Best Islamic Forex Brokers

Islamic forex brokers provide swap-free trading accounts that comply with Sharia law by eliminating riba (interest) on overnight positions. I tested Islamic accounts from UAE-regulated brokers and matched them to different trading needs based on platform quality, market access, execution speed, and compliance with Islamic finance principles.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

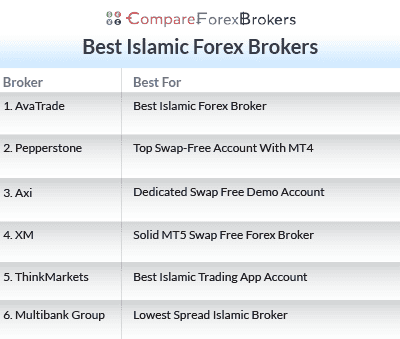

Best Islamic Forex Brokers

- AvaTrade - Best Islamic Forex Broker

- Pepperstone - Top Swap Free Account With MT4

- Axi - Dedicated Swap Free Demo Account

- XM - Solid MT5 Swap Free Forex Broker

- ThinkMarkets - Best Islamic Trading App Account

- MultiBank Group - Lowest Spread Islamic Broker

What is the top forex broker who offers a swap free account?

AvaTrade offers the best Islamic forex account in the UAE with automatic swap-free status on all accounts, zero application fees, and access to over 1,250 instruments. The broker provides comprehensive Sharia-compliant trading across forex, commodities, indices, and cryptocurrencies through AvaTradeGO, MT4, and MT5 platforms.

1. AvaTrade - Best Islamic Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 1.2 AUD/USD = 0.9

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

I recommend AvaTrade as the best Islamic forex broker in the UAE because you get market-level spreads with no swaps for the first 5 days. After this grace period, a small admin fee applies along with swaps (so I suggest closing positions before day 5 to maximise the swap-free benefit).

AvaTrade operates under ADGM regulation, which means your funds are segregated and you’re protected. They also provide Arabic-speaking support, which is particularly valuable if you prefer conducting broker communication in Arabic.

I found the platform selection comprehensive as you can access 55+ forex pairs, 30+ commodities, and 23 indices across AvaTradeGO, MT4, and MT5. The AvaProtect feature particularly caught my attention, as it insures losing positions up to $50,000 when using AvaTradeGo.

The Trading Academy offers 43 video tutorials across all levels, plus weekly live webinars and daily market analysis from the Sharp Trader platform. In my experience, the beginner tutorials were particularly well-structured if you’re new to Islamic forex trading.

You’ll need to request Islamic account status after funding your account, but once approved, you get commission-free trading with competitive spreads.

Pros & Cons

- 1,250+ instruments including crypto

- Three professional platforms

- 95+ indicators on mobile app

- Arabic customer support

- Swap fees apply after 5-day holding period

- Certain currency pairs restricted (ZAR, TRY, RUB, MXN)

- Cryptocurrency trading not available on Islamic accounts

- Standard Account spreads start at 0.9 pips

- Withdrawal processing takes 2-3 business days

Broker Details

Comprehensive Platform Suite

AvaTrade’s AvaTradeGO mobile app delivers 95 technical indicators including Moving Averages, Bollinger Bands, RSI, MACD, and Fibonacci retracements. The TradeCentral AI feature identifies head and shoulders, triangles, and flag formations across your watchlist in real-time. You get nine chart types (including Heikin Ashi, Renko, Kagi, and Point & Figure) beyond standard candlesticks.

MT4 includes 30 built-in indicators, 23 analytical objects (trend lines, channels, Fibonacci tools), and nine timeframes. The Strategy Tester backtests Expert Advisors using tick-by-tick or 1-minute OHLC bars. AvaTrade’s exclusive AvaProtect tool insures losing positions up to $50,000 with premiums of 3-10% based on trade duration.

MT5 expands functionality with 21 timeframes, 38 technical indicators (adding Adaptive Moving Average, Fractals, Gator Oscillator), and 44 analytical objects. The integrated Economic Calendar shows high-impact events with red/yellow/green volatility forecasts. DOM displays order book liquidity across 10 price levels, helping you gauge available volume before entering larger positions.

Multi-Asset Islamic Trading

Beyond the 55+ forex pairs, AvaTrade’s Islamic accounts provide swap-free access to commodities including gold, silver, and oil. Index CFDs cover major global markets like the S&P 500, NASDAQ, and regional indices. For something different you can also trade vanilla options for 44 Forex pairs along with gold and silver when using AvaOptions app.

The broker offers fractional trading on major instruments, letting you trade micro-lots as small as 0.01 lots. This position sizing flexibility helps you manage risk while building your trading strategy. Leverage reaches 30:1 on forex pairs for retail accounts, though Islamic accounts must still comply with position sizing best practices.

Educational Resources and Support

AvaTrade’s Islamic account holders access their Trading Academy with 43 video tutorials organized into three levels: Beginner (videos covering forex basics, order types, and risk management), Intermediate (videos on technical indicators like RSI, MACD, and Fibonacci), and Advanced (videos on multi-timeframe analysis and trading psychology).

The Sharp Trader analytical platform provides daily market analysis with specific entry/exit recommendations, technical chart patterns, and economic event coverage across major pairs.

Weekly webinars run Tuesdays at 14:00 GMT and Thursdays at 18:00 GMT, covering live market analysis with Q&A sessions averaging 45-60 minutes. The AvaAcademy PDF library includes 12 comprehensive guides, such as “Introduction to Forex Trading”, “Technical Analysis Mastery”, and “Islamic Finance in Forex Markets”.

2. Pepperstone - Top Swap Free Account With MT4

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

I recommend Pepperstone if you’re seeking tight spreads combined with a generous swap-free grace period. During my testing, I found their Standard Account spreads consistently averaged 1.0 to 1.2 pips on EUR/USD, which are noticeably tighter than most Islamic brokers in the region. You get 5 days with no swaps, then a $100 administrative fee per lot applies.

What impressed me most was Pepperstone’s MT4 integration. It offers the most comprehensive MetaTrader experience in the region, with 30 built-in indicators, nine timeframes, and unrestricted Expert Advisor access for you as an Islamic trader. You can also use MT5 or cTrader if you prefer those platforms for trading without swaps.

The instrument selection caught my attention – 94 Forex pairs (that’s significantly larger than most competitors) along with 44 cryptocurrencies and 24 indices. You can also trade ETFs, stocks, forwards and commodities. All up 1,712 CFDs are available, giving you serious diversification options within a single Islamic account.

Pros & Cons

- ECN execution with raw spreads from 0.0 pips

- Full MT4 and MT5 platform with EA support

- cTrader support

- 30ms average execution speed

- No minimum deposit requirement

- $100/lot administrative fee after 5-day grace period

- MT4 only (MT5 available but MT4 is the focus)

- Standard Account has wider spreads (1.0+ pips)

- Limited educational resources compared to competitors

Broker Details

MT4 Platform Features for Islamic Trading

Pepperstone’s MetaTrader 4 Islamic accounts give you full platform functionality without restrictions. The platform includes the Strategy Tester for backtesting automated systems using historical data spanning 10+ years, with three modes: Every Tick, 1 Minute OHLC, and Open Prices Only.

You can optimise Expert Advisors across 28 input parameters simultaneously, testing combinations to find optimal settings for your automated strategies.

The one-click trading panel displays default lot sizes, lets you preset stop loss distances, and configure take profit targets. The platform’s alert system sends push notifications via MT4 mobile app, email alerts, or audible desktop alerts when price crosses specific levels, indicators hit thresholds, or patterns form.

MT4’s charting includes candlesticks, OHLC bars, and line charts across nine timeframes. You get 23 analytical objects (trend lines, channels, Fibonacci tools, and Gann tools) . The Navigator panel organizes custom indicators, Expert Advisors, and scripts into folders for quick access across multiple currency pairs.

In addition to MT4, you can also trade using MT5 and cTrader.

Standard Account ECN-like Execution

The Standard Account delivers ECN-like pricing with direct market access to Pepperstone’s liquidity providers. During my testing, spreads for EUR/USD, GBP/USD and AUD/USD averaged 1.0 to 1.2 pips for EUR/USD commission structure. These low spreads give you near-institutional pricing without swap charges or commission cost.

Market depth shows up to 10 price levels with visible liquidity at each tier. This transparency helps you gauge order flow and potential slippage before entering large positions. The Standard Account requires no minimum deposit, making it accessible regardless of your starting capital.

Trading Infrastructure

Pepperstone offers 94 Forex pairs, 44 cryptos, 33 hard or soft commodities, 38 CFD forwards, 24 indices and 95 ETF. You can also trade over 1300 cfd stocks across 5 exchanges – NASDAQ, NYSE, ASX, LSE and DAX.

The brokers maintains server infrastructure in Equinix data centers across New York, London, and Tokyo. This geographic distribution ensures low-latency connections regardless of your location in the UAE. The broker’s connectivity to multiple liquidity providers means your orders get filled even during major news releases.

The platform supports hedging strategies where you can hold simultaneous long and short positions on the same pair. This flexibility helps you manage risk during uncertain market conditions. FIFO requirements don’t apply, giving you control over which positions you close first.

Stop loss and take profit orders execute at market prices without guaranteed fills. During extreme volatility, slippage can occur, though Pepperstone’s deep liquidity pool minimises this risk. Trailing stops adjust automatically as prices move in your favor, locking in profits without manual intervention.

3. Axi - Dedicated Swap Free Demo Account

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.2 AUD/USD = 0.2

Trading Platforms

MT4

Minimum Deposit

$0

Why We Recommend Axi

Axi delivers the most comprehensive demo account experience for Islamic traders in the UAE. I tested their swap-free demo across MT4 and MT5, finding unlimited duration access with $50,000 in virtual funds that mirrors live account conditions perfectly. The demo lets you practice with realistic swap-free trading conditions, showing exactly how Islamic accounts operate before you commit real capital.

Axi’s Standard Account offers spreads from 1.2 pips on EUR/USD with zero commission, while the Pro Account tightens this to 0.4 pips with $3.50 per lot charges. Islamic accounts provide 5 swap-free days; after this grace period, holding fees apply.

The broker provides 80+ currency pairs in demo mode, letting you test exotic pairs and cross rates without time pressure. What sets Axi apart is their Sharia-compliant demo account that accurately reflects the 5-day grace period and holding fee structure you’ll face in live Islamic accounts.

Pros & Cons

- Unlimited demo duration

- $50,000 virtual funds with reset option

- Multi-platform access (MT4, MT5)

- Autochartist pattern recognition included

- Realistic Islamic fee structure in demo

- Multiple sub-accounts for strategy testing

- Holding fees apply after 5-day grace period

- Standard Account spreads start at 1.2 pips

- Can’t hold Standard/Pro and Swap-Free accounts simultaneously

- Copy trading requires live account

- Some social features limited in demo

Broker Details

Unlimited Demo Account Access

Axi’s swap-free demo never expires, giving you permanent access to practice trading without deadline pressure. The $50,000 starting balance can be reset through customer support if you exhaust your virtual funds. You can also create multiple demo sub-accounts to test different strategies simultaneously across Standard and Pro account types.

The demo tracks your profit and loss exactly as a live account would, including realistic spread widening during low liquidity periods. This helps you understand how trading costs impact your overall profitability before risking real money. Account statements are generated daily, providing trade history and performance analytics.

You can adjust leverage from 1:1 up to 500:1 in demo mode but do know DFSA regulation limits Forex to 30:1 for major pairs and 20:1 for minor pairs with your live account. The demo includes full access to Autochartist pattern recognition software, which scans charts for technical patterns and trading opportunities. This premium feature typically requires live account funding at other brokers.

Multi-Platform Testing Environment

Axi’s demo spans MT4 and MT5. MT4 provides 30 technical indicators (Moving Averages, Oscillators, Volumes, Bill Williams) with full parameter customisation. Chart templates save your indicator configurations, letting you apply identical setups across 20+ pairs with one click. The platform’s alert system sends notifications when price conditions are met.

MT5 expands indicators to 38 (adding Adaptive Moving Average, Double Exponential Moving Average, Fractal Adaptive Moving Average, Variable Index Dynamic Average) with 21 timeframes from M1 to MN.

The Economic Calendar shows 400+ scheduled events monthly with impact ratings: high (red), medium (orange), low (yellow). Clicking calendar events displays historical data showing how EUR/USD moved during previous NFP releases.

The Axi proprietary Copy Trading platform lets you browse 500+ strategy providers showing verified performance metrics. Demo mode shows strategies but requires live funding ($500 minimum) to activate actual copying. TradingView integration provides 100+ built-in indicators, 50+ drawing tools (trend lines, channels, Pitchfork, Elliott Wave), and 12 chart types (including Heikin Ashi, Renko, and Kagi).

Realistic Islamic Account Simulation

The demo accurately represents how Axi’s Islamic accounts operate in live trading. Instead of swap charges, you see administrative fees that vary by instrument and holding period. These fees typically range from 0.05% to 0.2% of position value per day, depending on the currency pair and market conditions.

This transparent fee structure helps you calculate the true cost of holding positions long-term. The demo shows these fees in real-time, updating your account balance as positions age.

You can test the transition from demo to live by comparing execution speeds and fill prices. Axi maintains that demo fills use the same pricing engine as live accounts, though extreme volatility may create some execution differences. The broker recommends trading at least 20 positions in demo before moving to live Islamic accounts.

4. XM - Solid MT5 Swap Free Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.2 GBP/USD = 0.5 AUD/USD = 0.8

Trading Platforms

MT4, MT5, XM App/Tablet

Minimum Deposit

$5

Why We Recommend XM

XM provides excellent MT5 platform access for Islamic traders seeking advanced technical analysis capabilities and multi-asset trading from a single account. The broker’s swap-free accounts is only available with Ultra Low account (not with Standard account). This account has spreads from 09 pips on EUR/USD and an impressive 1000:1 leverage.

XM’s Islamic accounts stand out for having no administrative fees or time limits on swap-free positions. Unlike many brokers that implement fee structures after 5-7 days, XM provides genuine unlimited swap-free trading across all account types.

As one of the best MT5 brokers in the UAE, XM’s platform provides 38 built-in indicators, 21 timeframes, and an economic calendar integrated directly. You get access to 1,000+ instruments including 55 forex pairs, 30+ commodities, 18 indices, and 100+ stock CFDs across US and European markets. The broker requires just a $5 minimum deposit for Standard and Micro accounts.

Pros & Cons

- MT5 with 38 technical indicators

- Three account types with swap-free options

- 0.6 pips spreads on Ultra Low Account

- 1,000+ instruments including stocks and commodities

- No administrative fees

- Multiple regulatory licenses

- Standard Account spreads wider at 1.6 pips

- Withdrawal processing can take 2-5 days

- No guaranteed stop-loss orders

5. ThinkMarkets - Best Islamic Trading App Account

Forex Panel Score

Average Spread

EUR/USD = 0.11 GBP/USD = 0.4 AUD/USD = 0.3

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

I recommend ThinkMarkets for Islamic traders who prioritise mobile trading without sacrificing professional features. Their ThinkTrader app combines institutional-grade tools with intuitive navigation, which is something rare in mobile forex platforms.

What impressed me most was the economic calendar integration. It shows high-impact events with one-tap access to historical volatility data, helping you avoid trading during major announcements that could trigger slippage.

The TradingView Charts implementation stands out with over 100 technical indicators, 50 drawing tools, and 10+ chart types. You get desktop-level technical analysis without switching devices.

I particularly like the Traders Gym feature, which lets you backtest strategies using historical data directly from the app. Most brokers only offer this on desktop platforms. The Trend-Risk Scanner automatically flags potential reversals and overbought/oversold conditions across your watchlist.

The app’s swap-free functionality works seamlessly with spreads starting from 0.0 pips on EUR/USD through their ThinkZero Account (with $3.50 per lot commission) and 0.4 pips with Standard account. ThinkTrader also offers 6 pending order types, making it easy to set up complex entry strategies on the go.

Islamic accounts receive 7 swap-free days before weekly administrative fees apply: $5 per week for major forex pairs and $10 per week for minor forex pairs. One thing to note is that you must prove your Islamic faith to use these accounts.

When trading with ThinkMarkets you can choose the DFSA entity, which has leverage of 1:30 or their global entity with leverage of 1:1000.

Pros & Cons

- 0.0 pips spreads on ThinkZero Account

- Award winning ThinkMarkets apps

- One-tap order execution

- Full charting capabilities mobile

- ThinkZero requires larger deposits

- Weekly admin fees after 7-day grace period

- Standard Account spreads start at 1.2 pips

- Limited cryptocurrency selection

6. MultiBank Group - MT5 Broker With Low Spread and Commission

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.5 AUD/USD = 0.4

Trading Platforms

MT4, MT5, Multibank Social Trading

Minimum Deposit

$50

Why We Recommend Multibank Group

Multibank Group consistently delivers the lowest spreads among Islamic brokers in the UAE through their ECN Prime Account, averaging 0.07 pips with a $6 per lot commission structure (round-turn), making them one of the most cost-effective options for active Islamic traders.

The broker’s swap-free accounts apply across 240+ instruments, including 65 forex pairs (majors, 28 minors, 18 exotics), 22 indices (S&P 500, NASDAQ, DAX, FTSE), 8 precious metals (gold, silver, platinum, palladium), and 5 energy products (WTI crude, Brent crude, natural gas).

Multibank operates as one of the largest financial derivatives institutions globally with offices in 20+ countries and over $10 billion in annual trading volume. Their UAE regulation through the DFSA (Dubai Financial Services Authority) ensures proper licensing and compliance with local requirements.

The platform includes 87 technical indicators, 26 drawing tools, and eight chart types, though the interface requires some learning compared to MT4’s familiar layout. I found their proprietary platform delivers institutional-grade execution with average speeds under 50 milliseconds.

Pros & Cons

- 0.07 pips average spread on EUR/USD

- 240+ instruments available

- DFSA regulated in UAE

- Sub-50ms execution speeds

- Multiple account currencies supported

- Professional trading infrastructure

- Proprietary platform learning curve

- $6 per lot commission on ECN accounts

- Limited educational resources

- Standard Account spreads wider at 1.4 pips