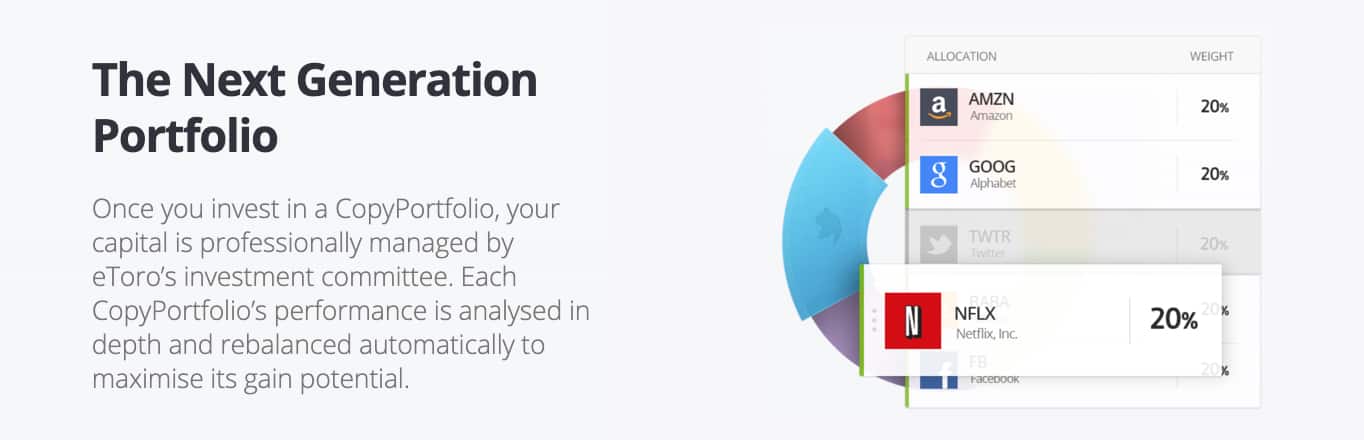

CopyPortfolios

On top of copying Popular Investors, we also had the choice to invest in CopyPortfolios, which include a bundle of financial instruments. eToro presents two distinct portfolio types, requiring an initial deposit of $5000. What’s even better? There are no ongoing portfolio management fees.

- Top Trader Portfolios: A bundle of trading strategies developed by eToro’s top-performing, highly experienced traders.

- Market Portfolios: A bundle of top-performing assets such as Share CFDs, ETFs and Commodities.

7. FOREX.com - Best Demo Account for New Forex Traders

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.6

AUD/USD = 1.4

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

We liked that Forex.com offers demo accounts for their proprietary trading platform and MetaTrader 4 (MT4), allowing beginners a real feel for the market. Novice traders experience real-time market conditions in an environment similar to a live account. With over 80 currency pairs and metals available for practice, you can backtest against historical data. This broker genuinely understands the needs of beginner traders in Malaysia, and it’s a top pick for those starting their forex journey.

Pros & Cons

- Wide range of forex pairs to trade

- User-friendly trading platforms for beginners

- Integrated charting tools available

- High minimum deposit requirement

- Doesn’t provide 24/7 support

- Charges inactivity fees

Broker Details

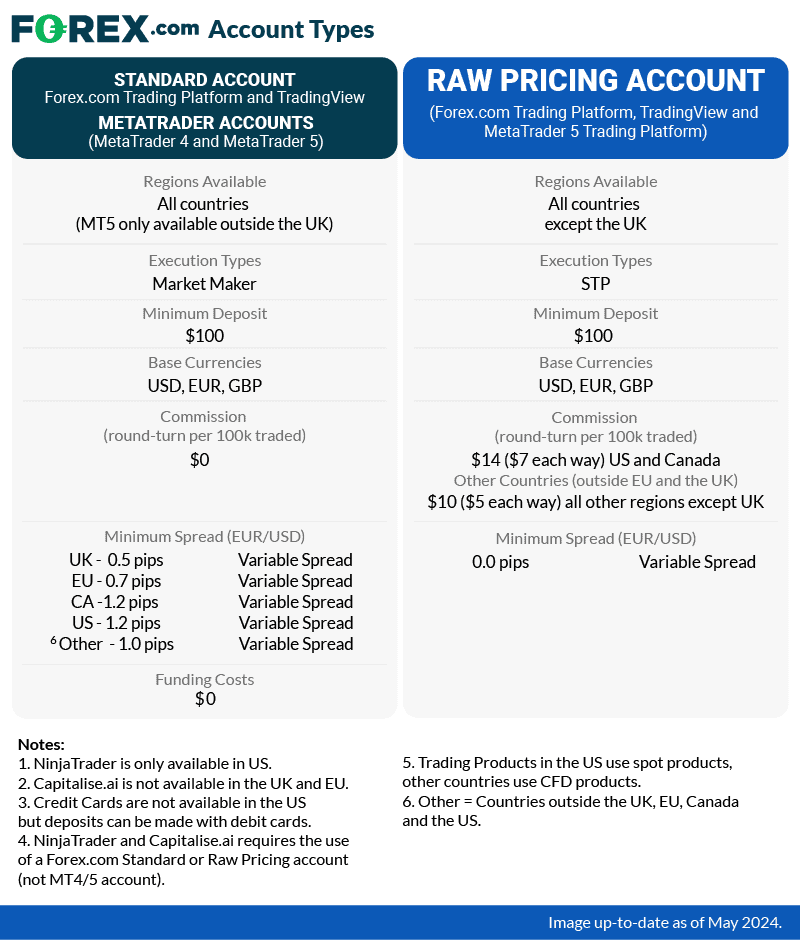

Demo accounts are one of the most valuable educational tools we found beneficial as beginner traders. Forex.com provides demo accounts for 4 trading platforms – Forex.com, TradingView, MetaTrader 4 and MetaTrader 5.

Demo accounts are available for 30 days and funded with $10,000 virtual money. You can open one demo account per platform, meaning if you are still determining which platform to try, you can open a demo trading account on both the Forex.com proprietary trading platform and MT4.

When choosing a demo account, you will need to choose between one of three account types., these being: Standard, MetaTrader and RAW Pricing. The first two are commission free while the latter has spread from 0 pips and a commission of USD 5 each way.

You can view our Best Forex Demo Accounts review or visit the Forex.com site below.

Your capital is at risk up to ‘76% of retail CFD accounts lose money with FOREX.com’

8. easyMarkets - Broker With Leading Risk Management Features

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

MT4, MT5, TradingView, easyMarkets Trading

Minimum Deposit

$25

Why We Recommend easyMarkets

We liked how easyMarkets provides beginner traders with four distinct risk management tools to help minimise the inherent risks of CFD and forex trading. Utilising these tools, new traders can confidently protect their account balances. Specifically, we found the deal cancellation, freeze rate, set spreads, and guaranteed stop-loss orders invaluable assets for newcomers in the forex scene. Based on our experience, this broker offers a supportive environment for those starting in Malaysia.

Pros & Cons

- Low fixed spreads

- User-friendly trading platform

- Unique risk management features

- No 24/7 customer support

- Lacks copy trading tools

- No RAW spread accounts

Broker Details

easyMarkets offers forex traders four unique risk management tools to reduce the risk of CFD and forex trading. Beginner forex traders can protect their trading account balances with three key easyMarkets risk management features:

- You can manage risk with easyMarkets’ unique deal cancellation tool

- Freeze rate so you don’t lose the spread you want

- You can use Guaranteed stop-loss orders to manage the high risk of trading

- Fixed spreads so there is no slippage

Deal Cancellation

easyMarkets was the first forex broker to launch Deal Cancellation back in 2016. The tool allows you to cancel a trade within 60 minutes and get your money back should market prices move in an unfavourable direction.

Freeze Rate

Unique to easyMarkets, Freeze Rate allows you to freeze the price you see quoted for some time so it doesn’t change while you execute your trade. With Forex being so volatile, these extra few seconds help ensure you don’t miss out on your desired price.

Fixed Spreads

Most broker spreads are variable, which means you can experience slippage as prices can change during the execution of your trade. easyMarkets spreads are fixed, which means the spread will not change. To get fixed spreads, you need to use MT4 or the easyMarkets trading platform; MT5 has variable spreads that can result in slippage.

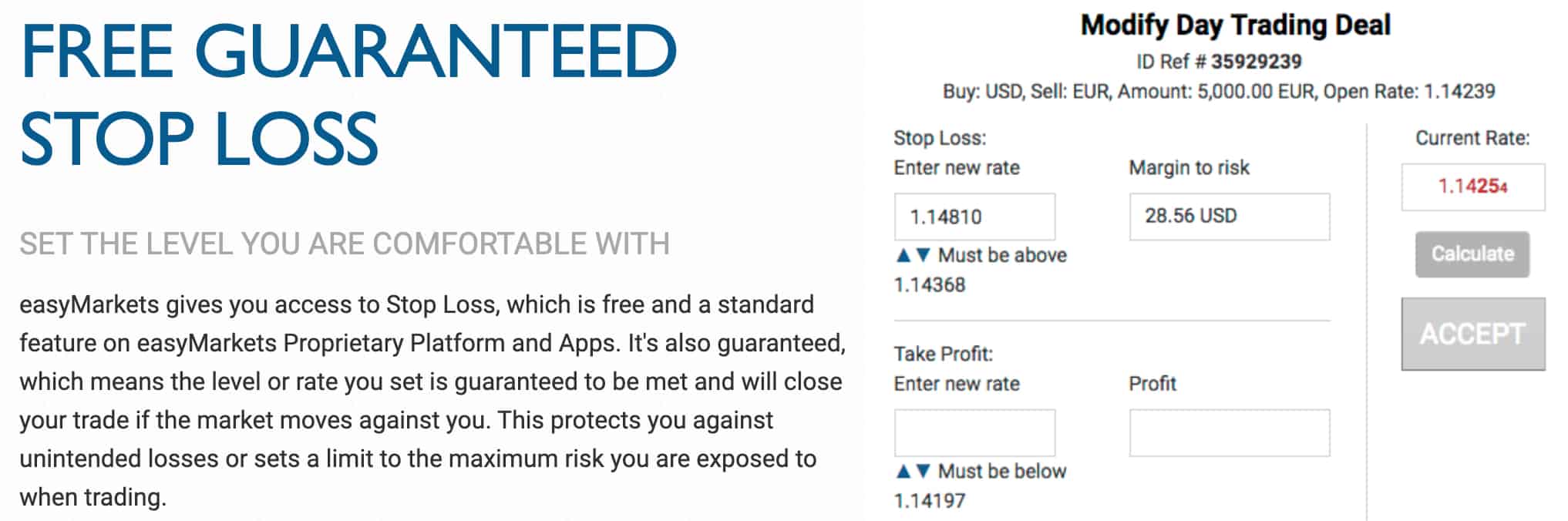

Free Guaranteed Stop-Loss Orders

All forex brokers offer basic stop-loss features to manage risk, which allows you to pre-set the amount you are willing to gain or lose on a trade. As discussed above, spreads are fixed with easyMarkets, which means the broker can guarantee your stop-loss orders.

Deal cancellation, freeze rate, fixed spreads, and guaranteed stop-loss orders are four features that will help you if you are a beginner trader.

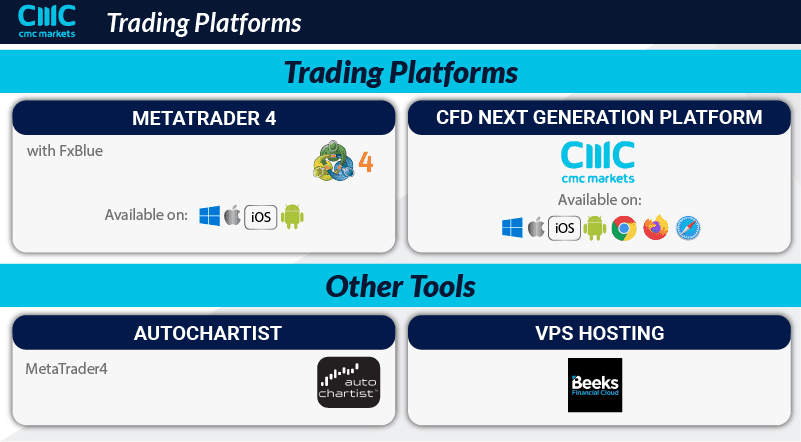

9. CMC Markets - Broker With a Huge Range of FX Pairs and Stocks

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.3

AUD/USD = 1.64

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

We liked that CMC Markets provides broad access to over 9,500 financial markets, instilling trust with its regulation by reputable authorities. Their distinctive trading platform, Next Generation, impressed us with its ability to navigate the entire CMC CFD product suite, including shares. For beginner traders in Malaysia, this platform offers both depth and security.

Pros & Cons

- $0 minimum deposit

- Strong trading platform

- Guaranteed stop-loss orders

- No social trading tools

- Customer service is limited on mobile app

- Large choice of FX pairs may confuse beginners

Broker Details

CMC Markets provides access to over 9,500 financial markets and is overseen by multiple top-tier regulators worldwide (FCA, IIROC, ASIC, FMA, and MAS). You must use the broker’s proprietary trading platform, Next Generation, to trade CMC’s full CFD product range, including shares.

Next Generation

The easy-to-use trading platform is available in a standard layout for beginners or an advanced format for experienced traders. The platform offers many inbuilt features to help you with trading and risk management when starting.

- Comprehensive charting tools include 115 technical indicators, 70 chart patterns, and 12 chart types

- Automatic pattern recognition and price projection tools to find trading opportunities

- Client sentiment data

- A trading community with chat forums to share ideas and chart analysis

- iOS and Android mobile apps

- Real-time news and financial market calendar

- Multiple order types, including guaranteed stop-loss orders

Financial Instruments Available to Trade

- Forex CFDs: 330+ major, minor, and exotic FX pairs

- ETFs and Share CFDs: 9000+ shares from 23 different countries, including 2000 Australian stocks

- Commodities: 100+ commodity products such as natural gas, oil, and metals

- Treasury CFDs: 50+ treasuries such as US T-Bonds and Euro Bonds

- Index CFDs: 90+ major indices including Germany 30, Australia 200, and UK 100

10. AvaTrade - Great Broker for Mac Forex Traders

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

We recommend AvaTrade for its tailored approach to Mac users, providing direct access to over 250 financial instruments through MetaTrader 4. Their online trader platform can be accessed across most browsers, saving you from unnecessary software downloads. Additionally, they have a suite of Mac-compatible tools. For Malaysian newcomers looking for a Mac-friendly forex platform, AvaTrade is a solid choice.

Pros & Cons

- MAC-friendly trading platform

- Negative balance protection

- Commission-free trading account

- Has inactivity fee

- Customer support is only 24/5

- High minimum deposit

Broker Details

- Analysis tools: 3 chart types and 30 analytical tools

- Multiple order types with trailing stop-loss orders and pending orders

- One-click trading

- Automated trading with Expert Advisors (MQL4)

- Mac demo account

Ask an Expert

Which online broker is easiest to use?

Easiest is in the eye of the beholder but here are some things you can consider

1. Trading Platforms

MetaTrader 4 is the worlds most popular trading platform. More traders use the platform than any other and this is partly because it is an easy to use platform and partly there are more resources freely available to help you use this platform.

Brokers that have MetaTrader 4 include Pepperstone, IC Markets, FP Markets, Markets.com

2. Trading Accounts

Standard accounts are generally easier to use than commission accounts due to the simpler cost structure. Brokers that offer this type of account include

Pepperstone, Markets.com, IC Markets, IG Markets, CMC Markets,

3. Type of spreads

Fixed spreads make for easier trading than variable spreads. AvaTrade, easyMarkets are good options for these type of spreads.

Which of these platforms provides the best beginner-focused research and analysis for me to use?

Beginner traders are looking for different things on a platform. Useful features traders new to trading should look for in a platform include a clean and easy to use interface that is free from clutter, a platform with good customer support and good risk management tools.

It’s hard to say any platform provides analysis targeted specifically at beginners but most do include in-built news features such as insights – Pepperstone, IC Markets include Autochartist which other brokers include Trading Central. Many also connect with Reuters and other similar news services. All platforms connect with economic calendars for the latest news events.