Best MT5 Broker in the UAE

I tested MT5 across different UAE brokers to find out which ones give you the platform’s real advantages. A lot of brokers offer MT5, but what matters is whether you’re getting the extra timeframes, advanced charting, proper multi-asset access, and fast execution that make MT5 worth using over MT4

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

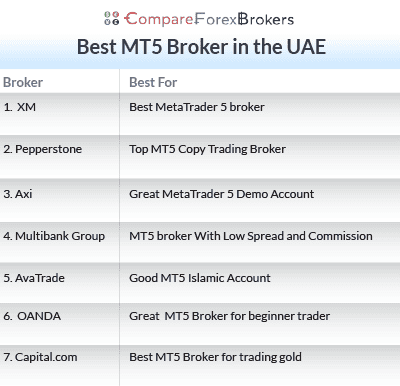

Best MT5 Broker

- XM - Best MetaTrader 5 Broker

- Pepperstone - Top MT5 Copy Trading Broker

- Axi - Great MetaTrader 5 Demo Account

- Multibank Group - MT5 Broker With Low Spread and Commission

- AvaTrade - Good MT5 Islamic Account

- OANDA - Great MT5 Broker For Beginner Trader

- Capital.com - Best MT5 Broker For Trading Gold

What is the best forex broker with MT5

XM is the best MetaTrader 5 broker in the UAE because it combines powerful platform features, competitive trading costs, and fast execution. On MT5, you get advanced charting with 80+ technical indicators, 40 analytical tools, and one-click trading across desktop, web, & mobile. Spreads are very attractive, with variable pricing from 0.6–0.8 pips and zero commissions on many account types.

1. XM - Best MetaTrader 5 Broker

Forex Panel Score

Average Spread

EUR/USD = 0.2 GBP/USD = 0.5 AUD/USD = 0.8

Trading Platforms

MT4, MT5, XM App/Tablet

Minimum Deposit

$5

Why We Recommend XM

In my view, XM is the best MetaTrader 5 broker in the UAE because it combines powerful platform features, competitive trading costs, and fast execution tailored for active traders.

On MT5 you get advanced charting with 80+ technical indicators, 40 analytical tools, and one-click trading across desktop, web, and mobile, ideal for both technical and automated strategy traders.

I believe its spreads are very attractive, with variable pricing from as low as around 0.6–0.8 pips and zero commissions on many account types, keeping costs low.

Crucially, XM’s infrastructure provides seamless, no-requote execution and ultra-fast fills, which is essential for scalpers and news traders.

Broker Details

When I first looked at XM as a broker, what immediately stood out was its breadth of markets and accessibility. XM offers easy access to over 1,400 global assets, from major forex pairs like EUR/USD to indices like the S&P 500, commodities like gold, and equities such as Apple stock. That kind of range means you don’t have to hop between brokers to build a diversified trading plan.

On the trading platform side, XM supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are industry-standard platforms used by traders worldwide. You can use them on desktop, web, and mobile, making it easy for me to manage positions on the go or deep-dive with advanced charting tools.

XM’s accounts are another strong point. There are beginner-friendly options like Micro and Standard accounts with low minimum deposits (around USD 5), and more cost-efficient choices like the Zero or Ultra-Low accounts if you’re focused on tight spreads. The fact that Islamic swap-free accounts are offered without extra admin charges also made XM appealing from a flexibility standpoint.

Fees at XM are transparent and competitive: spreads can be as low as 0.6–0.8 pips on major forex pairs, and there are no hidden deposit or withdrawal fees for most methods. While overnight and inactivity fees do apply, the overall cost structure is clear and manageable.

Overall, XM has a solid platform lineup, diverse markets, and flexible account options, which is exactly what I’d look for in a broker that supports both learning and serious trading.

2. Pepperstone - Top MT5 Copy Trading Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why we recommend Pepperstone

I recommend Pepperstone as the Top MT5 Copy Trading Broker in the UAE because its copy trading ecosystem is seamlessly integrated with MetaTrader 5. Through CopyTrading by Pepperstone, UAE traders can copy thousands of verified signal providers directly into their MT5 accounts, making passive and strategy-based trading simple and efficient.

Beyond copy trading, I’m impressed by Pepperstone’s deep liquidity and fast execution, which is ideal for volatile markets, and its low-cost Razor account pricing with raw spreads from 0.0 pips and transparent commissions. For UAE traders, this combination of automation, pricing, and platform quality makes Pepperstone a standout choice.

Broker Details

What really impressed me about Pepperstone as a broker is how it balances professional-grade trading conditions with accessibility for everyday traders. On their official site, they highlight access to over 1,350 CFD markets covering forex, shares, indices, commodities, ETFs, and crypto — giving you a huge range of markets whether you’re trading currencies like EUR/USD or speculating on global stock movements without owning the underlying asset.

One thing I appreciate is Pepperstone’s suite of trading platforms. You can trade via MetaTrader 4 and MetaTrader 5, which are industry standards for both manual and automated strategies, but they also support cTrader, TradingView, and their own web/mobile platform — all offering charting, indicators, and execution tools that suit different styles from technical analysis to algorithmic trading.

Pepperstone’s account structure gives you choice. Their Standard account has no commission and spreads built into pricing, which is ideal when you’re starting out. Their Razor account targets more active or experienced traders with raw spreads from 0.0 pips and transparent commissions (e.g., ~$3.50 USD per lot per side). We rated this combination of low spreads and platform variety very highly in 2026, noting Pepperstone as one of the market’s best brokers.

Fee-wise, there are no deposit or withdrawal fees in most cases, no inactivity fees, and competitive spreads/commissions across instruments. Between the deep liquidity, choice of instruments, and flexible pricing, it’s easy to see why I’d consider Pepperstone a strong choice whether you’re refining your first strategy or scaling up your trading approach.

3. Axi - Great MetaTrader 5 Demo Account

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.2 AUD/USD = 0.2

Trading Platforms

MT4

Minimum Deposit

$0

Why We Recommend Axi

We recommend Axi for UAE traders because its MetaTrader 5 demo account lets you practise with real-market conditions and $50,000 in virtual funds before trading live — ideal for building confidence without risk.

Axi offers tight spreads from around 0.0-0.6 pips on major forex pairs and competitive commissions (about $3.50 per round-trip) on raw accounts, helping reduce trading costs.

It’s regulated by top authorities including ASIC (Australia), FCA (UK), and the DFSA in Dubai, offering peace of mind for UAE traders. Plus, you get access to diverse asset classes — forex, indices, commodities, stocks, and cryptocurrencies — all from one broker.

Broker Details

In my view, Axi stands out as a compelling broker for traders in the UAE primarily because of its combination of robust platforms, competitive pricing and strong regulatory backing.

Since 2007 Axi has built its reputation on transparency and reliable execution, I think are especially valuable qualities if you’re trading from the Middle East, where trust and local support matter a lot.

First, one notable feature of Axi is its integration with the MetaTrader 4 (MT4) platform, including enhanced tools like Autochartist and MT4 NexGen that go beyond the basic MT4 experience. I personally appreciate these extensions because they make technical analysis and trade execution smoother and more insightful.

Second, in my view, Axi’s pricing and execution quality is a clear advantage. The broker offers raw spreads from as low as 0.0 pips and connects directly to more than 20 top-tier liquidity providers, which can result in faster fills and lower trading costs, something cost-conscious traders in the UAE will likely value.

Third, I think strong regulation and fund protection are key reasons a UAE-based trader would choose Axi. The broker is regulated by major authorities including the Dubai Financial Services Authority (DFSA), plus ASIC and FCA globally, giving me confidence that client funds are segregated and handled with high standards.

Additionally, Axi’s multilingual support (including Arabic where available) and regionally tailored services make it easier for traders in the UAE to get help when needed. All things considered, I’d say Axi is worth exploring if you want a broker that balances global expertise with localised service.

4. MultiBank Group - MT5 Broker With Low Spread and Commission

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.5 AUD/USD = 0.4

Trading Platforms

MT4, MT5, Multibank Social Trading

Minimum Deposit

$50

Why we recommend MultiBank

We recommend MultiBank as an MT5 broker with low spreads and commissions because it offers traders genuinely competitive trading conditions and flexible pricing structures.

MultiBank’s ECN accounts provide raw spreads as low as 0.0 pips on major forex pairs with a industry leading low commission of $3.00 per-lot round-turn. The other account available is the Pro accounts which combines tight spreads from around 0.8 pips with zero commissions, which I think is ideal for cost-sensitive MT5 traders.

I also like that MultiBank supports the MetaTrader 5 platform across desktop, web and mobile, giving traders access to advanced charting, deeper market data and automated strategies using Expert Advisors.

Finally, I believe the transparent fee structure, including no deposit or withdrawal fees and access to a wide range of CFD markets, makes it straightforward to understand your trading costs without surprises.

5. AvaTrade - Good MT5 Islamic Account

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 1.2 AUD/USD = 0.9

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why we recommend AvaTrade

We recommend AvaTrade for its good MT5 Islamic account because it caters to Muslim traders who want to trade within Sharia-compliant (swap-free) conditions, with no overnight interest (swap) charges on positions held up to a certain period.

I also like that AvaTrade’s Islamic accounts are supported on MetaTrader 4 and MetaTrader 5 (MT5), giving you access to advanced charting, multiple timeframes, and algorithmic tools on a familiar platform.

On top of that, I think AvaTrade’s commission-free pricing (costs built into spreads rather than per-trade fees) and its range of tradable assets, from forex pairs to indices and commodities, make it a practical choice if you want both ethical trading and broad market access.

6. OANDA - Great MT5 Broker For Beginner Trader

Forex Panel Score

Average Spread

EUR/USD = 0.89 GBP/USD = 1.54 AUD/USD = 1.37

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why we recommend OANDA

We recommend OANDA as a great MT5 broker for a beginner trader because it combines accessibility, ease of use and powerful tools that help new traders learn the ropes confidently.

For starters, OANDA supports MT5 across desktop, web and mobile, giving beginners access to advanced charting, a host of built-in technical indicators and user-friendly order types. I think this makes skill development much smoother.

I also like that there’s no minimum deposit requirement, so you can begin trading with very small amounts while you learn without pressure.

Additionally, OANDA offers educational resources like webinars and video tutorials that are designed to help beginners improve their understanding of markets and trading strategies, something I personally see as valuable when you’re just starting out.

Finally, the broker’s commission-free standard accounts with spreads from 0.7 pips keep trading costs simple and predictable, which I think is ideal for someone who’s new to forex and CFDs.

7. Capital.com - Best MT5 Broker For Trading Gold

Forex Panel Score

Average Spread

EUR/USD = 0.6 GBP/USD = 1.3 AUD/USD = 0.6

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$0

Why We Recommend Capital.com

We recommend Capital.com as one of the best MT5 brokers for trading gold because it combines robust multi-asset MT5 functionality with competitive pricing on gold CFDs.

On MT5 with Capital.com you get all the platform advantages, advanced charting, multiple timeframes and full algorithmic/EAs support, which I think are ideal for analysing gold price action deeply.

What really stands out for me is how tight the spreads are on gold (often around ~$0.30), especially considering there’s 0% commission on trades.This means your costs are embedded in competitive spreads rather than extra fees. This makes it straightforward and cost-effective to trade gold regularly or during volatile market moves.

I also like that Capital.com gives you access to 4,500+ CFD markets including commodities like gold alongside forex, indices and crypto, so you can diversify your strategy all from one MT5 account.